Market Overview

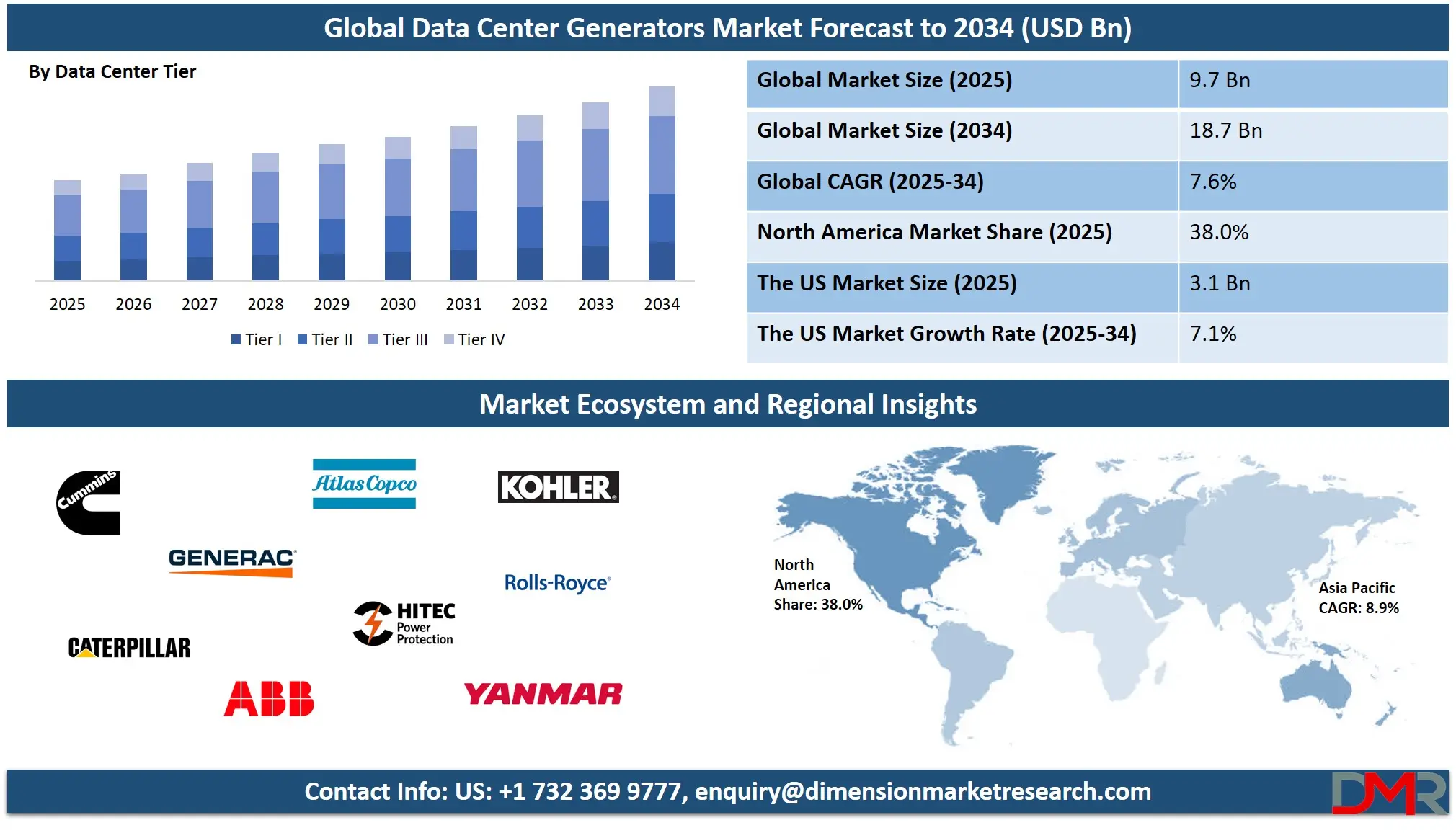

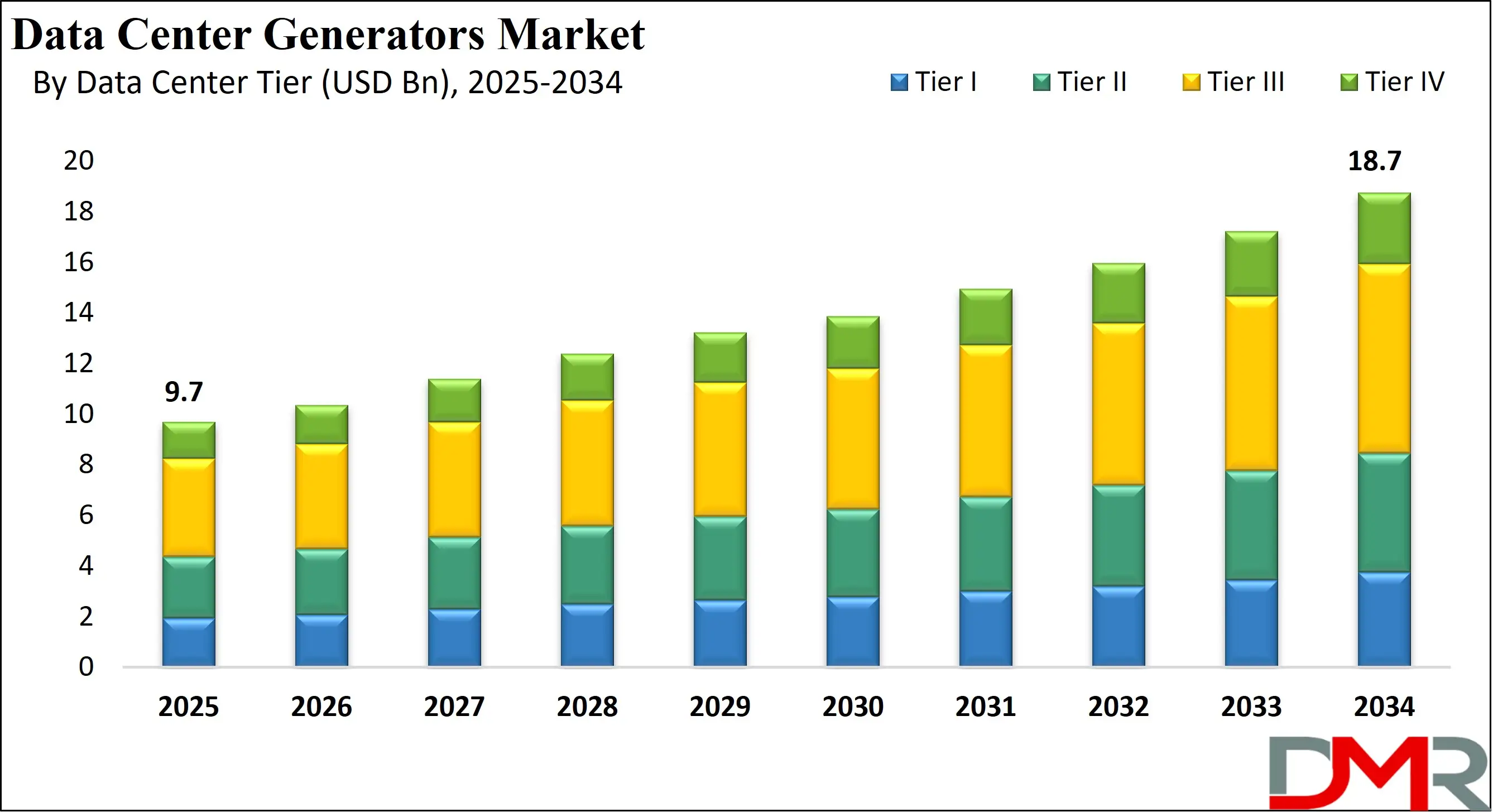

The global data center generators market was valued at USD 9.7 billion in 2025 and is projected to reach USD 18.7 billion by 2034, growing at a compound annual growth rate of 7.6%, driven by increasing demand for reliable backup power, cloud infrastructure expansion, and energy-efficient data center solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Data center generators are specialized power systems designed to provide continuous and reliable electricity to data centers in case of power interruptions or outages. These generators are capable of supporting high-density IT equipment and critical infrastructure, ensuring uninterrupted operations for servers, storage devices, networking equipment, and cooling systems. They are typically engineered for rapid startup, high efficiency, and integration with uninterruptible power supply systems to maintain data integrity and operational continuity. Data center generators can run on diesel, natural gas, biogas, or hybrid fuel configurations, catering to diverse operational needs and regulatory compliance requirements while maintaining optimal performance and environmental standards.

The global data center generators market encompasses the production, distribution, and deployment of backup and continuous power solutions for data centers across industries and regions. This market includes diesel, gas, and hybrid generators that support enterprise, colocation, hyperscale, and edge computing facilities. The market growth is driven by the increasing demand for cloud computing, data storage, artificial intelligence workloads, and digital transformation initiatives. Companies operating in this market focus on delivering high-performance, energy-efficient, and environmentally compliant generator solutions capable of meeting the growing uptime and reliability requirements of modern data centers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Market expansion is fueled by the proliferation of hyperscale data centers and the rising adoption of edge computing infrastructure that requires modular and scalable power systems. North America and Asia-Pacific are key regions with significant investments in data center infrastructure, while Europe and the Middle East are witnessing growth due to government and enterprise digitization projects. The market is characterized by innovation in fuel efficiency, integration with uninterruptible power supply systems, and the development of smart monitoring and control solutions that optimize performance and reduce operational costs. Leading companies are also focusing on hybrid and renewable-ready generators to meet sustainability targets and reduce carbon emissions.

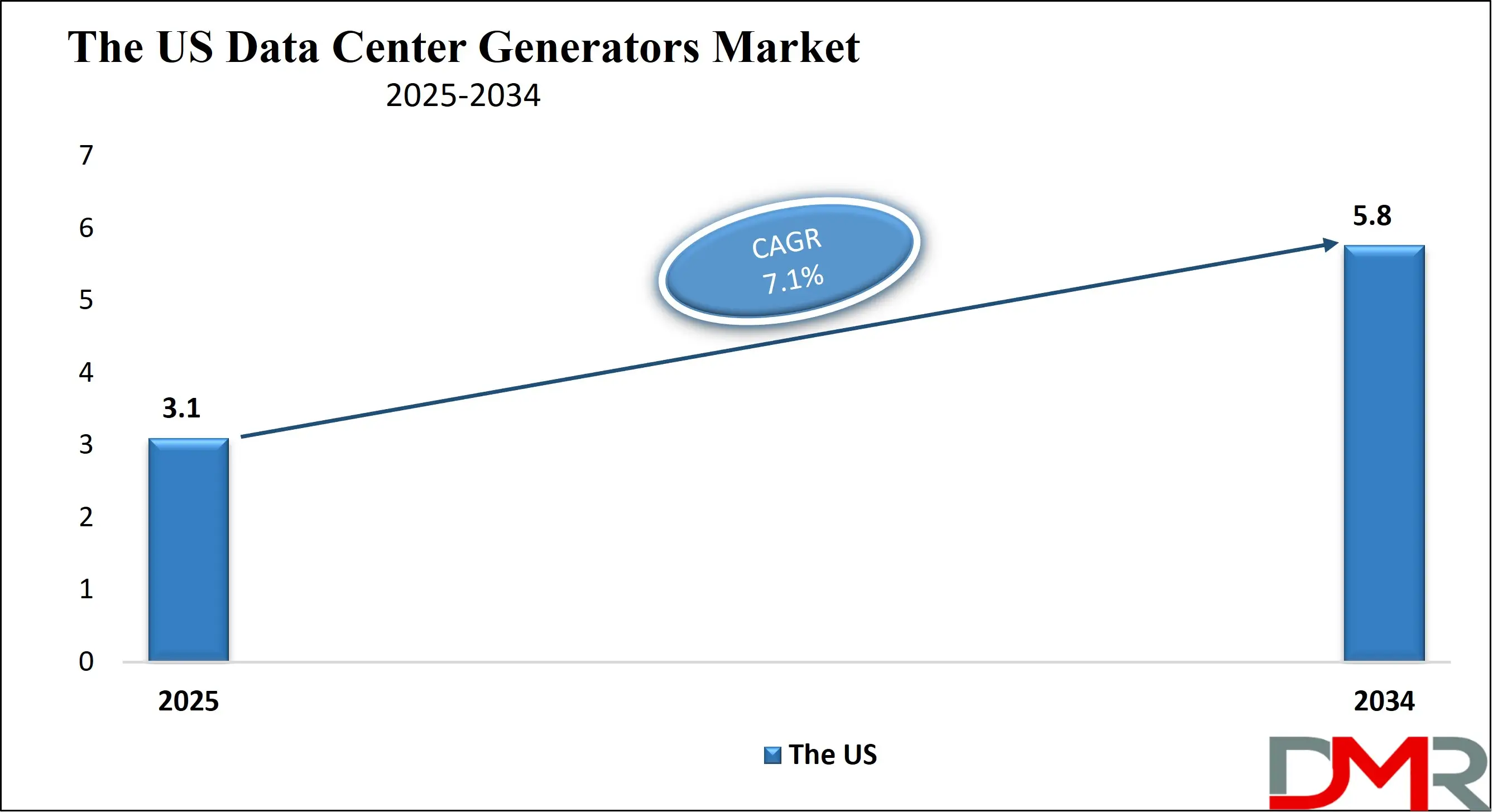

The US Data Center Generators Market

The U.S. Data Center Generators market size was valued at USD 3.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.8 billion in 2034 at a CAGR of 7.1%.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The United States market is driven by rapid expansion of hyperscale, enterprise, and colocation facilities across major regions such as Virginia, Texas, and California. Rising adoption of cloud services, edge computing, and artificial intelligence workloads is creating strong demand for reliable and uninterrupted operational systems. Diesel units dominate due to high reliability, fast startup capability, and suitability for high-density server setups. Gas and hybrid fuel generators are increasingly adopted as organizations focus on energy efficiency, emissions reduction, and compliance with environmental standards. Strict uptime requirements, disaster recovery planning, and the need for continuous operational performance for critical infrastructure further fuel market growth.

Investments in modular and scalable units, integration with uninterrupted supply systems, and advanced monitoring technologies are key trends in the United States market. Organizations are implementing hybrid-ready and renewable-compatible generators to meet sustainability goals and reduce environmental impact. Leading manufacturers focus on delivering high-performance, low-maintenance, and environmentally compliant solutions that meet stringent reliability and efficiency standards. The emphasis on innovative technologies, operational optimization, and compliance with environmental regulations continues to shape the competitive landscape and drive market development.

Europe Data Center Generators Market

The European Data Center Generator Market reached approximately USD 2.5 billion in 2025, driven by the expansion of enterprise, colocation, and hyperscale facilities across major economies such as Germany, France, and the United Kingdom. Increasing adoption of cloud services, edge computing infrastructure, and artificial intelligence applications fueled demand for reliable, high-performance generators. Diesel generators dominated due to their operational reliability, fast startup, and compatibility with high-density IT setups, while gas and hybrid fuel units gained traction as organizations focused on energy efficiency, emissions reduction, and compliance with stringent environmental regulations.

Market growth in Europe was further supported by investments in modular and scalable generator systems that could adapt to evolving operational demands. Integration with monitoring and predictive maintenance technologies enabled facilities to optimize fuel consumption, reduce downtime, and enhance overall operational efficiency. Sustainability initiatives, including hybrid-ready and low-emission generator solutions, drove adoption across enterprise and colocation facilities, reflecting Europe’s strong growth within the global generator solutions market with a CAGR of 7.9%.

Japan Data Center Generators Market

The Japanese Data Center Generator Market reached approximately USD 58.2 million in 2025, reflecting moderate growth driven by the expansion of enterprise, colocation, and regional computing facilities. The adoption of cloud services, edge computing, and artificial intelligence applications increased demand for reliable and compact generator systems capable of supporting continuous operations in space-constrained environments. Diesel generators remained widely used for their operational reliability and rapid startup capabilities, while gas and hybrid units gained gradual adoption as organizations emphasized energy efficiency, lower emissions, and compliance with environmental regulations.

Market development in Japan was supported by investments in modular and scalable generators that could accommodate evolving workload demands. Integration with monitoring systems and predictive maintenance technologies enabled facilities to optimize fuel consumption, reduce downtime, and enhance operational efficiency. Sustainability initiatives, including hybrid-ready and low-emission generator solutions, further contributed to market growth, positioning Japan with a steady CAGR of 6.0% within the global generator solutions landscape.

Global Data Center Generators Market: Key Takeaways

- Rapid Expansion of Hyperscale and Edge Infrastructure: The growth of hyperscale, colocation, and edge computing facilities is driving strong demand for reliable and scalable generator systems that ensure uninterrupted operations for high-density IT workloads.

- Diesel Dominance with Hybrid Adoption Rising: Diesel generators continue to lead due to reliability and rapid startup, while gas and hybrid-ready units are gaining traction for energy efficiency, sustainability, and regulatory compliance.

- Modular and Integrated Solutions Gain Importance: Standalone units remain widely used, but integrated power systems and modular generators are increasingly adopted to optimize energy management, predictive maintenance, and scalability.

- Regional Leadership and Growth Hotspots: North America maintains the largest market share due to extensive data center infrastructure, while Europe and Asia-Pacific exhibit strong growth driven by cloud adoption, AI workloads, and government digitization initiatives.

- Technology-Driven Efficiency and Sustainability: AI-enabled monitoring, predictive analytics, and hybrid-ready configurations are enhancing operational efficiency, reducing downtime, and supporting carbon reduction goals across global data center facilities.

Global Data Center Generators Market: Use Cases

- Hyperscale Cloud Facilities: Generators are critical for maintaining uninterrupted operations in hyperscale cloud platforms that host massive computing and storage workloads. Diesel and gas units provide high reliability, rapid startup, and seamless integration with modular IT infrastructure. Organizations adopt scalable generators to ensure continuous performance during grid interruptions and to meet strict uptime and service-level requirements.

- Colocation Service Providers: Colocation facilities rely on generators to guarantee uninterrupted service for multiple tenants. Hybrid fuel and renewable-ready generators are increasingly deployed to enhance energy efficiency and reduce carbon emissions. Integrated monitoring systems optimize fuel consumption and reduce operational costs while maintaining high reliability for shared IT infrastructure.

- Edge Computing Installations: Generators support edge computing sites that require local, continuous operation for latency-sensitive applications. Compact and modular units enable rapid deployment and scalable capacity. Diesel and gas generators ensure uninterrupted performance for industrial automation, IoT networks, and regional computing hubs.

- Enterprise IT and Telecom Facilities: Large enterprise and telecom operations use generators to maintain critical business applications and communication networks. High-efficiency units combined with monitoring and control solutions minimize downtime risk. Organizations adopt hybrid and gas generators to align with sustainability initiatives and regulatory compliance while securing continuous operational performance.

Impact of Artificial Intelligence on the global Data Center Generators market

- Enhanced Demand for Reliable Operations: Artificial intelligence workloads require uninterrupted computational capacity and low-latency performance. This drives higher adoption of generators with fast startup, high reliability, and integration with monitoring systems to ensure continuous operations during grid fluctuations or outages.

- Optimized Energy Efficiency and Predictive Maintenance: AI-enabled monitoring and analytics allow operators to optimize fuel consumption, predict equipment failures, and schedule maintenance proactively. This reduces operational costs and enhances efficiency while extending the lifespan of generator units.

- Support for Edge and Modular Infrastructure: The rise of AI applications in edge computing and distributed processing increases demand for compact, modular, and scalable generators. These units ensure consistent power supply for latency-sensitive and high-density computing environments while supporting hybrid and renewable-ready configurations.

Global Data Center Generators Market: Stats & Facts

- International Energy Agency (IEA)

- In 2024, data centers accounted for about 1.5 % of global electricity consumption, equivalent to approximately 415 terawatt‑hours (TWh). Global electricity use by data centers has grown about 12 % per year since 2017.

- Global data center electricity consumption is projected to double to around 945 TWh by 2030, slightly more than Japan’s total electricity consumption today.

- Electricity consumption from data center accelerated servers (mainly driven by AI) is expected to grow by around 30 % annually, contributing nearly half of the net increase in global data center electricity use.

- Data centers, China, and the United States are projected to account for nearly 80 % of global growth in data center electricity consumption through 2030.

- U.S. Department of Energy / Lawrence Berkeley National Laboratory (DOE / LBNL)

- U.S. data centers consumed about 176 TWh in 2023, representing roughly 4.4 % of total U.S. electricity use.

- Total U.S. data center electricity usage climbed from 58 TWh in 2014 to 176 TWh in 2023.

- Based on DOE projections, U.S. data center electricity consumption could reach between 325 TWh and 580 TWh by 2028, potentially accounting for 6.7 %–12 % of U.S. electricity consumption.

- United States Congress / Government Reports

- Some projections show U.S. data centers could consume up to 12 % of national electricity by 2028.

- A Congressional Research Service overview confirms U.S. data centers consumed approximately 176 TWh in 2023.

- National Energy Administration (China Government Related Reporting)

- As of early 2025, there were around 8 900 data centers globally, with approximately 37 % located in the United States, 16 % in Europe, and nearly 10 % in China.

- In 2023, U.S. data centers consumed about 4.4 % of U.S. total electricity.

Global Data Center Generators Market: Market Dynamics

Global Data Center Generators Market: Driving Factors

Rapid Growth of Hyperscale and Enterprise Facilities

The increasing number of hyperscale, colocation, and enterprise facilities globally is driving demand for high-reliability generators. These facilities require uninterrupted operational continuity to handle high-density server workloads, cloud computing services, and artificial intelligence applications. Scalable and modular generator solutions are essential to support expanding infrastructure while ensuring service-level compliance.

Emphasis on Energy Efficiency and Regulatory Compliance

Organizations are focusing on reducing fuel consumption and emissions through efficient diesel, gas, and hybrid generators. Compliance with environmental regulations and sustainability standards is encouraging adoption of renewable-compatible and low-emission units, helping businesses achieve operational efficiency and carbon reduction targets.

Global Data Center Generators Market: Restraints

High Capital Expenditure and Installation Costs

The deployment of large-scale generator systems involves significant initial investment, including equipment, installation, and integration with monitoring solutions. Small and medium enterprises often face financial constraints that limit adoption of advanced or hybrid generator systems, restraining overall market growth.

Maintenance Complexity and Operational Downtime RiskGenerator systems require regular maintenance and skilled personnel for monitoring and repair. Any lapse in maintenance or operational errors can lead to downtime, affecting uptime-critical operations and deterring organizations from upgrading or expanding their existing generator infrastructure.

Global Data Center Generators Market: Opportunities

Adoption of Hybrid and Renewable-Compatible Generators

Rising emphasis on sustainability and carbon footprint reduction presents an opportunity for hybrid and renewable-ready generator solutions. Integrating natural gas, biogas, and hydrogen-compatible units enables organizations to meet environmental standards while enhancing operational reliability.

Expansion in Edge Computing and Regional Facilities

The growth of edge computing infrastructure and regional computing hubs creates demand for compact, modular, and scalable generators. These units support latency-sensitive workloads, industrial IoT applications, and local IT operations, offering new avenues for market expansion beyond traditional enterprise and hyperscale facilities.

Global Data Center Generators Market: Trends

Integration with Smart Monitoring and Predictive Analytics

Modern generators are increasingly equipped with AI-enabled monitoring systems that track performance, optimize fuel consumption, and predict maintenance needs. This trend improves operational efficiency, reduces downtime, and enhances the reliability of mission-critical infrastructure.

Shift towards Modular and Scalable Solutions

Organizations are moving toward modular generator configurations to support flexible capacity expansion. Scalable solutions allow facilities to adapt to evolving workload demands, edge deployments, and high-density computing setups, reducing upfront investment while improving energy efficiency.

Global Data Center Generators Market: Research Scope and Analysis

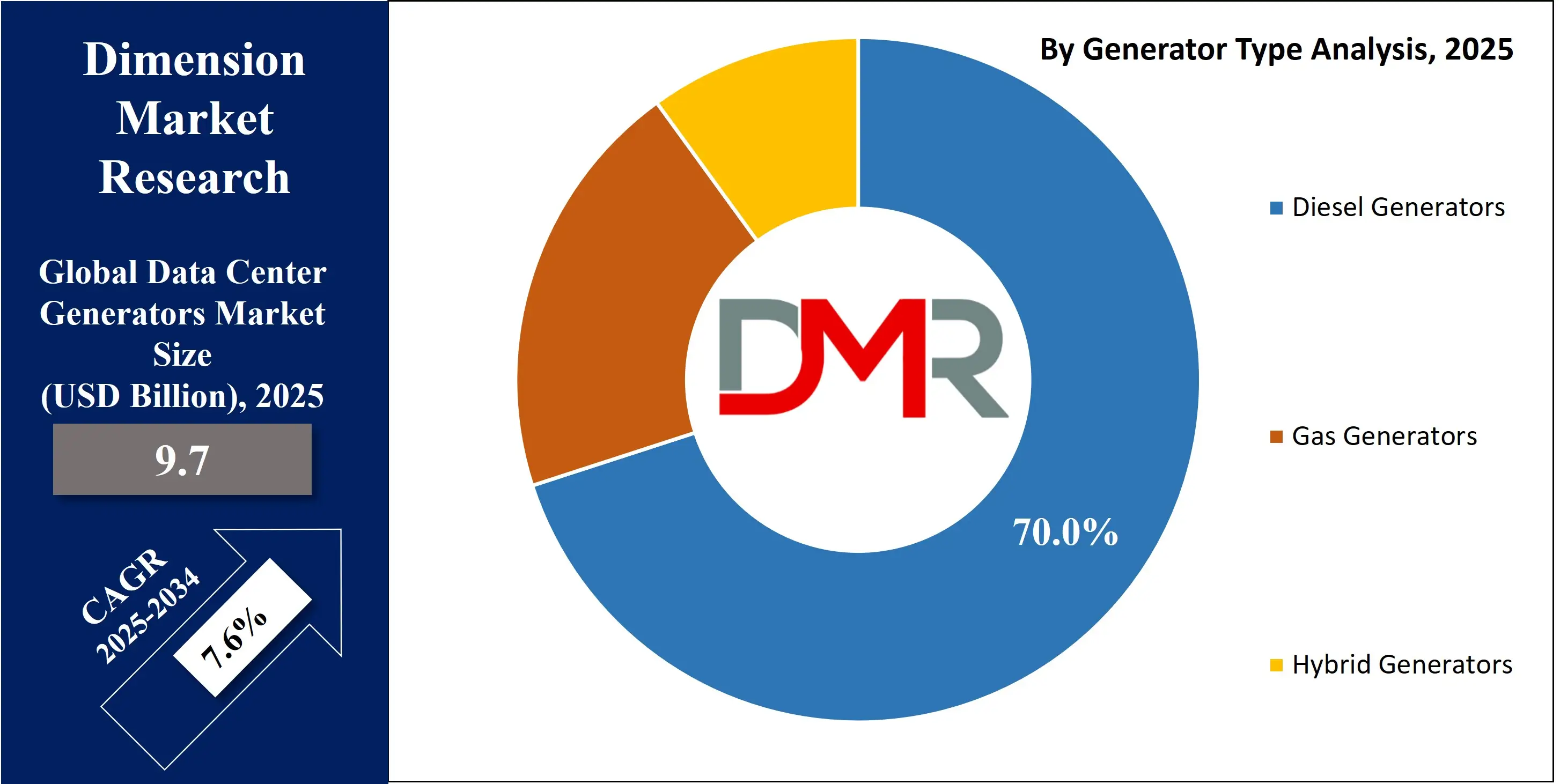

By Generator Type Analysis

In the generator type segment, diesel generators are expected to maintain a dominant position, capturing approximately 70.0% of the total market share in 2025. Their widespread adoption is attributed to their proven reliability, rapid startup capabilities, and compatibility with high-density server setups and critical infrastructure. Diesel units offer consistent performance even in regions with fluctuating grid stability, making them the preferred choice for enterprise, hyperscale, and colocation facilities. Additionally, diesel generators provide flexibility in fuel sourcing, long operational life, and ease of maintenance, which reinforces their leading role in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Gas generators, while holding a smaller market share compared to diesel, are gaining traction due to their environmental advantages and suitability for energy-efficient operations. These generators primarily use natural gas and dual-fuel configurations, offering lower emissions and compliance with increasingly strict environmental regulations. Gas generators are often deployed in facilities prioritizing sustainability, operational efficiency, and reduced carbon footprint. Their quieter operation, integration with hybrid systems, and compatibility with renewable-ready infrastructure are also contributing factors that support their gradual growth in the global generator solutions market.

By Integration Type Analysis

Standalone generators are the preferred choice for most facilities, expected to capture around 65.0 % of the integration type segment in 2025. Their widespread use is driven by simplicity, reliability, and the ability to provide uninterrupted operational support independently of other systems. They are particularly suitable for facilities that require dedicated emergency backup or have existing infrastructure where integration with other power solutions is not feasible. Standalone units offer flexibility in deployment, easier maintenance, and proven performance under high-demand conditions, which reinforces their preference among enterprises, hyperscale operators, and colocation service providers.

Integrated power systems, while accounting for a smaller portion of the market, are gaining importance due to their ability to optimize energy management and operational efficiency. These systems combine generators with uninterruptible supply setups and monitoring technologies to provide coordinated, seamless operation. Integrated solutions are especially valuable for modern facilities that prioritize energy efficiency, scalability, and real-time performance tracking. Their adoption is driven by the growing demand for hybrid-ready systems and intelligent infrastructure capable of reducing fuel consumption, emissions, and operational downtime, making them a strategic choice for forward-looking organizations.

By Power Rating Analysis

Below 1 megawatt generators are expected to lead the power rating segment, capturing around 55.0% of the market share in 2025. Their dominance is driven by the increasing deployment of compact and modular facilities, edge computing sites, and small to medium enterprise installations that require reliable and flexible solutions for uninterrupted operations. These generators are favored for their ease of installation, lower operational costs, and ability to support high-density server setups without demanding significant space or infrastructure modifications. Their scalability and compatibility with hybrid-ready configurations further contribute to their widespread adoption across diverse facilities.

Generators in the 1 to 2 megawatt range are also gaining traction as medium to large enterprise and colocation facilities seek higher-capacity solutions. These units provide robust performance to support larger operational loads and critical IT infrastructure while maintaining energy efficiency and reliability. Organizations often deploy these generators in scalable configurations to match growing operational demands and to integrate with advanced monitoring and control systems. Their ability to balance performance, efficiency, and operational continuity makes them an important segment within the global generator market.

By Data Center Tier Analysis

Tier III facilities are expected to lead the data center tier segment, capturing around 40.0% of the market share in 2025. These facilities require N+1 or N+2 redundancy generators to ensure high availability and uninterrupted operations for critical IT infrastructure. The adoption of Tier III standards is driven by the growing demand for enterprise, colocation, and hyperscale facilities that prioritize operational reliability, uptime compliance, and disaster recovery capabilities. Generators in this segment are designed for seamless integration with uninterruptible supply systems and monitoring technologies, providing both redundancy and scalability to accommodate increasing computational and storage workloads.

Tier II facilities, while representing a smaller portion of the market, continue to play an important role for medium-sized enterprises and regional colocation sites. These facilities typically use N or partial redundancy generator setups that provide reliable operational support with moderate capacity and cost efficiency. Tier II generators are often deployed in environments where moderate uptime requirements are sufficient, balancing performance with investment and maintenance considerations. Their adoption is supported by growing small and medium enterprise infrastructure and regional computing hubs that require dependable yet cost-effective solutions.

By Distribution Channel Analysis

OEM direct sales channel will dominate the distribution channel segment, accounting for approximately 47.0% of the market share in 2025. Large hyperscale, enterprise, and colocation facilities often purchase generators directly from manufacturers to secure tailored solutions, service agreements, and reliable operational performance. Direct procurement ensures access to technical support, maintenance contracts, and seamless integration with existing infrastructure, making it the preferred option for high-capacity installations where uptime and efficiency are critical.

System integrators, while holding a smaller market share, provide essential turnkey solutions including design, installation, and commissioning of generator systems. They are typically engaged by medium to large facilities requiring coordinated deployment with uninterruptible supply systems, monitoring tools, and energy-efficient setups. Their expertise ensures optimal operational efficiency, reduces downtime risk, and supports the redundancy and scalability requirements of modern facilities.

By End-User Analysis

Hyperscale facilities are expected to lead the end-user segment, capturing around 44 percent of the market share in 2025. These facilities require high-capacity, reliable generator systems to support massive computing and storage workloads that underpin cloud services, artificial intelligence applications, and enterprise-level operations. Diesel and hybrid-ready generators are widely adopted for their rapid startup, scalability, and ability to integrate with monitoring and control systems. The emphasis on operational continuity, energy efficiency, and compliance with uptime standards drives significant investment in high-performance generator solutions for hyperscale deployments.

Colocation facilities, while representing a smaller share of the market, rely heavily on generators to ensure uninterrupted service for multiple tenants. These facilities often deploy modular and scalable units to optimize operational efficiency and meet varying load demands across different clients. Gas and hybrid fuel generators are increasingly used in colocation environments to reduce emissions, enhance sustainability, and comply with regulatory standards. Integrated monitoring and predictive maintenance systems further help operators minimize downtime and maintain continuous performance for all hosted infrastructure.

The Data Center Generators Market Report is segmented on the basis of the following

By Generator Type

- Open Type Generators

- Enclosed Generators

- Natural Gas Generators

- Dual-Fuel Generators

- Biogas Generators

- Hydrogen Generators

By Integration Type

- Standalone Generators

- Integrated Power Systems

By Power Rating

- Below 1 Megawatt

- 1 to 2 Megawatt

- Above 2 Megawatt

By Data Center Tier

- Basic Redundancy Generators

- Non-Redundant Generators

- N Redundancy Generators

- Partial Redundancy Generators

- N+1 Redundancy Generators

- N+2 Redundancy Generators

- 2N Redundancy Generators

- 2(N+1) Redundancy Generators

By Distribution Channel

- OEM Direct Sales

- System Integrators

- EPC Firms

- Distributors

- Online Platforms

By End-User

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Government Data Centers

- Industrial Data Centers

Global Data Center Generators Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global generator solutions market, accounting for approximately 38 percent of total revenue in 2025. The region’s growth is driven by the expansion of hyperscale, enterprise, and colocation facilities, particularly in states like Virginia, Texas, and California, which host some of the largest computing and storage infrastructures. High adoption of cloud services, edge computing, and artificial intelligence workloads increases demand for reliable and scalable generator systems. Organizations are increasingly deploying diesel, gas, and hybrid-ready units with advanced monitoring and control technologies to ensure uninterrupted operations, optimize energy efficiency, and comply with environmental regulations, reinforcing North America’s dominant position in the market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness significant growth in the global generator solutions market over the coming years. Rapid digital transformation, increasing adoption of cloud computing, and the expansion of hyperscale and enterprise facilities in countries such as China, India, and Japan are driving demand for reliable and scalable generator systems. Rising investments in edge computing infrastructure and government initiatives to modernize IT and industrial operations further support market expansion. Additionally, organizations in the region are increasingly focusing on energy-efficient, hybrid-ready, and low-emission generator solutions to meet sustainability goals and regulatory compliance, contributing to robust regional growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center Generators Market: Competitive Landscape

The competitive landscape of the global generator solutions market is characterized by intense rivalry among manufacturers and solution providers focusing on innovation, reliability, and efficiency. Companies are increasingly investing in research and development to offer diesel, gas, and hybrid-ready units with advanced monitoring, predictive maintenance, and modular configurations. Strategic partnerships, mergers, and acquisitions are common to expand regional presence and enhance service capabilities. Market players are also emphasizing sustainability by developing low-emission and renewable-compatible solutions, while prioritizing scalability and integration with high-density IT and edge computing infrastructures to meet the growing demands of hyperscale, enterprise, and colocation facilities worldwide.

Some of the prominent players in the global Data Center Generators market are

- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems Inc.

- ABB Ltd

- Atlas Copco AB

- HITEC Power Protection

- KOHLER Co.

- Rolls‑Royce plc

- Yanmar Holdings Co. Ltd.

- Eurodiesel Services

- Himoinsa

- Deutz AG

- Kirloskar Oil Engines Limited

- Mitsubishi Motors Corporation

- Siemens AG

- Wärtsilä Corporation

- Aggreko

- Aksa Power Generation

- Detroit Diesel

- INNIO

- Other Key Players

Global Data Center Generators Market: Recent Developments

- January 2026: Rolls‑Royce launched a new fast‑start gas generator designed for high‑demand infrastructure environments, featuring a 2.8 MW output and the ability to reach full capacity in approximately 45 seconds, addressing rapid operational requirements and supporting evolving energy needs tied to artificial intelligence and digital workloads.

- January 2026: Vistra announced an agreement to acquire Cogentrix Energy for approximately USD 4.7 billion, adding 10 natural gas generation facilities and expanding its capacity footprint, reflecting strategic consolidation to meet rising electricity demand from artificial intelligence and digital workloads.

- September 2025: An independent energy developer secured substantial venture funding to advance modular energy storage and dispatchable solutions tailored to energy‑intensive commercial applications, indicating broader financial interest in scalable energy systems that support rapid computational growth.

- April 2025: A major equipment manufacturer introduced a lineup of high‑capacity generators ranging from 2.25 MW to 3.25 MW, engineered for hyperscale, enterprise, colocation, and edge installations, enhancing scalability and integration into modern infrastructure ecosystems while meeting stringent performance and emissions criteria

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.7 Bn |

| Forecast Value (2034) |

USD 18.7 Bn |

| CAGR (2025–2034) |

7.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.1 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Segments Covered |

By Generator Type (Diesel Generators, Gas Generators, Hybrid Generators), By Integration Type (Standalone Generators, Integrated Power Systems), By Power Rating (Below 1 Megawatt, 1 to 2 Megawatt, Above 2 Megawatt), By Data Center Tier (Tier I, Tier II, Tier III, Tier IV), By Distribution Channel (OEM Direct Sales, System Integrators, EPC Firms, Distributors, Online Platforms), and By End-User (Hyperscale Data Centers, Colocation Data Centers, Enterprise Data Centers, Government Data Centers, Industrial Data Centers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Caterpillar Inc., Cummins Inc., Generac Power Systems Inc., ABB Ltd, Atlas Copco AB, HITEC Power Protection, KOHLER Co., Rolls Royce plc, Yanmar Holdings Co. Ltd., Eurodiesel Services, Himoinsa, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global Data Center Generators market?

▾ The global Data Center Generators market size was valued at USD 9.7 billion in 2025 and is expected to reach USD 18.7 billion by the end of 2034.

What is the size of the US Data Center Generators market?

▾ The US Data Center Generators market was valued at USD 3.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.8 billion in 2034 at a CAGR of 7.1%.

Which region accounted for the largest global Data Center Generators market?

▾ North America is expected to have the largest market share in the global Data Center Generators market, with a share of about 38.0% in 2025.

Who are the key players in the global Data Center Generators market?

▾ Some of the major key players in the global Data Center Generators market are Caterpillar Inc., Cummins Inc., Generac Power Systems Inc., ABB Ltd, Atlas Copco AB, HITEC Power Protection, KOHLER Co., Rolls Royce plc, Yanmar Holdings Co. Ltd., Eurodiesel Services, Himoinsa, and Others.