Market Overview

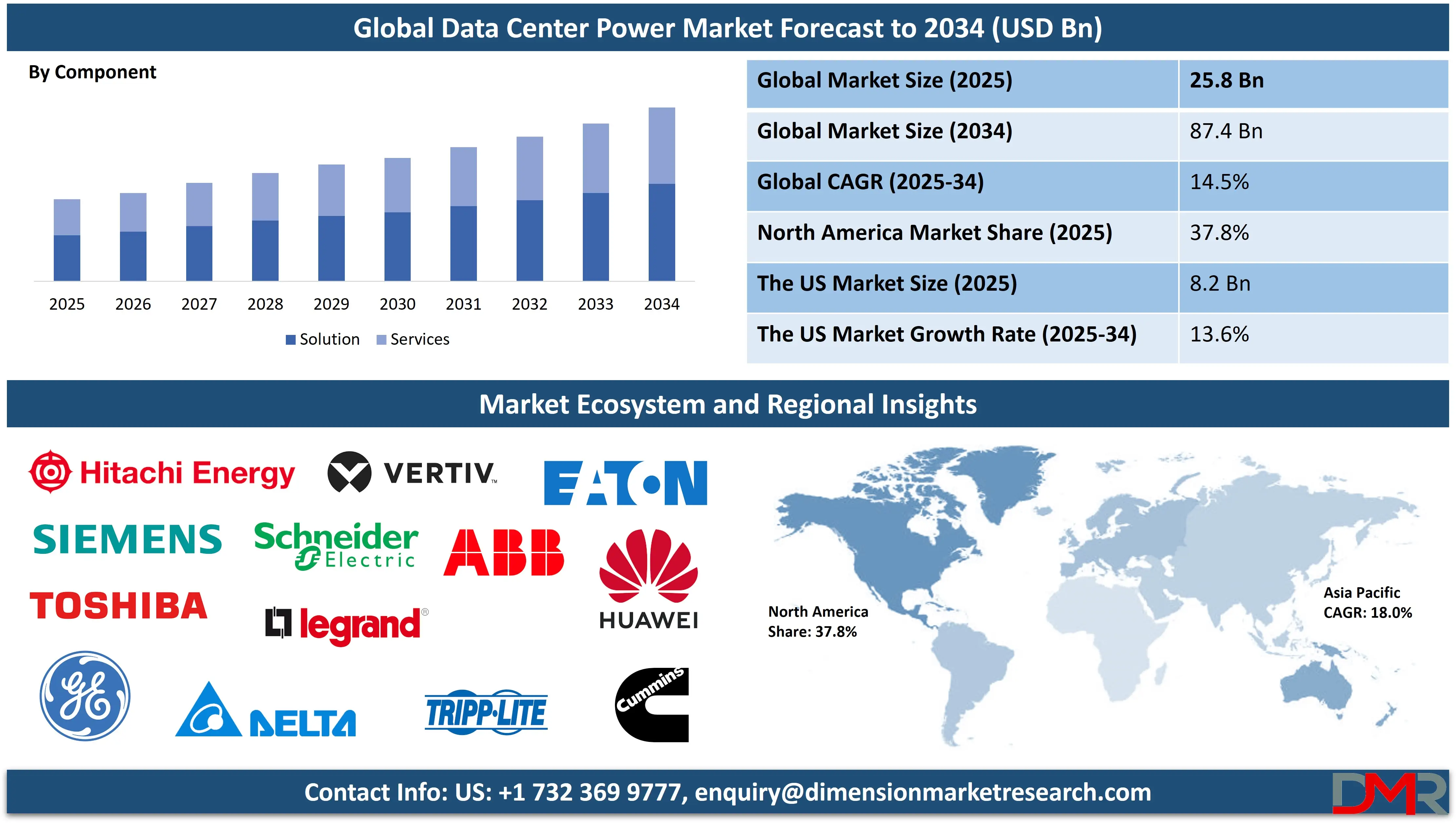

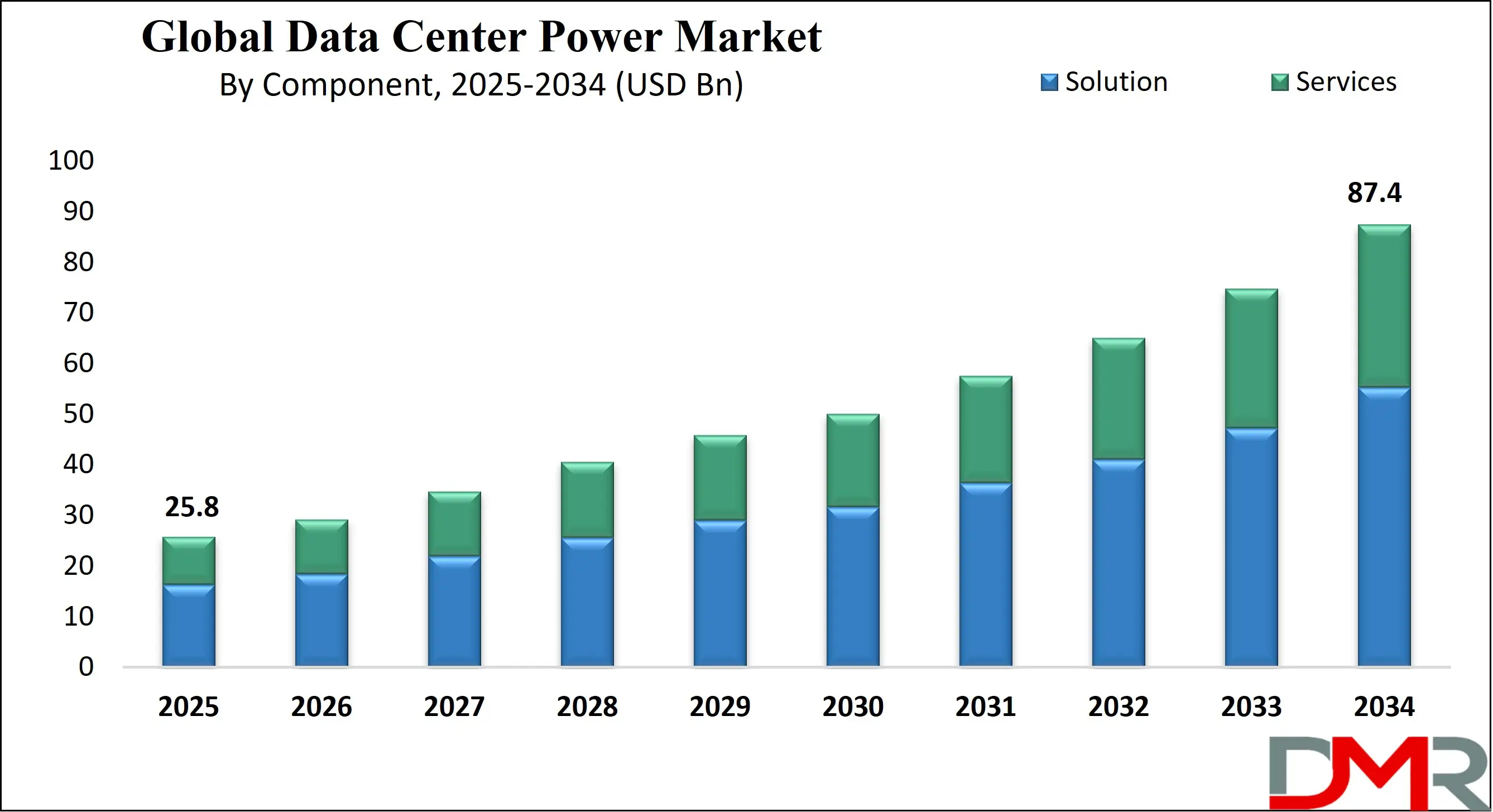

The Global Data Center Power Market is projected to reach USD 25.8 billion in 2025 and grow at a compound annual growth rate of 14.5% from there until 2034 to reach a value of USD 87.4 billion.

The global data center power market is witnessing accelerated evolution driven by hyperscale expansion, surging data volumes, and demand for real-time services. With global data usage projected to exceed 180 zettabytes by 2025, the reliability and scalability of power infrastructure have become paramount in supporting digital transformation initiatives. Mission-critical environments such as cloud-native facilities, AI data lakes, and high-frequency trading platforms demand uninterruptible power systems (UPS), intelligent power distribution units (PDUs), modular busways, and grid-tied backup generators to maintain continuity and prevent latency or failure events.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

One of the major trends reshaping the market is the pivot toward sustainable and energy-efficient power systems. Organizations are shifting to green data centers powered by renewables such as wind, solar, and hydrogen fuel cells. Lithium-ion batteries and flywheel-based UPS systems are replacing legacy lead-acid setups to ensure space efficiency and long battery life. Smart grid integration, dynamic load balancing, and real-time power analytics are enabling automated control and predictive maintenance in high-density environments.

However, the market faces significant restraints such as high energy consumption, increasing operational costs, and stringent regulatory compliance around carbon emissions. Global data centers currently consume over 200 terawatt-hours annually, prompting pressure from environmental regulators and international climate accords. Smaller operators find it challenging to scale power systems while remaining cost-efficient and carbon-neutral.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Opportunities lie in developing markets across Southeast Asia, Latin America, and Eastern Europe, where digital infrastructure is expanding rapidly. Edge data centers, containerized facilities, and software-defined power (SDP) are poised to support latency-sensitive applications like autonomous mobility, industrial automation, and telemedicine, positioning the global market for robust growth.

The US Data Center Power Market

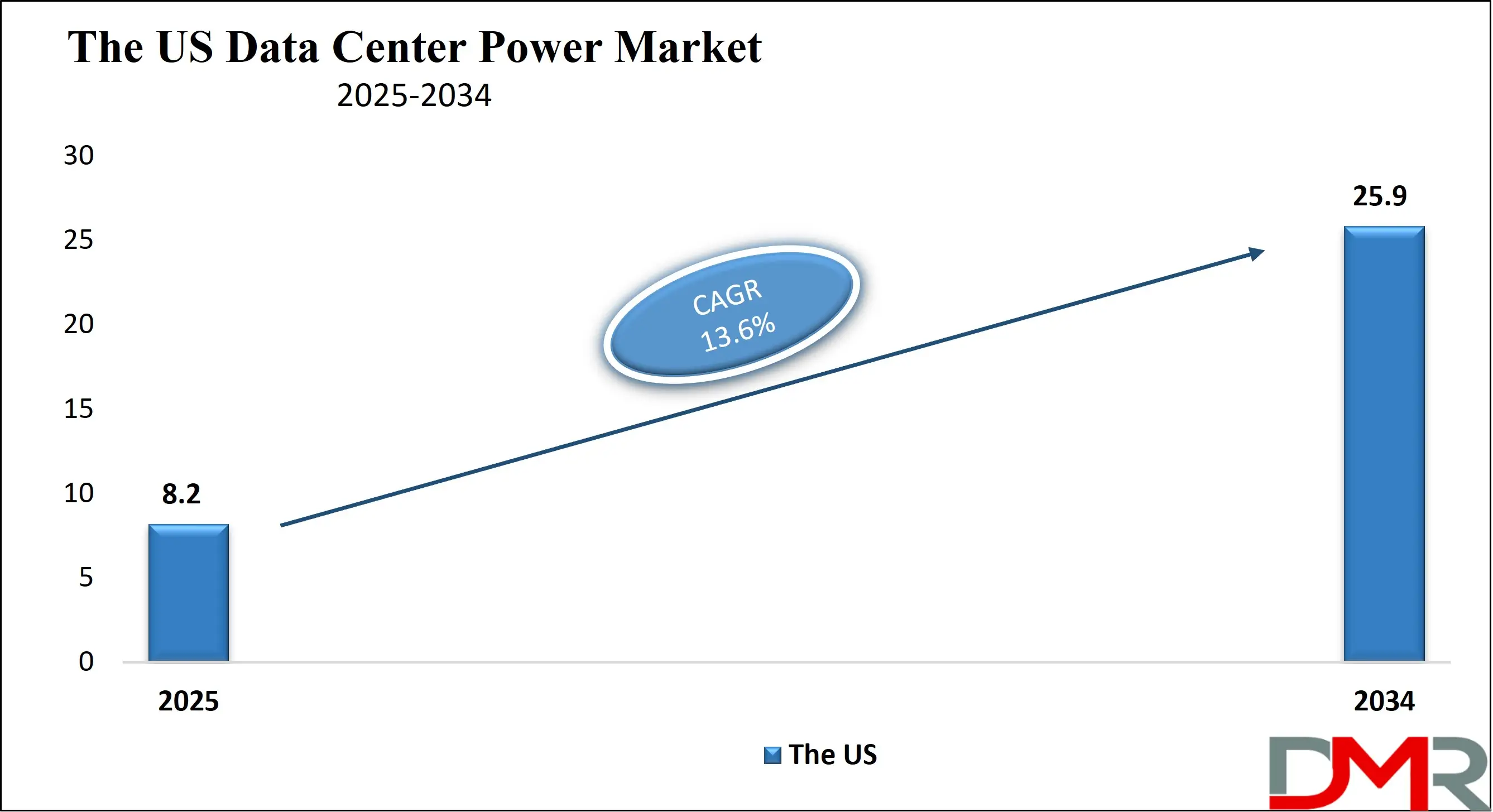

The US Data Center Power Market is projected to reach USD 8.2 billion in 2025 at a compound annual growth rate of 13.6% over its forecast period.

The United States remains the global leader in data center infrastructure, with more than 2,700 facilities distributed across major metros and secondary edge locations. According to the U.S. Department of Energy and the Energy Information Administration (EIA), national data centers consume over 70 billion kilowatt-hours annually, highlighting the enormous demand for efficient, scalable power systems. The U.S. General Services Administration (GSA) further supports consolidation and optimization of federal data centers through the Data Center Optimization Initiative (DCOI), driving the deployment of intelligent power systems in public sector IT facilities.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

States like Virginia, Texas, and Arizona have emerged as leading data center clusters due to favorable electricity rates, abundant land, and robust power grids. Virginia's "Data Center Alley" alone houses over 100 facilities, many powered by dedicated substations and hybrid renewable sources. The National Renewable Energy Laboratory (NREL) promotes integration of on-site solar, energy storage systems, and AI-based energy management software to reduce dependency on fossil fuels.

Demographically, the U.S. enjoys high internet penetration, widespread cloud adoption, and a tech-savvy enterprise environment, resulting in surging demand for high-density, fault-tolerant data centers. Mission-critical applications in fintech, defense, telehealth, and AI are driving investment in UPS with lithium-ion support, intelligent PDUs, and modular power scalability.

Challenges include grid congestion in key metros, rising demand charges, and aging transmission infrastructure. However, public-private collaborations, government funding for grid modernization, and growing ESG (Environmental, Social, Governance) initiatives are catalyzing a new era of sustainable and high-efficiency data center power solutions across the U.S. market.

The Europe Data Center Power Market

The Europe Data Center Power Market is estimated to be valued at USD 3.8 billion in 2025 and is further anticipated to reach USD 10.7 billion by 2034 at a CAGR of 12.0%.

Europe’s data center power market is characterized by a highly regulated environment, commitment to sustainability, and a strong digital economy. According to the European Commission’s “Digital Economy and Society Index,” Northern and Western Europe exhibit high digital maturity, with widespread adoption of cloud services, e-governance, and AI applications. The European Environment Agency (EEA) reports that data centers contribute over 2.7% of EU electricity use, prompting the enactment of energy-efficiency standards like EN 50600 and the Climate Neutral Data Centre Pact.

Germany, the Netherlands, Ireland, and Sweden are central to Europe’s data center ecosystem. These nations offer robust energy grids, high availability zones, and government-backed incentives for green energy use. For instance, Sweden’s tax reductions on renewable-powered facilities and use of heat-recovery systems support dual objectives: operational efficiency and district energy sustainability. The Netherlands encourages high-voltage interconnects and localized substations for hyperscale power needs.

Europe’s demographic strength lies in urban density, skilled labor, and a tech-forward SME base. This, coupled with strict General Data Protection Regulation (GDPR) laws, drives the growth of local, high-security data centers with independent power architecture. Governments are pushing for the integration of hydrogen fuel cells, offshore wind, and smart UPS systems with predictive load balancing.

However, constraints such as limited land in metro areas, complex permitting, and soaring electricity costs in some regions limit large-scale expansion. Nevertheless, Europe’s leadership in green technology and regulatory frameworks positions it as a model for sustainable data center power practices, with significant investments anticipated in eco-centric solutions.

The Japan Data Center Power Market

The Japan Data Center Power Market is projected to be valued at USD 1.5 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 5.4 billion in 2034 at a CAGR of 15.0%.

Japan’s data center power market is rapidly expanding in response to growing demand for cloud infrastructure services, digital and AI-driven applications. According to Japan’s Ministry of Economy, Trade and Industry (METI), digital investments are central to national economic revitalization plans, with Tokyo, Osaka, and Sapporo seeing surges in hyperscale and edge data center projects. Japan’s Smart Energy System initiative promotes renewable integration and resilient energy storage in next-generation facilities.

Demographically, Japan’s urbanized population, high broadband penetration, and aging infrastructure make digital resilience critical. The Ministry of Internal Affairs and Communications (MIC) highlights the importance of robust disaster recovery systems, prompting operators to deploy redundant power setups including dual utility feeds, gas-engine generators, and advanced battery storage. Earthquake-prone zones necessitate seismic-proof power infrastructure with real-time failover.

The government’s Green Growth Strategy supports the adoption of carbon-neutral technologies in digital infrastructure. Operators are increasingly using DC power distribution, lithium-ion UPS, and AI-driven power analytics to manage loads, predict faults, and optimize energy efficiency. Prefabricated modular power blocks and liquid-cooled power racks are gaining traction in high-density colocation environments.

Challenges persist around land availability in metro cores, complex construction codes, and high electricity tariffs, which raise the TCO for new data center projects. Yet, government subsidies for renewable deployment and power-efficient design are mitigating cost burdens. As Japan prepares for greater digital integration across autonomous mobility, telehealth, and Industry 5.0, its data center power market will continue to evolve toward highly resilient, disaster-tolerant, and environmentally responsible energy systems.

Global Data Center Power Market: Key Takeaways

- Global Market Size Insights: The Global Data Center Power Market size is estimated to have a value of USD 25.8 billion in 2025 and is expected to reach USD 87.4 billion by the end of 2034.

- The US Market Size Insights: The US Data Center Power Market is projected to be valued at USD 8.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 25.9 billion in 2034 at a CAGR of 13.6%.

- Regional Insights: North America is expected to have the largest market share in the Global Data Center Power Market, with a share of about 37.8% in 2025.

- Key Players: Some of the major key players in the Global Data Center Power Market are Schneider Electric SE, Eaton Corporation plc, ABB Ltd., Vertiv Holdings Co., Siemens AG, Legrand SA, Huawei Technologies Co., Ltd., Delta Electronics, Inc., and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 14.5 percent over the forecasted period of 2025.

Global Data Center Power Market: Use Cases

- AI Workload Optimization: AI training clusters and inferencing engines require power delivery with ultra-low latency and zero fluctuation. Advanced UPS systems with adaptive transfer switching and modular battery banks ensure consistent performance of large language models (LLMs) and neural networks during peak power loads, safeguarding against data corruption and computational anomalies.

- Edge Data Centers for Smart Cities: Urban smart grids integrate micro data centers powered by compact UPS modules and renewable energy backups. These centers manage traffic lights, surveillance feeds, and IoT devices in real-time. Intelligent PDUs with power metering capabilities ensure uptime in space-constrained environments, while battery redundancy supports emergency resilience and energy balancing.

- Financial Transaction Processing: Financial institutions deploy data centers with redundant power supply units (PSUs), real-time energy metering, and fault-tolerant PDUs to maintain uninterrupted trading, payments, and risk analytics. These systems ensure zero downtime for blockchain transactions, ATM networks, and high-frequency trading platforms by using N+1 or 2N power configurations.

- Content Delivery & Streaming: OTT platforms and content delivery networks rely on distributed edge data centers with high-availability UPS and energy-efficient cooling systems to deliver latency-sensitive 4K/8K content. Predictive energy analytics and automated failover mechanisms ensure bandwidth optimization and server reliability during major global events or peak usage hours.

- Healthcare Imaging & Genomics: Hospitals and genomic research facilities use data centers with isolated dual power feeds and lithium-ion UPS backups to support the continuous operation of imaging devices, digital pathology tools, and genome sequencing servers. Downtime is minimized through hot-swappable battery modules and integrated monitoring for healthcare regulatory compliance.

Global Data Center Power Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- Data centers consumed between 120 and 195 terawatt-hours (TWh) in the U.S. in 2023, highlighting their growing share of the national energy demand. This represents nearly 3.5% of the U.S.'s total electricity usage, emphasizing the critical role power infrastructure plays in sustaining cloud and AI services.

- Computing and data center activities comprised about 8% of total commercial sector electricity consumption in 2024, and this figure is projected to rise to 20% by 2050. This growth trajectory underlines the increasing energy intensity of digital infrastructure, especially as AI and machine learning gain traction.

- The commercial sector, including data centers, saw a 3% rise in electricity demand in 2024, with a further 1% projected in 2025. This surge correlates with increasing cloud deployments, colocation expansions, and government IT modernization.

- The U.S. housed over 5.9 million commercial buildings consuming 6.8 quadrillion BTUs of energy, indicating the vast footprint of potential data center installations and retrofits.

- Combined residential and commercial sectors used 20.6 quadrillion BTUs in 2023, underscoring the significant proportion of national energy dedicated to infrastructure supporting digital services.

International Energy Agency (IEA)

- Global data centers consumed between 300 and 380 TWh of electricity in 2023, excluding cryptocurrency mining. This places them among the top industrial sectors in terms of power usage, driven by expanding digital applications.

- North America alone accounted for 125–200 TWh of global data center electricity demand, with the United States responsible for 120–195 TWh of this figure, making it the region with the highest data center energy density globally.

- Asia-Pacific data centers used 105–180 TWh in 2023, with China consuming 70–130 TWh and Japan between 10–20 TWh. These numbers reflect the region’s rapid digitalization and urbanization, accompanied by growth in hyperscale and edge infrastructure.

- European data centers accounted for 55–80 TWh, driven by colocation hubs in countries such as Germany, Ireland, and the Netherlands.

- Total global data center power consumption was estimated at 290–470 TWh in 2023, with a central estimate of 360 TWh, signifying data centers’ position as major consumers of electricity worldwide.

- Data center energy demand is projected to reach 830 TWh by 2028, making up around 2.9% of global electricity consumption. The projected growth is attributed to generative AI, immersive digital services, and increasing real-time data requirements.

- In several large economies, including the U.S., Germany, and Japan, data centers already account for 2–4% of national electricity consumption, illustrating their growing impact on energy policy and infrastructure planning.

European Environment Agency (EEA) / Joint Research Centre (JRC)

- Data centers in the EU-27 consumed between 45 and 65 TWh in 2022, representing approximately 1.8–2.6% of the region’s total electricity usage. This number is expected to rise significantly as digital services continue to expand.

- Telecom networks across the EU used between 25 and 30 TWh, which is equivalent to 1–1.2% of the total electricity usage in the region. Combined with data center power usage, the ICT sector is becoming a central focus of EU energy efficiency policy.

- Total digital infrastructure energy use in the EU reached 70–95 TWh in 2022, accounting for nearly 4% of the entire electricity footprint across member states.

- Large-scale data centers (e.g., hyperscale and colocation) made up nearly 65% of total data center energy use, even though they represent less than 40% of the total data center count, due to their higher density and continuous workloads.

- In Germany, data centers consumed roughly 15 TWh in 2022, representing 3% of national electricity use, while France recorded about 10 TWh, equating to approximately 2.2%.

- Digital infrastructure energy use surpassed 5% of total electricity consumption in countries like Ireland (19%), Netherlands (6%), Luxembourg (5.5%), Denmark (5%), and Sweden (2.3%), making energy-efficient data center design a national strategic priority.

- By 2026, the EU’s data center electricity demand is expected to be 30% higher than in 2023, putting pressure on operators to invest in sustainable, high-efficiency infrastructure to comply with EU climate objectives.

- A historical benchmark shows that EU data center energy consumption was 76.8 TWh in 2018, projected to reach 98.5 TWh by 2030, a nearly 28% increase driven by rising digital workloads and stricter compliance standards.

Ireland (AP / EirGrid Data)

- Data centers in the Dublin region consumed 21% of Ireland’s national electricity output in 2023, the highest concentration in Europe relative to national supply. This has raised concerns over grid resilience and energy security.

- EirGrid, Ireland’s transmission operator, temporarily paused approvals for new data center connections in Dublin until 2028, citing grid limitations and capacity management challenges in the region.

European Commission / Reuters

- Europe’s data center power demand is expected to nearly triple to 150 TWh by 2030, up from approximately 62 TWh in 2023. This demand surge is largely driven by AI, enterprise cloud, and digital sovereignty initiatives.

- Projected IT load for European data centers is set to rise from 10 GW currently to 35 GW by 2030, emphasizing the need for grid upgrades, renewable sourcing, and advanced load-balancing systems.

- Infrastructure investment requirements to meet Europe’s growing data center demand are estimated at USD 250–300 billion, excluding costs associated with energy generation. This includes investment in new facilities, energy storage, and substation upgrades.

Japan METI / MIC

- In March 2025, Japan’s Ministry of Economy, Trade and Industry (METI) and Ministry of Internal Affairs and Communications (MIC) formed the "Watt-Bit Collaboration Advisory Council", a cross-sectoral group aimed at coordinating energy and digital infrastructure development.

- The third interim report by METI (October 2024) emphasized decentralization of data center capacity and the need for resilient regional energy systems, particularly to address vulnerability in Tokyo and Osaka during disasters.

- Japan’s second strategic energy report on digital infrastructure (May 2023) focused on the need for a carbon-free power supply for data centers and incentivizing operators to adopt high-efficiency UPS and cooling technologies.

- Japan’s 7th Strategic Energy Plan, updated in 2025, mandates a strong shift toward energy-efficient, disaster-resilient, and renewable-powered data centers, aligning national digital transformation with the 2050 carbon neutrality goal.

- On June 10, 2025, METI and GE Vernova launched a strategic collaboration to enhance electrification and secure resilient supply chains for Japan’s digital economy, reinforcing the importance of power reliability in high-density computing zones.

Global Data Center Power Market: Market Dynamic

Driving Factors in the Global Data Center Power Market

Rising Global Data Traffic and Cloud Infrastructure Expansion

A primary growth driver in the data center power market is the exponential rise in global data traffic, largely fueled by cloud computing, video streaming, IoT, and enterprise digitization. According to global telecom regulatory authorities and infrastructure studies, data traffic is projected to exceed 400 exabytes per month globally by 2026, creating unprecedented demand for reliable, high-performance data centers.

Hyperscale cloud providers like AWS, Microsoft Azure, and Google Cloud are aggressively expanding server farms across the U.S., Europe, and Asia to keep pace with demand, triggering high-volume procurement of power systems such as UPS, PDUs, bus ducts, and backup generators. Cloud-native applications require zero downtime and real-time processing, making power reliability a critical parameter in facility design.

In response, operators are deploying tier III and IV rated facilities with modular power topologies to scale dynamically. The adoption of multi-cloud and hybrid cloud models also necessitates the deployment of edge data centers that require compact, localized, and energy-efficient power systems. Furthermore, the growth of 5G, AI, and real-time analytics is amplifying the need for power infrastructure capable of supporting ultra-low latency operations. This digital wave, backed by private and public sector investments, ensures a sustained trajectory for power system growth within the data center ecosystem.

Government Incentives and Energy Efficiency Regulations Worldwide

Another potent growth driver is the increasing availability of government incentives and policy frameworks aimed at enhancing energy efficiency within data centers. Countries across North America, Europe, and Asia-Pacific are offering financial incentives, including tax credits, capex depreciation benefits, and energy-efficiency grants, to operators that adopt sustainable power solutions.

For instance, the European Union has initiated the Climate-Neutral Data Centre Pact and the Ecodesign Directive to enforce energy performance standards and sustainability benchmarks. Similarly, the U.S. Department of Energy supports initiatives like the Better Buildings Challenge, promoting best practices in data center energy management. In Japan, METI has launched collaborative initiatives with cloud service providers to ensure resilient, low-carbon power systems in seismic zones.

These frameworks incentivize the use of modular UPS systems, AI-powered energy optimization tools, lithium-ion and flow batteries, and renewable integration at the facility level. Additionally, emerging regulations require reporting of metrics such as Power Usage Effectiveness (PUE), Data Center Infrastructure Efficiency (DCiE), and carbon footprint per compute unit. Compliance with these mandates often yields competitive advantages, public trust, and operational cost savings. Thus, regulatory momentum is not only reshaping design norms but also catalyzing investments in advanced power infrastructure that aligns with global energy transition goals.

Restraints in the Global Data Center Power Market

Rising Energy Costs and Utility Grid Limitations in Urban Centers

One of the most pressing restraints facing the data center power market is the rising cost of energy coupled with utility grid constraints, particularly in dense urban hubs. As cities like London, Amsterdam, Dublin, Singapore, and Frankfurt approach saturation in terms of grid availability, the cost of securing reliable power for new data center construction has skyrocketed.

In several metropolitan areas, moratoriums on new grid connections have been enacted due to the inability of aging infrastructure to support additional load. This presents significant challenges for operators attempting to scale facilities or meet redundancy standards like 2N or Moreover, demand charges, peak-time tariffs, and energy import restrictions further inflate operational expenses.

In the U.S., for instance, the commercial cost per kWh has increased due to inflationary pressure on fuel sources and grid modernization delays. These escalating costs directly impact return on investment (ROI), making it harder for small and medium data center operators to remain competitive. The need for on-site generation through fuel cells or renewables offers some relief, but adds complexity and capital burden. In regions lacking energy policy cohesion, such as parts of Southeast Asia and Africa, these challenges are even more pronounced, restraining data center expansion despite growing digital demand.

High Capital Expenditure and Complexity of Upgrading Legacy Power Systems

Another significant restraint is the high capital intensity and technical complexity associated with upgrading legacy data center power systems. Many enterprise data centers, especially those built a decade ago, were designed for significantly lower power densities and lack the modularity needed to support modern workloads. Retrofitting such facilities with current-generation lithium-ion UPS units, intelligent PDUs, and high-efficiency cooling systems involves extensive redesign of electrical layouts, breaker panels, floor loading capacity, and HVAC integration.

These upgrades often require facility downtime or staged renovations, both of which impact service availability. The cost of such overhauls can reach millions of dollars, depending on size and scope, deterring operators from pursuing modernization even when performance benefits are clear.

Additionally, compatibility challenges between legacy and modern power systems, especially in mixed-vendor environments, require custom integration and pose operational risks. In jurisdictions with strict safety and electrical code compliance, obtaining approvals for high-voltage installations or liquid-cooled power modules further delays deployment.

The complexity increases in multitenant data centers where power upgrades must align with diverse SLAs and tenant requirements. Without cost-effective, scalable retrofit solutions, many older facilities risk obsolescence or relegation to secondary workloads, limiting their contribution to high-performance, low-latency applications.

Opportunities in the Global Data Center Power Market

Edge Data Center Deployment in Tier II and Tier III Cities

The proliferation of edge data centers represents a major growth opportunity for the data center power market, particularly in emerging digital economies and underserved Tier II and III cities. Edge data centers enable real-time processing close to the data source, reducing latency and enhancing application performance in areas such as autonomous vehicles, industrial IoT, smart grids, and AR/VR content.

These smaller, distributed facilities require scalable and compact power solutions such as prefabricated modular UPS units, containerized lithium-ion battery packs, and plug-and-play energy monitoring systems. As edge computing architectures expand to support 5G and AI inference at the network edge, power infrastructure must evolve to accommodate dynamic loads, limited floor space, and environmental challenges.

Operators are investing in microgrid-based systems, hybrid AC/DC power conversion technologies, and decentralized power backup schemes for seamless failover in remote locations. Additionally, edge deployments are increasingly powered by solar PV and wind microturbines combined with battery storage to ensure sustainable operations.

This decentralization of infrastructure creates a vast addressable market for power system providers catering to edge-specific configurations. Governments and telecom regulators are also promoting edge infrastructure to bridge digital divides, further accelerating demand for efficient and resilient power technologies tailored to regional and rural environments.

Integration of AI and Software-Defined Power in Data Center Operations

A transformative opportunity lies in the integration of artificial intelligence (AI) and software-defined power (SDP) into the operational layer of data center energy systems. AI-enabled power management platforms leverage machine learning algorithms to analyze historical energy consumption patterns, forecast demand spikes, and autonomously or chestrate power distribution across critical workloads.

This enables dynamic allocation of energy resources, predictive maintenance scheduling, and real-time anomaly detection, significantly improving uptime and reducing overhead. SDP architecture decouples the control plane from the power hardware layer, allowing operators to virtualize power paths, remotely reconfigure circuit loads, and execute energy-saving protocols from a central dashboard. These technologies empower facilities to transition from static to adaptive power environments, optimizing resource use and enhancing resilience.

As workloads become more unpredictable due to multi-tenant use and AI training spikes, AI-driven orchestration ensures agile and energy-efficient operations. Furthermore, these systems support integration with building management systems (BMS), renewable energy input, and grid APIs, creating intelligent, grid-aware data centers. Vendors that provide AI-powered power orchestration platforms and SDP-compatible hardware will have a competitive edge in serving modern data center operators who prioritize automation, flexibility, and energy transparency. The convergence of digital intelligence and power engineering marks a new frontier in data center sustainability and operational excellence.

Trends in the Global Data Center Power Market

Shift Toward Sustainable and Green Power Architectures

One of the most significant trends in the data center power market is the growing industry-wide transition toward sustainable and environmentally responsible power infrastructure. Data centers, traditionally viewed as carbon-intensive facilities, are undergoing strategic overhauls to align with net-zero emissions goals. Operators are increasingly adopting renewable energy sources such as solar, wind, hydro, and hydrogen-based fuel cells to power operations, particularly in hyperscale environments.

Companies like Google and Microsoft have committed to running on 100% renewable electricity, while others are leveraging power purchase agreements (PPAs) to offset their carbon footprint. In tandem, green building certifications like LEED and BREEAM are becoming standard in new data center construction, driving innovations in power-efficient UPS systems, battery energy storage, and grid-interactive power configurations.

These trends are supported by regulatory mandates across Europe, North America, and Asia-Pacific that demand carbon neutrality within specific timelines. The increased availability of smart power analytics and AI-driven load optimization tools further enhances the feasibility of clean energy adoption.

Additionally, governments are incentivizing clean energy use through tax breaks and grants, thereby fueling sustainable transformation in data center power design. As sustainability becomes a competitive differentiator in the digital infrastructure sector, the adoption of green power systems is poised to become the dominant paradigm shaping future data center investments.

Rapid Evolution of Power Management Technologies for AI and High-Density Computing

The second major trend redefining the data center power landscape is the accelerated evolution of intelligent power management technologies, spurred by the rise of AI, machine learning, and high-density computing workloads. Emerging technologies like generative AI and deep learning models require significantly more computing power and corresponding electrical load capacities, often exceeding traditional design parameters.

This has led to the deployment of advanced modular UPS systems with lithium-ion batteries, software-defined power infrastructure, real-time voltage optimization, and predictive analytics platforms. These innovations help monitor power usage effectiveness (PUE), manage capacity loads, and ensure N+1 or 2N redundancy across zones.

With rack densities surpassing 30 kW in AI-optimized facilities, power distribution infrastructure such as intelligent PDUs, high-efficiency transformers, and direct-current (DC) powered busways is being utilized for granular control. AI-integrated power controllers can forecast failure points, trigger automated switchover, and adjust load curves to optimize performance while avoiding brownouts.

As AI workloads grow in scale and complexity, data center power systems must evolve to meet demands for low latency, high availability, and ultra-efficient power delivery. This evolution reflects a broader convergence between IT and OT (operational technology) layers, redefining how power infrastructure is planned, deployed, and maintained in modern facilities.

Global Data Center Power Market: Research Scope and Analysis

By Component Analysis

The solution segment is projected to lead the component classification in the global data center power market because it forms the foundational infrastructure for reliable, efficient, and scalable energy delivery. This segment includes a range of products such as Uninterruptible Power Supply (UPS) systems, Power Distribution Units (PDUs), generators, busways, cabling, and networking infrastructure. These components are vital for maintaining power continuity, protecting sensitive data center equipment, and ensuring uninterrupted performance during utility outages or power fluctuations.

UPS systems, particularly lithium-ion and modular variants, are central to facility uptime, offering low footprint, longer life, and faster charge cycles compared to traditional VRLA batteries. Intelligent PDUs enable granular power monitoring and load balancing across high-density racks, especially important in AI and HPC environments. Busways and advanced cabling infrastructure provide flexible and scalable distribution of power across zones, supporting agile expansion without major redesigns.

With data centers trending toward high rack power densities (20–40 kW or more), solutions must be engineered for thermal efficiency, real-time monitoring, and adaptive control. Moreover, intelligent solutions now integrate software-defined power layers, enabling predictive maintenance, automated fault detection, and integration with Building Management Systems (BMS). As facility operators strive for sustainability and operational excellence, modern power solutions also support renewable integration, load shedding, and energy efficiency metrics like PUE (Power Usage Effectiveness) and DCiE.

Unlike services, which are typically short-term or project-specific, power solutions are capital-intensive, form the backbone of continuous operations, and directly affect ROI, reliability, and compliance. Their technological evolution, continuous demand, and central role in critical infrastructure make them the dominant force in the component segmentation.

By Data Center Size Analysis

Small and Medium-sized Data Centers (SMDCs) is expected to dominate the size-based segmentation of the market, due largely to their wide-scale deployment across industries and regions. While hyperscale facilities by cloud giants receive high visibility, it is SMDCs that numerically represent the bulk of global installations. These facilities typically serve regional enterprises, hospitals, universities, government departments, and mid-sized digital service providers, offering a critical balance between proximity, latency, security, and cost.

SMDCs are essential for edge computing, real-time analytics, and localized compliance, especially in countries enforcing data sovereignty regulations. In emerging markets, Tier II and Tier III cities are witnessing a surge in SMDC development due to increasing digitization, urbanization, and cloud adoption by small-to-medium enterprises (SMEs). These facilities need power systems that are compact, cost-effective, modular, and easy to deploy, such as rack-mounted UPS systems, micro PDUs, pre-integrated busways, and plug-and-play battery systems.

Additionally, SMDCs are often purpose-built for hybrid IT environments, requiring flexible power configurations that support legacy and virtualized workloads alike. Many also leverage containerized power modules and microgrid integration, especially in off-grid or remote locations. Furthermore, energy-efficient solutions are key for SMDCs, as operating costs must be minimized without compromising availability.

With the proliferation of 5G, IoT, and decentralized digital services, the need for SMDCs is growing rapidly, expanding the addressable market for power infrastructure tailored to their scale. Their prevalence, increasing sophistication, and ability to deliver low-latency services make SMDCs the dominant data center size segment globally.

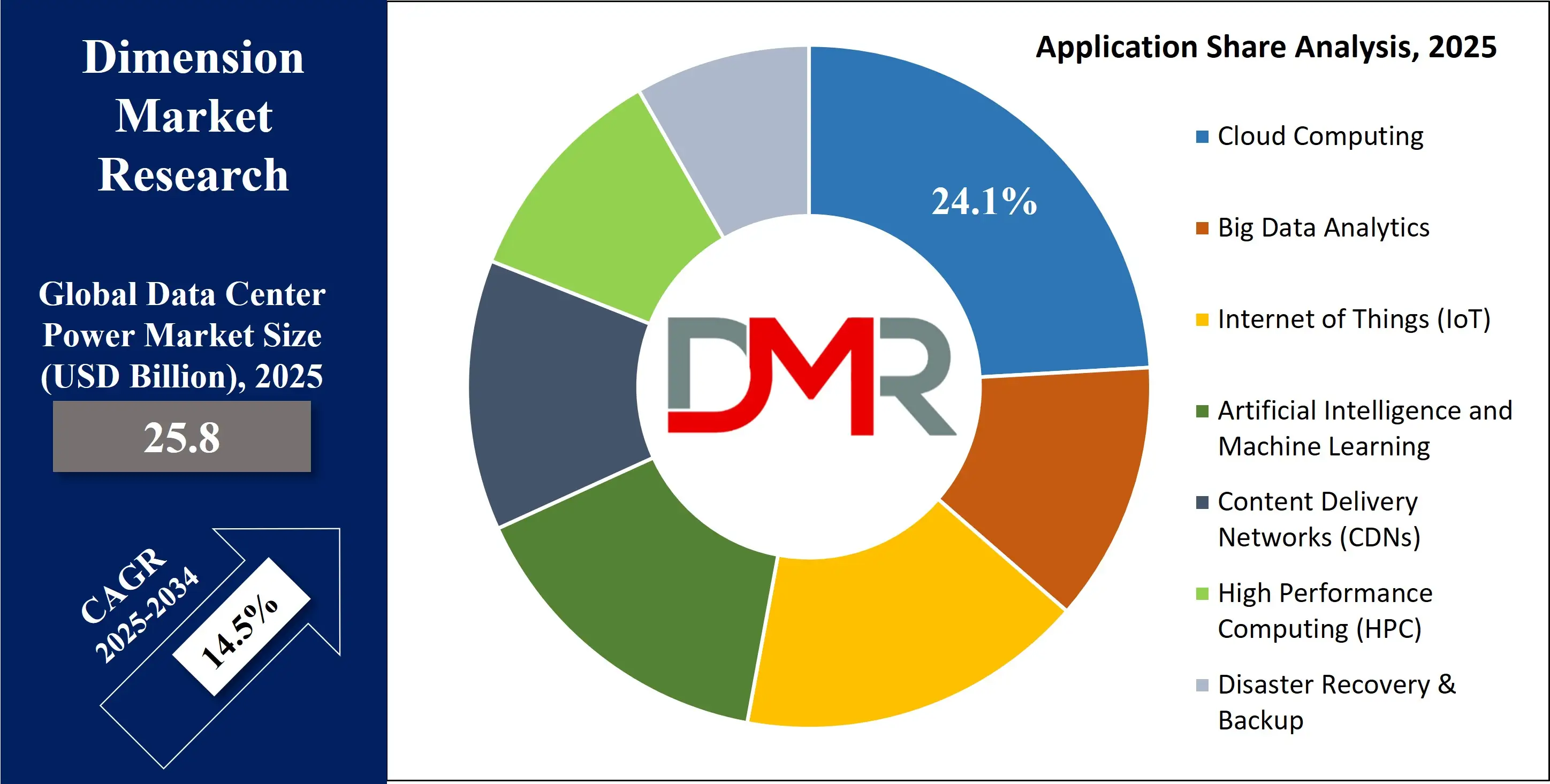

By Application Analysis

Cloud computing is expected to hold the dominant position in the application-based segmentation of the data center power market, driven by its ubiquitous role in powering modern business ecosystems. The rise of Infrastructure-as-a-Service (IaaS), Platform-as-a-Service (PaaS), and Software-as-a-Service (SaaS) platforms has transformed how enterprises and consumers consume digital services, requiring massive, continuously operational, and power-intensive data centers.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Hyperscale cloud providers like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Alibaba Cloud are building data center campuses that host millions of servers. These facilities are characterized by extremely high power densities, multi-layered redundancy (2N and N+1), and cutting-edge load balancing systems. They utilize high-efficiency modular UPS units, intelligent PDUs, and automated energy orchestration platforms to manage real-time resource allocation.

Cloud data centers must ensure near-zero downtime, high availability zones, and automated failover capabilities, making power infrastructure critical to their value proposition. Additionally, cloud platforms are integrating AI-based orchestration, enabling dynamic voltage regulation, capacity prediction, and real-time failure mitigation. With the proliferation of multi-cloud, hybrid cloud, and cloud-native frameworks, power systems must scale elastically while maintaining low latency and efficiency.

Cloud players are also investing heavily in green data centers, with 100% renewable commitments, onsite solar or wind generation, and waterless cooling, all of which require advanced power infrastructure. The cloud model’s agility, elasticity, and criticality to global digital operations ranging from streaming and e-commerce to fintech and government digital platforms make cloud computing the dominant application in driving data center power demand.

By Industry Vertical Analysis

The IT and telecommunications sector is poised to dominate the industry vertical segmentation of the global data center power market because of its deep reliance on high-density, low-latency, and continuously available data infrastructure. Telecom operators and IT service providers run complex global networks, backbone transmission systems, mobile cores, and internet exchange points, all of which require data centers with highly resilient and redundant power systems.

These entities are investing in 5G core infrastructure, multi-access edge computing (MEC), NFV (Network Function Virtualization), and cloud-native networks, which demand scalable and intelligent power ecosystems. Given the mission-critical nature of voice, video, data, and messaging services, even a few minutes of power disruption could lead to catastrophic revenue loss and SLA violations.

Telecom and IT data centers often operate with power densities exceeding 25–30 kW per rack, utilizing AI-driven load management, redundant UPS units, and automated failover mechanisms. Many facilities are adopting software-defined power (SDP), allowing centralized control of distributed energy assets, real-time energy optimization, and remote diagnostics.

Moreover, telecom towers and base stations increasingly rely on edge data centers, which must be equipped with compact and ruggedized power solutions. In rural or power-unstable areas, this includes hybrid systems integrating solar, diesel generators, and battery storage.

Government mandates often require telecom companies to provide backup power for a minimum duration to ensure network availability during emergencies. This vertical’s regulatory demands, digital traffic growth, and capital strength make it the largest and most consistent consumer of advanced power infrastructure in the global data center power ecosystem.

The Global Data Center Power Market Report is segmented on the basis of the following

By Component

- Power Distribution Units (PDUs)

- Uninterruptible Power Supplies (UPS)

- Generators

- Cabling Infrastructure

- Networking & Power Monitoring Infrastructure

- Design & Consulting

- Integration & Deployment

- Support & Maintenance

By Data Center Size

- Small and Medium-sized Data Centers

- Large Data Centers

By Application

- Cloud Computing

- Big Data Analytics

- Internet of Things (IoT)

- Artificial Intelligence and Machine Learning

- Content Delivery Networks (CDNs)

- High Performance Computing (HPC)

- Disaster Recovery & Backup

By Industry Vertical

- IT and Telecommunications

- BFSI (Banking, Financial Services, and Insurance)

- Media and Entertainment

- Healthcare and Life Sciences

- Government, Military, and Defense

- Retail and E-commerce

- Manufacturing and Industrial Automation

- Others

Global Data Center Power Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to remain the largest and most dominant region in the global data center power market as it commands over 37.8% of the market share in 2025, due to its mature digital economy, dense hyperscale presence, and advanced utility infrastructure. The U.S. accounts for a significant portion of global data traffic and cloud service hosting, with cities like Northern Virginia, Silicon Valley, Dallas, and Phoenix acting as strategic data center corridors. Companies such as Microsoft, Google, Amazon, and Meta operate large-scale campuses that require continuous, redundant power supported by sophisticated UPS systems, modular PDUs, and grid-tied backup generators.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The region benefits from reliable utility grids, integration of on-site renewable energy like wind and solar, and established carbon credit trading programs that incentivize clean energy use. Government and military IT modernization projects, along with the rise of AI and real-time analytics, are accelerating the demand for high-performance, energy-efficient power infrastructure.

Furthermore, the U.S. Department of Energy’s efficiency initiatives, coupled with local energy rebate programs, foster continuous power innovation. In Canada, rising digital investments and cooler climates make provinces like Quebec and Ontario attractive for sustainable data center development. Collectively, the North American market thrives on technological leadership, policy support, and robust private-public digital infrastructure partnerships, positioning it as the global epicenter for next-generation data center power systems.

Region with the Highest CAGR

The Asia-Pacific region is projected to exhibit the highest CAGR in the global data center power market, propelled by a unique convergence of rapid urbanization, expanding cloud adoption, and increasing digital penetration. Countries like China, India, Indonesia, Vietnam, Japan, and Australia are witnessing massive demand for hyperscale and edge data centers to support fintech, e-commerce, gaming, and digital health platforms.

Government-led initiatives such as India’s Digital India, Japan’s Society 5.0, and China’s New Infrastructure Plan are creating robust demand for high-efficiency, scalable power infrastructure. Telecom giants and global cloud players are investing in data centers across APAC to serve fast-growing consumer bases.

This has led to a surge in the deployment of lithium-ion UPS systems, containerized power modules, intelligent busbars, and renewable-integrated generator systems. Regions like Southeast Asia, with relatively low electricity costs and rising tech-savvy populations, are ideal for greenfield investments. Moreover, the push for localized data processing under new data sovereignty laws in countries like India and China is accelerating regional data center expansions. The favorable cost structure, policy reforms, and infrastructure investments fuel APAC’s rapid market acceleration.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center Power Market: Competitive Landscape

The global data center power market is intensely competitive and technologically dynamic, with leading players offering comprehensive hardware, software, and service portfolios. Schneider Electric, Eaton Corporation, Vertiv Holdings, ABB Ltd., and Siemens AG dominate the market, leveraging global supply chains and deep domain expertise in electrical infrastructure to offer advanced UPS systems, PDUs, busways, switchgear, and power monitoring software.

Their offerings integrate smart control systems, support for lithium-ion energy storage, and software-defined energy orchestration catering to hyperscale, enterprise, and modular data centers alike. Legrand, with its stronghold in power distribution and enclosure systems, plays a pivotal role in edge deployments and colocation centers.

Huawei, Delta Electronics, and Mitsubishi Electric are expanding aggressively across Asia-Pacific and the Middle East, focusing on localized energy-efficient solutions and scalable power configurations. These companies provide integrated DC/AC conversion systems, energy-efficient cooling, and AI-powered energy dashboards. Innovation in liquid-cooled UPS, modular container power, and renewable energy-inverter hybrids is driving product differentiation.

The competitive landscape is further intensified by collaborations with cloud providers, participation in net-zero initiatives, and growing emphasis on cybersecurity and predictive maintenance. Emerging startups are entering the market with niche power orchestration platforms and microgrid solutions. In this evolving environment, sustainability, intelligence, and adaptability remain key factors shaping vendor success in the global data center power space.

Some of the prominent players in the Global Data Center Power Market are

- Schneider Electric

- Eaton Corporation

- ABB Ltd.

- Vertiv Holdings Co.

- Siemens AG

- Legrand SA

- Huawei Technologies Co., Ltd.

- Delta Electronics, Inc.

- General Electric (GE)

- Tripp Lite

- Cyber Power Systems (USA), Inc.

- Rittal GmbH & Co. KG

- Toshiba Corporation

- Riello Elettronica Group

- Socomec Group

- AEG Power Solutions

- Borri S.p.A.

- Cummins Inc.

- Kehua Tech

- Hitachi Energy

- Other Key Players

Recent Developments in the Global Data Center Power Market

June 2025

- Surging Power Demand Forecast for AI-Driven Data Centers: In July 2025, multiple federal energy authorities reported that data centers in the U.S. could account for between 6.7% and 12% of total electricity consumption by 2028 due to AI workloads and high-performance computing. This increasing demand has raised concerns over grid reliability and has prompted new investment strategies in on-site generation, power purchase agreements (PPAs), and renewable integration within hyperscale data centers.

June 2025

- Fermi America Proposes Nuclear-Powered AI Data Center Campus in Texas: A major development was the filing of plans by Fermi America to construct a nuclear-powered AI data center hub near Amarillo, Texas. The proposed “AI Campus” would utilize four AP1000 nuclear reactors with a combined capacity of over 11 GW. This initiative marks one of the largest energy-infrastructure proposals linked to AI computing and highlights the intersection of nuclear power with long-term digital capacity.

- Exelon Announces $38 Billion Grid Modernization Plan: Exelon Corporation announced a $38 billion investment over the next three years to expand grid infrastructure, focusing on transmission lines and substations needed to support growing data center zones. This includes upgrades for renewable power corridors and digitized grid management to maintain load stability amid rising computational intensity.

May 2025

- Blackstone Eyes Strategic Utility-Data Center Synergy with TXNM Acquisition: Blackstone Infrastructure proposed an $11.5 billion acquisition of TXNM, a regional utility company. Regulatory groups expressed concern about how this utility-data hybrid model could reshape power pricing and prioritization for digital infrastructure, raising critical questions about private control over energy routes to hyperscale campuses.

- PowerBridge and NEX Infrastructure Launch $1 Billion Power-Ready Sites in Texas: Infrastructure developer PowerBridge, backed by Five Point Energy, committed nearly $1 billion to develop "power-secured" data center campuses in the Permian Basin. The project includes on-site natural gas generation, carbon capture, and direct connection to AI workload customers. These new facilities are designed with grid independence and 24/7 power redundancy in mind.

April 2025

- Exowatt Raises $70 Million for Thermal Power Modules for AI Data Centers: Exowatt, a U.S.-based startup specializing in thermal energy storage, raised $70 million in Series A funding to pilot its modular systems for edge and AI data centers. These units store solar or off-peak electricity as heat and convert it back to power on demand, reducing reliance on diesel generators and lithium batteries.

- Siemens and Compass Datacenters Partner for Medium-Voltage Modular Power: Siemens partnered with Compass Datacenters to deliver 1,500 modular medium-voltage skids equipped with digital monitoring systems. These pre-engineered power units simplify the deployment process, reduce commissioning time, and integrate smart grid compatibility, critical for multi-site, rapid-build data center rollouts across North America.

- Asia-Pacific Regional Surge in Data Center Development: Numerous strategic announcements in Asia-Pacific were made in April. TikTok announced an $8.8 billion investment for a multi-site data center network in Thailand. SoftBank unveiled plans for a 300+ MW AI-optimized data center campus in Japan’s Hokkaido region. Meanwhile, EdgePoint launched Malaysia’s first solar-hybrid edge data center, aligning with the region's renewable energy targets and rising edge computing demands.

March 2025

- CDCE Expo 2025 Announced for Shanghai: The International Data Center & Cloud Computing Industry Expo (CDCE) announced its 2025 edition, scheduled for November 18–20 in Shanghai. The expo is expected to highlight next-generation power technologies including liquid-cooled UPS systems, intelligent PDUs, and on-site renewable microgrid integration. Over 500 exhibitors and 30,000 visitors are expected, including major OEMs and utility providers.

January 2025

- Vertiv Acquires BiXin's Chiller and Power Management Assets: Vertiv Holdings completed the acquisition of select assets from BiXin, a China-based firm specializing in precision cooling and intelligent power control. This move strengthens Vertiv’s thermal and power infrastructure capabilities, especially for high-density AI and edge deployments across the Asia-Pacific region.

- U.S. GSA Signs Historic Nuclear PPA for Federal Data Facilities: The U.S. General Services Administration entered a 10-year power purchase agreement with Constellation NewEnergy to supply over 10 million megawatt-hours of nuclear power to more than 80 federal data facilities. This marks one of the largest zero-carbon electricity procurement efforts in public sector digital infrastructure.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 25.8 Bn |

| Forecast Value (2034) |

USD 87.4 Bn |

| CAGR (2025–2034) |

14.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 8.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solution, Services), By Data Center Size (Small and Medium-sized Data Centers, Large Data Centers), By Application (Cloud Computing, Big Data Analytics, Internet of Things (IoT), Artificial Intelligence and Machine Learning, Content Delivery Networks (CDNs), High Performance Computing (HPC), Disaster Recovery & Backup), By Industry Vertical (IT and Telecommunications, BFSI (Banking, Financial Services, and Insurance), Media and Entertainment, Healthcare and Life Sciences, Government, Military, and Defense, Retail and E-commerce, Manufacturing and Industrial Automation, Other) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Schneider Electric SE, Eaton Corporation plc, ABB Ltd., Vertiv Holdings Co., Siemens AG, Legrand SA, Huawei Technologies Co., Ltd., Delta Electronics, Inc., General Electric Company, Tripp Lite (a brand of Eaton), Cyber Power Systems (USA), Inc., Rittal GmbH & Co. KG, Toshiba Corporation, Riello Elettronica Group, Socomec Group S.A., AEG Power Solutions B.V., Borri S.p.A., Cummins Inc., Kehua Data Co., Ltd., Hitachi Energy Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Data Center Power Market?

▾ The Global Data Center Power Market size is estimated to have a value of USD 25.8 billion in 2025 and is expected to reach USD 87.4 billion by the end of 2034.

What is the size of the US Data Center Power Market?

▾ The US Data Center Power Market is projected to be valued at USD 8.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 25.9 billion in 2034 at a CAGR of 13.6%.

Which region accounted for the largest Global Data Center Power Market?

▾ North America is expected to have the largest market share in the Global Data Center Power Market, with a share of about 37.8% in 2025.

Who are the key players in the Global Data Center Power Market?

▾ Some of the major key players in the Global Data Center Power Market are Schneider Electric SE, Eaton Corporation plc, ABB Ltd., Vertiv Holdings Co., Siemens AG, Legrand SA, Huawei Technologies Co., Ltd., Delta Electronics, Inc., and many others.

What is the growth rate in the Global Data Center Power Market in 2025?

▾ The market is growing at a CAGR of 14.5 percent over the forecasted period of 2025.