Market Overview

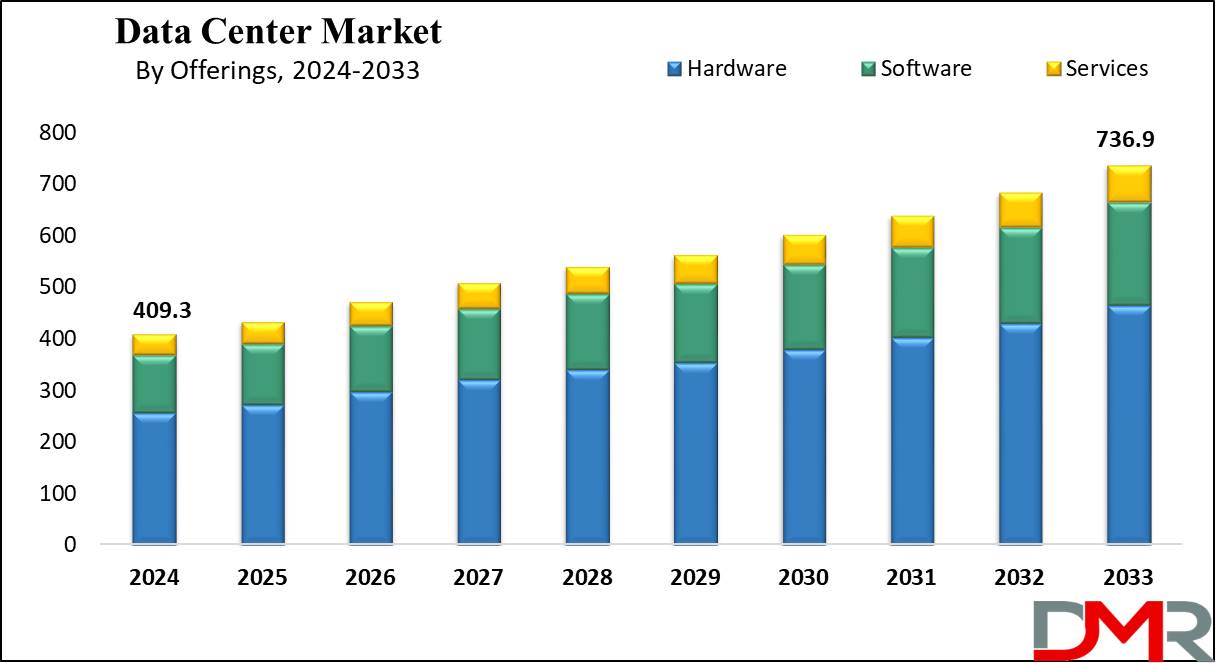

The Global Data Center Market is projected to reach USD 409.3 billion in 2024 and grow at a compound annual growth rate of 6.8% from there until 2033 to reach a value of USD 736.9 billion.

A data center is an ecosystem of technologies, businesses, and services included in the development, usage, and operation of data center facilities. It includes various components, like hardware, software, and services. Hardware such as server storage devices, racks, networking equipment, and other hardware is utilized to store and distribute digital data and services. The emergence of Micro Data Center deployments is streamlining edge computing operations and enabling efficient data processing at remote or compact locations.

The market is dynamic and competitive with constant innovation in designs, operational practices, and technologies, like cloud computing and edge computing, to meet the evolving needs of organizations and businesses across industries. New advancements in Contact Center Intelligence and

Call Center AI are also contributing to this evolution, helping companies enhance customer experience through smarter, real-time analytics and service automation, further supporting demand for digital infrastructure solutions.

The US Data Center Market

The US Data Center Market is projected to reach USD 146.4 billion in 2024 at a compound annual growth rate of 6.4% over its forecast period.

The data center market in the US provides growth opportunities through growth in cloud adoption, growing demand for edge computing, and advancements in AI. Key sectors like finance, healthcare, and e-commerce are driving data storage and processing needs. In addition, sustainability efforts and green data centers present further potential as companies look for energy-efficient solutions to meet regulatory and environmental goals.

