Market Overview

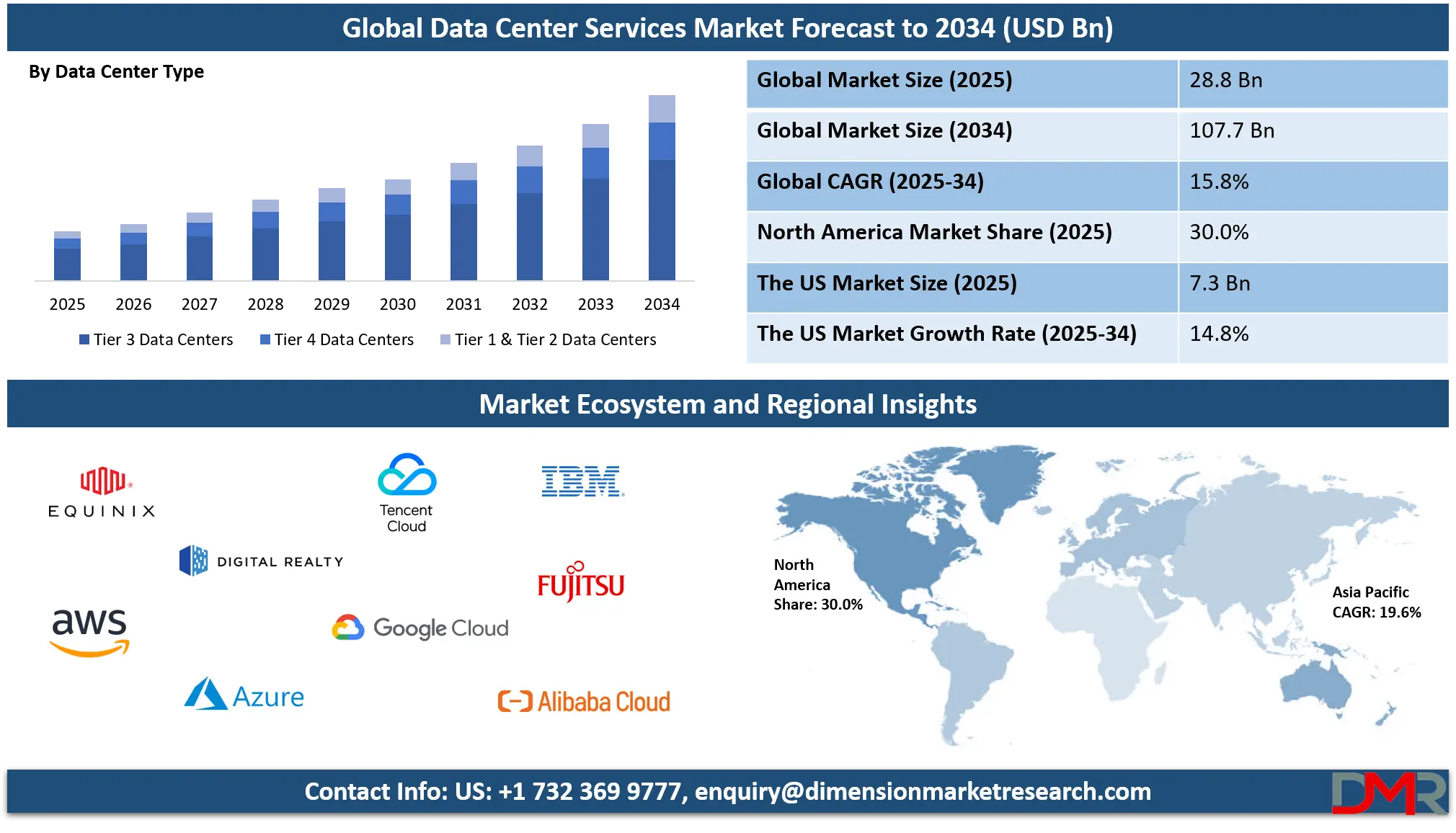

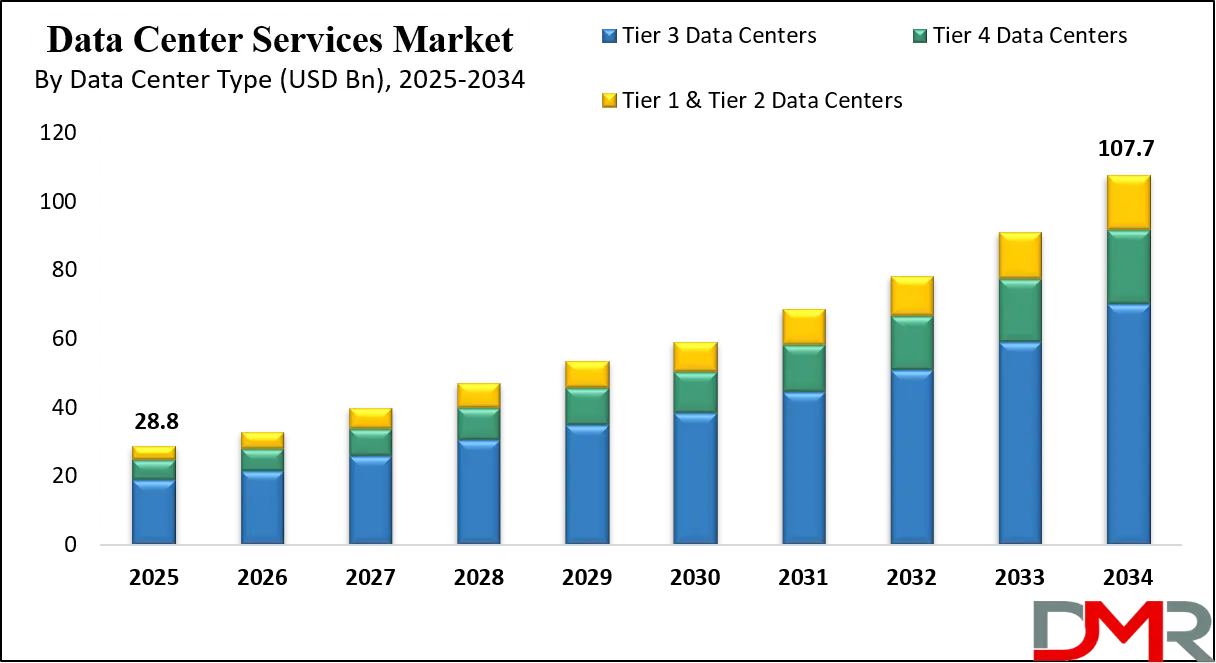

The global data center services market is projected to reach USD 28.8 billion in 2025 and is expected to expand to USD 107.7 billion by 2034, registering a CAGR of 15.8%. This growth is driven by increasing cloud adoption, rising demand for colocation services, expansion of hyperscale facilities, and accelerating digital transformation across IT, telecom, BFSI, healthcare, and government sectors.

Data center services refer to the comprehensive range of solutions and support provided to manage, maintain, and optimize data centers which act as the backbone of digital infrastructure. These services include colocation, managed hosting, cloud-based virtual data centers, network management, security, and professional consulting to ensure uninterrupted operations of critical IT systems.

They enable organizations to efficiently store, process, and safeguard data while improving scalability, reducing downtime, and ensuring compliance with international standards and security frameworks. By offering both physical infrastructure management and advanced digital solutions, data center services allow enterprises to focus on core business functions while relying on trusted providers for infrastructure reliability and technological agility.

The global data center services market represents the ecosystem of providers, technologies, and industries driving demand for outsourced IT infrastructure management across regions. This market has grown significantly due to rising adoption of cloud computing, big data analytics, artificial intelligence, and the Internet of Things, which all require vast amounts of secure data storage and processing. Enterprises across IT and telecom, BFSI, healthcare, manufacturing, and government are increasingly relying on managed services and colocation providers to reduce operational costs while achieving higher reliability and compliance with global standards.

In addition, the market is fueled by the expansion of hyperscale data centers, increasing digital transformation initiatives, and the need for sustainable green data centers to reduce energy consumption. Emerging economies in Asia Pacific and the Middle East are witnessing rapid investments in digital infrastructure, further reshaping the competitive landscape. With strong growth opportunities in cloud-based services and hybrid data center models, the global data center services market continues to evolve as a cornerstone of enterprise IT strategy and a critical enabler of the modern digital economy.

The US Data Center Services Market

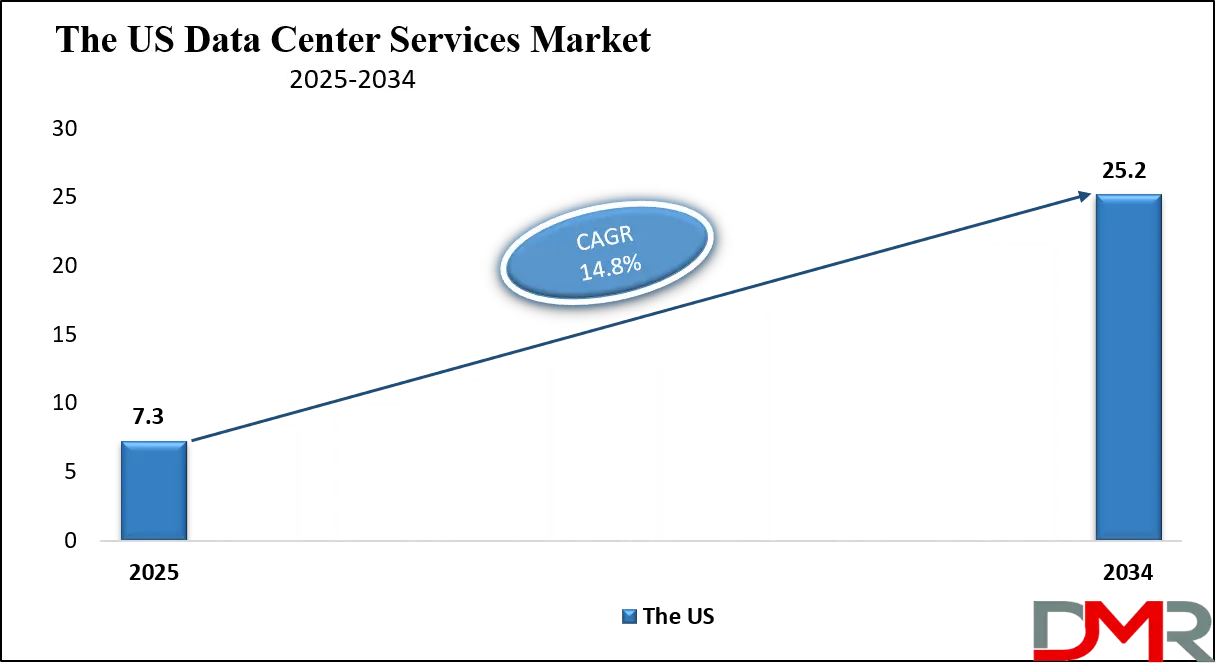

The U.S. Data Center Services market size is projected to be valued at USD 7.3 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 25.2 billion in 2034 at a CAGR of 14.8%.

The US data center services market stands as one of the most advanced and mature ecosystems globally, supported by a dense concentration of hyperscale data centers, colocation providers, and cloud service giants such as Amazon Web Services, Microsoft Azure, and Google Cloud. The country benefits from robust digital infrastructure, high internet penetration, and strong enterprise adoption of hybrid and multi cloud strategies, which continue to drive demand for managed hosting, network management, and professional consulting services.

The presence of technology hubs in regions like Northern Virginia, Silicon Valley, and Dallas makes the US a global leader in colocation capacity, with enterprises leveraging these facilities to reduce latency, enhance scalability, and ensure data security. Furthermore, increasing demand for data sovereignty, compliance with regulatory frameworks, and investments in advanced cybersecurity solutions are reinforcing the importance of managed and outsourced services within the US market.

The expansion of the US data center services industry is further fueled by the exponential rise in big data analytics, artificial intelligence, and Internet of Things applications, which require vast computational power and reliable storage infrastructure. Hyperscale facilities continue to dominate the landscape, while the increasing shift toward green and energy efficient data centers highlights a major trend in sustainability.

The healthcare and BFSI sectors in particular are accelerating investments in colocation and cloud based data centers to support digital health initiatives and real time financial transactions. With enterprises prioritizing operational resilience, disaster recovery, and edge computing adoption, the US data center services market remains at the forefront of global innovation and is expected to maintain its leadership position as demand for low latency, secure, and scalable IT infrastructure intensifies.

Europe Data Center Services Market

The Europe data center services market is projected to reach a value of approximately USD 5.7 billion in 2025, reflecting steady growth driven by increasing digital transformation initiatives across the region. Enterprises are increasingly adopting cloud computing, hybrid IT strategies, and colocation services to enhance operational efficiency, scalability, and data security. Strong demand from key sectors such as IT and telecommunications, BFSI, healthcare, and government is further supporting market expansion. Countries like the UK, Germany, France, and the Netherlands are leading investments in hyperscale facilities, edge data centers, and high-performance computing infrastructure to accommodate increasing enterprise workloads and ensure regulatory compliance.

The market in Europe is expected to grow at a compound annual growth rate of 10.0%, fueled by the rising adoption of AI, big data analytics, and Internet of Things applications. Green and energy-efficient data center initiatives are also gaining momentum as enterprises and providers focus on sustainability and operational cost optimization. Increasing demand for disaster recovery solutions, low-latency edge computing, and managed services is further driving the adoption of modern data center solutions. The combination of technological innovation, regulatory support, and digital transformation initiatives positions Europe as a key growth region within the global data center services landscape.

Japan Data Center Services Market

The Japan data center services market is projected to reach approximately USD 0.7 billion in 2025, driven by the country’s rapid digital transformation and increasing adoption of cloud computing and managed IT services. Enterprises across IT and telecommunications, BFSI, and healthcare sectors are increasingly leveraging colocation, virtual data center, and hybrid cloud solutions to enhance operational efficiency, ensure data security, and support business continuity. The country’s focus on advanced technologies such as artificial intelligence, big data analytics, and IoT applications is creating strong demand for high-performance computing infrastructure and low-latency data center services.

The Japanese market is expected to grow at a robust compound annual growth rate of 12.4%, fueled by investments in hyperscale and edge data centers, as well as initiatives to improve energy efficiency and sustainability. Government programs supporting digital transformation, smart cities, and 5G network deployment are further accelerating demand for modern data center solutions.

Additionally, enterprises are increasingly prioritizing disaster recovery, compliance with data protection regulations, and scalable infrastructure to support AI-driven workloads and real-time analytics, making Japan a rapidly expanding segment within the global data center services market.

Global Data Center Services Market: Key Takeaways

- Market Value: The global Data Center Services market size is expected to reach a value of USD 107.7 billion by 2034 from a base value of USD 28.8 billion in 2025 at a CAGR of 15.8%.

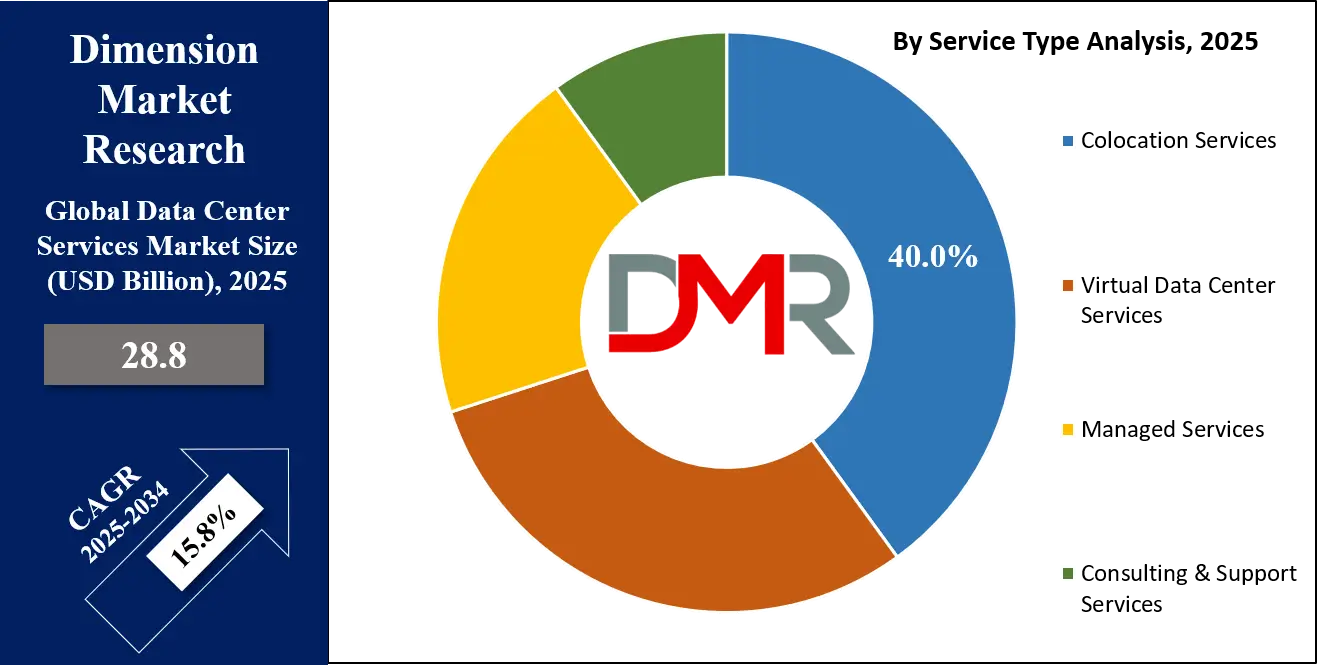

- By Service Type Analysis: Colocation Services are anticipated to dominate the service type segment, capturing 40.0% of the total market share in 2025.

- By Data Center Type Segment Analysis: Tier 3 Data Centers are expected to maintain their dominance in the data center type segment, capturing 65.0% of the total market share in 2025.

- By End-Use Industry Segment Analysis: The IT & Telecommunications industry will account for the maximum share in the end-use industry segment, capturing 30.0% of the total market value.

- Regional Analysis: Asia Pacific is anticipated to lead the global Data Center Services market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Data Center Services market include Equinix, Digital Realty Trust, Amazon Web Services (AWS), Microsoft Corporation (Azure), Google LLC (Google Cloud), Alibaba Cloud, Tencent Cloud, IBM Corporation, Fujitsu Limited, NTT Communications, Hewlett Packard Enterprise (HPE), Dell Technologies, Cisco Systems, Vertiv Co., Singtel (Singapore Telecommunications), Iron Mountain, and Others.

Global Data Center Services Market: Use Cases

- Cloud Migration and Hybrid IT Optimization: Enterprises across industries are increasingly adopting cloud migration strategies to modernize legacy systems and achieve operational agility. Data center services support seamless migration to public, private, or hybrid cloud models, enabling organizations to balance cost efficiency, performance, and compliance requirements. With managed hosting and colocation services, businesses reduce downtime, ensure secure workload management, and scale resources as demand fluctuates.

- AI and Big Data Analytics Enablement: The rise of artificial intelligence, machine learning, and big data analytics requires vast compute power and reliable infrastructure. Data center services offer high-performance storage, low-latency networks, and advanced cooling systems to manage massive volumes of structured and unstructured data. This enables enterprises to accelerate data-driven decision making, improve predictive analytics, and support complex applications in sectors such as BFSI, healthcare, and retail.

- Business Continuity and Disaster Recovery: Organizations are increasingly focused on resilience and risk management to protect against system failures, cyber threats, or natural disasters. Data center services deliver disaster recovery solutions, backup management, and redundant power systems to ensure uninterrupted business operations. Enterprises use these services to comply with industry regulations, protect sensitive customer data, and safeguard critical IT assets, reducing the risk of costly downtime.

- Edge Computing and Low Latency Applications: With the rapid growth of IoT, 5G, and real time digital services, edge computing has become a critical use case for data center services. Providers are deploying edge data centers closer to end users to minimize latency and improve application performance. This supports use cases such as autonomous vehicles, smart cities, remote healthcare, and immersive entertainment experiences, where milliseconds in data processing can significantly impact outcomes.

Impact of Artificial Intelligence on the global Data Center Services market

The integration of artificial intelligence is profoundly transforming the global data center services market by driving demand for high-performance computing, advanced storage solutions, and intelligent network management. AI workloads require massive computational power, low-latency networks, and efficient cooling systems, which is encouraging enterprises to leverage hyperscale data centers and cloud-based services.

Data center providers are increasingly offering AI-optimized infrastructure, including GPU-enabled servers and automated resource allocation, to support machine learning models, deep learning algorithms, and big data analytics. This shift is enabling organizations across IT, BFSI, healthcare, and manufacturing sectors to accelerate innovation, improve operational efficiency, and gain real-time insights from large datasets.

Artificial intelligence is also influencing operational and energy management within data centers. Predictive maintenance, automated monitoring, and intelligent workload distribution are reducing downtime and improving overall reliability while optimizing energy consumption. AI-powered analytics help operators anticipate hardware failures, balance server loads, and enhance security through anomaly detection, contributing to sustainable and resilient data center operations. As AI adoption grows globally, data center services are evolving into more intelligent, adaptive, and scalable solutions, further reinforcing their critical role in enterprise digital transformation and the broader digital economy.

Global Data Center Services Market: Stats & Facts

United States (Source: U.S. Department of Energy, 2023–2025)

- 2023: U.S. data centers consumed approximately 176 terawatt-hours (TWh) of electricity, about 4.4% of the nation’s total electricity usage.

