Market Overview

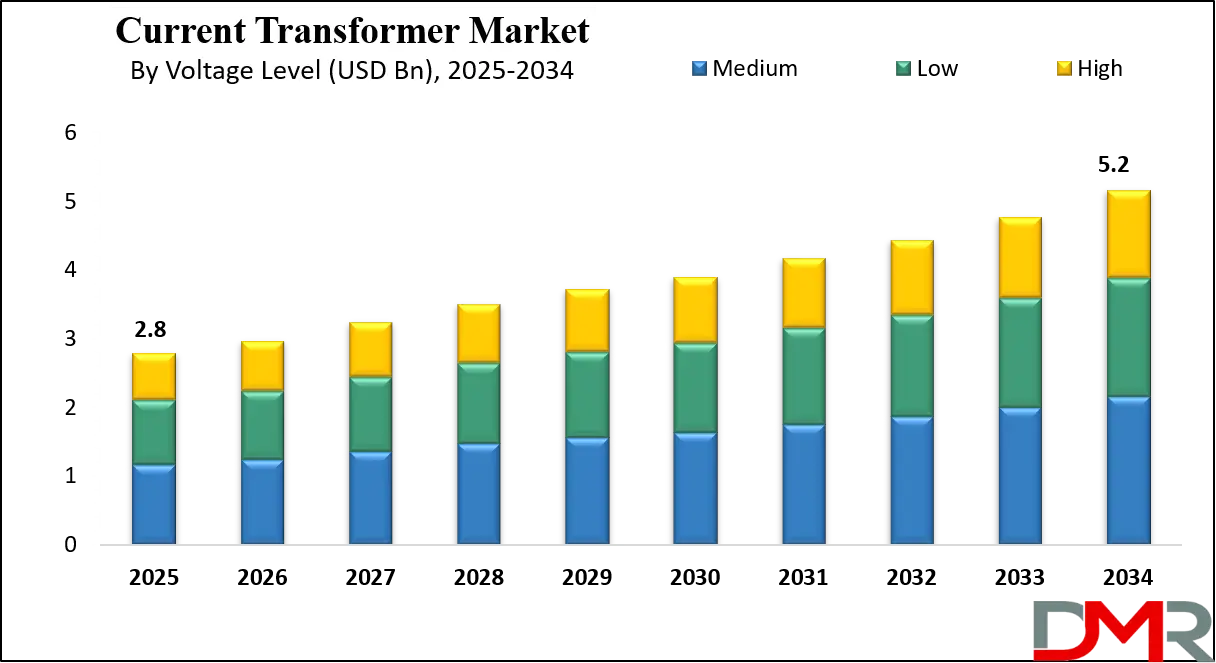

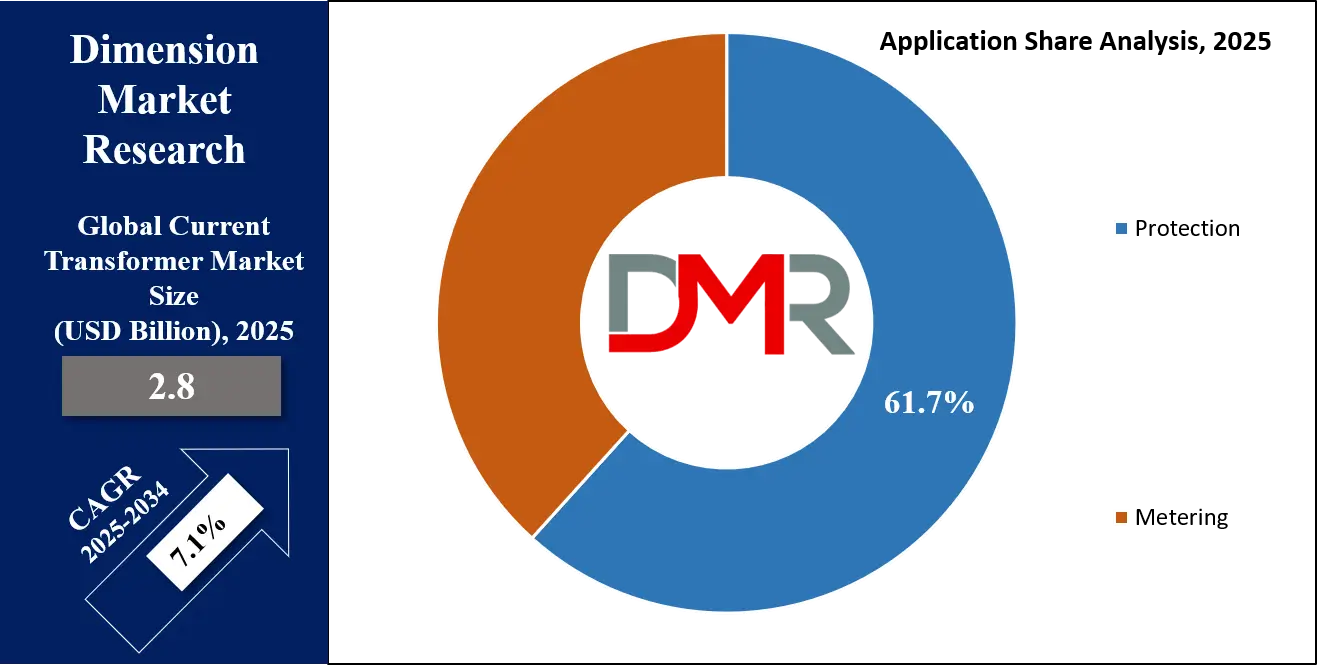

The Global Current Transformer Market size is projected to reach USD 2.8 billion in 2025 and grow at a compound annual growth rate of 7.1% from there until 2034 to reach a value of USD 5.2 billion.

A current transformer (CT) is an electrical device used to measure and monitor high-voltage current by converting it into a lower, safer level that can be easily read by standard instruments. It works by producing a current in its secondary coil that is proportional to the current flowing in its primary circuit. CTs are essential components in power systems for metering and protection, ensuring the smooth and safe operation of power grids, transformers, and other electrical equipment.

The growing demand for electricity across industrial, commercial, and residential sectors is pushing the need for reliable and efficient power infrastructure, which in turn drives the demand for current transformers. Modern power systems need accurate monitoring and fault detection, especially as smart grids become more widespread.

Additionally, the expansion of renewable energy installations, such as wind and solar farms, adds complexity to the grid, requiring precise current measurement and protection, further boosting the use of CTs.

One of the major trends in this market is the rising adoption of digital and smart current transformers. These advanced versions offer higher accuracy and better data communication, aligning with the growing use of automation and Internet of Things (IoT) technologies in power systems. Another noticeable trend is the miniaturization of components to fit compact electrical setups, especially in urban or modular energy systems. There is also an increasing focus on maintenance-free and self-powered transformers that reduce long-term operating costs.

In recent years, the rollout of smart grids and intelligent substations has created fresh opportunities for current transformer manufacturers. Governments and utilities are heavily investing in grid modernization projects to enhance energy efficiency, reliability, and flexibility. These efforts often include the deployment of advanced current transformers that can communicate real-time data to central systems. This shift is transforming CTs from basic measuring tools to vital elements in digital energy infrastructure.

There has also been a major focus on environmentally friendly insulation materials and sustainable manufacturing practices in transformer production. In response to stricter regulations and climate goals, manufacturers are innovating CT designs to lower energy loss and minimize environmental impact. Dry-type transformers, for instance, are gaining preference in specific applications due to their safer, non-oil design.

Events such as infrastructure upgrades in developing countries, increased urbanization, and industrial automation have further supported the market for CTs. Power utilities, renewable energy firms, and heavy industries continue to invest in systems requiring accurate and secure current measurement, reinforcing the current transformer’s role as a critical component in global power systems.

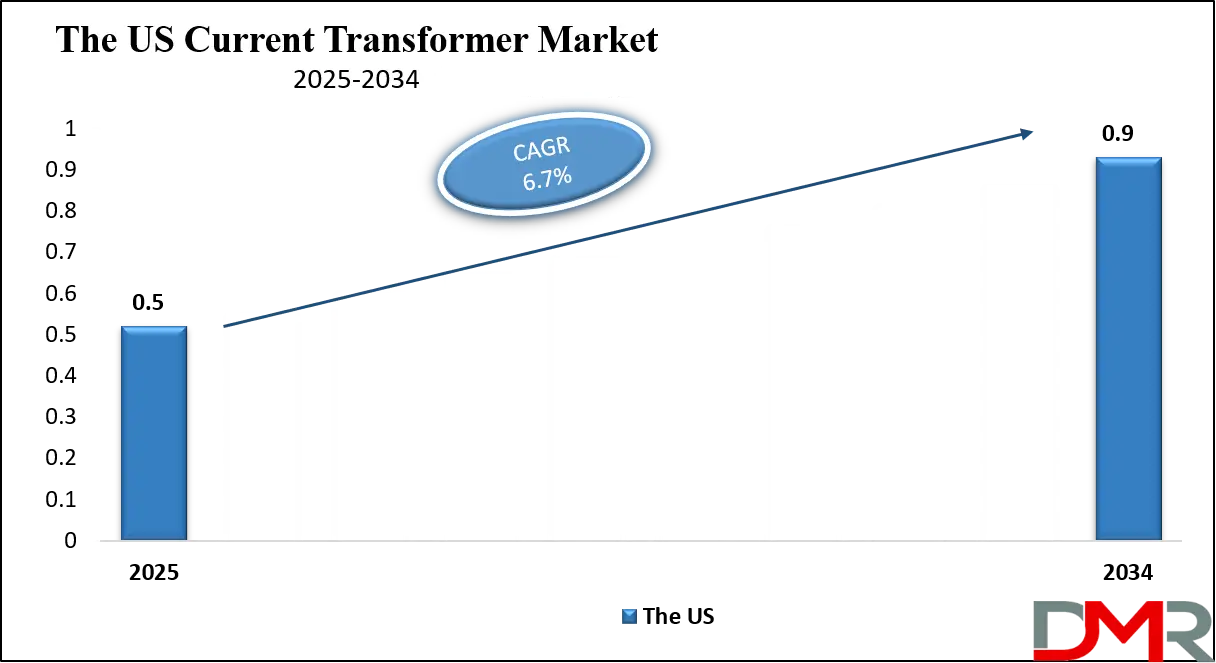

The US Current Transformer Market

The US Current Transformer Market size is projected to reach USD 0.5 billion in 2025 at a compound annual growth rate of 6.7% over its forecast period.

The US plays a significant role in the current transformer market due to its advanced power infrastructure, growing renewable energy projects, and rapid adoption of smart grid technologies. With widespread investments in grid modernization, the US drives demand for high-precision and digital current transformers. The country also supports innovation through strong R&D, encouraging the development of smarter, more efficient CTs. Its industrial sector, including manufacturing, oil and gas, and data centers, relies heavily on accurate current monitoring, further boosting market needs.

Additionally, government policies promoting energy efficiency and infrastructure upgrades support consistent demand. The US also acts as a key exporter of high-performance transformers and sets technology benchmarks that influence global CT market trends.

Europe Current Transformer Market

Europe Current Transformer Market size is projected to reach USD 0.7 billion in 2025 at a compound annual growth rate of 6.4% over its forecast period.

Europe plays a vital role in the current transformer market through its strong emphasis on sustainability, grid reliability, and renewable energy integration. Countries across Europe are heavily investing in modernizing aging power infrastructure, which boosts the demand for advanced and smart current transformers. The region’s push for clean energy, including large-scale wind and solar installations, requires precise current measurement and protection solutions. Europe also has strict regulatory standards for energy efficiency and safety, driving the adoption of high-quality CTs.

Additionally, European manufacturers are known for innovation in compact, digital, and eco-friendly designs. The presence of major energy and automation companies, combined with supportive government policies, positions Europe as a key market and technology leader in the global CT industry.

Japan Current Transformer Market

Japan Current Transformer Market size is projected to reach USD 0.1 billion in 2025 at a compound annual growth rate of 7.3% over its forecast period.

Japan plays a key role in the current transformer market due to its advanced electrical infrastructure, strong industrial base, and focus on energy efficiency. The country emphasizes precise current monitoring in sectors like manufacturing, automation, and smart buildings, driving demand for compact and high-performance current transformers.

Japan is also a leader in technological innovation, contributing to the development of miniaturized and digital CTs suited for space-constrained applications. With ongoing efforts to improve disaster-resilient energy systems and modernize aging grids, current transformers are essential for system protection and load management. Japan's commitment to renewable energy, especially solar and offshore wind, further expands CT usage. Its high standards and quality-driven market set a benchmark for precision and reliability in the global CT industry.

Current Transformer Market: Key Takeaways

- Market Growth: The Current Transformer Market size is expected to grow by USD 2.2 billion, at a CAGR of 7.1%, during the forecasted period of 2026 to 2034.

- By Voltage Level: The Medium segment is anticipated to get the majority share of the Current Transformer Market in 2025.

- By Application: The protection segment is expected to get the largest revenue share in 2025 in the Current Transformer Market.

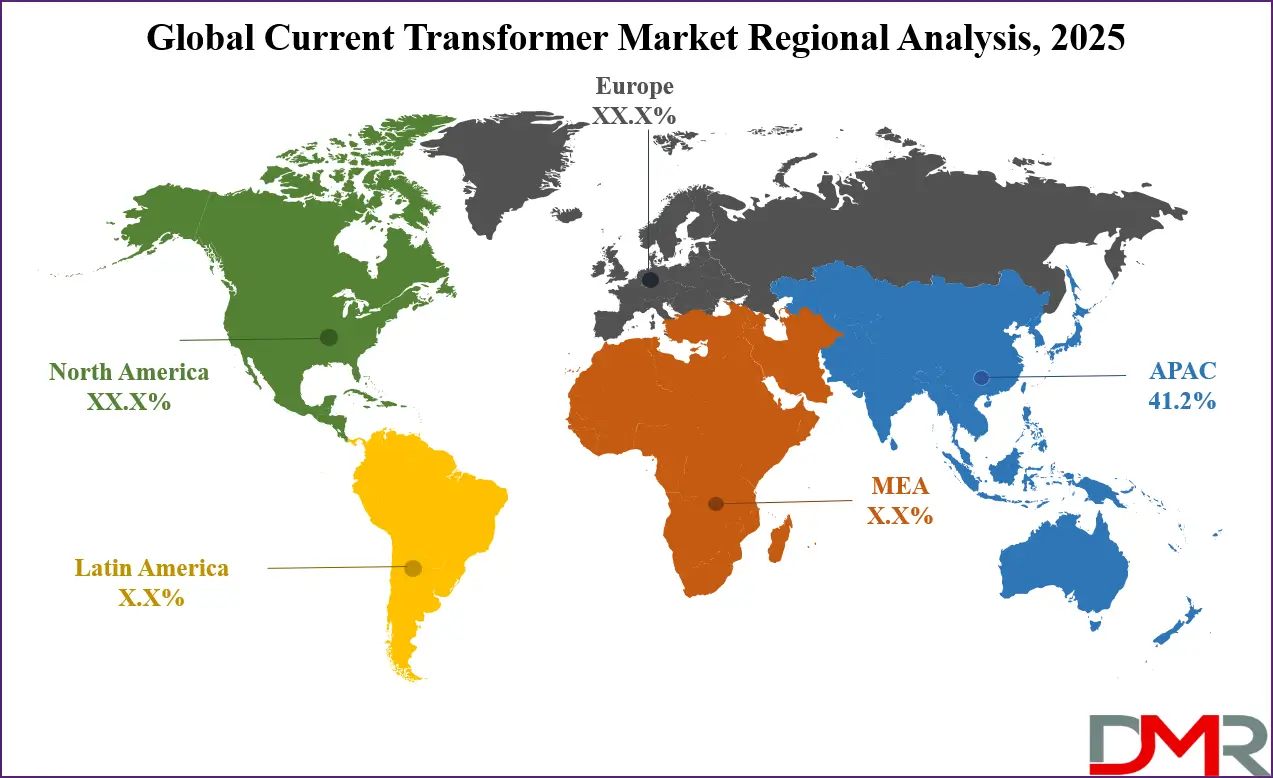

- Regional Insight: Asia Pacific is expected to hold a 41.2% share of revenue in the Global Current Transformer Market in 2025.

- Use Cases: Some of the use cases of the Current Transformer include industrial automation, railway electrification, and more.

Current Transformer Market: Use Cases

- Power Grid Monitoring: Current transformers are widely used in high-voltage power grids to monitor current flow and ensure system stability. They help detect faults, prevent overloads, and support safe electricity distribution. Their accurate measurement allows for better control of power systems in real time.

- Industrial Automation: In factories and large industrial setups, current transformers play a key role in managing electrical equipment. They provide precise current readings that support the operation of automated machines and help in predictive maintenance. This leads to improved safety and reduced downtime.

- Renewable Energy Systems: Current transformers are crucial in solar and wind power installations to measure generated current and integrate it smoothly with the main grid. They ensure safe operation and effective performance tracking. Their use supports stable power delivery from variable sources.

- Railway Electrification: Electric rail systems use current transformers for protection and metering in traction power networks. They help detect irregular currents and protect sensitive components from damage. This ensures uninterrupted and safe operation of trains and infrastructure.

Market Dynamic

Driving Factors in the Current Transformer Market

Expansion of Smart Grids and Digital Infrastructure

The rapid development and adoption of smart grids across many countries is a major growth driver for the current transformer market. These modern grids require real-time data monitoring, automation, and advanced fault detection, all of which depend heavily on precise current measurement. Current transformers enable utilities to collect accurate load data, monitor system health, and ensure proper operation of protection relays.

As governments invest in digital infrastructure to improve energy efficiency and reduce transmission losses, the demand for smart and digital current transformers is rising. Integration with IoT platforms and data analytics systems is also pushing the market forward. This digital shift is not only transforming legacy grids but also creating new opportunities in both developed and developing economies.

Rising Renewable Energy Integration

The increasing use of renewable energy sources like wind, solar, and hydro power has created a growing need for current transformers in distributed energy systems. These sources produce variable power outputs that must be carefully measured and managed to maintain grid stability. Current transformers help monitor the flow of electricity from these sources, allowing safe and efficient integration with existing transmission lines.

As renewable energy projects expand globally, especially in regions focused on reducing carbon emissions, the role of current transformers becomes even more critical. The growth of microgrids, hybrid power systems, and energy storage solutions further contributes to the expanding use of CTs. This trend is expected to continue as clean energy policies gain more traction worldwide.

Restraints in the Current Transformer Market

High Cost of Advanced Current Transformers

One of the key restraints in the current transformer market is the high cost associated with advanced and digital CTs. These modern units often require specialized components, high-grade insulation, and built-in communication capabilities, which significantly increase their production costs. For many small and mid-sized utilities or industrial users, these expenses can be a major barrier to adoption, especially in regions with tight budgets or low infrastructure spending.

Additionally, the cost of installation, calibration, and ongoing maintenance adds to the overall investment. In price-sensitive markets, this limits the shift from conventional to smart CT technologies. The lack of affordability may slow down modernization efforts in areas where cost-efficiency remains the top priority.

Complex Installation and Technical Challenges

Installing and maintaining current transformers, especially in high-voltage or densely packed electrical systems, can be technically challenging. These devices require precise alignment, insulation, and testing to function correctly, and any errors can lead to safety risks or inaccurate readings. Skilled labor is needed for proper setup, which is not always readily available in all regions, particularly in developing countries.

Furthermore, as systems become more complex, the need for specialized training and tools increases. This technical barrier can delay deployment and discourage smaller operators from upgrading to newer CT models. It also raises the risk of system errors, reducing user confidence in the long-term performance of advanced solutions.

Opportunities in the Current Transformer Market

Growth in the Electrification of Developing Regions

The ongoing electrification efforts in developing countries present a strong opportunity for the current transformer market. Governments and utility providers in these regions are investing in new transmission lines, substations, and rural electrification projects to meet the rising electricity demand. As power networks expand, the need for reliable current measurement and protection increases, directly supporting the demand for CTs.

Moreover, with international support and funding for infrastructure development, these markets are becoming more accessible to manufacturers. Affordable and durable current transformers suited for challenging environments can find strong adoption. The push for stable and safe electricity supply in remote areas will continue to create steady market openings in Asia, Africa, and parts of Latin America.

Advancements in Smart Metering and Energy Monitoring

The growing focus on energy efficiency and grid transparency is fueling the adoption of smart metering systems, which rely heavily on accurate current transformers. As industries, utilities, and even residential users seek to better understand their power usage, demand for CTs with digital output, high precision, and integration capabilities is on the rise. These smart transformers allow for real-time current tracking, helping reduce energy losses and detect anomalies faster.

This creates new opportunities for CT makers to collaborate with smart meter manufacturers, automation companies, and building management system providers. As energy management becomes central to both environmental and cost-saving strategies, CTs designed for digital and IoT-enabled systems will be increasingly in demand.

Trends in the Current Transformer Market

Rise of Smart, Digital & IoT-Enabled CTs

Current transformers are increasingly built with digital intelligence—integrated sensors, microprocessors, and communication modules—allowing real-time monitoring, diagnostics, and remote data transfer. These smart CTs support grid automation, predictive maintenance, and faster fault detection, making them ideal for modern substations and industrial environments. Integration with IoT platforms enables utilities to gather detailed load data and respond proactively to anomalies across the network. The result is enhanced reliability and efficiency in energy distribution, aligning with global moves toward digitized infrastructure.

Adoption of Advanced CT Technologies (Optical & Rogowski Designs)

There's a growing shift from traditional iron-core CTs to advanced designs like optical and Rogowski coil-based transformers. Optical CTs leverage fiber‑optic sensing for immunity to electromagnetic interference, reduced weight, and more accurate, fast response in high-voltage settings. Meanwhile, Rogowski coils are flexible, installation‑friendly, and great at capturing high-frequency and harmonic currents without saturation issues. These technologies address challenges posed by harmonics, variable renewable inputs, and pulsed loads—offering precise and adaptable current measurement in modern electrical systems.

Research Scope and Analysis

By Type Analysis

Wound current transformer, leading in 2025 with a share of 31.6%, is expected to play a major role in the growth of the current transformer market due to its accuracy, durability, and wide application in power systems. This type is commonly used in high-current and high-voltage environments, making it ideal for substations, power plants, and large industrial facilities. Its strong insulation properties and stable performance make it reliable for both metering and protection purposes.

The demand for wound-type transformers is increasing with the expansion of grid networks, renewable energy projects, and smart substations. Utilities and industries prefer them for their ability to deliver consistent readings even under load variations. With grid modernization and infrastructure upgrades happening across regions, this segment is expected to maintain strong demand and steady adoption, especially in applications where long-term performance, safety, and high precision in current sensing are required.

Further, Rogowski coil, having significant growth over the forecast period, is gaining popularity in the current transformer market due to its flexible design and ease of installation. Unlike traditional types, it does not saturate under high currents and is well-suited for applications that require measurement of alternating current with changing frequencies. The growing use of power electronics, renewable energy systems, and Smart Grid Sensors is driving the adoption of Rogowski coils for monitoring dynamic load conditions.

These coils are lightweight, compact, and offer excellent performance in detecting harmonic currents and transient events. Their role is becoming more important in modern electrical systems, where accurate current measurement and space-saving solutions are needed. As more utilities and industries look for reliable and non-intrusive current sensing technologies, the Rogowski coil segment is expected to see steady growth, especially in advanced monitoring systems, building automation, and compact switchgear setups.

By Voltage Level Analysis

Medium voltage segment as a voltage level, leading in 2025 with a share of 41.8%, is expected to remain the backbone of the current transformer market’s growth, thanks to its broad usage in industrial distribution networks, commercial buildings, and utility substations. These transformers are essential for monitoring and protecting equipment in voltage ranges typically between 1kV and 36kV, where power demand and risk factors are higher. The expansion of medium-voltage distribution networks, especially in fast-developing urban and semi-urban areas, is a major driver.

Growing demand for reliable energy supply, smart metering, and fault detection systems further boosts this segment’s adoption. Infrastructure upgrades, renewable energy projects, and industrial automation all require efficient and accurate current sensing in the medium voltage range. With ongoing grid expansion and modernization efforts across regions, the segment will continue to attract strong investment and remain central to power system operations.

Further, Low-voltage segment, having significant growth over the forecast period, is rapidly gaining momentum as industries and commercial users seek affordable and compact solutions for power monitoring. These CTs are widely used in panel boards, smart meters, and energy management systems where current measurement below 1kV is required. The segment benefits from growing urbanization, increasing deployment of building automation, and the rising demand for energy efficiency in homes, offices, and small industries.

Their ease of installation, cost-effectiveness, and compatibility with smart devices make them popular across both new constructions and retrofit projects. As the need for precise power usage data grows across low-load applications, these transformers are playing a key role in enabling real-time energy tracking and helping users manage consumption. Their increasing use in smart homes and low-voltage distribution systems supports steady market growth across developed and developing economies alike.

By Application Analysis

The protection application segment, leading in 2025 with a share of 61.7%, will continue to drive the core growth of the current transformer market as power systems become more complex and sensitive to faults. This segment plays a critical role in safeguarding electrical infrastructure by isolating faults, detecting abnormal currents, and triggering safety systems like circuit breakers. With rising power consumption, grid modernization, and the integration of renewable energy, the risk of overloads and short circuits has increased, making protection transformers more important than ever.

Utilities and industries rely on these CTs to maintain system stability and avoid costly downtime or equipment damage. Their accuracy, reliability, and compatibility with protective relays make them essential in both high-voltage and medium-voltage applications. As the demand for uninterrupted power and operational safety rises globally, protection-focused current transformers will remain a strategic necessity in all major energy and industrial networks.

The metering application segment, having significant growth over the forecast period, is gaining strong momentum as precision and energy management become top priorities for utilities and businesses. These current transformers are mainly used in billing systems, energy audits, and load profiling across residential, commercial, and industrial setups. The growth of smart metering infrastructure, driven by rising electricity costs and government mandates, is increasing the adoption of metering CTs.

Their ability to deliver accurate and consistent readings helps utilities track energy use and reduce transmission losses. With the rise of distributed energy systems and smart grids, metering transformers are also being integrated into advanced monitoring platforms. Their role in supporting real-time energy analytics and efficient grid management ensures this segment continues to expand, especially in urban areas and regions undergoing digital transformation of their power networks.

By End Use Vertical Analysis

Power utilities segment, leading in 2025 with a share of 47.2%, will continue to be the backbone of the current transformer market as global energy demands increase and grids become more dynamic. Utility companies require reliable and accurate current transformers for fault detection, load monitoring, and system protection across transmission and distribution networks. With major investments flowing into upgrading outdated infrastructure and expanding grid capacity, CTs are essential to ensure uninterrupted power delivery.

The integration of smart grid systems, automation technologies, and remote monitoring has made advanced CTs even more valuable. Power utilities also rely on these transformers to comply with safety standards and support energy efficiency initiatives. As energy consumption rises across urban and rural areas, the role of CTs in power utility operations will expand, making them indispensable for stable, efficient, and intelligent energy management systems worldwide.

The renewables segment, having significant growth over the forecast period, is emerging as a strong force in shaping the future of the current transformer market. Solar farms, wind parks, and other clean energy projects depend heavily on current transformers for monitoring, control, and grid synchronization. As renewable sources produce variable power outputs, CTs are crucial for detecting fluctuations and maintaining system balance.

Their role in ensuring safety, optimizing output, and enabling smooth energy flow into the grid is driving adoption. The global shift toward sustainable power generation, supported by policies and investments in green energy, is increasing the demand for compact, high-performance, and digitally ready current transformers. With the rise of distributed energy resources and hybrid power setups, renewables will continue to open new opportunities for CT deployment in both centralized and decentralized power networks.

The Current Transformer Market Report is segmented on the basis of the following:

By Type

- Wound

- Bar-Type

- Split-Core

- Rogowski Coil

- Clamp-On

By Voltage Level

- Low Voltage

- Medium Voltage

- High Voltage

By Application

By End Use Vertical

- Power Utilities

- Industrial

- Commercial

- Transportation

- Data Centers

- Renewables

- Others

Regional Analysis

Leading Region in the Current Transformer Market

Asia Pacific, leading in 2025 with a share of 41.2%, is playing the most vital role in the growth of the current transformer market due to rapid industrialization, urban development, and increasing investments in power infrastructure. Countries like China, India, South Korea, and Southeast Asian nations are heavily expanding their electrical grids to meet rising electricity demand.

The region is also witnessing a surge in renewable energy projects, including solar and wind, which require accurate current monitoring systems. With government support for smart grid development and infrastructure modernization, the use of current transformers is expanding quickly. Growing manufacturing activity and large-scale electrification in rural areas are further fueling demand. In addition, the presence of several key manufacturers and low production costs contribute to the market’s growth from within the region.

Fastest Growing Region in the Current Transformer Market

Middle East and Africa (MEA) is showing significant growth over the forecast period in the current transformer market, driven by rising investments in power generation, grid expansion, and industrial development. Countries in the Gulf Cooperation Council (GCC), such as Saudi Arabia and the UAE, are upgrading their electrical infrastructure to support smart grids and high-voltage transmission systems.

In Africa, expanding electrification projects and renewable energy installations, especially in solar power, are boosting the need for reliable current measurement and protection solutions. As industries and urban centers grow, the demand for compact, high-accuracy, and low-maintenance current transformers continues to increase across the MEA region, supporting steady market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The current transformer market is highly competitive, with many players offering a wide range of products for various power and industrial needs. The competition mainly revolves around technology upgrades, product quality, pricing, and the ability to deliver reliable performance in harsh conditions. Companies are focusing on innovation, such as smart and digital current transformers, to meet the rising demand for smart grid applications and better energy monitoring.

