Market Overview

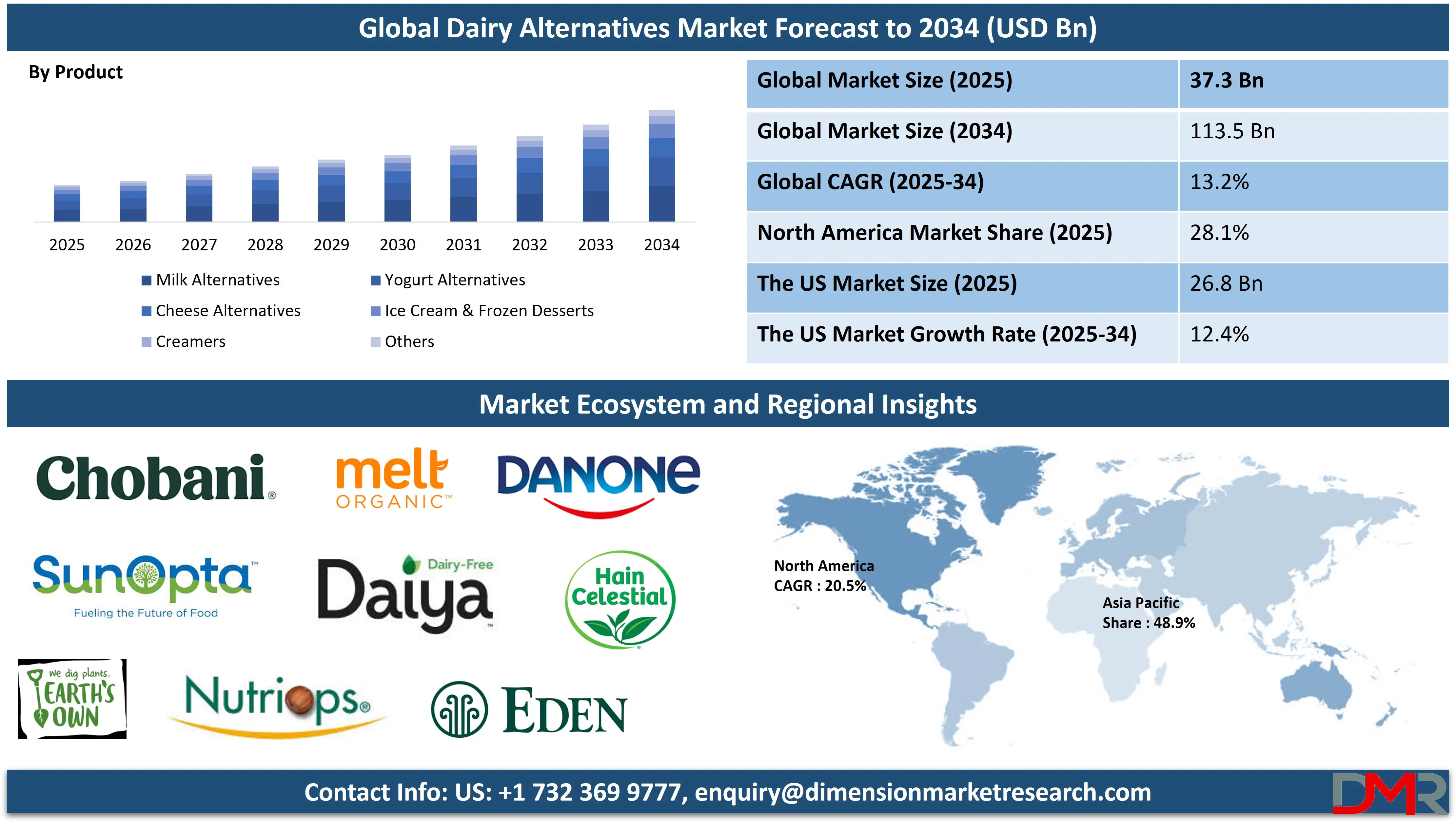

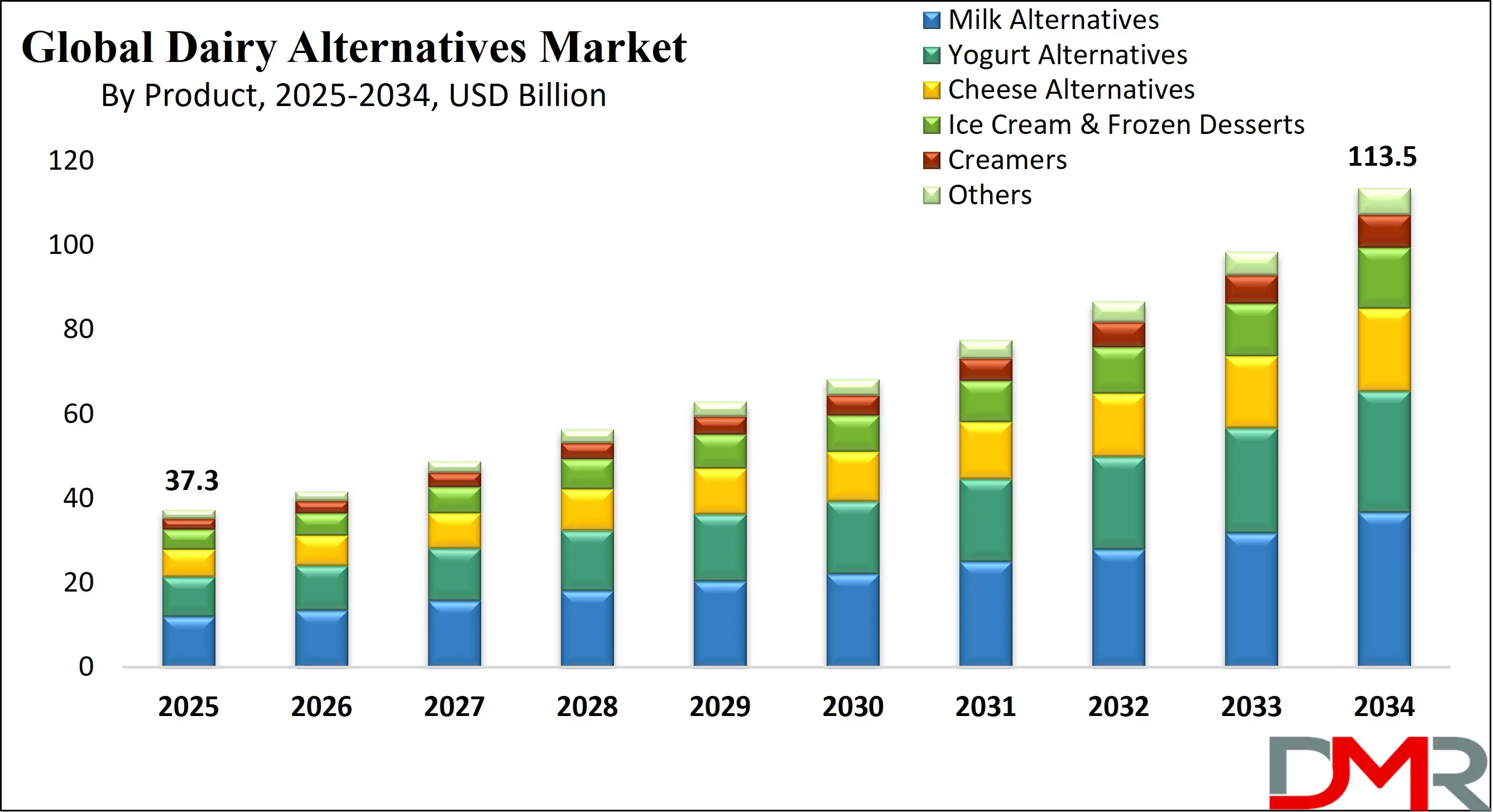

The Global Dairy Alternatives Market is predicted to be valued at

USD 37.3 billion in 2025 and is expected to grow to

USD 113.5 billion by 2034, registering a compound annual growth rate (CAGR) of

13.2% from 2025 to 2034.

Dairy alternatives are plant-based products designed to replace traditional dairy items like milk, cheese, yogurt, and butter. Common sources include soy, almond, oat, coconut, rice, and cashew. These alternatives cater to people who are lactose intolerant, allergic to dairy, vegan, or seeking healthier or more sustainable options. They often contain added nutrients like calcium and vitamin D to mimic the nutritional profile of dairy. While taste and texture may vary, many dairy alternatives offer similar culinary uses. As demand grows, their availability and variety have expanded significantly in grocery stores and restaurants worldwide.

The Global Dairy Alternatives Market encompasses plant-based products designed to replace traditional dairy items, including milk alternatives, yogurt substitutes, cheese alternatives, and frozen desserts. These products are primarily derived from sources such as soy, almond, coconut, oats, and rice, catering to consumers seeking lactose-free, vegan, or health-conscious options. The market’s scope extends across various applications like beverages, bakery and confectionery, infant nutrition, and ready-to-eat foodservice preparations.

Increasing consumer awareness about lactose intolerance, dairy allergies, and environmental sustainability is a major factor driving the shift toward dairy-free options. Growing preference for plant-based diets, fueled by health and wellness trends, also accelerates demand. However, challenges such as taste variability, texture differences compared to conventional dairy, and price sensitivity continue to restrain widespread adoption. Additionally, supply chain complexities for sourcing high-quality plant ingredients can impact market stability.

Innovations in product formulation and fortification with vitamins and minerals enhance nutritional profiles, addressing consumer expectations for both health benefits and sensory experience. Technological advancements in processing techniques improve texture and flavor, helping to bridge gaps with traditional dairy. The rise of clean-label and organic plant-based alternatives reflects evolving consumer preferences for transparency and natural ingredients.

Leading companies adopt strategies including mergers, acquisitions, product diversification, and expansion into emerging markets to strengthen their foothold. Regulatory frameworks around labeling and safety standards vary globally, influencing product development and marketing practices. Insights into consumer behavior reveal an increasing inclination towards functional and sustainable products, making the Dairy Alternatives market a dynamic and rapidly evolving sector within the broader plant-based food industry.

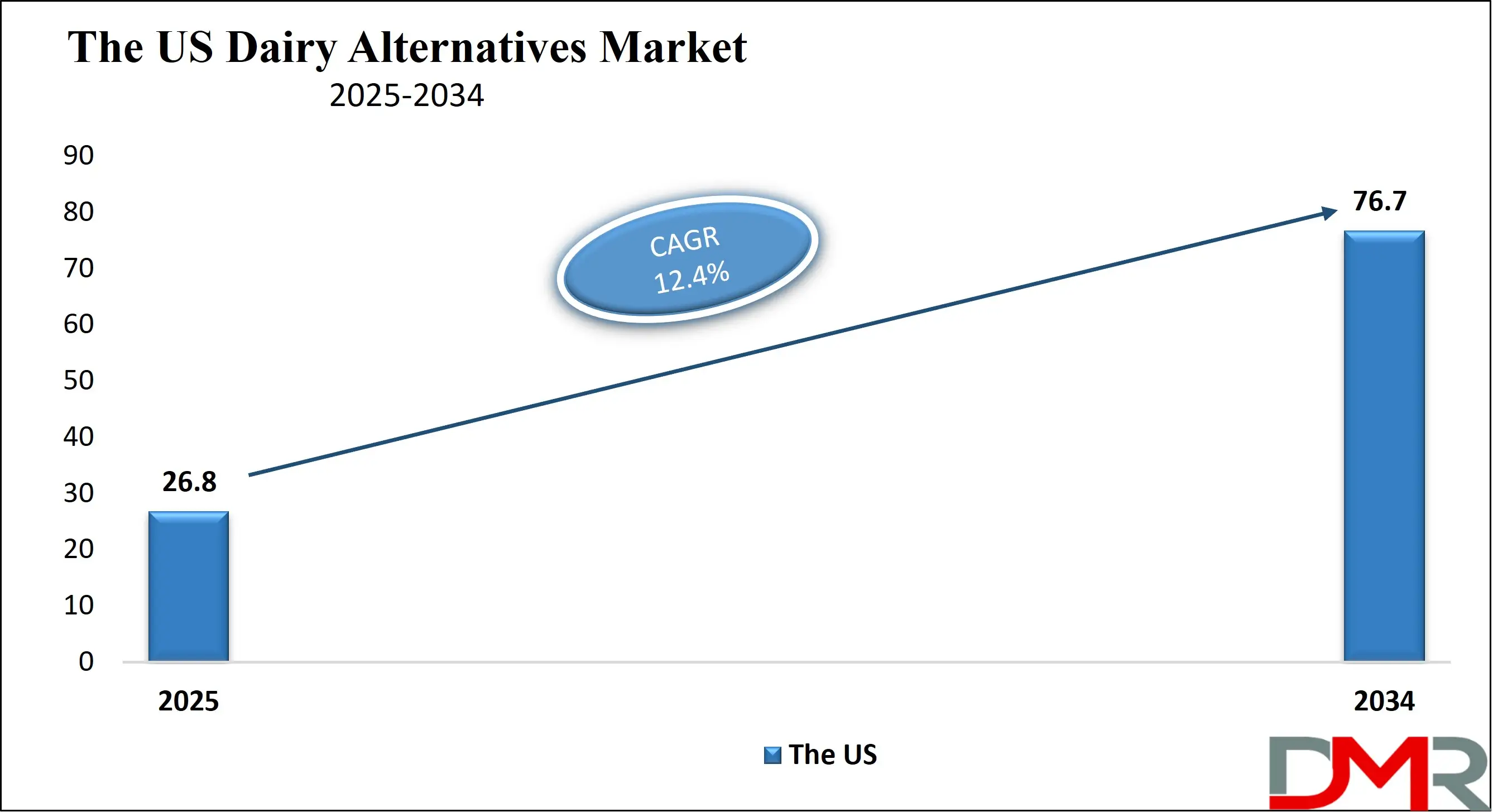

The US Dairy Alternatives Market

The US Dairy Alternatives market is projected to be valued at USD 26.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 76.7 billion in 2034 at a CAGR of 12.4%.

The US dairy alternatives market is driven by growing health awareness and rising cases of lactose intolerance and milk allergies. Consumers are increasingly seeking plant-based options that align with vegan and flexitarian lifestyles. Heightened concerns over animal welfare and environmental sustainability further boost demand for non-dairy substitutes. Innovation in flavor, texture, and nutritional content by key players has enhanced product appeal.

Additionally, the expanding availability of dairy-free products across mainstream retail channels and quick-service restaurants has improved accessibility. Influencer-led marketing campaigns and celebrity endorsements are also playing a pivotal role in encouraging adoption among younger, health-conscious demographics.

The US market is witnessing a surge in oat and almond-based products due to their creamy texture and versatile applications. Clean label and organic claims are gaining traction, with consumers seeking transparency in sourcing and ingredient lists. Functional fortification, like added protein, probiotics, and vitamins, is a growing trend in dairy-free offerings. Brands are innovating with indulgent dessert alternatives and barista-style beverages to cater to niche preferences.

E-commerce growth and direct-to-consumer models are enabling personalized shopping experiences. Additionally, collaborations between food-tech startups and major brands are accelerating the development of advanced dairy-alternative formulations using precision fermentation and biotechnology.

The Japan Dairy Alternatives Market

The Japan Dairy Alternatives market is projected to be valued at USD 3.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.3 billion in 2034 at a CAGR of 12.6%.

Japan’s dairy alternatives market is driven by growing health consciousness and a shift towards plant-based diets due to digestive issues associated with dairy consumption. Cultural preferences for soy-based foods, such as tofu and soymilk, provide a natural foundation for market growth. The aging population is seeking lighter, easily digestible options, further boosting demand. Rising awareness of sustainable consumption and the environmental impact of dairy farming is influencing purchasing behavior. Additionally, government support for food innovation and increased imports of global plant-based brands are expanding consumer exposure. Convenience and adaptability in traditional Japanese cuisine also drive dairy-free product development.

The dairy alternatives market is seeing increased innovation in soy-based yogurts, desserts, and beverages tailored to local taste preferences. Matcha, black sesame, and yuzu flavors are being incorporated into dairy alternatives to appeal to culturally attuned consumers. Minimalist and functional packaging with health claims is popular among urban shoppers. There is a growing trend of dairy-free products being integrated into bento boxes and convenience store offerings. Plant-based café culture is emerging in metropolitan areas, enhancing consumer awareness. Brands are leveraging traditional Japanese food values with modern plant-based ingredients, creating fusion offerings that reflect both innovation and cultural authenticity.

The Europe Dairy Alternatives Market

The Europe Dairy Alternatives market is projected to be valued at USD 6.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 19.9 billion in 2034 at a CAGR of 12.9%.

The European dairy alternatives market is propelled by rising veganism and ethical consumption trends, driven by environmental and animal welfare concerns. Increasing lactose intolerance among the population is also fueling demand. Government initiatives promoting plant-based diets and sustainable agriculture are encouraging market growth. Retailers and foodservice providers are expanding dairy-free product lines to meet evolving consumer preferences.

Additionally, the rising popularity of flexitarian diets and wellness-oriented lifestyles is prompting consumers to experiment with plant-based substitutes. Strong cultural acceptance of food innovation and the presence of multinational plant-based brands are further supporting the rapid adoption of dairy alternatives across Europe.

In Europe, there is a noticeable shift towards locally sourced, organic, and sustainably packaged dairy alternative products. Oat milk has gained remarkable popularity, particularly in coffee shops and among eco-conscious consumers. Hybrid dairy products that combine plant-based and traditional ingredients are emerging as a trend to ease the transition for new users. Functional wellness is influencing formulations, with added nutrients like calcium, B12, and omega-3s. The rise of artisanal and gourmet dairy-free cheeses and yogurts reflects growing sophistication in consumer tastes. Plant-based brands are increasingly participating in climate-positive campaigns, aligning their offerings with broader sustainability goals and consumer expectations.

Dairy Alternatives Market: Key Takeaways

- Market Overview: The global dairy alternatives market is anticipated to reach USD 37.3 billion by 2025, with projections indicating significant growth to USD 113.5 billion by 2034, reflecting a robust CAGR of 13.2% during the forecast period from 2025 to 2034.

- The US Dairy Alternatives Market: In 2025, the U.S. dairy alternatives market is expected to be valued at USD 26.8 billion, with continued expansion projected to bring it to USD 76.7 billion by 2034, growing at a CAGR of 12.4%.

- The Japan Dairy Alternatives Market: Japan’s dairy alternatives market is estimated at USD 3.2 billion in 2025, and is forecasted to grow to USD 9.3 billion by 2034, registering a CAGR of 12.6% over the forecast period.

- The Europe Dairy Alternatives Market: The European market for dairy alternatives is projected to be worth USD 6.7 billion in 2025, with expectations of reaching USD 19.9 billion by 2034, at a CAGR of 12.9%.

- By Source Analysis: Among the sources, soy is expected to remain the leading segment, contributing approximately 35.6% of the global market share by the end of 2025.

- By Product Analysis: Milk alternatives are projected to be the most prominent product category, representing about 58.3% of the global dairy alternatives market by 2025.

- By Distribution Channel Analysis: Supermarkets and hypermarkets are likely to dominate distribution, accounting for nearly 45.1% of the total market share by 2025.

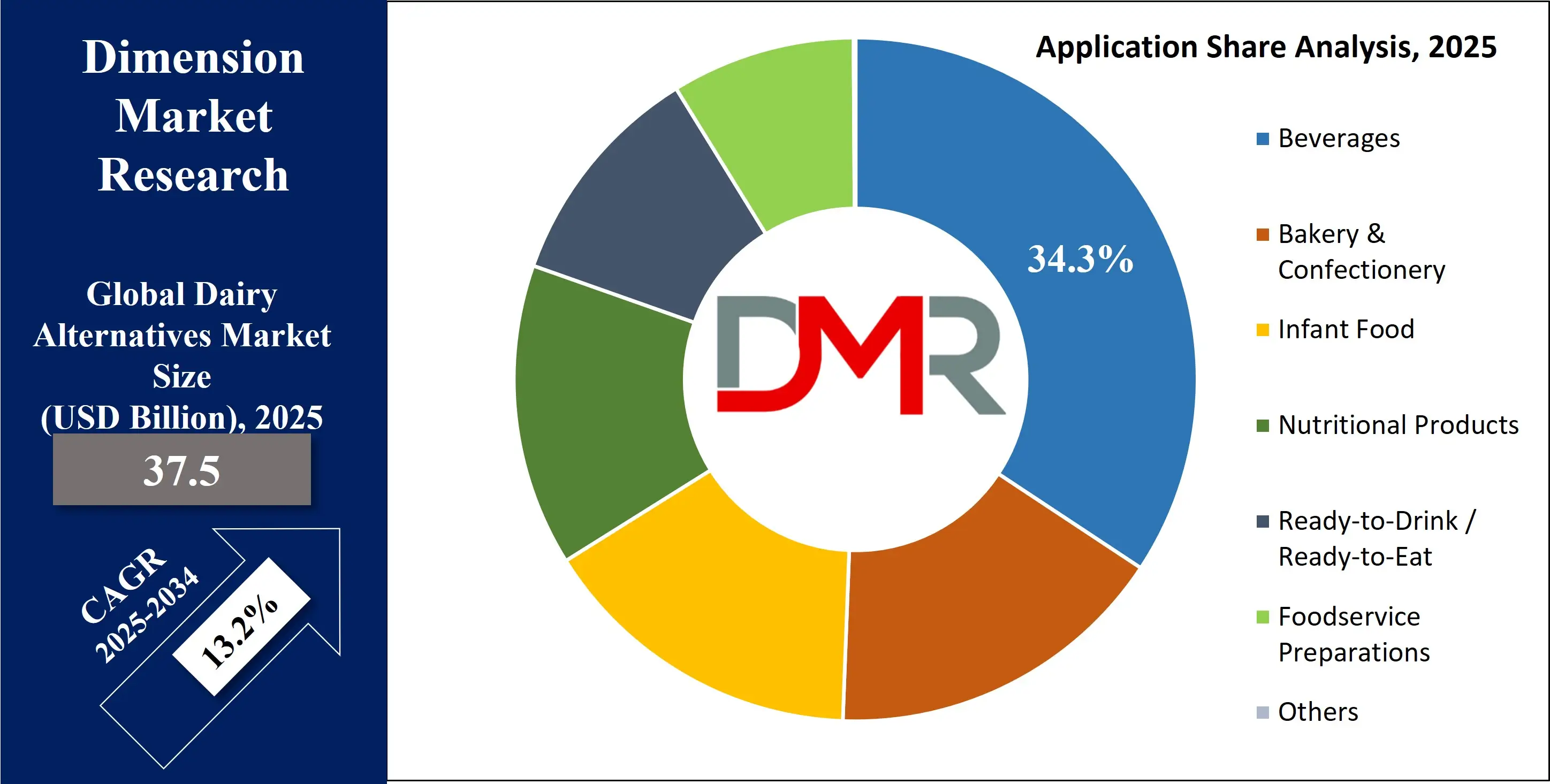

- By Application Analysis: The beverages segment is expected to lead the market in terms of application, comprising around 34.3% of the total share by the end of 2025.

- By End User Analysis: Lactose-intolerant consumers are anticipated to represent the largest user group, capturing approximately 38.9% of the global market share by 2025.

- Region with the Largest Share: The Asia Pacific region is set to lead the global dairy alternatives market, projected to account for about 48.9% of total revenue by the end of 2025.

Dairy Alternatives Market: Use Cases

- Lactose-Free Beverages: Dairy alternatives like almond or oat milk offer a lactose-free beverage option for individuals with lactose intolerance, enabling them to enjoy coffee, smoothies, and cereals without digestive discomfort or compromising on taste and nutritional intake.

- Vegan & Plant-Based Diets: Dairy alternatives are essential in vegan diets, replacing traditional dairy in recipes, drinks, and snacks. They allow ethical and plant-based consumers to enjoy familiar textures and flavors while aligning with animal-free and environmentally conscious lifestyle choices.

- Baking & Cooking Applications: In baking and cooking, dairy alternatives such as soy or coconut milk substitute cow’s milk in cakes, sauces, soups, and desserts. They offer versatility and cater to dietary restrictions while maintaining flavor and consistency in culinary applications.

- Infant & Toddler Nutrition: Specially formulated dairy-free infant formulas and toddler drinks made from soy or rice provide essential nutrients for children with milk allergies or intolerances, supporting healthy growth and development without triggering adverse allergic reactions.

Dairy Alternatives Market: Stats & Facts

- Food and Agriculture Organization (FAO): Global plastic use in agriculture was estimated at 12.5 million tonnes annually, with agricultural films accounting for a significant portion, particularly in mulching, silage, and greenhouse films.

- European Commission: Agricultural plastics, including films, are widely used across Europe, with mulching films covering over 2 million hectares of agricultural land.

- PlasticsEurope: The demand for plastic films in agriculture has grown due to their ability to boost crop yields by up to 30%, especially in arid regions.

- United Nations Environment Programme (UNEP): Improper disposal of agricultural films contributes to the growing issue of microplastic pollution in soil, which may affect soil fertility and food safety.

- Journal of Cleaner Production: Biodegradable agricultural films can reduce plastic waste by 40–60%, compared to conventional polyethylene-based films, without significantly compromising crop productivity.

- World Bank: Use of greenhouse films has contributed to increased agricultural productivity by extending growing seasons and improving water efficiency, especially in regions facing climate variability.

- US Department of Agriculture (USDA): Silage films are vital in livestock farming as they help preserve up to 90% of forage nutrients, critical for year-round animal feeding.

- International Solid Waste Association (ISWA): Recovery and recycling rates for agricultural plastics are still below 30% globally, posing a challenge for sustainable waste management.

- Royal Society of Chemistry (RSC): Research shows that UV-stabilized greenhouse films can last 2–5 years, offering long-term durability in extreme weather conditions.

- ScienceDirect: Studies have shown that the use of colored or reflective mulch films can alter soil temperature and pest behavior, leading to more efficient pest control and better crop outcomes.

Dairy Alternatives Market: Market Dynamics

Driving Factors in the Dairy Alternatives Market

Rising Lactose Intolerance and Dietary PreferencesThe increasing prevalence of lactose intolerance worldwide is a primary driver for the dairy alternatives market growth. Consumers seeking lactose-free milk alternatives such as almond milk, soy milk, and oat milk are driving demand for plant-based dairy products. Additionally, the surge in veganism and vegetarianism fuels the adoption of dairy substitutes like coconut yogurt and cashew cheese. Health-conscious buyers increasingly prefer low-cholesterol and low-fat dairy alternative products, further pushing the market. The growing awareness of dairy allergies and the search for nutritious, cruelty-free options is prompting supermarkets and online retailers to expand their dairy-free product portfolios, enhancing availability and consumer reach.

Environmental and Sustainability Concerns

Sustainability concerns are significantly propelling the dairy alternatives market, with consumers opting for plant-based milk alternatives due to their lower environmental footprint. Traditional dairy farming is associated with high greenhouse gas emissions, water usage, and land degradation, prompting environmentally conscious consumers to choose almond, oat, and rice milk options. The rising demand for sustainable packaging and organic dairy alternatives also aligns with eco-friendly consumption trends. Foodservice providers and retailers are responding by incorporating more plant-based dairy alternatives in their menus and shelves, helping to boost market growth driven by climate-conscious and ethically minded consumers.

Restraints in the Dairy Alternatives Market

Taste and Texture Limitations

Despite the growing popularity of dairy alternatives, the taste and texture differences compared to traditional dairy products remain a significant restraint. Many consumers find plant-based milk and cheese substitutes less creamy or flavorful than cow’s milk products. This sensory gap limits wider acceptance among mainstream consumers who prioritize taste in beverages, yogurt alternatives, and cheese alternatives. Furthermore, some dairy-free products have inconsistent textures or may require additives and stabilizers to mimic dairy, which can deter health-conscious buyers. The challenge to replicate the sensory profile of natural dairy continues to hinder broader adoption, especially in markets where traditional dairy consumption is deeply entrenched.

Higher Price Points and Limited Availability

The dairy alternatives market often faces barriers related to higher retail prices compared to conventional dairy products. Premium pricing for almond milk, oat milk, and other plant-based beverages limits affordability for price-sensitive consumers, particularly in developing regions. Additionally, the supply chain constraints and limited distribution networks restrict availability in smaller retail outlets and rural areas. This reduced accessibility can hamper market penetration and consumer trial. Moreover, fluctuations in raw material costs, such as nuts and grains, contribute to price volatility, making it challenging for manufacturers to offer competitively priced dairy-free products at scale.

Opportunities in the Dairy Alternatives Market

Innovation in Product Development and Fortification

There is substantial opportunity in innovating dairy alternatives by improving nutritional profiles and diversifying product offerings. Manufacturers are developing fortified plant-based milks enriched with calcium, vitamin D, and protein to match the nutritional benefits of cow’s milk. New variants like oat-based creamers, pea protein yogurts, and nut-based cheeses cater to evolving consumer tastes and dietary needs. The introduction of organic, gluten-free, and allergen-friendly dairy substitutes attracts niche markets, including fitness enthusiasts and allergy sufferers. Advances in formulation technology and clean-label trends enable the creation of better-tasting, healthier dairy alternatives, expanding market appeal.

Trends in the Dairy Alternatives Market

Clean Label and Organic Dairy Alternatives

The demand for clean-label dairy alternatives is a prominent market trend, with consumers seeking products free from artificial additives, preservatives, and GMOs. Organic almond milk, coconut yogurt, and oat milk variants are gaining popularity as buyers prioritize natural ingredients and sustainability. Transparent labeling and certifications regarding allergen-friendliness and non-GMO status are influencing purchasing decisions. Brands are increasingly investing in organic sourcing and clean production methods to meet consumer expectations for transparency and health benefits. This trend is driving product reformulation and new launches aimed at wellness-conscious customers looking for minimally processed dairy substitutes.

Rise of Functional and Fortified Dairy Alternatives

Functional dairy alternatives enriched with probiotics, prebiotics, vitamins, and minerals are trending strongly. Consumers increasingly seek plant-based yogurts and beverages that not only serve as milk substitutes but also offer digestive health benefits and immune support. Fortified almond milk with added calcium or oat milk with extra protein caters to specific nutritional demands, including for children and elderly populations. This trend aligns with broader health and wellness movements emphasizing gut health, immunity, and personalized nutrition. Market players are innovating formulations that combine taste with enhanced functionality, attracting a diverse consumer base focused on holistic well-being.

Dairy Alternatives Market: Research Scope and Analysis

By Source Analysis

Soy is expected to dominate the global dairy alternatives market by the end of 2025, accounting for approximately 35.6% of the total market share. This dominance is attributed to its high protein content, affordability, and long-standing consumer acceptance, especially in emerging economies. The growing demand for plant-based dairy, increased vegan population, and rising awareness of lactose intolerance have further boosted soy-based product sales. Soy milk, in particular, remains a preferred option due to its nutritional similarity to cow’s milk. The segment's performance is also supported by its widespread application across non-dairy yogurts, vegan cheeses, and dairy-free creamers, driven by evolving consumer dietary preferences and increasing environmental sustainability concerns within the food and beverage industry.

Oats are projected to witness the highest CAGR among dairy alternative sources by the end of 2025. The segment's rapid growth is fueled by increasing demand for gluten-free and allergen-friendly options, particularly in North America and Europe. Oat-based dairy alternatives offer a creamy texture and natural sweetness, making them ideal for plant-based beverages, coffee creamers, and vegan ice creams. The oat segment is also gaining traction among environmentally conscious consumers due to its low carbon footprint and sustainable farming benefits. Accelerated product innovation and strategic investments by food manufacturers have further amplified oat milk’s appeal. The market is benefiting from the rise of flexitarian diets and expanding availability across mainstream grocery and e-commerce platforms.

By Product Analysis

Milk alternatives are projected to lead the global dairy alternatives market by the end of 2025, holding an estimated 58.3% share. This segment continues to dominate due to widespread use in everyday consumption and its strong presence across global retail shelves. Consumers are increasingly shifting from conventional dairy to plant-based milk driven by health-conscious diets, rising lactose intolerance, and demand for cholesterol-free options. The expansion of product portfolios—ranging from almond and oat milk to soy and rice variants which caters to a broad spectrum of dietary preferences. Growing urbanization, food sensitivity awareness, and the adoption of plant-based nutrition have further propelled dairy-free milk as a staple in both households and the hospitality sector.

Yogurt alternatives are expected to register the highest CAGR in the dairy alternatives market by the end of 2025. This growth is driven by surging demand for gut-health-promoting foods and the popularity of probiotic-rich plant-based products. Consumers seeking dairy-free functional foods are increasingly turning to soy, almond, and coconut-based yogurts, which offer both taste and nutritional benefits. The segment is also benefiting from innovations in dairy-free fermented foods and clean-label trends. Expanding vegan product lines, rising availability in convenience stores, and growing health and wellness awareness have collectively accelerated demand. The increase in flexitarian consumers and preference for on-the-go healthy snacks are major contributors to this segment’s fast-paced expansion across global markets.

