Market Overview

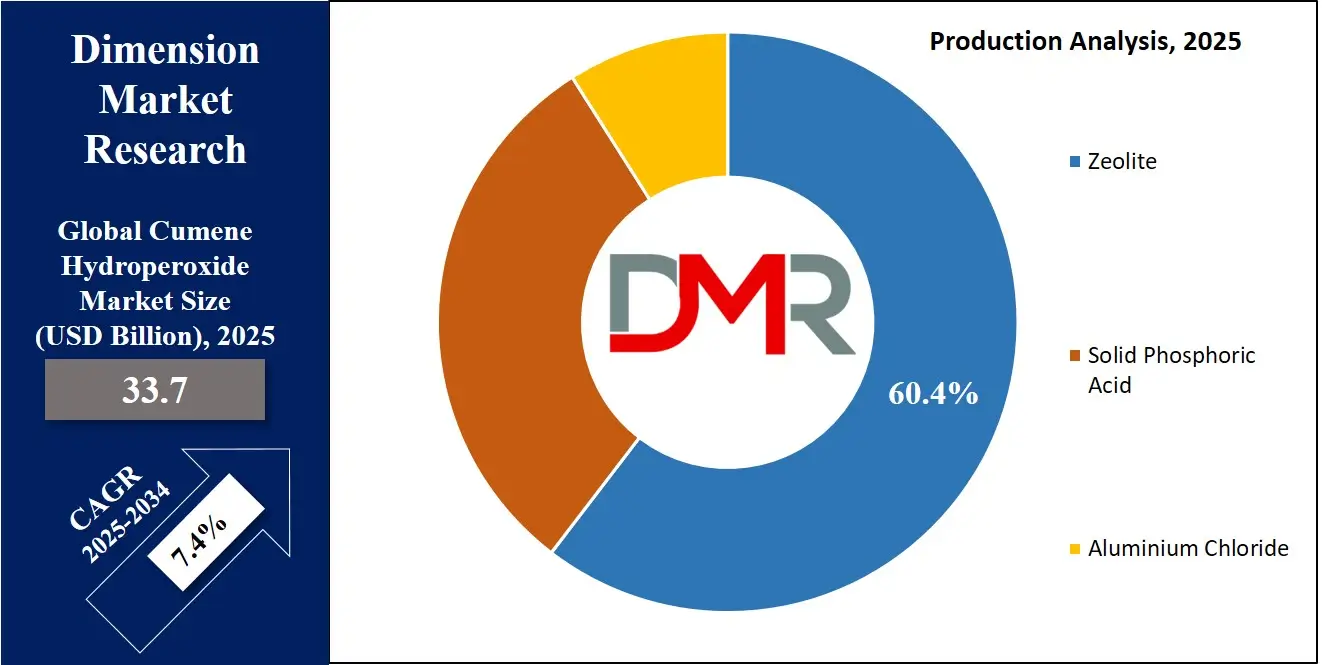

The Global Cumene Hydroperoxide Market size is expected to be valued at

USD 33.7 billion in 2025, and it is further anticipated to reach a market value of

USD 63.9 billion by 2034 at a

CAGR of 7.4%.

Cumene hydroperoxide (CHP) plays an essential role in the chemical industry, serving as a main precursor for producing two essential chemicals - phenol and acetone. Phenol is widely used in manufacturing plastics, resins, synthetic fibers, pharmaceuticals, and personal care products while acetone acts as a solvent in paints, coatings, and personal care products. Cumene hydroperoxide market growth is being driven by rising phenol and acetone demand from sectors like plastics, automotive, pharmaceuticals, and consumer goods.

Chemicals play an integral part in everyday products ranging from packaging materials to pharmaceuticals, contributing significantly to an expanding global chemical manufacturing industry. Technology advances are increasing the efficiency of CHP manufacturing processes, making this raw material even more appealing to chemical producers.

Furthermore, emerging markets like Asia-Pacific growth have increased CHP demand as countries within this region are pushing for the production of petrochemicals. Asia-Pacific has emerged as a dominant player in the cumene hydroperoxide (CHP) market due to rapid industrialization and increasing chemical production capacity. Countries such as China, India, and South Korea have established new petrochemical plants and downstream manufacturing units at a rapid rate.

Manufacturing units benefiting from low labor costs, abundant raw materials, supportive government policies, and favorable government policies are finding these regions attractive for expansion production, driving demand for CHP while simultaneously shifting global trade dynamics as Asia-Pacific becomes a source for phenol, acetone, and other products.

