Market Overview

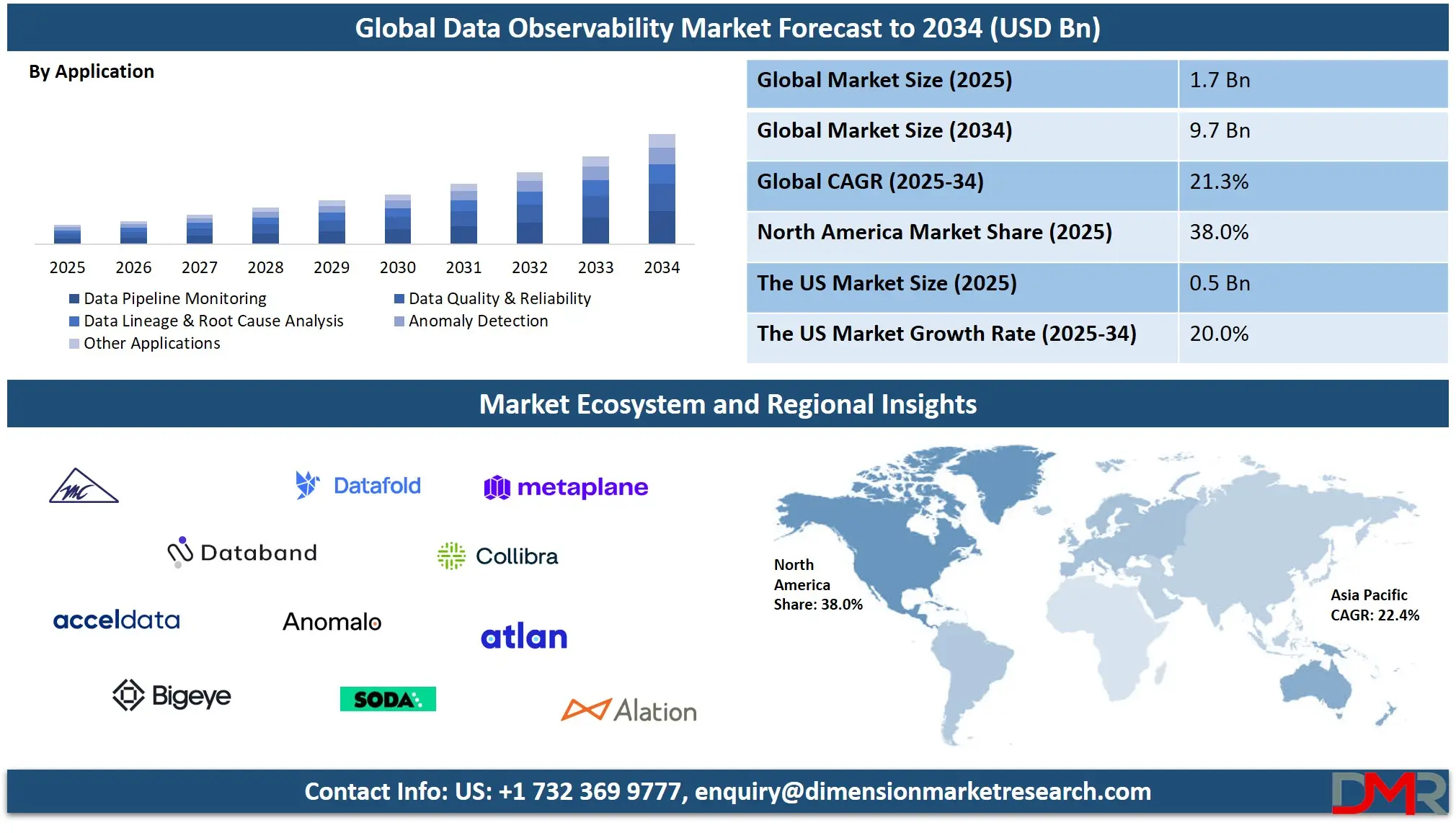

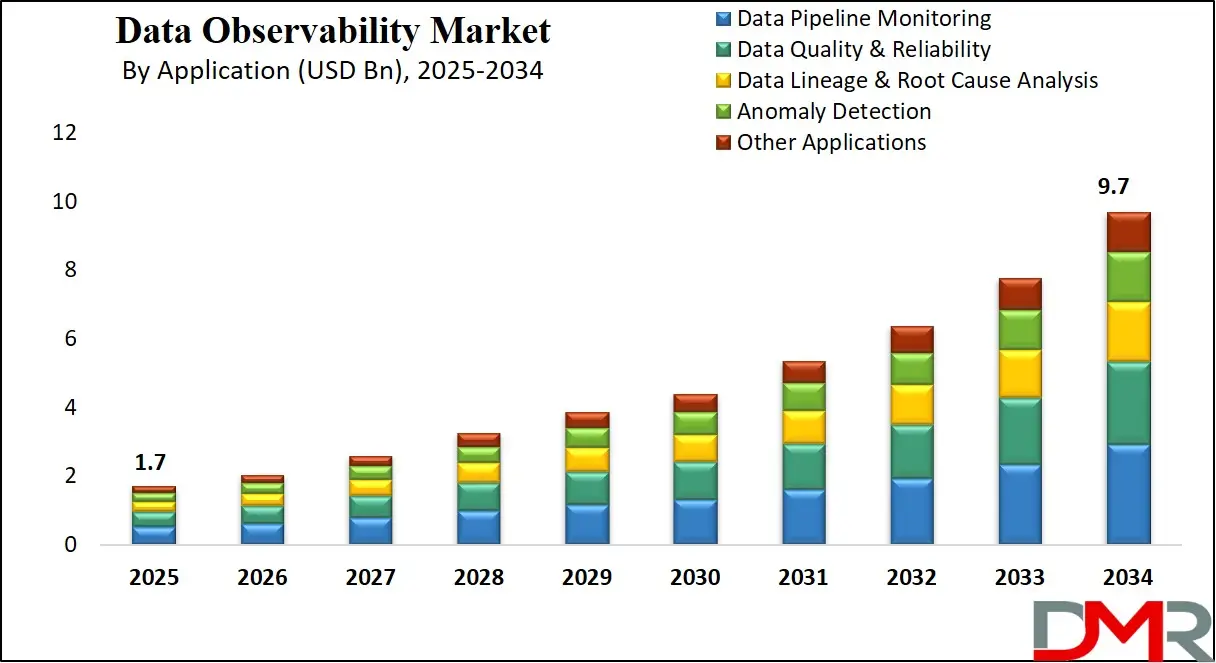

The Global Data Observability Market is projected to reach USD 1.7 billion in 2025 and surge to USD 9.7 billion by 2034, growing at a robust CAGR of 21.3%. This growth is driven by growing adoption of data reliability tools, real-time monitoring platforms, and AI-powered observability solutions across cloud-native and hybrid data ecosystems.

Data observability refers to an organization’s ability to fully understand the health and quality of its data systems. It involves continuous monitoring, tracking, and analysis of data flows, pipelines, and transformations across complex IT infrastructures. Leveraging advanced telemetry, metadata analysis, anomaly detection, and automated alerting, data observability ensures that data remains accurate, timely, and trustworthy across its lifecycle.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

It empowers data engineers, analysts, and IT operations teams to detect data outages, quality issues, schema changes, and lineage breakdowns in real time, thereby enabling proactive troubleshooting and maintaining data reliability in both batch and real-time environments.

The global data observability market is witnessing significant growth driven by the rapid proliferation of data across cloud-native platforms, big data architectures, and AI-powered analytics ecosystems.

