Market Overview

The

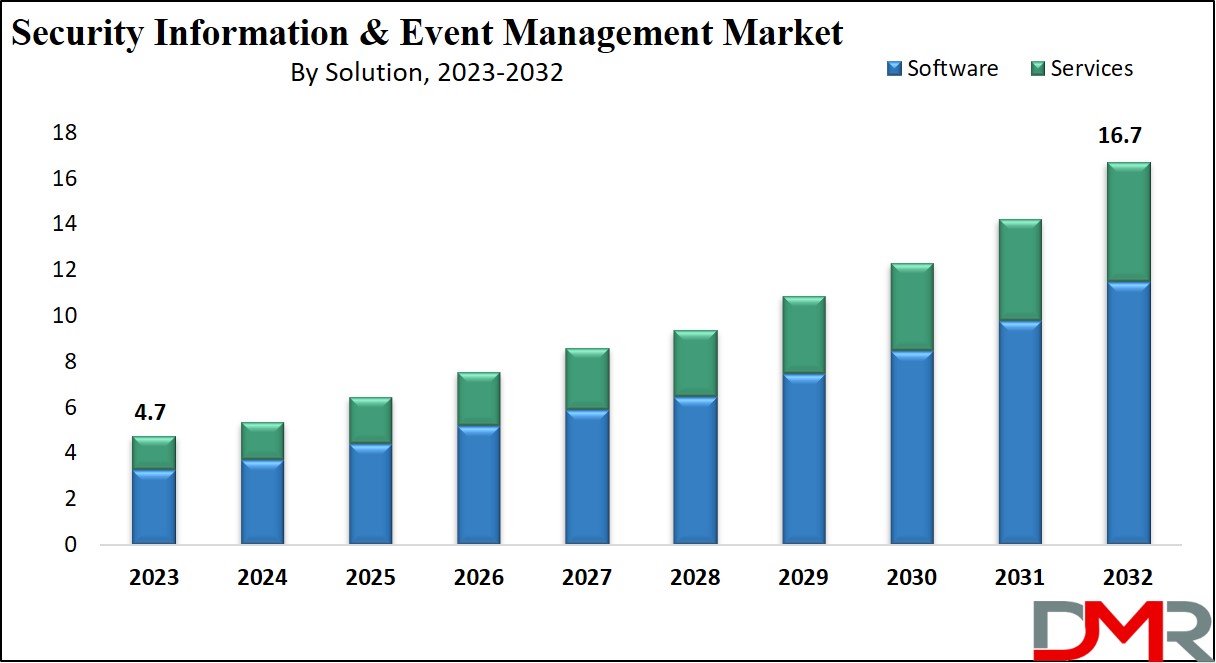

Global Security Information and Event Management Market (SIEM) is expected to reach a

value of USD 4.7 billion in 2023, and it is further anticipated to reach a market value of USD 16.7 billion by 2032 at a

CAGR of 15.0%. The market has seen a significant increase in the recent past and is predicted to grow significantly during the forecasted period as well.

Security Information & Event Management acts as a security tool that helps enterprises identify and reduce potential security threats & vulnerabilities constantly, avoiding disruptions in business operations. SIEM systems play a major role in detecting anomalies in user behavior & employing artificial intelligence to automate multiple manual processes related to recognizing threats & responding to incidents.

Further, in the future, there are chances of an increase in cyber-attack & security breach risks across industries, mainly in banking & healthcare. The likelihood of critical data extraction increases concerns. Thus, the market growth is further driven by factors like increasing security worries due to regulatory mandates & government access to national financial data.

Market Dynamic

In a fast-advancing

cybersecurity landscape, the adoption of emerging technologies increases vulnerabilities & trust-based security risks across systems. Sectors such as BFSI, retail, manufacturing, and IT & telecom using AI &

machine learning provide growth prospects. The Metaverse introduction brings a lot of security & privacy threats, requiring strong threat identification & secure device deployment. Among digitalization & industry shifts, the SIEM market holds favorable growth opportunities.

However, the effective implementation & management of SIEM technology need strong personnel equipped with expertise in areas like network architecture, security operations, & log analysis. Companies that lack a skilled workforce may find difficulties in the installation of SIEM solutions seamlessly, and integrating them with specific systems, & operating them to meet essential business needs.

Research Scope and Analysis

By Solution

In 2023, the software segment within the solution category generated high revenue for the global security information & event Management Market. Security information & event management software play a major role in identifying, addressing, & reducing cyber threats like malware, ransomware, & data breaches. By integrating event data & providing real-time analysis, this technology allows businesses to safeguard their data spread across diverse environments, driving substantial investments. Moreover, the importance of adhering to cybersecurity regulations has led organizations to adopt SIEM solutions, further driving market growth.

By Deployment

In 2023, the cloud-based segment takes center stage in the market, capitalizing on its cost-efficient nature. Cloud-based SIEM solutions created the advantage of lower installing expenses compared to their on-premise counterparts, which typically involve significant upfront costs in hardware & software infrastructure. Moreover, cloud-based options provide global coverage & easy data accessibility, catering particularly well to enterprises grappling with complex data storage requirements.

Further, the on-premise segment is also anticipated to a significant growth, with a high growth rate. On-premise SIEM solutions excel in giving high security & control over essential & critical organizational data. This model empowers businesses to maintain complete command over their SIEM platforms, facilitating customization according to clear business requirements.

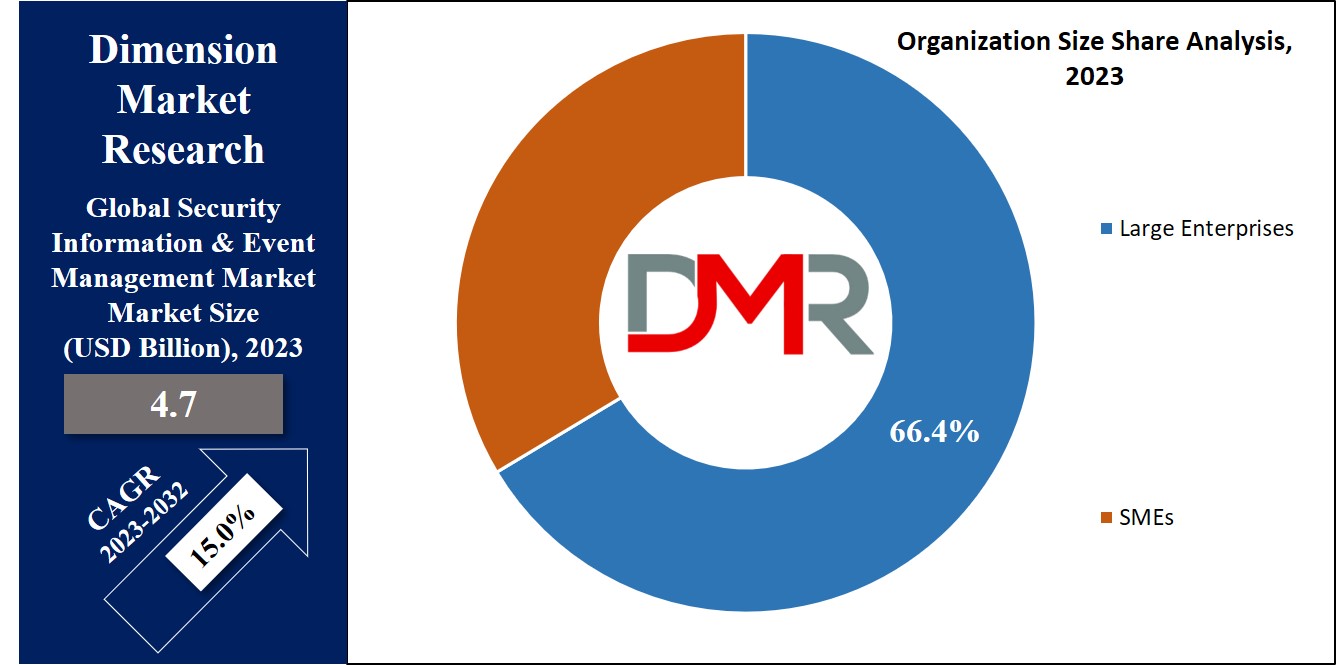

By Organization Size

The significant share of revenue in 2023 for the SIEM market is commanded by the large enterprise segment. In recent times, substantial cybersecurity breaches have troubled large enterprises due to their growing reliance on