By Distribution Channel Analysis

Supermarkets & hypermarkets are forecasted to dominate the global dairy alternatives market by the end of 2025, capturing approximately 45.1% of the total market share. This channel benefits from strong consumer trust, a wide product assortment, and the ability to offer plant-based dairy products with promotions and in-store sampling. The growing demand for non-dairy beverages, lactose-free items, and vegan alternatives is well-supported by the retail infrastructure of large grocery chains. Enhanced visibility, dedicated shelf space, and the convenience of one-stop shopping continue to attract mainstream buyers. Moreover, expanding product penetration in urban and semi-urban areas and rising health food sections in major stores are further fueling sales of dairy-free options through this distribution format.

Online retail is projected to exhibit the highest CAGR in the dairy alternatives market by the end of 2025, driven by digitalization and shifting consumer purchasing behaviors. The rise of e-commerce platforms has empowered consumers to easily access dairy-free products, including almond milk, coconut-based yogurt, and vegan cheese alternatives. Busy lifestyles, pandemic-driven habits, and growing trust in direct-to-consumer brands have boosted sales through digital channels. Additionally, tailored subscriptions, doorstep delivery, and discounts on bulk purchases are encouraging repeat buying. Online platforms also support the exploration of niche brands and specialty items that may not be widely available in physical stores. The increased focus on plant-based nutrition and convenience is set to sustain online retail’s rapid market expansion.

By Application Analysis

Beverages are expected to dominate the global dairy alternatives market by the end of 2025, accounting for nearly 34.3% of the total market share. This segment leads due to the massive consumption of plant-based milk, such as oat, almond, soy, and rice milk, as direct dairy replacements. Consumers increasingly prefer non-dairy drinks as part of their daily routines, particularly for breakfast, coffee, and smoothies. The rise of functional beverages, enriched with vitamins, minerals, and proteins, has further boosted this segment’s appeal. Rising health concerns, demand for lactose-free hydration, and a growing shift toward flexitarian diets are all contributing to its prominence. Additionally, the widespread availability of vegan drinks in cafes and ready-to-drink packaging formats strengthens its market position.

Nutritional products are projected to witness the highest CAGR in the dairy alternatives market by the end of 2025. This rapid growth stems from increased consumer interest in functional foods and performance-focused nutrition. Plant-based protein powders, fortified beverages, and vegan supplements are becoming popular among athletes, gym-goers, and health-conscious buyers. As awareness of clean eating and sustainable nutrition rises, many are turning to dairy-free protein shakes, energy bars, and superfood blends made from coconut, pea, or almond bases. The trend is also fueled by innovations in plant-based formulation technology and the growing demand for allergen-free wellness products. Expanding offerings in sports nutrition and personalized health supplements continue to push this segment forward at a significant pace.

By End User Analysis

Lactose-intolerant individuals are anticipated to dominate the global dairy alternatives market by the end of 2025, accounting for around 38.9% of the total share. This dominance is driven by the increasing global prevalence of lactose intolerance, particularly in Asia-Pacific and Latin America. Consumers are actively seeking lactose-free dairy alternatives such as almond milk, soy yogurt, and plant-based creamers to avoid digestive discomfort. The demand is further supported by healthcare professionals recommending dairy-free diets to manage gastrointestinal issues. With improved accessibility of non-dairy options in mainstream retail and growing public awareness about dairy sensitivity, this user group continues to drive steady sales. Additionally, clear product labeling and fortified options attract consumers with dietary restrictions and medically driven nutritional needs.

Sustainability-minded buyers are expected to register the highest CAGR in the dairy alternatives market by the end of 2025. These consumers are motivated by environmental concerns and are shifting toward plant-based foods to reduce their ecological footprint. Dairy-free products, particularly oat and almond-based items, are seen as eco-friendlier alternatives to conventional dairy, with significantly lower greenhouse gas emissions and water usage. The surge in climate activism and ethical consumerism has pushed many to embrace cruelty-free, ethical food choices. Brands emphasizing carbon neutrality, regenerative agriculture, and zero-waste packaging strongly appeal to this demographic. As awareness of the dairy industry’s impact on the planet grows, more individuals are aligning their food choices with their environmental values.

The Dairy Alternatives Market Report is segmented on the basis of the following

By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

By Product

- Milk Alternatives

- Yogurt Alternatives

- Cheese Alternatives

- Ice Cream & Frozen Desserts

- Creamers

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Application

- Beverages

- Bakery & Confectionery

- Infant Food

- Nutritional Products

- Ready-to-Drink / Ready-to-Eat

- Foodservice Preparations

- Others

By End User

- Lactose-Intolerant Individuals

- Vegans & Vegetarians

- Health-Conscious Consumers

- Sustainability-Minded Buyers

- Fitness & Wellness Enthusiasts

Regional Analysis

Region with the largest Share

Asia Pacific is projected to hold the largest share in the global dairy alternatives market by the end of 2025, accounting for approximately 48.9% of total revenue. This dominance is driven by high lactose intolerance rates across countries such as China, India, and Japan, where plant-based dairy products are increasingly integrated into daily diets. The rising middle-class population, urbanization, and growing awareness of plant-based nutrition are contributing to the market surge.

Traditional familiarity with soy-based beverages also supports strong regional demand. Moreover, government initiatives promoting healthy eating and sustainable agriculture, coupled with expanding retail and e-commerce networks, are accelerating the adoption of dairy-free alternatives. Major regional manufacturers and startups are fueling innovation tailored to local taste preferences.

Region with Highest CAGR

North America is expected to register the highest CAGR in the dairy alternatives market by the end of 2025, driven by the rapid adoption of plant-based lifestyles and growing demand for clean-label food products. Consumers across the U.S. and Canada are increasingly seeking dairy-free options due to health concerns, ethical considerations, and environmental awareness. The rise of veganism, combined with fitness trends and dietary shifts like flexitarianism, is accelerating market growth. Advancements in food processing technology, high investment in product innovation, and strong retail presence are further boosting the segment. Moreover, a surge in lactose-free product launches across beverages, snacks, and ready-to-eat meals is drawing consumer interest. Premium branding, strong marketing, and celebrity endorsements also amplify regional market momentum.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the dairy alternatives market is characterized by intense rivalry among key global and regional players striving to innovate and expand their product portfolios. Leading companies like Danone, Nestlé, Oatly, and Blue Diamond Growers have established strong footholds through strategic mergers, acquisitions, and partnerships aimed at increasing market penetration. These companies continuously invest in research and development to introduce novel plant-based formulations, including almond, oat, soy, and coconut-based products, to meet evolving consumer preferences.

Brand differentiation through product innovation, sustainability initiatives, and clean-label offerings is a significant factor driving competition. Market leaders focus on enhancing the nutritional profile of their dairy-free milk, yogurt, cheese, and creamers to cater to health-conscious and lactose-intolerant consumers. Additionally, expansion of distribution channels, including online retail and large supermarket chains, plays a crucial role in reaching a wider audience.

Sustainability practices, such as eco-friendly packaging and responsible sourcing of raw materials, are increasingly influencing competitive strategies. Regional players are also gaining traction by catering to local tastes and price sensitivities, especially in emerging markets across Asia-Pacific and Latin America. The rise of direct-to-consumer brands and increasing consumer demand for plant-based nutrition are reshaping the competitive dynamics, pushing companies to adopt innovative marketing and product development approaches to stay relevant in this rapidly growing industry.

Some of the prominent players in the Global Dairy Alternatives Market are

- Chobani, LLC

- Danone S.A.

- Hain Celestial

- Daiya Foods

- Eden Foods

- NUTRIOPS, SL

- Earth’s Own

- SunOpta

- Melt Organic

- Oatly AB

- Blue Diamond Growers

- Ripple Foods

- Vitasoy International Holdings Ltd

- Organic Valley

- Living Harvest

- Califia Farms, LLC

- Nestlé S.A.

- Valio Ltd.

- The Kraft Heinz Company

- Tofutti Brands Inc.

- Other Key Players

Recent Developments

- In May 2025, U.S. dairy heavyweight Chobani acquired New York-based plant-based startup Daily Harvest, signaling its entry into the frozen ready-meal sector. Known for its nutrient-rich, plant-based bowls and smoothies, Daily Harvest was purchased for an undisclosed amount. This move follows Chobani’s previous major acquisition of La Colombe Coffee Roasters in 2023 for $900 million.

- In April 2025, Germany’s DMK Group and Denmark’s Arla Foods revealed plans to merge, aiming to form Europe’s largest dairy cooperative. The merger, pending approval from cooperative representatives and regulatory bodies, would unite over 12,000 dairy farmers and generate estimated combined revenues of €19 billion.

- In February 2024, Califia Farms, a U.S. brand specializing in plant-based beverages, launched a new creamy milk alternative made from a blend of pea, chickpea, and fava bean proteins. The product offers all nine essential nutrients and amino acids.

- In March 2024, South Canara Coconut Farmers' Producer Company Ltd. (FPC) in Puttur, India, introduced three innovative coconut-based products: tender coconut milkshake, tender coconut ice cream, and a sprout-based dessert.

- In April 2024, Singapore-based Yeo Hiap Seng launched Yeo’s Immuno Soy Milk, a vitamin B6- and zinc-enriched beverage designed to support immune health. Marketed under the “Healthier Choice” label in Singapore and Malaysia, it offers a nutritious, lactose-free breakfast alternative.

- In May 2024, Lactalis’ Canadian branch introduced Enjoy, a plant-based milk line catering to health-focused consumers. The range includes six unsweetened products made from oats, almonds, and hazelnuts, each delivering 8g of pea protein per 250ml serving, though not marketed as barista-friendly options.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 37.3 Bn |

| Forecast Value (2034) |

USD 113.5 Bn |

| CAGR (2025–2034) |

13.2% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 26.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Source (Soy, Almond, Coconut, Rice, Oats, Others), By Product (Milk Alternatives, Yogurt Alternatives, Cheese Alternatives, Ice Cream & Frozen Desserts, Creamers, Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online Retail, Others), By Application (Beverages, Bakery & Confectionery, Infant Food, Nutritional Products, Ready-to-Drink / Ready-to-Eat, Foodservice Preparations, Others), By End User (Lactose-Intolerant Individuals, Vegans & Vegetarians, Health-Conscious Consumers, Sustainability-Minded Buyers, Fitness & Wellness Enthusiasts) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Chobani, LLC, Danone S.A., Hain Celestial, Daiya Foods, Eden Foods, NUTRIOPS, SL, Earth’s Own, SunOpta, Melt Organic, Oatly AB, Blue Diamond Growers, Ripple Foods, Vitasoy International Holdings Ltd, Organic Valley, Living Harvest, Califia Farms, LLC, Nestlé S.A., Valio Ltd., The Kraft Heinz Company, Tofutti Brands Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Dairy Alternatives Market size is estimated to have a value of USD 37.3 billion in 2025 and is expected to reach USD 113.5 billion by the end of 2034.

Asia Pacific is expected to be the largest market share for the Global Dairy Alternatives Market with a share of about 48.9% in 2025.

Some of the major key players in the Global Dairy Alternatives Market are Danone S.A., Nestlé S.A., Oatly AB, and many others.

The market is growing at a CAGR of 13.2% over the forecasted period

The US Dairy Alternatives Market size is estimated to have a value of USD 26.8 billion in 2025 and is expected to reach USD 76.7 billion by the end of 2034