As governments approve cultured meat products, this sector should experience explosive growth - particularly in regions with stringent environmental laws and high rates of meat consumption.

Investment in research and development is vital for meeting market challenges like scaling production up quickly and improving cost efficiency. Production costs remain relatively high; however, advancements in bioprocessing technology should help bring these down over time and make cultured meat a competitive meat alternative. Partnerships between startups and established food companies help scale operations efficiently while broadening market presence - showing signs of greater acceptance from both sides.

Cultured meat production's potential to reduce carbon emissions associated with traditional meat production while simultaneously using minimal land and water resources is in line with global sustainability objectives, drawing eco-minded customers. Furthermore, cultured meat addresses ethical concerns related to animal farming which makes it a progressive option in food markets - though as its industry expands successfully navigating regulatory environments and consumer attitudes will become crucial to its widespread acceptance and commercial success.

Key Takeaways

- The cultured meat market is expected to grow from $451.01 million in 2024 to $6,762.14 million in 2033, with a CAGR of 35.1%.

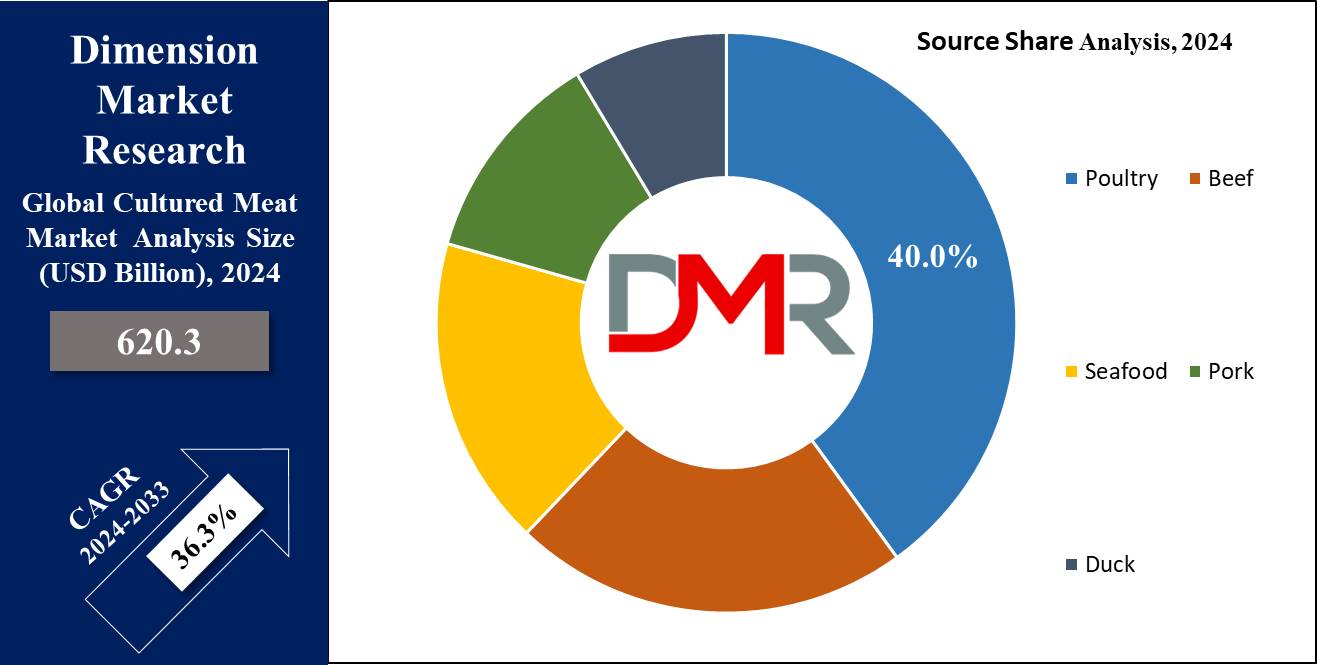

- Poultry is the leading source of cultured meat, capturing over 40% of the market in 2023.

- Burgers are the most common product type, making up 43% of the cultured meat market in 2023.

- North America holds a 38% share of the cultured meat market, fueled by increased consumer awareness and favorable regulations.

- Animal welfare concerns drive the growth of cultured meat, which avoids traditional animal farming using cell cultures.

Use Cases

- Cultivated meat production offers a more sustainable option to traditional livestock methods by dramatically decreasing land, water and resource requirements.

- Cellular agriculture offers food security by producing consistent meat supplies irrespective of climate or geography, making it a vital technology for future generations.

- Animal Welfare is an innovative solution to meat production that eliminates animal slaughtering and improves animal welfare significantly.

- Cellular agriculture has many uses beyond just producing crops on plates; its cultivation of human tissues for research and therapeutic uses may lead to major advancements in medicine, potentially speeding the path toward medical innovation.

- Cultivated meat can be tailored to meet the dietary requirements of individuals for improved nutritional profiles that support improved health outcomes.

Driving Factors

Promoting Ethical Treatment of Animals as an Essential Component for Cultured Meat Adoption.

Concerns for animal welfare have been one of the main drivers behind cultured meat's rise in popularity. Traditional methods often raise ethical issues when treating animals for meat production; cultured meat production provides an alternative that alleviates such concerns by using cells rather than whole animals for production of protein-rich meals.

This shift not only provides an ethical alternative, but it also attracts an ever-increasing number of consumers identifying as vegans, vegetarians and flexitarians who prioritize animal welfare considerations in their dietary decisions. As a result, market growth is enhanced thanks to these ethical considerations, drawing in customers who would have otherwise shied away from meat products altogether.

Environmental Sustainability: Cultured Meat as an Eco-Friendly Alternative

Environmentalism is at the core of cultured meat market growth. Traditional livestock farming requires massive resources in terms of land, water and feed consumption and is also one of the primary contributors of greenhouse gases emissions; but cultured meat production promises significant reduction in these footprints.

Studies indicate that cultured meat production could use up to 96% less land and 96% less water compared to conventional beef production, and reduce greenhouse gases by 96% - making cultured meat an extremely sustainable food option for regions affected by environmental regulations or climate change. As consumers gain awareness of these advantages, support grows for cultured meat products resulting in market expansion.

Consider Cultured Meat as a Sustainable Protein Source

Health consciousness has increasingly informed food choices. Studies linking red and processed meat consumption with various health conditions such as heart disease, cancer and obesity has caused people to look for alternative protein sources with minimal risks associated with consumption. This has spurred consumers to explore other sources that provide beneficial qualities without adverse side effects.

Cultured meat has earned itself the label of being cleaner due to being produced under strictly monitored conditions and potentially leading to less instances of bacteria such as E. coli or Salmonella contamination that often occur with traditional processing techniques. Furthermore, its nutritional profile can be tailored and improved during production to align with consumer health-driven trends - something which bolsters growth of cultured meat markets as consumers look for products which align with healthier lifestyle choices.

Growth Opportunities

Geographic Diversification: Exploiting Emerging Market Opportunities

2023 is poised to offer cultured meat producers exceptional opportunities in new geographies, particularly emerging economies with increasing middle-class populations fueled by protein consumption.

Such regions, marked by rapid urbanization and health awareness awareness campaigns provide ideal environments for cultured meat companies looking for sustainable and ethical protein alternatives that they can introduce via partnerships or regional investments aimed at navigating regulatory frameworks and consumer preferences, positioning cultured meat as viable replacement in markets previously dominated by conventional meat.

Technological Developments: Leveraging AI for Improved Production

Integrating artificial intelligence (AI) and machine learning (ML) technologies into cultured meat production in 2023 could be transformative. AI technology could significantly increase efficiency, scaleability and quality control while simultaneously decreasing costs to make cultured meat more affordable and accessible to a wider range of people.