Cumene hydroperoxide market growth in North America and Europe is further propelled by established chemical industries as well as stringent occupational safety and environmental regulations. Manufacturers operating within these regions strive to maximize operational efficiency while complying with safety protocols to manage CHP's reactive properties, adopting advanced storage and transportation solutions to minimize risks related to its flammability or instability.

Though its market is vastly promising, environmental regulations present significant hurdles to production processes. Regulators across the globe have implemented stringent standards to limit emissions and waste from chemical plants, forcing manufacturers to adopt cleaner technologies. While this increases operational costs initially, it also presents opportunities for innovation and differentiation.

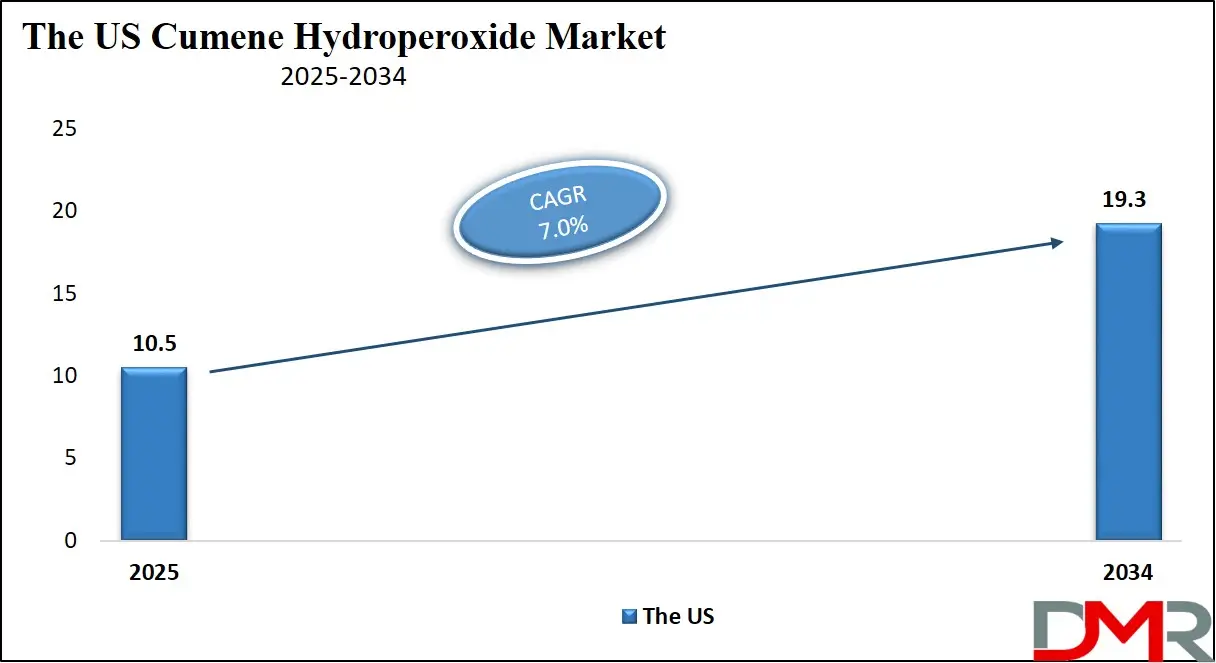

The US Cumene Hydroperoxide Market

The US Cumene Hydroperoxide Market is projected to be valued at

USD 10.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period as it holds

USD 19.3 million in 2034 at a

CAGR of 7.0%.

The US market for cumene hydroperoxide represents an integral segment of global supply chains, driven by its established chemical industry and demand for downstream products like phenol and acetone. Being a developed market, its advanced production capabilities, stringent regulatory standards, and technological innovations, all play a part in making it one of the key contributors in providing global cumene hydroperoxide supplies. One of the primary drivers of the US cumene hydroperoxide market is the strong demand for phenol and acetone derivatives such as polycarbonates and resins produced using them.

Such materials are widely utilized by automotive and construction industries for their lightweight durability and impact resistance. Acetone plays a pivotal role in industries like paints, coatings, and personal care products contributing significantly to cumene hydroperoxide's continuous demand as an intermediate raw material.

The US market benefits from an excellent industrial infrastructure and leading chemical manufacturers with significant production capacities. Companies use advanced catalytic processes to maximize cumene hydroperoxide yield while simultaneously minimizing cost efficiency and environmental impact. Moreover, CHP production units often integrate seamlessly with downstream units producing phenol and acetone production units enabling seamless operations and minimizing logistical challenges.

