Market Overview

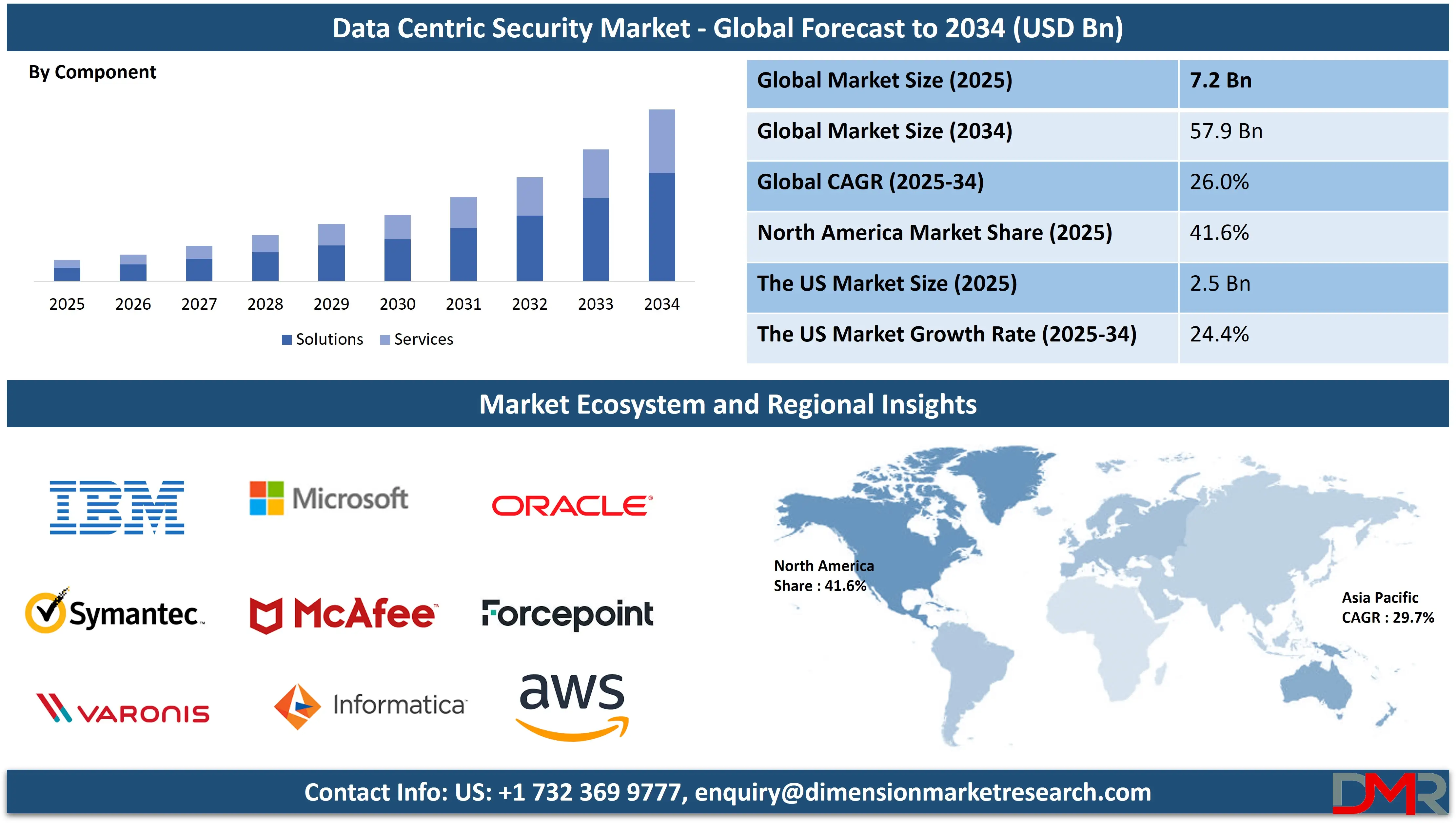

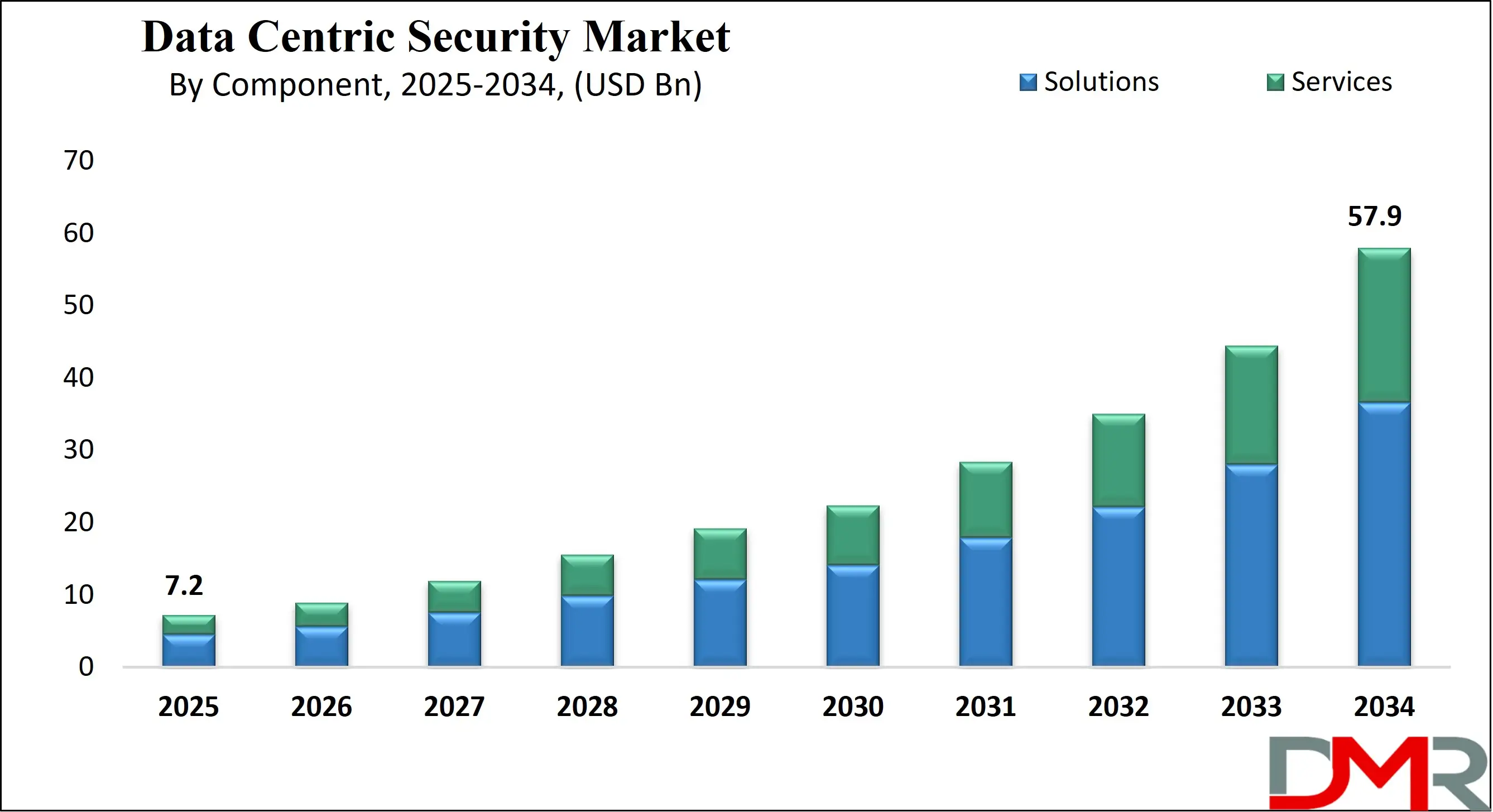

The Global Data Centric Security Market is predicted to be valued at USD 7.2 billion in 2025 and is expected to grow to USD 57.9 billion by 2034, registering a compound annual growth rate (CAGR) of 26.0% from 2025 to 2034.

Data-centric security is a security approach that focuses on protecting data itself, rather than just securing networks, servers, or applications. It ensures that data remains protected throughout its lifecycle, at rest, in transit, and in use, regardless of its location or format. This method employs technologies such as encryption, tokenization, data masking, and access controls to safeguard sensitive information.

Data-centric security enables organizations to maintain data privacy, prevent unauthorized access, and comply with regulatory requirements. It is especially critical in Cloud Storage and mobile ecosystems where data moves across boundaries, making traditional perimeter-based security ineffective.

The global data centric security market is experiencing robust growth driven by rising concerns over data breaches, cyber threats, and evolving regulatory landscapes. As organizations increasingly adopt cloud computing, big data analytics, and remote work models, traditional perimeter-based security is no longer sufficient.

Data centric security emphasizes safeguarding the data itself, irrespective of where it resides—on-premises, in transit, or in cloud environments. This approach has gained traction across industries such as banking and finance, Mobile Banking, healthcare, government, and retail, which handle large volumes of sensitive and regulated information.

The market is being shaped by the growing need for advanced data protection strategies, especially with the expansion of IoT ecosystems and mobile device usage. Key solutions in the data centric security ecosystem include data discovery and classification, encryption, tokenization, identity and access management, and data loss prevention. Integration of artificial intelligence and machine learning into security platforms has further enhanced threat detection and response capabilities.

Moreover, strict data privacy regulations like GDPR, HIPAA, and CCPA have compelled enterprises to adopt proactive security frameworks to ensure compliance and avoid penalties. The rise of zero-trust security models and secure access service edge (SASE) architectures is also promoting the adoption of data-centric security.

Vendors in this space are focusing on offering scalable, interoperable, and policy-driven security solutions that align with enterprise digital transformation initiatives. As cybersecurity threats grow more sophisticated, the demand for real-time monitoring, end-to-end encryption, and centralized data governance will continue to fuel innovation in the data centric security market, particularly in sensitive industries such as Healthcare IT Solutions and BFSI.

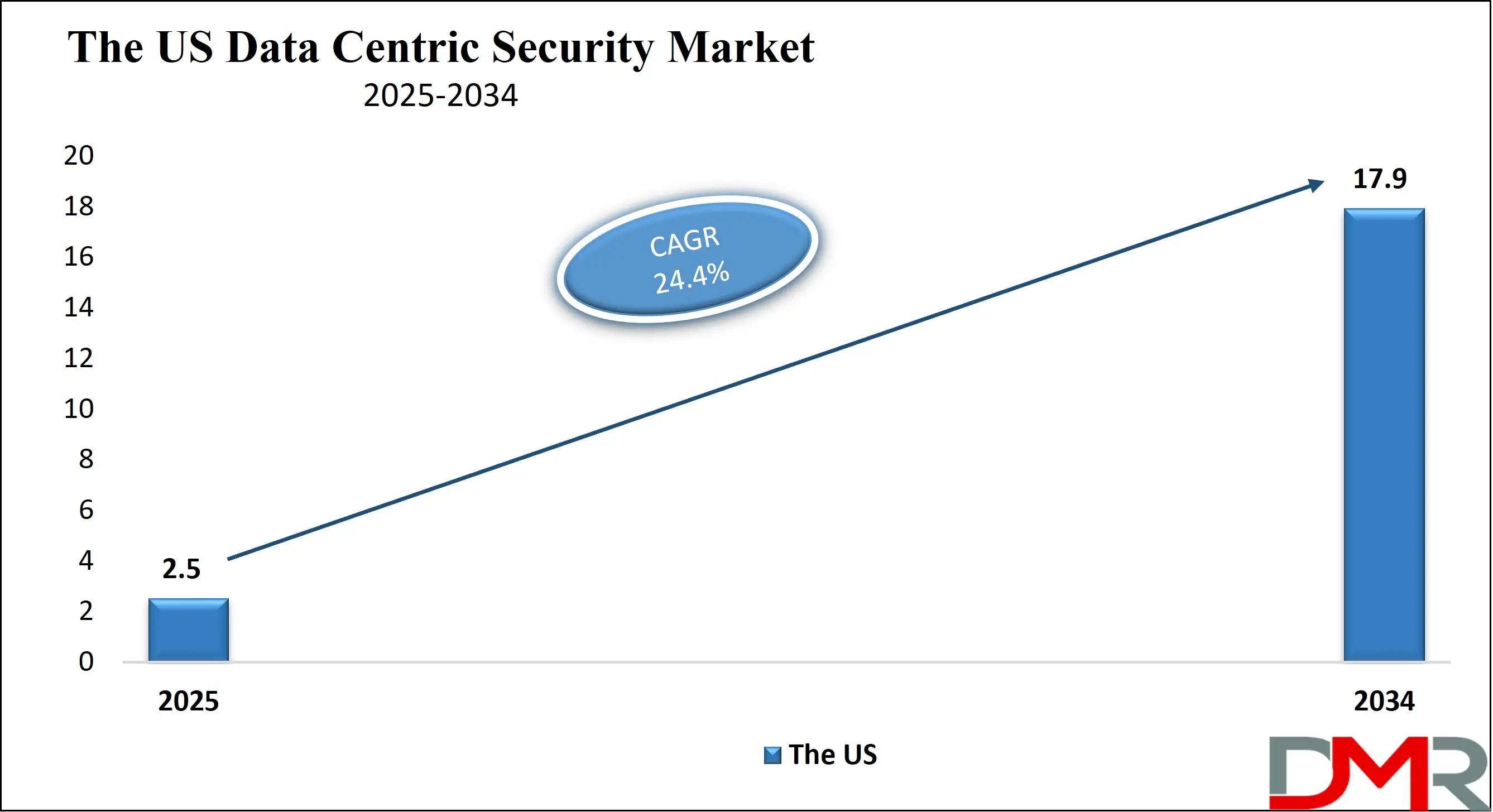

The US Data Centric Security Market

The US Data Centric Security Market is projected to be valued at USD 2.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 17.9 billion in 2034 at a CAGR of 24.4%.

The growing volume of sensitive data generated across sectors like healthcare, finance, and government is a major driver of the US data-centric security market. Increasing concerns over data breaches, insider threats, and compliance with evolving regulations such as HIPAA and CCPA have encouraged enterprises to prioritize data-level protection.

With the rapid adoption of cloud computing and hybrid IT infrastructures, businesses are focusing on encryption, tokenization, and access controls. The shift toward zero-trust architecture further accelerates the integration of data-centric security solutions, making data the primary point of control regardless of where it resides or how it moves.

A major trend in the US market is the integration of artificial intelligence and machine learning into data protection frameworks, enabling predictive threat detection and automated responses. Companies are increasingly investing in unified data visibility and classification tools that ensure consistent security across on-premises and cloud environments.

The emergence of secure data lakes and data mesh architectures is also influencing how organizations manage security at the granular level. Additionally, there is a notable rise in the adoption of encryption-as-a-service and privacy-enhancing technologies that align with stringent data governance frameworks, supporting proactive risk management.

The Japan Data Centric Security Market

The Japan Data Centric Security Market is projected to be valued at USD 0.5 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.9 billion in 2034 at a CAGR of 25.8%.

Japan's focus on data-centric security is propelled by its increasing digitalization across key industries such as manufacturing, finance, and government. The nation's strategic push toward Society 5.0, a vision integrating cyber and physical spaces, necessitates advanced data governance and protection measures.