AI will play a critical role in optimizing growth media formulations and bioreactor conditions to achieve maximum yield and quality, giving cultured meat an unprecedented competitive edge and consumer trust as it becomes mainstream in society.

Businesses-to-Business (B2B) Strategies: Utilizing Cultured Meat as a Culinary Ingredient

2023 promises an abundant opportunity for growth of the B2B cultured meat market. By targeting restaurants and catering services with cultured meat-based ingredients as cutting edge sustainable choices for culinary use, companies can introduce innovative cultured meat-based solutions as sustainable options to chefs and food service professionals while creating greater consumer acceptance through tailored recipes for professional kitchen use.

Cultured meat can even be tailored specifically for specific culinary applications to increase its appeal for professional kitchen use while potentially shifting public perception through high quality chef-endorsed dishes that could influence public opinions of its quality and chef-endorsed dishes that may alter public opinions of its quality through high-quality dishes that highlight chef endorsement from professional chefs themselves!

Key Trends

Products With Clean Labels take priority

Consumer preferences have seen an increasing shift toward transparency when it comes to food production and labeling, especially for products like cultured meat that may still be unfamiliar to many shoppers. A growing consumer trend toward clean label products involves using less and more easily identifiable ingredients; this trend becomes particularly pertinent with cultured meat since consumers require assurance about production methods and ingredient lists.

Companies that prioritize clear, straightforward labeling that emphasizes simplicity may gain competitive edge by appealing more effectively with health-minded customers looking for natural and unadulterated ingredients in their product formulations.

Integration of Nutraceuticals Into Cultured Meat Products

An increasingly significant trend in cultured meat production is fortification with vitamins, minerals and other nutraceuticals to increase its inherent health benefits and meet increasing consumer interest in functional foods supporting overall wellbeing beyond basic nutrition. By fortifying cultured products with health-promoting compounds like vitamins or other nutraceuticals, producers can position them within this lucrative wellness market segment.

Regenerative Agriculture Practices: Making Connections

Linking cultured meat production with regenerative agriculture practices has gained increasing attention as an approach for increasing its sustainability narrative. Such initiatives use by-products from cultured meat production as feedstock to support such practices such as creating biofertilizers from them - amplifying cultured meat's environmental benefits while appealing to ecologically aware customers who prioritize ecological impacts when making purchasing decisions.

Restraining Factors

Economic Challenges: High Production Costs Restrain Market Penetration

Production costs remain one of the key obstacles facing cultured meat. Even with technological improvements, initial costs associated with setting up cultured meat production--such as bioreactors, growth mediums and infrastructure costs--are significant. Cellular agriculture resources are both costly and complicated to operate effectively and thus hinder cultured meat's cost competitiveness with conventional meat.

At present, cultured meat remains an expensive alternative, typically accessible only through premium markets or limited product launches. Therefore, continued research and development efforts towards finding cheaper production methods is of critical importance if cultured meat is to become mainstream protein source option. Without economies of scale and cost reduction strategies in place, cultured meat may remain niche product that remains an expensive protein option.

Cultural and Consumer Acceptance of Cultured Meat: Overcoming Skepticism Around Cultured Meat

Consumer skepticism presents one of the primary obstacles to wide-scale adoption of cultured meat. Many consumers express reservations over meat grown in laboratories, raising questions over taste, texture and perceived naturalness of products produced using cultured methods. Traditional proteins have deep-seated cultural dining practices and culinary traditions which make gaining ground difficult for alternative proteins like cultured proteins.

Lab-grown meat often conjures an image of unnaturalness that overshadows its benefits such as sustainability and ethical production. Education and transparent marketing strategies play a pivotal role in changing perceptions to demonstrate that cultured meat can match or surpass its quality and safety, unlike its conventional counterpart.

Research Scope and Analysis

Source Analysis

Poultry was the clear leader in the Source segment of the Cultured Meat market in 2023, commanding more than 40% share. This high market share can be attributed to poultry's wide acceptance across various culinary cultures as well as its less complex cell structure which eases cultivation process compared to red and seafood meats. Furthermore, its familiarity with consumers as a staple food provides them with incentive to try cultured versions - ultimately serving as gateway for wider acceptance of cultured meat products.

