Market Overview

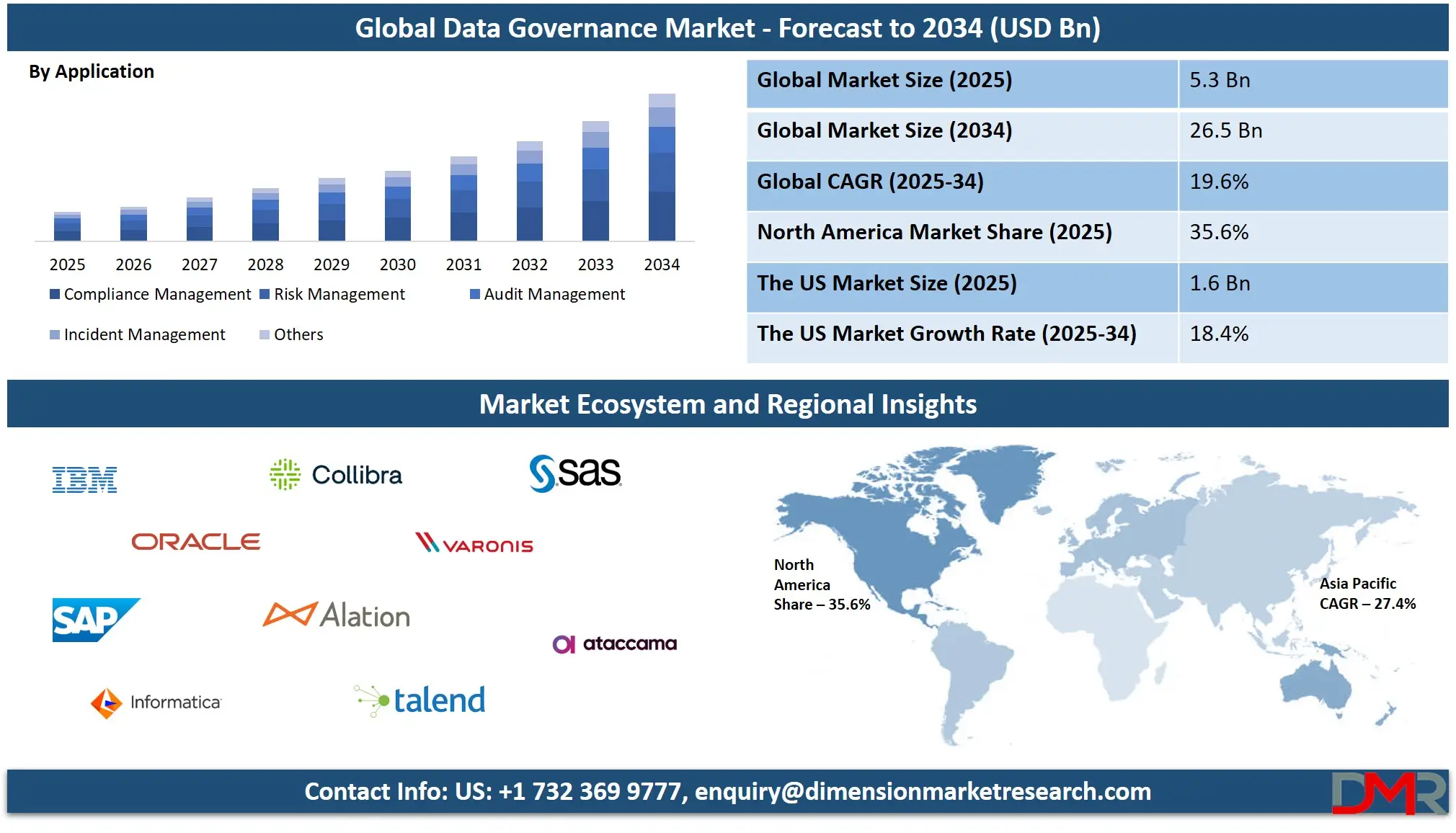

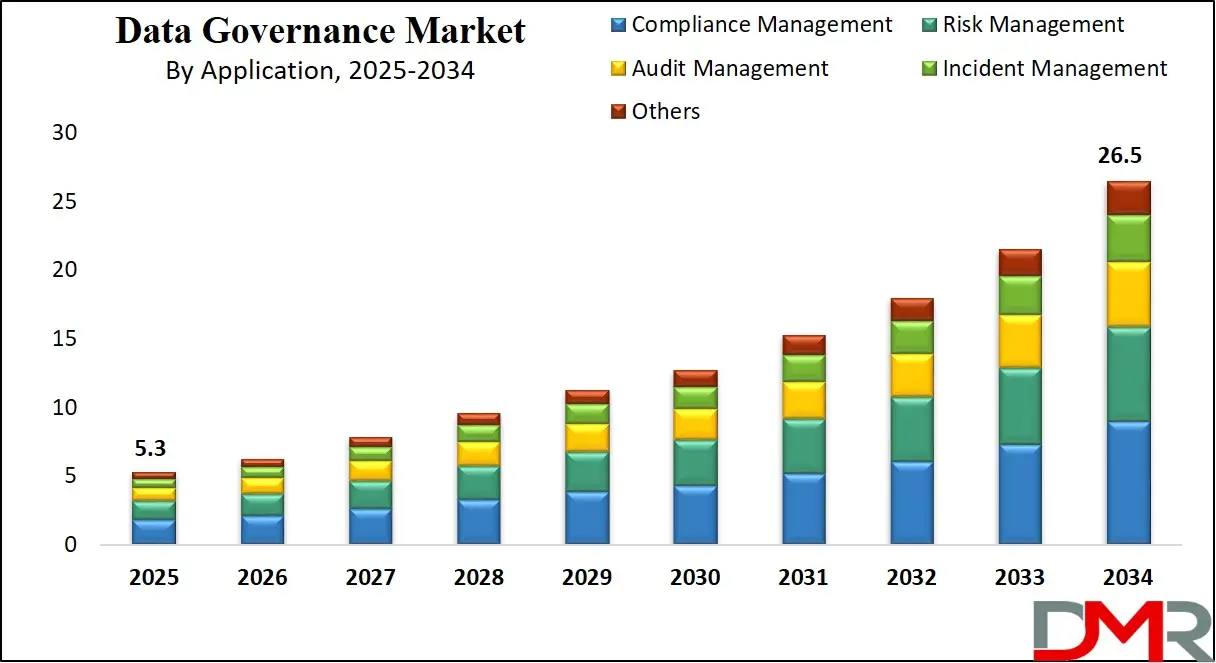

The global data governance market size is expected to be valued at

USD 5.3 billion in 2025 and is projected to reach

USD 26.5 billion by 2034, expanding at a compound annual growth rate (CAGR) of

19.6% during the forecast period.

This substantial growth is primarily driven by the increasing emphasis on data quality, regulatory compliance, enterprise-wide data management, and metadata-centric governance strategies. Growing investments in data security, privacy infrastructure, and advanced analytics are further positioning data governance as a critical operational priority across diverse industry verticals.

Data governance refers to the strategic framework and set of practices that ensure the availability, integrity, usability, and security of data across an organization. It encompasses the policies, procedures, standards, and metrics that guide how data is managed and utilized. Effective data governance helps companies maintain compliance with data protection regulations, optimize business intelligence, improve data stewardship, and enable accurate reporting and decision-making. By assigning ownership, establishing clear data standards, and implementing governance tools, businesses are better positioned to mitigate risks associated with poor data quality, data silos, and inconsistent information handling across departments.

The global data governance market is evolving rapidly as organizations recognize data as a strategic asset. Enterprises across sectors such as healthcare, BFSI, manufacturing, and retail are prioritizing the implementation of robust data management frameworks to support digital transformation and enhance operational efficiency. The shift toward cloud computing, big data analytics, and artificial intelligence has intensified the demand for scalable governance solutions capable of managing structured and unstructured data across hybrid environments. Companies are not only focusing on protecting sensitive information but also on leveraging high-quality data to drive innovation and gain a competitive edge.

Regulatory pressure is another driving force reshaping the landscape of data governance. With the enforcement of global standards like GDPR, CCPA, HIPAA, and others, organizations are compelled to adopt consistent data handling practices that ensure accountability and traceability. These compliance requirements are pushing businesses to invest in policy management, audit trail capabilities, and enterprise-wide data classification systems. In parallel, there is a growing need for transparency and trust in data-driven decision-making, which is fostering the rise of automated governance tools and metadata management platforms that provide visibility across the entire data lifecycle.

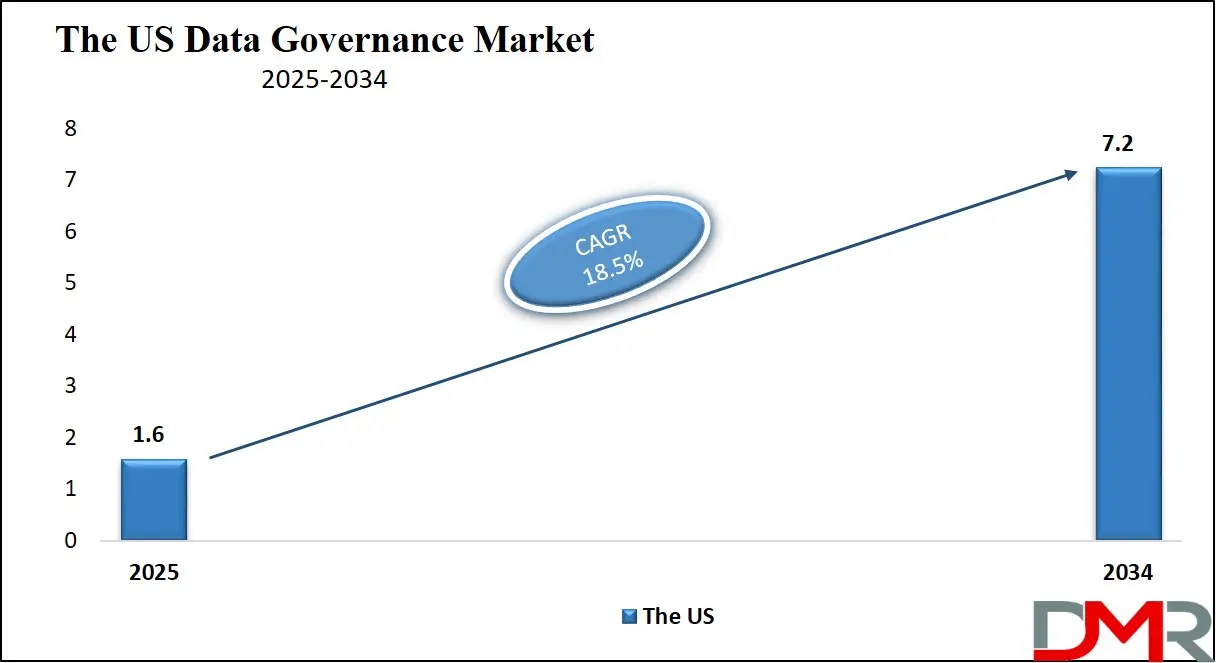

The US Data Governance Market

The U.S. Data Governance Market size is projected to be valued at USD 1.6 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7.2 billion in 2034 at a CAGR of 18.4%.

The US data governance market is characterized by its early adoption of advanced data management practices driven by a highly regulated business environment and a strong emphasis on digital innovation. Organizations across industries such as finance, healthcare, technology, and government are prioritizing data governance to navigate complex compliance landscapes and safeguard sensitive information. The prevalence of strict regulations like HIPAA, SOX, and the California Consumer Privacy Act has compelled enterprises to build robust governance frameworks that ensure data transparency, integrity, and accountability. These frameworks are deeply integrated with enterprise data architecture, enabling seamless collaboration between IT and business units while fostering a culture of data ownership and accountability.

Another key driver in the US market is the rapid proliferation of data sources fueled by cloud computing, IoT, AI, and machine learning. With organizations managing petabytes of data across hybrid and multi-cloud environments, there is an escalating demand for scalable governance platforms capable of orchestrating data across distributed systems. Companies are leveraging automated data cataloging, metadata management, policy enforcement, and lineage tracking to achieve unified data visibility and control. As data becomes central to strategic decision-making, the focus in the US is shifting from basic compliance to proactive data intelligence, enabling enterprises to extract more value from their data assets while maintaining trust, security, and ethical standards.

The European Data Governance Market

In 2025, the data governance market in Europe is expected to reach a value of approximately

USD 0.7 billion, reflecting the growing need for organizations across the region to adopt robust data management strategies. This growth is underpinned by a strong compound annual growth rate (CAGR) of

20.0%, signifying a rapid and sustained rise in demand for data governance solutions in the coming years.

The European market’s growth can be attributed to several critical factors. One of the most significant drivers is the enforcement of stringent regulations such as the General Data Protection Regulation (GDPR). GDPR has reshaped how businesses handle data privacy and security, placing considerable emphasis on transparency, consent, and compliance. Organizations across Europe are now required to have comprehensive data governance frameworks in place to ensure compliance with these regulations. This has led to an increased adoption of tools that allow businesses to better manage data integrity, security, and privacy while minimizing risks associated with non-compliance.

Additionally, Europe has seen a wave of digital transformation, with industries like finance, healthcare, retail, and manufacturing relying on data-driven strategies. As businesses adopt cloud computing, artificial intelligence, and big data technologies, the need for solid data governance frameworks has become more pressing. These frameworks enable organizations to secure sensitive information, optimize data management, and ensure consistency and accuracy across various data systems. The rising complexity of data environments, including the explosion of unstructured data, is further pushing organizations to invest in scalable and flexible data governance solutions.

The Japanese Data Governance Market

In 2025, the data governance market in Japan is projected to reach approximately USD 0.1 billion, with a compound annual growth rate (CAGR) of 15.3%. While this market share represents a smaller portion of the global data governance market, the steady growth is indicative of Japan’s growing focus on data privacy, security, and compliance as part of its broader digital transformation efforts.

Japan’s data governance market is being driven by several key factors. One of the primary influences is the rise of stringent data protection laws, such as Japan’s Act on the Protection of Personal Information (APPI), which mandates businesses to implement robust data governance frameworks to ensure data privacy and security. With a growing volume of data being generated from industries such as technology, manufacturing, e-commerce, and finance, there is a growing need to ensure this data is managed in compliance with evolving regulations.

As businesses in Japan continue to scale their digital operations and move toward cloud-based infrastructures, data governance becomes even more critical in managing data quality, preventing data breaches, and safeguarding sensitive customer and organizational information. The adoption of digital technologies such as artificial intelligence, big data, and machine learning is another factor driving the demand for data governance solutions in Japan.

As Japanese companies rely on these technologies to enhance operational efficiency, customer experience, and innovation, the need for comprehensive data governance frameworks has become evident. Effective governance solutions are essential for maintaining the accuracy, integrity, and security of data across complex ecosystems, which often include hybrid and multi-cloud environments. Companies are looking for governance tools that can support data privacy, risk management, compliance, and data lineage tracking to ensure smooth and secure data flow across their operations.

Global Data Governance Market: Key Takeaways

- Market Value: The global data governance size is expected to reach a value of USD 26.5 billion by 2034 from a base value of USD 5.3 billion in 2025 at a CAGR of 19.6%.

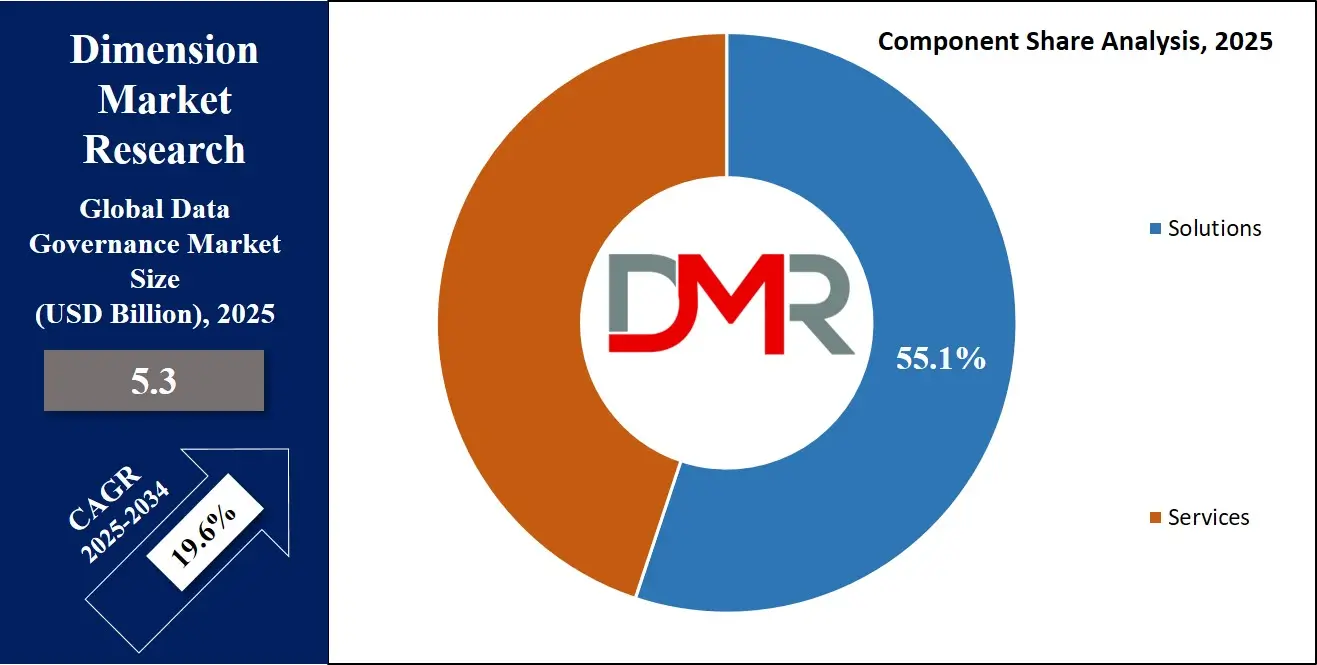

- By Component Type Segment Analysis: Solutions are poised to consolidate their dominance in the component type segment, capturing 55.1% of the total market share in 2025.

