Market Overview

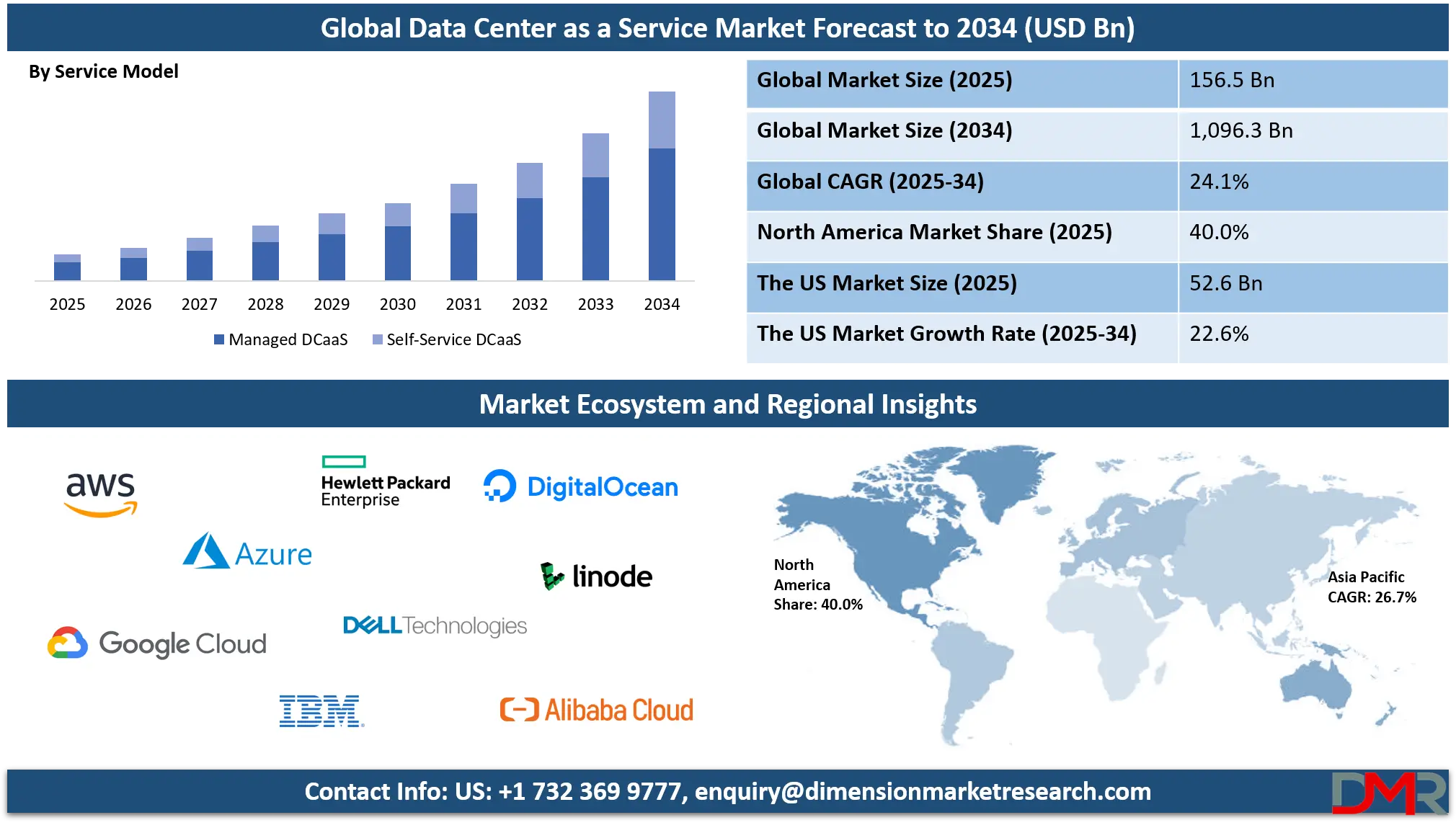

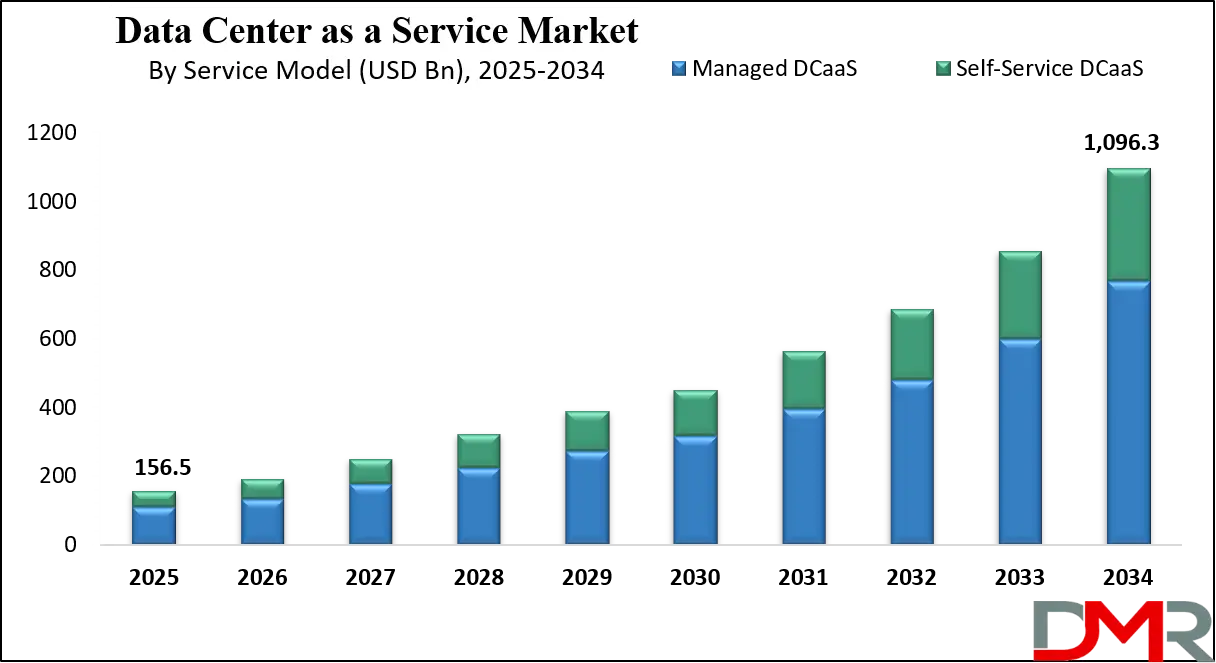

The global Data Center as a Service market is projected to grow from USD 156.5 billion in 2025 to USD 1,096.3 billion by 2034, expanding at a robust CAGR of 24.1%. This growth is driven by rising cloud adoption, demand for scalable IT infrastructure, data storage solutions, high-performance computing, and digital transformation initiatives across industries globally.

Data Center as a Service (DCaaS) is a cloud-based offering that provides businesses with fully managed data center infrastructure and resources on a subscription or pay-as-you-go model. It allows organizations to access computing power, storage, networking, and security services without the need to invest in physical data center facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

DCaaS integrates advanced technologies such as virtualization, automation, and cloud orchestration to deliver scalable and flexible infrastructure that can support high-performance workloads, big data analytics, artificial intelligence applications, and enterprise software platforms. By leveraging a remote, service-based model, companies can optimize operational costs, enhance disaster recovery capabilities, ensure compliance with industry standards, and rapidly deploy IT resources to meet dynamic business requirements.

The global Data Center as a Service market encompasses the comprehensive adoption of cloud-driven infrastructure solutions across industries including IT and telecom, healthcare, banking, financial services, retail, and government. This market is driven by the growing need for scalable storage solutions, high-speed networking, and secure computing environments, as well as the rising implementation of artificial intelligence and machine learning applications.

Organizations are growingly shifting from traditional on-premises data centers to cloud-based services to reduce capital expenditure, enhance operational efficiency, and improve overall IT agility. Key factors such as digital transformation initiatives, growing data volumes, and the demand for flexible and remote-managed IT infrastructure contribute to market growth across regions.

The market landscape includes a wide range of service models and deployment options such as public, private, and hybrid clouds, offering enterprises the ability to choose solutions tailored to their business needs. Geographic adoption patterns show strong growth in North America and Europe due to technological maturity and regulatory frameworks, while Asia-Pacific demonstrates rapid expansion driven by digitalization and cloud adoption in emerging economies.

The competitive environment is characterized by major global technology companies and cloud service providers offering integrated solutions with advanced monitoring, security, and management capabilities. Increasing awareness of data security, compliance requirements, and energy-efficient infrastructure further fuels investment in data center as a service offerings globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Data Center as a Service Market