Rising cyberattacks targeting critical infrastructure and the need to safeguard personal and corporate information have led to stronger investments in encryption, tokenization, and secure data access. Furthermore, evolving national data protection laws and guidelines, including alignment with global frameworks, are encouraging organizations to implement robust data-centric architectures.

A prominent trend in Japan is the integration of data-centric security tools with Internet of Things (IoT) frameworks, especially in sectors like smart manufacturing and healthcare. The growing reliance on cloud services by both large enterprises and SMEs has led to a surge in demand for data loss prevention and secure data access platforms.

There is also a rising emphasis on AI-powered data classification and automated policy enforcement. Japanese companies are increasingly adopting privacy-enhancing computation methods to secure data analytics processes without exposing raw data, supporting innovation while maintaining compliance.

The Europe Data Centric Security Market

The Europe Data Centric Security Market is projected to be valued at USD 1.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.3 billion in 2034 at a CAGR of 26.1%.

Strict regulatory frameworks such as the General Data Protection Regulation (GDPR) are primary drivers shaping the adoption of data-centric security solutions in Europe. Organizations are compelled to secure personal and sensitive data at all stages, at rest, in motion, and in use.

Rising cyber threats, especially from sophisticated ransomware attacks and nation-state actors, are pushing enterprises to adopt robust encryption, data masking, and identity access management tools. The growth in digital transformation and remote work trends is further intensifying the need for secure data sharing, thereby boosting demand for centralized data protection architectures.

The European market is witnessing growing adoption of privacy-first security strategies driven by regulatory compliance and consumer awareness. A key trend is the integration of blockchain and decentralized identity management solutions for data validation and access control. Organizations are leveraging data-centric policies to enhance cross-border data transfers within the EU and beyond.

Moreover, the shift toward secure data collaboration tools among enterprises and third parties reflects the increasing importance of persistent data protection. There is also a focus on developing sovereign cloud initiatives and localized encryption services to maintain control over sensitive datasets.

Data Centric Security Market: Key Takeaways

- Market Overview: The global data-centric security market is forecasted to reach a valuation of USD 7.2 billion in 2025, with expectations to grow significantly and hit USD 57.9 billion by 2034, progressing at a compound annual growth rate (CAGR) of 26.0% over the forecast period from 2025 to 2034.

- By Component Analysis: Among the components, solutions are anticipated to lead the market by the end of 2025, contributing approximately 68.4% of the total revenue share, driven by increasing adoption of data protection technologies.

- By Deployment Analysis: Cloud-based deployment is expected to be the dominant model by 2025, accounting for around 61.2% of the market share, owing to the growing shift toward scalable and cost-effective data security solutions.

- By Organization Size Analysis: Large enterprises are projected to hold the majority share of the data-centric security market by the close of 2025, representing 72.5% of the overall industry share, as they continue to invest heavily in comprehensive security infrastructure.

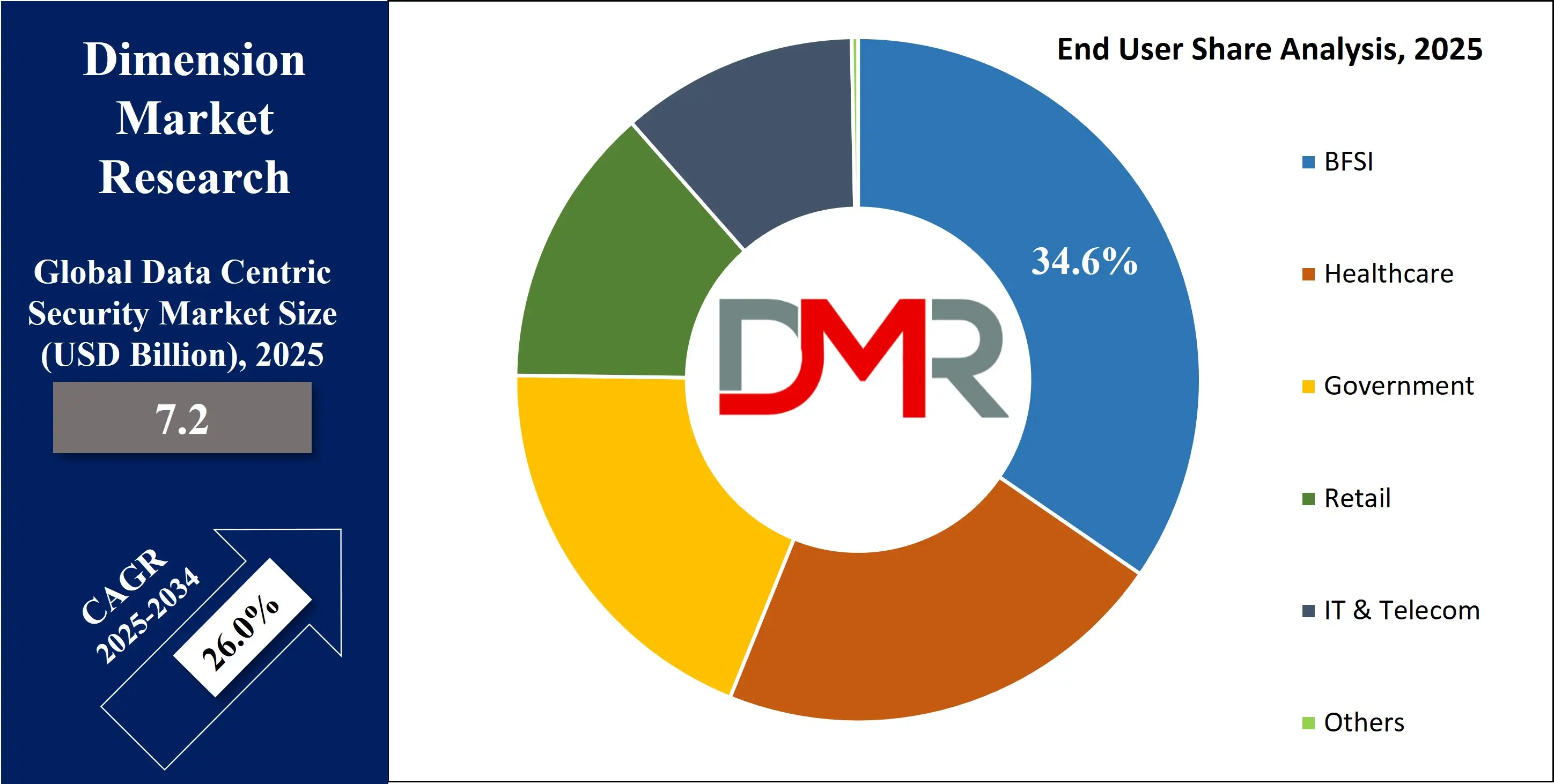

- By End User Analysis: The BFSI sector is forecasted to lead all end users in the market by 2025, making up 34.6% of the global share, driven by the need for stringent data protection and regulatory compliance.

- Region with the Largest Share: North America is expected to dominate the regional landscape of the data-centric security market in 2025, contributing the largest revenue portion with a 41.6% share, owing to advanced cybersecurity adoption and strong regulatory frameworks.

Data Centric Security Market: Use Cases

- Financial Services Compliance: Banks use data-centric security to protect sensitive customer data, including account numbers and transaction records. By encrypting data at rest and in transit, institutions ensure compliance with regulations like GDPR and PCI-DSS while preventing insider threats and breaches during interbank data transfers.

- Healthcare Record Protection: Hospitals adopt data-centric security to safeguard electronic health records (EHRs) across systems. Sensitive patient data is protected with fine-grained access controls, ensuring only authorized personnel can view or modify records, even when shared between providers or stored in cloud-based platforms.

- Remote Workforce Security: Companies with remote employees rely on data-centric security to protect corporate information across personal devices and insecure networks. Using persistent encryption and digital rights management, organizations maintain control over confidential files regardless of device, location, or network environment.

- Cloud Data Governance: Organizations moving to hybrid or multi-cloud environments use data-centric security to retain control over critical assets. Data is encrypted before leaving on-premises environments, and policies follow the data to ensure consistent protection across storage locations, workloads, and cloud vendors.

Data Centric Security Market: Stats & Facts

- IBM Security reported in its 2023 "Cost of a Data Breach" report that breaches involving data stored in the cloud cost on average USD 4.75 million, and organizations using data-centric security practices like encryption and tokenization reduced breach costs by over USD 300,000.

- Gartner stated that by 2025, 60% of large enterprises will mandate the use of data-centric audit and protection (DCAP) tools to manage data security risks, up from 20% in 2021.

- Verizon’s 2024 Data Breach Investigations Report revealed that 83% of breaches involved data stored in digital environments, making access control and data classification essential elements of data-centric strategies.

- Microsoft shared that organizations using Azure Information Protection saw a 35% improvement in compliance with data privacy regulations, highlighting the effectiveness of labeling, classification, and encryption, key elements of data-centric security.

- Ponemon Institute found that organizations with a mature data-centric security framework experienced 43% fewer security incidents than those relying solely on traditional perimeter-based models.

- NIST (National Institute of Standards and Technology) guidelines (SP 800-53 Rev. 5) emphasize data-centric controls such as Access Control (AC-3) and System and Communications Protection (SC-12 to SC-28), which are increasingly adopted across federal agencies and critical infrastructure sectors.

- Accenture’s Cybersecurity Report 2023 stated that 69% of CISOs are shifting investment toward data-centric technologies like digital rights management and persistent encryption.

- ENISA (European Union Agency for Cybersecurity) found in a 2022 assessment that data-centric approaches reduced the risk exposure to insider threats by up to 55%, especially when integrated with zero trust architecture.

Data Centric Security Market: Market Dynamics

Driving Factors in the Data Centric Security Market

Rising Volume of Data across Enterprises

The exponential growth in structured and unstructured data generated by organizations is a major driving force in the data-centric security market. With increasing reliance on big data analytics, cloud computing, and digital transformation initiatives, businesses are compelled to protect sensitive data at its core.