- By Deployment Model Type Segment Analysis: On-Premises deployment mode is anticipated to maintain its dominance in the deployment model type segment, capturing 70.4% of the total market share in 2025.

- By Organization Size Segment Analysis: Small and Medium-Sized Enterprises are expected to maintain their dominance in the organization size segment, capturing 45.8% of the total market share in 2025.

- By Application Type Segment Analysis: Compliance Management applications are poised to consolidate their market position in the application type segment, capturing 33.7% of the total market share in 2025.

- By Industry Vertical Segment Analysis: The BFSI industry is anticipated to maintain its dominance in the industry vertical segment, capturing 32.9% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global data governance market landscape with 35.6% of total global market revenue in 2025.

- Key Players: Some key players in the global data governance market are IBM, Oracle, SAP, Informatica, Collibra, Alation, Talend, SAS Institute, Varonis Systems, Ataccama, ASG Technologies (a Rocket Company), Microsoft, AWS (Amazon Web Services), Google Cloud, Erwin (by Quest Software), Data Advantage Group, Precisely, Syniti, TIBCO Software, and Other key players.

Global Data Governance Market: Use Cases

- Regulatory Compliance and Risk Mitigation: Organizations across sectors use data governance solutions to ensure adherence to global data privacy regulations such as GDPR, CCPA, HIPAA, and SOX. These tools enable enterprises to maintain comprehensive audit trails, enforce data access policies, and implement data retention rules. By standardizing compliance workflows and automating policy enforcement, companies reduce regulatory risks and avoid costly penalties. This use case is especially critical for industries like healthcare, finance, and insurance, where data sensitivity and legal accountability are paramount.

- Enhancing Data Quality and Integrity across Enterprises: Data governance frameworks play a pivotal role in improving data quality, consistency, and accuracy across business units. Through master data management (MDM), metadata cataloging, and data profiling, organizations can eliminate duplicates, resolve inconsistencies, and ensure a single source of truth. This leads to better business analytics, reporting accuracy, and informed decision-making. Industries like retail and manufacturing leverage these capabilities to optimize supply chain management, customer experience, and inventory planning using clean, reliable datasets.

- Cloud Data Management and Hybrid Infrastructure Control: As businesses adopt hybrid and multi-cloud architectures, data governance platforms provide centralized control and visibility over distributed data assets. Enterprises can define and apply governance policies across cloud-native, on-premise, and SaaS environments, ensuring unified data stewardship and compliance. Features like data lineage tracking, role-based access, and encryption standards are essential for managing data across diverse ecosystems. This use case is particularly important for technology firms and global enterprises managing complex IT environments.

- Facilitating Data-Driven Innovation and AI Readiness: To support AI, machine learning, and predictive analytics, organizations must ensure high-quality, well-governed datasets. Data governance enables the curation of reliable, labeled, and accessible data, which is foundational for training accurate models and generating actionable insights. Businesses across telecom, automotive, and energy sectors use governance frameworks to unlock the value of big data, accelerate digital transformation, and fuel innovation. By aligning data strategy with business goals, companies position themselves for long-term agility and competitive advantage.

Global Data Governance Market: Stats & Facts

- European Union - European Commission

- The European Commission has implemented the Data Governance Act to enhance data sharing and provide a clear framework for data privacy and transparency across the EU.

- The EU General Data Protection Regulation (GDPR) imposed a significant compliance burden on organizations, with over 1,000 enforcement actions taken since its inception in 2018 to ensure compliance with data privacy standards.

- The EU is expected to invest over €1.3 billion in the development of secure data infrastructures and technologies, including AI and data governance tools, to bolster its digital economy.

- In 2022, European data protection authorities collectively issued over €300 million in fines related to data governance and privacy violations under GDPR.

- The European Union’s digital transformation initiatives emphasize data governance frameworks, with the EU planning to establish common European data spaces across multiple sectors, including healthcare, manufacturing, and finance.

- United States Government - U.S. Department of Energy (DOE)

- In 2020, the U.S. government passed the "Data Act," mandating federal agencies to implement stricter data governance practices, leading to improvements in the accessibility and transparency of public data.

- The U.S. Department of Energy (DOE) reports that over 35% of public sector data is now governed under specific data stewardship programs to ensure compliance with federal data privacy regulations.

- The Federal Risk and Authorization Management Program (FedRAMP) certifies cloud solutions, requiring stringent data governance practices for any cloud services used by U.S. federal agencies.

- The U.S. Federal Communications Commission (FCC) noted that data governance frameworks are now essential for ensuring secure transmission of sensitive data in telecommunications, especially with the growth of 5G.

- The National Institute of Standards and Technology (NIST) has developed the NIST Privacy Framework to help U.S. organizations develop comprehensive data governance protocols focused on protecting individuals' privacy.

- United Kingdom (Government Bodies) - Information Commissioner’s Office (ICO)

- In 2023, the UK's National Health Service (NHS) allocated over £1 billion to upgrade its data governance systems as part of its modernization efforts to handle increasing volumes of healthcare data.

- The UK Data Protection Act, which mirrors GDPR, continues to play a critical role in driving data governance adoption, with the Information Commissioner’s Office (ICO) overseeing data handling compliance and issuing penalties for non-compliance.

- The Office for National Statistics (ONS), is working on improving data quality by enforcing stricter data governance practices, following public scrutiny of data accuracy during the pandemic.

- The UK’s Department for Digital, Culture, Media and Sport (DCMS) introduced a data strategy that emphasizes data governance, requiring public sector bodies to implement robust data management frameworks to support economic growth.

- Global Initiatives and Government Organizations - United Nations (UN)

- The United Nations (UN) encourages member states to implement data governance policies, citing their importance for improving data availability and transparency, particularly in government statistical practices.

- In 2022, the UN’s World Health Organization (WHO) established a global health data governance framework to improve the transparency and security of healthcare data shared between nations.

- The Organisation for Economic Co-operation and Development (OECD) released guidelines in 2021 for enhancing data governance to ensure global financial stability, emphasizing the need for improved data quality standards across global markets.

- The International Telecommunication Union (ITU) has developed data governance guidelines for nations to secure their communication infrastructure, focusing on data sovereignty and user privacy in global data exchanges.

- Australia - Australian Government

- The Australian government has committed AUD 3 billion over the next five years to improve national data governance frameworks, focusing on strengthening data sharing policies across the public sector.

- Japan - Japanese Government

- The Japanese government has revised its Act on the Protection of Personal Information (APPI) to align with international data governance standards, thus reinforcing compliance and data privacy across its digital economy.

- India - Indian Government

- In 2020, the Indian government launched the National Data Governance Framework, aiming to provide guidelines for public and private organizations to manage and safeguard critical data assets.

- South Korea - South Korean Government

- In South Korea, the Ministry of Science and ICT invested over KRW 2 trillion into AI-driven data governance programs, facilitating enhanced data transparency, security, and management in the tech sector.

- Data Governance in Healthcare - U.S. Department of Health and Human Services (HHS)

- In 2021, the U.S. Department of Health and Human Services (HHS) reported that over 25% of healthcare organizations in the country had adopted formal data governance frameworks to improve the management of patient data and comply with regulations like HIPAA.

- Financial Sector Data Governance - U.S. Securities and Exchange Commission (SEC)

- In 2020, the U.S. Securities and Exchange Commission (SEC) reported that 40% of financial institutions in the country had implemented new data governance protocols focused on ensuring compliance with federal financial regulations, such as the Dodd-Frank Act and Sarbanes-Oxley Act.

- The European Central Bank (ECB) estimated that 50% of European financial institutions now have integrated data governance systems to comply with the EU's Markets in Financial Instruments Directive (MiFID II) to maintain data transparency and security.

- Data Governance in the Retail Industry - Information Commissioner’s Office (ICO), UK

- In 2022, the U.K.'s Information Commissioner’s Office (ICO) found that nearly 35% of retail companies in the country had adopted robust data governance strategies to enhance customer data protection and align with GDPR compliance.

- According to the Australian Digital Transformation Agency, 40% of retail businesses in Australia were incorporating data governance practices to manage and secure customer data during digital transactions.

- Data Governance in the Education Sector - U.S. Department of Education

- In 2021, the U.S. Department of Education reported that 30% of educational institutions were implementing formal data governance programs to ensure compliance with the Family Educational Rights and Privacy Act (FERPA) and improve the security of student data.

- The Government of Canada highlighted that in 2022, 25% of Canadian universities had adopted improved data governance policies, aiming to safeguard personal information and provide transparency for students.

- Data Governance in the Tech Industry - U.S. Department of Commerce

- In 2022, the U.S. Department of Commerce reported that 20% of tech companies in the U.S. were investing in advanced data governance frameworks to comply with emerging regulations around artificial intelligence and machine learning applications.

- In 2021, the Australian government’s Cybersecurity Centre noted that 35% of tech firms in Australia were improving their data governance policies in response to the increasing frequency of cyber threats in the industry.

- Role of Chief Data Officers (CDOs) - U.S. Office of Personnel Management (OPM)

- A report from the U.S. Office of Personnel Management (OPM) in 2021 found that 28% of large federal agencies had appointed a Chief Data Officer (CDO) to oversee data governance initiatives and improve data management capabilities.

- The UK’s Government Digital Service (GDS) revealed that 22% of public sector organizations in the UK had appointed a Chief Data Officer to oversee the management and security of critical public data by 2022.

- Data Governance in Public Sector IT - U.S. General Services Administration (GSA)

- According to the U.S. General Services Administration (GSA), 30% of public sector agencies in the U.S. had adopted cloud-based data governance solutions by 2021, ensuring compliance with both security and privacy standards for federal data.

- The European Union Agency for Cybersecurity (ENISA) reported that by 2022, 40% of public sector IT departments in the EU had adopted automated data governance frameworks to streamline data compliance and cybersecurity measures.

- Data Governance for Personal Privacy Protection - U.S. Federal Trade Commission (FTC)

- The U.S. Federal Trade Commission (FTC) reported that in 2021, 65% of large tech companies had implemented or upgraded their data governance programs to comply with privacy regulations like the California Consumer Privacy Act (CCPA).

- In 2022, the Brazilian National Data Protection Authority (ANPD) found that 50% of Brazilian companies had adopted enhanced data governance practices following the implementation of the General Data Protection Law (LGPD).

- Government Data Governance Initiatives - Data.gov, U.S. Government

- The U.S. Government’s Data.gov initiative, which promotes transparency, reported that over 250,000 datasets were made available for public use in 2021, demonstrating a significant effort to enhance government data governance and access.

- In 2022, the European Union launched a new initiative to establish "Data Spaces" across various sectors, which required compliance with specific data governance standards to facilitate secure cross-border data sharing.

Global Data Governance Market: Market Dynamics

Global Data Governance Market: Driving Factors

Increasing Regulatory Pressures across IndustriesOne of the key forces propelling the global data governance market is the surge in global regulatory frameworks that mandate strict data management practices. Regulations such as the General Data Protection Regulation in Europe, the California Consumer Privacy Act in the United States, and others across Asia-Pacific and Latin America are pushing organizations to prioritize compliance. Enterprises are adopting data governance solutions to enforce policies, maintain data lineage, and create detailed audit trails. This regulatory environment is encouraging businesses to establish formal data ownership models and governance councils to mitigate risk and enhance transparency.

Growing Emphasis on Data Quality and Business Intelligence

Enterprises are focusing on maximizing the value of their data assets by improving data quality and enabling more accurate decision-making. Data governance tools help ensure consistency, accuracy, and reliability through features like data profiling, master data management, and metadata cataloging. With growing reliance on real-time analytics and business intelligence platforms, companies are prioritizing governance initiatives to support cleaner data pipelines and more dependable insights. This drive is especially strong in sectors such as retail, manufacturing, and telecommunications, where data volume and complexity are rapidly growing.

Global Data Governance Market: Restraints

High Implementation Complexity and Cost Barriers

Despite the benefits, implementing a full-scale data governance program requires significant investment in both technology and change management. Organizations often face challenges related to integrating governance tools with legacy systems, training staff, and aligning cross-functional teams. The complexity of managing large volumes of structured and unstructured data across departments can delay adoption. Small and medium-sized enterprises, in particular, may struggle with the costs associated with hiring data stewards, deploying governance software, and maintaining compliance frameworks.

Lack of Skilled Workforce and Governance Culture

Another limiting factor is the shortage of skilled professionals who understand data governance concepts such as policy design, metadata management, and regulatory compliance. Additionally, fostering a data-centric culture within an organization requires executive sponsorship, clear communication, and continuous governance education across departments. In many organizations, data still operates in silos, making it difficult to enforce enterprise-wide governance. This cultural inertia slows the adoption of governance strategies and limits their effectiveness.

Global Data Governance Market: Opportunities

Expansion of Cloud and Hybrid Data Environments

The accelerated shift toward cloud computing and hybrid infrastructure is creating significant opportunities for growth in the data governance market. Businesses are seeking solutions that can provide centralized visibility and control across multi-cloud and on-premise data ecosystems. Cloud-native governance platforms that offer features like real-time policy enforcement, automated compliance monitoring, and cross-environment data lineage are gaining traction. Providers offering flexible and scalable governance frameworks are well-positioned to support enterprises transitioning to modern digital infrastructures.

Integration with Artificial Intelligence and Automation Technologies

The rise of artificial intelligence and machine learning technologies is opening new avenues for automated data governance. Organizations are looking to embed governance directly into data pipelines using AI-driven tools that can detect anomalies, classify sensitive data, and recommend corrective actions in real time. Automation helps reduce manual effort, enhance data accuracy, and accelerate compliance reporting. This trend is paving the way for self-service data governance, where business users can confidently access and manage data without compromising security or compliance.

Global Data Governance Market: Trends

Adoption of Data Fabric and Unified Governance Architectures

A growing trend in the global data governance space is the movement toward unified data architectures, particularly data fabric models that integrate data governance directly into the enterprise data strategy. These architectures enable consistent policy application, real-time metadata synchronization, and governance at the edge, supporting agile data operations. Businesses are moving away from siloed governance tools toward comprehensive platforms that offer seamless integration across analytics, storage, and processing environments.

Increasing Focus on Ethical Data Use and Privacy by Design

With rising awareness of data ethics and digital responsibility, enterprises are embedding privacy and ethical considerations into their governance models. Concepts like privacy by design, data minimization, and algorithmic transparency are becoming essential components of modern data governance strategies. Companies are not only striving to meet compliance standards but also to build customer trust and demonstrate accountability in how data is collected, processed, and shared. This trend is leading to greater collaboration between data officers, legal teams, and IT departments to align governance with broader corporate responsibility goals.

Research Scope and Analysis

By Component Analysis

In the component type segment of the global data governance market, solutions are poised to consolidate their dominance, capturing an estimated 55.1% of the total market share in 2025. This commanding position is driven by the growing reliance on advanced tools that streamline data quality management, metadata integration, master data control, and regulatory compliance.

As enterprises expand their data ecosystems across hybrid and multi-cloud environments, there is a growing need for robust governance solutions that offer end-to-end visibility, automate policy enforcement, and support secure data access. These platforms are designed to ensure data consistency, improve lineage tracking, and support governance across both structured and unstructured data sources, making them vital to modern data strategies.

Complementing the rise of solutions, services continue to play a crucial role in accelerating adoption and maximizing the impact of data governance initiatives. This segment includes a wide range of offerings such as consulting, integration, support, training, and managed services. Consulting services help organizations define governance frameworks, assess data maturity, and align governance with regulatory and business requirements.

Implementation services are essential for deploying governance tools across diverse IT infrastructures, while support and training services ensure the long-term sustainability and effectiveness of governance programs. As enterprises face growing complexity in managing data across departments and geographies, these services provide the necessary expertise and scalability to operationalize governance frameworks and achieve enterprise-wide data accountability.

By Deployment Model Analysis

In the deployment model type segment of the global data governance market, on-premises deployment is expected to retain its dominant position, capturing a substantial

70.4% of the total market share in 2025. This preference for on-premises solutions is driven by a variety of factors, including the need for enhanced security, control, and compliance, especially within industries such as finance, healthcare, and government, where sensitive data handling and strict regulatory compliance are critical.

On-premises solutions allow organizations to maintain full control over their infrastructure, ensuring that data governance tools are seamlessly integrated with legacy systems and enabling robust customization to meet specific business requirements. This model also offers companies the ability to enforce tighter security protocols, such as internal firewalls and access controls, which is vital for mitigating risks associated with data breaches and unauthorized access.

While on-premises models dominate, cloud-based solutions are also emerging as a significant player in the market, providing organizations with scalability, flexibility, and lower upfront costs. The cloud deployment model is gaining traction due to its ability to support decentralized data management, especially as businesses embrace multi-cloud and hybrid environments. Cloud-based data governance solutions offer benefits such as real-time data synchronization, automated compliance monitoring, and enhanced collaboration across distributed teams.

These solutions are particularly attractive to organizations that need to quickly scale their data governance capabilities or integrate them with cloud-native applications, analytics, and business intelligence tools. Cloud deployment also provides the advantage of continuous updates, ensuring that organizations stay aligned with evolving regulatory requirements and industry best practices without the burden of manual upgrades. As cloud adoption continues to grow, hybrid deployment models, which combine both on-premises and cloud solutions, are likely to become more prevalent as organizations look to strike a balance between control, flexibility, and operational efficiency.

By Organization Size Analysis

In the organization size segment of the global data governance market, small and medium-sized enterprises (SMEs) are expected to maintain their dominance, capturing an estimated 45.8% of the total market share in 2025. SMEs are recognizing the importance of effective data governance in securing sensitive information, ensuring compliance with regulations, and improving operational efficiency. These businesses are prioritizing scalable and cost-effective governance solutions that allow them to manage data privacy, improve data quality, and streamline decision-making without the heavy upfront investments typically associated with large-scale enterprise solutions.

Cloud-based data governance tools, in particular, are appealing to SMEs as they offer lower initial costs, easier implementation, and flexibility to grow alongside their data management needs. The growing focus on data-driven strategies and the need for accurate reporting and business intelligence is driving the adoption of governance platforms that support efficient data stewardship and regulatory compliance for these organizations.

On the other hand, large enterprises, while also adopting data governance frameworks, face different challenges and opportunities due to their larger data volumes, complex data infrastructures, and more stringent compliance requirements. These organizations often require more sophisticated, customized solutions that can integrate across multiple departments, geographies, and legacy systems. Large enterprises are prioritizing data governance solutions that offer advanced features such as multi-layered data security, fine-grained access controls, enterprise-wide data lineage, and enhanced reporting capabilities to ensure compliance with complex global regulations.

They often prefer on-premises deployment models for greater control and to meet internal security standards. However, there is also growing interest in hybrid solutions that blend on-premises systems with cloud-based platforms to gain the flexibility and scalability required for innovation. As large enterprises continue to expand their data ecosystems, the demand for advanced governance tools capable of supporting large-scale data operations, managing third-party vendor data, and enabling data-driven insights will further drive the adoption of governance solutions in this segment.

By Application Analysis

In the application type segment of the global data governance market, compliance management applications are expected to strengthen their market position, capturing an impressive 33.7% of the total market share in 2025. The growing complexity of data privacy laws and regulations across different regions, such as the GDPR in Europe and the CCPA in the U.S., is a key factor driving the demand for compliance-focused governance solutions. These applications help organizations automate and streamline compliance processes by providing tools for data classification, access control, audit trails, and reporting.

By enabling enterprises to ensure that their data management practices meet regulatory requirements, compliance management applications are becoming essential for mitigating legal risks, maintaining data transparency, and building trust with customers. As data handling becomes more scrutinized globally, the importance of automated solutions to ensure real-time compliance monitoring and reporting continues to grow, making these applications a priority for businesses of all sizes.

In parallel, risk management applications are also gaining prominence within the data governance market. These tools focus on identifying, assessing, and mitigating risks associated with data security, data breaches, and non-compliance. As businesses face sophisticated cyber threats and data privacy concerns, effective risk management has become crucial for safeguarding sensitive information and preventing financial or reputational damage. Risk management applications enable organizations to perform regular risk assessments, implement security protocols, and enforce data protection policies across their networks.

These tools also help businesses identify vulnerabilities in their data infrastructure, prioritize risk mitigation actions, and ensure business continuity. In industries like finance, healthcare, and retail, where the consequences of data breaches are particularly severe, the adoption of risk management applications is expected to rise significantly. Together with compliance management, risk management applications are essential for businesses looking to strengthen their overall data governance strategy while minimizing potential threats to their data assets.

By Industry Vertical Analysis

In the industry vertical segment of the global data governance market, the BFSI (Banking, Financial Services, and Insurance) industry is expected to maintain its dominance, capturing a significant 32.9% of the total market share in 2025. This dominance is driven by the stringent regulatory environment in which financial institutions operate, along with the need for robust data management systems to ensure compliance with data privacy laws and mitigate financial risks.

Data governance in the BFSI sector is critical for ensuring the security of sensitive customer information, maintaining accurate financial records, and enabling real-time transaction monitoring. As financial services become digitized, the volume of data grows exponentially, making the need for efficient governance systems even more vital. These systems not only help financial institutions meet regulatory requirements but also improve operational efficiency by enabling better risk management, fraud detection, and customer insights through clean and structured data.

The retail and consumer industry is also seeing a rising adoption of data governance solutions as businesses focus on improving customer experience, optimizing supply chains, and maintaining regulatory compliance. In this sector, data governance plays a crucial role in managing vast amounts of consumer data, from purchase histories to personal preferences, and ensuring it is used responsibly while adhering to privacy regulations.

Retailers rely on governance tools to ensure the accuracy and integrity of their customer data, which is vital for personalized marketing, targeted promotions, and inventory management. As e-commerce continues to grow, retailers need scalable data governance solutions that can manage both structured and unstructured data across multiple platforms, such as websites, mobile apps, and social media channels.

Data governance solutions also help retail businesses comply with data privacy laws like GDPR, ensuring that customer data is securely handled and providing transparency into how data is collected and used. Moreover, by ensuring data consistency across their operations, retailers can enhance decision-making, improve customer loyalty, and gain a competitive edge in a fast-paced and data-driven marketplace.

The Data Governance Market Report is segmented on the basis of the following

By Component

- Solutions

- Services

- Managed Services

- Professional Services

- Consulting Services

- Support and Maintenance

- Deployment and Integration

By Deployment Model

By Organization Size

Small and Medium-Sized Enterprises

By Application

- Compliance Management

- Risk Management

- Audit Management

- Incident Management

- Others

By Industry Vertical

- BFSI

- Retail & Consumer

- Government

- Healthcare

- Manufacturing

- Telecom and IT

- Transportation & Logistics

- Others

Global Data Governance Market: Regional Analysis

Region with the Largest Revenue Share

North America is poised to lead the global data governance market, capturing an estimated 35.6% of the total global market revenue in 2025. The region’s dominance can be attributed to several key factors, including its advanced technological infrastructure, high adoption rates of cloud services, and stringent regulatory requirements. As one of the most developed markets, North America is home to many of the world’s largest and most data-intensive industries, such as finance, healthcare, retail, and technology.

These sectors are recognizing the importance of effective data governance to manage the growing volumes of data, ensure regulatory compliance, and mitigate risks related to data breaches and cyber threats. The region's robust legal and compliance framework, including regulations like the Health Insurance Portability and Accountability Act (HIPAA) and the California Consumer Privacy Act (CCPA), continues to drive the demand for comprehensive data governance solutions.

Region with significant growth

The Asia Pacific (APAC) region is expected to experience the highest compound annual growth rate (CAGR) in the global data governance market. This rapid growth can be attributed to several factors that are driving the digital transformation and adoption of data governance solutions across the region. As APAC is home to some of the world’s fastest-growing economies, including China, India, and Southeast Asia, the demand for effective data governance is growing as businesses in these countries strive to leverage the power of data for competitive advantage.

Additionally, many organizations in the region are undergoing a shift towards cloud computing, big data analytics, and artificial intelligence, all of which require robust data governance frameworks to ensure that data remains secure, compliant, and well-managed. One of the major driving forces behind the growth of data governance in the APAC region is the rise in data privacy regulations. Countries such as China, India, Japan, and South Korea are enacting stringent data protection laws, which are prompting organizations to adopt more sophisticated governance solutions to comply with these regulations.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Governance Market: Competitive Landscape

The global competitive landscape of the data governance market is characterized by the presence of both established multinational corporations and emerging startups that are innovating across various aspects of data management. As the demand for robust data governance solutions increases, a wide range of companies are vying for market share by offering diverse product portfolios, including data governance platforms, data privacy solutions, compliance management tools, and risk management systems.

The competitive dynamics of this market are shaped by factors such as technological advancements, mergers and acquisitions, strategic partnerships, and regional expansions. Companies in the data governance space are continuously evolving to meet the growing demand for data security, privacy, and compliance, while addressing the challenges posed by the growing complexity of data environments and the rapid pace of digital transformation. Key players in the market, such as IBM, Oracle, SAP, Microsoft, and Amazon Web Services (AWS), dominate the competitive landscape due to their established brand reputation, extensive resources, and comprehensive data governance solutions.

Some of the prominent players in the Global Data Governance are

- IBM

- Oracle

- SAP

- Informatica

- Collibra

- Alation

- Talend

- SAS Institute

- Varonis Systems

- Ataccama

- ASG Technologies (a Rocket Company)

- Informatica

- Microsoft

- AWS (Amazon Web Services)

- Google Cloud

- Erwin (by Quest Software)

- Data Advantage Group

- Precisely

- Syniti

- TIBCO Software

- Other Key Players

Global Data Governance Market: Recent Developments

- March 2025: Informatica acquires Cloudendix, enhancing its data governance and data privacy capabilities by integrating AI-driven data management solutions for cloud-native environments.

- January 2025: SAS Institute announces the acquisition of DataFlux, a move to strengthen its data quality and data governance solutions across enterprise analytics platforms.

- November 2024: Collibra acquires Data Governance Institute, expanding its suite of data governance offerings with an added emphasis on regulatory compliance solutions for global markets.

- August 2024: Ataccama announces the acquisition of TIBCO Software’s data governance business, broadening its data stewardship, automation, and compliance solutions portfolio.

- June 2024: Microsoft acquires BlueTalon, a data access and governance company, further expanding its Azure Data Governance capabilities with fine-grained access control and data security tools.

- March 2024: IBM completes its acquisition of Turbonomic, improving its ability to offer data governance alongside AI-powered optimization and workload management in cloud environments.

- December 2023: Oracle acquires Palantir Technologies, strengthening its data governance offerings with enhanced analytics, security, and data privacy tools for enterprise clients.

- September 2023: Alation merges with Informatica, creating a unified platform that offers both data governance and data cataloging capabilities, focusing on end-to-end data management solutions.

- June 2023: SAP acquires Trifacta, integrating advanced data wrangling and governance capabilities into its data management suite to improve business process automation and data quality for clients.

- March 2023: AWS (Amazon Web Services) acquires Tecton, a machine learning Operations Company, boosting its data governance framework with AI-enhanced data privacy, security, and compliance solutions.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 5.3 Bn |

| Forecast Value (2034) |

USD 26.5 Bn |

| CAGR (2025–2034) |

19.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.6 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Solutions and Services), By Deployment Model (On-Premises and Cloud), By Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), By Application (Compliance Management, Risk Management, Audit Management, Incident Management, and Others), and By Industry Vertical (BFSI, Retail and Consumer, Government, Healthcare, Manufacturing, Telecom and IT, Transportation and Logistics, and Others) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

IBM, Oracle, SAP, Informatica, Collibra, Alation, Talend, SAS Institute, Varonis Systems, Ataccama, ASG Technologies (a Rocket Company), Microsoft, AWS (Amazon Web Services), Google Cloud, Erwin (by Quest Software), Data Advantage Group, Precisely, Syniti, TIBCO Software, and Other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The global data governance market size is estimated to have a value of USD 5.3 billion in 2025 and is expected to reach USD 26.5 billion by the end of 2034.

The US data governance market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.2 billion in 2034 at a CAGR of 18.4%.

North America is expected to have the largest market share in the global data governance market, with a share of about 35.6% in 2025.

Some of the major key players in the global data governance market are IBM, Oracle, SAP, Informatica, Collibra, Alation, Talend, SAS Institute, Varonis Systems, Ataccama, ASG Technologies (a Rocket Company), Microsoft, AWS (Amazon Web Services), Google Cloud, Erwin (by Quest Software), Data Advantage Group, Precisely, Syniti, TIBCO Software, and Other key players.

The market is growing at a CAGR of 19.6 percent over the forecasted period.