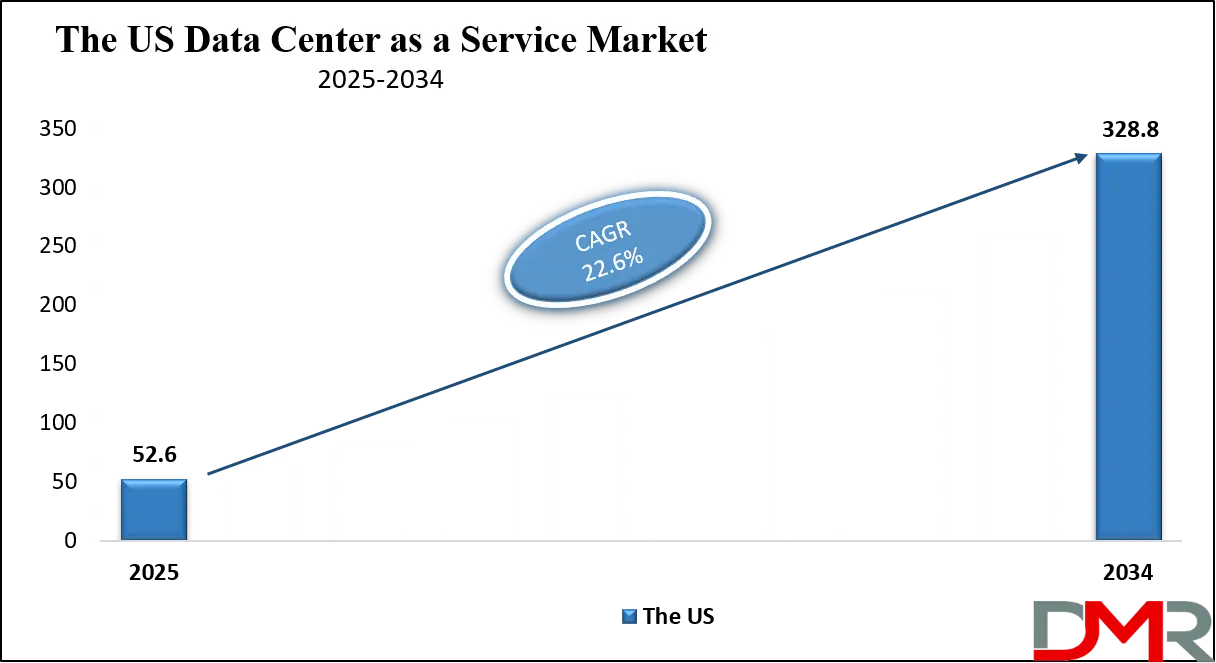

The US Data Center as a Service Market is projected to be valued at USD 52.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 328.8 billion in 2034 at a CAGR of 22.6%.

The United States Data Center as a Service market is witnessing significant growth driven by enterprises growingly migrating from traditional on-premises infrastructure to cloud-based solutions. The adoption of public, private, and hybrid cloud models allows organizations to scale computing resources, storage, and networking services efficiently while reducing capital expenditure.

Industries such as IT and telecom, banking, financial services, healthcare, and retail are leveraging DCaaS for high-performance computing, big data analytics, artificial intelligence workloads, and disaster recovery solutions. The demand for secure, compliant, and remotely managed data centers is also fueling growth as organizations aim to enhance operational efficiency, maintain business continuity, and support digital transformation initiatives.

In the United States, technological advancements in virtualization, automation, and cloud orchestration are further strengthening the DCaaS market. Key service providers are offering integrated solutions with advanced monitoring, energy-efficient infrastructure, and scalable storage and networking options to meet enterprise needs.

The market is characterized by strong investments in data center expansion, cybersecurity, and edge computing to reduce latency and improve real-time data processing capabilities. Government regulations, compliance standards, and growing awareness of data security are additional factors driving adoption. Overall, the US DCaaS market is poised for rapid expansion as organizations prioritize flexible, cost-effective, and high-performance IT infrastructure solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Data Center as a Service Market

The European Data Center as a Service market is projected to reach approximately USD 43.8 billion in 2025, reflecting significant adoption of cloud-based infrastructure across the region. The growth is largely fueled by the widespread digital transformation initiatives undertaken by enterprises in key economies such as Germany, the United Kingdom, France, and the Nordics.

Organizations across sectors including IT and telecom, BFSI, healthcare, and retail are growingly relying on DCaaS solutions to access scalable computing power, storage, and networking services without heavy investment in physical data center infrastructure. The region’s mature IT ecosystem, advanced network connectivity, and focus on regulatory compliance make it a favorable environment for managed and hybrid cloud deployments.

The European DCaaS market is expected to grow at a robust CAGR of 15.0% over the forecast period, driven by rising demand for high-performance computing, AI workloads, and big data analytics. The growing emphasis on energy-efficient and sustainable data center solutions is further propelling market expansion, as enterprises and service providers aim to reduce operational costs and carbon footprint.

Additionally, the growing adoption of multi-cloud and hybrid cloud strategies, combined with advancements in edge computing and automation, is enhancing the flexibility and efficiency of cloud-managed infrastructure. These factors position Europe as a significant contributor to the global DCaaS market, offering lucrative opportunities for service providers and technology vendors alike.

Japan Data Center as a Service Market

The Japanese Data Center as a Service market is projected to reach approximately USD 5.5 billion in 2025, reflecting steady adoption of cloud-managed infrastructure across industries. The growth is driven by enterprises in IT and telecom, banking, financial services, healthcare, and manufacturing that are growingly shifting from on-premises data centers to scalable, flexible, and secure cloud-based solutions.

Japan’s highly developed technological ecosystem, robust network infrastructure, and strong regulatory compliance standards make it an attractive market for both domestic and international DCaaS providers. Organizations are leveraging these services to optimize operational costs, enhance disaster recovery capabilities, and support digital transformation initiatives, including AI, big data analytics, and edge computing applications.

The market is expected to grow at a compound annual growth rate of 14.8% over the forecast period, driven by rising demand for high-performance computing, efficient storage solutions, and low-latency networking. The emergence of hyperscale and energy-efficient data centers is further propelling adoption, as enterprises aim to reduce power consumption and carbon footprint while maintaining high operational reliability.