The need to secure personally identifiable information (PII), intellectual property, and financial records further fuels the demand for encryption, tokenization, and data masking solutions. Enterprises are recognizing that perimeter-based security is no longer sufficient, thus investing in data discovery and classification tools. This transition to content-aware security policies is leading to broader adoption of data-centric security frameworks in sectors like BFSI, healthcare, and government.

Stringent Regulatory Compliance Requirements

Growing concerns around data privacy have triggered an upsurge in regulatory mandates worldwide, driving the demand for robust data governance and security frameworks. Regulations such as GDPR in Europe, CCPA in California, and HIPAA in the U.S. compel organizations to implement data centric security measures to ensure compliance. These laws mandate greater accountability in data handling, including secure storage, sharing, and auditing practices.

As a result, companies are prioritizing data-centric solutions like access control, policy enforcement, and end-to-end encryption. This legal pressure is especially prominent in industries handling sensitive customer data, propelling the growth of the data centric security market on a global scale.

Restraints in the Data Centric Security Market

High Implementation Complexity and Integration Challenges

One of the key restraints hindering the data centric security market is the complexity involved in integrating these solutions into legacy IT systems. Many organizations operate with outdated infrastructure, making it difficult to deploy advanced data protection tools such as rights management, data-centric audit and protection (DCAP), and real-time data activity monitoring.

The absence of standardized protocols and interoperability issues with existing security information and event management (SIEM) systems further complicate deployment. This often results in increased costs, resource strain, and longer implementation cycles, particularly for small and medium enterprises (SMEs) with limited IT capabilities.

Limited Awareness and Skill Shortages

Despite growing threats to data privacy, a significant number of businesses lack awareness of the benefits of a data centric security approach. Many still rely on traditional perimeter defense systems, underestimating risks such as insider threats and data leakage. Furthermore, the market suffers from a shortage of skilled cybersecurity professionals trained in advanced encryption techniques, data policy orchestration, and zero-trust architecture.

This skills gap limits the widespread adoption of data protection frameworks and hampers efficient incident response. Consequently, many organizations delay investments in comprehensive data-centric solutions due to the perceived operational complexity and lack of in-house expertise.

Opportunities in the Data Centric Security Market

Growth in Cloud-Based Security Solutions

The shift toward hybrid and multi-cloud environments presents a lucrative opportunity for vendors in the data centric security market. As enterprises migrate sensitive workloads to cloud platforms, the demand for cloud-native data protection tools such as cloud access security brokers (CASBs), secure data lakes, and data loss prevention (DLP) systems is surging.

These solutions ensure visibility, control, and compliance in dynamic environments. The opportunity lies in offering scalable, API-integrated, and AI-powered security models that enable real-time data monitoring and encryption regardless of location. Cloud-based security enhances agility and cost-efficiency, making it a strategic focus for enterprises and a growth area for solution providers.

Increasing Adoption of AI and Machine Learning in Cybersecurity

The integration of artificial intelligence and machine learning into data centric security tools is unlocking new growth avenues. AI algorithms can detect anomalous data behavior, automate threat responses, and enhance data classification accuracy. These technologies empower security teams to proactively defend against advanced persistent threats and ransomware attacks.

With the evolution of intelligent automation in security orchestration, businesses are adopting next-gen solutions that offer real-time alerts, predictive risk analysis, and self-healing capabilities. Vendors leveraging AI to deliver adaptive data protection and threat intelligence analytics are well-positioned to capitalize on the growing demand for smarter, context-aware security systems.

Trends in the Data Centric Security Market

Zero Trust Architecture Gaining Momentum

The zero trust model is emerging as a dominant trend in the data centric security landscape. Rather than relying on traditional trust assumptions, zero trust enforces continuous verification of users, devices, and applications before granting data access. This trend is driven by the increasing frequency of insider threats and sophisticated cyberattacks.

Zero trust principles align seamlessly with data centric security strategies, emphasizing strong identity governance, least privilege access, and micro-segmentation. As remote work and cloud adoption rise, enterprises are shifting toward this granular, identity-driven security model to safeguard sensitive information across decentralized ecosystems.

Emergence of Data Security Posture Management (DSPM)

A significant trend reshaping the data centric security market is the rise of Data Security Posture Management. DSPM solutions provide continuous assessment of how sensitive data is stored, accessed, and protected across environments, particularly in the cloud. These platforms offer automated discovery, risk scoring, and remediation capabilities, allowing organizations to maintain compliance and reduce the attack surface.

As businesses strive for proactive governance and visibility, DSPM is gaining traction in data-driven industries like finance, healthcare, and e-commerce. This evolution reflects a broader market shift toward holistic, data-centric risk management approaches integrated with DevSecOps and security automation platforms.

Data Centric Security Market: Research Scope and Analysis

By Component Analysis

Solutions are predicted to dominate the global data-centric security market by the end of 2025, accounting for 68.4% of the overall revenue share. The widespread demand for integrated data discovery tools, encryption solutions, and policy enforcement frameworks drives this dominance. Enterprises are increasingly focused on preventing data leaks at the file level rather than the network level, making comprehensive solutions more appealing.

The rise in structured and unstructured data across financial, healthcare, and e-commerce platforms compels businesses to deploy robust data protection technologies to ensure regulatory compliance and reduce exposure to cyber threats, thereby fueling the demand for advanced software-based data security architectures.

Services are anticipated to grow with a notably high CAGR in the global data centric security market by 2025. The surge is driven by growing enterprise reliance on managed security services, consulting, and implementation support for data security frameworks. As regulations like GDPR and HIPAA become stricter, businesses seek expert assistance in deploying compliant and scalable solutions.

Furthermore, the growing complexity of data ecosystems involving cloud, IoT, and AI systems makes specialized services essential. The integration of security orchestration and analytics within service offerings further accelerates adoption across sectors aiming for risk-based access and centralized data governance.

By Deployment Analysis

Cloud deployment is projected to lead the global data centric security market by 2025, capturing 61.2% of the total market share. This growth is attributed to rapid adoption of cloud-native security platforms, scalability, and cost-efficiency benefits. Cloud-based solutions offer flexibility and real-time protection of sensitive data assets across distributed environments, supporting remote workforces and multi-cloud strategies.

As organizations migrate critical workloads to public and private clouds, the need for centralized data access control and continuous monitoring becomes essential. Cloud deployment also facilitates easier integration with cloud access security brokers (CASB), enhancing overall protection against unauthorized access and data exfiltration.

On-premises deployment is expected to register a relatively higher CAGR by 2025. Industries with stringent data residency and compliance requirements, such as banking and government which continue to prefer in-house data control. On-premise infrastructure allows organizations to fully manage their internal security protocols without relying on third-party infrastructure.

This segment is also gaining traction due to enhanced customization options and reduced latency in critical applications. Sectors handling classified information or operating in regions with limited internet infrastructure are increasingly investing in robust on-premises data loss prevention mechanisms, which drives consistent growth.

By Organization Size Analysis

Large Enterprises are projected to dominate the data-centric security market by the end of 2025, accounting for 72.5% of the market share. These organizations have larger and more complex IT ecosystems, requiring comprehensive identity and access management (IAM) and enterprise-grade data security policies.

Their higher security budgets support the adoption of advanced tools such as automated data classification, tokenization, and insider threat prevention systems. Regulatory compliance and cross-border data flow mandates further compel large corporations to invest in end-to-end visibility and monitoring of sensitive information across hybrid infrastructure.

SMEs are anticipated to witness a higher CAGR owing to increasing awareness of data privacy risks and the growing availability of affordable, scalable solutions. As small businesses digitize operations, adopt e-commerce platforms, and store customer data online, they face heightened risks of breaches. The introduction of lightweight and modular data-centric security tools tailored for SMEs enhances accessibility. Moreover, governments and industry groups are promoting cybersecurity readiness in SMEs, further boosting investments in automated threat detection and low-maintenance security frameworks across this segment.

By End User Analysis

BFSI is projected to dominate the global data-centric security market by 2025 with a share of 34.6%. The sector manages a vast volume of sensitive information, ranging from personal identifiers to transaction data, which makes it a top target for cyberattacks. To address this, institutions are investing in data masking, real-time activity tracking, and compliance automation. With stringent financial regulations and the adoption of digital banking, the BFSI industry is prioritizing resilient cyber defense frameworks that safeguard both structured and unstructured data from internal and external threats.

The Healthcare sector is expected to grow at the highest CAGR by 2025. The sector's exponential growth in electronic health records (EHRs), telemedicine, and wearable device data has intensified the need for robust data confidentiality and integrity safeguards. Rising ransomware incidents targeting hospitals have prompted investment in end-to-end encryption and breach detection solutions. Additionally, compliance with regulations like HIPAA and evolving patient privacy laws worldwide is accelerating the adoption of zero-trust security models and contextual data usage policies within the healthcare domain.

The Data Centric Security Market Report is segmented on the basis of the following:

By Component

By Deployment

By Organization Size

By End User

- Government

- Healthcare

- BFSI

- Retail

- IT & Telecom

- Others

Regional Analysis

Region with the largest Share

North America holds the largest share in the data-centric security market, with a revenue share of 41.6% in 2025, primarily due to the presence of advanced digital infrastructure, early adoption of cybersecurity frameworks, and a strong focus on compliance with data privacy regulations such as CCPA and HIPAA.

The widespread use of cloud computing and IoT devices has increased the demand for robust data protection strategies in the region. Major technology providers and financial institutions have implemented data governance and risk management solutions to secure sensitive information. Enterprises are also increasingly investing in data masking, tokenization, and access control solutions to safeguard customer and corporate data, which further propels the market’s dominance in this region.

Region with Highest CAGR

Asia Pacific is expected to witness the highest compound annual growth rate in the data-centric security market. The region is experiencing rapid digitalization, increased smartphone penetration, and a surge in cloud-based services, all contributing to a greater need for secure data practices. Governments across countries like China, India, and Japan are introducing stricter cybersecurity laws, driving enterprises to adopt advanced encryption and access control tools.

The rising volume of cyber threats targeting emerging economies has accelerated the deployment of data-centric audit and protection solutions. Growing awareness among businesses about the importance of data classification and policy enforcement is also fueling market growth in this dynamic and evolving region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Data Centric Security Market

- Intelligent Threat Detection and Prevention: AI enhances data-centric security by enabling real-time threat detection through behavioral analytics and anomaly identification. Machine learning algorithms analyze user behavior, access patterns, and network traffic to detect unusual activity. This proactive approach allows for faster threat mitigation, reducing the risk of data breaches and insider attacks.

- Automated Data Classification and Tagging: AI automates the process of data discovery, classification, and tagging based on sensitivity and compliance requirements. This improves visibility and control over unstructured and structured data across cloud and on-premises environments. Accurate classification ensures appropriate encryption, access control, and monitoring, forming a strong foundation for data-centric security strategies.

- Adaptive Access Control and Policy Enforcement: With AI, organizations can implement dynamic and context-aware access controls. AI evaluates factors like user roles, behavior, device status, and location to enforce granular security policies. This minimizes over-permissioning, reduces the attack surface, and ensures that only authorized individuals access sensitive data in real time.

- Enhanced Incident Response and Risk Management: AI supports faster and more effective incident response through intelligent alert prioritization and automated remediation. By analyzing historical data and attack patterns, AI-driven systems can predict vulnerabilities, recommend security actions, and reduce response times, significantly improving organizational resilience against evolving cybersecurity threats.

Competitive Landscape

The data-centric security market is highly competitive, with leading companies offering a wide range of data protection solutions tailored to various industry needs. Prominent players include IBM Corporation, Symantec (Broadcom), Forcepoint, Microsoft Corporation, and Varonis Systems, among others. These firms are actively enhancing their data discovery, classification, and access management tools to meet evolving compliance mandates and address the growing threat landscape. Vendors are increasingly focusing on integrating artificial intelligence and machine learning with data loss prevention and encryption technologies to deliver real-time threat intelligence and policy automation.

Startups and niche players are also entering the market, offering innovative data-centric audit and protection solutions targeting SMEs and specific verticals such as healthcare, BFSI, and government. Strategic collaborations, mergers and acquisitions, and investments in cloud-native platforms have become critical to gaining market presence.

Companies are developing modular solutions that seamlessly integrate with hybrid and multi-cloud environments, facilitating scalable deployment. The competitive dynamics are being shaped by the demand for unified data protection platforms that combine risk analytics, role-based access control, and zero-trust security models. This evolving landscape highlights the ongoing emphasis on securing data at rest, in motion, and in use across modern enterprise ecosystems.

Some of the prominent players in the Global Data Centric Security Market are

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Symantec

- McAfee Corp.

- Forcepoint LLC

- Varonis Systems, Inc.

- Informatica Inc.

- Amazon Web Services, Inc.

- Google LLC

- Thales Group

- Imperva, Inc.

- Hewlett Packard Enterprise

- NetApp, Inc.

- Hitachi Vantara LLC

- Protegrity Inc.

- Talend S.A.

- Dataguise (PKWARE)

- Seclore Technology Pvt. Ltd.

- Digital Guardian

- Other Key Players

Recent Developments

- In May 2025, IBM announced a strategic alliance with Palo Alto Networks to integrate IBM's Guardium Insights with Palo Alto’s Cortex XDR platform, enhancing data visibility and access control across hybrid environments.

- In April 2025, Munich-based DataGuard raised $60 million to expand its cloud-native data privacy and compliance platform focused on data-centric policy automation and governance.

- In March 2025, Forcepoint completed the acquisition of Bitglass's cloud access security broker (CASB) solutions to strengthen its portfolio in zero-trust data-centric protection across SaaS and IaaS environments.

- In January 2024, Fortinet introduced upgraded AI-powered data protection capabilities within its security infrastructure, enabling organizations to more efficiently identify and address data breaches.

- In March 2024, Symantec announced improvements to its endpoint security offerings, featuring real-time data tracking and anomaly detection to better safeguard against insider threats.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.2 Bn |

| Forecast Value (2034) |

USD 57.9 Bn |

| CAGR (2025–2034) |

26.0% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 2.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions, Services), By Deployment (Cloud, On-Premises), By Organization Size (SMEs, Large Enterprises), By End User (Government, Healthcare, BFSI, Retail, IT & Telecom, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

IBM Corporation, Microsoft Corporation, Oracle Corporation, Symantec, McAfee Corp., Forcepoint LLC, Varonis Systems, Inc., Informatica Inc., Amazon Web Services, Inc., Google LLC, Thales Group, Imperva, Inc., Hewlett Packard Enterprise (HPE), NetApp, Inc., Hitachi Vantara LLC, Protegrity Inc., Talend S.A., Dataguise (PKWARE), Seclore Technology Pvt. Ltd., Digital Guardian, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Data Centric Security Market size is estimated to have a value of USD 7.2 billion in 2025 and is expected to reach USD 57.9 billion by the end of 2034.

North America is expected to be the largest market share for the Global Data Centric Security Market with a share of about 41.6% in 2025.

Some of the major key players in the Global Data Centric Security Market are IBM Corporation, Microsoft Corporation, Oracle Corporation, and many others.

The market is growing at a CAGR of 24.4% over the forecasted period.

The US Data Centric Security Market size is estimated to have a value of USD 2.5 billion in 2025 and is expected to reach USD 17.9 billion by the end of 2034.