Market Overview

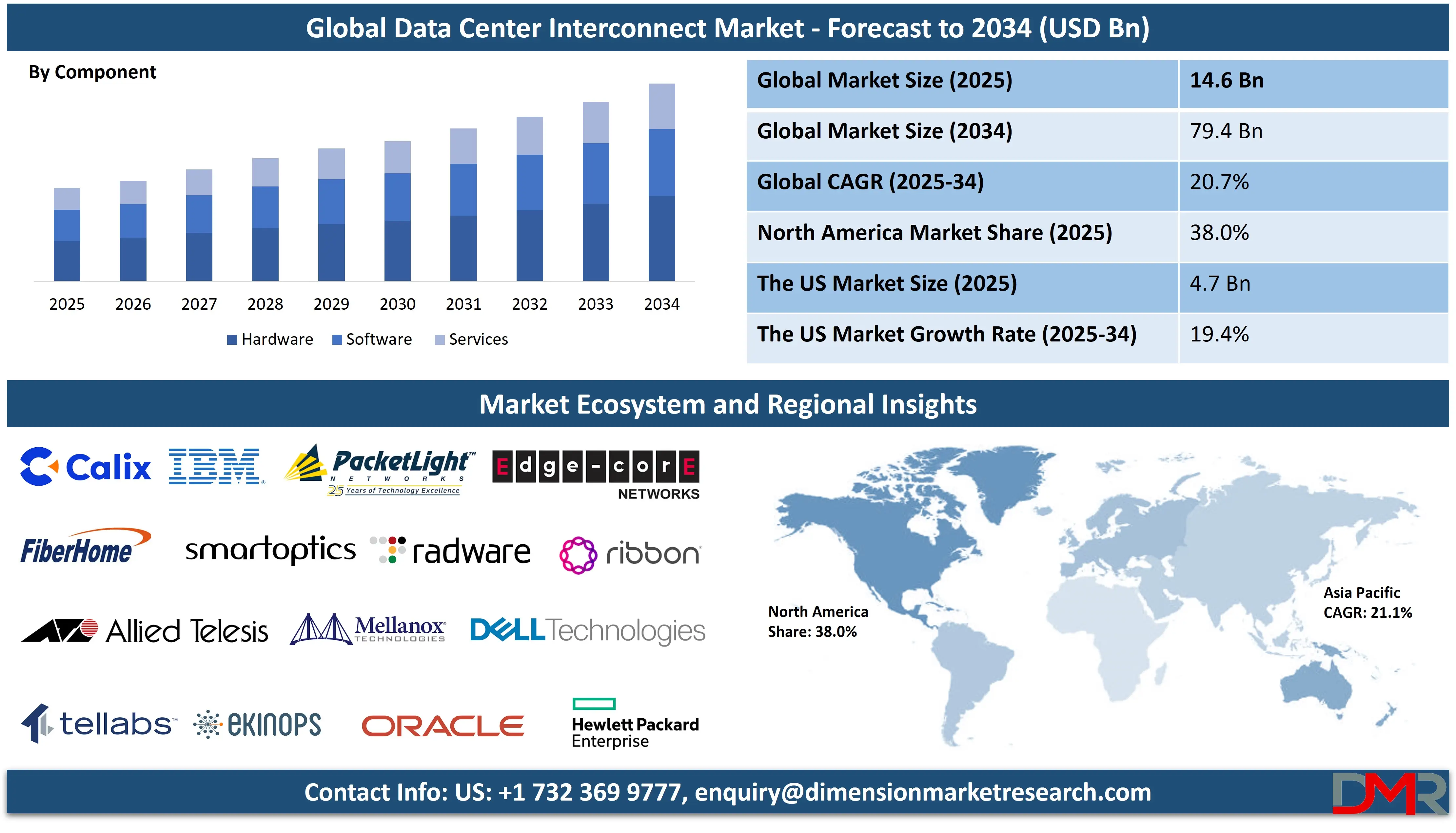

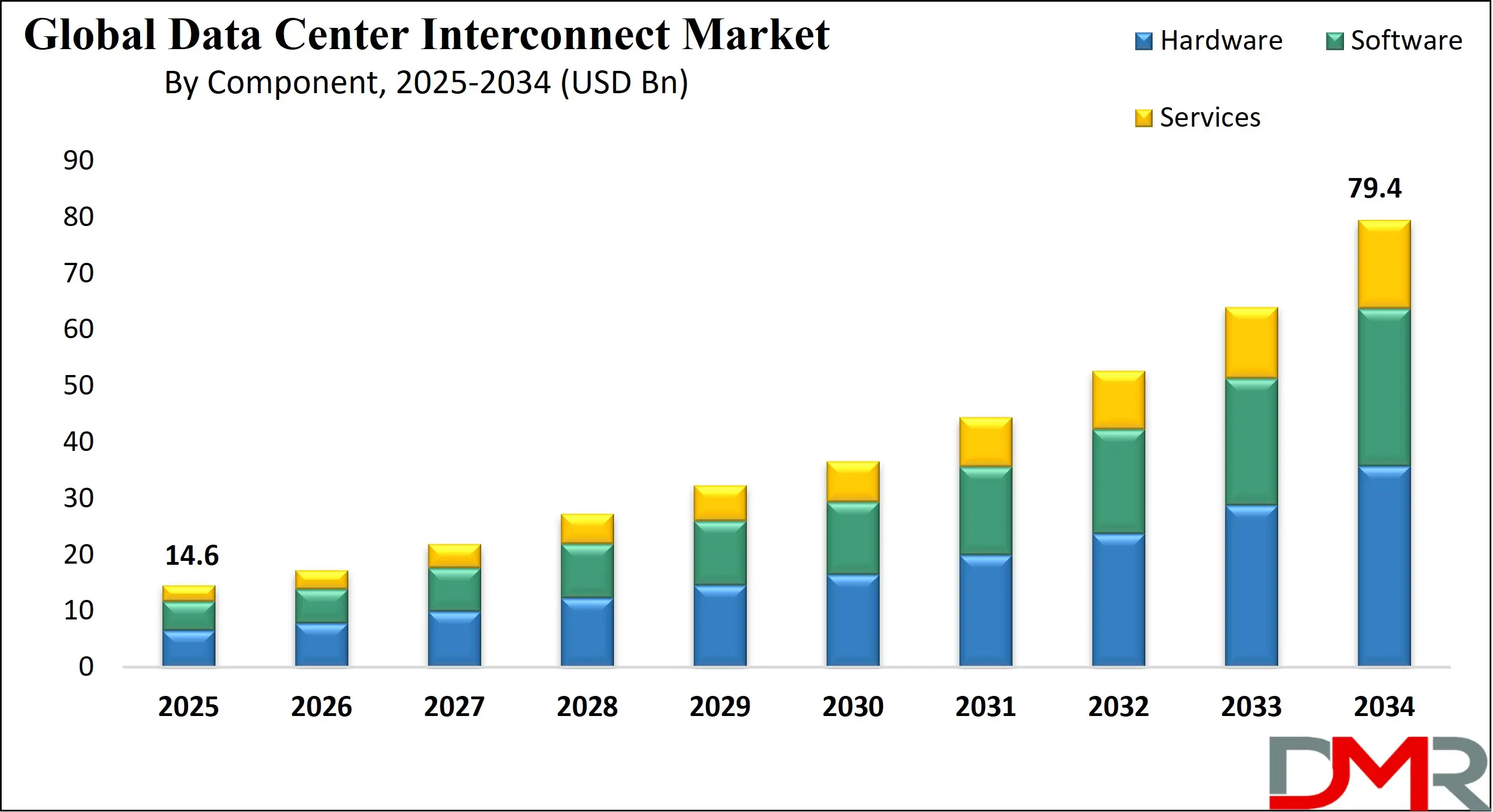

The Global Data Center Interconnect Market is projected to reach USD 14.6 billion in 2025 and grow at a 20.7% CAGR through 2034, ultimately hitting USD 79.4 billion. This growth is fueled by expanding cloud computing, hyperscale data centers, and rising demand for high-speed, low-latency connectivity.

Growth is fueled by the increasing adoption of AI and machine learning workloads, rising demand for real-time data synchronization and disaster recovery, and the integration of software-defined networking (SDN) and network function virtualization (NFV). Additionally, expanding applications in enterprise IT, telecommunications, and content delivery networks, coupled with the growing availability of advanced optical and packet networking solutions, are expected to further accelerate market expansion globally.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global landscape for data center interconnect is experiencing a profound transformation, moving beyond simple point-to-point links into the core of distributed cloud architectures. A significant trend is the shift towards interconnected data center fabrics, where enterprises and service providers are establishing meshed networks to enable seamless workload migration and data mobility.

This interconnection facilitates improved application performance, business continuity, and resource optimization. Concurrently, the technology is advancing into AI-driven operations, where automation focuses on dynamic bandwidth allocation and predictive fault management, though this remains largely in the enhancement phase. The integration of advanced encryption and security protocols with DCI solutions is also emerging, ensuring data integrity and compliance across distributed environments.

The market's expansion is fueled by substantial opportunities in hybrid and multi-cloud strategies, particularly in crafting resilient and scalable networks that offer unparalleled performance and flexibility compared to traditional WAN solutions. The telecommunications industry has become a major adopter, leveraging the technology for the rapid and efficient delivery of 5G services, edge computing, and low-latency applications, which have revolutionized service provider architectures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, the ongoing development of novel, high-capacity optical technologies, including coherent optics and wavelength division multiplexing, opens new avenues for creating links that can handle massive data flows. These innovations are poised to address complex challenges in global business operations and digital service delivery, providing solutions that were previously unimaginable.

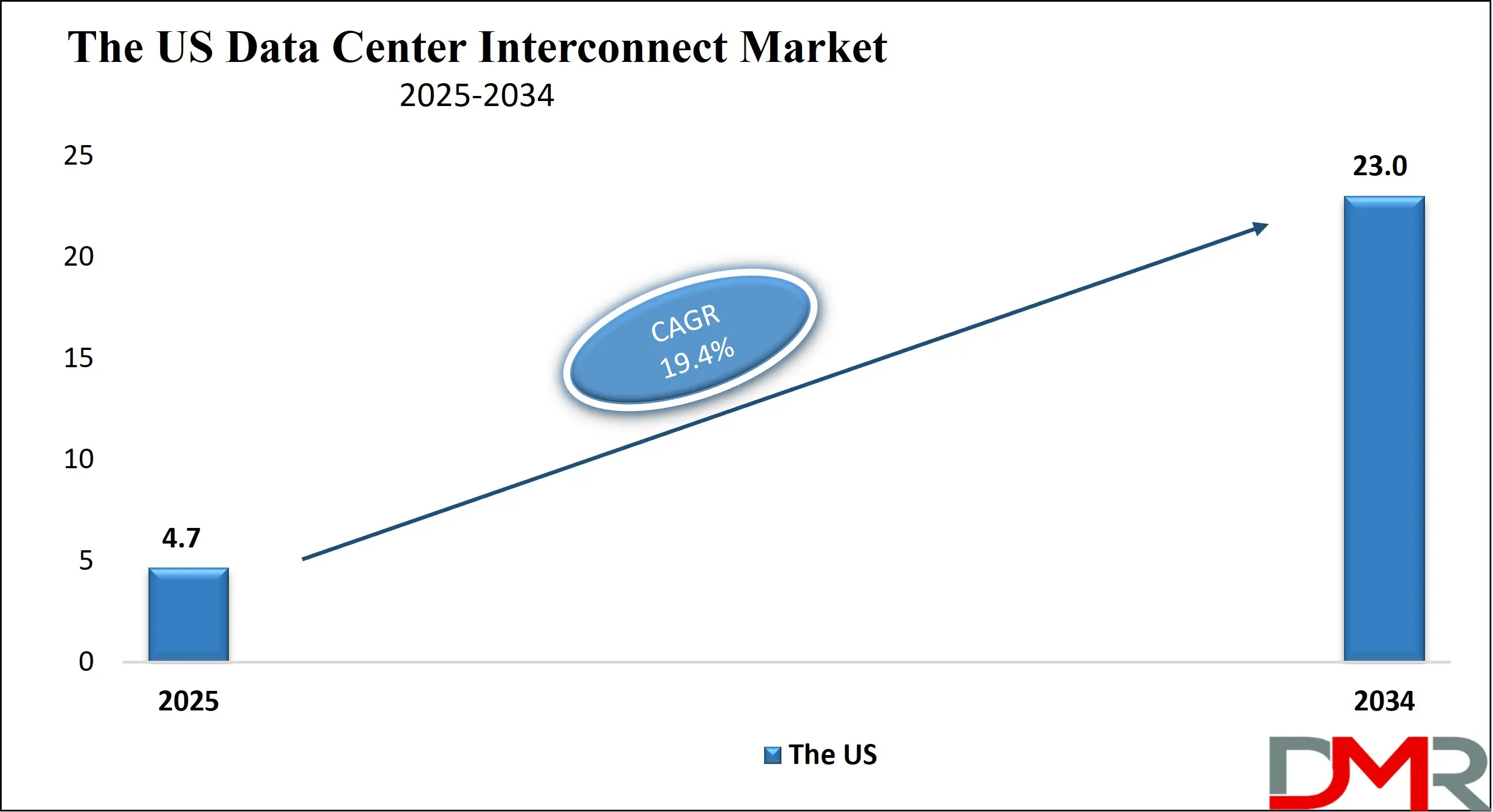

The US Data Center Interconnect Market

The US Data Center Interconnect Market is projected to reach USD 4.7 billion in 2025 at a compound annual growth rate of 19.4% over its forecast period.

The United States maintains a leadership position in the data center interconnect landscape, a status fortified by substantial investment from cloud giants and a robust technological ecosystem. Agencies and industry consortia actively foster innovation through initiatives that standardize technologies and promote secure data exchange. Proactive regulatory stances on data sovereignty and cybersecurity create a stable environment for technological advancement and commercial investment in the sector.

The presence of world-leading technology companies and hyperscale data center operators, including those in major hubs like Northern Virginia and Silicon Valley, further drives adoption through cutting-edge infrastructure deployments and the establishment of sophisticated, interconnected campuses that directly support digital economy growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A significant structural advantage for the U.S. market is its concentration of global cloud and internet giants, a trend documented by market analysts. This concentration predicts a substantial increase in the need for high-speed, high-availability interconnects to support distributed applications and services, which in turn drives demand for advanced DCI solutions. The need for low-latency connections for financial trading, real-time analytics, and content delivery is rising in direct correlation.

Furthermore, the high enterprise IT expenditure, as reported by industry bodies, indicates a market capable of adopting advanced, albeit sometimes costly, technologies. This financial capacity, combined with a growing body of evidence demonstrating the value of robust DCI in ensuring business continuity and enabling digital transformation, is encouraging more enterprises and carriers to integrate this technology into their core infrastructure, ensuring continued market growth.

The Europe Data Center Interconnect Market

The Europe Data Center Interconnect Market is estimated to be valued at USD 1.6 billion in 2025 and is further anticipated to reach USD 6.4 billion by 2034 at a CAGR of 15.0%.

The European data center interconnect ecosystem is characterized by strong collaboration between public institutions, carriers, and cloud providers, guided by a comprehensive regulatory framework. The General Data Protection Regulation (GDPR) and various national cybersecurity directives provide a stringent set of requirements for data transfer and protection, influencing DCI architecture and security implementations across member states.

This is supported by significant funding from the European Union's digital strategy programs, which have allocated resources to projects focused on improving digital infrastructure, including the development of pan-European data gateways and cloud interconnects. National telecom regulators and major carriers are exploring the deployment of advanced DCI for specific applications, which is critical for guiding widespread adoption and ensuring digital sovereignty.

Europe's digital economy structure, as analyzed by Eurostat, presents a clear driver for the DCI sector. The region has a strong and growing cloud market, leading to a higher demand for secure and efficient cross-border data links. This creates a pressing need for innovative, high-performance interconnectivity that can support the digital single market. The strong data protection laws prevalent across the continent are increasingly focused on secure and compliant data routing, seeking technologies that can reduce latency and improve service reliability.

The presence of a highly skilled network engineering workforce and a dense network of carrier-neutral data centers in hubs like Frankfurt, London, and Amsterdam facilitates the development and application of complex DCI solutions, from private financial exchanges in the UK to multi-cloud hubs in Germany, positioning Europe as a critical and advanced market for DCI innovation.

The Japan Data Center Interconnect Market

The Japan Data Center Interconnect Market is projected to be valued at USD 648 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2,911 million in 2034 at a CAGR of 17.6%.

Japan's foray into advanced data center interconnection is heavily influenced by its status as a technologically advanced society with a high demand for digital services, a reality extensively documented by the Japanese Ministry of Internal Affairs and Communications. This has created an urgent and growing demand for low-latency connectivity for fintech, online gaming, and enterprise digitalization. In response, the Japanese government has strategically prioritized digital infrastructure through national initiatives, with relevant agencies funding projects that bridge the gap between academic research and commercial application.

The regulatory body for telecommunications has been working to establish clear guidelines for infrastructure sharing and competition, providing a structured, though rigorous, environment for providers to bring new services to market, ensuring they meet high reliability standards.

The technological advantage for Japan lies in its society's high bandwidth consumption and its urgent need to support next-generation applications like smart cities and IoT. This drives innovation in creating high-capacity, resilient interconnect solutions that cater to the specific demands of a dense, urbanized population. National research institutes are actively involved in R&D on advanced optical networking and network automation suitable for these applications.

Furthermore, the high density of corporate headquarters and financial institutions in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new DCI applications. This combination of market demand, strong governmental support for technology, and a culture of engineering excellence positions Japan as a unique and highly advanced market focused on leveraging DCI to maintain its competitive digital edge.

Global Data Center Interconnect Market: Key Takeaways

- Global Market Size Insights: The Global Data Center Interconnect Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 79.4 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Data Center Interconnect Market is projected to be valued at USD 4.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.0 billion in 2034 at a CAGR of 19.4%.

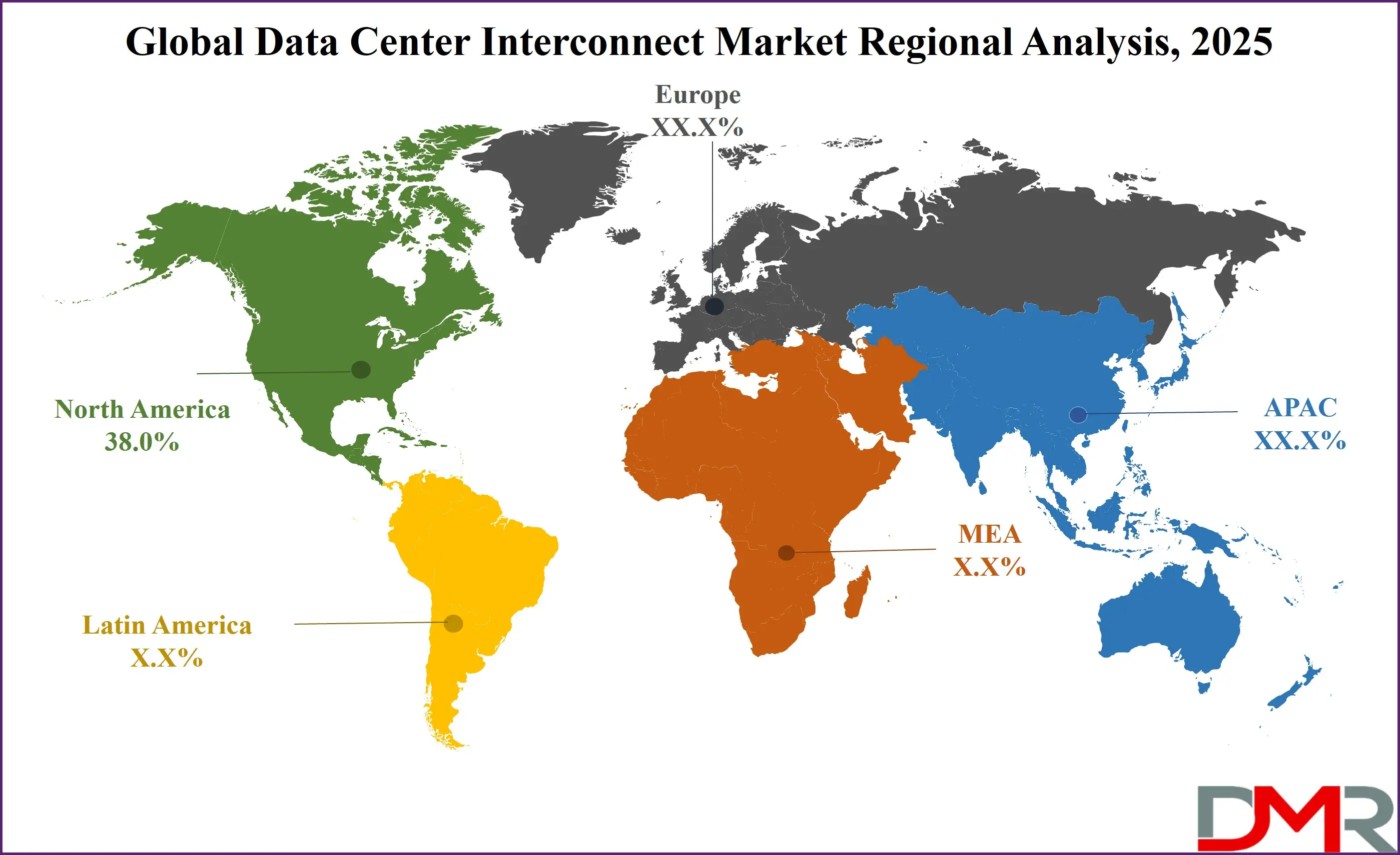

- Regional Insights: North America is expected to have the largest market share in the Global Data Center Interconnect Market with a share of about 38.0% in 2025.

- Key Players: Some of the major key players in the Global Data Center Interconnect Market are Cisco Systems, Inc., Ciena Corporation, Nokia Corporation, Huawei Technologies Co., Ltd., Infinera Corporation, Juniper Networks, Inc., ADVA Optical Networking SE (now part of ADTRAN), Arista Networks, Inc., and many others.

Global Data Center Interconnect Market: Use Cases

- Disaster Recovery and Business Continuity: Enterprises use high-availability DCI links to synchronously or asynchronously replicate critical data and applications between geographically dispersed data centers, ensuring operational resilience and minimal downtime during an outage.

- Geographically Distributed Load Balancing: Cloud providers and large enterprises leverage DCI to dynamically distribute workloads across multiple data centers, optimizing resource utilization, improving application response times for end-users, and handling traffic spikes.

- Interconnecting Hybrid and Multi-Cloud Environments: Organizations use DCI solutions to create secure, high-performance private connections between their on-premises data centers and various public cloud platforms (AWS, Azure, Google Cloud), enabling a seamless hybrid cloud experience.

- Content Delivery Network (CDN) Optimization: CDN providers deploy DCI to interconnect their points of presence (PoPs), ensuring popular content is cached closer to end-users, which dramatically reduces latency and improves video streaming and web browsing quality.

- Financial Services Trading Platforms: High-frequency trading firms and financial institutions require ultra-low-latency, dedicated DCI links between exchanges and their data centers to execute trades in microseconds, where speed is a critical competitive advantage.

Global Data Center Interconnect Market: Stats & Facts

International Telecommunication Union (ITU)

- ITU-T has developed numerous standards (G-series recommendations) critical for optical transport networks, which form the backbone of most DCI solutions.

Internet Engineering Task Force (IETF)

- IETF RFCs such as those defining MPLS, EVPN, and Segment Routing are foundational technologies for building scalable and flexible DCI networks.

European Telecommunications Standards Institute (ETSI)

- ETSI's NFV ISG has published over 100 specifications for Network Functions Virtualization, which is increasingly integrated with DCI solutions for service agility.

Cloud Security Alliance (CSA)

- CSA published the "Security Guidance for Critical Areas of Focus in Cloud Computing," which includes best practices for securing inter-cloud and data center connections.

U.S. National Institute of Standards and Technology (NIST)

- NIST published the "Framework for Improving Critical Infrastructure Cybersecurity," which is widely referenced for securing DCI infrastructure

Global Data Center Interconnect Market: Market Dynamics

Driving Factors in the Global Data Center Interconnect Market

Exponential Growth of Data and Cloud Adoption

The global surge in data generation, fueled by IoT, big data analytics, and ubiquitous cloud service adoption, is a primary driver for the DCI market. The need to move, synchronize, and process this data across distributed data centers and cloud regions necessitates high-bandwidth, low-latency interconnects. DCI technology is uniquely positioned to address these needs by providing the scalable and reliable network fabric required for modern distributed applications, data-intensive workloads, and hybrid cloud architectures, ensuring performance and business agility.

Supportive Regulatory Frameworks and Digital Infrastructure Investments

The establishment of clear policies regarding data localization, cross-border data flow, and critical infrastructure protection by governments worldwide has provided a framework for DCI deployment. Furthermore, substantial public and private investments in national broadband plans, 5G backhaul, and digital transformation initiatives directly fuel the demand for robust interconnection infrastructure. This financial and regulatory support de-risks large-scale projects and catalyzes the transition of DCI from a niche carrier technology to a mainstream enterprise and cloud enabler.

Restraints in the Global Data Center Interconnect Market

High Capital and Operational Costs

The significant initial investment required for high-capacity optical transport equipment, routers, and specialized DCI switches, along with the ongoing costs for leased dark fiber or wavelength services, presents a major barrier to entry, particularly for smaller enterprises and regional providers. Beyond the hardware, the total cost of ownership includes complex network design, integration, and specialized skilled personnel. This financial hurdle can slow down widespread adoption, as organizations must conduct rigorous ROI analyses to justify the investment.

Shortage of Specialized Workforce and Skill Gaps

The effective implementation and operation of advanced DCI networks require a unique skill set that combines expertise in optical networking, IP routing, network automation, and cybersecurity. There is a pronounced shortage of professionals trained in this niche intersection, creating a significant human resource bottleneck. The rapid evolution of technology further exacerbates this challenge. Without a larger pool of qualified network architects and engineers, the pace of deployment and innovation can be critically hampered.

Opportunities in the Global Data Center Interconnect Market

Expansion in the Edge Computing Ecosystem

The rapid growth of edge computing represents one of the largest and most rapidly expanding opportunities for DCI adoption. The technology is ideal for providing high-capacity, low-latency backhaul links that connect distributed edge data centers and micro-data centers to regional or central core cloud locations. This shift from a purely centralized cloud model to a distributed edge-core architecture offers significant gains in application performance for latency-sensitive services like autonomous vehicles and AR/VR.

AI and Machine Learning Workload Distribution

A high-potential growth frontier lies in interconnecting AI/ML training and inference clusters. Training complex models often requires pooling computational resources across multiple data centers. DCI enables the creation of a "virtual supercomputer" by providing the high-throughput, low-latency fabric necessary for synchronizing models and data across geographically dispersed GPU clusters. This capability for distributed AI could revolutionize how large-scale models are developed, opening a new and substantial market segment for ultra-high-performance DCI.

Trends in the Global Data Center Interconnect Market

Adoption of Coherent Optics and Higher Order Modulation

A dominant trend is the rapid migration to higher-capacity coherent optical technologies directly in DCI platforms. Advances in coherent DSPs and higher-order modulation (e.g., 64-QAM, 96-QAM) are enabling single-wavelength speeds of 400G, 800G, and beyond over long distances. This allows for a massive increase in the capacity of each fiber link, reducing the cost per bit and meeting the insatiable bandwidth demands of cloud and content providers without requiring new fiber builds.

Integration of Automation and AIOps

The industry is witnessing rapid innovation in the application of AI and machine learning to DCI operations. This includes the use of AI for predictive analytics to foresee potential network failures, automated provisioning for on-demand bandwidth services, and intelligent traffic engineering to dynamically optimize network paths for performance and cost. These advancements are transforming DCI from a static infrastructure into a self-optimizing, self-healing network fabric, pushing the boundaries of operational efficiency and reliability.

Global Data Center Interconnect Market: Research Scope and Analysis

By Component Analysis

The Hardware segment is projected to remain the backbone of the Data Center Interconnect (DCI) market, driven by substantial upfront investments in switches, routers, optical transport systems, and high-capacity transmission modules. These include DCI-optimized packet switches, coherent optical transceivers, programmable routers, and DWDM systems designed for long-haul and metro transport.

Due to the capital-intensive nature of these components, hardware continues to command the largest share of market revenue. Cloud hyperscalers, telecom operators, and large enterprises must invest heavily in physical infrastructure to support bandwidth-dense interconnects and secure, scalable data exchange across geographically distributed sites. As workloads grow and data volumes surge, these buyers consistently refresh and upgrade their hardware to higher capacity tiers, reinforcing ongoing revenue dominance.

However, the Software and Services segment is emerging as the fastest-growing and strategically crucial category. Software orchestrates, automates, and secures the DCI ecosystem, enabling intent-based networking, virtualized interconnects, zero-touch provisioning, and real-time traffic analytics. Solutions for encryption management, SDN control, predictive maintenance, and network monitoring drive recurring revenue streams.

Additionally, managed services, integration, and lifecycle support add long-term value, especially as enterprises shift toward hybrid cloud models and require expert oversight. Because DCI complexity is increasing, driven by AI workloads, multi-cloud routing decisions, and data governance requirements, software and services are becoming critical differentiators for operational efficiency, cost optimization, and network resilience.

By Technology Analysis

Packet-Based Switching is poised to be positioned as the most widely deployed and versatile technology within DCI, primarily due to its adaptability in enterprise-driven and IP-centric environments. Solutions leveraging MPLS, VXLAN, EVPN, and segment routing offer strong support for mixed workloads, including voice, data, video, and storage traffic, making packet-based switching ideal for modern multi-tenant, virtualized, and cloud-integrated networks. Enterprises prefer packet DCI architectures because they provide granular traffic engineering, scalable Layer 2/Layer 3 connectivity, and simplified workload mobility across distributed data centers.

Optical Transport Networking (OTN) and Wavelength Division Multiplexing (WDM), particularly Dense WDM (DWDM), form the core transport technologies for high-capacity and long-haul data center connectivity. DWDM maximizes fiber utilization by transmitting multiple wavelengths simultaneously, supporting terabits of throughput across a single fiber pair. This makes it indispensable for hyperscale cloud providers, content delivery networks, and telecom carriers that require massive backbone capacity and ultra-low latency. As AI training clusters and edge-cloud architectures expand, demand for coherent optics and high-speed photonic systems is accelerating.

SD-WAN increasingly serves as an overlay to optimize application-aware routing and enhance cost-efficiency. While not a core transport technology, SD-WAN enhances DCI by offering centralized management, dynamic path selection, and policy-driven performance optimization, especially for enterprise branches accessing cloud-hosted workloads. Together, these technologies form a layered ecosystem, enabling flexible, high-speed, secure, and scalable interconnects across hybrid and multi-cloud infrastructures.

By Application Analysis

The Enterprise IT & Cloud Connectivity segment is anticipated to stand as the dominant application area for DCI, fueled by the global shift toward hybrid and multi-cloud architectures. Enterprises across BFSI, healthcare, retail, and manufacturing increasingly rely on geographically distributed data centers to support digital transformation, business continuity, and real-time analytics.

DCI enables mission-critical functions such as disaster recovery, synchronous data replication, workload mobility, and dedicated cloud on-ramps. As organizations adopt cloud-native applications, containerized workloads, and data-intensive platforms like AI and IoT, the need for seamless connectivity between private data centers and public cloud regions grows exponentially. This makes DCI a foundational component of modern enterprise IT strategies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Telecommunications & Carrier segment also plays a central role, driven by the demands of 5G, FTTH expansion, and next-generation broadband services. Telecom operators rely heavily on high-capacity DCI links to connect central offices, metro aggregation points, and core data centers. With 5G networks generating massive backhaul traffic and requiring ultra-reliable, low-latency transport, DCI becomes vital for scalable and high-performance service delivery. Carriers also use DCI to support wholesale bandwidth services, cloud connectivity offerings, and edge computing deployments. As their networks evolve toward open, virtualized, and distributed architectures, the importance of resilient, programmable interconnects continues to expand.

Together, enterprise and carrier applications consistently drive the largest share of deployment, shaping DCI as an indispensable infrastructure pillar supporting modern digital ecosystems.

By End-User Analysis

Cloud Service Providers (CSPs) and Telecommunications Carriers are expected to remain the dominant end-users of DCI solutions, reflecting their critical role in building global digital infrastructure. Hyperscale CSPs, including providers of public cloud, AI data centers, and global backbone networks, depend on DCI to link availability zones, regions, and edge data centers. These interconnects support cross-region data replication, failover capabilities, global application delivery, and ultra-fast inter-region traffic demanded by AI/ML workloads. With exponential growth in cloud services, content delivery, and AI compute clusters, CSPs continually expand their DCI footprints, making them the largest revenue contributors.

Telecommunications carriers likewise rely on DCI for expanding fiber backbones, metro networks, and centralized data hosting environments. Carriers use DCI to link core switching facilities, central offices, and distributed network nodes, enabling high-speed transport, 5G backhaul, and wholesale connectivity. As operators transition toward open RAN, cloud-native core networks, and edge computing, their dependency on robust DCI increases significantly.

Enterprises, including BFSI, healthcare, retail, IT services, manufacturing, and government, represent the fastest-growing end-user segment. Their rapid adoption of private clouds, multi-cloud strategies, edge data centers, and remote workforce platforms is driving new demand for secure, high-performance interconnects. Enterprises now use DCI to unify their data center architectures, support real-time analytics, and ensure compliance-driven data governance across regions. With digital workloads becoming increasingly distributed, enterprise reliance on DCI is scaling rapidly, positioning this segment as the most transformative contributor to future market growth.

The Global Data Center Interconnect Market Report is segmented on the basis of the following

By Component

- Hardware

- DCI Switches & Routers

- High-capacity Ethernet

- IP Switches

- Core/Edge Routers

- Optical Transport Systems

- DWDM systems,

- OTN platforms

- Transponders

- Muxponders

- Gateways

- Software

- Network Management & Control Software

- Provisioning

- Monitoring

- Automation

- telemetry

- SDN Controllers & Orchestration Platforms

- Security & Encryption Software

- MACsec

- IPsec

- optical layer encryption

- zero-trust DCI security

- Services

- Integration & Deployment Services

- Installation

- Configuration

- network design

- interoperability testing

- Consulting & Advisory Services

- Network transformation

- architecture consulting

- capacity planning

- Managed DCI Services

- Fully outsourced monitoring

- Optimization

- SLA-based operations

- Support & Maintenance Services

By Technology

- Packet-Based Switching

- Optical Transport (WDM, OTN)

- SD-WAN Overlay

By Application

- Enterprise IT & Cloud Connectivity

- Telecommunications & Carrier Networks

- Content Delivery Networks (CDNs)

- Government & Defense

- Research & Education

By End-User

- Cloud Service Providers

- Telecommunications Carriers

- Enterprises

- Content Providers

- Government Agencies

Impact of Artificial Intelligence in the Global Data Center Interconnect Market

- Enhanced Performance Optimization: AI algorithms analyze network telemetry data in real-time to predict congestion, dynamically reroute traffic, and optimize bandwidth utilization across the DCI fabric, reducing latency and improving application performance.

- Automated Provisioning and Operations: AI-driven software automates the provisioning of new virtual circuits or bandwidth changes, reduces manual configuration errors, and streamlines operational workflows, leading to faster service delivery.

- Predictive Maintenance and Anomaly Detection: AI-powered analytics detect subtle patterns indicative of impending hardware failures or security breaches, enabling proactive maintenance and enhancing network reliability and security.

- Intelligent Traffic Engineering: AI assists in modeling complex traffic flows and application requirements to compute optimal paths through the interconnected data center network, ensuring service level agreements (SLAs) are met.

- Data-Driven Capacity Planning: AI analyzes historical and real-time usage data to forecast future bandwidth needs and guide infrastructure investment decisions, enabling more efficient and cost-effective network growth.

Global Data Center Interconnect Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global data center interconnect market with 38.0% of market share by the end of 2025, due to a powerful confluence of technological leadership, a high concentration of hyperscale data centers, and a mature digital economy. The region is home to the world's leading cloud providers and technology vendors, which continuously drive innovation in both hardware and software. This technological edge is complemented by high enterprise cloud adoption and significant investments in digital infrastructure.

The presence of a robust ecosystem with high demand for low-latency connectivity enables continuous investment in cutting-edge technology. This synergy between established industry players, advanced enterprise end-users, and strong R&D spending creates a virtuous cycle that solidifies North America's dominant market position.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) in the data center interconnect market, fueled by massive digital transformation, government-led smart city initiatives, and compelling demographic and economic growth. Countries like China, India, and Japan are making substantial public and private investments in data center infrastructure as a core part of their digital economies.

This is coupled with a rapidly expanding internet user base and booming e-commerce and digital entertainment sectors. The region also faces a pronounced need to improve digital infrastructure to serve a vast and increasingly online population. The growing presence of local cloud providers and technology suppliers is making DCI solutions more accessible. This combination of strong governmental support, urgent digital infrastructure needs, a growing data economy, and increasing investment creates an explosive growth environment, positioning the Asia Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center Interconnect Market: Competitive Landscape

The competitive landscape of the global data center interconnect market is fragmented and highly dynamic, characterized by a mix of established networking giants, specialized optical firms, and a vibrant ecosystem of software-defined networking players. Dominant players like Cisco Systems, Inc., Ciena Corporation, and Nokia Corporation leverage their extensive portfolios of routing, switching, and optical transport technologies to maintain a stronghold, particularly in the realms of carrier and enterprise networks. These companies compete not only on technology but also on the strength of their global service and support networks.

A significant trend is the deep foray of specialized optical companies, such as Infinera Corporation and ADVA (now part of ADTRAN), which compete aggressively on performance and density for high-capacity DCI links. Simultaneously, the market sees intense competition from players focused on disaggregated networking and automation, including Arista Networks, Inc. and Juniper Networks, Inc., ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Global Data Center Interconnect Market are

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Oracle Corporation

- Broadcom Inc.

- Corning Incorporated

- Ribbon Communications

- Ekinops

- Radware Ltd.

- Mellanox Technologies (NVIDIA Networking)

- Smartoptics

- PacketLight Networks

- Tellabs

- Allied Telesis

- Edgecore Networks

- FiberHome Telecommunication Technologies

- CommScope Holding Company, Inc.

- Coriant (Now part of Infinera)

- Calix, Inc.

- Allot Ltd.

- Other Key Players

Recent Developments in the Global Data Center Interconnect Market

- May 2024: The Metro Ethernet Forum (MEF) announces new standards for SD-WAN and DCI interoperability, aiming to simplify multi-vendor service orchestration.

- April 2024: Ciena Corporation and Google Cloud announce a strategic collaboration to integrate network analytics and automation for simplified DCI management.

- March 2024: The Open Compute Project (OCP) accepts a new specification for open DCI switches, aimed at increasing choice and reducing costs for hyperscale data centers.

- February 2024: Cisco Systems completes its acquisition of Acacia Communications, enhancing its coherent optics portfolio for high-density DCI applications.

- January 2024: The "FutureNet World" conference in London features keynotes on the role of AI and automation in the future of carrier DCI networks.

- November 2023: Arista Networks launches the 7800R3 series, a new family of modular platforms designed for high-performance routing in cloud and DCI spines.

- October 2023: Infinera and a major European telecom operator announce a trial of 800G coherent technology on a live long-haul DCI network.

- September 2023: The International Telecommunication Union (ITU) publishes a new standard (G.698.4) for enhanced optical transport, influencing next-generation DCI deployments.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.6 Bn |

| Forecast Value (2034) |

USD 79.4 Bn |

| CAGR (2025–2034) |

20.7% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.7 Bn |

| Forecast Data |

2025 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Segments Covered |

By Component (Hardware, Software, Services); By Technology (Packet-Based Switching, Optical Transport (WDM, OTN), SD-WAN Overlay); By Application (Enterprise IT & Cloud Connectivity, Telecommunications & Carrier Networks, Content Delivery Networks (CDNs), Government & Defense, Research & Education); By End-User (Cloud Service Providers, Telecommunications Carriers, Enterprises, Content Providers, Government Agencies) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Cisco Systems, Ciena Corporation, Nokia Corporation, Huawei Technologies, Infinera Corporation, Juniper Networks, ADVA Optical Networking (ADTRAN), Arista Networks, Fujitsu Limited, NEC Corporation, ZTE Corporation, Extreme Networks, Pluribus Networks, DriveNets, Dell Technologies, Hewlett Packard Enterprise (HPE), IBM Corporation, Oracle Corporation, Broadcom Inc., Corning Incorporated, Ribbon Communications, Ekinops, Radware Ltd., NVIDIA (Mellanox), Smartoptics, PacketLight Networks, Tellabs, Allied Telesis, Edgecore Networks, FiberHome, CommScope, Coriant (Infinera), Calix Inc., Allot Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Data Center Interconnect Market?

▾ The Global Data Center Interconnect Market size is estimated to have a value of USD 14.6 billion in 2025 and is expected to reach USD 79.4 billion by the end of 2034.

What is the growth rate in the Global Data Center Interconnect Market in the forecast period?

▾ The market is growing at a CAGR of 20.7 percent over the forecasted period of 2025 to 2034.

What is the size of the US Data Center Interconnect Market?

▾ The US Data Center Interconnect Market is projected to be valued at USD 4.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.0 billion in 2034 at a CAGR of 19.4%.

Which region accounted for the largest Global Data Center Interconnect Market?

▾ North America is expected to have the largest market share in the Global Data Center Interconnect Market with a share of about 38.0% in 2025.

Who are the key players in the Global Data Center Interconnect Market?

▾ Some of the major key players in the Global Data Center Interconnect Market are Cisco Systems, Inc., Ciena Corporation, Nokia Corporation, Huawei Technologies Co., Ltd., Infinera Corporation, Juniper Networks, Inc., ADVA Optical Networking SE (ADTRAN), Arista Networks, Inc., and many others.