Some focus on customized solutions for specific industries like renewables or railways. Global expansion, partnerships, and investments in research and development are common strategies to stay ahead. Smaller manufacturers often compete by offering cost-effective alternatives, while larger players rely on strong distribution networks and long-standing customer relationships to maintain their market position.

Some of the prominent players in the global Current Transformer are:

- ABB

- Siemens

- Schneider Electric

- General Electric

- Eaton

- Mitsubishi Electric

- Toshiba

- Hitachi Energy

- CG Power and Industrial Solutions

- Instrument Transformers Limited (ITL)

- Kappa Electricals

- Beijing Power Equipment Group (BPEG)

- Mehru Electrical & Mechanical Engineers

- Sentran Corporation

- Shreem Electric Ltd.

- Huayi Electric Co., Ltd.

- TECNOL S.A.

- TBEA Co., Ltd.

- Orto Electric

- Indian Transformers Ltd.

- Other Key Players

Recent Developments

- In March 2025, JST Power Equipment announced that it will open a new padmount transformer factory in Wytheville, Virginia, in March 2025, following a strong 2024 and recent expansion in Mexico. The facility will focus on small-batch manufacturing of three-phase padmount transformers while also serving as a customer experience, service, and R&D center. Strategically located, it strengthens JST’s U.S. supply chain and operations, which, along with an enhanced online presence, highlights JST’s continued growth in power equipment and transformer technologies across North America.

- In March 2025, At CERAWeek, Hitachi Energy announced over USD 250 million in additional investments by 2027 to expand global production of key transformer components, which follows its recent USD 6 billion commitment and addresses the growing transformer shortage driven by rising electricity demand from AI and data centers. The expansion will boost manufacturing capabilities in the U.S., particularly in Virginia, Missouri, and Mississippi, enhancing transformer and component production, such as bushings and insulation, while strengthening supply chains for both Hitachi Energy and other manufacturers.

- In February 2025, Bourns, Inc. has introduced its new current transformer line, featuring the Model PCP300-T414250S. Built with high-efficiency permalloy, it minimizes heat loss and boosts energy efficiency, offering fast and precise power conversion ideal for power quality analysis. Designed for versatility, it supports a wide range of current measurements, including high-frequency sensing in power meters and motor load monitoring. With a 300 A current capacity and 3.5 kV dielectric strength, its protective housing ensures reliable and safe performance in demanding environments.

- In February 2025, Schneider Electric Infrastructure Ltd (SEIL) announced plans to expand its medium power transformer manufacturing capacity. In a regulatory filing, SEIL stated that its board approved the proposal during a meeting on February 11, 2025. The company will invest ₹13.6 crore, funded through internal accruals and/or borrowings, to increase production capacity by 1,500 MVA annually. This expansion aims to strengthen SEIL’s ability to meet growing demand and enhance its position in the medium power transformer segment.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 2.8 Bn |

| Forecast Value (2034) |

USD 5.2 Bn |

| CAGR (2025–2034) |

7.1% |

| The US Market Size (2025) |

USD 0.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Wound, Bar-Type, Split-Core, Rogowski Coil, and Clamp-On), By Voltage Level (Low Voltage, Medium Voltage, and High Voltage), By Application (Protection and Metering), By End Use Vertical (Power Utilities, Industrial, Commercial, Transportation, Data Centers, Renewables, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

ABB, Siemens, Schneider Electric, General Electric, Eaton, Mitsubishi Electric, Toshiba, Hitachi Energy, CG Power and Industrial Solutions, Instrument Transformers Limited (ITL), Ka ppa Electricals, Beijing Power Equipment Group (BPEG), Mehru Electrical & Mechanical Engineers, Sentran Corporation, Shreem Electric Ltd., Huayi Electric Co., Ltd., TECNOL S.A., TBEA Co., Ltd., Orto Electric, Indian Transformers Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Current Transformer Market size is expected to reach a value of USD 2.8 billion in 2025 and is expected to reach USD 5.2 billion by the end of 2034.

Asia Pacific is expected to have the largest market share in the Global Current Transformer Market, with a share of about 41.2% in 2025.

The Current Transformer Market in the US is expected to reach USD 0.5 billion in 2025.

Some of the major key players in the Global Current Transformer Market are ABB, Siemens, Schneider Electric, General Electric, and others

The market is growing at a CAGR of 7.1 percent over the forecasted period.