As enterprises scale their digital transformation efforts, the complexity of data pipelines and the demand for trustworthy data have intensified, creating a strong need for comprehensive observability solutions. Businesses across sectors such as finance, healthcare, retail, and telecom are adopting data observability platforms to enhance data governance, reduce downtime, and ensure seamless data integration across heterogeneous systems.

Rising regulatory pressures around data privacy and compliance, integrated with the growing adoption of hybrid and multi-cloud environments, are further fueling market expansion. Modern data observability tools now integrate features such as automated data profiling, predictive monitoring, and root cause analysis, offering end-to-end visibility into data health.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Vendors are also innovating with AI and machine learning capabilities to provide contextual insights and reduce mean time to resolution. As data continues to be a strategic asset, the demand for scalable and intelligent observability solutions is expected to accelerate in the coming years.

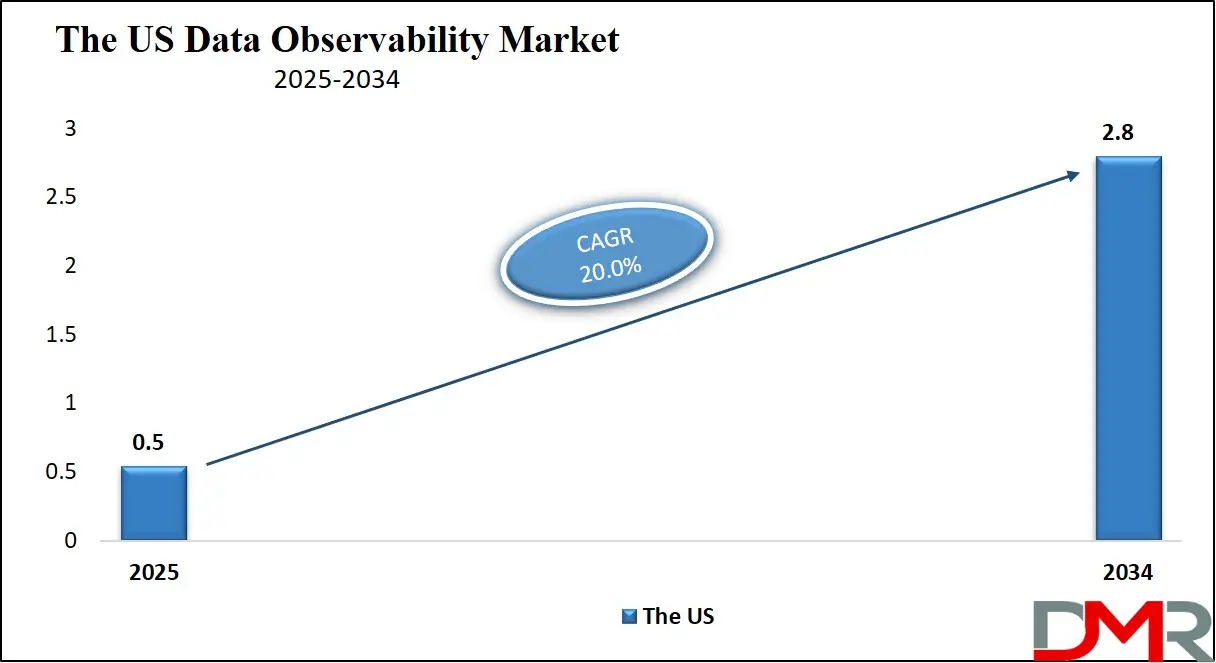

The US Data Observability Market

The U.S. Data Observability market size is projected to be valued at USD 0.5 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.8 billion in 2034 at a CAGR of 20.0%.

The US data observability market stands at the forefront of global adoption, driven by the country’s advanced digital infrastructure, rapid cloud migration, and growing reliance on real-time analytics. Enterprises across industries such as financial services, healthcare, retail, and technology are investing heavily in data observability tools to ensure data quality, pipeline resilience, and governance.

The demand is particularly strong among data-intensive organizations using distributed data systems like Snowflake, Databricks, and AWS. As U.S. companies embrace data-driven decision-making and AI-powered automation, the need for comprehensive data monitoring, lineage tracing, and anomaly detection has become mission-critical. The integration of observability with data operations (DataOps) and DevOps workflows is also accelerating market traction.

Regulatory compliance frameworks such as HIPAA, SOX, and CCPA are further pushing enterprises in the US to adopt robust data observability platforms that ensure traceability, accuracy, and real-time alerting. Cloud-native observability solutions that offer proactive diagnostics, schema change detection, and metadata-driven insights are gaining strong momentum.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Additionally, US-based vendors are leading innovation with features such as auto-healing data pipelines, AI-driven data validation, and multi-cloud observability dashboards. The market is also benefiting from strategic partnerships, VC funding, and enterprise demand for scalable, low-latency data infrastructure observability, positioning the United States as a global hub for cutting-edge data reliability and performance monitoring solutions.

Europe Data Observability Market

The European data observability market is estimated to reach USD 400 million in 2025, reflecting its strong position as one of the leading regions in this sector. This growth is driven by growing investments in cloud-native data infrastructure, widespread adoption of analytics and AI technologies, and a heightened focus on data compliance and governance due to regulations such as the General Data Protection Regulation (GDPR).

Countries like Germany, the United Kingdom, France, and the Netherlands are leading in implementation, particularly within sectors such as banking, healthcare, government, and retail. Enterprises in the region are deploying observability platforms to ensure data quality, reduce operational risks, and gain visibility into complex hybrid data environments.

With a projected CAGR of 28.5% from 2025 to 2034, the European market is set for sustained growth as digital transformation efforts accelerate. The rising demand for real-time data monitoring, anomaly detection, and automated root cause analysis is prompting both private enterprises and public sector organizations to adopt advanced observability solutions.

The growing complexity of data pipelines, combined with the region’s growing reliance on distributed cloud environments and AI-driven decision-making, further reinforces the need for robust observability frameworks. As European businesses continue to prioritize data reliability, security, and operational resilience, the region is expected to remain a key contributor to the global data observability market’s expansion.

Japan Data Observability Market

Japan’s data observability market is projected to reach USD 80 million in 2025, reflecting its steady adoption of advanced data monitoring and reliability tools across key industries. As enterprises in Japan modernize legacy systems and adopt digital-first strategies, there is a growing need for tools that can provide real time visibility into data pipelines, detect anomalies, and ensure data consistency across complex infrastructures.

Sectors such as manufacturing, telecommunications, and financial services are leading the adoption, driven by their need to maintain high operational efficiency, data accuracy, and system uptime. The government’s push for digital transformation under initiatives like “Society 5.0” is also supporting the expansion of observability platforms across the public and private sectors.

With a forecasted CAGR of 24.7% from 2025 to 2034, Japan’s data observability market is expected to grow steadily, though at a more measured pace compared to regions like North America or Europe. Cultural emphasis on precision, quality control, and risk avoidance aligns well with the objectives of data observability, encouraging broader acceptance over time.

As organizations increasingly migrate to cloud platforms, adopt AI-driven analytics, and rely on large-scale data integration, the demand for observability solutions is expected to strengthen. Vendors that offer localized support, compliance with Japanese data privacy laws, and integration with local infrastructure will be well-positioned to capture growth in this expanding market.

Global Data Observability Market: Key Takeaways

- Market Value: The global data observability market size is expected to reach a value of USD 9.7 billion by 2034 from a base value of USD 1.7 billion in 2025 at a CAGR of 21.3%.

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 72.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is expected to maintain its dominance in the deployment mode segment, capturing 66.0% of the total market share in 2025.

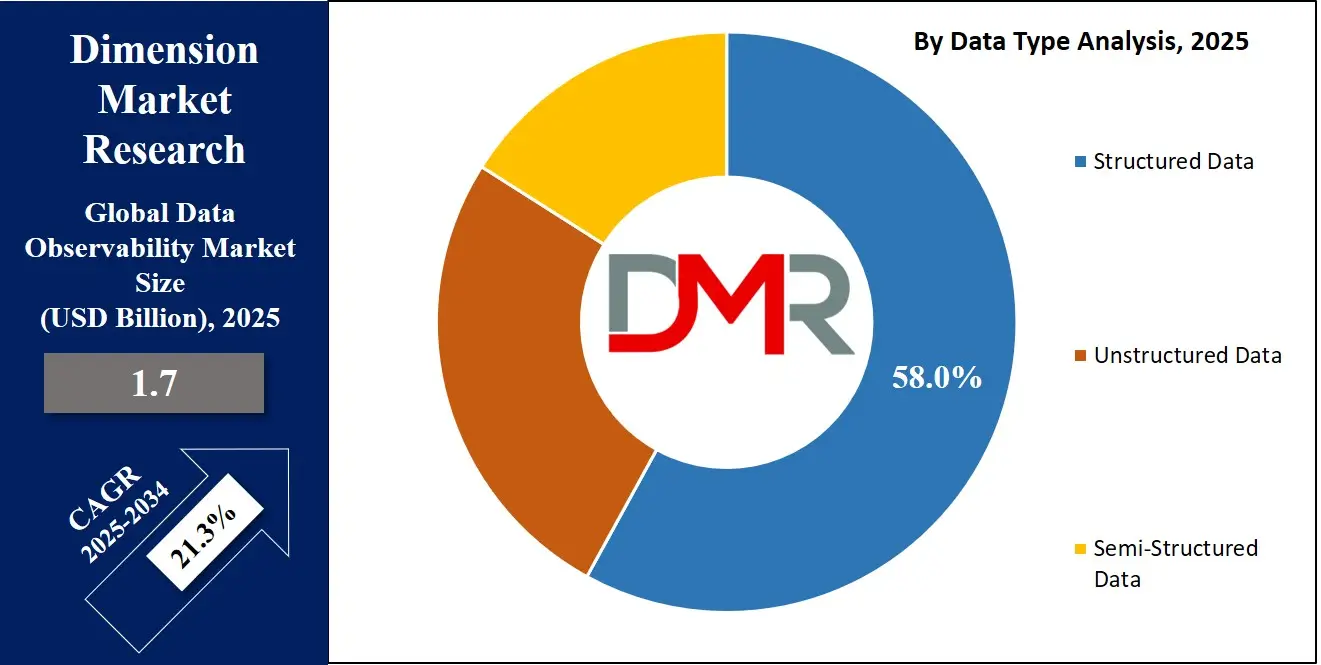

- By Data Type Segment Analysis: Structured Data type is poised to consolidate its dominance in the data type segment, capturing 58.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 68.0% of the market share in 2025.

- By Application Segment Analysis: Data Pipeline Monitoring applications will account for the maximum share in the application segment, capturing 28.0% of the total market value.

- By Industry Vertical Segment Analysis: Hospitals and Clinics are expected to consolidate their dominance in the industry vertical segment, capturing 40.0% of the market share in 2025.

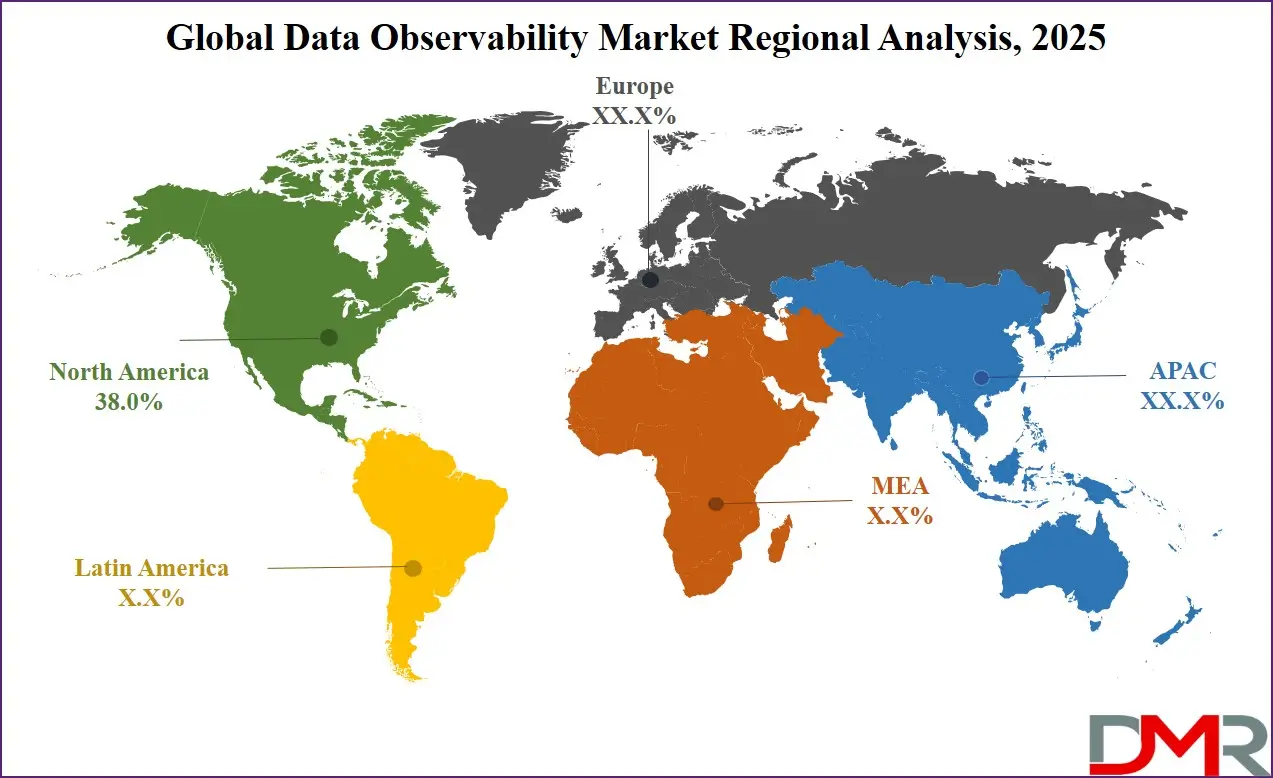

- Regional Analysis: North America is anticipated to lead the global data observability market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global data observability market are Monte Carlo, Databand (IBM), Acceldata, Bigeye, Datafold, Anomalo, Soda, Metaplane, Collibra, Atlan, Alation, Splunk, Dynatrace, New Relic, Datadog, Cribl, Observe Inc., LogicMonitor, and Others.

Global Data Observability Market: Use Cases

-

Real Time Monitoring of Data Pipelines in E-commerce: E-commerce companies rely on continuous data flows for personalized recommendations, inventory tracking, and real time analytics. Data observability platforms help monitor these pipelines, detecting issues like broken ETL jobs or schema changes before they impact operations. With real-time alerts and anomaly detection, businesses can maintain data freshness and consistency across systems. This ensures seamless customer experiences during high-traffic events such as sales or product launches. Observability also improves collaboration between engineering and data teams, reducing downtime and ensuring accurate data delivery across marketing, logistics, and customer engagement platforms.

- Compliance and Regulatory Reporting in Financial Services: Financial institutions must ensure data accuracy and traceability to comply with regulations such as SOX, GDPR, and Basel III. Data observability platforms provide visibility into financial data pipelines, enabling real time monitoring of data lineage, quality, and schema changes. This ensures that regulatory reports are built on clean and reliable data. The technology also helps automate error detection, audit logging, and validation of financial records. With observability, compliance teams can reduce risk, enhance transparency, and avoid penalties related to inaccurate data reporting or unauthorized data manipulation across banking, insurance, and investment domains.

- Ensuring Data Accuracy in Healthcare Analytics: Healthcare organizations use vast datasets for diagnostics, patient care, and clinical research. Data observability tools help monitor these data flows, ensuring accuracy and completeness across electronic health records, IoT devices, and lab systems. They detect anomalies, identify pipeline failures, and maintain compliance with standards like HIPAA. With observability, teams can ensure consistent data availability for real time analytics and decision-making. It supports timely alerts for data integrity issues, enhances patient safety, and strengthens trust in healthcare data used for operational reporting, treatment outcomes, and research studies.

- Optimizing DataOps and Cloud Migration in Enterprises: Enterprises migrating to cloud platforms or scaling digital operations often face pipeline instability and data fragmentation. Data observability platforms offer unified visibility into hybrid environments, allowing teams to detect and resolve pipeline errors, performance lags, or schema mismatches. During cloud migration, these tools validate data integrity and monitor pipeline behavior across legacy and modern systems. Observability improves DataOps efficiency by enabling automated monitoring, root cause analysis, and faster incident resolution. It supports scalability, enhances collaboration between data and engineering teams, and ensures smooth transitions without disrupting business operations or data reliability.

Impact of Artificial Intelligence on the Data Observability Market

Artificial Intelligence is significantly transforming the data observability landscape by enabling smarter, faster, and more autonomous monitoring of data systems. Traditional observability solutions rely heavily on manual rule configurations and static thresholds, which often struggle to detect complex or evolving data issues. With the integration of AI, observability platforms can automatically learn from data behavior, detect subtle anomalies, and predict potential failures before they occur. This reduces the dependency on human intervention and minimizes downtime across critical data pipelines.

AI-powered observability tools also enhance root cause analysis by correlating metrics, logs, and events to identify the exact source of data disruptions. Through machine learning models, these tools continuously adapt to changing data patterns, allowing real time decision-making and proactive incident response.

In addition, AI enables intelligent alerting, reducing alert fatigue by filtering out false positives and prioritizing the most impactful issues. As organizations scale their data environments across multi-cloud and hybrid infrastructures, AI-driven observability becomes essential to ensure performance, reliability, and compliance. The growing integration of generative AI and natural language querying is further simplifying data quality investigations, making observability accessible to business users and data stewards, not just engineers.

Global Data Observability Market: Stats & Facts

- In 2023, 61% of OECD countries had adopted metadata standards to support interoperability and data quality in digital public infrastructure.

- By mid-2025, 67% of OECD countries had adopted API standards, and 88% had implemented interoperability frameworks across 33 member nations.

- Saudi Data & AI Authority (SDAIA)

- As of 2024, Saudi Arabia had integrated over 320 government systems into its National Data Lake.

- The government also hosted more than 8,700 open datasets from 230 public entities.

- In 2025, Saudi Arabia ranked first globally in the Open Government Data Index, recognizing its national efforts in structured data sharing and governance.

- India – NITI Aayog (Government Think Tank)

- As of June 2025, inaccurate or duplicated beneficiary data contributed to an estimated 4% to 7% inflation in government welfare spending.

- This prompted the development of a nationwide data quality improvement roadmap for public sector programs and subsidies.

- U.S. Policy Experts and Public Sector Data Concerns

- In July 2025, a survey of policy experts showed that 89% were concerned about the declining quality of U.S. official economic data.

- Of those surveyed, 41% said they were “very concerned” about the situation.

- The Bureau of Labor Statistics had experienced a staff reduction of approximately 15% by mid-2025.

- Roughly 350 components of the Producer Price Index were scheduled for discontinuation due to limited resources and internal restructuring.

Global Data Observability Market: Market Dynamics

Global Data Observability Market: Driving Factors

Rising Complexity of Data Infrastructure across Enterprises

The growing adoption of hybrid and multi-cloud environments, combined with microservices and distributed data architectures, is significantly growing data pipeline complexity. This has created a strong need for comprehensive data observability platforms that offer real time monitoring, automated anomaly detection, and end-to-end data lineage. Enterprises are investing in observability solutions to ensure data reliability, prevent downtime, and maintain seamless data operations across disparate systems and applications.

Demand for Reliable and Trustworthy Data in Decision-Making

Organizations across industries are increasingly relying on analytics, machine learning, and real time dashboards for strategic decisions. As a result, the demand for high-quality, accurate, and timely data has surged. Data observability tools help ensure data freshness, identify schema drift, and validate transformations, making them essential for maintaining data trust. This is especially crucial in sectors like financial services, healthcare, and retail, where bad data can lead to compliance risks, customer dissatisfaction, or lost revenue.

Global Data Observability Market: Restraints

High Implementation Costs and Integration Challenges

Despite growing awareness, the adoption of data observability platforms can be restricted by high initial deployment costs, especially for small and mid-sized enterprises. Integrating these tools with legacy data systems, BI platforms, and cloud infrastructure often requires customization, skilled resources, and extended implementation timelines. These technical and financial barriers may slow down adoption in budget-constrained or resource-limited organizations.

Lack of Standardization and Unified Metrics in Data Observability

The data observability space is still evolving, and there is no universally accepted framework or set of metrics to define and measure data health. Different vendors offer varying capabilities, leading to confusion among end-users and inconsistent practices across organizations. This lack of standardization can hinder interoperability and reduce the effectiveness of observability strategies, particularly in complex, multi-platform environments.

Global Data Observability Market: Opportunities

Growing Adoption of DataOps and Automation in Analytics Workflows

As organizations embrace DataOps practices to streamline their data pipelines and analytics workflows, the need for automated data quality monitoring and observability becomes more pronounced. Data observability platforms integrated with DataOps tools can deliver continuous validation, faster incident resolution, and improved data governance. This creates a significant opportunity for vendors to offer scalable, AI-enabled observability solutions that support automation, collaboration, and agility in enterprise data ecosystems.

Expanding Role of Observability in Cloud Migration and Modernization Projects

Many enterprises are undergoing cloud modernization efforts, moving from on-premise systems to platforms like Snowflake, Databricks, and Google BigQuery. During these transitions, observability plays a key role in tracking data movement, ensuring consistency, and reducing migration risks. Vendors offering observability solutions tailored for cloud-native architectures are well-positioned to tap into this rapidly growing opportunity as digital transformation continues to accelerate globally.

Global Data Observability Market: Trends

Integration of AI and Machine Learning in Observability Platforms

AI-driven observability tools are becoming more prevalent as they enable intelligent alerting, predictive analytics, and contextual root cause analysis. These platforms can detect anomalies in real time, identify data drift, and adapt to changes in data patterns without manual intervention. The integration of generative AI and natural language interfaces is also making observability tools more user-friendly for data stewards and business teams.

Shift Toward Unified Data Observability and Governance Platforms

Organizations are increasingly looking for holistic platforms that combine observability, data cataloging, lineage, and governance features. This unified approach allows teams to manage data quality, compliance, and observability within a single framework. Vendors are responding by offering integrated solutions that support metadata management, automated monitoring, and policy enforcement, aligning data observability with broader enterprise data management strategies.

Global Data Observability Market: Research Scope and Analysis

By Component Analysis

Software components are expected to lead the component segment of the global data observability market, accounting for approximately 72.0% of the total market share in 2025. This dominance is driven by the widespread adoption of standalone and integrated observability platforms that offer real time monitoring, automated root cause analysis, anomaly detection, and data lineage tracking.

Organizations prefer software solutions for their scalability, ease of integration with existing data stacks, and ability to support cloud-native and hybrid environments. These tools enable enterprises to manage complex data workflows, improve data reliability, and ensure seamless analytics operations across distributed systems.

On the other hand, services within the data observability market include consulting, implementation, training, support, and managed services. Although this segment holds a smaller share, it plays a crucial role in helping organizations deploy and maintain observability solutions effectively.

Services are particularly valuable for enterprises with limited in-house technical expertise, as they assist in customizing observability tools to specific business needs, ensuring optimal configuration, and supporting continuous performance tuning. The services segment is also seeing increased demand as companies seek to accelerate their digital transformation initiatives and minimize time to value from observability investments.

By Deployment Mode Analysis

Cloud-based deployment mode is projected to dominate the deployment mode segment of the global data observability market, accounting for 66.0% of the total market share in 2025. This preference is driven by the growing shift of enterprises toward cloud-native data infrastructure, which requires scalable, flexible, and cost-effective observability solutions.

Cloud-based platforms offer real time monitoring, automated updates, seamless integrations, and faster time to deployment compared to traditional setups. Organizations across sectors are adopting these solutions to support their hybrid and multi-cloud strategies, enabling centralized data visibility and agility in managing complex, distributed data environments.

On-premise deployment, while holding a smaller share of the market, continues to be preferred by organizations with strict data privacy, compliance, or security requirements. Industries such as banking, healthcare, and government often opt for on-premise observability tools to maintain full control over their data environments and adhere to regulatory mandates.

These solutions are typically favored by companies operating in legacy systems or sensitive data ecosystems where cloud adoption is either limited or highly regulated. Despite slower growth, the on-premise segment remains relevant for businesses that prioritize customization, internal control, and data sovereignty.

By Data Type Analysis

Structured data is expected to maintain a dominant position in the data type segment of the global data observability market, capturing 58.0% of the total market share in 2025. This is largely due to the widespread use of structured data across enterprise applications, relational databases, and business intelligence platforms. Structured data is typically organized in rows and columns, making it easier to monitor, validate, and analyze using observability tools.

Organizations rely on structured data for critical operations such as financial reporting, customer management, and performance tracking, all of which require high levels of data accuracy, consistency, and traceability. As a result, observability solutions focused on structured data are in high demand, particularly in industries such as finance, healthcare, and retail.

Unstructured data, while holding a smaller share of the market, is becoming increasingly important due to the explosive growth of data from sources such as social media, emails, documents, video, and IoT devices. Observability for unstructured data presents unique challenges, as it lacks a predefined schema and often exists in disparate formats across various storage systems.

Despite these complexities, organizations are beginning to invest in tools that can monitor and analyze unstructured data for use in sentiment analysis, behavioral insights, and risk assessment. The rise of AI and machine learning technologies is further enabling the development of observability platforms that can extract metadata, detect anomalies, and ensure the integrity of unstructured data flows. As digital ecosystems continue to evolve, the demand for robust unstructured data observability is expected to grow steadily.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Organization Size Analysis

Large enterprises are expected to dominate the organization size segment of the global data observability market, accounting for 68.0% of the total market share in 2025. This dominance is driven by their complex data environments, larger IT budgets, and strong need for real time data quality management across numerous departments and systems.

These organizations typically operate across multiple geographies and rely heavily on data-driven decision-making, making it critical to have advanced observability solutions that can ensure the reliability, accuracy, and performance of their data pipelines. Large enterprises are also early adopters of cloud-native infrastructure, AI-driven analytics, and DataOps practices, all of which align with the capabilities offered by modern observability platforms.

Small and medium-sized enterprises, while holding a smaller share of the market, are showing growing interest in adopting data observability tools as they scale their digital operations. SMEs are recognizing the value of maintaining data trust and integrity as they rely more on cloud applications, automation, and real time analytics.

Although budget constraints and limited technical resources can pose challenges, the availability of affordable, user-friendly, and SaaS-based observability solutions is making it easier for smaller organizations to implement these tools. As data becomes a critical asset for growth and competitiveness, the adoption of observability platforms among SMEs is expected to gain momentum in the coming years.

By Application Analysis

Data pipeline monitoring applications are expected to capture the largest share in the application segment of the global data observability market, accounting for 28.0% of the total market value in 2025. This is primarily due to the growing complexity of modern data environments where data moves through multiple sources, transformation stages, and destinations.

Observability tools equipped for pipeline monitoring help track data movement in real time, identify failures or bottlenecks, and detect anomalies such as latency, schema changes, or incomplete loads. These capabilities are critical for maintaining operational continuity and ensuring that downstream analytics and business intelligence tools receive clean and timely data. Industries such as e-commerce, telecommunications, and logistics heavily depend on these applications to ensure high availability and performance of data infrastructure.

Data quality and reliability applications also hold a significant place in this segment, as organizations across sectors rely on trustworthy data to make strategic and operational decisions. These applications enable teams to measure data accuracy, completeness, consistency, and timeliness across their systems. By providing automated validation checks, anomaly detection, and lineage tracking, data observability tools ensure that insights drawn from the data are based on reliable foundations.

This is especially important in sectors like finance, healthcare, and public services, where data errors can lead to compliance issues, financial loss, or compromised outcomes. As the focus on data governance and business resilience grows, the importance of data quality and reliability within observability frameworks continues to rise.

By Industry Vertical Analysis

Hospitals and clinics are anticipated to dominate the industry vertical segment of the global data observability market, capturing 40.0% of the market share in 2025. This strong position is driven by the healthcare sector’s growing dependence on real-time data for patient care, diagnostics, and medical research. Hospitals deal with large volumes of structured and unstructured data generated from electronic health records, lab systems, imaging platforms, and medical devices.

Data observability tools help these institutions maintain data integrity, monitor data flows, and ensure compliance with strict regulations such as HIPAA. By enabling continuous monitoring and automated alerting, observability platforms reduce the risk of errors in patient information, support better clinical outcomes, and enhance trust in health data systems.

The IT and telecom sector also represents a significant segment in the data observability market, with growing adoption of tools to manage complex data ecosystems and ensure service continuity. These industries handle massive streams of customer usage data, operational logs, and infrastructure performance metrics, often in real time.

Observability platforms provide visibility into distributed systems, help detect anomalies, and improve the stability of digital services and applications. For telecom providers, maintaining uptime and data accuracy is essential to customer satisfaction and competitive differentiation. In the IT domain, observability supports DevOps practices, enabling rapid troubleshooting, reduced incident resolution time, and continuous delivery of high-performance applications. As these industries continue expanding their cloud-native architectures and digital services, the need for robust data observability solutions is expected to grow steadily.

The Data Observability Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Data Type

- Structured Data

- Unstructured Data

- Semi-Structured Data

By Organization Size

By Application

- Data Pipeline Monitoring

- Data Quality & Reliability

- Data Lineage & Root Cause Analysis

- Anomaly Detection

- Other Applications

By Industry Vertical

- BFSI

- IT & Telecom

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Manufacturing

- Others

Global Data Observability Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to lead the global data observability market in 2025, accounting for 38.0% of the total market revenue. This dominance is fueled by the region’s advanced digital infrastructure, widespread adoption of cloud-native platforms, and strong presence of leading technology vendors offering AI-driven observability solutions.

Enterprises across the United States and Canada are increasingly investing in data reliability tools to support complex analytics, ensure compliance with regulations such as HIPAA and CCPA, and drive real-time decision-making. The region's early adoption of DataOps, machine learning, and hybrid data architectures further accelerates the demand for comprehensive data observability platforms across key sectors like finance, healthcare, retail, and technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness the most significant growth in the global data observability market over the forecast period. This growth is driven by rapid digital transformation, growing cloud adoption, and the expansion of data-driven applications across emerging economies such as India, China, and Southeast Asian countries.

Organizations in the region are investing in advanced analytics, IoT, and AI technologies, all of which require high-quality and reliable data. As enterprises modernize their IT infrastructure and embrace hybrid cloud models, the need for scalable and automated data observability tools is rising sharply. Additionally, growing awareness around data governance, compliance, and operational efficiency is accelerating the adoption of observability platforms across industries including banking, telecom, manufacturing, and healthcare.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Data Observability Market: Competitive Landscape

The global competitive landscape of the data observability market is characterized by the presence of a mix of established technology giants and emerging startups, all striving to enhance their capabilities through innovation, strategic partnerships, and product differentiation. Leading players such as Datadog, Splunk, New Relic, and Dynatrace are leveraging their strong observability portfolios to expand into data-centric monitoring, while specialized vendors like Monte Carlo, Acceldata, Bigeye, and Anomalo are focusing on purpose-built platforms that address data quality, pipeline monitoring, and real-time anomaly detection.

Companies are increasingly incorporating artificial intelligence, automation, and metadata-driven insights into their solutions to gain a competitive edge. The market is also witnessing heightened M&A activity, particularly among cloud-native and data infrastructure-focused firms, as vendors aim to offer end-to-end observability across hybrid and multi-cloud environments. As demand for data reliability continues to surge, competition is intensifying around scalability, integration flexibility, and user-friendly interfaces tailored for both data engineers and business users.

Some of the prominent players in the global data observability market are:

- Monte Carlo

- Databand

- Acceldata

- Bigeye

- Datafold

- Anomalo

- Soda

- Metaplane

- Collibra

- Atlan

- Alation

- Splunk

- Dynatrace

- New Relic

- Datadog

- Cribl

- Observe, Inc.

- LogicMonitor

- AppDynamics (Cisco)

- Elastic N.V.

- Other Key Players

Global Data Observability Market: Recent Developments

- July 2025: Observe, Inc. closed a USD 156 million Series C funding round led by Sutter Hill Ventures to scale its AI-powered observability platform and global reach.

- June 2025: DataBahn.ai raised USD 17 million in a Series A round led by Forgepoint Capital for its security-native data pipeline and observability platform serving enterprise workloads.

- June 2025: Collibra acquired data access startup Raito to enhance its governance and secure access management offerings in observability and metadata control.

- April 2025: Datadog acquired Metaplane, an AI-powered data observability startup, strengthening its capabilities in column-level lineage tracking and end-to-end pipeline monitoring.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.7 Bn |

| Forecast Value (2034) |

USD 9.7 Bn |

| CAGR (2025–2034) |

21.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.5 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-Based and On-Premise), By Data Type (Structured Data, Unstructured Data, and Semi-Structured Data), By Organization Size (Large Enterprises and SMEs), By Application (Data Pipeline Monitoring, Data Quality & Reliability, Data Lineage & Root Cause Analysis, Anomaly Detection, and Other Applications), and By Industry Vertical (BFSI, IT & Telecom, Healthcare & Life Sciences, Retail & E-commerce, Government & Public Sector, Manufacturing, and Others). |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Monte Carlo, Databand (IBM), Acceldata, Bigeye, Datafold, Anomalo, Soda, Metaplane, Collibra, Atlan, Alation, Splunk, Dynatrace, New Relic, Datadog, Cribl, Observe Inc., LogicMonitor, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |