Market Overview

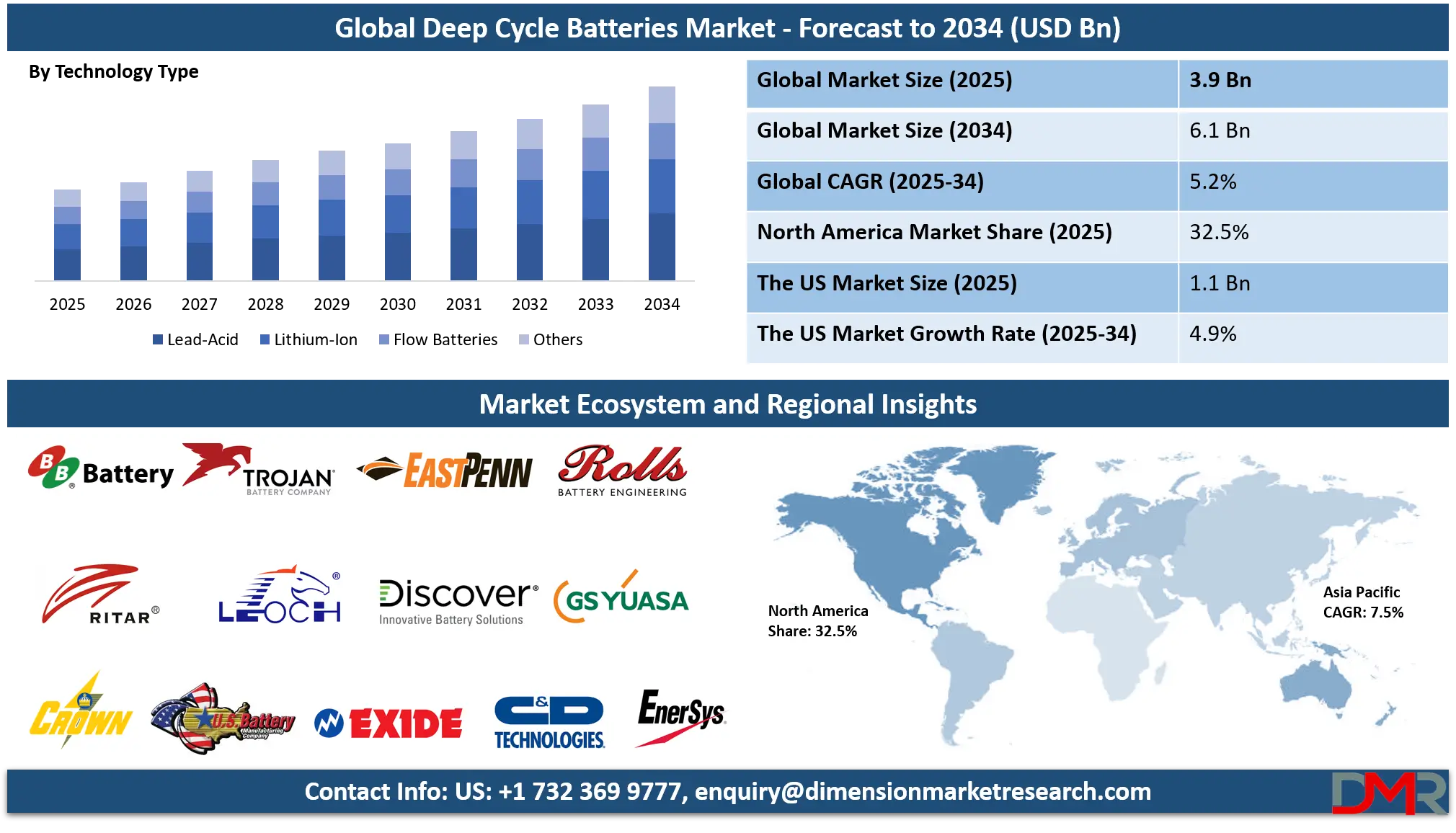

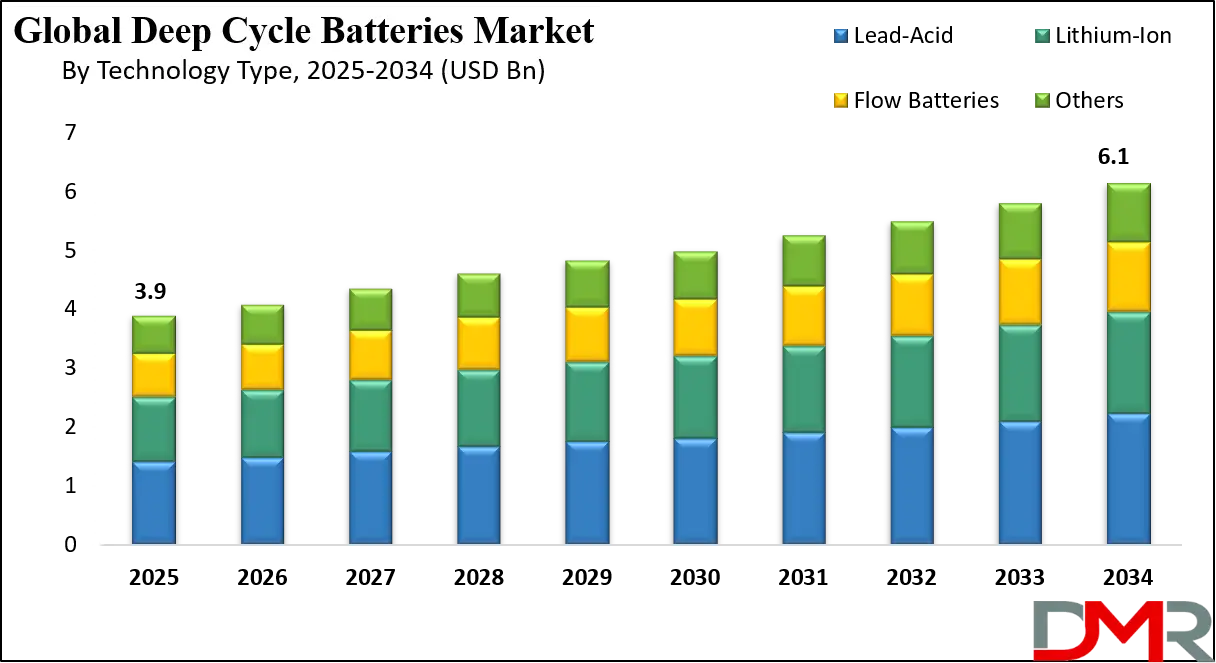

The Global Deep Cycle Batteries market is projected to reach USD 3.9 billion in 2025 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2025 to 2034, reaching an estimated USD 6.1 billion by 2034. This robust growth is fueled by the accelerating global transition to renewable energy and the critical need for reliable energy storage solutions. Deep cycle batteries, designed for long-duration discharge and recharge cycles, are essential for storing intermittent solar and wind power, enabling energy independence, grid stability, and electrification across transportation and industrial sectors.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Unlike starter batteries, deep-cycle batteries are engineered to provide sustained power over extended periods and withstand repeated deep discharges. This functionality is integral to off-grid and backup power systems, electric mobility, and smart grid applications. The market's expansion is underpinned by a powerful confluence of drivers like the exponential growth of renewable energy installations, supportive government policies and incentives for energy storage, rising adoption of

electric vehicles (EVs) and marine vessels, and increasing demand for uninterrupted power supply (UPS) in commercial and industrial facilities.

The evolution of the deep cycle battery market is characterized by rapid technological advancement and diversification. Innovations such as advanced lithium-ion chemistries (LFP, NMC) offering higher energy density and longer lifespan, smart battery management systems (BMS) with IoT connectivity, and improved lead-carbon and flow battery technologies are enhancing performance and safety. Concurrently, digitalization through energy management software and grid integration platforms is optimizing battery usage, enabling predictive maintenance, and facilitating participation in grid services like frequency regulation and peak shaving.

While the market faces headwinds from raw material price volatility (e.g., lithium, cobalt), supply chain constraints, and recycling and environmental concerns, the long-term value proposition is compelling. Levelized Cost of Storage (LCOS) for deep cycle batteries is declining steadily as manufacturing scales, and their value extends beyond simple energy storage to include grid resilience, demand charge reduction, and enabling higher penetration of renewables. Supported by robust policy frameworks like the U.S. Inflation Reduction Act (IRA) storage ITC and the EU's Battery Regulation, deep cycle batteries are transitioning from ancillary components to central pillars of the global clean energy and electrification ecosystem through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Deep Cycle Batteries Market

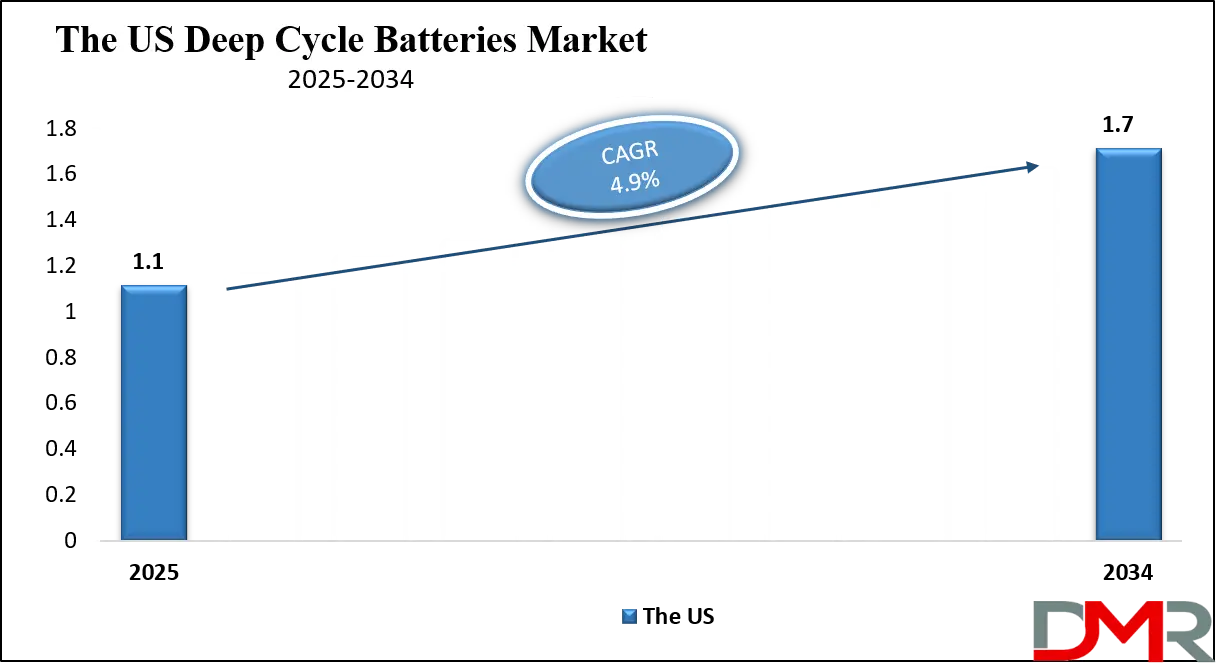

The U.S. Deep Cycle Batteries Market is projected to reach USD 1.1 billion in 2025 and grow at a CAGR of 4.9%, reaching USD 1.7 billion by 2034. The United States market is a dynamic engine of innovation and adoption, driven by federal policy, state-level renewable portfolio standards, and growing consumer and commercial demand for energy resilience. The Inflation Reduction Act (IRA) serves as a foundational catalyst, extending the Investment Tax Credit (ITC) to 30% for standalone energy storage, making deep cycle battery investments significantly more attractive for both behind-the-meter and front-of-the-meter applications.

California, Texas, and Hawaii continue to lead adoption due to high electricity prices, frequent grid disruptions, and ambitious renewable energy targets. Beyond regulation, powerful drivers include the corporate sector's commitment to 24/7 renewable energy and residential demand for home energy storage paired with rooftop solar. Major technology firms, utilities, and homeowners are increasingly deploying deep cycle battery systems for backup power, time-of-use bill management, and participation in virtual power plants (VPPs).

The innovation landscape is vibrant. Companies like Tesla (Powerwall), Enphase, and Generac are advancing integrated home energy systems. For utility-scale storage, players like Fluence and NextEra Energy are deploying massive lithium-ion battery arrays. Furthermore, the convergence of deep cycle batteries with EV charging infrastructure (V2G/V2H), microgrids, and advanced grid software is creating a holistic ecosystem where storage becomes an interactive node in a decentralized, resilient grid. This blend of policy, market demand, and technological entrepreneurship solidifies the U.S. as a global leader in both deep cycle battery innovation and deployment.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Deep Cycle Batteries Market

The Europe Deep Cycle Batteries Market is projected to be valued at approximately USD 741 million in 2025 and is projected to reach around USD 1,159 million by 2034, growing at a CAGR of about 5.2% from 2025 to 2034. Europe is a regulatory and technological leader in energy storage, with a market maturity built on stringent decarbonization targets and high energy security standards. The EU's Green Deal and Renovation Wave strategy, alongside the revised Energy Performance of Buildings Directive (EPBD), are significant drivers, promoting the integration of storage with on-site generation for buildings.

National frameworks amplify this effect. Germany's subsidies for home battery systems (KfW programs) and Italy's Superbonus 110% have spurred massive residential storage adoption. The UK's flexibility services market and Scandinavia's focus on grid-balancing are driving commercial and utility-scale projects. Europe's strength lies in its integrated value chain, with automotive battery giants (Northvolt, BMW) diversifying into stationary storage, and specialized storage firms (Sonnen, Tesvolt) offering integrated solutions.

The region also leads in circular economy and sustainability standards for batteries, driven by the EU Battery Regulation mandating recycled content and carbon footprint declarations. Furthermore, EU-funded research initiatives under Horizon Europe advance next-generation technologies like solid-state and sodium-ion batteries. This combination of stringent regulation, sustainability focus, and technological innovation ensures Europe's sustained leadership in market value and high-quality storage solutions.

The Japan Deep Cycle Batteries Market

The Japan Deep Cycle Batteries Market is projected to be valued at USD 327 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 512 million in 2034 at a CAGR of 5.2%.

Japan represents a mature yet steadily expanding market for deep cycle batteries, driven by the country’s strong focus on energy efficiency, renewable power integration, and advanced industrial applications. The market is supported by widespread adoption across backup power systems, renewable energy storage (particularly solar), telecommunications infrastructure, marine applications, and industrial equipment.

Continued investments in renewable energy, smart infrastructure, and industrial automation will remain key growth catalysts for the market over the forecast period. Growth is underpinned by Japan’s national energy transition policies, which emphasize grid resilience, distributed energy systems, and disaster-preparedness solutions following frequent natural events such as earthquakes and typhoons. These factors continue to drive demand for reliable, long-life energy storage solutions.

