The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Cyber insurance also known as third-party cyber liability insurance protects businesses that are unable to prevent a cyberattack or data breach affecting their clients, which handles the legal costs associated with cyber liability lawsuits, including any fines or settlements that may come from such incidents.

Market Dynamic

The easy availability of personal data online & the growth in the use of social media have encouraged cybercriminals to engage in illegal activities, like selling medical records, personal information like identities, & credit card details on the dark web. Further, the demand for cyber insurance is on the rise. With a major portion of the global population spending a large time on online platforms, the number of cyber threats is a key driver of this growing demand. In addition, government & regulatory organizations have taken steps to increase cybersecurity defenses, further driving the demand for cyber insurance, mainly due to data privacy laws like the European General Data Protection Regulation & the Health Insurance Portability and Accountability Act.

However, the market faces challenges in terms of a lack of expertise & technical knowledge, along with rising concerns about cybersecurity & data privacy. The absence of a vast historical record of cyber incidents & a general lack of understanding poses a significant challenge to the market's growth.

Research Scope and Analysis

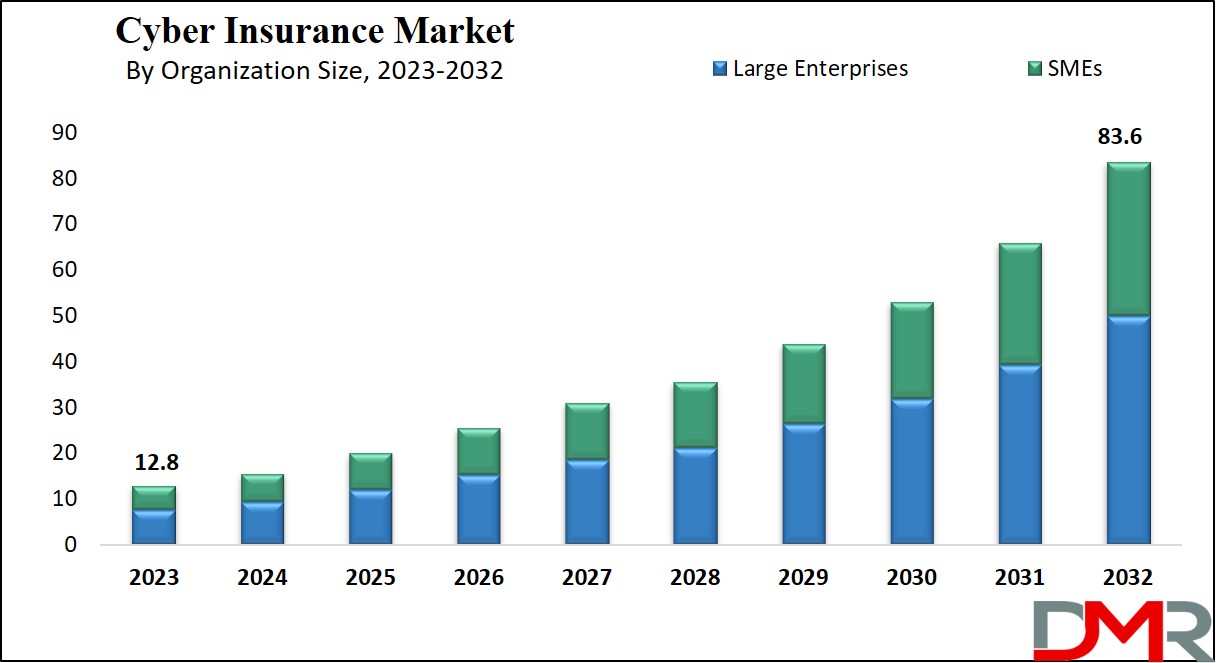

By Organization Size

The large enterprise segment dominates the market in 2023 & is projected to retain its domination over the forecast period. These organizations have a high spending capability to execute strong

cybersecurity solutions. In addition, large organizations are highly funded in cyber insurance policies to reduce risks related to a cyberattack. In addition, cyber insurance can highly contribute to enhancing computer security risk management in an organization, which is anticipated to further enhance the segment’s growth over the forecasted period.

Further, Small & medium enterprises (SMEs) are more at risk of cyberattacks as they don’t possess the essential security infrastructure. They are constantly looking to assess, identify, & respond to evolving threats. Cyber insurance has the potential to economize businesses by providing first-party & third-party protection coverage, as it includes business interruption, loss or damage to digital assets, online extortion, & theft of money along with computer forensics investigation, customer notification costs, loss of third-party data, multi-media liability, & third-party contractual indemnification.

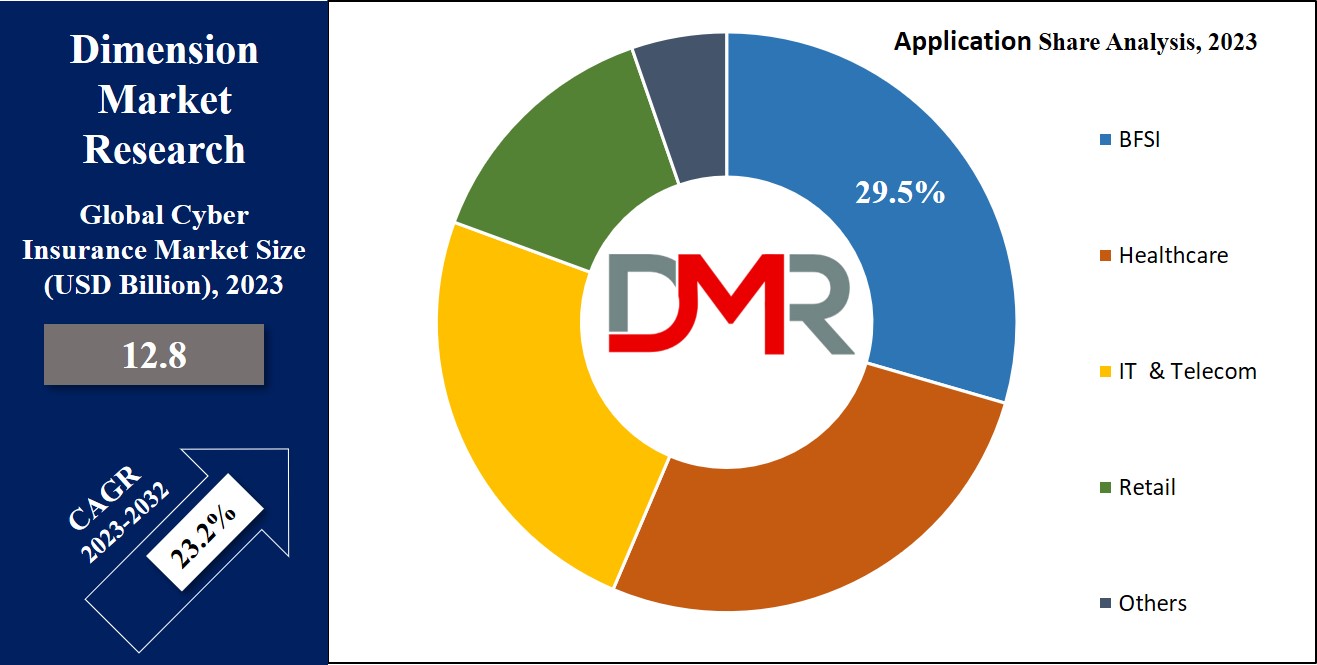

By Application

The BFSI (Banking, Financial Services, and Insurance) segment remains the dominant force in the cyber insurance market in 2023, as it has gained prominence due to the growth in monetary transactions it handles, making it a prime target for cybersecurity incidents, including extensive breaches, fraud, & heists. Given the important role of banking & financial services in the economy, protecting their security is of paramount importance. In addition, financial institutions & government agencies are highly adapting cyber insurance solutions to reduce increasing losses & enhance their overall risk management strategies.

Also, the healthcare segment is expected to exhibit a high growth rate in the coming years, as the

digital transformation in this sector has made patient data more accessible, but it has also raised concerns about online vulnerabilities. Sensitive healthcare information is highly exposed to both external & internal threats, making the sector an attractive end for hackers. To address these changing cyber threats, healthcare organizations are predicted to adopt cyber insurance as a practical measure to offset potential losses & strengthen their cybersecurity defenses.

The Cyber Insurance Market Report is segmented on the basis of the following:

By Organization Size

By Application

- BFSI

- Healthcare

- IT & Telecom

- Retail

- Others

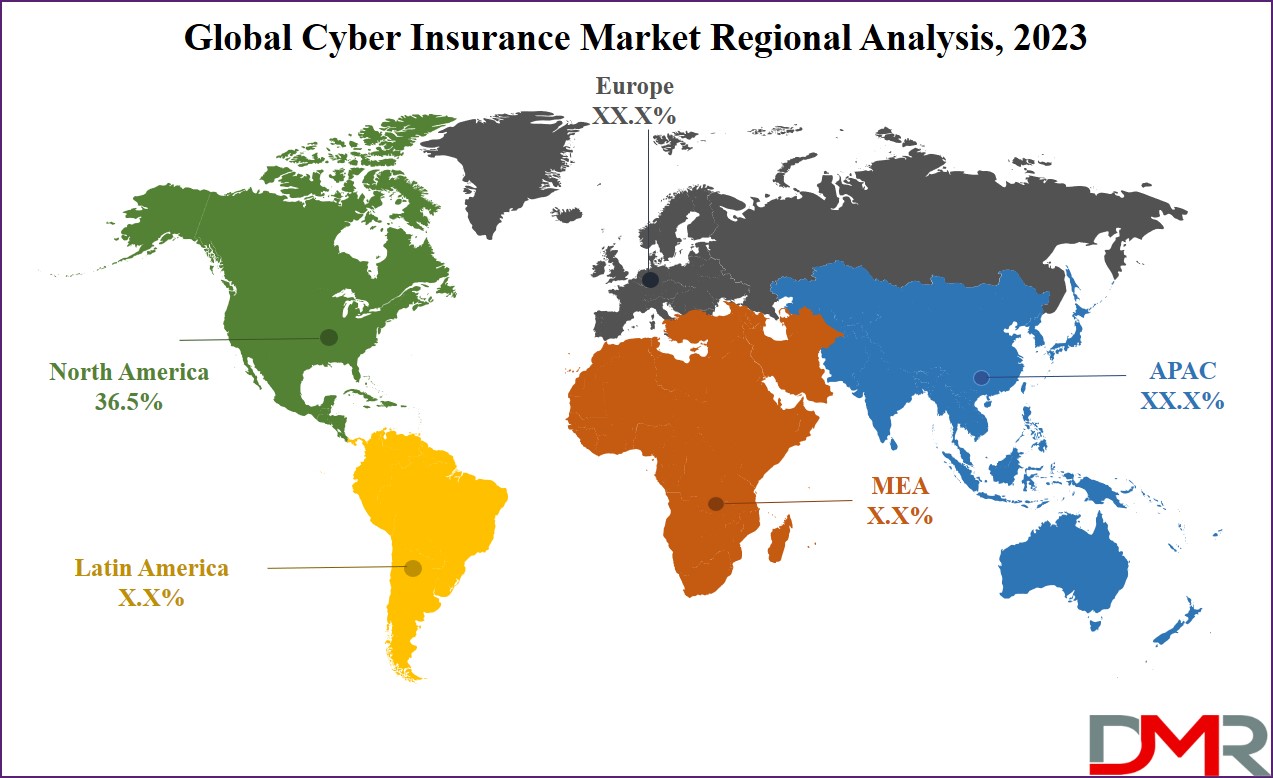

Regional Analysis

In 2023, the North American market leads the market with the major revenue

share at 36.5%. This can be said owing to the presence of major players like The Chubb Corporation and American International Group, Inc. The region's growth is further driven by increasing awareness of cyber insurance in small and medium-sized enterprises (SMEs), which is anticipated to boost demand in the coming years.

Also, the Asia Pacific region is expected to have significant growth during the forecasted period, primarily due to the growth in the occurrence of cybercrimes in developing countries like Australia, India, & China. The rise in prominence of Asian countries in the global economy has allowed governments to prioritize cybersecurity, leading to a growth in demand for cyber insurance. Insurers are looking for the opportunity to provide policies that cover cyber risks & underwrite cyber products, thus contributing to the expansion of cybersecurity strategies across various industries in the region.

By Region

North America

• The U.S.

• Canada

Europe

• Germany

• The U.K.

• France

• Italy

• Russia

• Spain

• Benelux

• Nordic

• Rest of Europe

Asia-Pacific

• China

• Japan

• South Korea

• India

• ANZ

• ASEAN

• Rest of Asia-Pacific

Latin America

• Brazil

• Mexico

• Argentina

• Colombia

• Rest of Latin America

Middle East & Africa

• Saudi Arabia

• UAE

• South Africa

• Israel

• Egypt

• Rest of MEA

Competitive Landscape

The cyber insurance market experiences moderate concentration, where major companies include advanced technology & expand their reach through established distribution networks. These tech-savvy leaders are committed to staying competitive by investing in new ideas, engaging in mergers & acquisitions, and forming partnerships to make sure they remain the leaders of the market.

For instance, in September 2022, The Coalition, a cyber insurance company based in San Francisco, expanded its services to assist small & medium-sized businesses in the USA to effectively handle cyber threats, by integrating cybersecurity tools, digital forensics access, monitoring, incident response, & comprehensive insurance coverage. As a result, the company expanded its customer base & ventured into the United Kingdom market, providing its expertise in managing & reducing cyber risks to a large audience.

Some of the prominent players in the global Cyber Insurance Market are:

- AON Plc

- American International Group Inc

- Berkshire Hathaway Inc

- AXA XL

- Munich Re Group

- Zurich Insurance Co Ltd.

- Allianz Global Corporate & Speciality

- XL Group

- The Chubb Corp

- Insureon

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Cyber Insurance Market:

The COVID-19 pandemic & the subsequent economic recession have had a significant impact on the global cyber insurance market. As businesses highly depend on digital technologies during the pandemic, cyber threats have grown in frequency & sophistication, which has driven up the need for cyber insurance as companies seek protection against data breaches & cyberattacks. However, the recession has also constrained budgets, leading some businesses to reevaluate their insurance spending. In addition, insurers have faced challenges in assessing & pricing cyber risks owing to the fast-evolving nature of the threat landscape. Further, while the pandemic boosted awareness of cyber insurance, economic uncertainties have influenced the market's growth, making it a dynamic & complex environment for insurers & businesses alike.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 12.8 Bn |

| Forecast Value (2032) |

USD 83.6 Bn |

| CAGR (2023-2032) |

23.2% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Organization Size (SMEs, Large Enterprises), By

Application (BFSI, Healthcare, IT & Telecom, Retail,

and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

AON Plc, American International Group Inc, Berkshire

Hathaway Inc, AXA XL, Munich Re Group, Zurich

Insurance Co Ltd., Allianz Global Corporate &

Speciality, XL Group, The Chubb Corp, Insureon, and

Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |