Data Center Liquid Immersion Cooling Market Overview

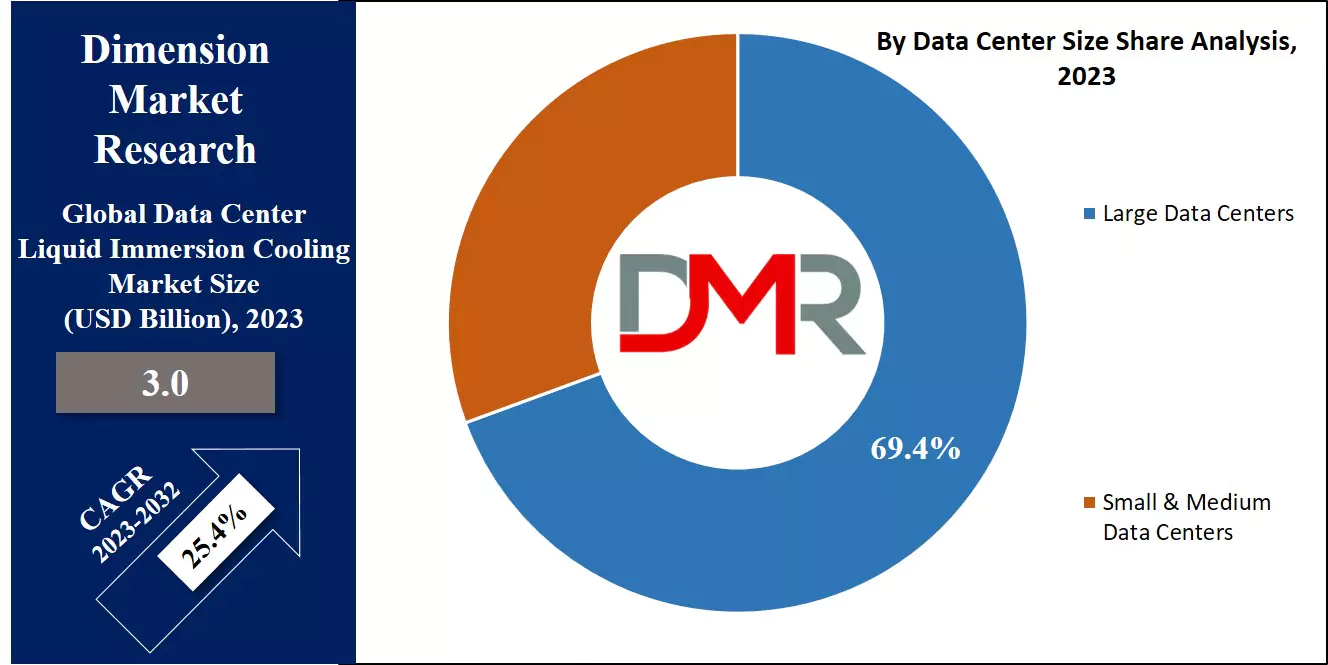

The Global Data Center Liquid Immersion Cooling Market is expected to reach a value of USD 3.0 billion in 2023, and it is further anticipated to reach a market value of USD 23.2 billion by 2032 at a CAGR of 25.4%. The market has seen significant growth over the past few years and is predicted to grow significantly during the forecasted period as well.

Data center liquid cooling includes liquid submersion technology, including large servers and essential equipment in a sizable tank filled with non-conductive coolants, which efficiently absorb the heat generated by the equipment.

Given that data centers consume significantly high electricity & produce much heat, the adoption of liquid cooling solutions becomes imperative for effective cooling, which not only addresses the heat issue but also drives the growth of the thermal management solutions market across industries.

Data Center Liquid Immersion Cooling Market Key Takeaways

- By Liquid Cooling Solution Type, Two-phase Immersion Cooling System takes the lead in 2024

- By End User, IT & Telecom sector takes the lead in 2024

- In addition, the BFSI sector is expected to have robust growth over the forecasted period.

- By Data Center Size, Large Data Centers take the lead & drive the market in 2024

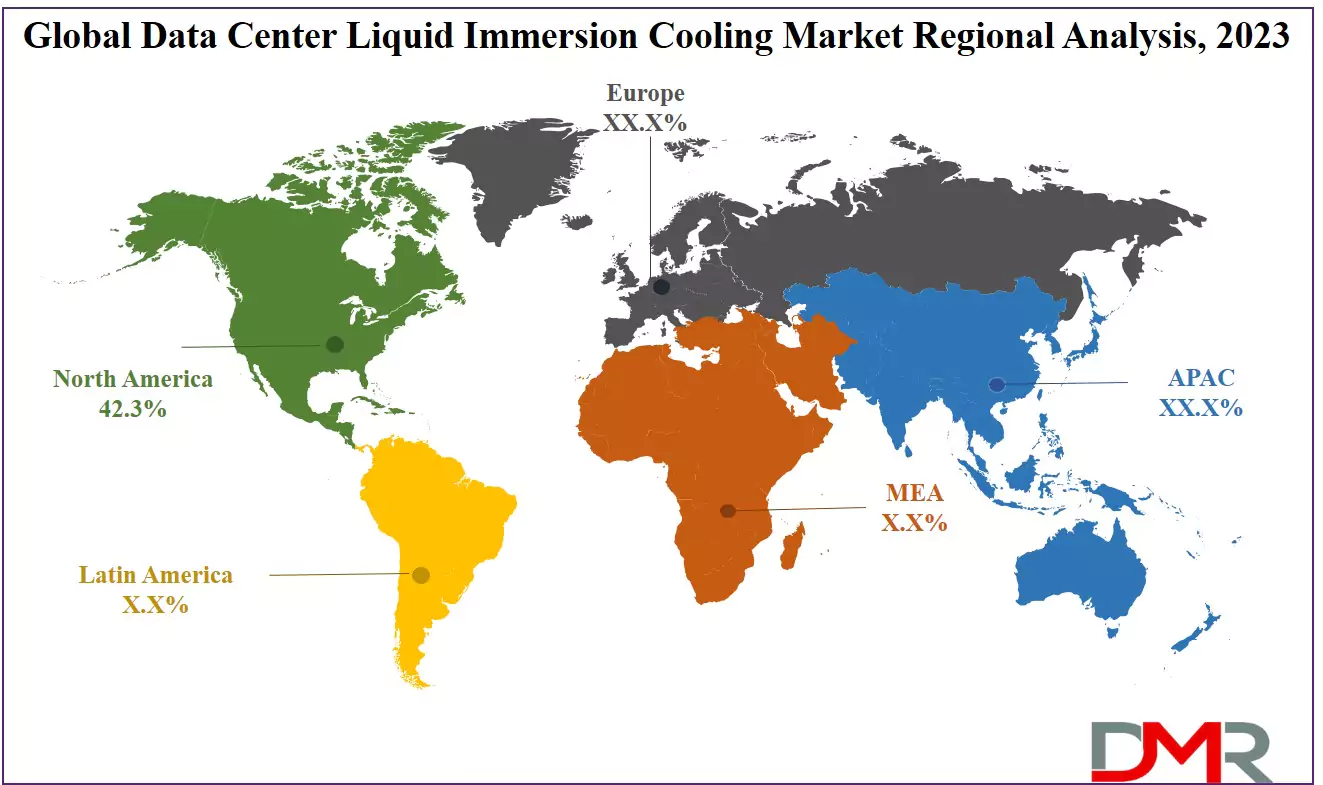

- North America has a 42.3% share of revenue in the Global Data Center Liquid Immersion Cooling Market in 2024

Use Data Center Liquid Immersion Cooling Market Use Cases

- High-Performance Computing (HPC): Enhances cooling efficiency for supercomputers used in AI, scientific research, and simulations.

- Cryptocurrency Mining: Reduces heat and energy consumption in large-scale Bitcoin and Ethereum mining operations.

- Edge Data Centers: Supports compact, remote, and edge computing facilities where traditional cooling is inefficient.

- AI & Machine Learning Workloads: Maintains optimal temperatures for GPUs and TPUs running deep learning and AI models.

- Hyperscale Data Centers: Improves energy efficiency and sustainability for large cloud service providers like AWS, Google, and Microsoft.

- Telecommunications & 5G Infrastructure: Ensures reliable performance in telecom data centers processing high-bandwidth 5G networks.

Data Center Liquid Immersion Cooling Market Dynamic

Telecom data centers rely heavily on large-scale fiber networks to allow the efficient & high-speed delivery of various services, including mobile services, content delivery, & cloud services. Thus, the demand for increased connectivity has led to the expansion in the use of high-density racks in these centers, driving the need for effective data center cooling solutions.

The growing adoption of AI & big data has transformative effects on enterprise servers, with traditional microprocessors struggling to effectively operate information from data center GPUs developed for deep learning technology & enterprise-grade performance, which has consequently increased the demand for data center cooling globally, especially in industries such as

Healthcare Cloud Computing and

Digital Map services where real-time processing is mission critical.

However, the installation of liquid cooling systems, while effective, comes at a higher cost compared to air cooling systems. The components & accessories required for liquid cooling must meet specific quality standards, and the use of special equipment consisting of expensive materials like bronze, cupronickel, or titanium further increases the overall capital expense, as these elevated costs create a challenge to the growth of the data center liquid cooling market.

Further, standardized products are favored in computing settings for their compatibility, & the absence of such standards in liquid cooling solutions presents significant restraints, especially when proprietary systems that are incompatible with consumer preferences are used.

Driver

Driver of Liquid Immersion Cooling The Data Center Liquid Immersion Cooling Market is driven by increasing demands for high-performance computing and energy efficiency within data centers. As processing requirements rise, traditional air-based cooling methods struggle to keep up, increasing energy usage and costs.

Liquid immersion cooling where servers are submerged in non-conductive liquids offers an effective solution, substantially cutting energy usage and costs while improving heat management within compact spaces ideal for urban or space constrained data centers as it supports AI/cloud computing processing needs. This eco-friendly, cost effective cooling approach supports AI/cloud computing processing requirements by supporting data center data processing demands as AI/cloud computing data needs are expanding exponentially.

Trend

Trend within the Data Center Liquid Immersion Cooling Market is its shift toward environmentally sustainable data center infrastructure. As environmental concerns and carbon emission regulations increase, businesses are turning to liquid immersion cooling technology as a means to lower their carbon emissions footprint and meet regulations. Immersion cooling fits within the larger movement towards sustainability within tech industries, where it facilitates power savings and waste reduction.

Leading technology companies and data centers are investing in research and development (R&D) to enhance immersion cooling fluid formulations, increasing thermal efficiency and equipment lifespan while being environmentally-conscious. This eco-conscious trend encourages innovation and adoption of advanced cooling techniques in data centers.

Restraint

Liquid immersion cooling's high initial cost remains a significant barrier to its adoption in the market, as its implementation requires specialist equipment and infrastructure - leading to higher capital investments than conventional air-cooling systems. Cost can be prohibitive for smaller companies or data centers with limited budgets, limiting adoption.

Furthermore, concerns over maintenance complexity and potential hardware compatibility issues add further resistance. Furthermore, specialization may be required for implementation and servicing as there are limited standardized solutions - something especially pertinent to emerging economies with tight budget constraints or minimal access to advanced cooling technologies.

Opportunity

AI and

edge computing present numerous growth opportunities for the Data Center Liquid Immersion Cooling Market. Both technologies require rapid data processing that generates significant heat, making liquid immersion cooling an ideal way to maintain optimal performance in edge data centers.

Furthermore, global privacy regulations call for localized processing; small data centers closer to end-users may benefit from using this compact yet effective cooling technology; partnerships and advancements also present market expansion potential.

Data Center Liquid Immersion Cooling Market Research Scope and Analysis

By Liquid Cooling Solution Type

In 2023 marks a pivotal year for Data Center Liquid Immersion Cooling Market with single-phase immersion cooling capturing 62% market share, driven by cost effectiveness, simplicity, and compatibility across a broad range of data center environments. Single-phase immersion cooling's dominance can be attributed to its cost effectiveness, simplicity and broad applicability across environments.

Effective thermal management by submerging servers into non-conductive liquid cooling solutions without complex phase change processes is provided through single phase cooling; its operation and maintenance ease is attractive to data center operators looking for efficient cooling solutions without incurring high infrastructure investments required with two phase systems.Two-phase Immersion Cooling Systems represent an increasing share of the market.

These cooling solutions utilize liquid that evaporates upon contact with server heat, offering higher cooling efficiencies than their counterparts and making them suitable for high density applications such as AI and HPC. Though adoption may currently be limited due to higher costs and complexity concerns, two-phase systems should become increasingly prevalent as demand for advanced cooling technologies increases in high density data centers.

By Data Center Size

Large Data Centers hold 68% of the Market for Data Center Liquid Immersion Cooling as of 2023. Their success can be attributed to their demand for highly efficient cooling solutions to support massive computational and storage demands of these large facilities, including 24/7 data processing needs and more efficient thermal management and energy consumption than traditional air cooling methods.

Thanks to liquid immersion cooling's improved thermal management and energy efficiency compared to air-cooling methods, large facilities can achieve operational cost reduction and meet sustainability goals by decreasing power consumption and emissions.

Small & Medium Data Centers have also begun adopting liquid immersion cooling in increasing numbers, yet still make up only a smaller market share. Such cooling solutions help optimize space and energy use at these facilities with high density computing requirements; however, their initial investment costs may limit budget flexibility more so than at large data centers.

By End User

In terms of end users, IT & Telecom leads the By

55% market share in Global Data Center Liquid Immersion Cooling Market in 2023, as it is a transformative force, providing optimal performance & reliability. With growing demands for data processing, this technology effectively manages heat generated by extensive computing systems. Liquid immersion cooling prevents hardware overheating, improves overall system stability, and maintains uninterrupted communication networks.

Further, the BFSI sector is expected to have significant growth over the forecasted period, as it proves indispensable for safeguarding critical financial operations, as an industry reliant on data-driven processes, this cooling technology plays a critical role in maintaining the integrity & security of financial transactions.

By optimizing server performance, minimizing energy consumption, & lowering operational costs, liquid immersion cooling reinforces the effectiveness of IT infrastructure in finance-related operations. Its adoption further showcases a commitment to technological innovation, allowing enhanced efficiency, security, & reliability in data management within the BFSI segment.

The Data Center Liquid Immersion Cooling Market Report is segmented on the basis of the following:

By Liquid Cooling Solution Type

- Single-phase Immersion Cooling System

- Two-phase Immersion Cooling System

By Data Center Size

- Small & Medium Data Centers

- Large Data Centers

By End User

- BFSI

- IT & Telecom

- Research & Academics

- Manufacturing

- Others

How Does Artificial Intelligence Contribute To Improve Data Center Liquid Immersion Cooling Market ?

- Real-time Temperature Optimization: AI continuously monitors and adjusts cooling parameters, ensuring optimal thermal management.

- Energy Efficiency Enhancement: AI-driven algorithms optimize cooling processes, reducing power consumption and operational costs.

- Predictive Maintenance: AI detects anomalies and predicts potential failures in cooling systems, preventing downtime.

- Workload-based Cooling Adjustment: AI dynamically regulates cooling levels based on server workloads, maximizing performance.

- Leak Detection & Risk Mitigation: AI-powered sensors identify leaks or faults in immersion cooling setups, enhancing system safety.

- Sustainability & Carbon Footprint Reduction: AI optimizes energy use and integrates with renewable sources, making data centers more eco-friendly.

Data Center Liquid Immersion Cooling Market Regional Analysis

North America emerges as the primary revenue-generating region in the global data center liquid immersion cooling market, capturing

a substantial 42.3% share in 2023, as the region's dominance is owing to the growing number of data centers, mainly in the U.S. & Canada, highlighting continuous expansion. Further, as the market matures, the region is expected for further growth in the upcoming years.

Also, the Asia Pacific region anticipates significant market growth in coming years due to ongoing technological developments in countries like India & China as well as the availability of essential resources like land & labor in India presents opportunities for major market players to establish research and development centers, fostering growth in the region.

Moreover, Europe is expected to experience moderate growth in the overall data center liquid immersion cooling market, influenced by the presence of a few key players in countries like the U.K. and Germany.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Data Center Liquid Immersion Cooling Market Competitive Landscape

The Global Data Center Liquid Immersion Cooling Market exhibits strong competition as key players vying for market share by focusing on technological innovation, improving cooling efficiency, & sustainable practices. Further companies engage in strategic partnerships & acquisitions to improve their position. As the need for efficient cooling solutions increases, the competitive landscape continues to change, driving developments in liquid immersion cooling technologies.

In April 2022, LiquidStack announced a partnership with Standard Power as they embarked on constructing the inaugural large-scale colocation data center in the US using 2-phase immersion cooling, which is gaining prominence, and offers an alternative to traditional liquid cooling methods like direct-to-chip (cold plates) & 1-phase immersion cooling.

Some of the prominent players in the global Data Center Liquid Immersion Cooling Market are

- Liquid Stack

- Asetek AS

- CoolIT System

- Mikros Technologies

- Lenovo Group

- Liquid Cool Solution

- USystems Ltd

- Midas Green Technologies

- Alfa Laval

- Fujitsu Ltd

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Data Center Liquid Immersion Cooling Market:

The COVID-19 pandemic & the following economic recession had major impacts on the Global Data Center Liquid Immersion Cooling Market. The start of pandemic-induced interruption slowed down some projects & investments, which also accelerated the digital transformation, allowing growth in dependency on data centers. Further, the recessionary environment led to cost-conscious decision-making, allowing data center operators to give importance to energy-efficient & affordable cooling solutions, which favored the adoption of liquid immersion cooling, known for its efficiency & reduced operational costs.

Moreover, as remote work and online activities grew during lockdowns, there was an increase in data processing demands, further showcasing the importance of effective cooling solutions. Even after these challenges, the market experienced resilience & adaptation, aligning with the changing needs of the digital landscape in the middle of the pandemic and economic uncertainties.

Data Center Liquid Immersion Cooling Market Recent Development

- In February 2022, Gigabyte introduced advanced high-performance computing servers, marking its entry into AMD EPYC & Nvidia A100-based systems, which are equipped with CoolIT's direct liquid cooling system, feature one or two AMD EPYC 7003-series processors with up to 128 cores and 4 or 8 Nvidia A100 80GB SXM4 modules. Further, CoolIT is set to develop a dedicated liquid cooling system to individually cool CPUs and GPUs, enabling optimal performance.

- In March 2022, SK Lubricant invested a substantial USD 25 million equity into GRC, which aims to expand SK Lubricant's liquid-based thermal management initiatives & advance their green ESG strategy. The collaboration includes joint efforts to develop premium single-phase immersion coolants & liquid immersion cooling systems, allowing the quick commercialization & standardization of these innovative technologies.

- In May 2022, Intel initiated a major step towards enhancing data center sustainability by channeling a substantial USD 700 million investment into a dedicated research facility focused on liquid and immersion cooling technologies. Further, Intel introduced the market's inaugural immersion cooling reference design, focused on encouraging broader adoption of this innovative cooling method in data centers on a global scale.

Data Center Liquid Immersion Cooling Market Report Details

| Report Characteristics |

| Market Size (2023) |

USD 3.0 Bn |

| Forecast Value (2032) |

USD 23.2 Bn |

| CAGR (2023-2032) |

25.4% |

| Historical Data |

2017 - 2022 |

| Forecast Data |

2023 - 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Liquid Cooling Solution Type (Single-phase Immersion Cooling System and Two-phase Immersion Cooling System), By Data Center Size (Small & Medium Data Centers and Large Data Centers), By End User (BFSI, IT & Telecom, Research & Academics, Manufacturing, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Liquid Stack, Asetek AS, CoolIT System, Mikros Technologies, Lenovo Group, Liquid Cool Solution, USystems Ltd, Midas Green Technologies, Alfa Laval, Fujitsu Ltd, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Data Center Liquid Immersion Cooling Market size is estimated to have a value of USD 3.0

billion in 2023 and is expected to reach USD 23.2 billion by the end of 2032.

North America has the largest market share for the Global Data Center Liquid Immersion Cooling Market

with a share of about 42.3% in 2023.

Some of the major key players in the Global Data Center Liquid Immersion Cooling Market are iquid

Stack, Asetek AS, CoolIT System, and many others.

The market is growing at a CAGR of 25.4 percent over the forecasted period.