Technological advancement is a key differentiator in the Japanese market. While traditional lead-acid deep cycle batteries remain widely used in industrial and backup power applications, lithium-ion deep cycle batteries are gaining momentum due to their higher energy density, longer cycle life, and declining costs. Japanese manufacturers and technology providers are actively investing in next-generation battery chemistries to support both stationary storage and mobility-related applications.

Global Deep Cycle Batteries Market: Key Takeaways

- Market Growth from Energy Transition: The market is set to triple from USD 3.9 billion in 2025 to USD 6.1 billion by 2034 (CAGR 5.2%), primarily driven by the global shift to renewable energy, which necessitates reliable storage to manage intermittency and ensure grid stability.

- Lithium-Ion as the Technology Leader: Lithium-ion batteries, particularly LFP chemistry, will dominate revenue share due to falling costs, high energy density, and long cycle life, especially in renewable energy storage and EVs. Advanced lead-acid remains significant in cost-sensitive segments.

- Renewable Energy Storage as the Primary Application: The integration of deep cycle batteries with solar and wind installations for residential, commercial, and utility-scale projects is the largest and fastest-growing application segment, enabling self-consumption and grid services.

- From Hardware to Integrated Energy Solutions: The competitive edge is shifting from selling standalone batteries to providing integrated storage systems with smart software, Battery-as-a-Service (BaaS) models, and grid service aggregation platforms, creating recurring revenue streams.

- Sustainability and Circularity as Imperatives: Leading manufacturers are increasingly designing for recyclability, incorporating secondary materials, and reducing carbon footprint in response to regulations like the EU Battery Regulation, influencing procurement decisions globally.

Global Deep Cycle Batteries Market: Use Cases

- Residential Solar-Plus-Storage: Homeowners install deep-cycle battery systems (e.g., Tesla Powerwall) alongside rooftop solar to store excess daytime generation for use at night, achieve backup power during outages, and reduce reliance on the grid.

- Commercial & Industrial Peak Shaving: Factories, data centers, and office buildings use large-scale battery storage to draw power during off-peak hours (charging) and discharge during peak demand periods, significantly reducing costly demand charges from utilities.

- Microgrids for Remote Communities: Island grids and remote villages deploy deep cycle battery banks paired with diesel generators and solar PV to reduce fuel consumption, ensure 24/7 power availability, and improve energy security.

- Marine and Recreational Vehicle (RV) Electrification: Boats, yachts, and RVs utilize deep cycle batteries (AGM, Lithium) as the primary house bank to power appliances, navigation, and lighting, enabling extended off-grid travel and reducing emissions.

- Utility-Scale Frequency Regulation: Grid operators deploy massive battery storage farms (100+ MW) to provide rapid frequency response services, stabilizing the grid as more variable renewable resources come online.

Global Deep Cycle Batteries Market: Stats & Facts

International Energy Agency (IEA)

- Global battery storage capacity expanded by 120% in 2023, reaching 55.7 GW.

- China’s battery storage capacity increased by 250% to 27.1 GW in 2023.

- U.S. battery storage capacity grew from 9.3 GW in 2022 to 16.2 GW in 2023.

- UK was the largest European market with 3.6 GW installed, followed by Germany (1.7 GW) and Ireland (0.4 GW).

- 11 jurisdictions had official battery storage targets as of 2023.

- 33 jurisdictions had financial incentives to support battery storage by 2023.

- Battery storage was the fastest-growing energy technology in 2023.

- Battery storage deployment more than doubled in 2023, adding 42 GW globally.

- Over 85 GW of battery storage was in use in the power sector by end of 2023.

- Battery costs have fallen by ~90% since 2010.

- EV battery deployment increased by ~40% in 2023, with 14 million new electric vehicles added.

- Total volume of batteries used in the energy sector surpassed 2,400 GWh in 2023, a fourfold rise since 2020.

- More than 2,000 GWh of lithium-ion battery capacity was added worldwide over the past five years.

- EVs accounted for over 90% of battery use in the energy sector in 2023.

- Battery storage accounted for ~35% of new battery storage capacity added in 2023.

- China accounts for nearly 85% of global battery cell production capacity.

- China, Europe, and the U.S. together accounted for over 90% of global battery investments in 2023.

REN21 (Renewables Global Status Report)

- Global renewable power capacity additions hit an estimated 473 GW in 2023.

- 623 billion USD was invested in new renewable power and fuels in 2023.

- 151 countries had net-zero targets in place in 2023.

- 130 countries pledged to triple renewable capacity and double energy efficiency at UN climate talks.

European Battery Storage Data (SolarPower Europe & related)

- 21.9 GWh of new battery energy storage systems were installed in Europe in 2024.

- Europe’s total battery storage fleet reached 61.1 GWh by 2024.

- Battery storage growth in Europe continued for the 11th consecutive year in 2024.

- Annual growth of battery installations slowed to 15% in 2024 but is forecast to rise.

U.S. Government Energy Data (EIA & DOE)

- The U.S. DOE’s Global Energy Storage Database covered 1,686 energy storage projects by 2020.

- U.S. Grid-scale battery capacity was reported at 20 GW by 2020 in DOE’s battery storage database.

United States Department of Energy – Broader Battery Storage Facts

- Battery storage is increasingly integrated with power grids to support reliability and resilience.

- DOE initiatives include national battery storage data, modeling tools, and storage valuation research.

- Federal programs are accelerating battery technology deployment through policy, safety codes, and standards.

Global Deep Cycle Batteries Market: Market Dynamic

Driving Factors in the Global Deep Cycle Batteries Market

Exponential Growth of Renewable Energy

The rapid deployment of solar PV and wind power globally creates an imperative for energy storage to manage their intermittent output, ensure grid stability, and maximize self-consumption, directly driving demand for deep cycle batteries. The inherent variability of solar and wind generation necessitates reliable storage solutions to balance supply and demand, prevent curtailment of excess renewable energy, and provide power during periods of low generation. This fundamental requirement positions deep cycle batteries as a critical enabling technology for achieving high renewable penetration targets worldwide, transforming them from an optional component to a grid-essential asset.

Supportive Government Policies and Incentives

Financial incentives like investment tax credits (ITC), grants, and favorable regulations mandating storage integration with new renewables are significantly lowering the barrier to entry and accelerating market adoption globally. Landmark policies such as the U.S. Inflation Reduction Act (IRA), which provides a standalone 30-70% Investment Tax Credit for energy storage, directly improve project economics. Similarly, national and state-level renewable portfolio standards (RPS) with storage mandates, grid modernization initiatives, and rebate programs for residential battery systems (e.g., in Germany, Italy, Australia) create predictable, policy-driven demand. These frameworks de-risk investments and catalyze private sector innovation and deployment.

Restraints in the Global Deep Cycle Batteries Market

Raw Material Price Volatility and Supply Chain Risks

Fluctuating prices and potential shortages of key materials like lithium, cobalt, and nickel can impact battery costs and manufacturing scalability, posing a challenge to consistent market growth. Geopolitical tensions, trade restrictions, and the concentration of mining and processing in a few countries create supply chain vulnerabilities. This volatility complicates long-term pricing, affects profit margins for manufacturers, and can delay project timelines, potentially slowing overall market expansion despite strong underlying demand.

High Upfront Capital Cost and Financing Hurdles

Despite falling prices, the initial investment for a complete battery storage system remains significant, particularly for residential and small commercial customers, requiring innovative financing solutions to broaden adoption. The total installed cost encompasses not just the battery modules but also power conversion systems (inverters), balance-of-system components, installation labor, and permitting. This high CapEx can deter adoption in price-sensitive segments and regions, highlighting the need for widespread access to low-interest green loans, leasing models, storage-as-a-service (SaaS) offerings, and utility on-bill financing programs.

Opportunities in the Global Deep Cycle Batteries Market

Second-Life Applications for EV Batteries

The coming wave of retired EV batteries, which often retain 70-80% capacity, presents a massive opportunity for repurposing into less demanding stationary storage applications, creating a circular economy and reducing costs. This "second-life" market can significantly lower the entry cost for grid-scale and commercial storage projects, extend the useful life and value of battery materials, and address sustainability concerns. Developing efficient battery health diagnostics, standardized repackaging processes, and supportive regulatory frameworks is key to unlocking this high-potential opportunity.

Integration with Electric Vehicle Charging Infrastructure

The co-location of deep cycle battery storage with fast EV charging stations can mitigate high power demand charges, reduce grid upgrade costs, and enable charging with renewable energy, especially in grid-constrained areas. Storage-integrated charging hubs can provide ultra-fast charging without overloading local transformers, support vehicle-to-grid (V2G) and vehicle-to-building (V2B) applications, and improve the overall economics and sustainability of the EV ecosystem. This synergy is a major growth vector as public and fleet charging networks expand rapidly.

Trends in the Global Deep Cycle Batteries Market

Dominance of Lithium Iron Phosphate (LFP) Chemistry

LFP batteries are gaining dominant market share due to their superior safety, longer lifespan, absence of cobalt, and competitive cost, making them the preferred choice for stationary storage and an increasing number of EVs. The trend is shifting decisively away from nickel-manganese-cobalt (NMC) for many stationary applications as LFP's thermal stability, tolerance to full state-of-charge operation, and cycle life exceeding 6,000 cycles outweigh its slightly lower energy density. Major manufacturers are now prioritizing LFP gigafactory expansions globally.

Digitalization and AI-Optimized Storage Management

The integration of AI and machine learning with battery management systems (BMS) and energy management software (EMS) enables optimal charging/discharging strategies, predictive maintenance, and automated participation in grid service markets. This trend sees batteries becoming intelligent, data-generating assets. Cloud-based analytics platforms use historical and real-time data to forecast energy needs, predict cell failures, optimize for weather patterns and electricity prices, and autonomously dispatch stored energy to maximize financial and operational value.

Global Deep Cycle Batteries Market: Research Scope and Analysis

By Type Analysis

Lithium-Ion Batteries are projected to dominate the global market, holding an estimated 68.5% revenue share through the forecast period. This dominance is anchored in their superior energy density, high round-trip efficiency, long cycle life, and rapidly declining costs. Within lithium-ion, Lithium Iron Phosphate (LFP) chemistry is becoming the standard for stationary storage due to its excellent thermal stability, safety, and cycle life, despite slightly lower energy density than NMC variants. Lithium-ion's primary applications span residential and commercial solar-plus-storage, utility-scale storage projects, and premium automotive/marine applications. Continuous advancements in cell design, manufacturing processes, and BMS intelligence are further solidifying its leadership.

Advanced Lead-Acid Batteries (including AGM and Gel) are expected to hold a significant, though declining, share. Their advantages lie in lower upfront cost, mature recycling infrastructure, and robustness in high-temperature or float applications. They remain the technology of choice for cost-sensitive markets, certain industrial applications (e.g., forklifts), backup power systems, and the automotive starting-lighting-ignition (SLI) segment with deep cycle needs. Innovations like lead-carbon electrodes are extending their cycle life and performance, ensuring their continued relevance in specific niches.

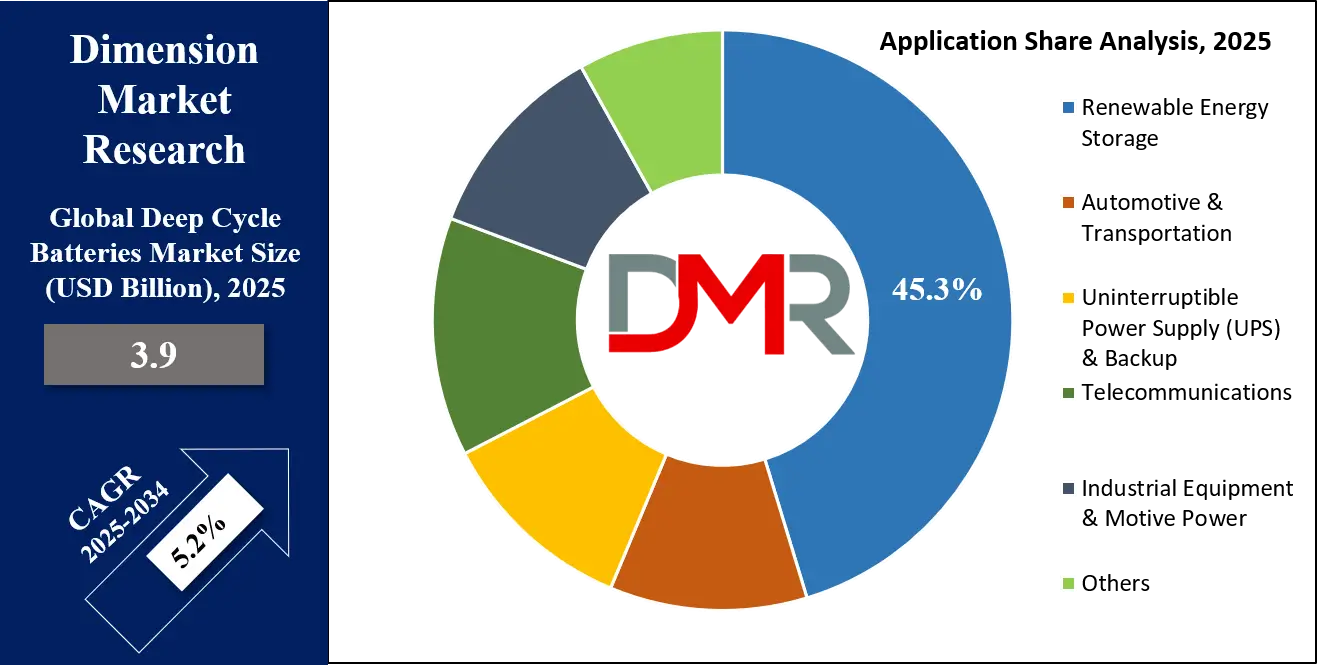

By Application Analysis

Renewable Energy Storage is poised to be the largest and most dominant application segment, expected to capture over 45.3% of the market revenue by 2030. This segment includes all storage systems directly integrated with solar PV or wind generation, from residential kilowatt-scale systems to utility-scale megawatt farms. The core driver is the economic and operational necessity to store excess renewable generation for later use, enabling energy arbitrage, backup power, and grid services. This segment demands batteries with high cycle life, depth of discharge tolerance, and seamless inverter compatibility.

Automotive & Transportation ranks as the second-largest application segment, driven by the electrification of vehicles beyond passenger cars. This includes deep cycle batteries for electric buses, trucks, marine vessels, recreational vehicles (RVs), material handling equipment (e.g., forklifts), and golf carts. The requirements here emphasize durability, vibration resistance, safety, and the ability to provide sustained power for auxiliary loads or propulsion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By End User Analysis

Utilities & Large-Scale Storage are anticipated to dominate the deep cycle battery market, accounting for 38.0% of total revenue throughout the forecast period. Utilities deploy storage for grid stabilization, frequency regulation, peak shaving, deferring grid upgrades, and integrating large renewable energy farms. This segment involves the largest individual system sizes and is highly sensitive to Levelized Cost of Storage (LCOS) and performance guarantees.

Residential End Users represent the fastest-growing segment (CAGR). Demand is driven by rising electricity prices, desire for energy independence, increasing frequency of weather-related grid outages, and the proliferation of rooftop solar. Homeowners seek turnkey, aesthetically pleasing storage solutions that integrate simply with existing solar and home energy management systems.

Commercial & Industrial (C&I) End Users are a major segment, utilizing storage for demand charge reduction, backup power for critical operations, and achieving sustainability (ESG) goals. This includes applications in data centers, manufacturing plants, retail stores, and office buildings.

The Global Deep Cycle Batteries Market Report is segmented on the basis of the following:

By Technology Type

- Lead-Acid

- Flooded

- Absorbent Glass Mat (AGM)

- Gel

- Lithium-Ion

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Others

- Flow Batteries

- Vanadium Redox

- Zinc-Bromine

- Others

By Application

- Renewable Energy Storage

- Automotive & Transportation

- Electric Vehicles

- Marine

- Recreational Vehicles (RVs)

- Material Handling

- Uninterruptible Power Supply (UPS) & Backup

- Telecommunications

- Industrial Equipment & Motive Power

- Others

By End User

- Residential

- Commercial & Industrial

- Utilities & Large-Scale Projects

- Automotive & Transportation OEMs

Impact of Artificial Intelligence in the Global Deep Cycle Batteries Market

- AI-Optimized Battery Management Systems (BMS): AI algorithms analyze real-time data on voltage, temperature, and current to precisely predict state-of-charge (SOC), state-of-health (SOH), and remaining useful life (RUL), enhancing safety, performance, and longevity.

- Predictive Maintenance and Failure Forecasting: Machine learning models analyze operational data to predict potential cell failures or performance degradation before they occur, enabling proactive maintenance and reducing downtime.

- Grid-Service Optimization Algorithms: AI software optimizes the charge/discharge schedule of distributed storage assets to maximize revenue from participation in multiple grid service markets (frequency regulation, energy arbitrage, capacity) simultaneously.

- Supply Chain and Manufacturing Optimization: AI is used to optimize battery cell manufacturing processes, improve yield, predict raw material needs, and manage complex supply chains for critical minerals.

- Second-Life Battery Screening and Repurposing: AI-powered diagnostic tools quickly and accurately assess the health and remaining capacity of used EV batteries, enabling efficient sorting and grading for optimal repurposing into second-life storage applications.

Global Deep Cycle Batteries Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate this market, holding a 32.5% revenue share in 2025. This leadership is anchored in a powerful combination of transformative policy, market maturity, and acute necessity. The U.S. Inflation Reduction Act (IRA) serves as a foundational catalyst, providing unparalleled financial certainty through its long-term, standalone storage Investment Tax Credit (ITC), which can exceed 50% with domestic content and energy community bonuses. This is compounded by some of the world's highest and most volatile retail electricity prices, particularly in leading states like California, Hawaii, and the Northeast, which dramatically improve the payback period for behind-the-meter storage.

Furthermore, a high frequency of extreme weather events wildfires, hurricanes, and polar vortexes has made energy resilience a top-tier concern for homeowners, businesses, and utilities alike, translating directly into demand for backup power solutions. The region benefits from a mature solar installation ecosystem, a culture of early technology adoption, and the presence of global innovation leaders like Tesla, Fluence, and NextEra Energy, which drive both product advancement and sophisticated project deployment. This confluence of generous subsidies, compelling economics, urgent need for grid stability, and deep pools of investment capital solidifies North America's position as the high-value revenue leader in the global deep cycle battery market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia-Pacific region is poised to achieve the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by an unprecedented, state-led convergence of industrial policy, energy security imperatives, and monumental infrastructure development. As the undisputed global hub for battery cell manufacturing, China home to giants like CATL and BYD exerts dominant influence over supply, costs, and technological roadmaps, enabling rapid, scalable deployment.

This manufacturing supremacy is harnessed by ambitious national mandates; China's "Dual Carbon" goals and its 14th Five-Year Plan explicitly target massive grid-scale storage additions, while Japan's Green Growth Strategy and South Korea's net-zero commitments prioritize storage for renewable integration.

Simultaneously, the world's most rapid urbanization and industrialization, especially in India and Southeast Asia, are straining existing grids and creating a non-negotiable demand for decentralized, reliable power, propelling storage into microgrids and commercial applications. The region is also the epicenter of the global electric vehicle revolution, creating massive synergies and scale economies between the automotive and stationary storage battery sectors.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Deep Cycle Batteries Market: Competitive Landscape

The competitive landscape is highly dynamic, featuring competition and collaboration between vertically integrated giants, specialized technology firms, and traditional energy companies. Integrated Battery & Automotive Giants: Companies like CATL, LG Energy Solution, Panasonic, and BYD leverage their scale in cell manufacturing for EVs to dominate the stationary storage market, offering cost-competitive, high-quality battery packs.

Specialist Energy Storage Companies: Pure-play firms like Tesla (Energy division), Fluence, ESS Inc., and Sonnen compete on integrated system design, software intelligence, and strong brand presence in specific segments (residential, utility). Traditional Lead-Acid and Power Solution Providers: Established players like EnerSys, East Penn Manufacturing (Deka), and Exide Technologies maintain strong positions in lead-acid segments and are expanding into lithium-ion offerings, leveraging their extensive distribution and service networks.

The battleground is shifting from selling kilowatt-hours of capacity to providing guaranteed performance, advanced software services, and comprehensive lifecycle management including recycling. Key competitive strategies include securing long-term raw material supply contracts, developing proprietary BMS software, forming partnerships with solar developers and utilities, and offering innovative financing models.

Some of the prominent players in the Global Deep Cycle Batteries Market are:

- Trojan Battery Company

- Exide Industries Ltd.

- EnerSys

- GS Yuasa Corporation

- East Penn Manufacturing

- C&D Technologies

- Rolls Battery Engineering

- U.S. Battery Manufacturing

- Crown Battery

- Discover Battery

- Leoch International Technology

- Ritar International Group

- B.B. Battery

- Power Sonic Corporation

- EverExceed Corporation

- Microtex Energy

- HBL Power Systems

- JYC Battery Manufacturer

- Shenzhen Coslight Power Technology

- Canbat Technologies Inc.

- Other Key Players

Recent Developments in the Global Deep Cycle Batteries Market

- February 2025: CATL Announces Breakthrough in Sodium-Ion Battery Mass Production. The company revealed a new manufacturing line for sodium-ion batteries with energy density rivaling LFP, targeting cost-sensitive residential and utility storage markets, reducing reliance on lithium.

- January 2025: U.S. DOE Finalizes Rules for "Domestic Content" Bonus ITC. New guidelines clarify how battery storage projects using a threshold percentage of U.S.-made cells and components can qualify for an additional 10% Investment Tax Credit, boosting domestic manufacturing.

- December 2024: Volkswagen Group Launches PowerCo Standalone Storage Division. The auto giant spun off its battery unit to serve both its EV needs and the external stationary storage market, starting with a new LFP gigafactory in Spain.

- November 2024: Fluence and Microsoft Partner on AI-Powered Grid Storage Optimization. The partnership integrates Fluence's storage systems with Microsoft's Azure AI to create a cloud-based platform for optimizing fleets of utility-scale batteries for grid services.

- October 2024: New UL 9540A Standard Update for Large-Scale Storage Safety. Underwriters Laboratories published significant updates to its safety standard for energy storage systems, focusing on fire propagation mitigation, influencing global product design and insurance requirements.

- September 2024: Amazon Launches "Clean Power Hub" with On-Site Storage Mandate. The tech giant announced that all new AWS data center regions must integrate on-site renewable generation coupled with battery storage, creating a major new demand channel for deep cycle batteries.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.9 Bn |

| Forecast Value (2034) |

USD 6.1 Bn |

| CAGR (2025–2034) |

5.2% |

| The US Market Size (2025) |

USD 1.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology Type (Lead-Acid, Lithium-Ion, Flow Batteries, Others), By Application (Renewable Energy Storage, Automotive & Transportation, Uninterruptible Power Supply (UPS) & Backup, Telecommunications, Industrial Equipment & Motive Power, Others), and By End User (Residential, Commercial & Industrial, Utilities & Large-Scale Projects, Automotive & Transportation OEMs) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Trojan Battery Company, Exide Industries Ltd., EnerSys, GS Yuasa Corporation, East Penn Manufacturing, C&D Technologies, Rolls Battery Engineering, U.S. Battery Manufacturing, Crown Battery, Discover Battery, Leoch International Technology, Ritar International Group, B.B. Battery, Power Sonic Corporation, EverExceed Corporation, Microtex Energy, HBL Power Systems, JYC Battery Manufacturer, Shenzhen Coslight Power Technology, Canbat Technologies Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Deep Cycle Batteries Market?

▾ The Global Deep Cycle Batteries Market size is estimated to have a value of USD 3.9 billion in 2025 and is expected to reach USD 6.1 billion by the end of 2034.

What is the growth rate in the Global Deep Cycle Batteries Market?

▾ The market is growing at a CAGR of 5.2 percent over the forecasted period of 2025 to 2034.

What is the size of the US Deep Cycle Batteries Market?

▾ The US Deep Cycle Batteries Market is projected to be valued at USD 1.1 billion in 2025. It is expected to reach USD 1.7 billion in 2034, growing at a CAGR of 4.9%.

Which region accounted for the largest Global Deep Cycle Batteries Market?

▾ North America is expected to have the largest market share in the Global Deep Cycle Batteries Market, driven by strong policy support like the Inflation Reduction Act and high demand for energy resilience.

Who are the key players in the Global Deep Cycle Batteries Market?

▾ Some of the major key players in the Global Deep Cycle Batteries Market are CATL, BYD Company Ltd., LG Energy Solution, Tesla, Inc., Panasonic, Fluence Energy, Inc., and EnerSys, among others.