Market Overview

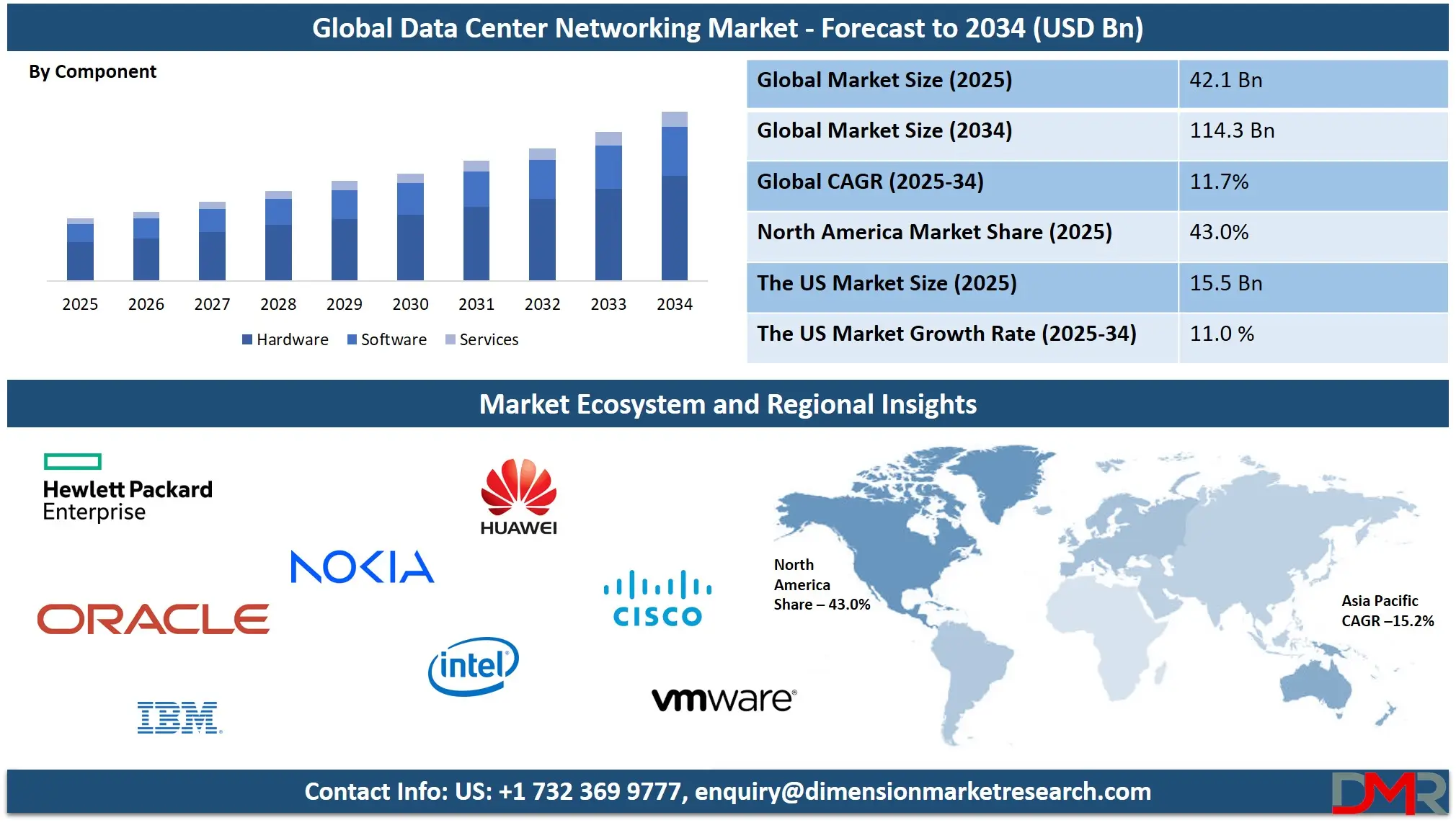

The Global Data Center Networking Market size is projected to reach USD 42.1 billion in 2025 and grow at a compound annual growth rate of 11.7% to reach a value of USD 114.3 billion in 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Data Center Networking Market comprises hardware, software, and services that enable high-performance, scalable, and secure connectivity across modern data center environments. Key components include Ethernet switches, routers, storage networking systems, cabling, network virtualization tools, and automation platforms that streamline infrastructure management. As enterprises adopt cloud computing, artificial intelligence (AI), and edge computing, data center networking remains central to ensuring seamless data flow and low-latency operations. Its growing relevance within digital transformation initiatives makes it a crucial pillar of global IT infrastructure.

In recent years, the market has experienced rapid transformation driven by software-defined networking (SDN), increasing adoption of automation, and the shift toward hyperscale architectures. Enterprises are prioritizing programmability, centralized control, and network agility, making SDN and virtualization foundational technologies. Another emerging shift is the movement toward energy-efficient and sustainable networking solutions, influenced by global regulations and carbon-reduction commitments. The rise of machine learning and high-performance computing workloads is also reshaping the design of data center networks, demanding higher bandwidth and more intelligent traffic handling.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Growth is further supported by the adoption of 400G and 800G Ethernet technologies, the expansion of colocation facilities, and rising investment in edge data centers to support real-time processing needs. Mergers, acquisitions, and strategic alliances among cloud service providers, telecom operators, and networking vendors have accelerated innovation. Government incentives for digital infrastructure modernization also play a key role. Collectively, these developments are reshaping market dynamics and positioning data center networking as a rapidly evolving ecosystem with expanding opportunities for vendors and enterprises alike.

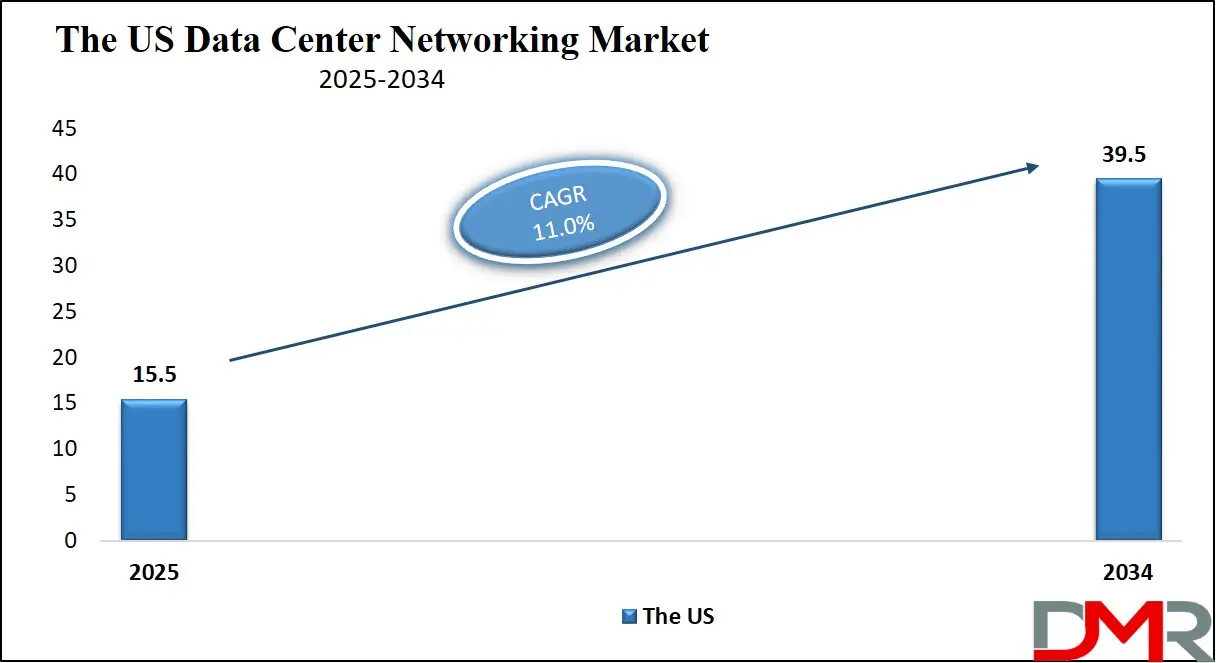

The US Data Center Networking Market

The US Data Center Networking Market size is projected to reach USD 15.5 billion in 2025 at a compound annual growth rate of 11.0% over its forecast period.

The U.S. Data Center Networking Market is shaped by strong cloud adoption, hyperscale data center expansion, and technological leadership in software-defined infrastructure. The region benefits from the presence of major cloud service providers, advanced research institutions, and robust digital ecosystems that drive early adoption of 400G and 800G networking technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Government initiatives supporting broadband expansion, cybersecurity enhancement, and large-scale digital transformation efforts indirectly stimulate demand for next-generation data center networking solutions. The U.S. also experiences significant investments in AI infrastructure, particularly for training large machine learning models, which require high-bandwidth, low-latency networking architectures. Meanwhile, evolving regulations on data security and sustainability push enterprises to modernize their existing data center networks through automation and virtualization, consolidating the U.S. position as a leading and highly mature regional market.

Europe Data Center Networking Market

Europe Data Center Networking Market size is projected to reach USD 12.6 billion in 2025 at a compound annual growth rate of 11.4% over its forecast period.

The European Data Center Networking Market is influenced by regional sustainability mandates, stringent data governance regulations, and initiatives such as the European Green Deal, which encourages energy-efficient infrastructure modernization. Countries like Germany, the Netherlands, and the Nordics are witnessing strong adoption of advanced networking technologies due to the expansion of green data centers.

The region's strict compliance requirements, including GDPR and various environmental standards, drive investments in secure, automated, and energy-optimized data center networks. Europe’s increasing shift toward cloud sovereignty and local cloud infrastructure creates further demand for SDN, automation, and encrypted networking technologies. Additionally, innovation in sectors such as telecom, automotive, and manufacturing accelerates the deployment of edge data centers, boosting demand for high-capacity networking designed for real-time workloads.

Japan Data Center Networking Market

Japan Data Center Networking Market size is projected to reach USD 2.9 billion in 2025 at a compound annual growth rate of 11.8% over its forecast period.

Japan's Data Center Networking Market is expanding rapidly due to accelerated urbanization, industrial automation, and government-led digital initiatives supporting data center expansion and IT modernization. The country’s growing AI, robotics, and smart-manufacturing ecosystem requires advanced networking capable of handling high-density, low-latency workloads. Japan is also investing heavily in disaster-resilient digital infrastructure, reinforcing demand for robust and reliable data center networks.

The proliferation of edge computing to support smart cities and autonomous technologies has resulted in greater adoption of virtualization, SDN, and automated network orchestration. Despite challenges such as limited land availability for large hyperscale construction, Japan continues to advance through partnerships between enterprises, telecom providers, and cloud operators, positioning it as a high-growth market within the Asia-Pacific region.

Data Center Networking Market: Key Takeaways

- Market Growth: The Data Center Networking Market size is expected to grow by USD 67.7 billion, at a CAGR of 11.7%, during the forecasted period of 2026 to 2034.

- By Component: The hardware segment is anticipated to get the majority share of the Data Center Networking Market in 2025.

- By Application: The IT & Cloud Workloads segment is expected to get the largest revenue share in 2025 in the Data Center Networking Market.

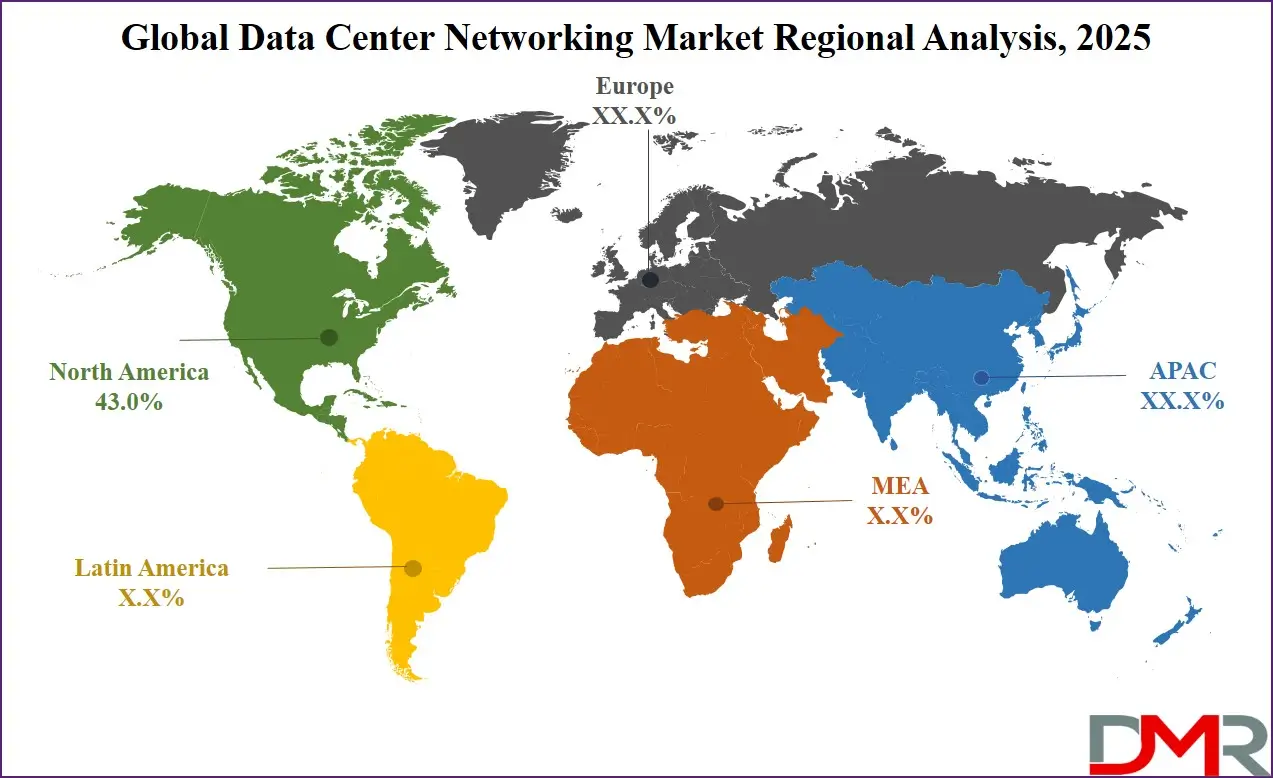

- Regional Insight: North America is expected to hold a 43.0% share of revenue in the Global Data Center Networking Market in 2025.

- Use Cases: Some of the use cases of Data Center Networking include edge computing deployments, high-performance cloud connectivity, and more.

Data Center Networking Market: Use Cases

- High-Performance Cloud Connectivity: Ensuring scalable and secure links between private, public, and hybrid cloud environments.

- AI/ML Infrastructure Enablement: Supporting high-bandwidth, low-latency networks required for advanced AI model training.

- Network Automation for IT Operations: Streamlining configuration, monitoring, and troubleshooting processes.

- Edge Computing Deployments: Enabling decentralized processing for IoT, 5G, and real-time analytics.

Stats & Facts

- The U.S. Department of Energy states that in 2024, energy-efficiency standards for data centers continue to influence the adoption of optimized networking equipment.

- The European Commission highlights ongoing efforts in 2024/2025 to reduce overall data center emissions, driving interest in energy-efficient data center networking.

- Japan’s Ministry of Internal Affairs and Communications has emphasized the expansion of resilient digital infrastructure in 2025, aiding investments in advanced networking technologies.

- The International Telecommunication Union (ITU) notes the rising global demand for high-capacity network infrastructure to support AI and cloud workloads in 2024/2025.

- The OECD reports continued digital transformation across industries in 2024, increasing reliance on scalable data center networks.

- The U.K. Department for Science, Innovation & Technology reinforces the importance of secure, high-performance data infrastructure in 2025, indirectly contributing to network modernization

Market Dynamic

Driving Factors in the Data Center Networking Market

Advancement of Virtualization and Software-Defined Technologies

One of the primary drivers of the Data Center Networking Market is the rapid evolution of virtualization, SDN, and network automation technologies. Organizations are shifting their focus from traditional hardware-driven architectures toward software-centric models that offer greater agility, scalability, and centralized management. This shift enables rapid provisioning of resources, dynamic traffic control, and cost-efficient operations, making data centers more responsive to the demands of cloud computing, AI, and hybrid IT environments. As enterprises scale digitally, automation-driven networking reduces operational complexities and downtime, significantly enhancing performance. The surge in AI/ML workloads further boosts demand for adaptive networks capable of handling unpredictable, high-density data flows.

Growth of Hyperscale and Edge Data Centers

Another major driver is the expansion of hyperscale and edge data centers supporting global cloud, streaming, and IoT growth. Hyperscale operators require ultra-high-capacity, energy-efficient, and automated networking systems to manage massive workloads and distributed operations. Meanwhile, edge data centers support low-latency applications, requiring compact yet high-performance networking architectures. These trends collectively stimulate investment in scalable switches, high-speed transceivers, intelligent routing platforms, and fabric networking. As enterprises adopt hybrid computing models, the need for seamless communication between core and edge environments becomes critical. This ongoing expansion of distributed digital ecosystems significantly accelerates adoption of advanced data center networking solutions.

Restraints in the Data Center Networking Market

High Capital and Operational Costs

Despite its growth potential, the Data Center Networking Market faces restraints due to the high cost of deployment, modernization, and ongoing operations. Implementing high-capacity switches, advanced routing solutions, fiber-optic systems, and automation platforms requires substantial capital investments, especially for small and mid-size enterprises. Operational expenses such as power consumption, cooling, and specialized maintenance add to the financial burden. Additionally, transitioning from legacy architectures to software-driven systems often involves complex integration processes and workforce upskilling. These challenges slow down adoption, particularly in regions with limited digital infrastructure funding, making cost a critical constraint for market expansion.

Skills Shortage and Complex Network Management

The increasing complexity of modern data center networks creates challenges related to talent shortages and operational management. Skilled professionals knowledgeable in SDN, network automation, high-speed switching, and multi-cloud integration are in short supply globally. This gap slows deployment of advanced networking technologies and increases reliance on outsourcing. Additionally, managing hybrid environments that combine legacy hardware with modern software-defined components creates operational complexities. Ensuring security, performance, and stability across distributed data centers further intensifies the challenge. These skill- and complexity-based limitations continue to restrain the pace of modernization across enterprises and service providers.

Opportunities in the Data Center Networking Market

Expansion of AI and High-Performance Computing Workloads

The rapid adoption of AI, machine learning, and high-performance computing across industries presents a major opportunity for the Data Center Networking Market. These workloads require high-bandwidth, ultra-low-latency, and highly resilient network environments, driving demand for 400G/800G switches, intelligent traffic management systems, and automated network orchestration. Enterprises investing in AI-driven analytics and digital transformation are increasingly upgrading their data center networks to support large-scale training and inference environments. As AI applications expand into healthcare, finance, retail, and scientific research, the opportunity to provide optimized networking solutions becomes more significant, positioning AI infrastructure growth as a long-term driver of the market.

Growth of Edge and Modular Data Centers

The rise of edge and modular data centers creates substantial opportunities for networking vendors. Edge facilities require compact, energy-efficient, and high-performance networking solutions to support distributed computing, 5G applications, IoT analytics, and real-time AI processing. Modular data centers, which offer rapid deployment and scalable capacity, also rely heavily on advanced networking to ensure seamless integration with core data centers. The growing use of remote industrial automation, autonomous transport, and smart city applications accelerates this demand. As enterprises pursue decentralized digital ecosystems, vendors offering flexible and scalable networking solutions are well positioned to benefit from this expanding segment.

Trends in the Data Center Networking Market

Shift Toward Network Automation and AI-Driven Operations

Automation is emerging as one of the most influential trends in the Data Center Networking Market. AI-driven analytics, intent-based networking, and automated orchestration are transforming traditional workflows by reducing manual intervention and minimizing errors. As hybrid and multi-cloud environments grow more complex, automation plays a crucial role in improving visibility, optimizing routing, and enhancing overall network performance. Predictive analytics allows data center operators to identify issues before they escalate, improving reliability. Automated provisioning and configuration accelerate deployment cycles, supporting faster digital transformations. This trend continues gaining traction as operators seek operational efficiency, cost savings, and greater network intelligence.

Adoption of High-Speed Ethernet and Fabric Architectures

The shift toward high-speed Ethernet—particularly 400G and 800G—along with advanced fabric networking architectures is reshaping data center design. These technologies deliver the bandwidth and low-latency performance needed to support AI, big data analytics, and hyperscale cloud workloads. Fabric networking allows scalable, non-blocking connectivity between servers and storage systems, reducing congestion and improving throughput. As enterprises migrate toward flatter architectures that emphasize east-west traffic, fabric-based designs become essential. This trend is accelerated by the emergence of ultra-dense workloads and the growing preference for disaggregated infrastructure, making high-speed networking a critical investment area across global data centers.

Impact of Artificial Intelligence in Data Center Networking Market

- AI enhances predictive maintenance by identifying network issues before failures occur.

- AI-driven automation accelerates provisioning, scaling, and configuration of network resources.

- Intelligent traffic management powered by AI improves latency and throughput during peak workloads.

- AI strengthens security by detecting anomalies and preventing advanced cyber threats.

- AI-based analytics provide deeper insights into performance, optimizing resource utilization and reducing operational costs.

Research Scope and Analysis

By Component Analysis

The Hardware segment dominates the Data Center Networking Market with an estimated 62% share, driven by the essential role of switches, routers, storage networking, and cabling in delivering foundational connectivity. As data center workloads increase due to the rise of AI, cloud computing, and edge deployments, enterprises are prioritizing investments in high-capacity Ethernet switches, fiber-optic infrastructure, and resilient routing systems. The transition toward 400G and 800G technologies further strengthens hardware demand, as organizations seek high-performance solutions capable of handling ever-growing network traffic. Hyperscale operators, in particular, continue to drive substantial upgrades in hardware infrastructure to meet AI and analytics workloads. Despite the rise of software-driven models, hardware remains critical for enabling low latency, high bandwidth, and secure data movements across modern data center environments, maintaining its dominant position.

The Software segment is the fastest-growing due to increasing adoption of SDN, network virtualization, and automated orchestration platforms. Enterprises are moving away from manual network management to software-defined control systems that offer centralized management, policy automation, and improved agility. As multi-cloud and hybrid IT environments become standard, software solutions enable scalable and programmable networks that adapt quickly to workload changes. This growth is further supported by AI-based network monitoring tools that enhance security and performance. The shift toward intent-based networking and self-optimizing systems positions the software segment for sustained expansion.

By Technology Analysis

Software-Defined Networking (SDN) leads this category with an approximate 58% share in 2025, reflecting the widespread adoption of programmable and centrally managed networks across enterprises and service providers. SDN enables dynamic configuration, automation, and streamlined control of large-scale network infrastructures, making it ideal for cloud-first strategies and hybrid architectures. Its ability to decouple control and data planes allows operators to optimize traffic flows, reduce operational complexity, and enhance security. Growing demand for multi-cloud connectivity, virtualized environments, and agile network management reinforces SDN's dominance. The rise of digital transformation initiatives and need for real-time service delivery further propel SDN’s leadership within the technology segment.

The Automation & Orchestration segment is experiencing the fastest growth as organizations seek to eliminate manual processes and improve operational efficiency. Automated workflows enhance network performance, reduce downtime, and accelerate configuration management. As data center networks scale to support AI, edge computing, and cloud workloads, orchestration services ensure seamless coordination across distributed environments. Integration with AI and machine learning strengthens the segment’s growth potential, enabling predictive analytics and autonomous network operations. This shift toward self-managing networks positions automation and orchestration as transformative technologies shaping the future of data center operations.

By Data Center Type Analysis

In 2025, Hyperscale Data Centers dominate this category with a significant 60% share, driven by the explosive growth of cloud computing, AI, and large-scale digital platforms. Hyperscalers require extremely high-capacity, low-latency, and energy-efficient networking infrastructure to support massive workloads across distributed global operations. These facilities invest heavily in advanced Ethernet technologies, fabric networking, and automated orchestration tools to ensure seamless scalability. Their continuous requirement for high-density networking solutions accelerates innovation in switches, routing systems, and fiber-optic networks. As cloud service providers expand globally, hyperscale facilities remain the backbone of digital services, securing their leading share in the market.