- 2024: DOE projects electricity demand from U.S. data centers could rise to 325–580 TWh by 2028 due to growing digital workloads.

- 2025: Data centers are expected to account for 6.7–12% of total U.S. electricity consumption by 2028.

China (Source: Ministry of Industry and Information Technology, 2023–2025)

- 2023: Over 7,000 data centers in China operated at an average utilization rate of 20–30%.

- 2025: China’s “Eastern Data, Western Computing” initiative redistributes computing power to balance load across regions.

Brazil (Source: Brazilian Ministry of Science, Technology, and Innovation, 2025)

- 2025: Brazil implemented tax exemptions on IT capital equipment to attract data center investments and digital infrastructure projects.

United Kingdom (Source: UK Government Department for Digital, Culture, Media & Sport, 2025)

- 2025: The UK supports investments in data center infrastructure, including Google’s £5 billion investment in new facilities to enhance cloud and AI services.

European Union (Source: Eurostat, 2023–2025)

- 2023: Enterprise cloud adoption across the EU increased by 4.2% compared to 2021.

- 2025: EU member states have introduced regulations to improve energy efficiency in large-scale data centers.

Germany (Source: Federal Ministry for Economic Affairs and Climate Action, 2025)

- 2025: Germany promotes hyperscale and green data centers as part of national digital transformation initiatives.

India (Source: Ministry of Electronics and Information Technology, 2025)

- 2025: India is expected to lead Asia-Pacific in new data center deployments due to digitalization and local cloud initiatives.

Global Data Center Services Market: Market Dynamics

Global Data Center Services Market: Driving Factors

Rapid Cloud Adoption and Digital Transformation

The increasing adoption of cloud computing, hybrid IT, and enterprise digital transformation initiatives is a key driver for the data center services market. Organizations are increasingly outsourcing IT infrastructure, leveraging colocation and managed hosting services to scale operations, reduce capital expenditures, and enhance data security. This trend is particularly strong in sectors like IT, BFSI, healthcare, and e-commerce, where the need for scalable, resilient, and compliant infrastructure is critical for business continuity and competitive advantage.

Demand for High-Performance Computing and AI Workloads

The proliferation of artificial intelligence, machine learning, and big data analytics is driving demand for high-performance computing capabilities within data centers. Enterprises require GPU-enabled servers, low-latency networks, and advanced storage solutions to manage large-scale AI workloads efficiently. Data center services are evolving to offer AI-optimized infrastructure, automated resource allocation, and predictive analytics, enabling organizations to accelerate decision-making, enhance operational efficiency, and gain real-time insights from large datasets.

Global Data Center Services Market: Restraints

High Capital Expenditure and Operational Costs

Setting up and maintaining data centers involves significant capital investment in physical infrastructure, networking equipment, cooling systems, and security frameworks. Additionally, operational costs, including energy consumption and skilled workforce requirements, can constrain market growth, particularly for small and medium-sized enterprises that may prefer cloud-based alternatives or shared colocation facilities over fully managed private data centers.

Regulatory Compliance and Data Sovereignty Challenges

Stringent data protection regulations, such as GDPR in Europe and CCPA in the United States, create compliance challenges for data center service providers. Ensuring data privacy, cross-border data transfer security, and adherence to industry-specific standards adds complexity and cost, potentially restraining market expansion, especially in regions with evolving regulatory frameworks.

Global Data Center Services Market: Opportunities

Expansion in Emerging Economies

Rapid digitalization and infrastructure investments in emerging economies such as India, Brazil, and the Middle East present significant growth opportunities. Enterprises and government organizations in these regions are adopting cloud services, colocation, and managed hosting solutions, creating demand for modern data centers. Providers can capitalize on this growth by offering scalable, energy-efficient, and compliant infrastructure tailored to local market requirements.

Green Data Centers and Sustainable Infrastructure

The increasing focus on sustainability and energy efficiency is driving the development of green data centers. Providers are investing in renewable energy, advanced cooling technologies, and energy-efficient server designs to reduce carbon footprints. This not only addresses environmental concerns but also attracts environmentally conscious enterprises seeking sustainable and cost-effective IT infrastructure solutions.

Global Data Center Services Market: Trends

Rise of Edge Computing and Low-Latency Services

Edge computing is reshaping the data center services market by moving computational resources closer to end users. This reduces latency, enhances real-time processing, and supports applications such as autonomous vehicles, IoT networks, remote healthcare, and immersive entertainment. Data center providers are investing in edge facilities and micro data centers to address these evolving demands.

Integration of AI and Automation in Data Center Operations

AI-driven automation is increasingly being adopted to optimize resource allocation, predict hardware failures, and enhance energy management. Intelligent monitoring systems, predictive maintenance, and AI-powered analytics improve operational efficiency and reduce downtime. These innovations are enabling data centers to deliver smarter, scalable, and more resilient infrastructure while supporting enterprise digital transformation strategies globally.

Global Data Center Services Market: Research Scope and Analysis

By Service Type Analysis

Colocation services are expected to lead the service type segment in the global data center services market, accounting for approximately 40% of the total market share in 2025. This dominance is driven by enterprises’ increasing preference to outsource physical IT infrastructure, allowing them to reduce capital expenditures, improve scalability, and ensure high availability of critical systems. Colocation facilities provide secure, managed environments with redundant power, cooling, and network connectivity, enabling organizations to focus on core business operations while benefiting from operational resilience and compliance with international standards. The increasing adoption of hybrid IT strategies and demand for reliable disaster recovery solutions further reinforce the prominence of colocation services in the market.

Virtual data center services, on the other hand, are gaining significant traction as businesses increasingly embrace cloud-based infrastructure solutions. These services allow organizations to deploy, manage, and scale virtual servers, storage, and networking resources without investing in physical hardware, offering greater flexibility and cost efficiency.

Virtual data center services support hybrid and multi-cloud architectures, enabling seamless workload migration and optimized resource utilization. With rising adoption of artificial intelligence, big data analytics, and enterprise digital transformation initiatives, virtual data center services are becoming a critical component of modern IT infrastructure, complementing traditional colocation offerings and driving overall market growth.

By Data Center Type Analysis

Tier 3 data centers are expected to maintain their dominance in the data center type segment, capturing around 65% of the total market share in 2025. Their prominence is driven by a balance of reliability, performance, and cost-efficiency that appeals to a wide range of enterprises across IT, BFSI, healthcare, and government sectors. Tier 3 facilities provide high availability with redundant power and cooling systems, enabling continuous operations even during maintenance or component failures. They support critical workloads, disaster recovery, and business continuity initiatives, making them the preferred choice for organizations seeking dependable infrastructure without the extremely high investment required for Tier 4 facilities.

Tier 4 data centers, while holding a smaller share of the market, are increasingly adopted for mission-critical applications requiring the highest levels of redundancy, fault tolerance, and uptime. These facilities feature fully fault-tolerant systems, multiple active power and cooling distribution paths, and advanced security measures to ensure zero unplanned downtime. Tier 4 data centers are essential for hyperscale enterprises, financial institutions, and government agencies that demand maximum operational resilience. Although they involve higher capital and operational expenditures, their ability to guarantee continuous service and support sophisticated workloads positions them as a increasing segment in the global data center services market.

By End-Use Industry Analysis

The IT and telecommunications industry is expected to account for the largest share in the end-use industry segment, capturing approximately 30% of the total market value. This dominance is driven by the sector’s extensive reliance on data-intensive operations, cloud services, and network management solutions. Enterprises in this segment require robust and scalable infrastructure to support digital services, high-speed connectivity, and large-scale data storage.

The increasing adoption of artificial intelligence, big data analytics, and hybrid IT strategies further fuels demand for colocation, managed hosting, and virtual data center services. Continuous investment in network expansion, cybersecurity, and disaster recovery also reinforces the sector’s significant contribution to the overall market.

The banking, financial services, and insurance (BFSI) sector represents another key end-use segment, leveraging data center services to manage sensitive financial data, ensure regulatory compliance, and support digital banking initiatives. BFSI organizations rely on high-availability infrastructure to handle large volumes of transactions, implement real-time analytics, and enable secure online services.

Colocation and cloud-based solutions help these enterprises optimize operational costs while maintaining data integrity and reducing downtime. With the increasing digitization of financial services, increasing adoption of fintech solutions, and rising demand for risk management and fraud detection systems, the BFSI segment continues to be a strong driver of growth in the global data center services market.

The Data Center Services Market Report is segmented on the basis of the following:

By Service Type

- Colocation Services

- Virtual Data Center Services

- Managed Services

- Consulting & Support Services

By Data Center Type

- Tier 3 Data Centers

- Tier 4 Data Centers

- Tier 1 & 2 Data Centers

By End-User Industry

- IT & Telecommunications

- BFSI

- Healthcare

- Manufacturing

- Government & Public Sector

- Others

Global Data Center Services Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global data center services market, capturing approximately 40% of total market revenue in 2025. This dominance is driven by rapid digital transformation, increasing adoption of cloud computing, and increasing investments in hyperscale and colocation facilities across countries such as China, India, Singapore, and Japan.

Enterprises in the region are expanding IT infrastructure to support big data analytics, artificial intelligence, and Internet of Things applications, while governments are promoting smart city initiatives and digital governance. The region’s expanding e-commerce, telecom, and BFSI sectors further contribute to strong demand for managed hosting, virtual data centers, and high-performance infrastructure, solidifying Asia Pacific’s position as the largest and fastest-increasing market globally.

Region with significant growth

The Middle East and Africa region is emerging as a high-growth market for data center services, driven by increasing digital adoption, government-led smart city initiatives, and investments in cloud infrastructure across countries such as the United Arab Emirates, Saudi Arabia, and South Africa. Enterprises and public sector organizations are adopting colocation, managed hosting, and virtual data center solutions to enhance operational efficiency, ensure data security, and support digital transformation strategies. The rising demand for low-latency edge computing, hyperscale facilities, and energy-efficient data centers further fuels market expansion, positioning the region as one of the fastest-increasing segments in the global data center services landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Center Services Market: Competitive Landscape

The global data center services market is highly competitive, characterized by the presence of major hyperscale cloud providers, colocation specialists, and managed service companies. Key players such as Equinix, Digital Realty Trust, Amazon Web Services, Microsoft Azure, Google Cloud, and Alibaba Cloud are driving innovation through investments in high-performance infrastructure, edge computing, and AI-optimized data centers. Companies are also focusing on strategic partnerships, mergers and acquisitions, and geographic expansion to strengthen their market presence and meet increasing enterprise demand.

Additionally, providers are differentiating through sustainable and energy-efficient operations, advanced security solutions, and tailored service offerings, creating a dynamic and evolving competitive environment across regions and industry verticals.

Some of the prominent players in the global Data Center Services market are:

- Equinix

- Digital Realty Trust

- Amazon Web Services (AWS)

- Microsoft Corporation (Azure)

- Google LLC (Google Cloud)

- Alibaba Cloud

- Tencent Cloud

- IBM Corporation

- Fujitsu Limited

- NTT Communications

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Cisco Systems

- Vertiv Co.

- Singtel (Singapore Telecommunications)

- Iron Mountain

- Cyxtera Technologies

- CoreSite Realty Corporation

- Capgemini SE

- Kyndryl Holdings Inc.

- Other Key Players

Global Data Center Services Market: Recent Developments

- September 2025: Equinix inaugurated its first AI-ready data center in Chennai, India, designed to support high-performance AI workloads with 800 cabinets initially and plans to scale further using liquid cooling technology.

- September 2025: Digital Realty launched its Innovation Lab to accelerate AI and hybrid cloud deployments, offering partners and customers a real-world testing environment for data center workloads.

- October 2024: Equinix announced a joint venture valued at over USD 15 billion to expand hyperscale data centers in the U.S., aiming to triple the investment capital of its xScale program.

- November 2024: Digital Realty announced the pricing of a USD 1.0 billion exchangeable senior notes offering to raise capital for acquisitions, development projects, and strategic initiatives.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 28.8 Bn |

| Forecast Value (2034) |

USD 107.7 Bn |

| CAGR (2025–2034) |

15.8% |

| The US Market Size (2025) |

USD 7.3 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Service Type (Colocation Services, Virtual Data Center Services, Managed Services, Consulting & Support Services), By Data Center Type (Tier 3 Data Centers, Tier 4 Data Centers, Tier 1 & 2 Data Centers), and By End-User Industry (IT & Telecommunications, BFSI, Healthcare, Manufacturing, Government & Public Sector, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Equinix, Digital Realty Trust, Amazon Web Services (AWS), Microsoft Corporation (Azure), Google LLC (Google Cloud), Alibaba Cloud, Tencent Cloud, IBM Corporation, Fujitsu Limited, NTT Communications, Hewlett Packard Enterprise (HPE), Dell Technologies, Cisco Systems, Vertiv Co., Singtel (Singapore Telecommunications), Iron Mountain, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |