Market Overview

The Global Data Center Semiconductor Market size is projected to reach USD 252.2 billion in 2025 and grow at a compound annual growth rate of 22.9% to reach a value of USD 1,613.9 billion in 2034.

The data center semiconductor market encompasses a wide range of chips powering modern data infrastructure processors, memory, storage controllers, networking silicon, and power/analog ICs. These components are central to enabling compute, storage, networking, power management, and security functions across traditional enterprise setups and modern hyperscale environments.

Demand is being driven by a rapid shift toward AI,

cloud computing, big data analytics, and distributed edge infrastructure. As workloads grow more specialized and intensive, data centers require chips that offer higher parallel processing, increased bandwidth, low latency, and better energy efficiency. This is fueling growth in advanced processors, accelerators, and high-performance memory systems.

Architectural innovation is accelerating beyond legacy server designs, with greater adoption of GPUs, ASICs, FPGAs, and custom silicon. Meanwhile, memory and storage subsystems are being reengineered to meet real-time processing needs, while networking and power management ICs ensure system scalability and rack-level efficiency in disaggregated, modular topologies.

Despite strong demand, the market faces headwinds including supply chain constraints, manufacturing complexity at advanced nodes, and margin compression across chip types. Yet, with cloud scale-out, AI workload expansion, and evolving infrastructure needs, the data center semiconductor segment remains a critical pillar in the future of digital computing.

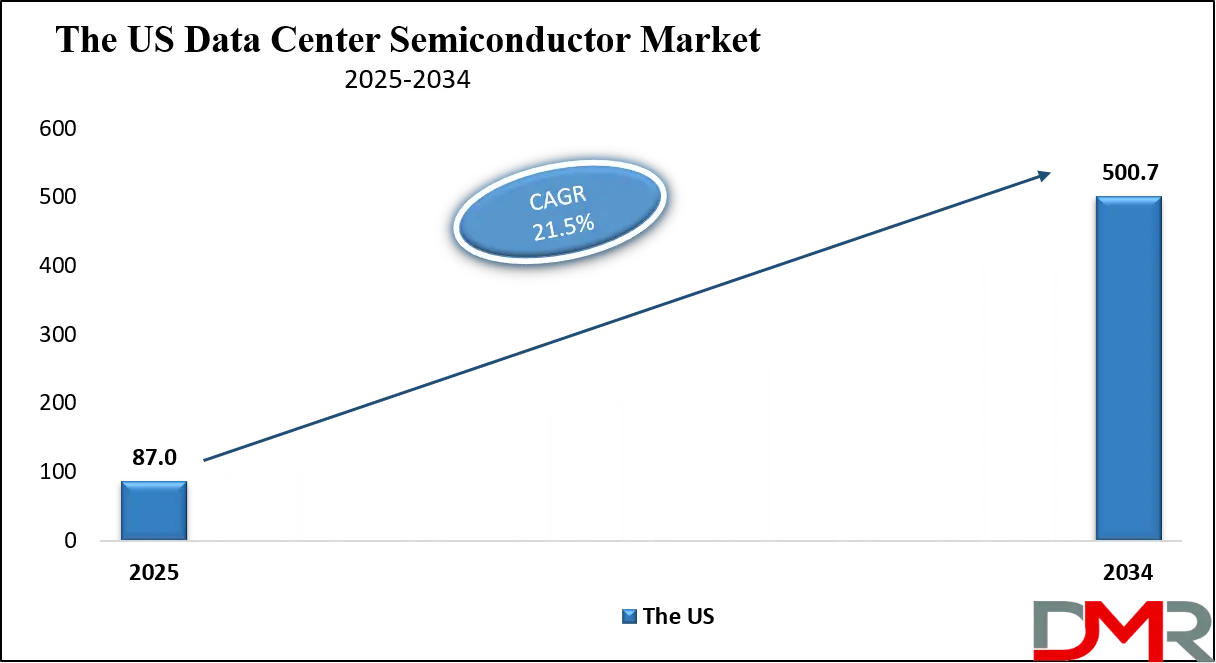

The US Data Center Semiconductor Market

The US Data Center Semiconductor Market size is projected to reach USD 87.0 billion in 2025 at a compound annual growth rate of 21.5% over its forecast period.

The U.S. market continues to lead in data‑center semiconductor development and infrastructure build‑out. Advanced‑node manufacturing (chips < 7 nm) is receiving strong investment and policy support, making the U.S. a key base for next‑generation processors and accelerators tailored to AI/data‑center workloads. Domestic firms and foundries are also ramping power‑and‑analog semiconductor solutions, recognizing that compute density and power constraints are increasingly critical in data‑centers.

On the demand side, hyperscale cloud providers and AI infrastructure operators are investing heavily in both chips and facility upgrades, accelerating hardware refresh cycles. The U.S. regulatory and tax environment (including the CHIPS Act) further supports semiconductor supply‑chain localization. However, supply‑chain constraints, packaging complexity and energy/power/cooling demands remain strong challenges. Overall, the U.S. stands at the forefront of both chipset innovation and data‑center expansion, with semiconductor and infrastructure strategies becoming tightly aligned.

Europe Data Center Semiconductor Market

Europe Data Center Semiconductor Market size is projected to reach USD 55.5 billion in 2025 at a compound annual growth rate of 20.2% over its forecast period.

In Europe, the semiconductor-data-center ecosystem is evolving under a dual constraint: strong regulatory and sustainability frameworks, combined with rising demand for high‑performance infrastructure. European governments and the EU as a bloc are committing major funds to build AI data centers and support semiconductor manufacturing capacity. This trend reflects the recognition that both compute hardware and data-center real estate are strategic assets.

While traditional European strength in automotive and industrial semiconductors remains, the shift to data-center-grade processors, memory, and networking chips is gaining pace. Regulatory support, infrastructure development, and cross‑border collaboration among EU member states are accelerating projects, though challenges persist around power availability, grid infrastructure, and cost competitiveness relative to U.S/Asia.

Japan Data Center Semiconductor Market

Japan Data Center Semiconductor Market size is projected to reach USD 15.1 billion in 2025 at a compound annual growth rate of 23.3% over its forecast period.

Japan’s data-center semiconductor and infrastructure market is gaining momentum as the national strategy aligns with global AI/data-center needs. Japan is ramping domestic semiconductor manufacturing (especially advanced nodes, foundries, back‑end packaging) and tying this into data-center growth via both domestic demand and export potential.

The energy‑infrastructure side is also critical: Japan is developing data centers using renewable energy, waste‑heat reuse, and high‑efficiency power/analog devices to support high‑density compute. In parallel, Japanese investment in memory, networking, and GPU‑based infrastructure for data centers is picking up. The collaboration between government, industry and infrastructure players is a key strength.

Data Center Semiconductor Market: Key Takeaways

- Market Growth: The Data Center Semiconductor Market size is expected to grow by USD 1,309.8 billion, at a CAGR of 22.9%, during the forecasted period of 2026 to 2034.

- By Technology Node: The 14nm segment is anticipated to get the majority share of the Data Center Semiconductor Market in 2025.

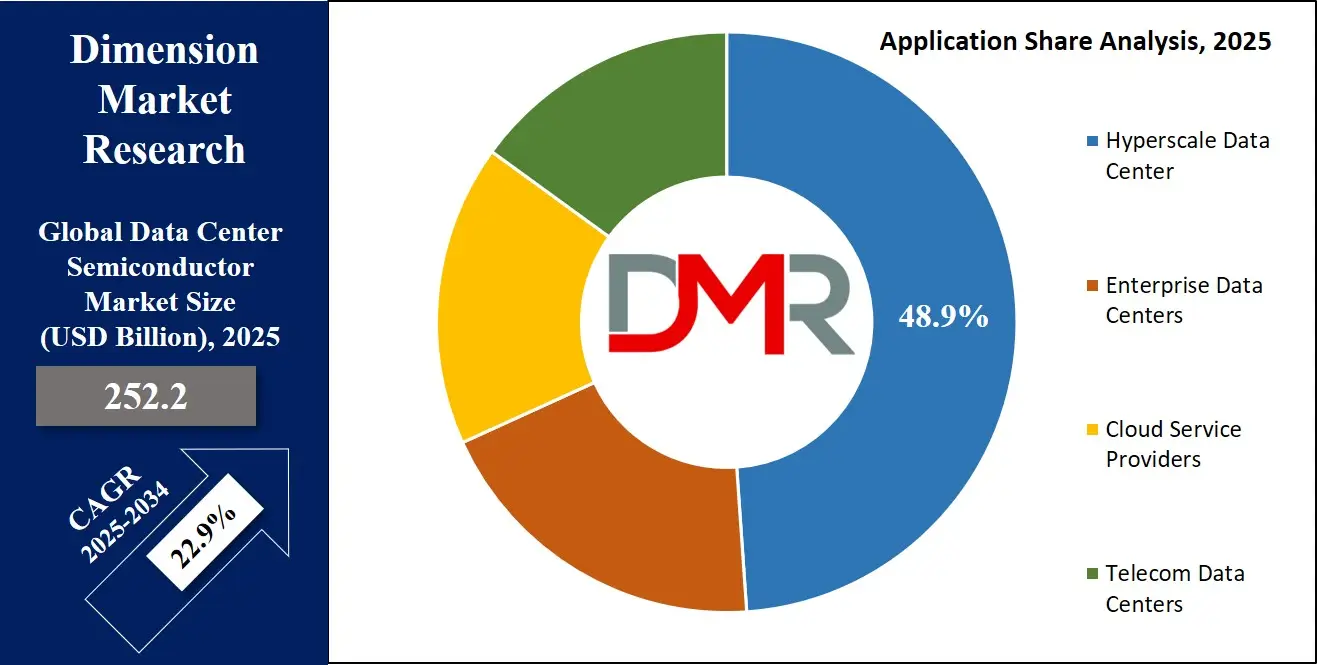

- By Application: The hyperscale data center segment is expected to get the largest revenue share in 2025 in the Data Center Semiconductor Market.

- Regional Insight: North America is expected to hold a 41.2% share of revenue in the Global Data Center Semiconductor Market in 2025.

- Use Cases: Some of the use cases of Data Center Semiconductor include hyperscale data centers, enterprise data center and more.

Data Center Semiconductor Market: Use Cases

- Hyperscale Data Centers: These large facilities deployed by cloud service providers host massive compute clusters and require high‑end processors, accelerators, memory and interconnect semiconductors to support AI training plus large‑scale data services.

- Enterprise Data Centers: Corporations and institutions run their own on‑premises or co‑located data centers for mission‑critical workloads, requiring server semiconductors optimized for reliability, security and virtualization rather than purely edge or AI‑training scale.

- Cloud Service Providers: Providers offering Infrastructure‑as‑a‑Service (IaaS) and Platform‑as‑a‑Service (PaaS) demand high‑efficiency, scalable semiconductor architectures to support multi‑tenant cloud infrastructure, AI inference and real‑time services.

- Telecom Data Centers: Telecom operators and network providers deploy data‑center grade semiconductors to manage network traffic, edge‑computing nodes, 5G/6G RAN consolidation and latency‑sensitive services, requiring optimized networking chips, accelerators and efficient power/analog subsystems.

Market Dynamic

Driving Factors in the Data Center Semiconductor Market

AI and workload expansion

The explosion of generative AI, deep learning, and large‑scale inference/training workloads is forcing data centers to upgrade semiconductor architectures. High‑performance GPUs, ASICs and accelerators are increasingly required for parallel compute, pushing demand for semiconductors optimized for throughput, bandwidth and power efficiency. As software models get larger and more complex, hardware must evolve rapidly, driving semiconductor adoption in compute, memory and networking.

Cloud & edge infrastructure growth

The expansion of hyperscale cloud data centers, along with the growing importance of edge computing and distributed data‑center footprints, is prompting operators to deploy more advanced semiconductors to manage latency, interconnect, power density and scalability. Telecom, IoT, and mobile workloads expanding into edge nodes further amplify demand for data‑center grade semiconductors outside conventional facilities.

Restraints in the Data Center Semiconductor Market

Node migration and manufacturing complexity

Advanced process nodes and packaging techniques (e.g., 3D stacking, chiplets) are required to deliver next‑generation performance and efficiency. However, migrating to <7nm or advanced packaging increases cost, development time and supply‑chain risk, hampering some adoption.

Supply‑chain and geopolitical constraints

The semiconductor ecosystem is subject to constrained foundry capacity, export controls, and regionalisation pressures. These factors affect availability of high‑end chips (especially GPUs and accelerators) for data centers, delaying roll‑out and increasing cost.

Opportunities in the Data Center Semiconductor Market

Specialized accelerators and domain‑specific chips

As operators seek efficiency gains and differentiation, the design and deployment of ASICs and disaggregated accelerator chips tailored to workloads (e.g., inference, memory bandwidth) represent big growth opportunities for chipset vendors.

Memory/compute disaggregation and interconnect innovation

Emerging architectures such as CXL (Compute Express Link), memory pooling, high‑bandwidth memory (HBM), photonic interconnects and modular data‑center racks create opportunities for new semiconductor solutions across memory, networking and power domains.

Trends in the Data Center Semiconductor Market

Shift toward heterogeneous compute and accelerators

Traditional CPU‑centric architectures are giving way to heterogeneous systems incorporating GPUs, FPGAs, ASICs and AI‑specific accelerators for higher efficiency in data‑center workloads, particularly AI.

Packaging and chip‑let integration rising

To meet performance/per‑watt demands and reduce costs, advanced packaging (3D stacking, chiplets, integrated interposers) is becoming more mainstream in data‑centre semiconductors. This enables faster deployment of highly‑customised semiconductor modules for AI clusters and high‑density racks.

Impact of Artificial Intelligence in Data Center Semiconductor Market

- AI demands are driving the need for highly‑parallel processing architectures in data‑centers, increasing GPU/accelerator adoption.

- AI workloads are creating memory bandwidth bottlenecks, pushing adoption of high‑bandwidth memory (HBM) and memory‐centric semiconductors.

- AI inference at scale is motivating deployment of domain‑specific ASICs optimized for TOPS‑per‑watt in data‑centers.

- AI and ML monitoring systems are enabling smarter power‑management and cooling subsystems in data centres, raising demand for power & analog semiconductors optimized for dynamic loads.

- AI driven architecture changes (e.g., disaggregation, CXL fabric, heterogeneous computing) are reshaping the semiconductor product roadmap in compute, networking and memory domains.

Research Scope and Analysis

By Component Type Analysis

In 2025, processors account for 43.5% of the total data center semiconductor market, reflecting their indispensable role in powering compute-intensive operations. The category includes CPUs for general-purpose compute, GPUs for parallel workloads, ASICs for specialized tasks like AI inference, and FPGAs for workload flexibility. Hyperscale and enterprise data centers rely on these chips to handle cloud services, AI training, virtualization, and container orchestration.

CPUs remain the anchor of server systems due to their architecture compatibility and consistent performance. Simultaneously, GPUs and AI accelerators are being widely adopted to support growing machine learning demands, particularly in sectors such as healthcare, finance, and research. The deployment of AI-specific ASICs further strengthens processor dominance, offering optimized power and compute performance. Processor innovation is also being driven by the adoption of advanced packaging and chiplet designs, which allow for modular scalability and efficiency. This evolution reinforces processors' position as the foundational layer in modern data center infrastructure.

Memory is the fastest-growing segment within data center semiconductors, driven by the explosion of data and increasing demand for higher storage speed and lower latency. DRAM is essential for in-memory processing and high-throughput environments like analytics and AI, where rapid data access is critical. NAND Flash is replacing traditional storage technologies due to its non-volatility, density, and fast response times, especially in NVMe-based storage systems. High-bandwidth memory (HBM) is gaining traction for AI/ML workloads that require simultaneous high-speed data streams.

Furthermore, innovations in persistent memory are enabling hybrid solutions that bridge the gap between DRAM and storage, enhancing performance in caching, edge compute, and real-time data analytics. Data centers are now outfitted with increased memory per server to support more applications simultaneously. This shift in architecture—coupled with AI models growing exponentially in size—is driving rapid memory innovation, making it a central investment area for hyperscalers and enterprises alike.

By Function Analysis

The compute function leads the data center semiconductor market with an estimated 46.2% share in 2025. This segment encompasses the processors and memory elements that execute and support critical workloads, including AI model training, big data analytics, and virtualized computing. Data centers are investing heavily in scalable compute infrastructures, with an emphasis on high-performance processors and tightly integrated memory systems. AI and HPC workloads require massive parallel processing, which fuels demand for CPUs, GPUs, and custom accelerators.

This, in turn, is driving innovations in server architecture, thermal design, and power delivery. With applications growing more complex, compute hardware must deliver better performance per watt while maintaining responsiveness and uptime. Moreover, the transition to heterogeneous compute environments where multiple types of processors work in tandem—is reshaping how compute functions are fulfilled. As cloud service providers expand their offerings, compute remains the most critical and resource-intensive function in data center operations.

Networking is the fastest-growing function segment in 2025, powered by increasing demand for data movement between compute nodes, storage units, and cloud edges. The rise of distributed computing, real-time applications, and data-heavy AI workloads necessitates faster, more reliable interconnects. This includes deployment of 200G and 400G Ethernet, InfiniBand for HPC environments, and smart NICs for offloading network functions from CPUs. Networking semiconductors play a vital role in reducing bottlenecks and latency, especially as data centers move toward software-defined and composable infrastructure.

Additionally, the shift to edge computing and hybrid cloud models is driving the need for secure, programmable, and high-bandwidth network chips. These semiconductors support features such as packet inspection, congestion control, and routing intelligence that are essential for maintaining high throughput and service reliability. With workloads becoming increasingly dynamic and distributed, advanced networking silicon is foundational to ensuring seamless data flow within and between modern data centers.

By Technology Node Analysis

In 2025, the 14nm technology node leads the market with a share of 41.8%, mainly due to its maturity, reliability, and cost-effectiveness for mainstream server components. Many CPUs, controllers, analog ICs, and networking chips continue to be manufactured on this node, as it balances performance and yield stability. While not suitable for the most advanced AI chips, 14nm remains optimal for I/O-heavy and general-purpose processing tasks. The long-standing infrastructure and manufacturing scalability at this node also make it a preferred choice for vendors seeking predictable output at high volumes.

Additionally, the design ecosystem for 14nm is well-established, allowing faster time to market. Data centers that do not require bleeding-edge compute power still rely on 14nm components to meet service-level agreements efficiently. Its continued use reflects the diverse needs of modern data centers, where not all workloads demand the highest processing density but still require dependable and cost-effective semiconductor performance.

Sub-7nm nodes are the fastest-growing technology segment as demand intensifies for more powerful and energy-efficient chips. AI accelerators, high-performance GPUs, and custom ASICs for data center use are increasingly being designed at these advanced nodes. Chips at this level deliver significantly higher transistor density, better performance-per-watt, and superior integration capabilities—ideal for handling complex AI inference, real-time analytics, and dynamic multi-tenant workloads.

Furthermore, chiplet architectures and advanced packaging are commonly integrated at <7nm, allowing for modular, high-bandwidth designs. These nodes are central to supporting energy-aware computing and achieving lower operational costs at scale. Data centers aiming to differentiate through performance and efficiency are fast-tracking the adoption of <7nm-based hardware. Although manufacturing at these nodes is more capital-intensive, the performance gains justify the investment for hyperscalers and AI-focused service providers. This transition is reshaping the semiconductor supply chain and spurring innovation across foundries, design tools, and thermal management systems.

By Application Analysis

Hyperscale data centers dominate the market in 2025, with approximately 48.9% of semiconductor demand. These massive facilities operated by tech giants and cloud providers require continuous upgrades in processing, memory, storage, and networking capabilities to meet exponential workload growth. From hosting AI applications to running SaaS platforms, hyperscale environments demand the highest density, speed, and energy efficiency. As a result, they consume large volumes of CPUs, GPUs, memory modules, smart NICs, and power-efficient chips.

Custom silicon development is also a key trend in this segment, allowing hyperscalers to optimize infrastructure for proprietary workloads. These players typically lead in early adoption of new technology nodes and chip architectures. Their scale gives them the leverage to influence design standards and semiconductor supply chains globally. The dominance of hyperscale data centers reflects both the centralization of computing resources and the global shift to cloud-first IT models across industries.

Cloud Service Providers (CSPs) are the fastest-growing end-user category, driven by rapid digital transformation and the shift toward scalable, on-demand infrastructure. Unlike hyperscalers that build and operate massive data centers for internal use, CSPs provide platforms and services to a broad range of enterprise, government, and SMB customers.

This requires flexible, modular, and cost-efficient semiconductor solutions that can support diverse workloads from simple web hosting to complex AI model deployment. CSPs are expanding globally, building regional data centers to address latency, compliance, and data sovereignty requirements. This growth is pushing demand for compute, memory, storage, and networking chips tailored for multitenant environments.

Additionally, CSPs are increasingly deploying AI-as-a-Service (AIaaS), boosting the need for accelerators and high-bandwidth memory components. The scalability and configurability of CSP platforms create significant opportunities for semiconductor vendors, especially in areas like power management, virtualization hardware, and advanced network interconnects.

The Data Center Semiconductor Market Report is segmented on the basis of the following:

By Component Type

- Processors

- Memory

- Storage Controllers

- Networking Chips

- Power Management ICs

- Analog & Mixed-Signal Semiconductors

By Function

- Compute

- Storage

- Networking

- Power Management

- Security

By Technology Node

By Application

- Hyperscale Data Centers

- Enterprise Data Centers

- Cloud Service Providers

- Telecom Data Centers

Regional Analysis

Leading Region in the Data Center Semiconductor Market

North America stands as the leading region in the data center semiconductor market in 2025, accounting for approximately 41.2% of the global share. This dominance is anchored by the presence of major hyperscale cloud providers, AI research hubs, and advanced semiconductor firms. The region hosts some of the world’s largest data centers, operated by cloud and tech giants, driving continuous investment in cutting-edge chips for compute, memory, networking, and storage.

North American data centers are also among the first to adopt AI accelerators, sub-7nm processors, and custom-designed silicon tailored for specific workloads. Government support for domestic semiconductor manufacturing and research initiatives further strengthens the region’s ecosystem. Moreover, early adoption of edge computing, hybrid cloud models, and modular data centers fuels consistent demand across all semiconductor functions. The combination of scale, technological maturity, and aggressive innovation makes North America the central hub for global data center semiconductor consumption and development.

Fastest Growing Region in the Data Center Semiconductor Market

Asia Pacific is the fastest-growing region in the global data center semiconductor market, driven by rapid digital transformation, rising cloud adoption, and increasing investments in hyperscale and telecom data centers. Countries like China, India, South Korea, and Singapore are expanding their data infrastructure to meet growing demand from AI services, 5G, and data localization policies.

This regional expansion is prompting aggressive deployment of advanced processors, memory technologies, and networking silicon across both cloud-native and enterprise facilities. Additionally, the region benefits from a strong semiconductor manufacturing base, making it well-positioned to scale production of both mature and advanced node chips. The convergence of local demand and production capability creates a highly dynamic market landscape. Governments in Asia Pacific are also incentivizing local semiconductor innovation and infrastructure expansion, further accelerating growth.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape in the data‑center semiconductor market is characterized by major manufacturers of processors, memory and networking semiconductors, as well as niche accelerator and power/analog suppliers. Leading semiconductor firms design and supply server CPUs, GPUs, and accelerators for hyperscale cloud data‑centers, often in collaboration with cloud service providers and foundries. Specialist chip firms focus on domain‑specific accelerators and high‑bandwidth memory or networking silicon. Further, differentiation is highly driven by software/hardware co‑design, memory/interconnect innovations, power optimization, and the ability to serve emerging workloads such as AI training/inference, disaggregated data‑centers, and edge deployments.

Some of the prominent players in the global Data Center Semiconductor are:

- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

- Broadcom Inc.

- Qualcomm Technologies Inc.

- Samsung Electronics Co., Ltd.

- Micron Technology, Inc.

- SK hynix Inc.

- Taiwan Semiconductor Manufacturing Company (TSMC)

- Marvell Technology, Inc.

- Texas Instruments Incorporated

- Infineon Technologies AG

- Analog Devices, Inc.

- NXP Semiconductors N.V.

- Microchip Technology Inc.

- Renesas Electronics Corporation

- Western Digital Corporation

- Kioxia Corporation

- Seagate Technology Holdings plc

- Arm Holdings plc

- IBM Corporation

- Other Key Players

Recent Developments

- In October 2025, NVIDIA and TSMC unveiled the first “Blackwell” AI‑chip wafer manufactured in the United States, marking a milestone in on‑shore advanced‑node chip production and reinforcing alignment of AI, data-center acceleration, and domestic manufacturing.

- In June 2025, GlobalFoundries announced a raised investment plan (capital expenditures and R&D) to support emerging semiconductor technologies critical for data-center infrastructure, including advanced packaging and silicon photonics.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 252.2 Bn |

| Forecast Value (2034) |

USD 1,613.9 Bn |

| CAGR (2025–2034) |

22.9% |

| The US Market Size (2025) |

USD 87.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component Type (Processors, Memory, Storage Controllers, Networking Chips, Power Management ICs, and Analog & Mixed-Signal Semiconductors), By Function (Compute, Storage, Networking, Power Management, and Security), By Technology Node (< 7nm, 7nm – 14nm, and 14nm), By Application (Hyperscale Data Centers, Enterprise Data Centers, Cloud Service Providers, and Telecom Data Centers) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation, Broadcom Inc., Qualcomm Technologies Inc., Samsung Electronics Co., Ltd., Micron Technology, Inc., SK hynix Inc., Taiwan Semiconductor Manufacturing Company (TSMC), Marvell Technology, Inc., Texas Instruments Incorporated, Infineon Technologies AG, Analog Devices, Inc., NXP Semiconductors N.V., Microchip Technology Inc., Renesas Electronics Corporation, Western Digital Corporation, Kioxia Corporation, Seagate Technology Holdings plc, Arm Holdings plc, IBM Corporation, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Data Center Semiconductor Market size is expected to reach a value of USD 252.2 billion in 2025 and is expected to reach USD 1,613.9 billion by the end of 2034.

North America is expected to have the largest market share in the Global Data Center Semiconductor Market, with a share of about 41.2% in 2025.

The Data Center Semiconductor Market in the US is expected to reach USD 87.0 billion in 2025.

Some of the major key players in the Global Data Center Semiconductor Market are Intel, TSMC, Micron, and others

The market is growing at a CAGR of 22.9 percent over the forecasted period.