edge computing, smart systems, digitalization, & IoT technology. In counter to this pressing concern, the adoption of SIEM technology has become major, offering real-time monitoring & corresponding activities across the enterprise network.

This capability needs large businesses to constantly identify & effectively counter potential threats. Moreover, SIEM technology plays a major role in identifying & reducing insider risks within these enterprises. Through the analysis of user activities, privileged access, & data exfiltration pathways, SIEM eases the detection of any suspicious or unauthorized actions carried out by insiders. By taking a proactive stance, organizations are made to take necessary measures to discard potential security breaches & ensure the safeguarding of their invaluable data & assets.

By End User Industry

In 2023, the IT & telecom sectors emerge as major industries, holding a significant share of the market. These sectors manage significant amounts of customer data, like sensitive financial information & personally identifiable details. Securing such data from breaches, unauthorized access, & internal threats is a major concern. Additionally, cybercriminals more often target these industries due to their potential for financial gain & the loads of valuable information they possess.

Within this industry, risks such as insider threats, distributed DDoS (denial-of-service) attacks, ransomware, & malware are general. Integrating SIEM software is essential to rapidly identifying & addressing security challenges, efficiently lowering the risk of data breaches while preserving the confidentiality of customers. This trend is anticipated to drive growth in the need for security information & event management solutions across the IT & telecom sectors.

The Global Security Information and Event Management Market Report is segmented on the basis of the following:

By Solution

By Deployment

By Organization Size

By End User Industry

- IT & Telecom

- BFSI

- Retail

- Healthcare

- Government

- Manufacturing

- Others

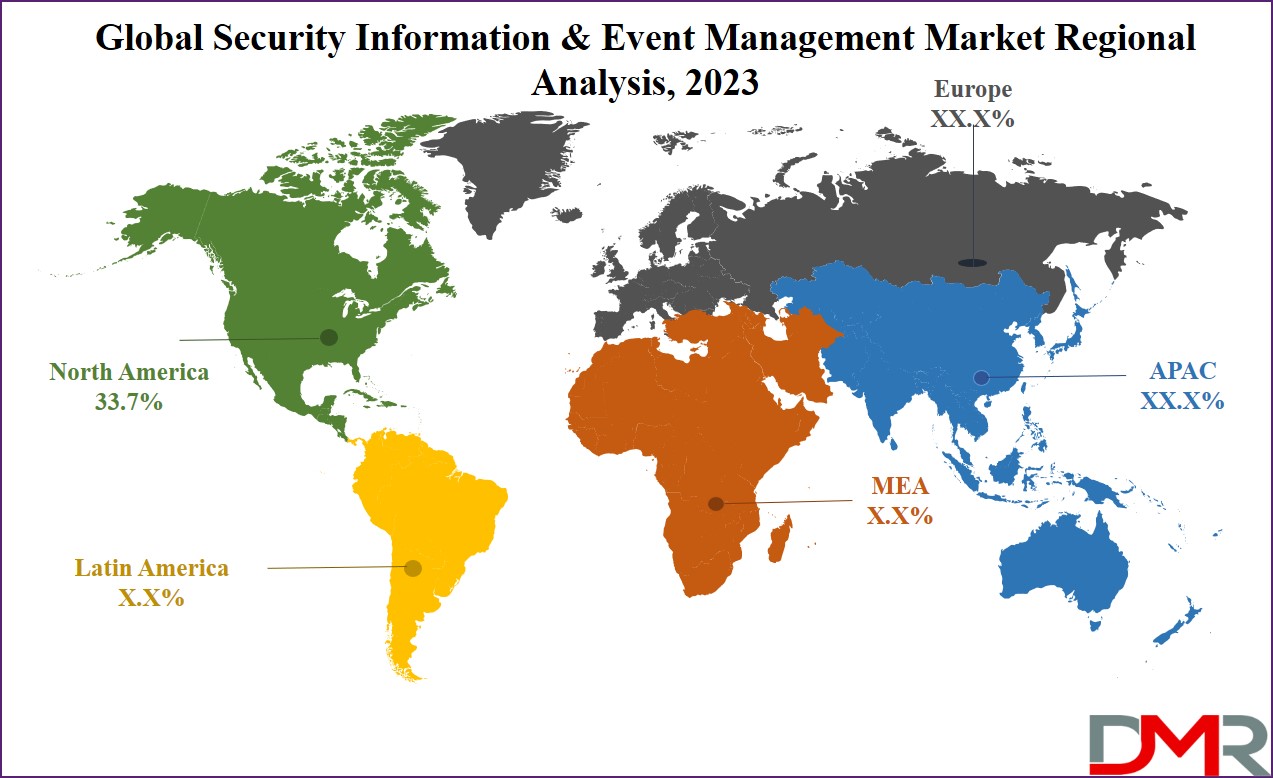

Regional Analysis

In 2023, North America emerges as the biggest market region for the security information & event management market, by showing its dominance with a significant revenue

share of 33.7%. This prominence can be said due to the region's vulnerability to worldwide cyber threats, highlighted by its strong financial sectors, critical infrastructure, & cooperative strategies such as public-private partnerships, supporting its cyber resilience. In addition, regional governments are constantly improving regulations & policies to properly address cyber threats across their respective countries.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The security information & event management market experiences consolidation, mainly driven by dominant players within the industry. Ongoing acquisitions & innovative ventures are key growth catalysts. Furthermore, SIEM providers are looking for collaborations with diverse end-user enterprises, crafting customized solutions to grow their market presence.

For instance, in October 2022, LogRhythm introduced Axon, a novel Cloud-Native Security Operations Platform designed as an improvement & advancement to LogRhythm SIEM, NDR, & UEBA. Axon allows security teams to effortlessly & intuitively achieve unified visibility across on-premises & cloud-based log sources, providing a strong foundation for their security operations.

Some of the prominent players in the Global Security Information and Event Management Market are:

- IBM Corp

- Splunk

- Micro Focus

- LogRhythm

- Fortinet Inc

- Securonix

- Rapid7

- AlienVault Inc

- Exabeam Inc

- McAfee

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Security Information and Event Management Market:

The COVID-19 pandemic increased the demand for SIEM solutions as remote work & rising digitalization increased cybersecurity risks. Sectors such as healthcare & finance prioritized SIEM to safeguard sensitive data, but budget restrictions in recession-affected industries led to varied adoption rates. Cloud-based SIEM attained traction, automation became essential for threat management, & regulatory compliance remained a driver. The increasing threat landscape due to pandemic-related cyber threats made organizations rethink & adapt their SIEM strategies accordingly.

| Report Characteristics |

| Market Size (2023) |

USD 4.7 Bn |

| Forecast Value (2032) |

USD 16.7 Bn |

| CAGR (2023-2032) |

15.0% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Solution (Software and Services), By Deployment (Cloud and On-Premises), By Size (Small & Medium-sized Enterprises and Large Enterprises), By End User Industry (IT & Telecom, BFSI, Retail, Healthcare, Government, Manufacturing and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

IBM Corp., Splunk, Micro Focus, LogRhythm, Fortinet Inc, Securonix, Rapid7, AienVault Inc, Exabeam Inc, McAfee and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Security Information and Event Management Market is estimated to reach USD 4.7 billion in 2023, which is further expected to reach USD 16.7 billion by 2032.

North America dominates the Global Security Information and Event Management Market with a share of 33.7% in 2023.

Some of the major key players in the Global Security Information and Event Management Market are IBM Corp, McAfee, Splunk, and many others.

The market is growing at a CAGR of 15.0% over the forecasted period.