Additionally, the trend toward hybrid and multi-cloud deployments enables Japanese organizations to manage diverse workloads efficiently, providing opportunities for DCaaS providers to expand their offerings. This positions Japan as a key growth market within the Asia-Pacific region and an important contributor to the global Data Center as a Service landscape.

Global Data Center as a Service Market: Key Takeaways

- Market Value: The global data center as a service market size is expected to reach a value of USD 1,096.3 billion by 2034 from a base value of USD 156.5 billion in 2025 at a CAGR of 24.1%.

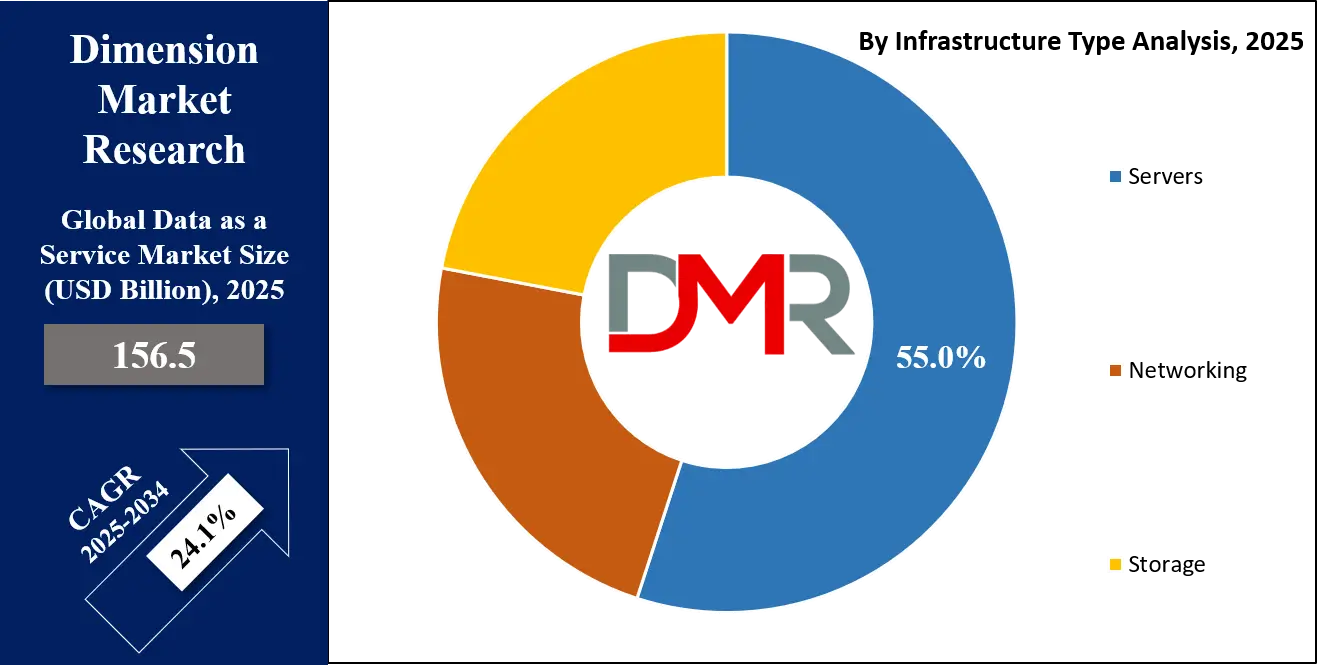

- By Infrastructure Type Segment Analysis: Servers are anticipated to dominate the infrastructure type segment, capturing 55.0% of the total market share in 2025.

- By Service Model Segment Analysis: Managed DCaaS models are expected to maintain their dominance in the service model segment, capturing 70.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Public Cloud will dominate the deployment model segment, capturing 60.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises are expected to maintain their dominance in the organization size segment, capturing 60.0% of the market share in 2025.

- By End-User Industry Segment Analysis: The IT & Telecom industry will account for the maximum share in the end-user industry segment, capturing 35.0% of the total market value.

- Regional Analysis: North America is anticipated to lead the global data center as a service market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global data center as a service market include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Alibaba Cloud, DigitalOcean, Linode, Equinix, Huawei Technologies, Meta Platforms, Oracle Cloud, Vantage Data Centers, and Others.

Global Data Center as a Service Market: Use Cases

- Cloud-Based Enterprise Resource Management: Organizations are growingly adopting Data Center as a Service to host enterprise resource planning and business applications in the cloud. By leveraging DCaaS, companies can access scalable computing power, centralized data storage, and secure networking without investing in physical data center infrastructure. This enables seamless collaboration across departments, supports real-time analytics, and ensures business continuity during peak workloads or unexpected disruptions. The use of managed services and automation also reduces operational complexity and lowers IT costs, making it ideal for large enterprises and SMEs alike.

- High-Performance Computing and AI Workloads: DCaaS provides the flexible and scalable infrastructure required for high-performance computing tasks and artificial intelligence workloads. Industries such as research, financial modeling, and healthcare rely on cloud-hosted servers, GPUs, and storage resources to process large datasets efficiently. With on-demand provisioning, automated resource allocation, and advanced virtualization, organizations can accelerate AI model training, run complex simulations, and deploy machine learning solutions without the limitations of traditional on-premises infrastructure.

- Disaster Recovery and Business Continuity: Data Center as a Service plays a crucial role in disaster recovery and business continuity planning. By replicating critical data and applications to remote, cloud-managed data centers, organizations can ensure minimal downtime in the event of system failures, cyberattacks, or natural disasters. DCaaS solutions offer automated backup, failover mechanisms, and continuous monitoring, helping businesses maintain operational resilience and compliance with industry regulations while safeguarding sensitive data.

- Scalable E-Commerce and Digital Platforms: E-commerce companies and digital service providers leverage DCaaS to handle fluctuating web traffic, seasonal demand spikes, and global customer engagement. Cloud-based infrastructure enables rapid scaling of storage, servers, and networking resources to ensure high website performance, fast transaction processing, and uninterrupted user experience. The integration of analytics, load balancing, and secure cloud networking enhances operational efficiency, reduces latency, and supports the expansion of digital platforms into new markets.

Impact of Artificial Intelligence on the global Data Center as a Service market

Artificial Intelligence is profoundly transforming the global Data Center as a Service market by driving demand for high-performance, scalable, and automated infrastructure. AI applications require extensive computing power, advanced storage solutions, and low-latency networking, which DCaaS platforms are uniquely positioned to provide through cloud-based, on-demand services. Machine learning algorithms and data analytics workloads are growingly hosted on cloud-managed servers, enabling organizations to accelerate decision-making, optimize resource allocation, and enhance predictive capabilities.

Additionally, AI-driven automation within DCaaS platforms improves operational efficiency, energy management, and system monitoring, reducing manual intervention and operational costs. This integration of AI not only boosts the adoption of data center services across industries but also supports innovation in edge computing, real-time analytics, and intelligent IT operations, making AI a key growth driver in the market.

Global Data Center as a Service Market: Stats & Facts

U.S. Census Bureau

- Employment in U.S. data centers grew steadily from 2023 to 2025, reflecting the expanding workforce in the sector.

- Data center workforce growth is driven by growing adoption of cloud and AI workloads.

- The number of IT specialists supporting data center operations has increased to meet operational demands.

U.S. Federal Communications Commission (FCC)

- Approximately 40% of global data center services were based in the U.S. in 2023.

- The U.S. maintained its leading position in 2024, with growing global connectivity initiatives.

- In 2025, the U.S. continued to hold a significant portion of global cloud infrastructure operations.

U.S. Department of Energy (DOE)

- Data centers consumed around 2% of U.S. electricity in 2023.

- Energy efficiency initiatives reduced electricity consumption per data center in 2024.

- By 2025, advanced energy management technologies further decreased power usage intensity.

U.S. Environmental Protection Agency (EPA)

- Data centers contributed to approximately 1.8% of global greenhouse gas emissions in 2023.

- Adoption of renewable energy in 2024 helped reduce data center emissions.

- Continued sustainability measures in 2025 are expected to improve environmental performance.

U.S. Department of Labor – Bureau of Labor Statistics (BLS)

- Over 500,000 individuals were employed in U.S. data centers in 2023.

- Employment continued to rise in 2024 to support cloud adoption and digital transformation.

- Workforce expansion persisted in 2025, reflecting industry growth and automation adoption.

U.S. Department of Homeland Security (DHS)

- Data centers were identified as critical infrastructure in 2023, requiring strong cybersecurity protocols.

- Security collaborations between government and private sector improved standards in 2024.

- By 2025, enhanced resilience initiatives were implemented to protect data centers from cyber threats.

U.S. Federal Reserve

- Data centers supported the financial sector’s digital operations in 2023.

- Cloud and AI integration improved financial infrastructure efficiency in 2024.

- In 2025, advanced technologies in data centers further streamlined financial services.

U.S. Small Business Administration (SBA)

- Small businesses growingly relied on cloud-managed data center services in 2023.

- Adoption programs in 2024 facilitated wider use of DCaaS solutions by SMEs.

- By 2025, small businesses continued expanding use of remote-managed infrastructure.

U.S. Department of Defense (DoD)

- Data centers were critical for secure defense operations in 2023.

- Investments in 2024 improved operational security and efficiency.

- Advanced data centers deployed in 2025 supported defense communications and AI workloads.

Global Data Center as a Service Market: Market Dynamics

Global Data Center as a Service Market: Driving Factors

Rising Cloud Adoption across Enterprises

The growing shift from traditional on-premises data centers to cloud-based infrastructure is a major driver for the DCaaS market. Organizations are growingly adopting scalable computing resources, flexible storage solutions, and high-speed networking offered by data center as a service platforms to support digital transformation initiatives. This adoption allows businesses to reduce capital expenditure, optimize IT operations, and deploy applications rapidly, particularly in industries such as IT and telecom, BFSI, and healthcare.

Growing Demand for High-Performance Computing and Big Data Analytics

The growing need for advanced analytics, machine learning, and artificial intelligence applications is boosting demand for DCaaS solutions. These workloads require high-performance servers, GPUs, and scalable storage that cloud-managed data centers can efficiently provide. By leveraging DCaaS, enterprises can run complex simulations, process large datasets, and implement real-time analytics without investing heavily in physical infrastructure.

Global Data Center as a Service Market: Restraints

Data Privacy and Security Concerns

Despite the benefits of DCaaS, organizations often hesitate due to concerns about data privacy, cyberattacks, and compliance with regulatory standards. Handling sensitive information in cloud-managed environments requires robust security protocols, encryption, and monitoring, and failure to meet compliance requirements can hinder adoption in regulated sectors like healthcare and banking.

High Operational and Integration Costs

While DCaaS reduces capital expenditure, integrating existing IT systems into cloud-managed platforms can involve significant operational costs. Organizations may face challenges in migrating legacy applications, training staff for cloud management, and maintaining hybrid cloud environments, which can limit adoption among small and medium enterprises with limited budgets.

Global Data Center as a Service Market: Opportunities

Expansion of Edge Computing Solutions

The rise of edge computing presents an opportunity for DCaaS providers to offer localized, low-latency data processing. By deploying smaller data centers closer to end users, organizations can enhance application performance, enable real-time analytics, and support IoT applications, which is particularly beneficial in manufacturing, logistics, and smart city initiatives.

Adoption of Energy-Efficient and Sustainable Data Centers

Sustainability initiatives are driving demand for green and energy-efficient data center solutions. DCaaS providers can capitalize on this trend by implementing eco-friendly infrastructure, optimized cooling systems, and renewable energy sources. This not only reduces operational costs but also aligns with corporate ESG goals and regulatory requirements, attracting environmentally conscious enterprises.

Global Data Center as a Service Market: Trends

Integration of Artificial Intelligence and Automation

AI and automation are growingly integrated into DCaaS platforms to optimize resource allocation, predict maintenance needs, and manage workloads efficiently. These intelligent systems enhance operational efficiency, reduce downtime, and enable predictive analytics, making DCaaS solutions more attractive for enterprises seeking advanced IT infrastructure management.

Growth of Hybrid and Multi-Cloud Deployments

Organizations are adopting hybrid and multi-cloud strategies to balance flexibility, security, and cost-effectiveness. DCaaS platforms supporting seamless integration across public, private, and hybrid clouds allow businesses to manage diverse workloads, ensure high availability, and achieve better disaster recovery, reflecting a major trend shaping market growth globally.

Global Data Center as a Service Market: Research Scope and Analysis

By Infrastructure Type Analysis

In the Data Center as a Service market, servers are projected to be the most dominant component within the infrastructure type segment, capturing around 55.0% of the total market share in 2025. This prominence is largely due to the growing reliance of enterprises on cloud-based computing and digital transformation initiatives that demand high-performance and scalable computing resources. Servers act as the backbone of DCaaS platforms, providing the processing power necessary to run enterprise applications, big data analytics, machine learning models, and virtualization workloads efficiently.

They enable organizations to consolidate multiple applications on a single platform, optimize resource utilization, and reduce physical infrastructure costs. Additionally, the growing adoption of AI-driven workloads and cloud-native applications further intensifies the demand for robust server infrastructure capable of handling intensive computational tasks while ensuring minimal latency and high reliability.

Networking infrastructure, while slightly smaller in market share compared to servers, remains a critical pillar of the DCaaS ecosystem. Advanced networking components such as high-speed switches, routers, firewalls, and software-defined networking solutions are essential for facilitating seamless data transfer, connectivity, and communication between distributed cloud resources and end-users. In a cloud-managed environment, networking ensures low-latency access to applications, reliable remote connectivity, and efficient traffic management, which are crucial for maintaining service quality and user experience.

As enterprises growingly rely on multi-cloud and hybrid cloud deployments, networking also plays a key role in integrating diverse environments, enabling secure data exchange, and supporting real-time analytics. The emphasis on network optimization, automated monitoring, and advanced security protocols has made networking an indispensable element in driving the overall performance, scalability, and reliability of Data Center as a Service solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Service Model Analysis

In the Data Center as a Service market, managed DCaaS models are anticipated to dominate the service model segment, accounting for approximately 70.0% of the total market share in 2025. This dominance is driven by the preference of enterprises for fully managed infrastructure solutions that reduce operational complexity and allow IT teams to focus on strategic initiatives rather than day-to-day data center management.

Managed DCaaS providers handle the deployment, monitoring, maintenance, and optimization of servers, storage, networking, and security, ensuring high availability, performance, and compliance with regulatory standards. Organizations benefit from predictable costs, rapid scalability, and enhanced reliability, making managed services particularly attractive for large enterprises, industries with critical workloads, and businesses undergoing digital transformation initiatives. The ability to leverage professional expertise and advanced automation further strengthens the adoption of managed DCaaS solutions globally.

Self-service DCaaS, while representing a smaller share of the market, offers organizations greater control and flexibility over their cloud-managed infrastructure. In this model, enterprises are responsible for managing their own servers, storage, and networking resources through an on-demand cloud platform, allowing them to tailor configurations to specific application requirements.

Self-service DCaaS is particularly suited for organizations with skilled IT teams, custom workloads, or unique compliance requirements that demand direct control over infrastructure. This model supports experimentation, rapid deployment, and agile application management while enabling cost optimization by allowing organizations to pay only for the resources they use. As a result, self-service DCaaS provides a valuable option for businesses seeking flexibility and autonomy in managing cloud-based data center resources.

By Deployment Model Analysis

In the Data Center as a Service market, the public cloud deployment model is expected to dominate, accounting for approximately 60.0% of the total market share in 2025. This dominance is driven by the growing demand for scalable, cost-effective, and flexible infrastructure solutions that can support a wide range of enterprise applications and workloads. Public cloud DCaaS offers on-demand access to computing power, storage, and networking without the need for organizations to invest in or maintain physical data center facilities. Enterprises benefit from rapid deployment, simplified management, and the ability to scale resources up or down based on fluctuating business needs.

Additionally, public cloud platforms provide robust disaster recovery, security features, and global accessibility, making them highly attractive for businesses looking to optimize operational efficiency, support digital transformation initiatives, and leverage advanced technologies such as artificial intelligence, big data analytics, and machine learning.

Private cloud deployment, while holding a smaller market share, remains crucial for organizations with stringent data security, compliance, and control requirements. In this model, the cloud infrastructure is dedicated solely to a single organization, providing enhanced privacy and the ability to customize resources, policies, and configurations according to specific business needs. Private cloud DCaaS is preferred by industries such as banking, healthcare, and government, where sensitive data and regulatory compliance are paramount.

It allows organizations to maintain greater control over security protocols, data residency, and access management while still benefiting from automation, scalability, and remote-managed infrastructure offered by service providers. This deployment model enables enterprises to combine the flexibility of cloud computing with the assurance of secure and tailored IT environments.

By Organization Size Analysis

In the Data Center as a Service market, large enterprises are projected to dominate the organization size segment, accounting for approximately 60.0% of the total market share in 2025. This dominance is primarily driven by the extensive IT requirements of large-scale businesses, including high-performance computing, big data analytics, enterprise applications, and artificial intelligence workloads. Large enterprises often seek DCaaS solutions to optimize operational efficiency, reduce capital expenditure on physical data center infrastructure, and ensure high availability and disaster recovery capabilities.

The ability to leverage managed services, advanced automation, and scalable cloud resources allows these organizations to support complex and mission-critical workloads while maintaining compliance with industry regulations. Furthermore, large enterprises benefit from the flexibility and agility provided by DCaaS platforms, enabling them to quickly adapt to evolving business demands and technological advancements.

Small and medium-sized enterprises, while representing a smaller share of the market, are growingly adopting DCaaS due to its cost-effectiveness and scalability. SMEs often face budgetary constraints and limited IT staff, making cloud-managed infrastructure an attractive alternative to building and maintaining on-premises data centers. By leveraging self-service or managed DCaaS solutions, SMEs can access enterprise-grade computing power, storage, and networking without significant upfront investments.

This allows them to deploy business applications rapidly, support remote operations, and scale IT resources based on fluctuating demands. The flexibility, reduced maintenance burden, and pay-as-you-go pricing model of DCaaS enable SMEs to enhance operational efficiency, remain competitive, and focus on core business functions while benefiting from advanced data center capabilities.

By End-User Industry Analysis

In the Data Center as a Service market, the IT and telecom industry is expected to hold the largest share in the end-user industry segment, accounting for approximately 35.0% of the total market value. This leadership is driven by the sector’s extensive reliance on cloud-based infrastructure to support critical applications, enterprise software, and large-scale data processing. IT and telecom companies require scalable computing resources, high-speed networking, and robust storage solutions to manage massive volumes of data, enable virtualization, and support digital transformation initiatives.

The adoption of DCaaS allows these organizations to optimize operational efficiency, reduce capital expenditure on physical data centers, and ensure uninterrupted service delivery. Additionally, the integration of advanced technologies such as artificial intelligence, machine learning, and edge computing further fuels the demand for cloud-managed data center services within this sector, enabling faster deployment of innovative solutions and enhanced customer experiences.

The banking, financial services, and insurance industry represents another significant segment in the DCaaS market, driven by the need for secure, compliant, and reliable infrastructure to manage sensitive financial data and critical transactions. BFSI organizations adopt DCaaS to ensure data privacy, regulatory compliance, and high availability of IT services while reducing the complexity of managing on-premises data centers.

Cloud-managed infrastructure enables real-time analytics, fraud detection, risk assessment, and digital banking operations, supporting faster decision-making and improved customer engagement. The ability to scale resources on demand, implement automated backup and disaster recovery solutions, and maintain robust cybersecurity measures makes DCaaS an essential solution for financial institutions seeking operational resilience, cost efficiency, and advanced technological capabilities.