Edge Data Centers are the fastest-growing segment due to rising demand for low-latency processing to support IoT, AI, 5G applications, and real-time analytics. These distributed micro facilities require compact yet high-performance networking infrastructure capable of supporting decentralized data processing. Their growth is further driven by smart city initiatives, autonomous systems, remote healthcare, and industrial IoT. As enterprises adopt hybrid ecosystems, edge facilities play a critical role in reducing latency and improving user experiences. This expanding application landscape ensures sustained growth for the segment.

By Application Analysis

In 2025, IT & Cloud Workloads hold the largest share at approximately 54%, driven by the rapid expansion of cloud-native applications, SaaS platforms, and enterprise digitalization initiatives. As organizations migrate to hybrid and multi-cloud environments, they require efficient, scalable, and secure networking to support large volumes of data and real-time application performance. This segment's dominance is reinforced by increasing reliance on cloud storage, cloud analytics, and virtualized computing. High demand for workload mobility, interoperability, and application resilience further boosts the need for advanced networking technologies. The continuous evolution of cloud computing ensures this segment’s sustained leadership.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

AI/ML Workloads represent the fastest-growing application segment due to the rising adoption of generative AI, predictive analytics, and autonomous systems. These workloads require ultra-high-bandwidth and low-latency networks capable of supporting large data sets and high-performance computing environments. As industries such as healthcare, finance, and manufacturing deploy AI-driven tools, demand for advanced networking infrastructure accelerates. High-speed Ethernet, fabric networking, and automated network management are essential for optimizing AI workflows, contributing to this segment’s rapid growth.

By End User Analysis

IT & Telecom leads this category with a 57% share in 2025, driven by strong adoption of cloud platforms, virtualization, and extensive digital infrastructure. Telecom operators, in particular, rely on high-capacity data center networks to support 5G rollout, edge computing, and large-scale content delivery platforms. The IT sector contributes significantly through migration to cloud-first models and rapid digital transformation. This segment's dominant role is reinforced by its continuous investment in advanced networking technologies, automation, and secure connectivity solutions, ensuring end-to-end high performance across distributed networks.

The Healthcare segment is the fastest-growing due to rising use of digital health applications, telemedicine, AI diagnostics, and electronic medical records. These applications require secure, high-performance, and reliable networking infrastructure capable of supporting sensitive data handling and real-time communication. With increasing digitalization and regulatory emphasis on secure data storage, healthcare facilities are modernizing their data centers, driving rapid adoption of advanced networking solutions.

The Data Center Networking Market Report is segmented on the basis of the following:

By Component

- Hardware

- Ethernet Switches

- Routers

- Storage Networking

- Cabling

- Software

- Network Virtualization

- Network Automation & Orchestration

- Network Monitoring & Management

- Services

- Professional Services

- Managed Services

By Technology

- Software-Defined Networking (SDN)

- Network Virtualization

- Automation & Orchestration

- Fabric Networking

By Data Center Type

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Data Centers

By Application

- IT & Cloud Workloads

- AI/ML Workloads

- Big Data & Analytics

- Virtualization & Consolidation

By End User

- IT & Telecom

- BFSI

- Government

- Healthcare

- Retail & E-Commerce

Regional Analysis

Leading Region in the Data Center Networking Market

North America leads the global Data Center Networking Market with a significant 43% share, driven by early technology adoption, strong presence of hyper-scale cloud providers, and robust digital infrastructure maturity. The region benefits from substantial investments in AI data centers, high-speed networking upgrades, and research innovation. The U.S. government’s focus on cybersecurity, broadband expansion, and modernization of IT infrastructure fuels additional growth.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Extensive enterprise adoption of cloud computing, edge solutions, and software-defined technologies further strengthens North America’s position. The concentration of technology giants, innovation hubs, and advanced telecom networks positions the region as the most influential market in shaping global data center networking trends.

Fastest Growing Region in the Data Center Networking Market

The Asia-Pacific region is the fastest-growing, supported by rapid industrialization, expanding digital economies, and strong government initiatives promoting cloud computing and advanced data infrastructure. Countries such as Japan, South Korea, India, and China are investing heavily in hyper-scale and edge data centers. The widespread adoption of 5G, AI, and IoT accelerates demand for intelligent and scalable networking solutions. Increasing digital transformation across manufacturing, retail, finance, and public sectors contributes to the region’s rapid growth. These factors collectively position Asia-Pacific as a major hub of future expansion in data center networking.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the Data Center Networking Market is defined by strategies that focus on innovation, scalability, and customer-centric solutions. Vendors prioritize R&D investments to develop high-speed, energy-efficient, and programmable networking technologies. Many companies pursue partnerships with cloud providers, telecom operators, and data center operators to strengthen ecosystem integration. Market participants also focus on automation, AI-driven network intelligence, and open-architecture solutions to address the demands of hybrid and multi-cloud environments. Barriers to entry remain relatively high due to capital requirements, technological complexity, and the need for global service capabilities. Competitive differentiation increasingly relies on software capabilities, interoperability, and value-added services.

Some of the prominent players in the global Data Center Networking are:

- Cisco

- Arista Networks

- Juniper Networks

- Huawei

- HPE

- Dell Technologies

- IBM

- Nokia

- Extreme Networks

- Broadcom

- Intel

- NVIDIA

- Mellanox (NVIDIA Networking)

- Lenovo

- Fujitsu

- NetApp

- Oracle

- VMware

- Fortinet

- Palo Alto Networks

- Other Key Players

Recent Developments

- In March 2025, TechEdge Networks introduced its HyperFabric Switch Series, designed to support 800G high-speed connectivity for AI and hyperscale data centers. The new product line integrates advanced telemetry, real-time analytics, and energy-efficient components optimized for large-scale workloads. This launch aims to address the increasing global demand for high-capacity networking infrastructure capable of supporting AI, ML, and hybrid cloud environments. The product aligns with market trends focused on automation, scalability, and sustainable data center operations.

- In January 2025, CloudCore Systems announced a major investment in developing an enhanced SDN Automation Platform designed to support intent-based networking for multi-cloud and hybrid environments. The investment focuses on expanding AI-driven orchestration, predictive analytics, and automated security functions. This initiative aims to strengthen the company’s position in the rapidly evolving software-defined networking space and meet rising enterprise demand for intelligent, self-optimizing network infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 42.1 Bn |

| Forecast Value (2034) |

USD 114.3 Bn |

| CAGR (2025–2034) |

11.7% |

| The US Market Size (2025) |

USD 15.5 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Hardware, Software, and Services), By Technology (Software-Defined Networking (SDN), Network Virtualization, Automation & Orchestration, and Fabric Networking), By Data Center Type (Hyper-scale Data Centers, Colocation Data Centers, Enterprise Data Centers, and Edge Data Centers), By Application (IT & Cloud Workloads, AI/ML Workloads, Big Data & Analytics, and Virtualization & Consolidation), By End User (IT & Telecom, BFSI, Government, Healthcare, and Retail & E-Commerce) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Cisco, Arista Networks, Juniper Networks, Huawei, HPE, Dell Technologies, IBM, Nokia, Extreme Networks, Broadcom, Intel, NVIDIA, Mellanox (NVIDIA Networking), Lenovo, Fujitsu, NetApp, Oracle, VMware, Fortinet, Palo Alto Networks, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Data Center Networking Market?

▾ The Global Data Center Networking Market size is expected to reach a value of USD 42.1 billion in 2025 and is expected to reach USD 114.3 billion by the end of 2034.

Which region accounted for the largest Global Data Center Networking Market?

▾ North America is expected to have the largest market share in the Global Data Center Networking Market, with a share of about 43.0% in 2025.

How big is the Data Center Networking Market in the US?

▾ The Data Center Networking Market in the US is expected to reach USD 15.5 billion in 2025.

Who are the key players in Data Center Networking Market?

▾ Some of the major key players in the Global Data Center Networking Market include Huawei, Nokia, IBM and others.

What is the growth rate in the Global Data Center Networking Market?

▾ The market is growing at a CAGR of 45.1 percent over the forecasted period.