Technologies such as

Data Center Liquid Immersion Cooling are gaining traction as organizations aim to reduce power consumption and improve thermal management efficiency, aligning with the rising trend of enterprise IT modernization.

Further, it is driven by increasing demand for cloud services, edge computing, and AI technologies, along with growth in sectors like finance, healthcare, and e-commerce. However, challenges like high energy consumption, rising operational costs, and strict environmental regulations act as challenges, making providers invest in energy-efficient infrastructure and sustainable practices to balance growth with compliance.

Key Takeaways

- Market Growth: The Data Center Market size is expected to grow by 302.8 billion, at a CAGR of 6.8% during the forecasted period of 2025 to 2033.

- By Offerings: The hardware segment is anticipated to get the majority share of the Data Center Market in 2024.

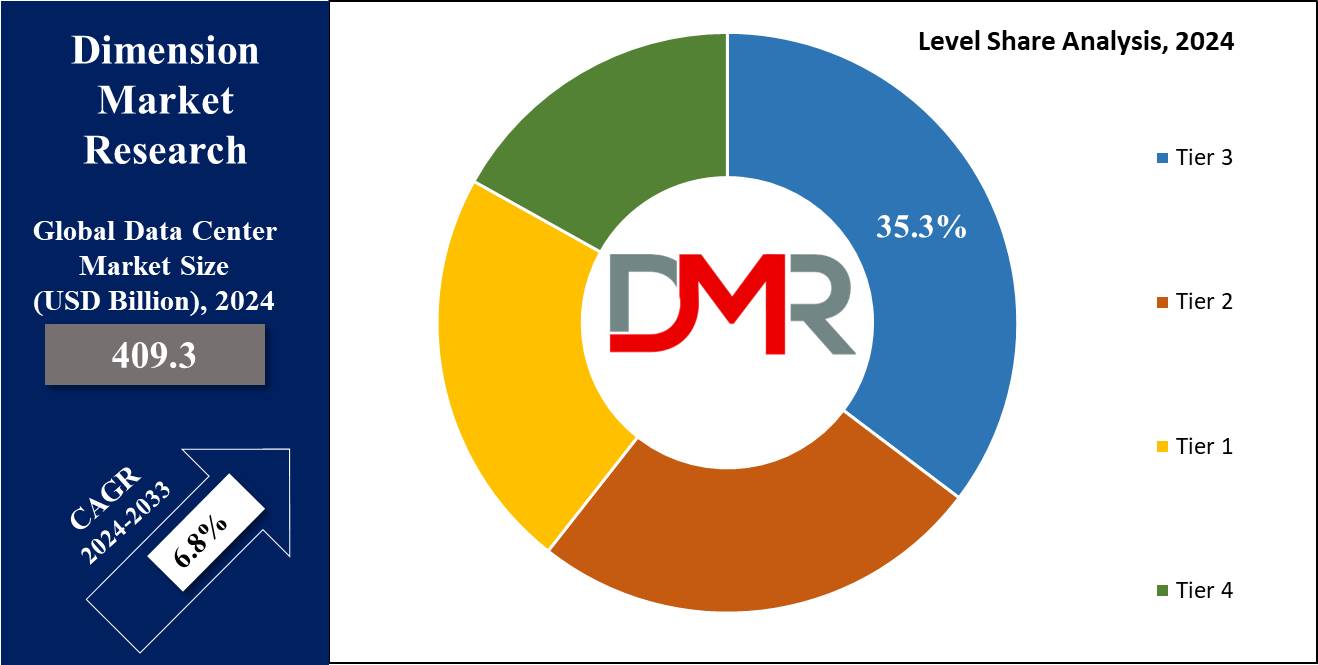

- By Level: The Tier 3 segment is expected to be leading the market in 2024

- By End User: The Cloud service providers are expected to get the largest revenue share in 2024 in the Data Center Market.

