Market Overview

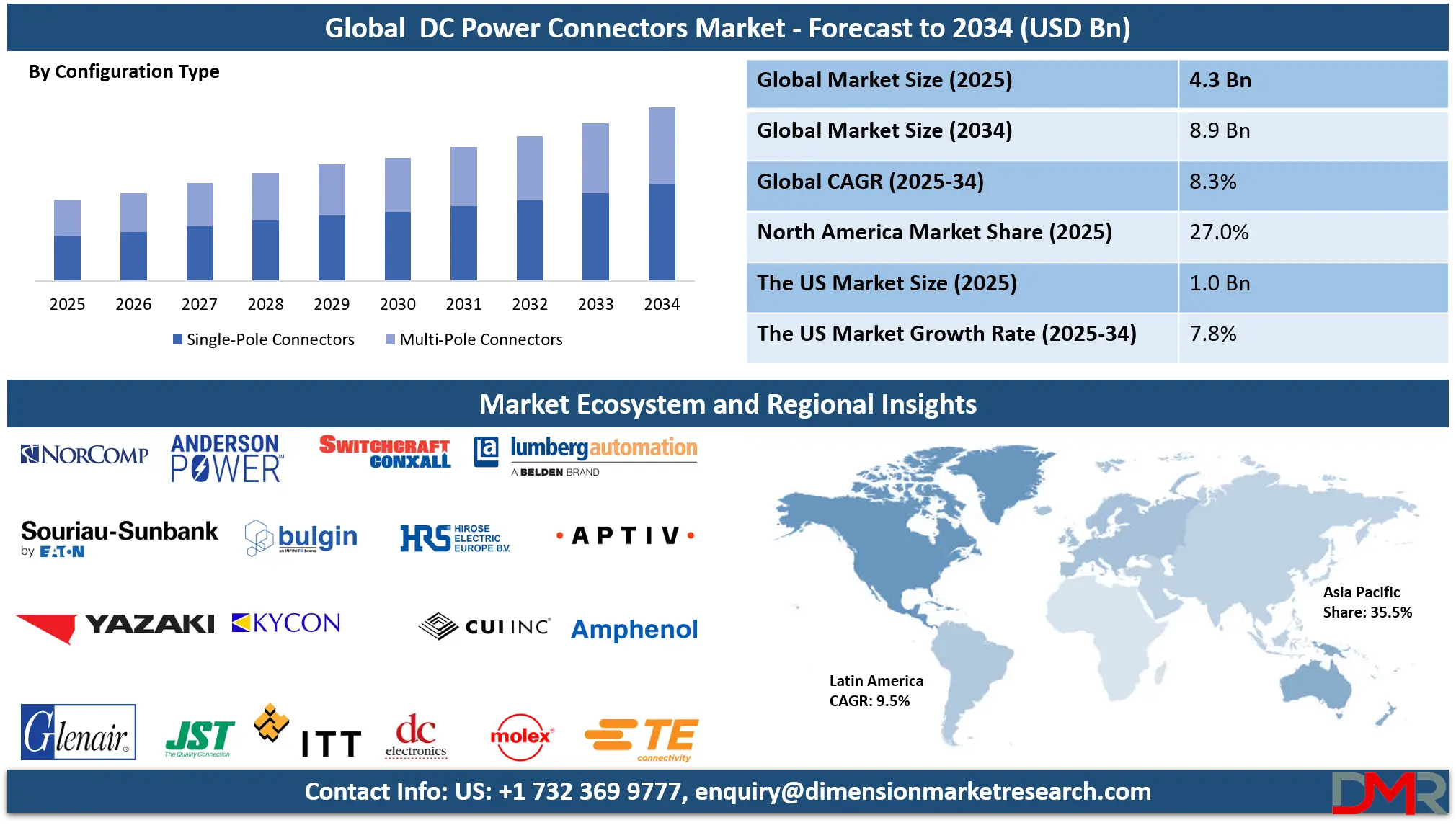

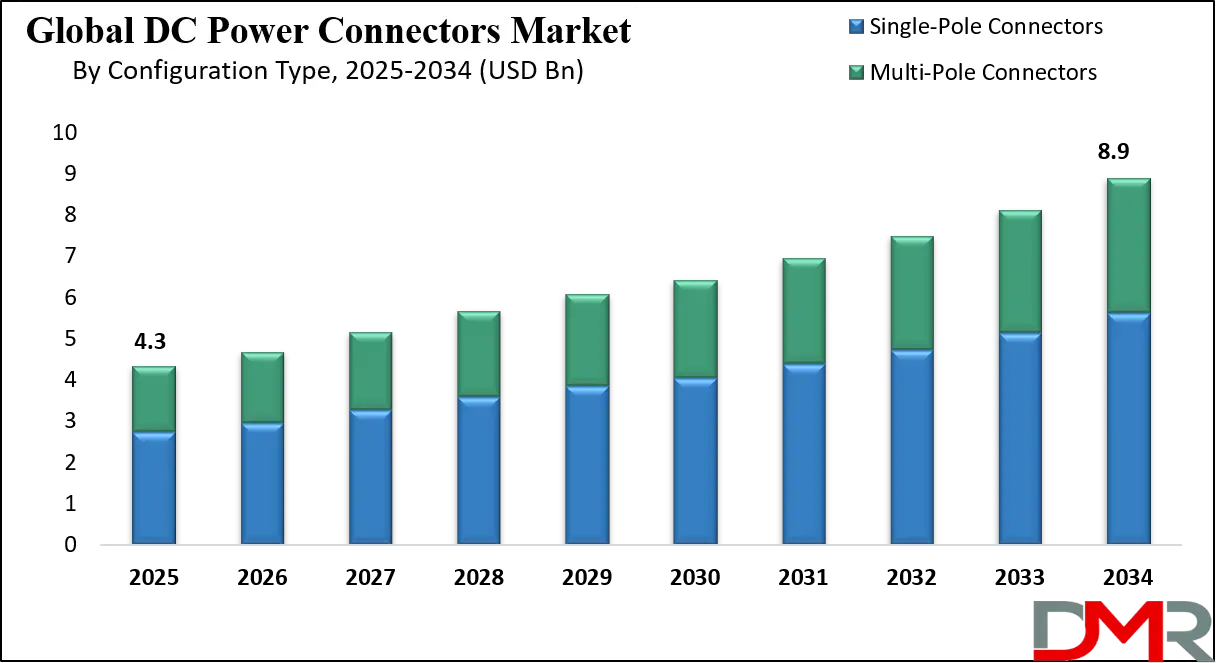

The Global DC Power Connectors Market is projected to reach USD 4.3 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 8.3% from 2025 to 2034, reaching a market value of USD 8.9 billion by 2034.

This strong growth trajectory is driven by rising demand for DC power connectivity solutions, increasing adoption of electric vehicles (EVs), rapid expansion of consumer electronics, and growing investments in renewable energy systems, energy storage, and industrial automation. The market is further supported by advancements in high-current and high-voltage DC connectors, increased deployment of 5G infrastructure and data centers, and the shift toward compact, efficient, and high-reliability power connectors across automotive, telecommunications, medical devices, and industrial equipment. Additionally, the expansion of smart grids, battery-powered systems, and charging infrastructure continues to accelerate demand for durable, high-performance DC power connector solutions, reinforcing sustained market growth through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market addresses fundamental challenges in modern electronics, such as energy efficiency optimization, device portability and design flexibility, user safety, and the need for standardized, interoperable power interfaces across diverse industries and global regions. As devices become more powerful and compact, the connectors must evolve to handle higher currents in smaller form factors while maintaining reliability over thousands of mating cycles.

Technological advancements are a primary catalyst, with innovations including miniaturized high-current connectors, smart connectors with integrated data pins and authentication chips, magnetically-attached (MagSafe-style) connectors for safe breakaway, sealed connectors with high IP ratings for harsh environments, and the widespread integration of USB-Power Delivery (PD) standards. The convergence of power and data in single-cable solutions is revolutionizing device connectivity. Furthermore, the use of advanced materials such as high-conductivity copper alloys, thermoplastic composites for durability, and advanced plating for corrosion resistance is reshaping product performance, longevity, and application scope.

Growing government and industry initiatives are significant accelerants. Global energy efficiency standards (like the EU's Ecodesign Directive and ENERGY STAR), mandatory safety certifications (UL, CE, TUV), and aggressive renewable energy adoption targets are compelling OEMs to adopt more efficient and standardized connector solutions. However, the market faces persistent barriers, including fragmented regional and application-specific standards, intense price sensitivity in high-volume consumer electronics segments, supply chain vulnerabilities, and the slow phase-out of legacy connector types. Despite these challenges, the powerful convergence of IoT device proliferation, 5G and edge computing infrastructure rollout, electric vehicle charging ecosystem development, and industrial automation (Industry 4.0) solidifies DC power connectors as a fundamental and growing enabler of global electrification through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US DC Power Connectors Market

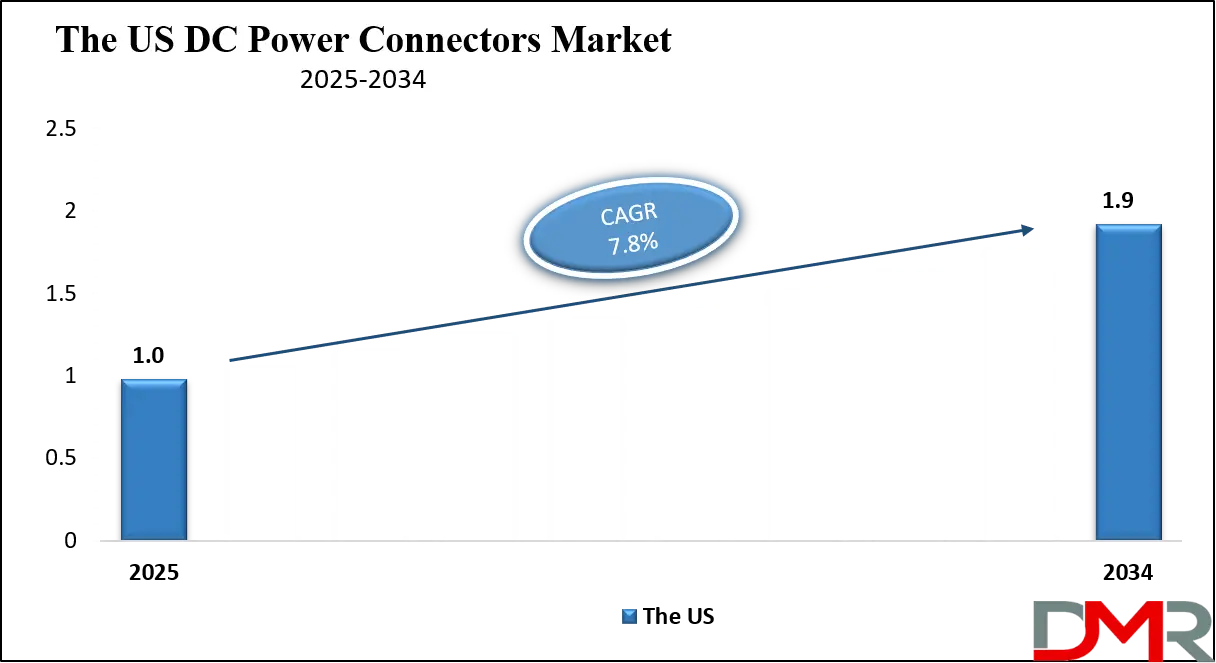

The U.S. DC Power Connectors Market is projected to reach USD 1.0 billion in 2025 and grow at a CAGR of 7.8%, reaching USD 1.9 billion by 2034. The U.S. maintains a leadership position in global demand, driven by its mature and innovative electronics manufacturing base, exceptionally high consumer electronics adoption rates, and substantial investments in next-generation infrastructure. The country is a hub for technology R&D, setting trends that often proliferate globally.

Strong, multifaceted demand originates from key sectors such as IT & telecommunications (data centers, networking gear), advanced medical devices, industrial automation and robotics, aerospace & defense, and the massive consumer electronics sector. Major technology corporations, automotive OEMs, and industrial conglomerates drive continuous innovation, pushing for more compact, higher-power, and "smarter" connector solutions with embedded intelligence. U.S.-based standards bodies and industry consortia play an outsized role in shaping global specifications for safety, performance, and interoperability.

The rapid and decisive shift towards USB Type-C with Power Delivery is a defining trend, recharging the landscape for portable computing, peripherals, and mobile devices. Concurrently, the ambitious expansion of renewable energy installations (utility-scale solar and wind) and the nationwide build-out of EV charging station networks, supported by federal funding and initiatives like the National Electric Vehicle Infrastructure (NEVI) program, create sustained, high-value demand for robust, high-current DC connectors. This combination of cutting-edge consumption and strategic infrastructure investment solidifies the U.S. market as a global leader in both volume demand and technological innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe DC Power Connectors Market

The Europe DC Power Connectors Market is projected to be valued at approximately USD 920 million in 2025 and is projected to reach around USD 1.7 billion by 2034, growing at a CAGR of about 6.7% from 2025 to 2034. Europe's market strength is anchored by its world-leading industrial and automotive manufacturing sectors, some of the planet's most stringent energy efficiency and environmental regulations, and ambitious, legally-binding green energy and carbon neutrality targets.

Countries such as Germany (with its "Industrie 4.0"), the U.K., France, Italy, and the Nordic nations are pivotal adopters and innovators. Demand is powerfully driven by automotive electrification, industrial IoT and automation, and large-scale renewable energy projects (particularly offshore wind and solar parks). The regional focus on quality engineering, product safety (CE marking), and circular economy principles profoundly influences connector design, favoring longevity, repairability, and the use of recyclable materials.

Europe's aggressive push for electric vehicle adoption, backed by a comprehensive charging infrastructure plan (Alternative Fuels Infrastructure Regulation - AFIR), and the deepening of industrial digitalization are primary growth engines. Significant funding through overarching initiatives like the European Green Deal and NextGenerationEU directly supports adoption in key areas such as solar micro-inverters, residential and grid-scale energy storage systems, and smart grid applications. This regulatory and financial backdrop ensures Europe remains a high-value, quality-driven, and innovation-focused market for DC power connectors.

The Japan DC Power Connectors Market

The Japan DC Power Connectors Market is anticipated to be valued at approximately USD 380 million in 2025 and is expected to attain nearly USD 700 million by 2034, expanding at a CAGR of about 7.1% during the forecast period. Japan's market is characterized by its advanced, high-precision electronics manufacturing, global leadership in miniaturization and robotics, and strong, export-oriented automotive and industrial sectors.

Japanese component manufacturers are globally renowned for their mastery of miniaturization, extreme reliability engineering, and quality control. They produce highly specialized connectors for compact consumer electronics (cameras, gaming devices), advanced medical imaging and diagnostic equipment, and sophisticated factory automation and robotics systems. The government's strategic promotion of Society 5.0 and digital transformation (DX) accelerates the integration of advanced, reliable connectors into smart cities infrastructure, next-generation devices, and connected systems.

Japan's continued leadership in automotive technology, with a strong focus on hybrid and electric vehicles, spurs continuous innovation in high-voltage DC charging connectors (including contributions to the CHAdeMO standard) and complex in-vehicle power distribution networks. The national cultural and industrial emphasis on monozukuri (craftsmanship and manufacturing excellence), quality, and precision, combined with its role as a critical global supplier of high-end components, solidifies Japan's position as a key innovator and premium supplier in the global DC power connectors value chain.

Global DC Power Connectors Market: Key Takeaways

- Steady and Substantial Global Market Growth: The Global DC Power Connectors Market is poised for consistent expansion, moving from an estimated USD 4.3 billion in 2025 to USD 8.9 billion by 2034. This growth is fundamentally supported by the irreversible trends of electronic device proliferation and the global energy transition.

- Stable CAGR Underpinned by Macro-Electrification Trends: The projected CAGR of 8.3% from 2025 to 2034 is fueled by the compounding demand from portable electronics, renewable energy systems, EV charging infrastructure, data center expansion, and industrial automation all of which rely on DC power interconnections.

- Robust and Advanced U.S. Market: The U.S. market, starting at USD 1.0 billion in 2025 and growing to USD 1.9 billion by 2034 (CAGR 7.8%), remains a powerhouse driven by technological leadership, high consumption, and major infrastructure investments, particularly in EVs and IT.

- Asia-Pacific as the Manufacturing and Consumption Epicenter: Asia-Pacific is expected to maintain its dominance in both production volume and increasing consumption share, driven by its unchallenged position as the world's electronics manufacturing hub, coupled with rapidly growing domestic markets for electronics, EVs, and green energy in China, India, and Southeast Asia.

- Accelerating Standardization and Technological Sophistication: The market is being reshaped by the rapid adoption of universal standards like USB-C PD and the development of increasingly sophisticated connectors featuring smart technology, enhanced durability, and higher power densities in smaller form factors.

- Demand Amplified by the Global Energy Transition: The strategic shift towards electric mobility, decentralized renewable energy generation, and energy-efficient devices across all sectors is creating sustained, long-term demand for reliable, safe, and efficient DC power interconnection solutions, moving connectors from a passive component to a critical system enabler.

Global DC Power Connectors Market: Use Cases

- Consumer Electronics Charging & Power Delivery: Standard barrel jacks, USB connectors (especially Type-C), and proprietary magnetic connectors provide safe, standardized power input for laptops, tablets, routers, monitors, gaming consoles, and smart home devices, often integrating data transfer capabilities.

- Electric Vehicle DC Fast Charging: High-power DC connectors (such as CCS, CHAdeMO, and GB/T) are the physical interface at public and commercial fast-charging stations, enabling the transfer of hundreds of kilowatts to charge an EV battery in minutes.

- Renewable Energy System Integration: Specialized DC connectors (e.g., MC4, Anderson SB) are essential for connecting solar panels in arrays, linking panels to charge controllers and inverters, and integrating battery storage in both off-grid and grid-tied solar installations.

- Industrial Automation & Machinery: Ruggedized terminal blocks, heavy-duty power jacks, and sealed circular connectors provide reliable, vibration-resistant power connections for PLCs, motors, sensors, robotics, and other machinery in demanding factory environments.

- Medical & Healthcare Equipment: Safe, reliable, and often locking or sealed DC connectors power a wide range of portable and stationary medical devices, including patient monitors, diagnostic ultrasound machines, infusion pumps, and surgical tools, where failure is not an option.

- Telecommunications & Data Center Infrastructure: DC power connectors are integral to power distribution units (PDUs) within server racks, for networking equipment like routers and switches, and in the power systems for 5G small cells and macro cell sites.

- Aerospace, Defense, and Transportation: Mil-spec and high-reliability connectors are used in avionics, military communications equipment, and railway systems, where they must withstand extreme temperatures, shock, vibration, and corrosive environments.

Global DC Power Connectors Market: Stats & Facts

U.S. Bureau of Labor Statistics (BLS) – Electronic Connector Manufacturing

- The Producer Price Index (PPI) for electronic connector manufacturing has increased steadily over the past decade, indicating sustained cost and demand pressure in connector production.

- Connector manufacturing is classified under NAICS 334417 – Electronic Connector Manufacturing.

- The electronic components manufacturing subsector employs over 1 million workers in the United States.

- Electrical and electronic equipment assemblers account for over 110,000 jobs within this subsector.

- Electrical and electronic engineering technicians total approximately 21,000 professionals in the U.S.

U.S. Department of Commerce – Electronics & Electrical Equipment Manufacturing

- The U.S. electronics and electrical equipment manufacturing sector includes more than 12,800 active facilities.

- The sector employs approximately 1.1 million people nationwide.

- Annual sales from electronics and electrical equipment manufacturing exceed USD 1.8 trillion.

- Around 56% of U.S. electronics manufacturers export products internationally.

- Approximately 23% of manufacturers import raw materials or components.

- The Southern U.S. hosts about 27% of electronics manufacturing facilities.

- The Western U.S. accounts for another 27% of facilities, followed by the Midwest at 25%.

- Only about 2% of electronics manufacturers are women-owned.

- Minority-owned firms also represent around 2% of the sector.

International Electrotechnical Commission (IEC)

- IEC has been developing global electrical and electronic standards for over 115 years.

- IEC standards govern voltage ratings, current capacity, and safety requirements for DC power connectors.

- IEC metric connector families include M5, M8, and M12 connectors, widely used in DC power and industrial applications.

- IEC standards are adopted in more than 170 countries worldwide.

- IEC standards support interoperability across consumer electronics, industrial automation, EVs, and telecom equipment.

International Organization for Standardization (ISO)

- ISO standards define quality, durability, and environmental compliance requirements for electrical connectors.

- ISO-compliant connectors are designed to meet global safety and performance benchmarks.

- ISO and IEC jointly influence most global connector certification frameworks.

U.S. Department of Defense – MIL Standards

- MIL-DTL-5015 defines specifications for rugged circular electrical connectors used in power applications.

- Military-grade connectors are engineered for high-vibration, high-temperature, and harsh environments.

- These connectors are extensively used in defense vehicles, aerospace systems, and industrial power distribution.

U.S. International Trade Commission (USITC)

- U.S. exports of electronic products exceeded USD 268 billion in a single reported year.

- Imports of electronic products increased by more than USD 34 billion year-over-year.

- Electronic components, including connectors, are a core category in U.S. electronics trade.

International Energy Agency (IEA)

- Global electric vehicle adoption has grown at double-digit annual rates, increasing demand for DC power connectors.

- Renewable energy systems increasingly rely on DC-based architectures, particularly solar PV and battery storage.

- Grid-scale battery installations are expanding rapidly, driving demand for high-current DC connectors.

Global DC Power Connectors Market: Market Dynamic

Driving Factors in the Global DC Power Connectors Market

The Global Energy Transition: EVs and Renewables

The strategic shift away from fossil fuels is a powerful, structural driver. Electric vehicles require a completely new ecosystem of high-power DC charging connectors for public infrastructure and home charging. Simultaneously, solar photovoltaic systems, wind turbines, and associated battery energy storage systems (BESS) are fundamentally DC-based technologies, reliant on robust, weather-resistant connectors for installation, efficiency, and safety. Government mandates and

subsidies worldwide are accelerating this transition.

Technological Advancement and Miniaturization

Continuous innovation in connector design and materials science propels the market forward. This includes the development of connectors capable of handling higher current densities in smaller packages, the integration of smart ICs for power negotiation and authentication, the creation of magnetic latching systems for user convenience and safety, and advancements in sealing technology for harsh environments. These innovations expand application possibilities and improve user experience.

Restraints in the Global DC Power Connectors Market

Fragmented Standards and Legacy System Inertia

The coexistence of numerous legacy connector types (barrel jacks of various sizes, old DC plugs) with new standards (USB-C) creates a fragmented market. This leads to consumer confusion, inventory complexity for retailers and manufacturers, and compatibility issues. The slow phase-out of established but less efficient proprietary connectors, due to existing device fleets and tooling investments, acts as a drag on standardization efforts.

Intense Price Pressure and Perceived Commoditization

In high-volume, consumer-facing segments, DC power connectors are often subjected to severe cost-down pressures, being viewed as simple commodities. This intense competition can compress manufacturer margins, potentially limiting R&D investment for next-generation products and, in the lowest-cost segments, leading to compromises in material quality and durability that can affect brand reputation and product safety.

Opportunities in the Global DC Power Connectors Market

The USB-C Power Delivery Ecosystem Consolidation

The ongoing and seemingly inevitable consolidation around USB Type-C with Power Delivery as a universal charging and data standard for devices under 240W presents a monumental opportunity. It creates a vast, unified market for compliant connectors, cables, and related chipsets, driving economies of scale and simplifying design for OEMs.

Explosion of High-Power Application Sectors

The rapid growth of markets demanding very high current handling presents high-value opportunities. This includes ultra-fast EV charging (350kW to 1MW+), high-density computing in data centers and for AI servers, and high-power industrial equipment. These applications require specialized connectors with advanced thermal management, superior materials, and extreme reliability, commanding higher price points and margins.

Trends in the Global DC Power Connectors Market

The Ubiquity of USB-C as the Default Power Port

The USB Type-C connector is transitioning from a premium feature to the default power (and data) port across nearly all new consumer electronics, computing devices, and an increasing number of industrial and medical products. Its reversible design, high power capability, and multi-protocol support make it the centerpiece of modern connectivity.

Integration of Intelligence and Communication

"Smart connectors" with embedded digital identification chips (E-Markers) and communication capabilities are becoming commonplace, especially in higher-power applications. These chips enable devices to negotiate optimal voltage and current, authenticate cable capabilities to prevent overloading, and communicate other data, enhancing safety, performance, and user experience.

Global DC Power Connectors Market: Research Scope and Analysis

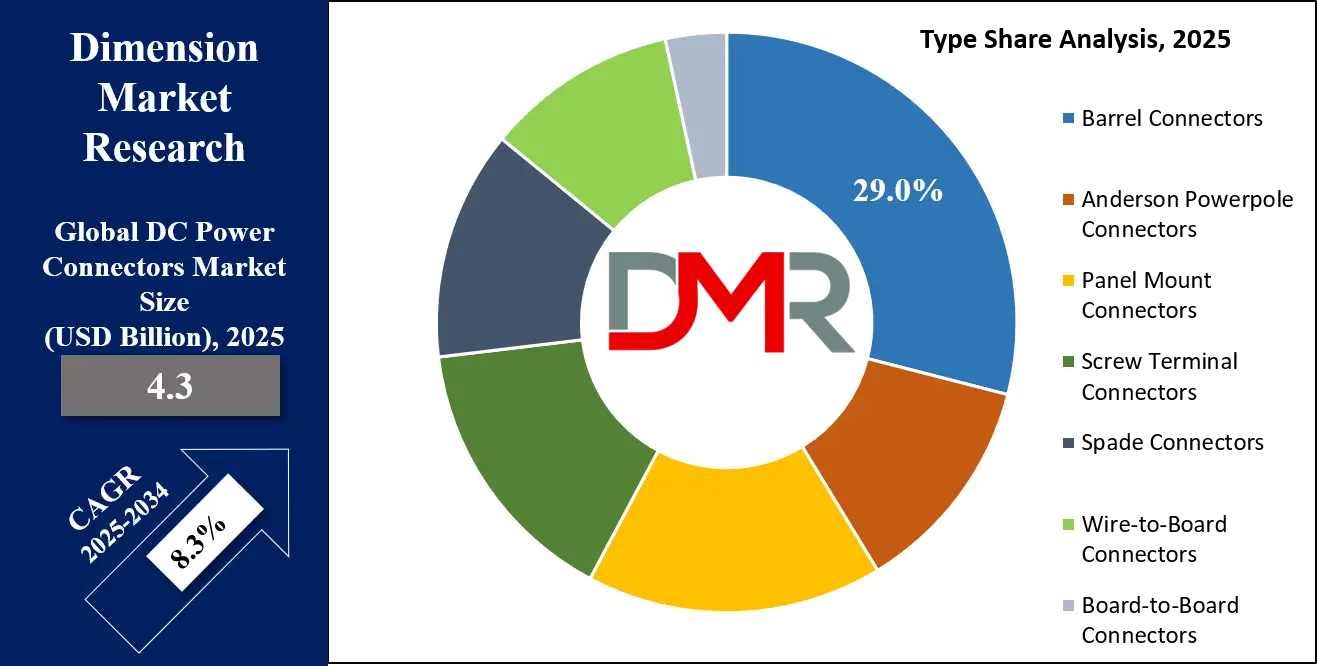

By Type Analysis

Barrel connectors dominate the DC power connectors market by type due to their extensive use across mass-market, low-to-medium power electronic devices. Their dominance is primarily driven by widespread adoption in consumer electronics such as laptops, routers, monitors, set-top boxes, audio equipment, and power adapters. The simple cylindrical design, standardized dimensions, ease of installation, and low manufacturing cost make barrel connectors the preferred choice for OEMs focused on high-volume production.

Another key factor supporting dominance is their compatibility with global power supply ecosystems. Power adapter manufacturers heavily standardize barrel connectors, enabling interoperability across multiple device categories. This standardization reduces design complexity and inventory costs for electronics manufacturers. Additionally, barrel connectors are well suited for low-voltage DC applications, which account for the largest share of total electronic device production globally.

From a supply-side perspective, barrel connectors benefit from strong economies of scale. A dense network of manufacturers particularly in Asia-Pacific produces these connectors at competitive costs while meeting international electrical and safety standards. Continuous improvements in materials, contact plating, and insulation have enhanced durability and current-handling capabilities without significantly increasing cost.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Configuration Type Analysis

Single-pole DC power connectors dominate this segment due to their simplicity, cost effectiveness, and suitability for the majority of DC power delivery applications. These connectors are widely used in consumer electronics, IT peripherals, small medical devices, and compact industrial equipment where only positive and negative power transmission is required without complex routing.

Their dominance is reinforced by the rapid growth of low-power and medium-power electronic devices that prioritize minimal design complexity and compact form factors. Single-pole connectors enable straightforward circuit layouts, easier installation, and faster assembly times, which are critical advantages for high-volume electronics manufacturing. OEMs favor single-pole configurations to reduce bill-of-materials costs and minimize failure points in power delivery systems.

From a performance standpoint, single-pole connectors offer sufficient current capacity and voltage stability for most DC-powered applications below industrial heavy-power thresholds. Advances in contact materials and insulation have further improved reliability while maintaining affordability.

Additionally, regulatory and safety compliance is easier to achieve with single-pole designs, particularly for consumer and commercial electronics distributed across global markets. This compliance advantage further accelerates adoption.

By Mounting Type Analysis

Surface mount DC power connectors dominate the mounting type segment due to their alignment with modern electronics manufacturing processes. Surface-mount technology (SMT) is the standard assembly method for high-density printed circuit boards used in consumer electronics, IT equipment, and telecommunications hardware.

The dominance of surface mount connectors is driven by their ability to support miniaturization, automated assembly, and high-speed production. These connectors allow manufacturers to reduce board space usage while maintaining reliable electrical performance. As devices become thinner, lighter, and more compact, surface mount connectors offer clear advantages over bulkier through-hole alternatives.

Another major factor is compatibility with automated pick-and-place assembly lines, which significantly reduces labor costs and increases manufacturing throughput. This makes surface mount connectors particularly attractive for large-scale OEMs producing millions of units annually.

Surface mount connectors also perform well in controlled electronic environments where extreme mechanical stress is limited, which matches the operating conditions of most consumer and commercial electronic products. Improvements in soldering techniques and mechanical reinforcement have further enhanced durability and thermal stability.

By Power Rating Analysis

Low-power DC connectors dominate the power rating segment, primarily due to their extensive use in consumer electronics and IT peripherals. Devices such as smartphones, tablets, routers, modems, wearables, and IoT products operate well within the low-power range, generating massive cumulative demand for low-power DC connectors.

The dominance of this sub-segment is reinforced by global trends toward energy efficiency, compact devices, and low-voltage architectures. Manufacturers increasingly design products to operate at lower power levels to improve safety, reduce heat generation, and comply with international energy regulations. Low-power connectors support these objectives while maintaining cost efficiency.

From a production standpoint, low-power connectors benefit from simpler designs, lower material requirements, and high production scalability. This enables suppliers to achieve cost leadership while maintaining consistent quality. Additionally, safety certification and regulatory compliance are easier and less costly for low-power components, accelerating time-to-market for OEMs.

As the number of DC-powered electronic devices continues to rise globally particularly in emerging markets the low-power segment remains the largest and most dominant contributor to overall DC power connector demand.

By Application Analysis

Consumer electronics dominate the DC power connectors market by application due to unmatched production volumes and continuous product innovation cycles. Devices such as smartphones, laptops, tablets, monitors, gaming consoles, and smart home products rely heavily on DC power connectivity. Short replacement cycles and frequent model upgrades drive consistent demand for connectors. Each new device generation requires reliable, compact, and cost-effective DC power solutions, sustaining long-term volume growth. Additionally, rising disposable incomes and digital adoption in emerging economies further expand the consumer electronics base.

Manufacturers in this segment prioritize connectors that balance performance, safety, and cost, favoring standardized DC power designs. This reinforces demand concentration and enables suppliers to achieve scale efficiencies. As consumer electronics remain central to global digitalization trends, this application continues to dominate overall DC power connector consumption.

By End User Analysis

Electronics manufacturers (OEMs) dominate the DC power connectors market by end user due to their central role in integrating connectors directly into finished electronic products. OEMs account for the largest share of global DC power connector consumption, as connectors are a critical component embedded at the design and production stages of consumer electronics, industrial equipment, automotive systems, and telecommunications hardware. Unlike aftermarket or distribution-based buyers, OEMs purchase connectors in very high volumes through long-term supply agreements, making them the primary revenue-generating customer group for connector suppliers.

The dominance of OEMs is largely driven by large-scale procurement capabilities and standardized sourcing strategies. Electronics manufacturers prioritize component uniformity across product lines to reduce design complexity, streamline manufacturing processes, and optimize inventory management. As a result, OEMs often rely on a limited number of approved connector suppliers that can consistently meet stringent quality, safety, and performance requirements while delivering at scale. Reliability and electrical performance are critical selection criteria, as power connectors directly impact device safety, lifespan, and regulatory compliance.

The Global DC Power Connectors Market Report is segmented on the basis of the following:

By Type

- Barrel Connectors

- Anderson Powerpole Connectors

- Panel Mount Connectors

- Screw Terminal Connectors

- Spade Connectors

- Wire-to-Board Connectors

- Board-to-Board Connectors

By Configuration Type

- Single-Pole Connectors

- Multi-Pole Connectors

By Mounting Type

- Surface Mount

- Through Hole

- Wire-to-Wire

By Power Rating

- Low Power (Up to 60W)

- Medium Power (60W - 300W)

- High Power (Above 300W)

By Application

- Consumer Electronics

- IT & Telecommunications Equipment

- Industrial & Automation Equipment

- Medical Devices

- Automotive & Transportation

- Renewable Energy Systems (Solar, Wind, BESS)

- Aerospace, Defense, and Marine

- Others

By End User

- Electronics Manufacturers (OEMs)

- Aftermarket & Retail Distribution

- Electric Vehicle Supply Equipment (EVSE) Providers

- Industrial System Integrators & Machine Builders

- Energy Sector EPCs & Installers (Solar/Wind)

- Others

Impact of Artificial Intelligence in the Global DC Power Connectors Market

- USB-C and Power Delivery as a Unifying Force: This convergence is arguably the most significant trend, collapsing multiple single-function ports into one. It simplifies industrial design for OEMs, reduces e-waste from proprietary chargers, and enhances user convenience through a single, reversible cable for charging, data transfer, and display connectivity.

- Smart Connector and Cable Technology: The integration of authentication chips (e.g., USB PD Controllers, E-Markers) transforms passive cables and ports into active, communicating components. This enables advanced features like dynamic power adjustment, cable capability identification, and protection against unsafe or non-compliant accessories, raising the bar for safety and performance.

- Advanced Thermal Management for High-Power Density: As power levels soar in shrinking form factors (e.g., in GaN chargers, ultrabooks), managing heat becomes critical. Innovations in connector design, including novel contact geometries, use of thermally conductive plastics, and integrated heat sinking, are essential to prevent overheating and ensure reliability.

- Sealed, Ruggedized, and Environmentally Resilient Designs: The expansion of electronics into outdoor, automotive, and industrial environments drives demand for connectors with high IP (Ingress Protection) ratings. Advances in sealing techniques, corrosion-resistant platings, and robust housing materials ensure reliable operation in the presence of moisture, dust, chemicals, and extreme temperatures.

- Wireless Power as a Complementary/Alternative Interface: While not a direct replacement for all wired DC connections, the maturation of medium-power wireless charging standards (beyond Qi) for laptops, tools, and robots influences the market. In some devices, it may reduce the need for a frequently accessed DC port, reserving it for high-speed data or backup charging, thus influencing connector design placement and specs.

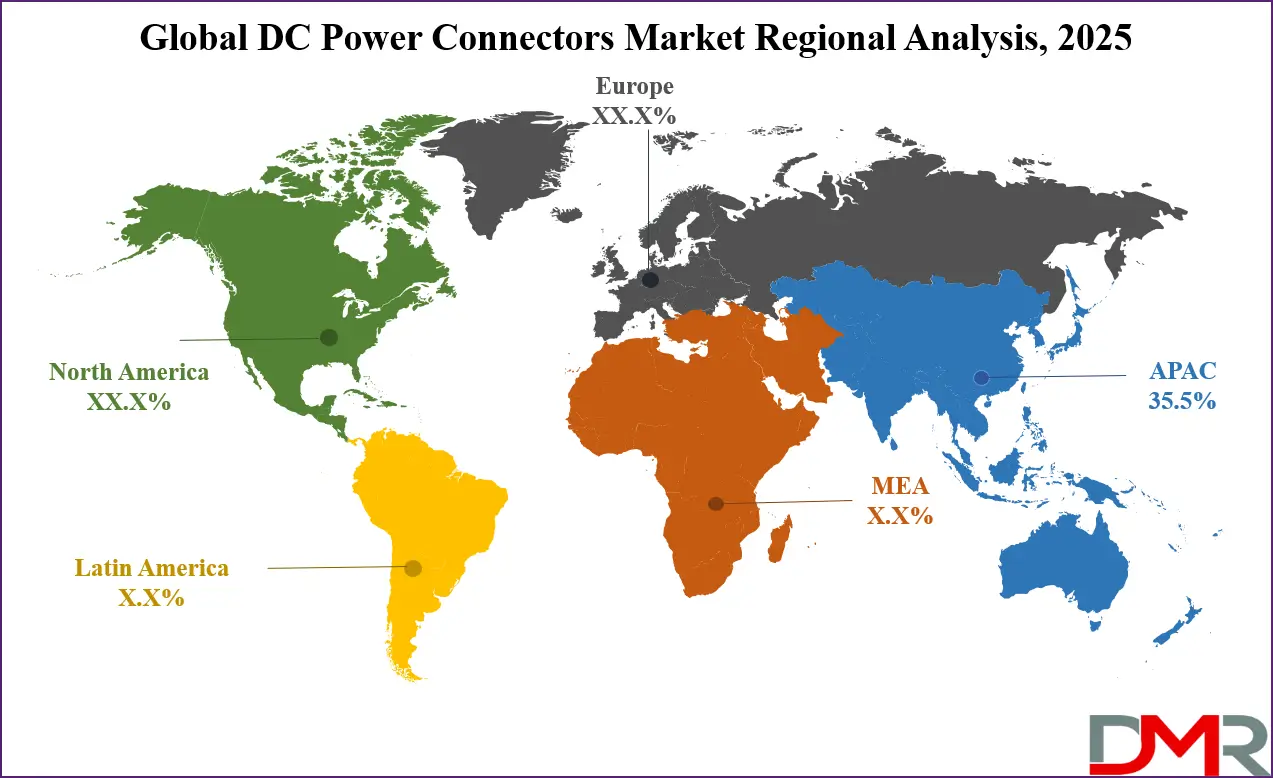

Global DC Power Connectors Market: Regional Analysis

Region with the Largest Revenue Share

Asia-Pacific is projected to dominate the Global DC Power Connectors Market with the 35.5% of the revenue share throughout the forecast period. This dominance is multi-faceted: it is the undisputed global hub for electronics manufacturing, housing the supply chains for the vast majority of the world's consumer electronics, computing devices, and telecommunications hardware. Countries like China, Japan, South Korea, Taiwan, and increasingly Vietnam, Thailand, and India are production powerhouses. Beyond manufacturing, domestic markets in China and India are experiencing explosive growth in electronics consumption, electric vehicle adoption, and renewable energy deployment, creating immense embedded demand. The region's dense ecosystem of both global connector giants and highly competitive local manufacturers fosters innovation, cost efficiency, and rapid scalability, solidifying its central role.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

Latin America is anticipated to register one of the highest compound annual growth rates (CAGR) during the forecast period, albeit from a smaller base. Accelerated growth in the region is supported by increasing industrialization, expanding consumer electronics adoption driven by urbanization, rising investments in telecommunications infrastructure including 5G and data centers, and significant development of renewable energy projects such as solar and wind power. Early-stage electric vehicle infrastructure and supportive government policies focused on digital transformation and energy diversification further contribute to the region’s strong growth outlook, positioning Latin America as the fastest-growing market for DC power connectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global DC Power Connectors Market: Competitive Landscape

The Global DC Power Connectors Market is characterized by a highly competitive and fragmented landscape, featuring a diverse ecosystem of large multinational electronic component conglomerates, specialized connector manufacturers, and a multitude of smaller regional players competing on price and niche applications. Competition is intense and based on a matrix of factors including technological innovation, product quality & reliability, global manufacturing and distribution footprint, pricing, and customer technical support.

Leading the market are broad-line electronic component giants with extensive portfolios that span multiple connector types and industries. Companies like TE Connectivity, Amphenol, Molex (a subsidiary of Koch Industries), and Hirose Electric command significant market share due to their vast R&D resources, global sales networks, and deep, long-standing relationships with major OEMs across automotive, consumer, industrial, and IT sectors.

Alongside these giants, specialized players have carved out strong positions in specific niches. Companies such as CUI Inc., Switchcraft (part of Amphenol), and Lumberg (part of Belden) are renowned for their expertise in specific areas like standard barrel jacks, audio connectors, and industrial circular connectors, respectively. The rise of USB Type-C has also drawn in prominent semiconductor companies like Analog Devices and Texas Instruments, who provide the critical controller chips, and cable/accessory specialists like Belkin and Anker.

The competitive landscape is dynamic, marked by continuous mergers, acquisitions, and strategic partnerships as companies seek to acquire new technologies, expand into growing application segments (like EV charging), and strengthen their geographic presence. Product innovation cycles are rapid, with a constant push towards higher performance, greater miniaturization, and increased intelligence embedded within the connector itself.

Some of the prominent players in the Global DC Power Connectors Market are:

- TE Connectivity Ltd.

- Amphenol Corporation

- Molex, LLC (Koch Industries)

- Hirose Electric Co., Ltd.

- J.S.T. Mfg. Co., Ltd.

- Aptiv PLC (including former Delphi connections business)

- CUI Inc.

- Switchcraft / Conxall (Amphenol)

- Lumberg Automation (Belden Inc.)

- Anderson Power Products

- Bulgin Limited (Equipmake)

- Kycon, Inc.

- DC Electronics Co., Ltd.

- Yazaki Corporation

- ITT Inc.

- Glenair, Inc.

- Souriau-Sunbank Connection Technologies (Eaton)

- NorComp (A Positronic Company)

- LEMO SA

- Rosenberger Hochfrequenztechnik GmbH & Co. KG

- Other Key Players

Recent Developments in the Global DC Power Connectors Market

- October 2025: The USB Implementers Forum released comprehensive test guidelines and performance benchmarks for the latest USB Power Delivery (USB-PD) 3.2 and Extended Power Range (EPR) specifications. This development provides clear compliance direction for manufacturers designing high-power DC connectors, cables, and power adapters capable of supporting up to 240W, accelerating adoption across consumer electronics and IT equipment.

- September 2025: Anderson Power Products announced the expansion of its high-current DC connector portfolio with new sealed and ruggedized Powerpole variants designed for battery energy storage systems, industrial power distribution, and electric mobility applications, strengthening its presence in high-power DC connectivity.

- August 2025: Amphenol Corporation confirmed the acquisition of CommScope’s Connectivity and Cable Solutions business. The transaction significantly expands Amphenol’s global interconnect portfolio and manufacturing scale, reinforcing its leadership position across power, signal, and DC connectivity markets.

- July 2025: TE Connectivity completed the acquisition of Richards Manufacturing, enhancing its capabilities in utility-grade electrical connectivity. The move strengthens TE’s position in grid modernization, renewable energy, and DC power infrastructure applications.

- June 2025: The International Electrotechnical Commission advanced updates to multiple IEC connector and low-voltage DC standards, supporting improved safety, interoperability, and performance requirements for industrial and energy-sector DC power connectors.

- May 2025: At the Electronica trade fair in Munich, leading connector manufacturers showcased next-generation compact DC power connectors optimized for higher current density, thermal management, and automated assembly, reflecting rising demand from EVs and industrial automation.

- March 2025: GlobalFoundries and Navitas Semiconductor announced a strategic collaboration focused on gallium nitride (GaN) power technologies, indirectly driving demand for advanced DC power connectors compatible with high-efficiency power conversion systems.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 4.3 Bn |

| Forecast Value (2034) |

USD 8.9 Bn |

| CAGR (2025–2034) |

8.3% |

| The US Market Size (2025) |

USD 1.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Barrel Connectors, Anderson Powerpole Connectors, Panel Mount Connectors, Screw Terminal Connectors, Spade Connectors, Wire-to-Board Connectors, Board-to-Board Connectors), By Configuration Type (Single-Pole Connectors, Multi-Pole Connectors), By Mounting Type (Surface Mount, Through Hole, Wire-to-Wire), By Power Rating (Low Power (Up to 60W), Medium Power (60W - 300W), High Power (Above 300W)), By Application (Consumer Electronics, IT & Telecommunications Equipment, Industrial & Automation Equipment, Medical Devices, Automotive & Transportation, Renewable Energy Systems (Solar, Wind, BESS), Aerospace, Defense, and Marine, Others), By End User (Electronics Manufacturers (OEMs), Aftermarket & Retail Distribution, Electric Vehicle Supply Equipment (EVSE) Providers, Industrial System Integrators & Machine Builders, Energy Sector EPCs & Installers (Solar/Wind), Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

TE Connectivity Ltd., Amphenol Corporation, Molex, LLC (Koch Industries), Hirose Electric Co., Ltd., J.S.T. Mfg. Co., Ltd., Aptiv PLC, CUI Inc., Switchcraft / Conxall (Amphenol), Lumberg Automation (Belden Inc.), Anderson Power Products, Bulgin Limited (Equipmake), Kycon, Inc., DC Electronics Co., Ltd., Yazaki Corporation, ITT Inc., Glenair, Inc., Souriau-Sunbank Connection Technologies (Eaton), NorComp (A Positronic Company), LEMO SA, Rosenberger Hochfrequenztechnik GmbH & Co. KG, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global DC Power Connectors Market?

▾ The Global DC Power Connectors Market size is estimated to have a value of USD 4.3 billion in 2025 and is expected to reach USD 8.9 billion by the end of 2034.

What is the growth rate in the Global DC Power Connectors Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 8.3 percent over the forecasted period from 2025 to 2034.

What is the size of the US DC Power Connectors Market?

▾ The US DC Power Connectors Market is projected to be valued at USD 1.0 billion in 2025. It is expected to witness subsequent growth, reaching USD 1.9 billion in 2034, expanding at a CAGR of 7.8%.

Which region accounted for the largest Global DC Power Connectors Market?

▾ Asia-Pacific is expected to have the largest market share in the Global DC Power Connectors Market, driven overwhelmingly by its central role in global electronics manufacturing and its rapidly growing domestic consumption markets.

Who are the key players in the Global DC Power Connectors Market?

▾ Some of the major key players in the Global DC Power Connectors Market are TE Connectivity Ltd., Amphenol Corporation, Molex, LLC, Hirose Electric Co., Ltd., and J.S.T. Mfg. Co., Ltd., among many other established and emerging competitors.