Strict environmental and occupational safety regulations in the US play an essential part in shaping the cumene hydroperoxide market. Agencies like the Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) enforce stringent guidelines regarding the handling, storage, and transportation of CHP. As a result, manufacturers have introduced advanced safety technologies into their production lines that ensure compliance while remaining efficient.

Global Cumene Hydroperoxide: Key Takeaways

- Market Value: The global cumene hydroperoxide market size is expected to reach a value of USD 63.9 billion by 2034 from a base value of USD 33.7 billion in 2025 at a CAGR of 7.4%.

- By Production Segment Analysis: Zeolite is anticipated to lead in the production type segment, capturing 60.4% of the market share in 2025.

- By Application Segment Analysis: Phenol is poised to consolidate its market position in the application type segment capturing 63.1% of the total market share in 2025.

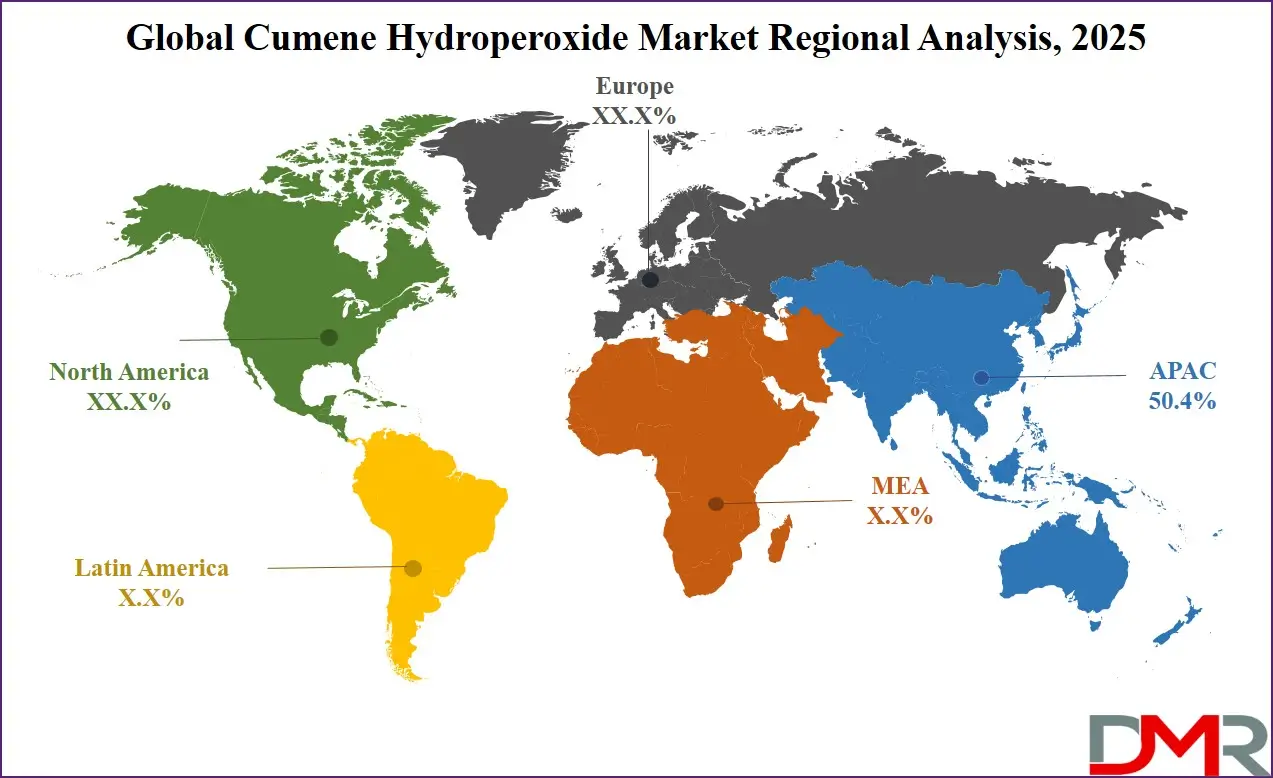

- Regional Analysis: Asia-Pacific is poised to lead the global cumene hydroperoxide landscape with 50.4% of total global market revenue in 2025.

- Key Players: Some major key players in the global cumene hydroperoxide market are, Braskem, Cepsa, Chang Chun Group, CITGO, Domo Chemicals, Dow, INEOS, Koch Industries Inc., and Other Key Players.

Global Cumene Hydroperoxide: Use Cases

- Phenol Production: One of the primary uses of cumene hydroperoxide is in the production of phenol, which is a crucial raw material for the manufacturing of a variety of products, including plastics, resins, synthetic fibers, and pharmaceuticals. The Hock process, which involves the cleavage of cumene hydroperoxide, produces phenol and acetone as by-products. Phenol is used to make polycarbonates, epoxy resins, and phenolic resins, which are essential in the production of automotive parts, electronics, coatings, and adhesives.

- Acetone Production: Alongside phenol, cumene hydroperoxide is used to produce acetone, a highly versatile chemical. Acetone is used as a solvent in paints, coatings, adhesives, and personal care products such as nail polish removers. It also plays an essential role in the production of methyl methacrylate (MMA), a precursor for producing acrylic plastics, which are used in everything from vehicle parts to furniture and home appliances.

- Polymerization Initiation in Synthetic Rubbers: Cumene hydroperoxide is used as a polymerization initiator in the production of synthetic rubbers. In this context, CHP is employed to initiate the polymerization of monomers, leading to the formation of synthetic rubbers used in tires, seals, gaskets, and other automotive and industrial products. These polymers offer high durability, chemical resistance, and elasticity, making them ideal for demanding applications in the automotive and manufacturing sectors.

- Chemical Synthesis in the Textile and Coating Industry: Cumene hydroperoxide is used in the chemical synthesis of various compounds in industries like textiles and coatings. CHP is employed in the creation of specialty chemicals that serve as intermediates in the manufacturing of dyes, pigments, and certain textile finishes. Additionally, its role in initiating polymerization reactions makes it useful in the production of coating materials used in the automotive and construction industries to provide surfaces with better durability, water resistance, and aesthetic appeal.

Global Cumene Hydroperoxide Market: Stats & Facts

- According to the National Library of Medicine, Cumene hydroperoxide is a colorless to light yellow liquid with a sharp, irritating odor.

- According to the National Library of Medicine, Cumene hydroperoxide is obtained by oxidizing cumene with air, usually in a cascade of stirred-tank reactors or bubble columns at temperatures in the range of 100-140 °C and a pressure of 6-7 bar and usually with small amounts of a buffer to prevent acids from building up.

Global Cumene Hydroperoxide Market: Market Dynamic

Global Cumene Hydroperoxide Market: Driving Factors

Rising Demand for Phenol and AcetoneCumene hydroperoxide market growth has been rising over recent years due to its critical role as an intermediate product used to manufacture phenol and acetone. Cumene hydroperoxide and phenol are indispensable chemicals in many industrial applications, making their demand directly proportional to industry expansion. Phenol is an integral raw material for bisphenol A (BPA) and other phenolic resin products. BPA is widely used in the production of polycarbonate plastics that play an essential role in the automotive, electronics, and construction sectors. Polycarbonate plastics are widely renowned for their lightweight yet high durability properties, making them indispensable in lightening vehicle weight and improving fuel efficiency, as well as creating impact-resistant materials used in construction and consumer goods.

Phenolic resins play an equally crucial role in providing adhesives, laminates, and insulation materials used extensively across high-performance industries such as aerospace manufacturing and industrial tooling. Acetone, another product derived from cumene hydroperoxide, holds immense industrial relevance. As a multifaceted solvent, acetone has proven itself indispensable in the pharmaceutical industry for formulating medications and synthesizing active pharmaceutical ingredients (APIs). Acetone has long been used in cosmetic products like nail polish removers and as a solvent in various formulations. Furthermore, it plays an essential role in producing methyl methacrylate (MMA) and isopropyl alcohol (IPA).

Increasing Demand for Specialty Chemicals in Emerging Industries

Cumene hydroperoxide market growth is driven largely by increasing demand for specialty chemicals in emerging industries such as pharmaceuticals, agriculture, and electronics. It serves as an integral raw material for producing various specialty chemicals necessary for providing solutions to specific industrial needs. Cumene hydroperoxide, used to synthesize active pharmaceutical ingredients (APIs) necessary in manufacturing medications that treat chronic diseases, is expected to experience increasing consumption globally as healthcare infrastructure improvements and novel therapeutic development expand.

Cumene hydroperoxide-derived specialty chemicals play an essential role in agriculture by producing high-performance agrochemicals such as pesticides and herbicides, helping enhance crop protection and yield, which is crucial to meeting an ever-expanding global population's food demands. Emerging economies are investing heavily in agricultural innovations derived from cumene hydroperoxide. Electronics industry growth is driving demand for specialty chemicals. Consumer electronics proliferation, 5G technology advancements, and electric vehicle adoption all are contributing to an upsurge in cumene hydroperoxide market growth as this sector experiences exponential expansion resulting in a cumulative impact on cumene hydroperoxide market growth overall.

Global Cumene Hydroperoxide Market: Restraints

Environmental and Health Concerns

Cumene hydroperoxide market growth may be hindered by environmental and health hazards related to its production, handling, and use. Cumene hydroperoxide is a highly reactive and unstable chemical due to its flammability, toxicity, and potential to cause serious damage if handled incorrectly. Its exposure poses numerous health hazards to workers, including respiratory irritation, skin burns, and, in rare instances, organ damage. Also, it may even cause chronic health conditions to arise and pose major safety concerns in industrial settings. As such, stringent safety measures and compliance with occupational health and safety regulations must be put in place to mitigate such risks.

Cumene hydroperoxide production and disposal can create toxic byproducts and pollutants that contribute to air and water contamination. Strict environmental regulations imposed by governments and agencies such as the Environmental Protection Agency (EPA) and European Chemicals Agency (ECHA), mandate manufacturers adopt advanced waste management technologies for emission control as part of environmental protection. Unfortunately, these regulatory requirements increase production costs significantly while acting as barriers for small and midsized enterprises to enter the market.

Sustainability concerns and eco-friendly alternatives have caused industries to search for replacements for cumene hydroperoxide. This shift towards greener and safer chemical processes poses an ongoing threat to market growth.

Volatility in Raw Material Prices

Cumene hydroperoxide market growth could also be limited by fluctuating raw material prices, especially those related to benzene and propylene. These two petrochemical derivatives serve as feedstock for producing cumene which in turn is used to synthesize cumene hydroperoxide. Any fluctuations in crude oil prices directly impact these costs of benzene and propylene, creating uncertainty regarding the overall production costs of cumene hydroperoxide.

Geopolitical tensions, supply chain disruptions, and global oil demand changes all play an integral part in driving price volatility for raw materials such as cumene hydroperoxide production. Price spikes or shortages in crude oil or its derivatives may suddenly increase manufacturing costs significantly and pressure profit margins compared with larger players with greater financial resilience.

Small and medium-sized enterprises may find it harder than their larger competitors to bear such costs and remain financially vulnerable. Due to renewable energy sources and reduced reliance on fossil fuels in certain regions, changes have occurred in the availability and pricing of petrochemical feedstocks that are further straining raw material supplies, which is affecting cumene hydroperoxide market dynamics and making production scheduling and pricing difficult for manufacturers, potentially inhibiting market expansion.

Global Cumene Hydroperoxide Market: Opportunities

Growing Adoption of Cumene Hydroperoxide in Advanced Polymer Production

Cumene hydroperoxide's use as an advanced polymer and composite production ingredient presents an exciting market opportunity, particularly as industries such as automotive, aerospace, and electronics continue to prioritize lightweight yet high-performance materials such as polycarbonate plastics and epoxy resins. Cumene hydroperoxide plays a significant role in synthesizing phenol-based intermediates which form specialty polymers derived from these intermediates for use in materials. Automotive industries are currently focused on reducing vehicle weight to improve fuel efficiency and encourage the development of electric vehicles (EVs).

This has driven an increase in demand for lightweight materials like polycarbonate and composite resins manufactured using cumene hydroperoxide phenol derivatives. Meanwhile, aerospace sectors require strong yet lightweight components, leading to further opportunities in cumene hydroperoxide markets. Sustainability also presents manufacturers with an opportunity to produce eco-friendly and recyclable polymers. By using cumene hydroperoxide in producing innovative phenol-based materials, companies can meet increasing consumer demands for eco-friendly options in high-performance applications. This development highlights cumene hydroperoxide's potential as a driving force behind advancements in polymer technology that may create new growth avenues on a global level.

Expansion of Emerging Markets in Asia-Pacific

Cumene hydroperoxide market growth opportunities exist due to rapid industrialization and economic development in emerging Asian markets such as China, India, and Southeast Asian nations like Vietnam. Such countries experience strong growth across industries including automotive, construction, electronics, and healthcare. Automobile and construction sectors are seeing increased urbanization and infrastructure development driving consumption of polycarbonate plastics and phenolic resins derived from cumene hydroperoxide phenol. Meanwhile, electronics industries supported by the increasing adoption of smart devices and the introduction of 5G technology are also driving an increased need for lightweight yet durable components made with phenol-based materials.

Healthcare sectors in emerging economies are growing quickly due to investments in medical infrastructure and pharmaceuticals, bolstered by increasing investments. Acetone, another derivative of cumene hydroperoxide, plays an integral role in producing isopropyl alcohol and methyl methacrylate used widely across pharmaceuticals, medical devices, sanitization products as well and other applications. With increasing focus on improving healthcare standards within emerging economies is propelling the demand for cumene hydroperoxide applications. Asia-Pacific markets present companies with ample opportunity for market expansion, due to supportive government policies, increased foreign investments, and an emphasis on local production to reduce import dependence, this region provides the ideal setting for expanding market presence.

Global Cumene Hydroperoxide Market: Trends

Increasing Shift Towards Sustainable and Green Chemical Processes

Cumene hydroperoxide market trends include an emerging shift towards green and sustainable chemical processes, with rising environmental awareness and stricter regulations on chemical production prompting companies to develop eco-friendly production methods for cumene hydroperoxide and its derivatives. This trend is driven by the need to reduce carbon emissions, minimize waste production, and use less hazardous chemicals in industrial processes. Manufacturers are investing in technologies to optimize cumene hydroperoxide production processes to lower energy usage and environmental impacts. There is also an initiative underway to develop biodegradable and recyclable plastics made using cumene hydroperoxide precursors, this effort aligns with wider industry efforts toward sustainability and circular economy principles.

Adopting green chemistry practices has gained increasing momentum within both pharmaceutical and agricultural industries, where cumene hydroperoxide plays an essential role in producing active pharmaceutical ingredients (APIs) and agrochemicals. Companies are prioritizing safer non-toxic alternatives that offer better environmental and health safety profiles for these chemicals. As demand for sustainable products and processes rises, manufacturers who can incorporate green technologies into their operations will likely gain a competitive edge, further driving the adoption of more eco-friendly practices in the cumene hydroperoxide market.

Increasing Adoption of Electric Vehicles (EVs) and Lightweight Materials

One trend affecting the global cumene hydroperoxide market is the growing adoption of electric vehicles (EVs) and the demand for lightweight materials. As automotive industries strive to move toward sustainability, production focus has shifted toward lighter vehicles that consume less fuel, such as those found within the growing electric vehicle segment. This transition has driven an increase in demand for advanced materials such as polycarbonate plastics and epoxy resins produced using cumene hydroperoxide as a precursor. Polycarbonate plastics, known for their strength, transparency, and lightweight properties are being increasingly utilized in automotive component production such as windows, bumpers, and interior components.

This trend is being fueled by both the desire to decrease the overall weight of vehicles to enhance energy efficiency and range as well as meet environmental regulations such as reduced CO2 emissions. As the EV market expands across regions like Europe, North America, and China, demand for phenol-based materials and resins should increase significantly, creating an opportunity for cumene hydroperoxide market players as this chemical plays an essential part in producing high-performance materials. Furthermore, lightweight trends combined with global energy conservation efforts point towards further opportunities in this market growth.

Global Cumene Hydroperoxide Market: Research Scope and Analysis

By Production

Zeolite is projected to maintain its dominance in the production type segment, capturing 60.4% of the market share in 2025, due to its central role in producing cumene as an essential precursor for its synthesis into cumene hydroperoxide. Zeolite catalysts have increasingly become preferred over traditional catalysts due to their numerous benefits for producing cumene hydroperoxide. Zeolites are microporous aluminosilicate minerals with unique physical and chemical properties that make them highly thermally stable, exceptional catalytic agents, and have the ability to promote chemical reactions selectively. Zeolite's popularity can be attributed to its superior performance when compared with other catalytic materials like aluminum chloride.

Zeolite catalysts feature longer lifespans, fewer maintenance needs, and higher yields resulting in increased economic efficiency in cumene production. Furthermore, these green materials produce less waste while being easier to regenerate, aligning perfectly with a growing focus on sustainability and green chemistry initiatives. Technological advancements such as the development of more effective zeolite catalysts with improved selectivity and stability will only serve to solidify its market leadership position. Furthermore, an increase in production efficiencies, waste reduction strategies, and overall sustainability measures is expected to further rely on zeolite catalysts.

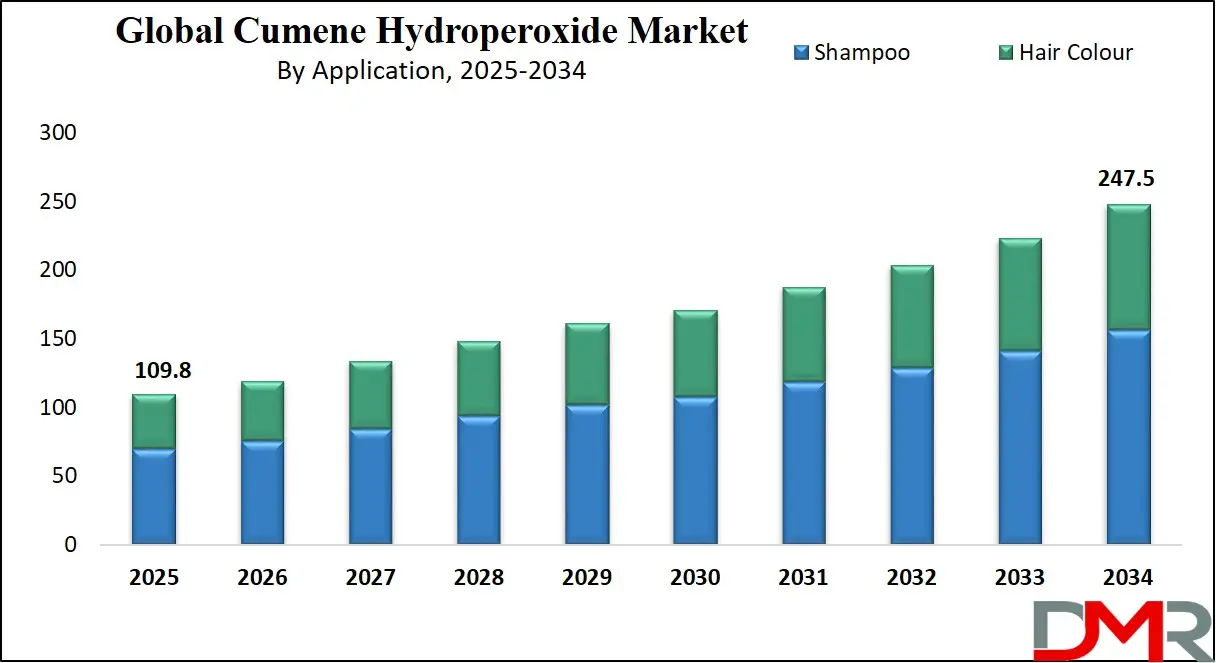

By Application

Phenol is poised to maintain its dominance in the application type segment

capturing 63.1% of the total market share in 2025 due to its extensive use in multiple industrial processes and as a precursor for various chemicals and materials production processes. Phenol plays an essential part in the production of bisphenol A (BPA), an ingredient used to manufacture polycarbonate plastics and epoxy resins used in numerous high-demand sectors such as automotive, construction, electronics, and aerospace applications. The automotive and electronics industries' increasing use of lightweight materials is driving demand for phenol.

Polycarbonate plastics, known for their durability, transparency, and lightweight qualities, are widely utilized in vehicle parts manufacturing as well as consumer electronics production and medical device production. The increase in electric vehicle (EV), sales has upsurged polycarbonate demand as manufacturers work to reduce vehicle weight to improve energy efficiency and overall performance. Phenol is essential in the production of phenolic resins, used for adhesives, coatings, electrical laminates, and insulation materials. Phenol resins have become essential components in industries requiring high-performance materials like construction and infrastructure development as they offer heat resistance, chemical stability, and insulating properties that make them highly sought after.

The Global Cumene Hydroperoxide Market Report is segmented on the basis of the following

By Production

- Zeolite

- Solid phosphoric acid

- Aluminum chloride

By Application

- Phenol

- Phenol resins

- Caprolactam

- Bisphenol A

- Alkylphenols

- Others

- Acetone

- Solvent use

- Methyl methacrylate

- Bisphenol A

- Aldol Chemicals

- Others

Global Cumene Hydroperoxide Market: Regional Analysis

Asia-Pacific is anticipated to lead the global cumene hydroperoxide landscape

with 50.4% of total global market revenue in 2025, due to rapid industrialization, strong end-user product demand, and growing chemical production capacities. One key contributor to Asia-Pacific's dominance is its industrial development, especially within major economies like China, India, and Japan. This region is home to some of the world's largest automotive, construction, and electronics industries, all relying heavily on cumene hydroperoxide-derived products like phenol and acetone for production. China and India's automotive industries are experiencing rapid expansion, particularly their electric vehicle (EV) sectors which demand lightweight materials like polycarbonate plastics and advanced epoxy resins made of phenol, a derivative of cumene hydroperoxide.

Asia-Pacific's construction sector is one of the key contributors to its dominance of the cumene hydroperoxide market. As Asia experiences rapid urbanization, infrastructure development, and industrialization in emerging economies, the demand for high-performance materials like phenolic resins used for adhesives, coatings, and insulation increases exponentially. These resins have proven essential in modern construction due to their durability, heat resistance, and electrical insulating properties, making them essential in developing new buildings, infrastructure projects, and electrical systems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Cumene Hydroperoxide Market: Competitive Landscape

Cumene hydroperoxide market competition is marked by both large multinational corporations and regional players utilizing strategies such as mergers and acquisitions, technological innovations, product diversification, and geographic expansion to strengthen their positions in the market. Industry giants such as BASF, LG Chem, and Huntsman Corporation dominate this field due to their formidable production capacities, wide product offerings, and vast research and development resources.

BASF is a top player in the global chemical industry and is best known for its production of cumene hydroperoxide and its derivatives. BASF invests actively in advanced manufacturing processes and sustainability initiatives, ensuring it remains competitive within its market segment. Furthermore, their focus on creating environmentally friendly solutions in line with global trends for sustainable chemical production has ensured their leadership position.

LG Chem, an established South Korean chemical company, has also made significant strides in the cumene hydroperoxide sector. Their integrated production of petrochemicals and strong position in Asia-Pacific give them an edge when meeting growing demand in emerging markets. Huntsman Corporation, a global producer of diverse chemicals, is also an influential player in the cumene hydroperoxide market. Huntsman has invested in increasing its market share through acquisitions and partnerships.

Some of the prominent players in the Global Cumene Hydroperoxide are

- Braskem

- Cepsa

- Chang Chun Group

- CITGO

- Domo Chemicals

- Dow

- INEOS

- Koch Industries Inc.

- Kumho P&B Chemicals Inc.

- Prasol Chemicals Pvt. Ltd

- Royal Dutch Shell PLC

- SABIC

- Versalis SpA

- Other Key Players

Global Cumene Hydroperoxide Market: Recent Developments

- March 2023: BASF announced the acquisition of a leading chemical manufacturing facility in Singapore. This strategic move aimed to enhance BASF's production capacity for cumene hydroperoxide and other key chemicals, catering to the growing demand in the Asia-Pacific region. The acquisition is expected to bolster BASF's market share and operational efficiency in the region.

- June 2022: LG Chem unveiled a state-of-the-art production line for cumene hydroperoxide at its facility in Ulsan, South Korea. This new line utilizes cutting-edge technology to improve production efficiency and reduce environmental impact. The launch aligns with LG Chem's commitment to sustainability and its strategy to meet the increasing demand for high-quality cumene hydroperoxide in various industries.

- September 2021: Huntsman Corporation entered into a joint venture with India's Reliance Industries to establish a new cumene hydroperoxide production facility in Gujarat, India. This partnership aimed to leverage Reliance's extensive distribution network and Huntsman's technological expertise to serve the growing demand in the Indian market.

- August 2021: Arkema S.A., a global leader in specialty chemicals, announced its entry into the cumene hydroperoxide market through the acquisition of a production facility in the United States. This strategic move aimed to diversify Arkema's product portfolio and strengthen its position in the North American chemical industry. The facility is expected to enhance Arkema's capabilities in producing high-quality cumene hydroperoxide for various applications, including epoxy resin curing and organic synthesis.

- December 2020: SABIC announced a significant investment in research and development to enhance the sustainability of its cumene hydroperoxide production processes. The company introduced a new catalyst system designed to increase yield and reduce energy consumption, reflecting SABIC's commitment to environmental responsibility and operational excellence.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 33.7 Bn |

| Forecast Value (2034) |

USD 63.9 Bn |

| CAGR (2025-2034) |

7.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 10.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Production (Zeolite, Solid Phosphoric Acid, and Aluminum Chloride), and By Application (Phenol, Acetone, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Braskem, Cepsa, Chang Chun Group, CITGO, Domo Chemicals, Dow, INEOS, Koch Industries Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global cumene hydroperoxide market size is estimated to have a value of USD 33.7 billion in 2025 and is expected to reach USD 63.9 billion by the end of 2034.

The US cumene hydroperoxide market is projected to be valued at USD 10.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 19.3 billion in 2034 at a CAGR of 7.0%.

Asia Pacific is expected to have the largest market share in the global cumene hydroperoxide market with a share of about 50.4% in 2025.

Some of the major key players in the global cumene hydroperoxide market are Braskem, Cepsa, Chang Chun Group, CITGO, Domo Chemicals, Dow, INEOS, Koch Industries Inc., and many others.

The market is growing at a CAGR of 7.4 percent over the forecasted period.