After poultry, cultured beef also displays significant market participation due to continuous developments aimed at replicating its taste and texture. Given beef's premium status and higher market value, cultured versions may become more palatable and affordable; though their share remains smaller compared to poultry's, its growth can be explained by consumer desire for sustainable options or environmental concerns that reduce consumption from conventional sources.

Cultured seafood and pork represent two emerging opportunities within the cultured meat market. Cultured seafood aims to address overfishing concerns while mitigating environmental impact of traditional fisheries; cultured pork utilizes advances in cellular agriculture technology in order to address significant obstacles related to disease management and ethical concerns in farming pigs.

Finally, duck is experiencing growth potential in areas with longstanding culinary traditions that emphasize its use. Cultured duck meat provides a sustainable option without altering texture and flavor preferences in Asian cuisines; therefore indicating potential expansion across certain markets.

End-use Analysis

Burgers dominated the End-use segment of the Cultured Meat Market in 2023, commanding 43% market share in End Use segment of End-Use segment of Cultured Meat market. Their wide appeal as an everyday food item drove this success; cultured meat burgers particularly benefit from consumer trials and media attention as the flagship product to introduce people to cultured meat cultured burgers can mimic traditional beef burgers both in texture and taste while offering sustainable dining habits while cutting environmental footprint. Cultured meat burgers' superior performance saw them become preferred products among both newcomers to cultured meat cultured Meat Market which saw them capture over 43% market share from End-Use Cultured Meat Market

Cultured meat sausages and nuggets were both highly successful products on the market due to their convenience and family-oriented appeal. Sausages gained increased adoption due to their multitude of culinary uses across European markets as they can easily fit into traditional meals; similarly, nuggets served fast-food audiences as familiar products that helped introduce cultured meat products to initially skeptical audiences.

Hotdogs and meatballs represent two key segments in the cultured meat market. Hotdogs benefit from being an essential staple at casual dining establishments like fast food chains, providing potential opportunities to add flavors or healthful components that stand out. Meatballs meanwhile enjoy popularity throughout many global cuisines like Italian or Middle Eastern cooking styles providing cultured meat with greater culinary diversity applications.

Each end-use segment contributes to the cultured meat market by offering products that fit within contemporary consumer eating patterns while expanding upon conventional meat consumption with more responsible and ethical approaches.

The Cultured Meat Market Report is segmented based on the following:

By Source

- Poultry

- Beef

- Seafood

- Pork

- Duck

By End-use

- Burgers

- Sausages

- Hotdogs

- Nuggets

- Meatballs

Regional Analysis

North America holds 38% of the cultured meat market. This growth can be attributed mainly to increased consumer awareness and an evolving regulatory framework which facilitates market entry and expansion. Within North America, U.S. firms led with multiple companies receiving regulatory approval to sell cultured meat products; as well as advanced biotech research, substantial investments, a thriving startup culture that fosters rapid expansion.

Europe follows closely behind, boasting stringent food safety regulations and an equally stringent consumer base that prioritizes sustainable practices and animal welfare. European consumers' high ethical consumption standards support cultured meat market expansion in countries such as Netherlands, Germany and UK; Europe also contains key pioneers and research institutions driving advancements in cultured meat technologies.

Asia Pacific region presents an emerging economy segment which is rapidly growing due to an increasing protein demand in emerging economies like China and India, coupled with technological innovations from countries like Singapore which was the first country to approve cultured meat for commercial sale. Furthermore, this region benefits from an abundant culinary landscape where alternative proteins may easily fit into traditional diets creating significant market penetration potential.

Middle East/Africa and Latin America are emerging cultures meat markets with great promise in this emerging space, given their expanding urban populations and rising health awareness. In particular, Middle Eastern entrepreneurs have begun pioneering cultured meat projects designed to meet dietary requirements while decreasing import dependence. Brazil and Argentina could serve as benchmarks in this regard due to their established agricultural industries that could pave the way for acceptance of cultured meat alternatives.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 was an outstanding year for cultured meat markets worldwide, featuring key contributions from key players who each brought innovative ideas and strategic developments that promoted both industry growth and consumer acceptance.

Aleph Farms and Mosa Meat have made notable strides to pioneer alternatives to beef in recent years, making headlines with innovative alternatives that meet consumer preferences for quality, naturalness and non-GMO ingredients. Meanwhile, Mosa Meat strives to reduce production costs through scaleability measures in their operations which facilitate mainstream market penetration.

Future Meat Technologies Ltd and UPSIDE Foods stand out with rapid advances in production technologies that reduce costs while simultaneously improving quality. UPSIDE Foods recently received regulatory approval in the U.S. to lead North American markets with its chicken products; thus establishing an industry framework.

Shiok Meats Pte Ltd specialises in seafood products such as shrimp and is rapidly expanding within this rapidly evolving segment, while remaining sensitive to environmental challenges associated with traditional shrimp farming techniques.

BlueNalu and Finless Foods both specialize in seafood production: BlueNalu seeks large-scale production of cell cultured seafood while Finless Foods pursues bluefin tuna conservation while meeting demand for premium foods.

Companies such as SuperMeat and Meatable prioritize consumer preferences and ethical considerations in product design for European markets with evolving regulatory advancements in mind.

WildType and New Age Eats, emerging players in niche markets such as salmon and pork production respectively, using novel biotechnologies to address specific consumer tastes as well as environmental considerations.

Some of the prominent players in the Global Cultured Meat Market are:

- Aleph Farms

- Future Meat Technologies Ltd

- Shiok Meats Pte Ltd

- Fork & Good, Inc.

- UPSIDE Foods

- Mission Barns

- Mosa Meat

- BlueNalu, Inc.

- Avant Meats Company Limited

- Biftek INC

- BioFood Systems Ltd

- SuperMeat

- Meatable

- Finless Foods, Inc

- WildType

- New Age Eats

Recent developments

Agronomics, an industry leader in cellular agriculture, announced on April 20, 2024 that one of their portfolio companies, Mosa Meat, has secured $40 Million. This substantial funding injection will go toward expanding production capabilities for their cultivated beef products ahead of an impending market launch - signalling industry readiness to move from experimental phases towards commercial meat production with sustainable solutions for production.

Tyson Foods, one of the top names in food industry, made headlines earlier this year when they announced their strategic investment in clean meat technologies. Tyson's move aligned perfectly with their diversification strategy in protein offerings as well as innovation strategies in response to growing consumer expectations for environmentally-friendly and ethical meat options. Tyson Food's investment is seen by many in this sector as significant support that may promote faster product development and adoption rates.

Meatable, an innovative company dedicated to cultivating meat, recently secured a successful $35 million investment round from investors, with this money set aside for technological upgrades and production capabilities expansion. Meatable's feat demonstrated confidence from investors regarding cultured meat's viability while propelling it closer toward commercialization, offering consumers with sustainable protein alternatives more sustainable food alternatives in 2023.

Report Details

| Report Characteristics |

| Market Size (2024) |

USD 620.3 Mn |

| Forecast Value (2033) |

USD 10088.2 Mn |

| CAGR (2024-2033) |

36.3% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Source(Poultry, Beef, Seafood, Pork, Duck), By End-use(Burgers, Sausages, Hotdogs, Nuggets, Meatballs) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Aleph Farms, Future Meat Technologies Ltd, Shiok Meats Pte Ltd, Fork & Good, Inc., UPSIDE Foods, Mission Barns, Mosa Meat, BlueNalu, Inc., Avant Meats Company Limited, Biftek INC, BioFood Systems Ltd, SuperMeat, Meatable, Finless Foods, Inc, WildType, New Age Eats |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |