Market Overview

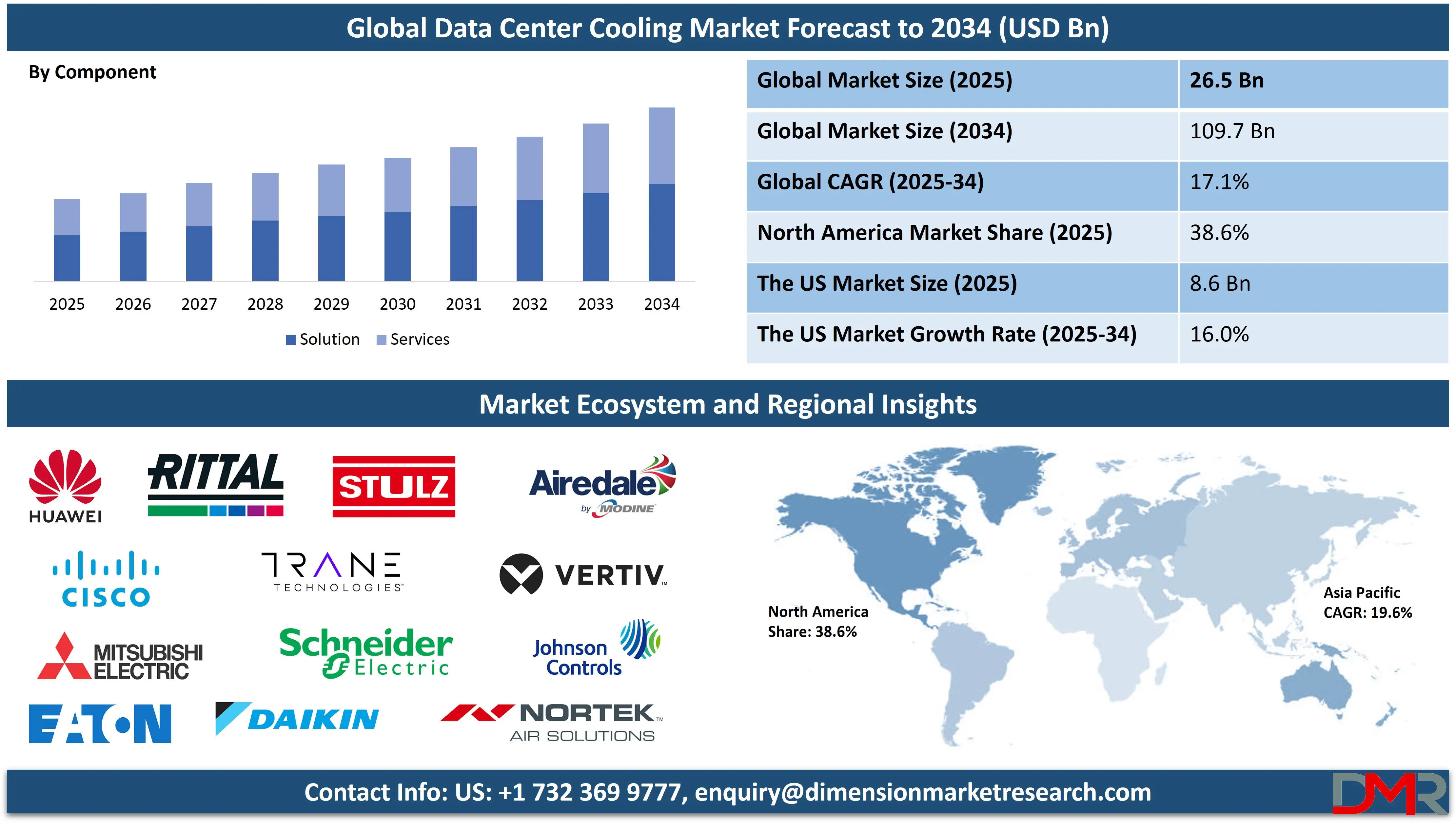

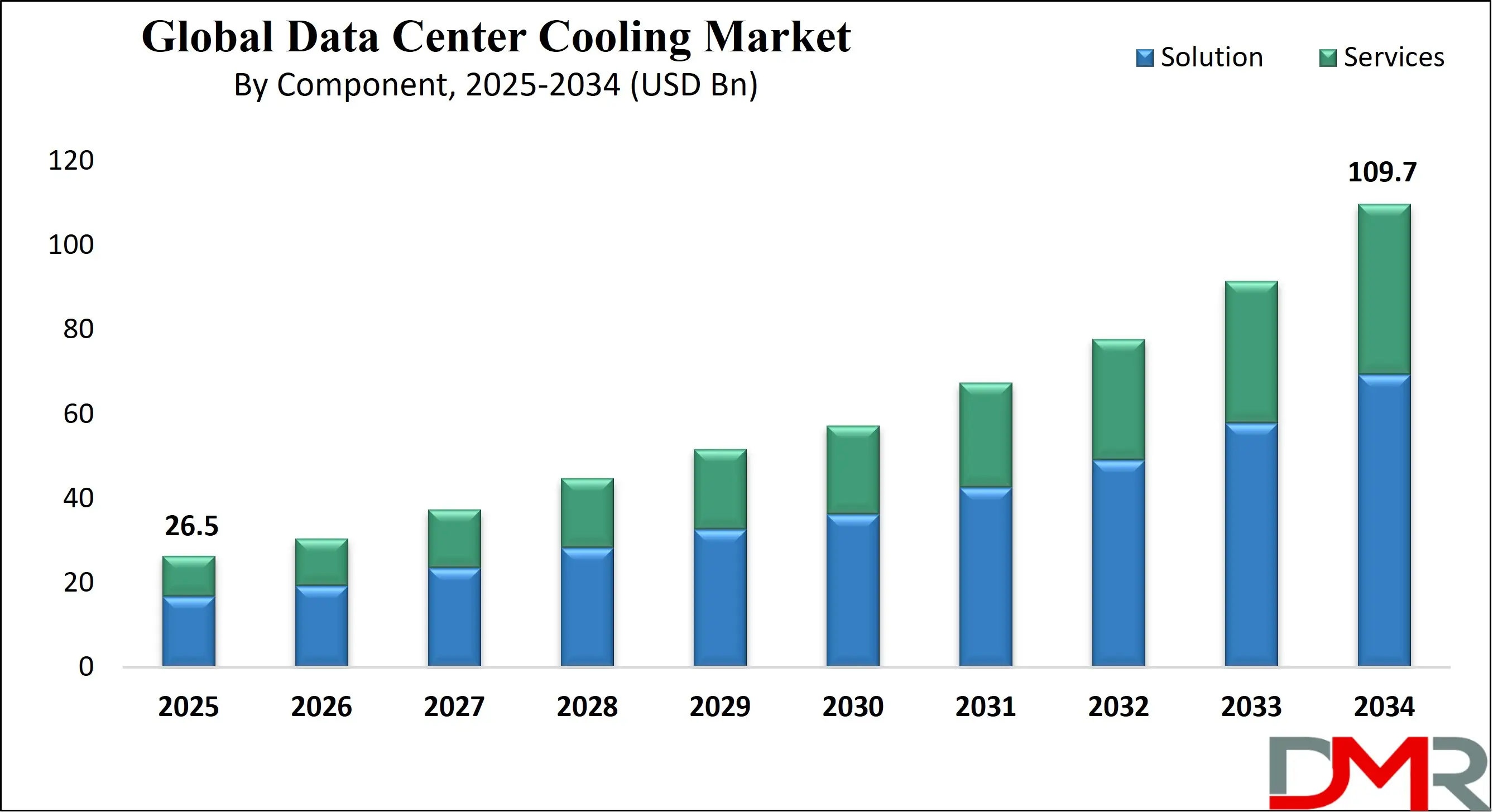

The Global Data Center Cooling Market is projected to reach USD 26.5 billion in 2025 and grow at a compound annual growth rate of 17.1% from there until 2034 to reach a value of USD 109.7 billion.

The global data center cooling market is experiencing dynamic growth, driven by the exponential rise in data processing needs stemming from technologies like artificial intelligence, cloud computing, 5G, IoT, and big data analytics. As workloads intensify and servers become denser, the requirement for effective thermal management has become indispensable to ensure uninterrupted operations and hardware longevity. Traditional air-based cooling solutions are being supplemented or replaced by advanced techniques such as liquid immersion, direct-to-chip liquid cooling, and evaporative cooling systems, which offer enhanced energy efficiency and localized heat extraction.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One major trend is the deployment of modular and scalable cooling solutions that respond in real-time to fluctuating thermal loads across zones within the data center. The increasing use of AI and machine learning for predictive maintenance and intelligent airflow control is further enhancing operational efficiency. Meanwhile, as edge data centers gain traction to support latency-sensitive applications, compact and energy-efficient cooling systems tailored for small footprints are witnessing growing demand.

Despite this robust trajectory, the market faces certain restraints, including high capital expenditure associated with retrofitting legacy data centers with modern cooling infrastructure. Additionally, there is a skill gap in managing complex cooling architectures, especially in developing regions. However, growing awareness of the environmental impact of data center operations is fueling investments in green cooling solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market holds substantial growth prospects with ongoing digital transformation initiatives, government-led sustainability goals, and hyperscale expansions. As companies aim to reduce Power Usage Effectiveness (PUE) and carbon emissions, innovative cooling solutions will remain critical to the evolving digital ecosystem worldwide.

The US Data Center Cooling Market

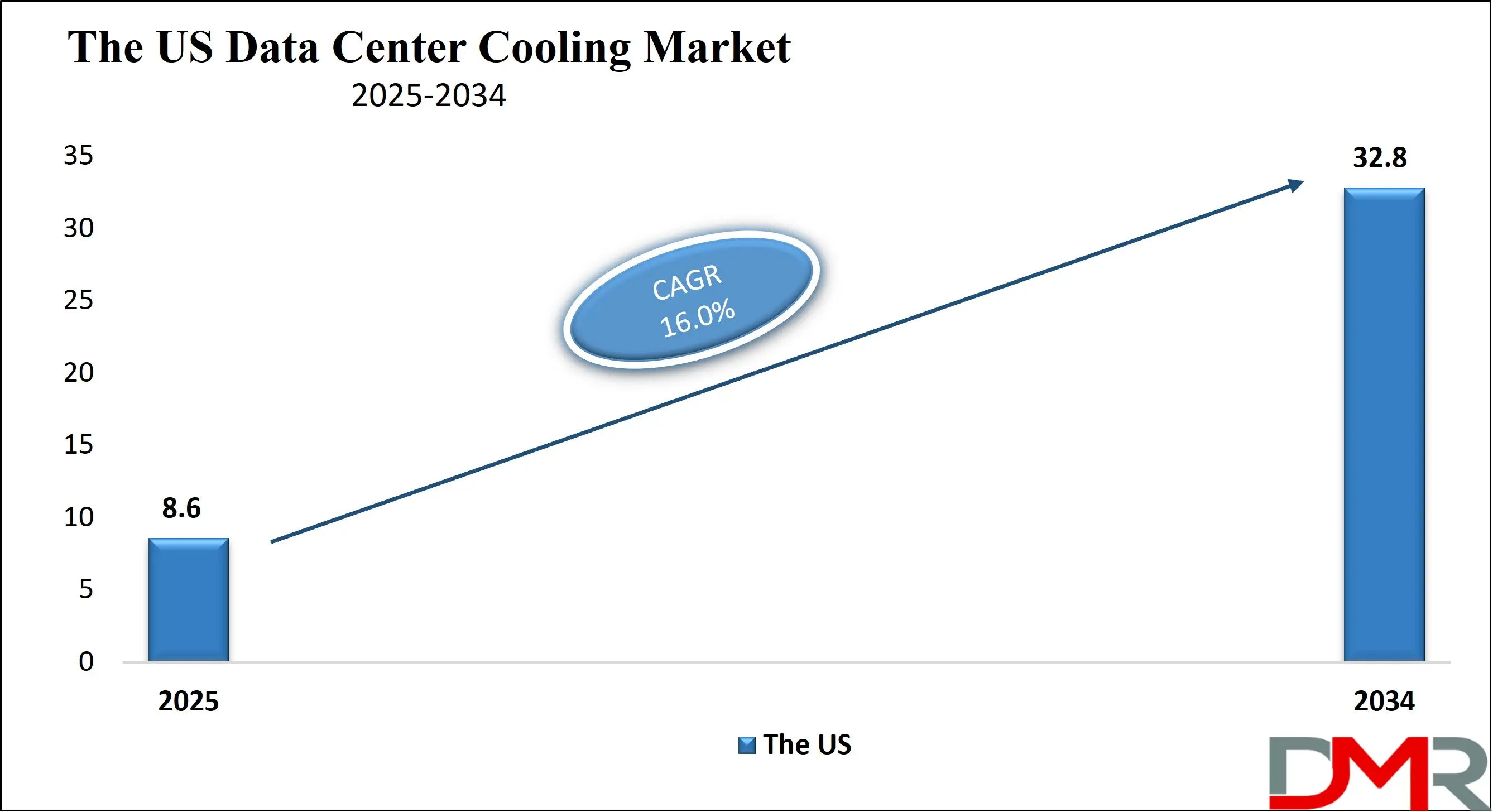

The US Data Center Cooling Market is projected to reach USD 8.6 billion in 2025 at a compound annual growth rate of 16.0% over its forecast period.

The United States remains the largest data center hub globally, underpinned by a combination of economic scale, digital innovation, and a robust regulatory environment. According to the U.S. Department of Energy (DOE), the country’s data centers consume roughly 70 billion kWh annually, equating to approximately 2% of total electricity usage. A significant portion of this power supports cooling systems that regulate thermal loads to prevent server outages and ensure 24/7 reliability.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Demographically, the U.S. benefits from a highly urbanized population and strong internet penetration, with nearly 93% of Americans using the internet according to the U.S. Census Bureau. This fuels rising demand for low-latency digital services, e-commerce, and cloud computing. Hyperscale data centers continue to expand in regions such as Northern Virginia, Texas, and Ohio due to access to renewable energy, favorable climate for natural cooling, and supportive tax policies.

Public-sector initiatives like the Federal Data Center Optimization Initiative (DCOI) and the General Services Administration (GSA)’s push for modernization underscore the government’s commitment to sustainable and efficient infrastructure. The National Renewable Energy Laboratory (NREL) promotes research into energy-efficient HVAC systems and AI-enabled thermal automation, which are gaining traction across both private and federal facilities.

Innovations such as hot aisle containment, liquid cooling, and dynamic thermal optimization are increasingly adopted to meet environmental targets and reduce Power Usage Effectiveness (PUE). With digital transformation accelerating in sectors like healthcare, finance, and defense, the U.S. data center cooling market is primed for continued leadership and rapid technological adoption.

The Europe Data Center Cooling Market

The Europe Data Center Cooling Market is estimated to be valued at USD 3.9 billion in 2025 and is further anticipated to reach USD 13.9 billion by 2034 at a CAGR of 15.0%.

Europe’s data center cooling market is characterized by a strong focus on energy efficiency, sustainability, and regulatory compliance. The European Commission's Green Deal and the Climate-Neutral Data Centre Pact require new data centers built after 2025 to meet strict efficiency benchmarks and achieve net-zero emissions by 2030. According to the European Environment Agency (EEA), data centers accounted for 2.7% of electricity consumption in 2022, prompting significant policy-level interventions aimed at curbing energy waste from cooling systems.

Countries like Ireland, Germany, the Netherlands, and Sweden are prominent data center locations, benefitting from reliable power grids, political stability, and naturally cooler climates conducive to free air and water-side economization. The Netherlands Enterprise Agency (RVO) and Germany’s Federal Environment Agency (UBA) actively support best practices in thermal reuse, promoting systems that redirect waste heat from data centers to local district heating networks, an approach already being piloted in Amsterdam and Frankfurt.

Demographic advantages such as high broadband penetration (exceeding 90% in many EU nations), urban digitization, and a strong manufacturing and financial services base drive the need for scalable data infrastructure. The European Telecommunications Standards Institute (ETSI) is working toward harmonized cooling standards to ensure interoperability and environmental accountability.

Space constraints and strict urban planning laws pose challenges for traditional cooling setups, increasing demand for modular, high-efficiency alternatives. Opportunities lie in AI-integrated thermal management, immersion cooling adoption, and public-private collaborations for green infrastructure. Europe’s regulatory leadership and climate-conscious strategies are positioning it as a pioneer in sustainable data center cooling practices.

The Japan Data Center Cooling Market

The Japan Data Center Cooling Market is projected to be valued at USD 1.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 6.9 billion in 2034 at a CAGR of 18.0%.

Japan’s data center cooling market is undergoing accelerated transformation, driven by a combination of digital expansion, climate challenges, and governmental sustainability directives. According to the Ministry of Internal Affairs and Communications (MIC), Japan's internet traffic has doubled over the past five years, primarily due to rising demand for high-speed connectivity, IoT, AI, and cloud computing. This surge in digital activity is creating heightened thermal loads across enterprise and hyperscale data centers, making advanced cooling infrastructure indispensable.

The Ministry of Economy, Trade and Industry (METI), through its “Green Growth Strategy,” is promoting energy-efficient IT infrastructure by incentivizing the adoption of low-carbon technologies such as liquid immersion cooling, air economizers, and waste heat utilization. Furthermore, Japan’s Agency for Natural Resources and Energy (ANRE) highlights that nearly 40% of data center electricity is consumed by cooling systems, urging a national shift toward high-efficiency, closed-loop systems.

Geographically, Japan’s dense urban clusters, Tokyo, Osaka, and Fukuoka, have high data demand but limited real estate, favoring modular and rack-based cooling solutions that conserve floor space. Additionally, the aging population and shrinking workforce are accelerating the need for AI-driven cooling automation and predictive maintenance.

The Tokyo Metropolitan Government also encourages district energy integration, supporting projects that reuse waste heat from data centers for urban heating networks. This circular approach aligns with Japan’s carbon neutrality targets for 2050.

In summary, Japan’s data center cooling market is shaped by urban density, government-backed sustainability goals, climate-specific engineering demands, and a mature digital ecosystem, making it a pivotal regional leader in thermal innovation.

Global Data Center Cooling Market: Key Takeaways

- The Global Data Center Cooling Market size is estimated to have a value of USD 26.5 billion in 2025 and is expected to reach USD 109.7 billion by the end of 2034.

- The US Data Center Cooling Market is projected to be valued at USD 8.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 32.8 billion in 2034 at a CAGR of 16.0%.

- North America is expected to have the largest market share in the Global Data Center Cooling Market with a share of about 38.6% in 2025.

- Some of the major key players in the Global Data Center Cooling Market are Schneider Electric, Vertiv Group Corp., Johnson Controls, Nortek Air Solutions, STULZ GmbH, Rittal GmbH & Co. KG, Eaton Corporation, and many others.

- The market is growing at a CAGR of 17.1 percent over the forecasted period of 2025.5

Global Data Center Cooling Market: Use Cases

- AI Data Centers: AI workloads require massive parallel processing, leading to intense heat output. Direct-to-chip liquid cooling and immersion cooling systems are deployed to manage these thermal loads efficiently, preventing hardware degradation and enabling continuous AI model training at optimal speeds without performance throttling.

- Edge Computing Nodes: Edge data centers operate in remote or urban edge environments where space and energy are limited. Compact row-based cooling units and self-contained modules provide effective thermal regulation, allowing stable operation in non-traditional data center sites with variable ambient conditions.

- Colocation Facilities: Colocation providers must manage diverse client-server configurations within shared spaces. They utilize hybrid cooling solutions with room-based airflow control and hot/cold aisle containment to handle variable thermal demands while ensuring SLA compliance and minimizing energy consumption.

- Green Data Centers: Sustainability-focused operators integrate renewable-powered systems with advanced economizer-based cooling. These setups leverage outdoor air and waterside cooling where climate permits, drastically reducing reliance on energy-intensive mechanical chillers and aligning with carbon neutrality targets.

- High-Density Server Environments: In hyperscale and AI-driven facilities, server densities often exceed 20kW per rack. These require direct-to-chip or rear door heat exchanger systems to handle dense thermal output, enabling greater computing power within the same footprint without compromising temperature stability or efficiency.

Global Data Center Cooling Market: Stats & Facts

U.S. Department of Energy (DOE)

- U.S. data centers consume approximately 70 billion kWh of electricity annually, with a major share used for cooling systems that manage thermal loads around the clock. This underscores the enormous energy footprint of cooling infrastructure in hyperscale and enterprise data centers.

- Cooling systems account for 30–40% of total energy use in typical data centers, highlighting the need for innovations in airflow design, chilled water systems, and containment solutions to reduce power consumption.

- Efficient cooling strategies can reduce total energy consumption by up to 45%, especially when using economizers, liquid cooling systems, and variable-speed fans. Such energy savings have significant implications for reducing operational expenditure and environmental impact.

- Airside economizers can save 60–80% of cooling energy in suitable climates, particularly in temperate regions, by using ambient outdoor air instead of mechanical refrigeration for part of the year.

U.S. Environmental Protection Agency (EPA)

- The EPA estimates that improved data center energy efficiency can save 20 billion kWh annually, primarily through optimized thermal management and intelligent cooling controls such as dynamic airflow and heat reuse systems.

- The ENERGY STAR program has certified over 200 data centers in the U.S., with many deploying advanced precision air conditioners, hot aisle containment, and efficient humidification technologies to qualify.

- U.S. data centers contribute about 2% of national electricity use, indicating that reducing cooling energy intensity can directly benefit national grid sustainability and emission reduction goals.

European Environment Agency (EEA)

- Data centers in the EU consumed 2.7% of the region’s total electricity in 2022, a figure projected to grow rapidly with the expansion of cloud infrastructure and edge facilities. Cooling systems remain the single most power-intensive operational component.

- Without strategic energy interventions, EU data center power demand is expected to double by 2030, driven by increased server densities and AI workloads, which require robust cooling capacity.

- Free cooling technologies in northern Europe have enabled average Power Usage Effectiveness (PUE) values below 1.5, showcasing how regional climate advantages are leveraged for thermal efficiency and carbon savings.

European Commission – Climate-Neutral Data Centre Pact

- From 2025 onward, new EU data centers must meet targets for energy reuse, water efficiency, and carbon neutrality, with cooling systems playing a key role in meeting these sustainability standards.

- The pact mandates 100% free cooling for at least 8,000 hours annually wherever climate conditions allow, encouraging the integration of airside and waterside economizers in modern facilities.

Japan Ministry of the Environment (MOE)

- Japan's long-term decarbonization strategy includes the data center industry, requiring thermal infrastructure to align with its net-zero roadmap by 2050, emphasizing retrofitting with smart cooling systems.

- Cooling system upgrades alone can cut CO₂ emissions by up to 30% per data center, particularly when switching from legacy air conditioning to liquid cooling or indirect evaporative solutions.

- The MOE promotes urban waste heat recovery systems, wherein waste heat from data centers is channeled to district heating networks in metropolitan areas like Tokyo, maximizing thermal reuse.

Japan Agency for Natural Resources and Energy (ANRE)

- Data center cooling systems consume between 35–45% of total site energy in Japan, driven by compact floor plans, high rack densities, and humid summer climates.

- Under Japan’s “Green IT” program, cooling retrofits receive up to one-third government subsidy, encouraging operators to adopt low-carbon, high-efficiency cooling systems like chilled water loops and heat exchangers.

- ANRE recommends closed-loop and liquid-based systems to address heat load challenges while reducing dependence on high-GWP refrigerants.

International Energy Agency (IEA)

- Globally, data centers used 460 TWh of electricity in 2022, with nearly 40% of this allocated to cooling, suggesting that cooling infrastructure remains a massive opportunity for efficiency gains.

- Liquid cooling solutions could reduce global electricity use by up to 20%, especially for high-density AI and HPC (high-performance computing) environments requiring precision heat management.

- The average PUE for hyperscale data centers has improved to 1.2, largely due to enhanced cooling strategies, including thermal containment, variable frequency drive (VFD) fans, and intelligent airflow control systems.

The Green Grid (Industry Consortium)

- Use of hot aisle containment can improve cooling efficiency by 15–30%, by isolating hot exhaust air and preventing it from mixing with intake airflow, optimizing CRAC (Computer Room Air Conditioning) performance.

- Variable flow chilled water systems can cut cooling energy costs by 25%, especially when integrated with demand-based airflow and temperature sensors.

- Liquid-cooled racks can support thermal loads of 50 kW per rack, compared to just 10–15 kW for air-cooled racks, enabling dense compute configurations in limited space.

European Telecommunications Standards Institute (ETSI)

- ETSI recommends data center ambient temperatures be maintained between 18–27°C (64–80°F), ensuring component reliability while minimizing excessive cooling overhead.

- Cooling systems should operate effectively under fluctuating energy supply conditions, as part of edge deployment standards in regions with variable grid availability.

- ETSI endorses AI-enabled cooling platforms, allowing real-time adjustment to thermal conditions, improving energy savings while complying with EU carbon regulations.

Singapore Infocomm Media Development Authority (IMDA)

- Singapore’s hot, humid climate limits air-based free cooling to fewer than 1,000 hours annually, necessitating hybrid or liquid cooling systems.

- IMDA mandates PUE targets of ≤1.3 for all new government-backed data center projects, encouraging deployment of evaporative and immersion cooling technologies.

- Pilot projects using two-phase immersion cooling showed 20% energy savings and 40% reduction in floor space, critical for land-constrained urban data centers.

Germany’s Federal Environment Agency (UBA)

- Germany promotes the use of data center waste heat for district heating, which could supply thermal energy to over 500,000 homes if widely implemented.

- This supports circular economy models and aligns with Germany’s commitment to reduce fossil fuel dependency through efficient heat reuse.

. Netherlands Enterprise Agency (RVO)

- New Dutch data centers must meet or exceed PUE 1.2 to secure construction permits, promoting the use of highly efficient evaporative or indirect air-cooling systems.

- More than 60% of Dutch data centers have transitioned to free cooling technologies, leveraging the mild climate and progressive regulatory landscape.

UK Department for Business, Energy & Industrial Strategy (BEIS)

- BEIS promotes the adoption of hydronic cooling in high-density urban centers, minimizing electrical strain on local infrastructure.

- Operators deploying advanced cooling systems can access Enhanced Capital Allowance (ECA) incentives, allowing faster write-offs on green investments.

Global Data Center Cooling Market: Market Dynamics

Driving Factors in the Global Data Center Cooling Market

Surge in Hyperscale Data Center Deployments Globally

The proliferation of hyperscale data centers, driven by the expansion of global cloud computing, AI infrastructure, and content streaming services, is a critical growth driver for the data center cooling market. Hyperscale facilities operated by major cloud providers like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure require highly efficient and scalable cooling systems to support multi-megawatt power loads and dense IT architectures. These mega data centers can span over 100,000 square feet and consume over 100MW of power, necessitating next-generation cooling solutions such as chilled water systems, rear-door heat exchangers, and modular liquid-cooled loops. Moreover, the hyperscale model prioritizes operational efficiency and sustainability.

According to a report by the U.S. Department of Energy, energy optimization in these facilities is paramount, with cooling systems accounting for 35- 45% of power consumption. Operators are investing in adaptive, AI-driven thermal management platforms and evaporative cooling towers to reduce PUE and align with carbon-neutral targets. In regions like North America, the Nordics, and Southeast Asia, government incentives, favorable climate conditions, and access to renewable energy are accelerating hyperscale expansion. This infrastructure boom creates consistent, long-term demand for innovative cooling technologies that are not only energy-efficient but also modular, scalable, and low in environmental impact.

Regulatory Push for Sustainable Data Center Operations

Governments worldwide are tightening regulations on energy-intensive industries, and data centers are no exception. Cooling systems are often the largest source of energy consumption in data centers, and IT equipment is under regulatory scrutiny for its carbon footprint. As a result, data center operators are being incentivized or required to adopt sustainable cooling solutions. In the European Union, the Climate-Neutral Data Centre Pact mandates that new facilities built after 2025 meet stringent energy and water efficiency targets, with specific expectations around cooling system performance, free cooling usage hours, and heat reuse.

Similarly, in Japan and Singapore, government policies mandate aggressive PUE targets, pushing operators toward technologies such as economizer-based cooling, liquid immersion, and waste heat recovery. In the United States, ENERGY STAR and the Department of Energy’s Better Buildings initiative promote best practices for thermal efficiency, offering certifications and rebates for facilities meeting defined energy benchmarks. These regulatory frameworks not only aim to reduce environmental impact but also foster innovation in green HVAC systems, AI-based control platforms, and smart containment. The tightening of environmental standards globally will continue to accelerate investments in advanced cooling systems that reduce energy use, minimize carbon emissions, and meet ESG reporting expectations from stakeholders.

Restraints in the Global Data Center Cooling Market

High Initial Investment and Operating Complexity

Despite long-term savings and environmental benefits, advanced cooling technologies such as liquid cooling, two-phase immersion, and chilled water systems often come with high initial capital expenditure. Retrofitting existing data centers to support new cooling architectures requires significant re-engineering of layout, piping, rack design, and monitoring systems. This financial burden is especially daunting for small and mid-sized enterprises or colocation providers operating on tight margins. Additionally, the operational complexity of managing advanced cooling, particularly liquid-based systems, demands highly skilled personnel for installation, maintenance, and emergency response.

Downtime risks, potential leaks, and lack of familiarity with newer technologies also deter widespread adoption, especially in regions lacking robust data center engineering talent. As a result, many operators opt to extend legacy air cooling systems with incremental improvements rather than overhauling their thermal infrastructure. This hesitancy could slow the overall adoption curve for next-generation cooling technologies and limit market penetration in budget-constrained segments.

Environmental and Water Resource Constraints

While sustainable cooling is a major goal, many high-efficiency systems, such as evaporative cooling, adiabatic systems, and water-cooled chillers, are heavily reliant on water availability. In regions facing water scarcity, regulatory limits on industrial water usage pose a major challenge to deploying these technologies. For example, jurisdictions in California, Spain, and parts of India have begun restricting large-scale water consumption for commercial cooling applications. Additionally, public opposition and ESG-driven scrutiny have intensified around data centers perceived to be water-intensive. As climate change exacerbates drought risks and water regulations tighten, data center operators may face barriers to scaling water-based cooling solutions.

Moreover, the wastewater generated from such systems, if not properly treated, can lead to environmental compliance issues. These constraints are prompting vendors to invest in closed-loop and air-only alternatives, but such systems may not always deliver the same energy efficiency. The tension between sustainability, performance, and water stewardship could slow deployment in water-stressed regions, posing a geographic limitation on market growth.

Opportunities in the Global Data Center Cooling Market

Rising Demand for Edge Data Centers in Emerging Markets

The shift toward edge computing is driving new opportunities for data center cooling providers. As applications such as autonomous vehicles, real-time analytics, industrial IoT, and 5G expand, there is a growing demand for localized, low-latency data processing. This demand is met by deploying edge data centers in remote, urban, and non-traditional environments, which in turn require highly efficient, compact, and low-maintenance cooling solutions. Unlike hyperscale facilities that benefit from centralized infrastructure, edge data centers face unique challenges, including limited physical space, restricted power availability, and exposure to variable environmental conditions. These constraints make traditional air-based cooling inefficient or unviable, leading to the adoption of innovative technologies like in-row cooling, modular rack-based cooling, and passive heat rejection units.

Furthermore, edge deployments in regions such as Southeast Asia, Africa, and Latin America where climate conditions are more extreme create demand for cooling systems that are both rugged and energy-efficient. Manufacturers are investing in hybrid cooling technologies that combine economizer functions with sealed enclosures to maintain thermal stability even under fluctuating temperatures. As digital infrastructure reaches deeper into rural and urban edge locations, the demand for scalable and intelligent cooling solutions tailored for the edge computing ecosystem represents a lucrative long-term growth avenue.

Technological Advancements in Smart and Modular Cooling Systems

The evolution of smart and modular cooling technologies presents another major growth opportunity. Traditional cooling infrastructure is often rigid, space-intensive, and capital-heavy, posing limitations for scalability and efficiency. Modular cooling systems, such as prefabricated micro data centers with integrated climate control, offer plug-and-play deployment with built-in liquid or air-based cooling tailored to specific use cases. These systems are especially advantageous for industries requiring rapid deployment, including healthcare, military, financial services, and remote research hubs. Smart cooling systems integrate IoT sensors, AI-based controllers, and real-time analytics dashboards to optimize energy consumption, detect anomalies, and enable predictive maintenance. These advancements reduce operational costs, enhance uptime, and extend equipment lifespan.

Leading vendors are developing containerized cooling pods and rear-door heat exchangers embedded with smart diagnostics, facilitating integration with data center infrastructure management (DCIM) platforms. These features are particularly attractive to enterprises adopting hybrid cloud models and edge expansion, where agility, visibility, and automation are crucial. As the global emphasis shifts to sustainability, modular systems are increasingly equipped with low-GWP refrigerants, energy-efficient fans, and heat recovery units. The convergence of digital control and physical infrastructure in smart cooling solutions creates a powerful value proposition for both large-scale and distributed data center environments.

Trends in the Global Data Center Cooling Market

Integration of AI and Machine Learning for Predictive Thermal Management

A major trend reshaping the data center cooling market is the integration of artificial intelligence (AI) and machine learning (ML) algorithms for predictive thermal management. Traditional cooling systems typically rely on reactive temperature regulation, often consuming more power than necessary. However, AI-enabled systems analyze real-time data from sensors distributed throughout server rooms to anticipate heat buildup before it becomes problematic. These intelligent systems adjust fan speeds, liquid flow rates, and HVAC parameters dynamically, resulting in lower energy usage and enhanced system longevity. Google reported a 40% reduction in cooling energy use at one of its data centers using DeepMind’s AI, setting a benchmark in the industry.

Moreover, these AI systems help maintain optimal humidity and airflow to prevent hotspots, thermal throttling, or hardware failures. The predictive capabilities not only minimize operational risk but also allow for early detection of inefficiencies or mechanical issues, reducing unplanned downtime. As regulatory pressures mount to reduce data center carbon emissions, AI’s role in optimizing energy efficiency through smarter cooling will become increasingly integral. Adoption is expanding from hyperscale operators to enterprise data centers, colocation facilities, and modular edge deployments, particularly where PUE metrics and ESG compliance are top priorities.

Growing Adoption of Liquid Cooling in High-Density Environments

As computational workloads intensify with the rise of AI, machine learning, and advanced analytics, server rack densities in modern data centers are reaching levels that challenge the capabilities of traditional air cooling systems. Liquid cooling, specifically direct-to-chip and immersion cooling, is becoming a dominant trend for managing extreme thermal loads in high-density configurations. These systems use a liquid medium to absorb and transport heat directly from critical components like CPUs and GPUs, offering superior heat transfer efficiency and reducing the need for large-scale mechanical air conditioning. Unlike air-based cooling, which struggles to manage heat in racks exceeding 20–30kW, liquid cooling systems can efficiently support racks above 50kW.

This allows hyperscale data centers to maximize space utilization without compromising temperature stability. Major tech players, including Meta and Microsoft, are actively deploying liquid immersion cooling for their AI training clusters and HPC applications. Additionally, liquid cooling contributes significantly to lower PUE (Power Usage Effectiveness) values and aligns with global sustainability goals. As data centers face increased pressure to reduce energy use and carbon emissions, liquid cooling offers a long-term solution that supports scalability, performance, and environmental compliance in a more compact, noise-free, and efficient infrastructure.

Global Data Center Cooling Market: Research Scope and Analysis

By Component Analysis

The solution segment is anticipated to dominate the data center cooling market due to its critical role in providing the physical infrastructure necessary to manage increasing thermal loads in modern data centers. Solutions include core hardware systems such as precision air conditioners, chillers, air handling units (AHUs), and liquid cooling mechanisms, all of which are essential for maintaining optimal operating temperatures. As data center densities continue to increase due to the deployment of high-performance computing (HPC), AI clusters, and edge computing nodes, the demand for high-efficiency cooling systems has risen correspondingly.

Unlike services, which are often project-based or periodic (e.g., installation, consulting, maintenance), cooling solutions represent recurring capital investments essential to every phase of the data center life cycle, from greenfield construction to retrofit upgrades. The solution segment also benefits from continuous innovation, with advancements in liquid-based cooling, rear-door heat exchangers, direct-to-chip systems, and smart airflow containment technologies.

Additionally, the increased emphasis on energy-efficient cooling systems, driven by sustainability mandates and ESG goals, is boosting investment in solution-based products that help lower Power Usage Effectiveness (PUE) ratios. Major hyperscale and colocation operators are increasingly allocating budget toward modular, scalable cooling hardware to improve thermal efficiency, reduce operational costs, and extend hardware lifespan.

Moreover, solution providers often bundle hardware with integrated software for real-time thermal monitoring and adaptive control, further increasing the value proposition of this segment. The indispensable nature, cost structure, and performance-critical role of cooling hardware collectively ensure the continued dominance of the solution component in the global data center cooling market.

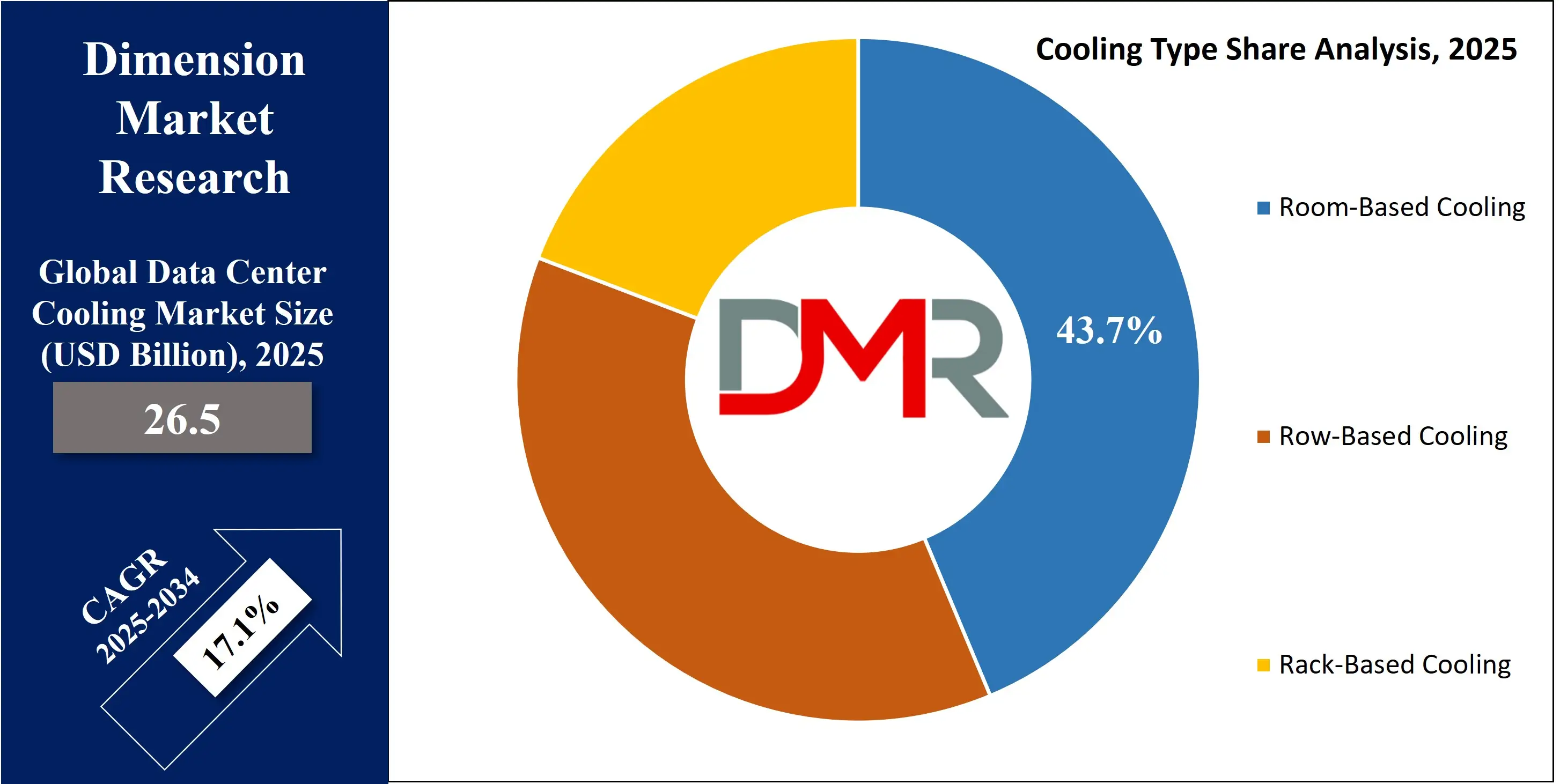

By Cooling Type Analysis

Room-based cooling is projected to remain the dominant cooling type in the data center cooling market owing to its widespread deployment, ease of implementation, and proven effectiveness in controlling ambient temperature across large server rooms. This cooling approach typically utilizes Computer Room Air Conditioners (CRAC) or Computer Room Air Handlers (CRAH), which circulate cool air through raised floor systems or overhead ducts. These systems provide centralized cooling, making them cost-effective and scalable for data centers that house uniform IT loads across larger spaces.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the major reasons for its dominance is legacy infrastructure. A significant proportion of enterprise and government data centers worldwide were designed and built before high-density computing was mainstream. These older facilities continue to rely on room-based cooling due to budget constraints and architectural limitations that make upgrades to row- or rack-based cooling impractical.

Room-based cooling is also easier to maintain and monitor using existing building management systems (BMS) and DCIM platforms. Operators familiar with traditional HVAC controls often prefer these systems for their simplicity and predictability, which helps reduce operational risks and training requirements.

Furthermore, room-based cooling has improved with technological integration. The addition of thermal containment, airflow optimization, and precision monitoring tools has significantly enhanced its energy efficiency, allowing it to meet modern performance expectations.

Although newer cooling types like rack-based and liquid immersion systems are gaining attention, room-based cooling continues to dominate due to its high compatibility, broad adoption, and the cost-efficiency it offers in low-to-medium-density data centers that form the bulk of today’s operational facilities.

By Containment Type Analysis

Hot Aisle Containment (HAC) is expected to dominate the containment type segment in the data center cooling market due to its superior thermal isolation, enhanced energy efficiency, and compatibility with high-density environments. In HAC configurations, hot exhaust air from servers is isolated and channeled back directly to the cooling units without mixing with cold intake air. This ensures consistent temperature zones, reduces hot spots, and allows cooling systems to operate at higher set points, reducing overall energy consumption.

HAC is particularly well-suited for large enterprises and hyperscale data centers where dense server configurations and increasing IT load demand require precise thermal control. Compared to Cold Aisle Containment (CAC), HAC offers a more efficient return airflow path, reducing the work done by air handling units (AHUs) or CRACs. This results in significant improvements in Power Usage Effectiveness (PUE), often achieving values close to 1.2 in optimized environments.

Its popularity is further driven by the rise of sustainability mandates and operator interest in reducing OPEX (operational expenditure). HAC supports higher supply air temperatures, which increases chiller efficiency and lowers mechanical load. Moreover, it integrates seamlessly with both air- and liquid-cooled systems, offering flexibility for future upgrades. For colocation providers and hyperscalers, HAC provides a modular and scalable way to deliver energy-efficient cooling without overhauling the entire infrastructure.

While initial deployment of HAC may be costlier than CAC, the long-term energy savings and operational reliability it provides offset the investment. As data centers become more power-dense and carbon-conscious, HAC stands out as the preferred choice for thermal containment strategies globally.

By Data Center Type Analysis

Enterprise data centers are poised to dominate the data center cooling market by type due to their extensive physical footprint, legacy infrastructure reliance, and significant IT operational demand. These facilities are typically owned and operated by large corporations across sectors such as banking, manufacturing, healthcare, and telecom, all of which require continuous data processing, storage, and security. Unlike hyperscale or cloud-native centers, enterprise data centers often rely on traditional cooling setups and have been slower to transition to micro or modular data centers, maintaining their volume dominance.

One major contributor to their dominance is the historical investment by enterprises in building and maintaining on-premise data centers for regulatory compliance, data sovereignty, and security control. These facilities continue to invest in upgraded cooling systems such as precision air conditioners, hot aisle containment, and air economizers to improve energy efficiency and reduce operational expenditure. As workloads expand and server racks become more densely populated, enterprise centers increasingly retrofit their cooling infrastructure with high-performance, scalable systems, sustaining demand in this segment.

Furthermore, enterprise data centers are often designed for hybrid computing environments, blending legacy workloads with newer cloud-native applications. This blend necessitates versatile, high-capacity cooling systems capable of supporting a mix of thermal profiles. Government and industry-specific regulations also drive enterprise users to invest in efficient and redundant cooling solutions to meet uptime and environmental standards.

With global enterprises continuing to digitize operations, adopt AI-driven analytics, and manage sensitive data on-premise, the demand for tailored and reliable cooling within enterprise data centers remains substantial, keeping this segment at the forefront of market share.

By Industry Vertical Analysis

The IT & Telecom industry is anticipated to lead the data center cooling market by vertical due to its unmatched scale of data processing, storage, and transmission demands. As one of the most data-intensive sectors, IT & Telecom generates high thermal loads from the continuous operation of large-scale networking equipment, cloud infrastructure, server clusters, and high-density compute environments. With the global rollout of 5G, increased smartphone penetration, IoT expansion, and real-time digital services like video conferencing and streaming, thermal management has become mission-critical for uninterrupted service delivery.

Telecom companies operate core, metro, and edge data centers across dispersed geographies, often in challenging environments. These facilities require cooling systems that are compact, reliable, and efficient to maintain network uptime. Similarly, hyperscale cloud service providers such as Google, AWS, Microsoft, and Tencent all part of the broader IT ecosystem run massive data centers that house millions of servers, requiring advanced cooling technologies to maintain thermal stability and energy efficiency.

The sector’s dominance is also tied to heavy investment in infrastructure. Telecom operators and IT companies are often early adopters of advanced thermal management systems such as liquid cooling, AI-driven airflow optimization, and modular containment solutions. Their need for both operational efficiency and environmental responsibility has made them frontrunners in integrating low-PUE cooling solutions.

Additionally, IT & Telecom providers face intense competition, requiring them to reduce operating costs while improving sustainability metrics. This constant pressure to optimize infrastructure makes efficient and scalable cooling systems indispensable, ensuring the industry remains the largest consumer within the global data center cooling ecosystem.

The Global Data Center Cooling Market Report is segmented on the basis of the following

By Component

- Air Conditioners

- Chillers

- Cooling Towers

- Economizer Systems

- Liquid Cooling Systems

- Air Handling Units (AHUs)

- Control Systems

- Others

- Consulting

- Installation & Deployment

- Support & Maintenance Services

By Cooling Type

- Room-Based Cooling

- Row-Based Cooling

- Rack-Based Cooling

By Containment Type

- Hot Aisle Containment (HAC)

- Cold Aisle Containment (CAC)

- Raised Floor with Containment

- Raised Floor without Containment

By Data Center Type

- Enterprise Data Centers

- Large Data Centers

- Mid-Sized Data Centers

- Small-Scale Data Centers

By Industry Vertical

- IT & Telecom

- BFSI

- Healthcare

- Retail

- Energy & Utilities

- Manufacturing

- Media & Entertainment

- Government & Defense

- Research & Academic

- Others

Global Data Center Cooling Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the data center cooling market as it holds 38.6% of the total revenue by the end of 2025, due to its massive concentration of hyperscale data centers, technological maturity, and strong investments in AI, cloud computing, and big data analytics. The U.S. alone hosts over 40% of the world’s data centers, with key locations in Virginia, Texas, California, and Oregon. These facilities are supported by robust power infrastructure and are increasingly adopting advanced cooling systems such as direct-to-chip liquid cooling, AI-based airflow management, and modular chillers. Additionally, the U.S. government and federal agencies are driving sustainable IT infrastructure under initiatives like the Federal Sustainability Plan, pushing operators toward energy-efficient cooling technologies. Leading tech giants such as Google, Amazon, Microsoft, and Meta continuously expand and retrofit their campuses with state-of-the-art cooling systems to meet operational and ESG goals. Moreover, a highly skilled workforce, favorable data protection regulations, and aggressive sustainability targets have created an ecosystem that supports rapid deployment of advanced thermal management technologies. These factors, combined with high digital service demand and 5G rollouts, solidify North America's leadership in the global data center cooling market.

Region with the Highest CAGR

Asia Pacific is witnessing the fastest CAGR in the data center cooling market due to exponential digitalization, increased cloud adoption, and surging demand for hyperscale and edge data centers. Countries like China, India, Singapore, and Indonesia are aggressively expanding their digital infrastructure to support rapid urbanization, mobile usage, and data consumption.

The growth of e-commerce, fintech, and AI-driven applications is leading to high-density server deployments, which in turn require advanced cooling solutions such as liquid immersion and row-based cooling systems. Government initiatives, such as India’s National Data Centre Policy and Singapore’s Green Data Centre Standard, are encouraging the use of energy-efficient and sustainable cooling technologies.

Moreover, the region's tropical climate presents significant cooling challenges, driving innovation in adaptive and hybrid cooling systems. Investments from global hyperscale operators and domestic colocation providers further accelerate market expansion. As Asia Pacific continues to urbanize and digitize at a rapid pace, its demand for advanced, scalable, and climate-resilient data center cooling solutions is expected to grow sharply.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center Cooling Market: Competitive Landscape

The global data center cooling market is moderately consolidated, with leading players competing on innovation, energy efficiency, sustainability, and global reach. Key players such as Vertiv Group Corp., Schneider Electric SE, Stulz GmbH, and Johnson Controls International dominate the landscape through a wide portfolio of precision cooling, liquid-based systems, and smart environmental controls. These companies continually invest in R&D to support high-density compute environments and minimize cooling-related energy use. Vertiv, for example, is recognized for its cutting-edge thermal management platforms for hyperscale and edge facilities, while Schneider Electric integrates AI and IoT into its EcoStruxure Cooling architecture to enhance real-time system performance.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Emerging companies and regional providers are gaining ground by offering modular and low-PUE cooling solutions tailored for edge, telecom, and mid-sized enterprise data centers. Strategic partnerships between equipment manufacturers and cloud providers have also become common, focusing on custom-built, scalable thermal solutions. For instance, STULZ and Huawei have collaborated on tailored solutions for APAC data centers.

Additionally, global expansion strategies, joint ventures, and acquisitions, especially in Asia-Pacific and the Middle East, are intensifying competition. As sustainability becomes a core differentiator, players emphasizing low-GWP refrigerants, renewable integration, and water-saving technologies are positioned for long-term market leadership.

Some of the prominent players in the Global Data Center Cooling Market are

- Schneider Electric

- Vertiv Group Corp.

- Johnson Controls

- Nortek Air Solutions

- STULZ GmbH

- Rittal GmbH & Co. KG

- Eaton Corporation

- Airedale International Air Conditioning Ltd.

- Daikin Industries, Ltd.

- Mitsubishi Electric Corporation

- Fujitsu Ltd.

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Black Box Corporation

- 3M Company

- IBM Corporation

- Delta Electronics, Inc.

- Coolcentric (Vette Corp)

- Climaveneta

- Trane Technologies

- Other Key Players

Recent Developments in the Global Data Center Cooling Market

May 2025:

- Samsung acquires FlaktGroup: Samsung Electronics announced its acquisition of German-based cooling systems provider FlaktGroup for €1.5 billion (approx. USD 1.7 billion). The acquisition aims to strengthen Samsung’s position in AI data center infrastructure, particularly in advanced HVAC and precision cooling solutions needed for high-performance AI workloads. FlaktGroup’s European manufacturing base and R&D will also support Samsung’s global expansion.

April 2025:

- Modine secures major contract for Airedale cooling systems: Modine Manufacturing received a USD 180 million order for its Airedale precision cooling systems from a large AI infrastructure client. The contract underscores growing demand for high-density thermal management solutions capable of supporting large-scale GPU clusters.

- SK Telecom signs MoU with Giga Computing and SK Enmove: SK Telecom, in collaboration with Giga Computing and SK Enmove, signed a memorandum of understanding to develop customized liquid cooling technologies for data centers operating AI and big data applications. The alliance will explore immersion cooling and direct-to-chip technologies.

March 2025:

- Vertiv partners with Tecogen for gas-powered chiller integration: Vertiv Holdings entered into a strategic technology partnership with Tecogen Inc. to incorporate natural gas-powered chillers into its data center cooling portfolio. This initiative aims to improve energy efficiency and reduce operational carbon footprints.

December 2024:

- Vertiv acquires BiXin Energy: Vertiv expanded its Asian footprint by acquiring China-based BiXin Energy, a manufacturer of centrifugal cooling systems. This move is intended to localize manufacturing and enhance Vertiv’s product line with advanced chiller solutions.

- Schneider Electric launches AI-optimized liquid cooling: Schneider Electric, in collaboration with Nvidia, launched an advanced rack-based liquid cooling solution optimized for AI servers. The system supports power densities up to 132 kW per rack, helping hyperscalers overcome thermal barriers.

November 2024:

- Schneider Electric acquires 75% of Motivair: Schneider Electric completed the strategic acquisition of a 75% stake in Motivair Corporation, a U.S. specialist in chilled door and liquid cooling technologies. The deal, valued at USD 850 million, allows Schneider to integrate Motivair’s rear-door heat exchangers into its EcoStruxure platform.

October 2024:

- Accelsius introduces NeuCool™ two-phase cooling: Innventure-backed Accelsius debuted NeuCool™, a direct-to-chip, two-phase liquid cooling system designed to handle extreme thermal loads from AI and high-performance computing (HPC) systems. The solution eliminates the need for air cooling at the chip level.

- M&M Carnot unveils CO₂-based cooling systems: M&M Carnot Refrigeration launched sustainable, high-capacity CO₂-based chiller units suitable for green data centers, addressing environmental regulations and enhancing cooling efficiency.

April 2024:

- Modine acquires TMGcore’s IP portfolio: Modine acquired a set of patents and intellectual property from TMGcore, expanding its capability in both single-phase and two-phase immersion cooling systems. This acquisition supports Modine’s strategy to enter direct-to-chip and immersion cooling segments.

- Schneider Electric and Nvidia strengthen collaboration: Schneider Electric announced a strengthened partnership with Nvidia to jointly deliver liquid-cooled rack solutions for AI workloads, enabling rack-level cooling up to 100+ kW while reducing facility footprint.

- Accelsius officially launches NeuCool™: Accelsius publicly released its NeuCool™ product line, offering modular deployment of two-phase cooling technology that can scale across hyperscaler and colocation data centers.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 26.5 Bn |

| Forecast Value (2034) |

USD 109.7 Bn |

| CAGR (2025–2034) |

17.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solution, Services), By Cooling Type (Room-Based Cooling, Row-Based Cooling, Rack-Based Cooling), By Containment Type (Hot Aisle Containment (HAC), Cold Aisle Containment (CAC), Raised Floor with Containment, Raised Floor without Containment), By Data Center Type (Enterprise Data Centers, Large Data Centers, Mid-Sized Data Centers, Small-Scale Data Centers), By Industry Vertical (IT & Telecom, BFSI, Healthcare, Retail, Energy & Utilities, Manufacturing, Media & Entertainment, Government & Defense, Research & Academic, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schneider Electric, Vertiv Group Corp., Johnson Controls, Nortek Air Solutions, STULZ GmbH, Rittal GmbH & Co. KG, Eaton Corporation, Airedale International, Daikin Industries, Mitsubishi Electric, Fujitsu Ltd., Huawei Technologies, Cisco Systems, Black Box Corporation, 3M Company, IBM Corporation, Delta Electronics, Coolcentric, Climaveneta, Trane Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Data Center Cooling Market?

▾ The Global Data Center Cooling Market size is estimated to have a value of USD 26.5 billion in 2025 and is expected to reach USD 109.7 billion by the end of 2034.

What is the size of the US Data Center Cooling Market?

▾ The US Data Center Cooling Market is projected to be valued at USD 8.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 32.8 billion in 2034 at a CAGR of 16.0%.

Which region accounted for the largest Global Data Center Cooling Market?

▾ North America is expected to have the largest market share in the Global Data Center Cooling Market, with a share of about 38.6% in 2025.

Who are the key players in the Global Data Center Cooling Market?

▾ Some of the major key players in the Global Data Center Cooling Market are Schneider Electric, Vertiv Group Corp., Johnson Controls, Nortek Air Solutions, STULZ GmbH, Rittal GmbH & Co. KG, Eaton Corporation, and many others.