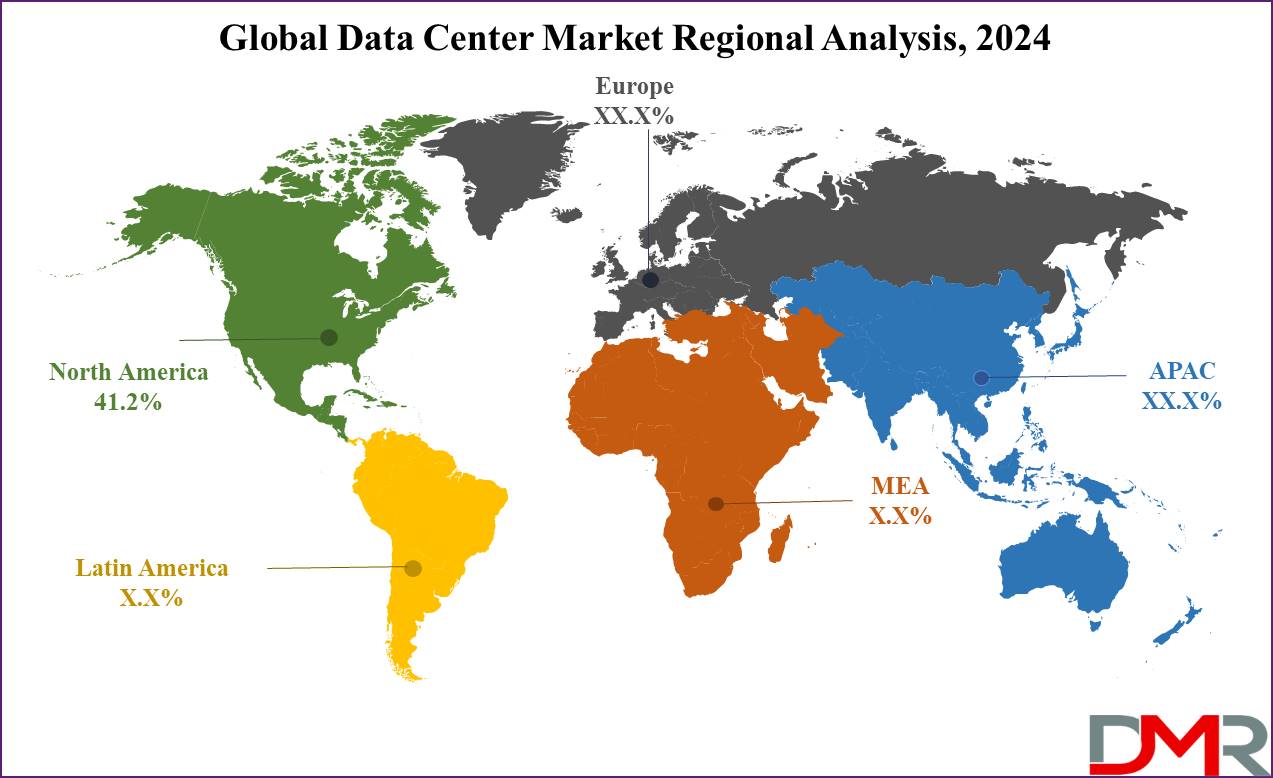

- Regional Insight: North America is expected to hold a 41.2% share of revenue in the Global Data Center Market in 2024.

- Use Cases: Some of the use cases of Data Centers include data storage & management, data storage & management, and more.

Use Cases

- Cloud Computing & Hosting Services: Data centers support cloud platforms by hosting virtual servers, allowing businesses to look into computing resources on demand.

- Disaster Recovery & Backup: Data centers provide redundancy and failover solutions to ensure business continuity by storing backups and allowing recovery during cyberattacks, natural disasters, or system failures.

- Data Storage & Management: They provide secure storage for large amounts of structured and unstructured data, supporting organizations' needs for databases, analytics, and archiving.

- High-Performance Computing (HPC): Used by industries like finance, healthcare, and research, data centers power large computations, like financial modeling, AI training, and genomic analysis.

Market Dynamic

Driving Factors

Rising Demand for Cloud Services and Edge Computing

The growth in cloud adoption by enterprises and the increasing use of edge computing for low-latency applications is driving the demand for more data centers.

Data Explosion and Digital Transformation

The increase in the volumes of data from e-commerce, streaming platforms, social media, and enterprises undergoing digital transformation is accelerating investments in data center infrastructure to meet storage and processing needs.

Restraints

High Capital and Operational Costs

Setting up and maintaining data centers requires significant investments in infrastructure, energy, cooling systems, and skilled personnel, making it difficult for smaller players to enter the market.

Environmental and Regulatory Challenges

Data centers require a high volume of power and water, raising environmental concerns. Stricter regulations on energy efficiency & carbon emissions are putting pressure on operators to attain sustainable practices, which can increase operational complexity and costs.

Opportunities

Adoption of Green Data Centers

A focus increased on sustainability is driving the need for energy-efficient data centers powered by renewable energy, opening opportunities for innovation in cooling technologies and eco-friendly infrastructure.

Expansion in Emerging Markets

Higher internet penetration, digitalization, and 5G rollout in developing regions provide many opportunities for new data center investments and partnerships. Notably,

The Kingdom of Saudi Arabia (KSA) Data Center market is experiencing rapid growth due to increased government investments, rising digital transformation efforts, and its Vision 2030 strategy, making it a focal point for regional infrastructure expansion.

Trends

AI and Predictive Analytics Integration

Data centers are highly using artificial intelligence (AI) and machine learning to optimize operations through predictive maintenance, energy efficiency management, and better security protocols. Predictive analytics help prevent potential disruptions, minimize downtime, and improve overall performance.

Shift to Edge Computing and 5G Networks

With the rise of IoT and real-time applications, the need for decentralized data storage is growing. Edge computing infrastructure, helped by 5G networks, allows data processing closer to the source, reducing latency, which is vital for emerging technologies such as autonomous vehicles and smart cities.

Research Scope and Analysis

By Offerings

The hardware segment is anticipated to account for the largest share of revenue in the data center market in 2024. The rapid growth of social media platforms, digital transactions, and IoT devices requires large storage and processing capabilities. To keep up, data centers must regularly upgrade hardware components like GPUs, CPUs, storage devices, servers, and memory.

These hardware upgrades ensure improved performance, scalability, and assistance for advanced technologies, driving the growth of the segment. Optimized hardware solutions are also important to handle intensive tasks like AI model training and complex data processing efficiently.

Further, the software segment is expected to expand the fastest during the forecast period. Increased adoption of virtualization, cloud computing, and better software solutions is driving this growth. Software plays a major role in enhancing data center security through features like encryption, intrusion detection, and real-time monitoring.

In addition, with the growth in the requirement for sustainable operations, software tools are important for managing energy-efficient data centers. These tools support monitoring power usage, cooling systems, and other processes, ensuring optimal performance while decreasing the environmental impact. As software constantly evolves, it will play a major role in enhancing the operational efficiency and sustainability of data centers.

By Level

Tier 3 data centers are projected to have the largest market share in 2024 due to their high reliability and redundant network connectivity, as they assist in connecting with multiple carriers and internet service providers, developing diverse communication pathways that reduce the risk of network disruptions, which allows reliable performance, making Tier 3 centers ideal for mission-critical applications that demand consistent uptime and smooth operations.

Further, Tier 4 data centers are anticipated to grow at the fastest rate during the forecast period, as they focus heavily on security, using advanced physical measures like biometric access, intrusion detection, surveillance cameras, and security portals to protect from unauthorized access. Moreover, apart from physical security, Tier 4 looks to incorporate strong cybersecurity strategies to defend against potential cyber threats and data breaches, ensuring maximum protection for sensitive data.

By Enterprise Size

Large enterprises are anticipated to dominate the data center market's revenue share in 2024. These organizations generate massive amounts of data from sources like customer interactions, transactions, and operations. To stay competitive, many are mostly adopting cloud computing to improve scalability, simplify operations, and reduce costs. Data centers play a major role in helping these efforts by hosting the necessary cloud infrastructure and ensuring reliable access to developed applications and services.

As large enterprises grow their global operations and use new technologies, the need for advanced data center solutions continues to grow. Further, the small enterprise segment is anticipated to experience the fastest growth in the coming years. Small businesses are investing highly in online technologies to attract customers and stay competitive in a global market. Data centers support them in managing vital information, like inventory, transactions, and customer data with efficiency and security.

Many small enterprises depend on cloud services for cost-effective access to software, infrastructure, and storage, which minimize operational costs and increase flexibility. As more small businesses adopt these digital solutions, their increase in dependency on data centers is expected to drive further market expansion in the coming years.

By Data Center Type

The colocation segment is set to hold the largest market share in the data center market in 2024, as it provides businesses the flexibility to scale their IT infrastructure quickly to meet changing demand without the high upfront costs of building their data centers. By sharing infrastructure like power, cooling, and security with other tenants, companies can highly minimize expenses, which also benefit from economies of scale, allowing colocation providers to provide affordable connectivity and better security solutions, which support lower ongoing operational costs for tenants.

Further, the hyperscale segment is anticipated to experience the fastest growth during the forecast period, as they are designed for quick and efficient scaling to help the large-scale data processing and storage needs. Their architecture allows easy expansion of computing, networking, and storage resources without compromising performance or reliability, which makes it ideal for handling growing workloads, mainly for businesses demanding high-volume data processing and cloud services. As demand for digital services and applications increases, hyperscale facilities will play a major role in meeting these expanding requirements efficiently.

By End User

Cloud service providers are anticipated to generate the largest share of revenue in the data center market in 2024, which is driven by the increase in the adoption of cloud computing across businesses, organizations, and individuals. Cloud services make data storage & processing more accessible while ensuring business continuity through backup & disaster recovery solutions. In addition, the growth in edge computing, where data is processed closer to its source, helps minimize latency, making cloud services even more appealing for end-users.

Together, these factors are driving the expansion of data center infrastructure to meet the growing demand. Further, the technology provider segment is anticipated to grow rapidly in the coming years, as industries across healthcare, finance, and other sectors are undergoing digital transformation to enhance customer experiences, streamline operations, and increase efficiency.

Data centers play a major role in supporting these innovations by providing the infrastructure needed for disruptive technologies. Like, healthcare institutions depend on data centers to securely manage electronic health records, store medical imaging, and facilitate telemedicine services, which reflects the growing need for reliable, scalable, and secure IT infrastructure to support modern business operations and technological advancements.

The Data Center Market Report is segmented on the basis of the following

By Offerings

- Hardware

- IT Modules

- Power Modules

- Cooling Modules

- Software

- Monitoring & Management Tools

- Automation & Orchestration Software

- Backup & Disaster Recovery

- Security Software

- Virtualization Software

- Analytics Software

- Services

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By Level

- Tier 1

- Tier 2

- Tier 3

- Tier 4

By Enterprise Size

By Data Center Type

- Cloud Data Center

- Colocation Data Center

- Hyperscale Data Center

- Enterprise Data Center

- Micro Data Center

- Edge Data Center

- Others

By End User

- Cloud Service Provider

- Technology Provider

- Telecom

- Healthcare

- BFSI

- Retail & E-commerce

- Entertainment & Media

- Energy

- Others

Regional Analysis

North America is anticipated to have the largest market

share of 41.2% in 2024, driven by its role as a hub for technological innovation and digital transformation, which creates a strong demand for data centers to assist cloud computing, e-commerce, and online services. Cloud adoption is broadly available in North America because of its scalability, flexibility, and cost-efficiency, demanding more infrastructure from cloud providers.

Key sectors like finance, healthcare, entertainment, and e-commerce generate large amounts of data that must be stored, processed, and analyzed, further enhancing the need for advanced data centers.

Further, the Asia Pacific region is anticipated to see the fastest growth during the forecast period, driven by quick digitization across industries like healthcare, finance, manufacturing, and retail. Data centers are important to help technological development like cloud computing, IoT, and AI.

The expansion e-commerce sector in the region also requires data centers to meet online transactions, manage inventories, and store customer data for smooth operations. In addition, the large use of mobile devices and smartphones in Asia Pacific increases the demand for data centers to support mobile applications, payments, and other mobile-based services, further fueling market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The data center market is driven by fast digital transformation and growing demand for cloud services, AI, and edge computing. Operators compete on efficiency, scalability, and sustainable infrastructure to meet changes in customer needs. New players are entering to create new solutions, while existing providers are expanding their footprints globally, mainly in emerging markets. The landscape is shaped by high capital investments, energy management challenges, and strict regulations. As data usage increases, companies focus on faster deployment, greener technologies, and simple connectivity to stay ahead.

Some of the prominent players in the Global Data Center are

- Google

- AWS

- Microsoft

- HPE

- NTT

- IBM

- Cisco

- Schneider Electric

- ABB

- Other Key Players

Recent Developments

- In September 2024, G42 announced its plans to plant 2 Gigawatts (GW) of AI data centers in India and deploy them as India’s largest supercomputers with up to 8 exaFLOP performanc, as its capacity is almost double India's total existing data centre capacity, which is estimated to be above 1 GW. The data centre investment will fall under a recent bilateral agreement where the UAE committed to fund in India’s data centre infrastructure and supercomputer capacity.

- In June 2024, Freshworks Inc launched its new data center, powered by Amazon Web Services (AWS), in the UAE, which showcases its’ commitment to driving innovation across the Middle East and Africa (MEA) by making it easy for businesses to have the full power of its modern, AI-powered customer and employee service solutions.

- In June 2024, CtrlS Datacenters unveiled its plan to create a data center campus in Kolkata by investing USD 264 million to build the data center campus, implemented over four phases, and offering more than 60MW of IT capacity.

- In May 2024, Microsoft unveiled its plan to build a new cloud and artificial intelligence (AI) infrastructure in Thailand, to provide AI skilling opportunities for over 100,000 people and help the nation's growing developer community. Further, the data center region will expand the availability of Microsoft's hyperscale cloud services, promoting enterprise-grade reliability, performance, and compliance with data residency and privacy standards.

- In January 2024, Digital Realty launched its first data center in India on a 10-acre campus capable of helping up to 100 megawatts of critical IT load capacity that is located in the heart of Chennai's industrial and manufacturing hub, which is a major addition to the company's global data center platform as it expands to meet digital transformation needs in key markets around the world.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 409.3 Bn |

| Forecast Value (2033) |

USD 736.9 Bn |

| CAGR (2024-2033) |

6.8% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 146.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offerings (Hardware, Software, and Services), By Level (Tier 1, Tier 2, Tier 3, and Tier 4), By Enterprise Size (Large Enterprises and SMEs), By Data Center Type (Cloud Data Center, Colocation Data Center, Hyperscale Data Center, Enterprise Data Center, Micro Data Center, Edge Data Center, and Others), By End User (Cloud Service Provider, Technology Provider, Telecom, Healthcare, BFSI, Retail & E-commerce, Entertainment & Media, Energy, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Google, AWS, Microsoft, HPE, NTT, IBM, Cisco, Schneider Electric, ABB, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Data Center Market size is expected to reach a value of USD 409.3 billion in 2024 and is expected to reach USD 736.9 billion by the end of 2033.

North America is expected to have the largest market share in the Global Data Center Market with a share of about 41.2% in 2024.

The Data Center Market in the US is expected to reach USD 146.4 billion in 2024.

Some of the major key players in the Global Data Center Market are Google, AWS, Microsoft, and others

The market is growing at a CAGR of 6.8 percent over the forecasted period.