The Data Center as a Service Market Report is segmented on the basis of the following:

By Infrastructure Type

- Servers

- Networking

- Storage

By Service Model

- Managed DCaaS

- Self-Service DCaaS

By Deployment Model

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

By End-User Industry

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Government & Public Sector

- Others

Global Data Center as a Service Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Data Center as a Service market, capturing approximately 40.0% of the total market revenue in 2025. This regional dominance is driven by the presence of major cloud service providers, widespread adoption of public and hybrid cloud solutions, and high investments in advanced IT infrastructure.

Enterprises across industries such as IT and telecom, BFSI, healthcare, and retail are growingly leveraging DCaaS to support digital transformation initiatives, big data analytics, and artificial intelligence workloads. Strong technological capabilities, well-established data center networks, regulatory compliance frameworks, and a focus on innovation further reinforce the region’s leadership in adopting scalable, secure, and high-performance cloud-managed infrastructure solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the Data Center as a Service market over the coming years, driven by rapid digitalization, growing cloud adoption, and the expansion of IT infrastructure in emerging economies such as China, India, and Southeast Asian countries. Growing investments in e-commerce, fintech, healthcare IT, and government digital initiatives are fueling demand for scalable, secure, and high-performance cloud-managed data centers.

Additionally, the rise of small and medium enterprises adopting flexible and cost-effective IT solutions, integrated with improvements in internet connectivity and data center policies, is accelerating market expansion, making Asia-Pacific one of the fastest-growing regions in the global DCaaS landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center as a Service Market: Competitive Landscape

The global Data Center as a Service market is highly competitive, led by major cloud providers such as Amazon Web Services, Microsoft Azure, and Google Cloud, which offer scalable, flexible, and high-performance infrastructure solutions to meet the growing demand for cloud-based computing. In addition to public cloud leaders, companies like IBM, Hewlett Packard Enterprise, and Dell Technologies provide hybrid and private cloud services tailored for organizations with specific compliance, security, and customization requirements.

Infrastructure providers such as Vantage Data Centers and CyrusOne are expanding their data center capacities to support AI, big data analytics, and enterprise workloads, while firms like Schneider Electric and Vertiv contribute critical solutions for energy management, cooling, and efficient operations. The market is thus shaped by a diverse ecosystem of players offering a combination of advanced technologies, managed services, and specialized infrastructure to meet the evolving requirements of businesses globally.

Some of the prominent players in the global Data Center as a Service market are:

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud

- IBM Corporation

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Alibaba Cloud

- DigitalOcean

- Linode

- Equinix

- Huawei Technologies

- Meta Platforms

- Oracle Cloud

- Vantage Data Centers

- NTT Global Data Centers

- CyrusOne

- GDS Holdings

- Telehouse (KDDI)

- Flexential

- Rackspace Technology

- Other Key Players

Global Data Center as a Service Market: Recent Developments

- September 2025: Microsoft announced a USD 7 billion investment in Wisconsin to build a second massive AI data center, joining its previously announced USD 3.3 billion facility. The project will host one of the world’s most powerful AI supercomputers using Nvidia chips and employ up to 800 people. The data center will use eco-friendly cooling and pre-paid electrical infrastructure to mitigate utility impacts.

- September 2025: Schneider Electric launched a new line of data center solutions designed for high-density AI and accelerated compute applications, offering scalable power distribution, thermal management, and pod-level designs.

- September 2025: Groq, an AI chip company, raised USD 750 million at a USD 6.9 billion valuation to expand its AI chip development and data center capabilities.

- September 2025: WhiteFiber, an AI data center infrastructure provider, saw its stock rise 11.7% after reporting USD 18.7 million in Q2 revenue, driven by strong demand for high-density AI infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 156.3 Bn |

| Forecast Value (2034) |

USD 1,096.3 Bn |

| CAGR (2025–2034) |

24.1% |

| The US Market Size (2025) |

USD 52.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Infrastructure Type (Servers, Networking, Storage), By Service Model (Managed DCaaS, Self-Service DCaaS), By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, SMEs), and By End-User Industry (IT & Telecom, BFSI, Healthcare, Retail, Government & Public Sector, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Alibaba Cloud, DigitalOcean, Linode, Equinix, Huawei Technologies, Meta Platforms, Oracle Cloud, Vantage Data Centers, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global data center as a service market?

▾ The global data center as a service market size is estimated to have a value of USD 156.5 billion in 2025 and is expected to reach USD 1,096.3 billion by the end of 2034.

What is the size of the US data center as a service market?

▾ The US data center as a service market is projected to be valued at USD 52.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 328.8 billion in 2034 at a CAGR of 22.6%.

Which region accounted for the largest global data center as a service market?

▾ North America is expected to have the largest market share in the global data center as a service market, with a share of about 40.0% in 2025.

Who are the key players in the global data center as a service market?

▾ Some of the major key players in the global data center as a service market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Corporation, Hewlett Packard Enterprise (HPE), Dell Technologies, Alibaba Cloud, DigitalOcean, Linode, Equinix, Huawei Technologies, Meta Platforms, Oracle Cloud, Vantage Data Centers, and Others.

What is the growth rate of the global data center as a service market?

▾ The market is growing at a CAGR of 24.1 percent over the forecasted period.