Market Overview

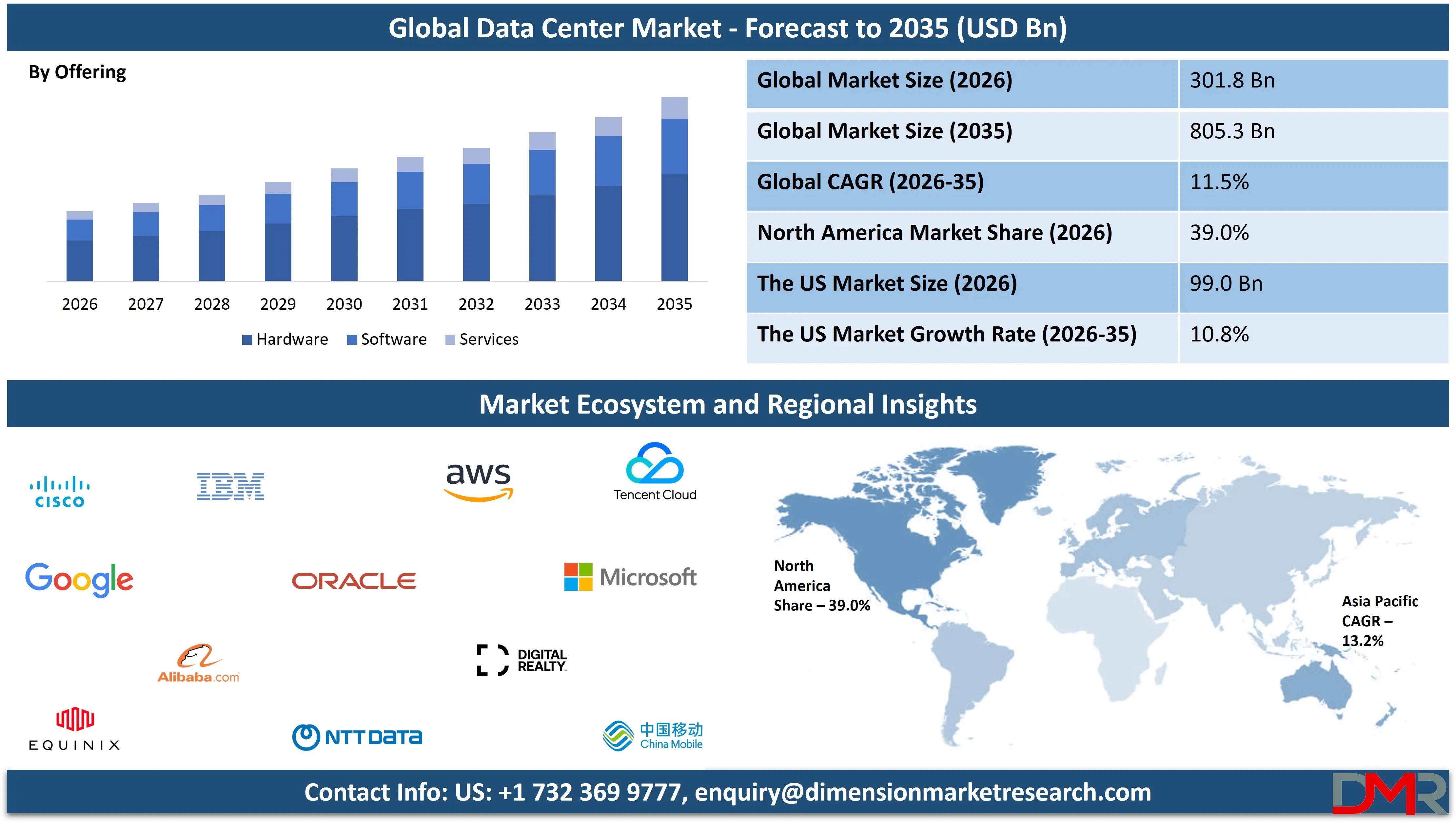

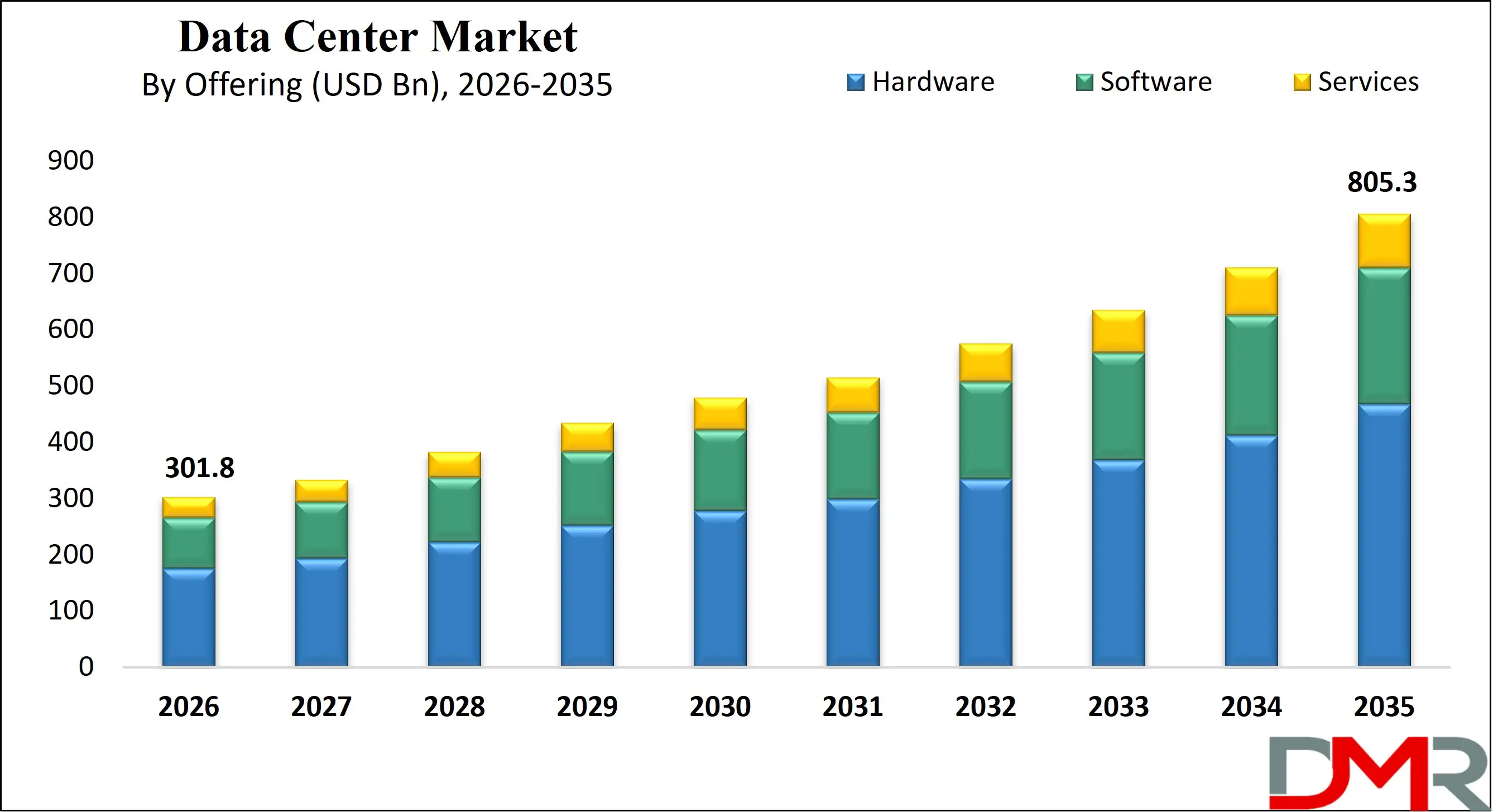

The Global Data Center Market size is projected to reach USD 301.8 billion in 2026 and grow at a compound annual growth rate of 11.5% to reach a value of USD 805.3 billion in 2035.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

A data center is a purpose-built facility that houses computing systems and related components used for the storage, processing, and management of digital information. It consists of IT infrastructure such as servers, storage devices, and networking equipment, supported by power supply systems, cooling technologies, physical security mechanisms, and operational management platforms. Data centers are engineered to deliver high availability, reliability, scalability, and data protection through controlled environments and redundant architectures, ensuring continuous operation of digital workloads.

The data center market is shaped by the rapid expansion of data generation driven by cloud adoption, streaming services, e-commerce, financial digitization, and remote work models. Operators are increasingly focused on improving energy efficiency, resiliency, and scalability to meet rising computational demands. Hyperscale and colocation facilities have emerged as dominant deployment models due to their ability to support high-density workloads while optimizing capital and operational expenditures. Sustainability considerations, including renewable energy integration and advanced cooling techniques, are becoming central to infrastructure planning and investment decisions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Ongoing shifts toward edge computing, hybrid deployment architectures, and automation are redefining how data centers are designed and operated. As enterprises balance latency, compliance, and cost requirements, demand is growing for modular, software-defined, and AI-optimized facilities. These trends collectively position the sector as a critical enabler of digital transformation across industries, with long-term relevance to economic productivity, innovation, and national digital resilience.

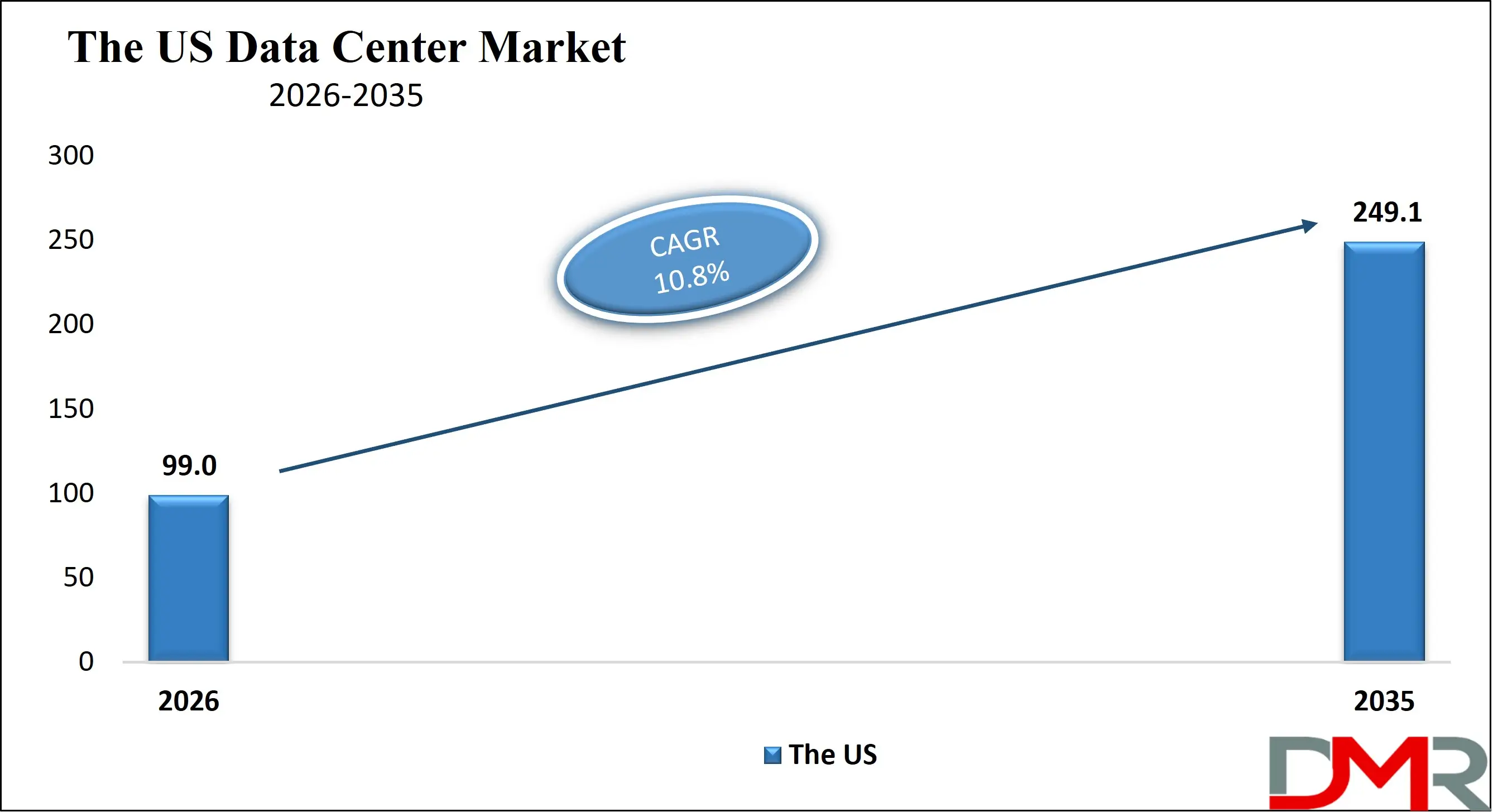

The US Data Center Market

The US Data Center Market size is projected to reach USD 99.0 billion in 2026 at a compound annual growth rate of 10.8% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Data Center market is driven by strong demand from hyperscale cloud providers, technology companies, and large enterprises undergoing digital transformation. The country benefits from a mature digital infrastructure ecosystem, deep capital markets, and the presence of leading colocation and cloud service providers. Favorable regulatory frameworks, combined with federal and state-level incentives for renewable energy adoption, have encouraged large-scale investments in energy-efficient facilities. Growing demand for AI workloads, high-performance computing, and data sovereignty compliance further strengthens market expansion. The US also leads in hyperscale capacity additions, supported by robust fiber connectivity and innovation in power management and cooling technologies.

Europe Data Center Market

Europe Data Center Market size is projected to reach USD 66.4 billion in 2026 at a compound annual growth rate of 9.8% over its forecast period.

Strong regulatory oversight, sustainability mandates, and regional digital sovereignty initiatives shape Europe’s Data Center market. Policies such as the European Green Deal and energy efficiency directives are pushing operators toward carbon-neutral operations, renewable power sourcing, and advanced cooling solutions. Demand is driven by cloud adoption, financial services digitization, and public-sector modernization across Western and Northern Europe. Colocation facilities play a significant role due to fragmented enterprise demand and cross-border data compliance requirements. While energy costs and permitting challenges pose constraints, Europe continues to lead in green data center design and regulatory-driven innovation.

Japan Data Center Market

Japan Data Center Market size is projected to reach USD 15.1 billion in 2026 at a compound annual growth rate of 10.3% over its forecast period.

Japan’s Data Center market is supported by advanced digital infrastructure, high enterprise IT spending, and strong demand for cloud and disaster-resilient facilities. Urban concentration, coupled with seismic risk considerations, has driven innovation in facility design, redundancy, and reliability standards. Government initiatives promoting digital transformation and smart city development are accelerating investments in hyperscale and edge facilities. The market benefits from strong demand in financial services, manufacturing, and telecommunications, though land availability and power constraints remain challenges. Japan’s focus on automation and energy efficiency presents long-term opportunities for next-generation data center deployments.

Data Center Market: Key Takeaways

- Market Growth: The Data Center Market size is expected to grow by USD 472.3 billion, at a CAGR of 11.5%, during the forecasted period of 2027 to 2035.

- By Offerings: The hardware segment is anticipated to get the majority share of the Data Center Market in 2026.

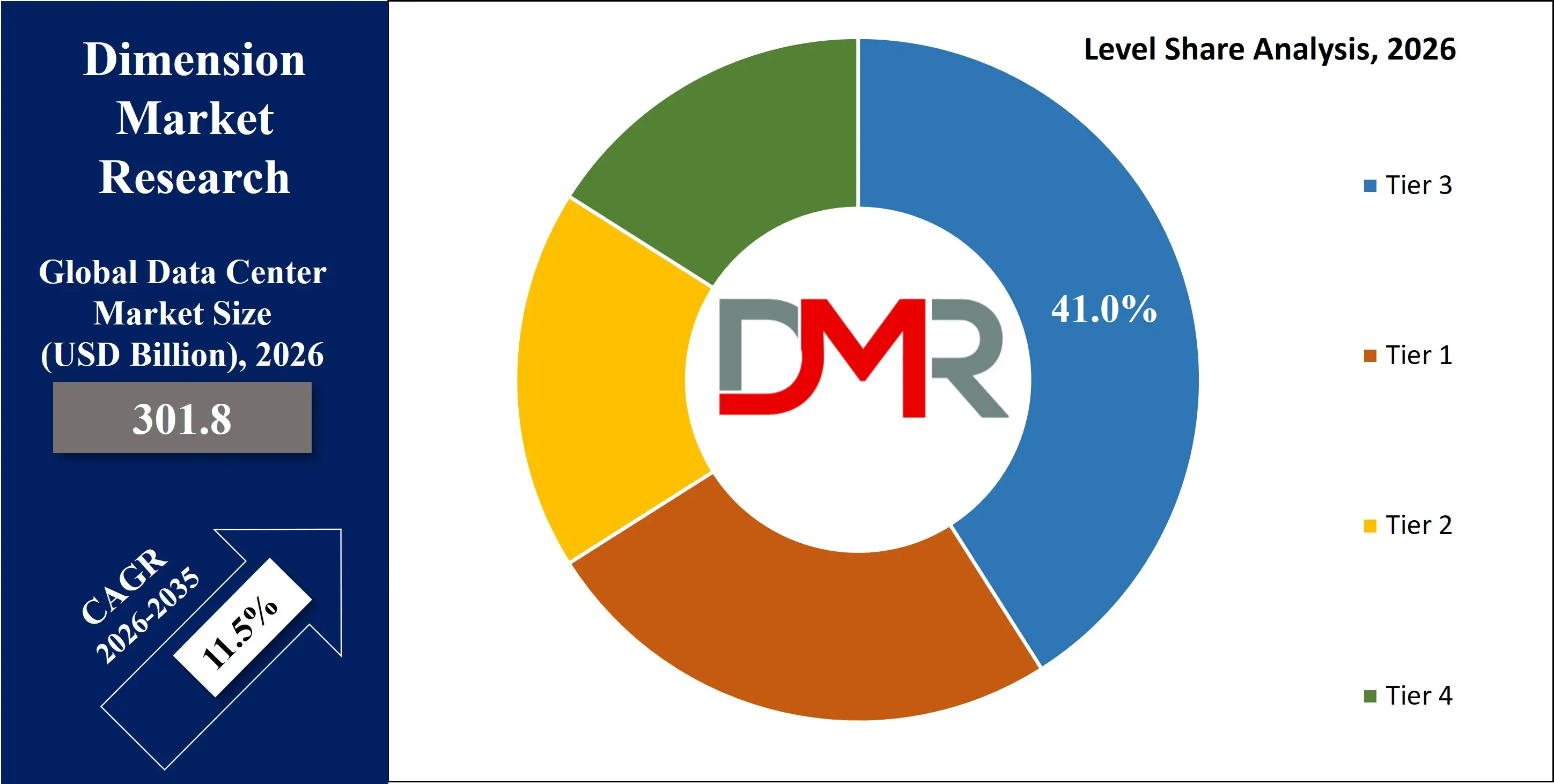

- By Level: The Tier 3 segment is expected to get the largest revenue share in 2026 in the Data Center Market.

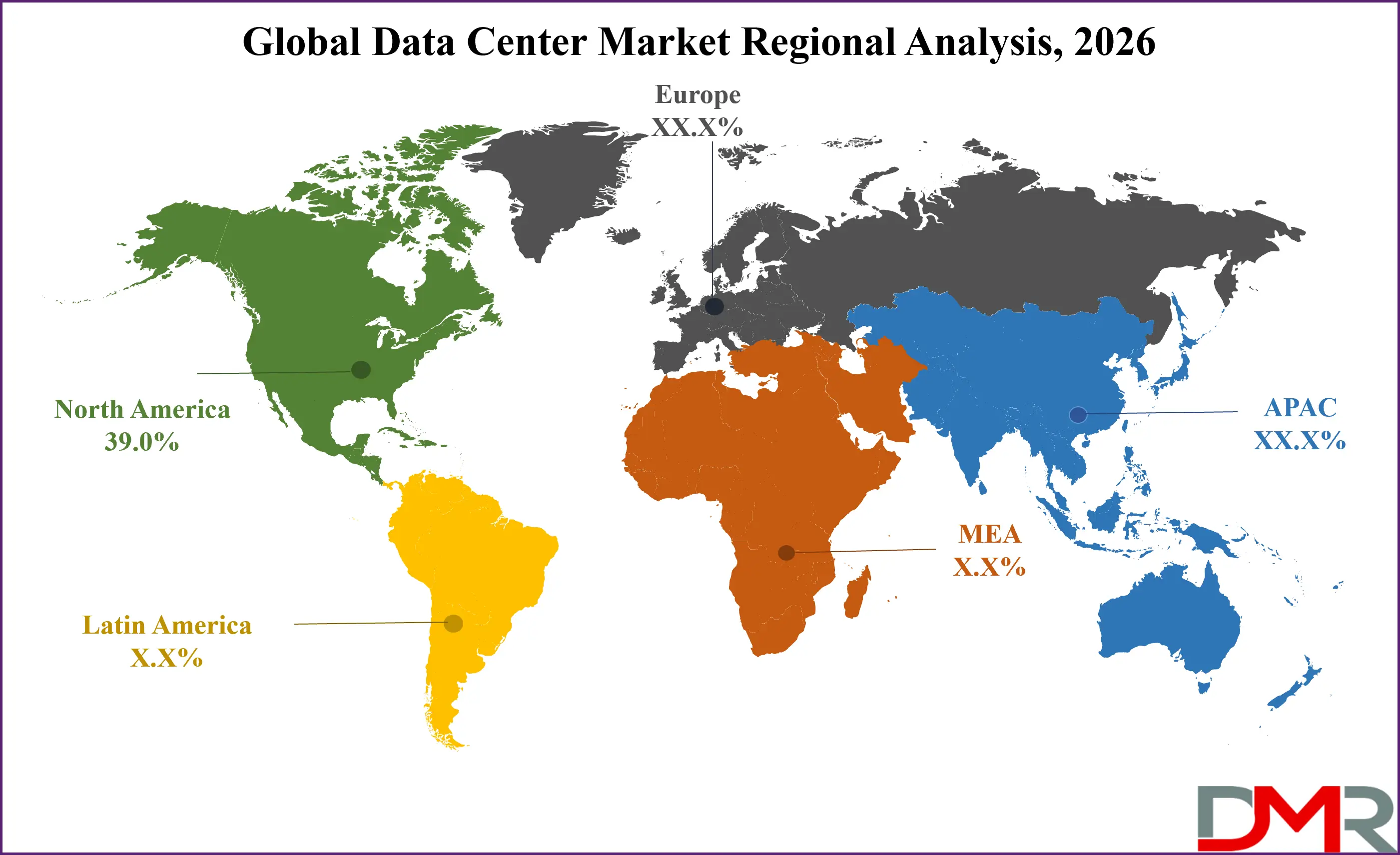

- Regional Insight: North America is expected to hold a 39.0% share of revenue in the Global Data Center Market in 2026.

- Use Cases: Some of the use cases of Data Center include cloud service hosting, AI workload, and more.

Data Center Market: Use Cases

- Cloud Service Hosting: Data centers support public, private, and hybrid cloud platforms by providing scalable compute, storage, and networking infrastructure for enterprises and consumers.

- Artificial Intelligence Workloads: High-density facilities enable AI model training and inference through GPU- and accelerator-optimized infrastructure with advanced cooling requirements.

- Disaster Recovery & Business Continuity: Facilities ensure data redundancy, backup, and rapid recovery for mission-critical enterprise and government operations.

- Edge Computing Enablement: Regional and far-edge facilities reduce latency for applications such as autonomous systems, smart cities, and real-time analytics.

- Financial Transaction Processing: Secure, low-latency infrastructure supports high-frequency trading, digital payments, and core banking operations.

- Content Delivery & Streaming: Data centers host and distribute video, gaming, and media content efficiently to global audiences.

- Healthcare Data Management: Facilities support electronic health records, medical imaging, and AI-driven diagnostics while ensuring compliance with data protection regulations.

Stats & Facts

- U.S. Department of Energy reports that data centers accounted for approximately 4% of total U.S. electricity consumption in 2024.

- U.S. Energy Information Administration recorded a year-over-year increase of over 15% in electricity demand from large-scale computing facilities in 2024.

- Eurostat indicates that data center energy efficiency initiatives reduced average power usage effectiveness across the EU by nearly 10% between 2020 and 2024.

- European Commission states that over 60% of new large data centers approved in 2025 committed to renewable energy sourcing.

- International Energy Agency highlights that global data traffic grew at more than 20% annually through 2024, driven largely by cloud and AI workloads.

- Japan Ministry of Economy, Trade and Industry reports sustained double-digit investment growth in digital infrastructure during 2024.

- OECD notes increased public-sector cloud migration across member countries in 2025.

- U.S. Federal Energy Management Program documents rising adoption of liquid cooling systems in high-density facilities in 2025.

- European Environment Agency confirms stricter emissions reporting requirements for large data facilities beginning 2025.

- World Bank identifies digital infrastructure as a core enabler of economic resilience in advanced economies during 2024.

Market Dynamic

Driving Factors in the Data Center Market

Expansion of Cloud Computing and Digital Services

The rapid expansion of cloud computing remains a primary force accelerating the Data Center market. Enterprises across industries are migrating workloads from on-premise infrastructure to cloud and hybrid environments to improve scalability, cost efficiency, and operational flexibility. This shift has increased demand for hyperscale and colocation facilities capable of supporting massive data volumes and high availability requirements. Growth in digital services such as streaming, online gaming, digital banking, and e-commerce further intensifies infrastructure needs. As organizations prioritize uptime, redundancy, and global reach, data centers have become mission-critical assets, reinforcing sustained investment in capacity expansion and technological upgrades.

Rising Adoption of AI, Big Data, and High-Performance Computing

The increasing use of artificial intelligence, big data analytics, and high-performance computing is reshaping data center design and capacity requirements. AI workloads demand higher rack densities, specialized processors, and advanced cooling solutions, driving infrastructure modernization. Enterprises and governments are investing heavily in data-intensive applications for automation, predictive analytics, and real-time decision-making. This has elevated the strategic importance of resilient, scalable facilities that can support energy-intensive workloads while maintaining efficiency. As AI adoption expands across sectors, demand for next-generation data centers continues to accelerate.

Restraints in the Data Center Market

High Capital Expenditure and Operational Costs

One of the most significant constraints in the Data Center market is the high capital investment required for facility construction, power infrastructure, and cooling systems. Land acquisition, grid connectivity, and redundancy requirements substantially increase upfront costs. Operational expenses, particularly electricity and maintenance, further strain profitability, especially in regions with volatile energy prices. Smaller operators and enterprises often face barriers to entry due to limited access to capital. These financial challenges slow market expansion and encourage consolidation among larger players with stronger balance sheets.

Power Availability, Sustainability, and Regulatory Barriers

Limited power availability and tightening environmental regulations pose growing challenges for data center operators. Grid capacity constraints in major hubs can delay new projects or restrict expansion. At the same time, governments are imposing stricter emissions reporting and energy efficiency standards, increasing compliance complexity. While sustainability initiatives drive innovation, they also raise costs and lengthen development timelines. Balancing growth with environmental responsibility remains a key challenge, particularly in urban and energy-constrained regions.

Opportunities in the Data Center Market

Growth of Edge and Regional Data Centers

The rise of latency-sensitive applications such as autonomous systems, smart manufacturing, and real-time analytics is creating strong opportunities for edge and regional data centers. These facilities bring compute resources closer to end users, reducing latency and improving performance. Telecommunications providers and enterprises are increasingly deploying distributed infrastructure to support 5G and IoT ecosystems. This shift opens new revenue streams beyond traditional hyperscale facilities and supports market expansion into secondary cities and emerging regions.

Government-Backed Digital Infrastructure Investments

Public-sector initiatives aimed at strengthening digital sovereignty, cybersecurity, and economic resilience present major growth opportunities. Governments worldwide are funding cloud adoption, smart city projects, and digital public services, all of which rely on robust data center infrastructure. Incentives for renewable energy integration and energy-efficient designs further encourage investment. These initiatives reduce risk for operators and create long-term demand stability, particularly in regulated and public-sector-driven markets.

Trends in the Data Center Market

Shift Toward Sustainable and Energy-Efficient Designs

Sustainability has become a defining trend in the Data Center market. Operators are increasingly adopting renewable power sourcing, advanced cooling technologies, and energy-efficient architectures to reduce environmental impact. Metrics such as power usage effectiveness are now central to facility performance evaluation. Liquid cooling, waste heat reuse, and AI-driven energy optimization are gaining traction as operators seek to balance performance with sustainability goals. This trend is reshaping investment priorities and facility design standards globally.

Automation and Software-Defined Infrastructure Adoption

The adoption of automation and software-defined infrastructure is transforming data center operations. Advanced monitoring, orchestration, and analytics tools enable predictive maintenance, workload optimization, and reduced downtime. Automation improves operational efficiency and supports scalability, particularly in large hyperscale environments. As facilities grow more complex, software-driven management is becoming essential for maintaining reliability, security, and cost control.

Impact of Artificial Intelligence in Data Center Market

- Predictive Maintenance: AI enables real-time monitoring of equipment health, reducing downtime and extending asset lifecycles.

- Energy Optimization: Machine learning algorithms optimize power and cooling usage, improving overall efficiency.

- Workload Management: AI dynamically allocates resources based on demand, enhancing performance and utilization.

- Security Enhancement: Intelligent threat detection improves physical and cyber security across facilities.

- Capacity Planning: AI models forecast demand growth, supporting data-driven expansion strategies.

- Cooling Innovation: AI controls liquid and hybrid cooling systems to manage high-density workloads.

- Automation of Operations: Autonomous systems reduce human intervention and operational errors.

- Cost Reduction: Optimized operations lower energy and maintenance costs.

Research Scope and Analysis

By Offering Analysis

Hardware remains the dominant offering segment, accounting for an estimated 58% share in 2026 due to continuous investments in servers, storage systems, networking equipment, power distribution units, and advanced cooling infrastructure. The growing deployment of hyperscale and AI-ready facilities has significantly increased demand for high-performance servers and energy-efficient power modules. Hardware dominance is further reinforced by periodic upgrade cycles driven by performance, security, and efficiency requirements. As data volumes grow and workloads become more compute-intensive, operators continue to prioritize robust physical infrastructure, sustaining the segment’s leadership.

Software represents the fastest-growing offering segment, driven by rising adoption of monitoring, automation, virtualization, and analytics platforms. Operators increasingly rely on intelligent software to manage complex, distributed environments efficiently. Growth is supported by the need for real-time visibility, predictive maintenance, and security management. As facilities scale, software becomes critical to optimizing resource utilization and reducing operational complexity, positioning it as a high-growth segment.

By Deployment Mode Analysis

On-premise deployment continues to account for an estimated 46% share of the Data Center market in 2026, reflecting its sustained relevance among organizations with stringent operational requirements. Large enterprises operating in BFSI, government, healthcare, and critical infrastructure sectors prioritize on-premise facilities due to heightened concerns around data security, regulatory compliance, and low-latency processing. These deployments provide complete control over hardware, software, and network configurations, enabling tailored optimization for mission-critical workloads. Although capital-intensive and costly to maintain, on-premise data centers remain essential where data sovereignty, uptime guarantees, and regulatory adherence are mandatory. Ongoing modernization through automation and energy-efficient infrastructure further reinforces this segment’s continued dominance.

Hybrid deployment is the fastest-growing model within the Data Center market, driven by enterprises seeking a balance between infrastructure control and cloud scalability. Organizations increasingly adopt hybrid architectures to distribute workloads based on performance sensitivity, cost efficiency, and compliance requirements. This model enables seamless integration between legacy on-premise systems and cloud-native applications, supporting phased digital transformation without operational disruption. Hybrid deployments reduce dependency on single environments while improving flexibility and resilience. As enterprises pursue agility and scalability without compromising governance, hybrid data centers are gaining strong traction, particularly among mid-to-large organizations managing diverse and dynamic workloads across multiple locations.

By Data Center Type Analysis

Colocation data centers are projected to account for approximately 34% of the market in 2026, driven by rising enterprise demand for scalable infrastructure without full ownership responsibility. Retail and wholesale colocation models provide flexibility in capacity expansion, geographic reach, and interconnection options. Enterprises leverage colocation facilities to reduce capital expenditure while maintaining high availability, redundancy, and compliance standards. The segment benefits from growing cloud ecosystems, increasing demand for low-latency interconnections, and expanding edge deployments. As digital transformation accelerates across industries, colocation continues to serve as a cost-effective and reliable alternative to enterprise-owned facilities.

Hyperscale data centers represent the fastest-growing data center type, fueled by exponential growth in cloud adoption, artificial intelligence workloads, and global digital platforms. These facilities are designed to operate at massive scale, supporting thousands of servers with high levels of automation and energy efficiency. Cloud service providers continue to invest heavily in hyperscale capacity to meet rising demand for compute-intensive and data-heavy applications. Standardized designs, advanced cooling technologies, and optimized power management enable hyperscale operators to achieve cost efficiency at scale. As AI and cloud services expand globally, hyperscale data centers remain central to infrastructure growth strategies.

By Level Analysis

Tier 3 data centers are expected to account for approximately 41% of the market in 2026, reflecting their optimal balance between cost and operational reliability. These facilities offer concurrently maintainable infrastructure, allowing planned maintenance without service disruption. Tier 3 data centers are widely adopted across enterprise and colocation environments supporting cloud services, BFSI operations, and telecommunications workloads. Their scalability and resilience make them suitable for most commercial applications requiring high availability. Compared to Tier 4, Tier 3 facilities deliver strong uptime performance at a lower capital cost, reinforcing their widespread preference among operators and enterprises.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Tier 4 data centers are the fastest-growing tier standard, driven by increasing demand for fault-tolerant infrastructure supporting mission-critical applications. These facilities are designed with fully redundant systems, ensuring near-zero downtime even during component failures. Adoption is strongest in financial services, defense, government, and hyperscale cloud operations where uninterrupted service is essential. Although Tier 4 data centers require significantly higher capital investment and operational complexity, growing reliance on digital platforms and real-time services continues to justify the cost. As digital dependency intensifies, Tier 4 infrastructure is increasingly viewed as a strategic necessity rather than a premium option.

By Enterprise Size Analysis

Large enterprises are projected to dominate the Data Center market with an estimated 63% share in 2026, supported by extensive data processing needs and global operational footprints. These organizations invest heavily in both owned and colocation facilities to support cloud platforms, analytics, and artificial intelligence initiatives. Large enterprises also lead in adopting advanced cooling systems, automation technologies, and cybersecurity frameworks to enhance efficiency and resilience. Their strong financial capacity enables continuous infrastructure upgrades and geographic expansion. As digital transformation becomes central to enterprise strategy, large organizations continue to drive sustained demand for high-capacity data center infrastructure.

Small and medium enterprises represent the fastest-growing segment in the Data Center market, driven by improved access to cloud-based and managed infrastructure services. SMEs increasingly rely on colocation and hybrid models to access enterprise-grade reliability, security, and scalability without high upfront investment. This shift allows smaller organizations to focus on core business activities while leveraging external infrastructure expertise. Growing digital adoption, e-commerce expansion, and remote work models further accelerate demand among SMEs. As service providers continue to offer flexible pricing and managed solutions, SME participation in the data center ecosystem is expected to expand rapidly.

By End User Analysis

Cloud service providers are projected to account for approximately 38% of total demand in 2026, making them the largest end-user group. Their dominance is driven by continuous expansion of hyperscale infrastructure to support public cloud platforms, AI services, and digital ecosystems. High utilization rates, long-term capacity planning, and global service delivery requirements sustain heavy investment in new facilities. Cloud providers also lead in adopting automation, renewable energy integration, and advanced cooling technologies. As enterprises increasingly migrate workloads to the cloud, demand from cloud service providers continues to shape overall market growth.

Healthcare is among the fastest-growing end-user segments due to rapid digitization of medical records, telemedicine platforms, and AI-driven diagnostics. Healthcare organizations require secure, compliant, and highly available infrastructure to manage sensitive patient data and real-time clinical applications. Regulatory requirements related to data privacy and system reliability further increase dependence on robust data center solutions. Growth is also supported by rising adoption of cloud-based healthcare systems and data analytics. As healthcare delivery becomes more digital and data-intensive, demand for reliable data center infrastructure continues to accelerate across public and private healthcare providers.

The Data Center Market Report is segmented on the basis of the following

By Offerings

- Hardware

- IT Modules

- Servers

- Storage Systems

- Networking Equipment

- Power Modules

- UPS Systems

- Power Distribution Units

- Backup Power Systems

- Cooling Modules

- Air-Based Cooling

- Liquid Cooling

- Precision Cooling Systems

- Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery Software

- Security Software

- Virtualization Software

- Analytics & Optimization Software

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Data Center Services

By Deployment Model

- On-Premise

- Hybrid

- Cloud-Based

By Data Center Type

- Enterprise Data Center

- Colocation Data Center

- Retail Colocation

- Wholesale Colocation

- Cloud Data Center

- Hyperscale Data Center

- Edge Data Center

- Micro Data Center

By Level (Tier Standard)

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- Cloud Service Providers

- Technology Providers

- Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Energy & Utilities

Regional Analysis

Leading Region in the Data Center Market

North America is expected to remain the leading region in the Data Center market, accounting for approximately 39% of global share in 2026. The region benefits from early cloud adoption, a strong hyperscale presence, advanced network infrastructure, and favorable investment conditions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Government support for digital infrastructure development, combined with innovation in energy-efficient designs, strengthens regional leadership. High demand from cloud service providers, technology firms, and large enterprises drives continuous capacity expansion. The presence of mature capital markets and skilled workforce further reinforces North America’s dominant market position.

Fastest Growing Region in the Data Center Market

Asia-Pacific is the fastest-growing region in the Data Center market, driven by rapid digitalization, expanding internet penetration, and strong government support for digital infrastructure. Emerging economies are investing heavily in cloud services, smart cities, and industrial automation initiatives. Rising enterprise IT spending, growth in e-commerce, and increasing demand for low-latency digital services accelerate infrastructure development. Regional governments are also promoting data localization and digital sovereignty, encouraging local data center investments. As digital economies mature across the region, Asia-Pacific is positioned as a key growth hub for future capacity expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The Data Center market is characterized by high entry barriers due to capital intensity, power requirements, and regulatory compliance. Market participants focus on scale expansion, energy efficiency, and service differentiation to maintain competitiveness. Strategic investments in renewable energy, automation, and advanced cooling technologies enhance operational efficiency. Partnerships with cloud providers, telecom operators, and energy companies are commonly used to secure long-term demand and power supply stability. Continuous R&D investment and geographic diversification remain critical strategies for sustaining market position.

Some of the prominent players in the global Data Center are

- Amazon Web Services

- Microsoft

- Google

- Alibaba Cloud

- Digital Realty

- Equinix

- Tencent Cloud

- Oracle

- IBM

- Meta Platforms

- NTT Global Data Centers

- China Telecom

- China Mobile

- China Unicom

- Schneider Electric

- Vertiv

- Huawei Technologies

- Dell Technologies

- Hewlett Packard Enterprise

- Cisco Systems

- Other Key Players

Recent Developments

- In October 2025, Adani Enterprises and Google announced a partnership to develop India’s largest AI data centre campus and new green energy infrastructure in Visakhapatnam, Andhra Pradesh. As Google’s AI hub in Visakhapatnam is a multi-faceted investment of approximately USD 15 billion over five years (2026-2030), comprising gigawatt-scale data centre operations, supported by a robust subsea cable network and clean energy, to drive the most demanding AI workloads in India,

- In September 2025, Equinix, Inc. announced the opening of its first International Business Exchange™ (IBX®) data center in Chennai, India, on a nearly six-acre plot of land, which will be interconnected with Equinix's Mumbai campus, and will consist of three IBX data centers. Further, the new facility will support local and global businesses by providing direct access to one of the world's fastest-growing digital economies that is driving innovation and AI adoption.

Report Details

| Report Characteristics |

| Market Size (2026) |

USD 301.8 Bn |

| Forecast Value (2035) |

USD 805.3 Bn |

| CAGR (2026–2035) |

11.5% |

| Historical Data |

2021 – 2025 |

| The US Market Size (2025) |

USD 99.0 Bn |

| Forecast Data |

2027 – 2035 |

| Base Year |

2025 |

| Estimate Year |

2026 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offerings (Hardware, Software, Services), By Deployment Model (On-Premise, Hybrid, Cloud-Based), By Data Center Type (Enterprise Data Center, Colocation Data Center, Cloud Data Center, Hyperscale Data Center, Edge Data Center, Micro Data Center), By Level (Tier Standard) (Tier 1, Tier 2, Tier 3, Tier 4), By Enterprise Size (Large Enterprises, Small & Medium Enterprises), By End User (Cloud Service Providers, Technology Providers, Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Energy & Utilities) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

TCS, Target, Salesforce, Nike, Nationwide, Klarna, J.P. Morgan, IBM, General Motors Co., Ford Motor Co., Flipkart, Citigroup, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Data Center Market?

▾ The Global Data Center Market size is expected to reach USD 301.8 billion by 2026 and is projected to reach USD 805.3 billion by the end of 2035.

Which region accounted for the largest Global Data Center Market?

▾ North America is expected to have the largest market share in the Global Data Center Market, with a share of about 39.0% in 2026.

How big is the Data Center Market in the US?

▾ The US Data Center market is expected to reach USD 99.0 billion by 2026.

Who are the key players in the Data Center Market?

▾ Some of the major key players in the Global Data Center Market include AWS, Microsoft, Google, and others

What is the growth rate in the Global Data Center Market?

▾ The market is growing at a CAGR of 11.5 percent over the forecasted period.