Market Overview

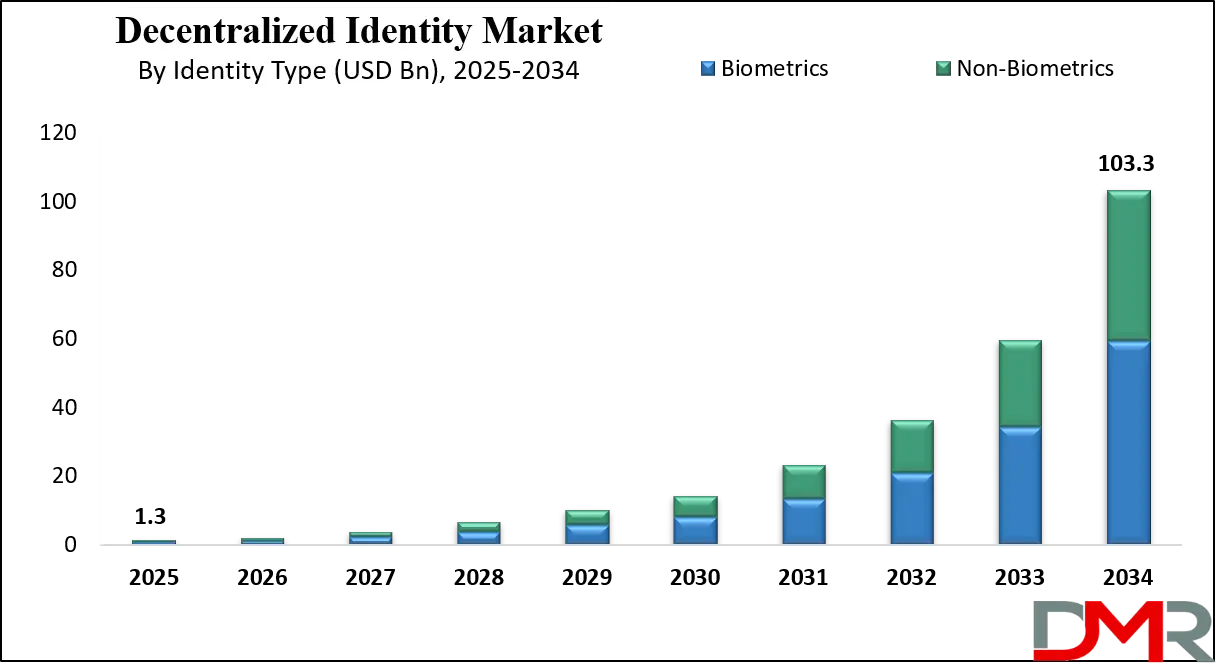

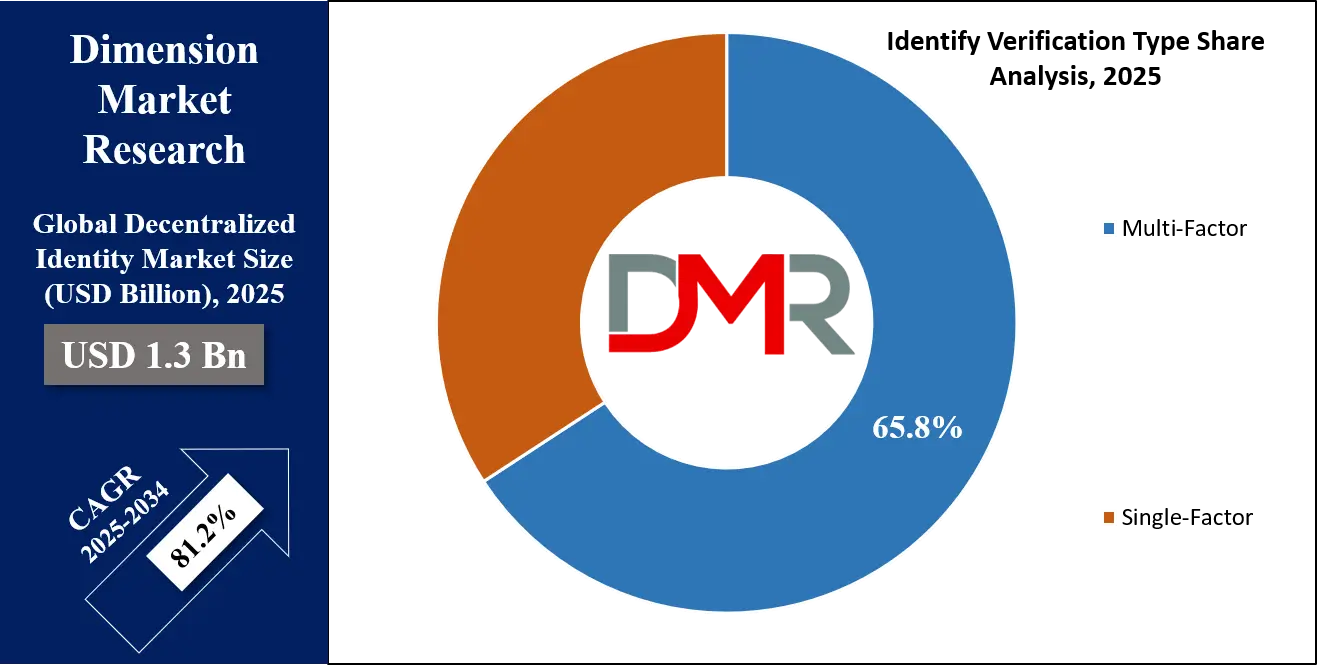

The Global Decentralized Identity Market size is projected to reach USD 1.3 billion in 2025 and grow at compound annual growth rate of 81.2% to reach a value of USD 103.3 billion in 2034.

Decentralized Identity (DID) is a digital identity model where individuals control and manage their identity information without relying on a central authority like a government, corporation, or social platform. Instead of being stored in one location, identity data is spread across a distributed network using technologies like blockchain. This gives people more privacy, security, and freedom over their personal information. They can choose what details to share, with whom, and for how long, using secure and verifiable credentials.

The demand for decentralized identity is growing rapidly as online activity increases and concerns around data breaches and privacy rise. More people are becoming aware of how much personal data is collected, stored, and even sold by organizations. Decentralized identity offers a solution by giving users ownership of their digital identity. This model is especially useful in sectors like healthcare, banking, government services, and education, where secure identity verification is critical.

In recent years, several trends have fueled the interest in decentralized identity. The growth of blockchain and Web3 platforms has provided the technical foundation for DID systems. The rise of self-sovereign identity (SSI) is closely linked to decentralized identity, emphasizing full control of credentials by users. There’s also a strong push from privacy-focused regulations like GDPR and growing demand for digital wallets and verifiable credentials in both the public and private sectors.

Many key events have helped bring decentralized identity into focus. Large technology firms and organizations have launched pilot projects and open-source frameworks. Initiatives like Microsoft’s ION on the Bitcoin network, the World Wide Web Consortium’s (W3C) work on DID standards, and support from the European Union’s eIDAS 2.0 regulation show serious commitment. Additionally, the COVID-19 pandemic accelerated digital transformation and highlighted the need for secure, remote identity verification.

One of the biggest benefits of decentralized identity is reducing reliance on passwords and centralized databases, which are often targeted by hackers. Instead, users can store credentials securely on their devices and use cryptographic proofs to verify their identity. This model not only improves security but also reduces friction in identity processes across apps, websites, and services.

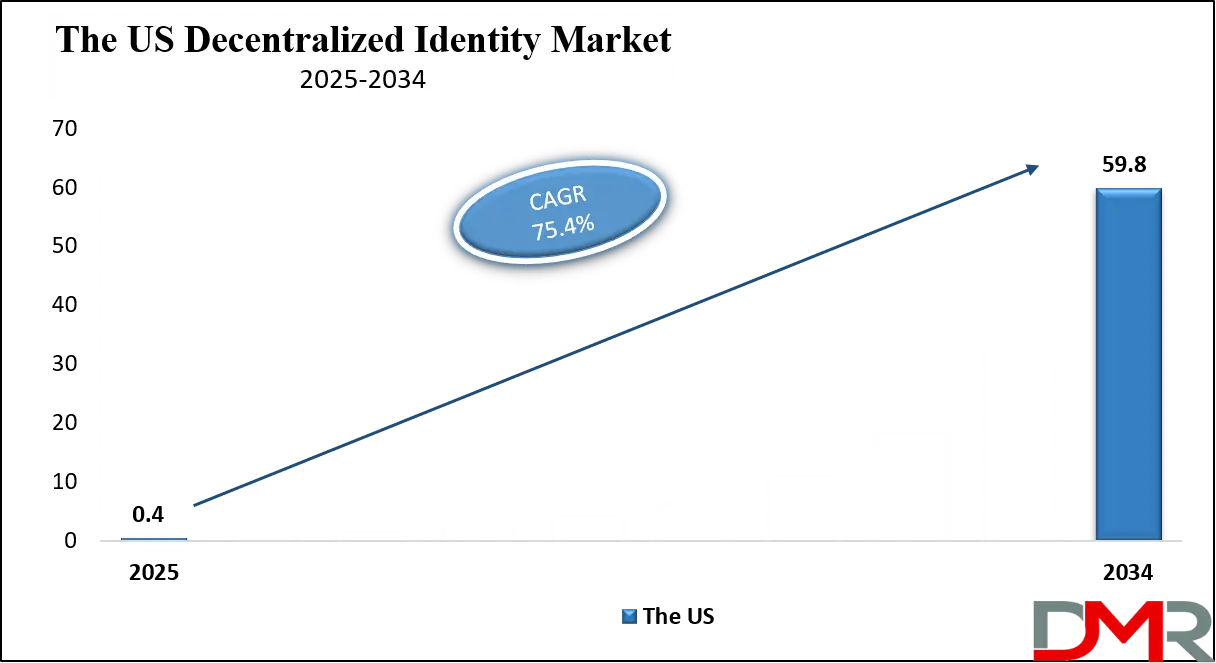

The US Decentralized Identity Market

The US Decentralized Identity Market size is projected to reach USD 400 million in 2025 at a compound annual growth rate of 75.4% over its forecast period.

The US plays a leading role in the decentralized identity market due to its strong technology ecosystem and early adoption of blockchain and digital identity solutions. Home to many major tech companies, startups, and innovation hubs, the US drives research, development, and implementation of decentralized identity platforms. Government-backed initiatives and pilot programs are exploring the use of decentralized ID for public services, digital credentials, and cybersecurity.

The private sector in the US is also investing heavily in creating secure, user-controlled identity systems to improve data privacy and reduce fraud. Additionally, the US contributes significantly to global standards and frameworks, collaborating with international bodies to shape the future of decentralized identity across sectors such as finance, healthcare, and education.

Europe Decentralized Identity Market

Europe Decentralized Identity Market size is projected to reach USD 325 million in 2025 at a compound annual growth rate of 78.7% over its forecast period.

Europe plays a crucial role in shaping the decentralized identity market, especially through its strong regulatory focus on data privacy and digital rights. With regulations like GDPR and the upcoming eIDAS 2.0 framework, Europe is setting standards that encourage the use of decentralized and self-sovereign identity models. Many European governments and organizations are piloting decentralized identity systems to provide secure access to public services, cross-border identification, and digital credentials.

The region also hosts active collaboration between public institutions, tech companies, and academic bodies to develop interoperable identity frameworks. Europe’s emphasis on citizen control, privacy, and digital trust is driving innovation and adoption of decentralized identity across finance, healthcare, education, and government services, making it a global leader in policy-driven adoption.

Japan Decentralized Identity Market

Japan Decentralized Identity Market size is projected to reach USD 65 million in 2025 at a compound annual growth rate of 82.3% over its forecast period.

Japan is emerging as a key player in the decentralized identity market through a mix of government support and private sector collaboration. The national Digital Agency is promoting the use of digital identity wallets and verifiable credentials, expanding existing ID systems like the My Number Card into more secure and user-controlled digital formats.

Japanese banks, technology firms, and system integrators are working together on decentralized identity pilot projects, particularly to streamline know-your-customer (KYC) processes in the financial sector. The country is also involved in cross-border initiatives with partners like Australia to explore digital ID in areas such as tourism. With strong digital infrastructure, regulatory clarity, and active innovation, Japan is building a foundation that could support broader adoption of decentralized identity in Asia.

Decentralized Identity Market: Key Takeaways

- Market Growth: The Decentralized Identity Market size is expected to grow by USD 101.2 billion, at a CAGR of 81.2%, during the forecasted period of 2026 to 2034.

- By Identity Type: The biometric segment is anticipated to get the majority share of the Decentralized Identity Market in 2025.

- By Identify Verification Type: The multi-factor segment is expected to get the largest revenue share in 2025 in the Decentralized Identity Market.

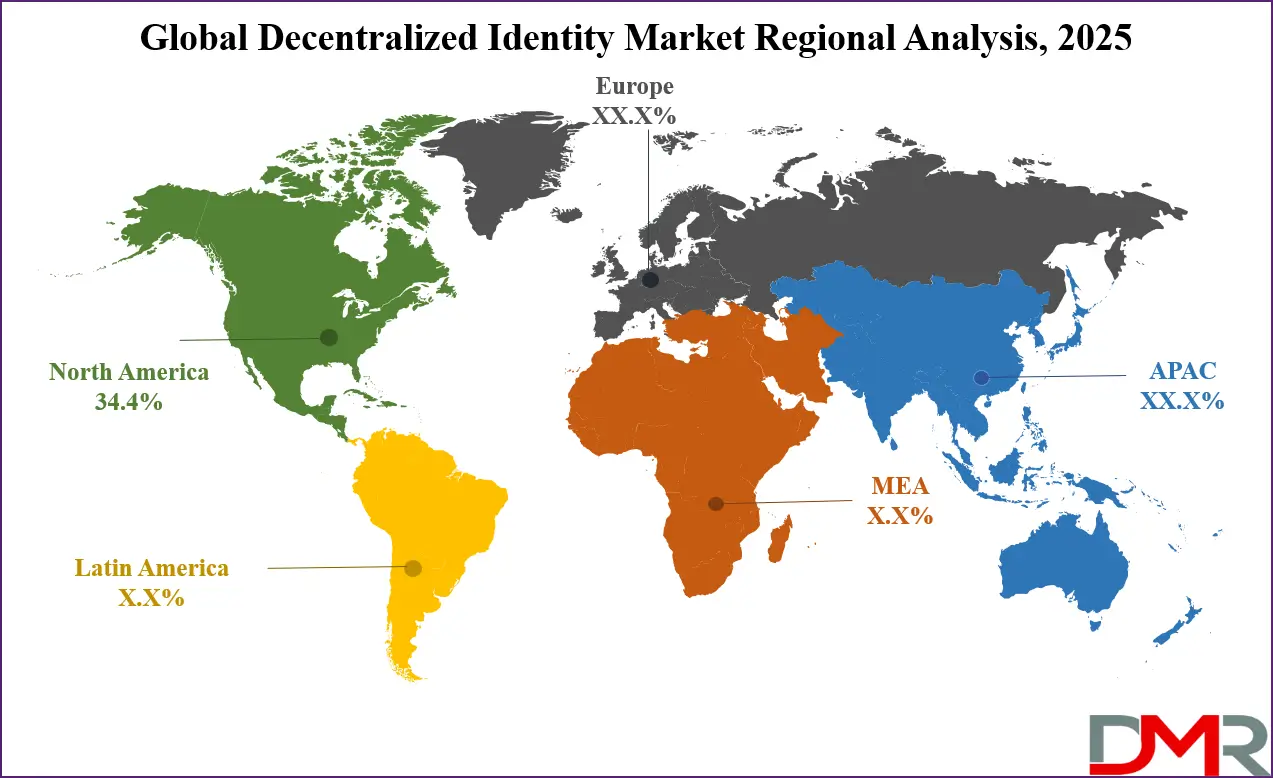

- Regional Insight: North America is expected to hold a 34.4% share of revenue in the Global Decentralized Identity Market in 2025.

- Use Cases: Some of the use cases of Decentralized Identity include financial services, healthcare access, and more.

Decentralized Identity Market: Use Cases

- Financial Services: Decentralized identity helps banks and fintech firms verify users quickly and securely without relying on central databases. It simplifies Know Your Customer (KYC) processes while reducing fraud risks. Users can share only necessary information, protecting their privacy during digital transactions.

- Healthcare Access: Patients can store and control their medical records using decentralized identity systems. They can share their data securely with doctors, hospitals, or insurers without giving full access to their history. This improves privacy, trust, and speed in healthcare interactions.

- Government Services: Citizens can use decentralized identity to access government portals, voting platforms, or social services securely. It helps reduce document fraud and makes cross-border identity verification easier. Governments also benefit from lower costs and more efficient systems.

- Education and Employment: Graduates can receive verifiable digital certificates that can be shared directly with employers or institutions. Employers can instantly verify a candidate’s credentials without calling the university or third parties. This streamlines hiring and helps reduce credential fraud.

Stats & Facts

- According to CyberArk, 99% of security decision makers believe their organizations will experience an identity-related compromise within the next year, driven by the expanding number of identities and the increasing complexity of IT environments. Further, it reveals that the number of identities—both human and machine—is expected to grow by 240% in just 12 months, significantly widening the attack surface.

- IBM reports that 40% of data breaches involve data stored across multiple environments, with public cloud-stored data breaches resulting in the highest average cost of USD 5.17 million. The use of generative AI and Internet of Things further complicates cloud security, requiring organizations to implement better governance and monitoring practices across hybrid infrastructures.

- CrowdStrike highlights that 80% of all cyberattacks use identity-based techniques, such as credential theft and privilege escalation, to infiltrate systems, indicating that identity is now the primary target for threat actors across most sectors.

- Mimecast research finds that 3 out of 4 CISOs believe collaboration tools bring significant new risks, and 94% say the native security features in Microsoft 365 are not sufficient. This shows a growing need for enhanced email and collaboration tool security in enterprise environments.

- IBM found that organizations implementing AI and automation in their cybersecurity strategies saved an average of USD 2.22 million in breach costs compared to those that did not. These technologies enhance threat detection, reduce response times, and support prevention strategies such as red-teaming and posture management.

- One Identity reports that 80% of organizations believe improved identity and access management could have prevented some or all of the cyberattacks they experienced. This emphasizes how central IAM has become to building effective cybersecurity defenses.

- According to Mimecast, 97% of 1,700 IT professionals reported being targeted by phishing emails within the past year, and 75% noted a rise in email-based threats. Additionally, 59% say attacks have grown more sophisticated, suggesting phishing remains a leading entry point for attackers.

- Microsoft observed an average of 156,000 daily attempts of business email compromise over the course of a year, illustrating the persistent and large-scale nature of phishing and impersonation attacks targeting enterprise users.

- Arctic Wolf reports that 48% of organizations now see ransomware as their top concern, with 42% having already experienced a ransomware attack in the past year. In another CyberArk survey, 89% of organizations stated they were targeted by ransomware, highlighting the scale of this threat.

- IBM states that breaches stemming from compromised credentials or insider threats take the longest to contain, with an average time to identify and resolve at 328 and 308 days, respectively. These prolonged breach durations increase exposure and potential financial losses.

- CrowdStrike again notes that identity-based attacks account for 80% of cyber threats, underlining the critical need for robust identity security solutions to guard against widespread credential misuse and lateral movement.

- According to Microsoft, password-based attacks surged to ten times their previous levels over the past year, signaling a growing reliance by attackers on stolen or weak credentials as a gateway into enterprise systems.

Market Dynamic

Driving Factors in the Decentralized Identity Market

Growing Privacy Concerns and Data Ownership Awareness

One of the key drivers of the decentralized identity market is the rising awareness around data privacy and ownership. With frequent data breaches, leaks, and misuse of personal information by centralized platforms, individuals are increasingly seeking control over their digital identities. Decentralized identity offers a secure alternative where users can manage their personal data independently and decide what to share and with whom.

This shift in mindset—from trusting organizations to owning one’s data—is gaining momentum, especially in regions with strong privacy regulations like GDPR. It aligns with the broader trend of digital sovereignty and user empowerment. As digital interactions grow across finance, healthcare, and education, demand for privacy-first identity solutions is expected to rise sharply, boosting adoption.

Rising Digital Transformation Across Sectors

The accelerated pace of digital transformation across industries is significantly pushing the adoption of decentralized identity solutions. Organizations in finance, healthcare, education, travel, and government are rapidly adopting digital tools to provide remote services and streamline processes. However, traditional identity systems often struggle with security, interoperability, and user verification in these digital environments.

Decentralized identity solves these challenges by offering trusted, cross-platform identity verification without relying on central authorities. As services become more digital and global, the need for seamless, secure, and scalable identity systems is becoming a top priority. This growing reliance on digital infrastructure is creating a favorable environment for decentralized identity technologies to grow and evolve.

Restraints in the Decentralized Identity Market

Lack of Standardization and Interoperability

One major restraint in the decentralized identity market is the lack of universal standards and interoperability across systems. While various organizations are working on frameworks and protocols, there is no single widely accepted global standard. This makes it difficult for solutions to work seamlessly across different platforms, countries, or industries.

As a result, companies and governments may hesitate to invest in systems that might not be compatible with future developments. The absence of consistent guidelines can also slow down the integration of DID solutions into existing infrastructure. Without harmonized technical and regulatory standards, widespread adoption remains challenging. This fragmentation poses a barrier to scalability and limits the overall trust in decentralized identity systems.

Limited Awareness and Technical Complexity

Another significant barrier is the limited awareness and understanding of decentralized identity among both users and businesses. Many people are unfamiliar with how DID works, especially when compared to traditional identity systems like passwords or government-issued IDs. Even organizations may lack the technical expertise to deploy or manage decentralized identity platforms. The underlying technologies such as blockchain, cryptographic keys, and digital wallets can appear complex and intimidating.

This creates hesitation in adoption and can lead to poor implementation without proper guidance or education. Additionally, concerns around the usability and accessibility of DID tools for non-technical users may prevent mainstream acceptance, particularly in regions with low digital literacy.

Opportunities in the Decentralized Identity Market

Integration with Government Digital Identity Initiatives

A major opportunity for the decentralized identity market lies in its integration with government-led digital identity programs. As many countries aim to digitize public services, they face growing concerns around data security, identity fraud, and centralized control. Decentralized identity offers a privacy-focused alternative that can empower citizens while reducing the government’s data management burden. By adopting decentralized identity systems, governments can enable secure access to services like voting, tax filing, healthcare, and benefits distribution.

It can also support cross-border identity verification for travel or migration. Collaborations between governments and tech providers could lead to national-level implementations, especially in regions pushing for digital sovereignty. This opens the door for large-scale deployments and trust-building at the institutional level.

Rising Demand for Secure Digital Identity in Emerging Markets

Emerging economies present a significant growth opportunity for decentralized identity solutions due to a large population of unbanked and under-identified individuals. In many developing regions, people lack access to formal identification systems, limiting their ability to participate in financial, educational, or healthcare services. Decentralized identity, particularly when paired with mobile technology, can offer these individuals a way to create, control, and use a secure identity without relying on physical documents.

This can help improve inclusion, reduce fraud, and support social and economic development. Governments and non-profits are increasingly exploring decentralized identity to close the identity gap. As mobile penetration and internet access rise, so does the potential for widespread adoption of DID platforms in these regions.

Trends in the Decentralized Identity Market

Adoption of Advanced Privacy‑Enhancing Technologies

One major trend in decentralized identity is the widespread use of privacy‑enhancing technologies such as zero‑knowledge proofs (ZKPs). These techniques allow users to validate specific attributes like age or citizenship without sharing their full personal information. By balancing regulatory needs with user privacy, these cryptographic methods are being integrated into identity platforms to reduce data exposure and build trust. This trend is particularly strong in industries with strict data protection regulations like finance and healthcare, where verifying identity without revealing sensitive information is key.

Push Toward Interoperability and Cross‑Chain Compatibility

Another emerging trend is the increasing focus on interoperability and cross‑chain identity systems. As multiple blockchain networks and DID frameworks proliferate, users and organizations want identity systems that work seamlessly across different platforms. Solutions like chain abstraction layers or interoperable protocols such as W3C DIDs and Verifiable Credentials are gaining traction, enabling credentials to be portable and verifiable across diverse ecosystems. This shift supports simpler user experiences and broader adoption across varied digital environments.

Impact of Artificial Intelligence in Decentralized Identity Market

- Smarter Identity Verification: Artificial Intelligence improves the accuracy of identity verification by analyzing biometric data like facial features, voice, and behavior patterns in real time, helping to detect fraud or suspicious activity more effectively.

- Automated Risk Assessment: AI can assess the trustworthiness of identity credentials by analyzing usage patterns and behavior over time, helping organizations make real-time decisions on access control or identity validation.

- Enhanced User Experience: With AI, decentralized identity platforms can offer personalized, faster, and more intuitive user experiences, such as instant approvals, predictive prompts, and voice-based authentication.

- Fraud Detection and Prevention: AI can detect anomalies in identity usage, flagging possible threats and preventing unauthorized access, reducing the chances of identity theft or impersonation.

- Smart Credential Management: AI helps manage digital credentials by learning user behavior and preferences, suggesting when and where to share identity data securely and only when needed.

Research Scope and Analysis

By Identity Type Analysis

Biometrics, expected to lead the decentralized identity market in 2025 with a share of 57.4%, plays a central role in making identity verification more secure and user-friendly. By using physical traits like fingerprints, facial recognition, or iris scans, biometric identity makes it easier to authenticate users without relying on passwords or physical documents. In decentralized identity systems, biometrics adds an extra layer of security and convenience, allowing people to access services quickly and safely.

This technology supports the move toward self-sovereign identity and helps reduce identity fraud in sectors like banking, healthcare, and travel. As more people use digital wallets and mobile ID solutions, biometric technology and authentication are becoming a preferred choice for seamless access. With growing trust in biometric technology solutions and strong demand for secure, real-time verification, biometrics will remain a key driver in the expansion of decentralized identity platforms worldwide.

Non-biometrics identity, including methods like PINs, passwords, digital certificates, and device-based authentication, is expected to show significant growth over the forecast period. This segment supports users who prefer alternatives to biometric verification or operate in environments where biometrics aren't feasible. In decentralized identity systems, non-biometric credentials play an important role in enabling flexible, privacy-friendly identity verification.

These solutions allow users to control access to their digital identity with cryptographic keys or secure login methods. They are often used in financial services, enterprise security, and government platforms where layered authentication is required. As awareness of self-sovereign identity grows, non-biometric methods will gain more attention, especially for low-bandwidth or high-privacy use cases. With growing adoption of secure digital identity frameworks, non-biometric identity types will continue supporting user choice and accessibility in decentralized identity ecosystems.

By Organization Type Analysis

Large enterprises, anticipated to lead the decentralized identity market in 2025 with a 60.8% share, are playing a major role in adopting and scaling identity solutions across global operations. These organizations manage vast amounts of user and employee data and face increasing pressure to improve cybersecurity, ensure regulatory compliance, and prevent identity fraud. By implementing decentralized identity frameworks, large enterprises gain better control over data access and authentication processes, while enhancing user privacy and reducing dependency on traditional identity systems.

These solutions support seamless integration across various departments and systems, from customer onboarding to internal access controls. The shift toward self-sovereign identity and verifiable credentials aligns well with large-scale operations that demand scalability, interoperability, and trust. With digital transformation a key business priority, large enterprises continue investing heavily in decentralized identity to improve data protection, reduce operational risks, and enhance digital trust across multiple business environments.

SMEs are experiencing significant growth in the adoption of decentralized identity solutions over the forecast period, driven by the need for cost-effective, secure, and user-controlled identity management. Unlike large corporations, small and medium-sized enterprises often lack the resources to build complex identity infrastructures, making decentralized identity an attractive, scalable option. These systems allow SMEs to enhance customer trust, reduce fraud, and streamline digital onboarding processes without maintaining large databases of sensitive data.

As awareness grows around data privacy and self-sovereign identity, more SMEs are exploring blockchain-based digital identity platforms that offer better control, flexibility, and regulatory compliance. They also benefit from cloud integration, easy deployment, and compatibility with various digital wallets and verifiable credentials. With increased reliance on digital services and remote interactions, SMEs are becoming an important force in expanding the decentralized identity market across sectors like retail, education, and professional services.

By Identity Verification Type Analysis

Multi-factor authentication, projected to lead the decentralized identity market in 2025 with a 65.8% share, is becoming a core feature of secure identity systems. By combining two or more verification methods—such as biometrics, PINs, and device-based authentication—multi-factor verification strengthens protection against identity theft and unauthorized access. In decentralized identity frameworks, it ensures that users have complete control over their credentials while maintaining a high level of security across digital platforms.

This is especially important for industries like finance, healthcare, and government services, where sensitive data must be protected. The growth of self-sovereign identity and verifiable credentials further supports the adoption of multi-factor systems by reducing reliance on passwords and enabling flexible, user-centric authentication. As digital risks increase and data protection regulations tighten, multi-factor authentication is becoming the preferred approach for organizations aiming to secure access and improve trust within decentralized identity ecosystems.

Single-factor authentication methods, such as passwords or one-time codes, are also seeing notable growth in the decentralized identity market over the forecast period. While simpler than multi-factor systems, they remain widely used due to ease of implementation and user familiarity. Many small businesses and digital platforms adopt single-factor identity verification for basic access control, especially in low-risk environments.

In decentralized identity systems, single-factor options serve as an entry point for organizations transitioning from traditional ID models. These methods are often combined with other secure layers, like blockchain-based credentials or encrypted tokens, to provide a balance between simplicity and security. As awareness grows around decentralized identity and privacy-first digital access, single-factor verification is evolving to support lightweight and accessible identity solutions for a broader range of users and use cases.

By Application Analysis

Access management, set to dominate the decentralized identity market in 2025 with a 24.1% share, plays a key role in how organizations control and secure user entry to systems, applications, and data. In decentralized identity systems, access management is improved by using verifiable credentials and self-sovereign identity to give users direct control over their digital identities. This reduces the need for traditional usernames and passwords, lowering the risk of data breaches and unauthorized access.

It also simplifies the user experience by enabling secure, passwordless login methods. Businesses across industries are adopting decentralized access solutions to manage internal users, external partners, and customers with greater flexibility and efficiency. With rising concerns about cybersecurity and compliance, decentralized access management provides a scalable, secure, and privacy-respecting way to protect critical systems and data while improving trust across digital interactions.

Digital voting is gaining strong momentum in the decentralized identity market with significant growth expected over the forecast period, especially as governments and organizations look for secure, transparent, and tamper-proof voting systems. Decentralized identity plays a vital role in verifying voter eligibility without exposing sensitive personal information. By using verifiable credentials and blockchain-based authentication, digital voting systems can ensure that each voter casts only one vote while keeping identities private.

This not only boosts voter trust but also reduces the risk of fraud, manipulation, or data breaches. It supports remote and cross-border participation, making elections more inclusive and efficient. As countries and institutions explore secure digital governance, the integration of decentralized identity in digital voting is becoming a valuable application area that supports democratic engagement and innovation.

The Decentralized Identity Market Report is segmented on the basis of the following:

By Identity Type

- Biometrics

- Non-biometrics

By Organization Size

-

Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Identify Verification Type

- Single-Factor

- Multi-Factor

By Application

- Access Management

- KYC & Compliance

- Credential Issuance

- Authentication

- Fraud Prevention

- Digital Voting

- Others

Regional Analysis

Leading Region in the Decentralized Identity Market

North America, leading the decentralized identity market in 2025 with a share of 34.4%, continues to play a major role in driving innovation and adoption of digital identity technologies. The region’s growth is fueled by a strong presence of tech companies, rising concerns over data privacy, and increasing demand for secure digital services across industries like finance, healthcare, and government. The decentralized identity market in North America benefits from early adoption of blockchain and verifiable credentials, supported by both public and private sector initiatives.

Governments are exploring decentralized identity solutions for digital public services, while enterprises are integrating them for secure access management and compliance with privacy regulations. The region also supports active development of global standards and frameworks, encouraging interoperability and user control. With increasing focus on self-sovereign identity and digital wallets, North America is expected to maintain its leadership as more organizations and individuals shift toward privacy-first, user-owned identity systems in the decentralized identity ecosystem.

Fastest Growing Region in the Decentralized Identity Market

Asia Pacific is showing significant growth in the decentralized identity market over the forecast period, driven by rapid digital transformation, expanding internet usage, and rising demand for secure identity verification. Governments across the region are actively exploring blockchain-based identity frameworks to improve access to public services and reduce fraud.

Countries like Japan, South Korea, India, and Australia are supporting initiatives around digital ID, self-sovereign identity, and verifiable credentials. The region’s large population, increasing smartphone penetration, and focus on financial inclusion create strong potential for decentralized identity adoption. It is also estimated that Asia Pacific will continue investing in scalable, privacy-focused identity systems to support both public and enterprise-level digital ecosystems.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The decentralized identity market is becoming more competitive as both tech startups and large established companies are entering the space with new solutions. Many players are focusing on building secure digital wallets, identity verification tools, and blockchain-based identity networks. The competition is driven by the growing demand for privacy, data ownership, and secure online access.

Some firms specialize in self-sovereign identity platforms, while others focus on creating interoperable systems that work across various apps and services. Open-source development and global partnerships are common, helping expand the reach of these solutions. With rising interest from governments, financial services, and healthcare providers, the market is evolving quickly, pushing companies to innovate faster and offer more user-friendly, trustworthy, and scalable identity systems.

Some of the prominent players in the global Decentralized Identity are:

- Microsoft

- IBM

- Accenture

- SecureKey Technologies

- Civic Technologies

- Evernym

- Avast

- Serto

- Spruce Systems

- Jolocom

- Okta

- Ping Identity

- 1Kosmos

- SelfKey

- Dock Labs

- Affinidi

- Clear

- IndyKite

- Transmute

- Sphereon

- Other Key Players

Recent Developments

- In June 2025, Moca Foundation launched Moca Chain, a new layer-1 blockchain designed for privacy-preserving identity and data authentication. Built specifically for identity and user data management, the network enables individuals, devices, and AI agents to control and verify their credentials securely without dependence on centralized providers. Moca Chain’s goal is to power identity protocols that enhance trust, security, and autonomy in digital interactions while fostering decentralized authentication solutions.

- In February 2025, Linux Foundation Decentralized Trust (LF Decentralized Trust) announced a new project, CREDEBL, as well as the release of Hyperledger Iroha 2.0. In addition, four code bases have been accepted as new LF Decentralized Trust Labs in the last four months. This includes Paladin, an LF Decentralized Trust lab for programmable privacy on EVM, and other new tools for increasing scale and implementing new trust models.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.3 Bn |

| Forecast Value (2034) |

USD 103.3 Bn |

| CAGR (2025–2034) |

81.2% |

| The US Market Size (2025) |

USD 0.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Identity Type (Biometrics and Non-biometrics), By Organization Size (Large Enterprises and Small and Medium-sized Enterprises (SMEs)), By Identify Verification Type (Single-Factor and Multi-Factor), By Application (Access Management, KYC & Compliance, Credential Issuance, Authentication, Fraud Prevention, Digital Voting, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Microsoft, IBM, Accenture, SecureKey Technologies, Civic Technologies, Evernym, Avast, Serto (formerly Consensys Mesh), Spruce Systems, Jolocom, Okta, Ping Identity, 1Kosmos, SelfKey, Dock Labs, Affinidi, Clear, IndyKite, Transmute, Sphereon, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Decentralized Identity Market size is expected to reach a value of USD 1.3 billion in 2025 and is expected to reach USD 103.3 billion by the end of 2034.

North America is expected to have the largest market share in the Global Decentralized Identity Market, with a share of about 34.4% in 2025.

The Decentralized Identity Market in the US is expected to reach USD 0.4 billion in 2025.

Some of the major key players in the Global Decentralized Identity Market are Microsoft, IBM, Asvat and others

The market is growing at a CAGR of 81.2 percent over the forecasted period.