As incidences of degenerative disc diseases among geriatric populations have risen, the global degenerative disc disease treatment market has experienced remarkable expansion.

Major market players in this industry have increased investments in research and development to develop cutting-edge diagnostic tools and treatments and raise awareness about alternative pain relief approaches available on the market.

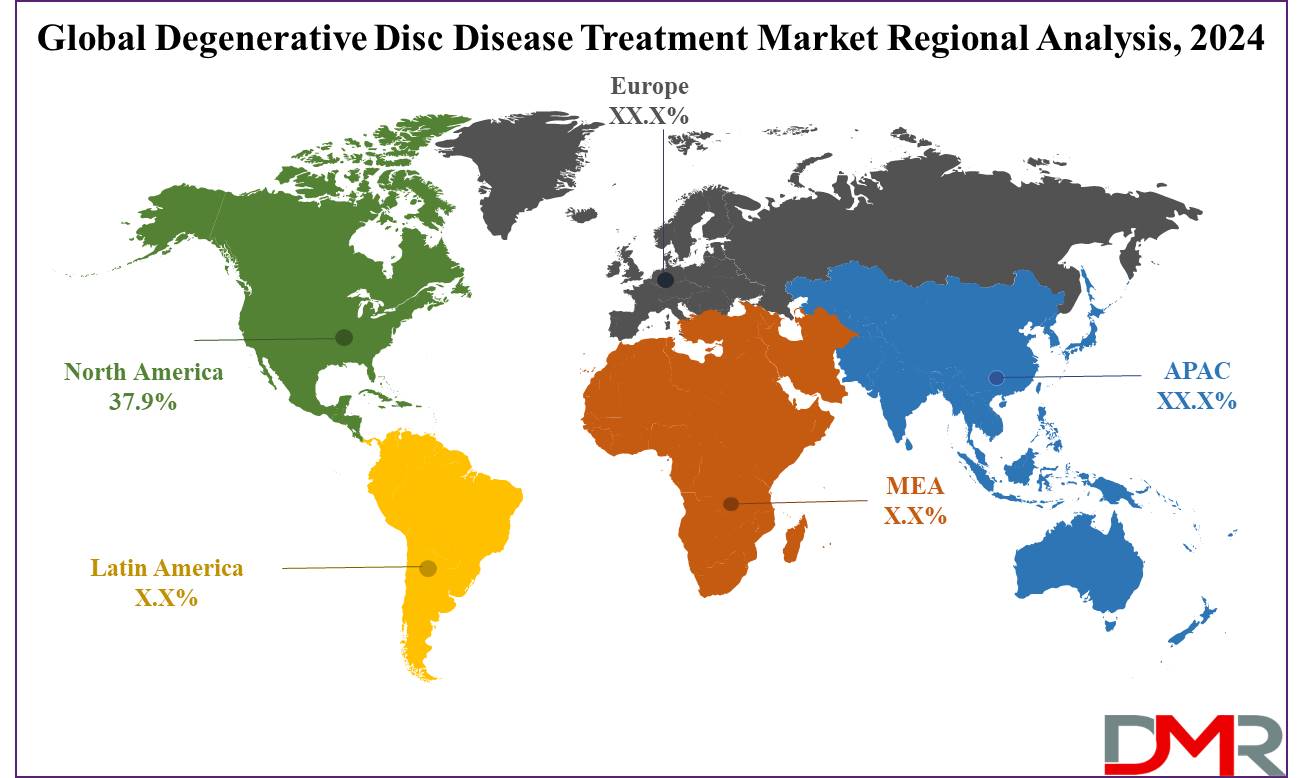

This trend also serves to drive market activity. Geographically, North America dominates the global degenerative disc disease treatment market due to the large patient pool affected by degenerative disc conditions as well as key market players located there.

Therefore, market analysts see an extremely optimistic market outlook with continued improvements being observed across treatment modalities boosting further market expansion. Overall analysis revealed a healthy compound annual growth rate expected to create milestones by 2033.

As per PubMed, this study included 975 participants (324 men, mean age 67.2; 651 women, mean age 66.0) with ages ranging from 21 to 97 years, as part of the Wakayama Spine Study. DD on MRI was classified using Pfirrmann’s system, with grades 4 and 5 indicating degenerative disc disease (DD). The study assessed DD prevalence in the cervical, thoracic, and lumbar regions.

Results showed that the overall prevalence of DD was 71% in men and 77% in women under 50 years old, rising to over 90% in those aged over 50. The highest prevalence of DD was found at C5/6 (men: 51.5%, women: 46%), T6/7 (men: 32.4%, women: 37.7%), and L4/5 (men: 69.1%, women: 75.8%). DD presence was associated with age, obesity, and low back pain in the lumbar region.

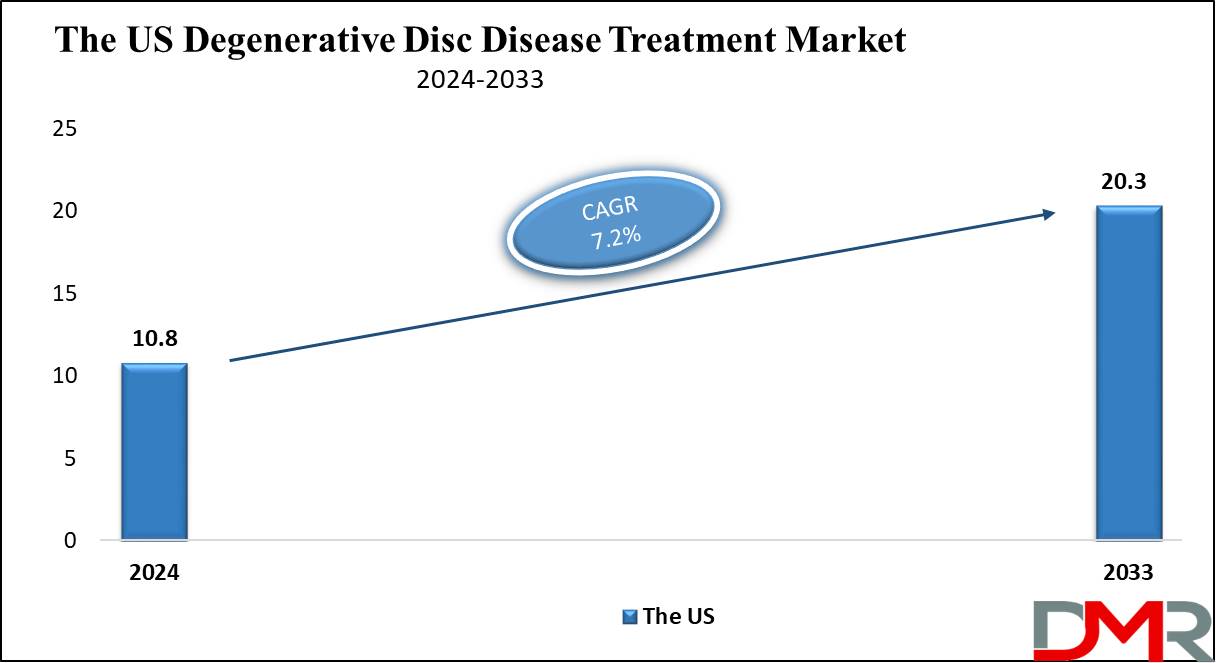

The US Degenerative Disc Disease Treatment Market

The US Degenerative Disc Disease Treatment Market is projected to be valued at

USD 10.8 billion in 2024. It is expected to witness subsequent growth in the upcoming period as it holds

USD 20.3 billion in 2033 at a

CAGR of 7.2%. The United States accounts for a major share of the global degenerative disc disease treatment market, as it has been the home of various major companies that have set various trends and developments.

Degenerative disc disease is becoming increasingly common in the population within the United States due to the rapid growth in the aging population factor that surges demand for effective treatment options. Pharmacological treatments, mostly pain relievers and muscle relaxants, dominate the US market because of the large consumption rate and ease of administration. Furthermore, the innovation of medical devices to advance spinal fusion devices and artificial discs are other drivers for growth in this market.

Recent trends in the US market include an increasing reliance on minimally invasive surgical techniques and orthobiologic therapies such as cell-based and tissue-engineered products to increase patient outcomes by shortening recovery times from treatments. This trend can be explained by increasing focus on optimizing outcomes while shortening recovery periods from treatments.

The market analysis further strengthens major players' contributions in driving changes in innovation and expanding product portfolios to meet evolving customer needs. Hence, the degenerative disc disease treatment market in the US is likely to grow steadily with continuous research and development elucidated along with strong health infrastructure.

Key Takeaways

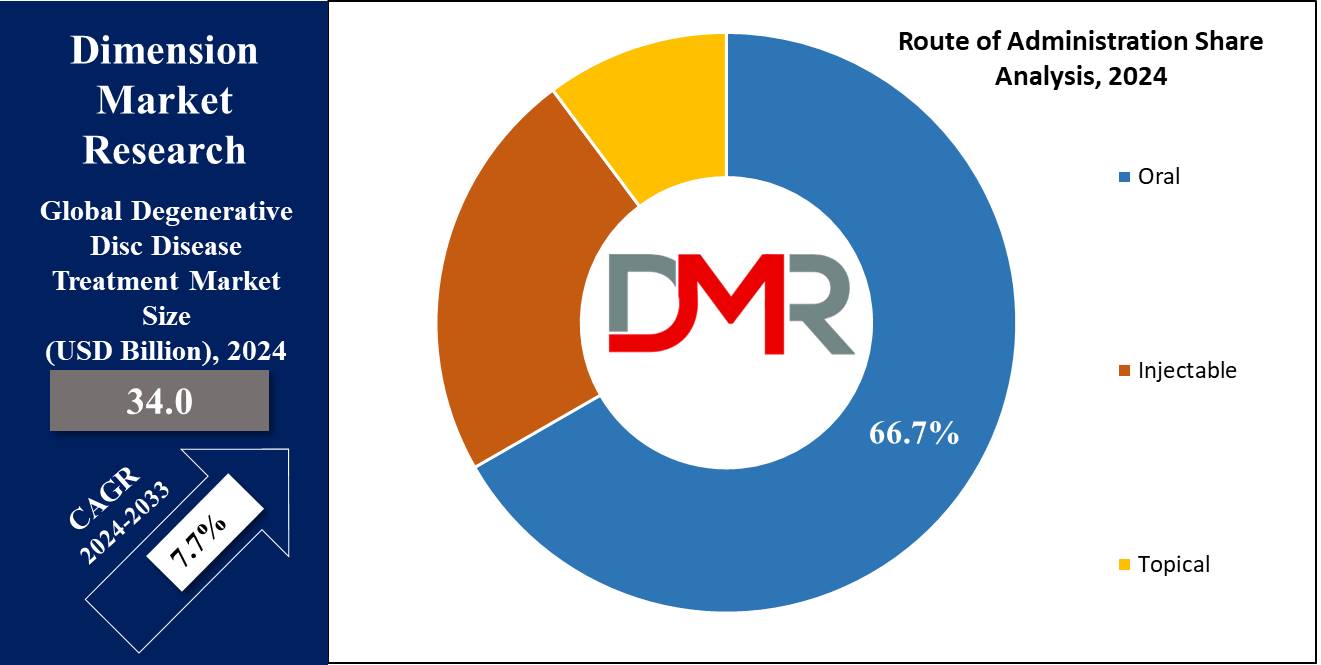

- Global Market Size: The global degenerative disc disease treatment market size is estimated to have a value of USD 34.0 billion in 2024 and is expected to reach USD 66.2 billion in 2033.

- The US Market Size: The US degenerative disc disease treatment market is projected to be valued at USD 10.8 billion in 2024 and it is expected to witness subsequent growth in 2033 as it holds USD 20.3 billion in 2033 at a CAGR of 7.2%.

- By Treatment Type Segment Analysis: Pharmacological treatments (drugs) are projected to dominate this segment as they hold 61.9% of the market share in 2024.

- By Route of Administration Segment Analysis: The oral route of administration is projected to exert its dominance in this segment as it holds 66.7% of the market share in 2024.

- Regional Analysis: North America is expected to have the largest market share in the global degenerative disc disease treatment market with a share of about 37.9% in 2024.

- Global Growth Rate: The market is growing at a CAGR of 7.7% over the forecasted period.

Use Cases

- Artificial Disc Replacement: Artificial disc replacement surgery is an incision-less, minimally invasive technique for replacing injured or degenerated intervertebral discs with artificial ones to facilitate better mobility with faster recoveries and quicker recoveries.

- Spinal Fusion Devices: Spinal fusion devices are surgical devices used to permanently attach two or more vertebrae, thus eliminating motion between them and providing stability to the spine while relieving pain. They're often utilized in cases of degenerative disk disease to stabilize it and relieve associated discomfort.

- Gene Therapy Vectors: In an attempt to provide a long-term solution for DDD, the aim is for gene therapy vectors to replace or repair defective genes that cause disc degeneration.

- Mesenchymal Stem Cells (MSCs): Cell therapy in the use of MSC regenerates the tissues of damaged discs by their growth and, thus, facilitates their healing to reduce degenerative disc disease.

Market Dynamic

Trends

Shift Towards Minimally Invasive Treatments

Recently, the treatment for degenerative disc disease globally has experienced a major trend toward minimally invasive surgical procedures. The main motive behind it is the increase in demand for treatments with quicker recovery, fewer complications, and shorter hospital stays. Nowadays, artificial disc replacements and spinal fusions by modern surgical techniques are widely adopted as they preserve spinal mobility and decrease the risk of adjacent segment disease.

Advancements in Orthobiologic Therapies

Regarding treatments for degenerative disc disease, orthobiologic treatments offer the current leading edge of innovation. Suppose gene therapy, cell-based therapy, or tissue engineering that can cure not only symptoms but also the cause leading to disc degeneration are added to these methods. For instance, techniques of gene editing to correct genetic mutations that predispose one to disc degeneration, and cell-based therapies through the use of MSCs are in development processes, envisioned for regenerating damaged disc tissues. More emphasis on personalized medicine.

Increased Focus on Personalized Medicine

There is an increasing focus on personalized medicine as far as treatment for degenerative disc disease is concerned. It's everything about designing a treatment plan, taking into consideration a patient's unique genetic profile, lifestyle, or the stage at which the disease is diagnosed. The rationale behind this approach is facilitated by rapid advances in genomics and proteomics, enabling more specific diagnosis and targeted therapies. For instance, pharmaceutical medications or surgical approaches can be more effective in certain patients with particular genetic markers.

Growth Drivers

Aging Population and Rising Prevalence

Global populations are rapidly aging, leading to an exponential rise in those aged 60 or above who are susceptible to degenerative disc disease. With intervertebral discs naturally degenerating over time, prevalence rates for conditions like Lumbar Degenerative Disc Disease continue to rise, this demographic trend is driving demand for treatments ranging from traditional

physical therapy and pharmaceutical interventions through to surgical procedures as more people age into their risk threshold.

Technological Advancements in Medical Devices

Ongoing medical device innovations thus help boost the growth of the degenerative disc disease treatment market. For example, new spinal fusion devices are being made more durable and biocompatible to minimize revision surgeries. Artificial discs are also engineered to approximate the movement of the spine naturally to improve patient performance.

The introduction of robotic-assisted surgery and real-time imaging technologies has also gradually improved success rates in complex spinal surgeries by reducing complications and recovery periods. Increased Healthcare Spending. Some of the key factors responsible for this growth in the degenerative disc disease treatment market include increasing healthcare expenditure, especially in developed regions such as North America and Europe.

Growth Opportunities

Expansion in Emerging Markets

For the degenerative disc disease treatment market, emerging markets particularly those in Asia-Pacific and Latin America offer enormous growth opportunities. These regions are also characterized by increasing economic growth, translated to a higher disposable income level and improved access to healthcare services.

The demand for treatment modalities with the use of advanced minimally invasive surgeries and orthobiologic therapies has been increasing as healthcare infrastructures in these regions continue to develop. Large and aging populations further contribute to the sizable patient population, as seen in countries like China and India, which, in turn, represents an imperative toward the need for effective management of degenerative disc disease.

Development of Novel Therapies

The development of Novel Therapies, including gene therapy and advanced cell-based treatments, is opening new vistas for growth in this market. Such novel therapeutics might revolutionize the approach toward DDD since they would provide options to extend beyond symptomatic treatments into disease-modifying interventions. Such could be the use of gene therapy vectors directed at specific genetic mutations that in turn might prevent or even reverse disc degeneration.

Restraints

High Treatment Costs

High cost due to advanced treatment for degenerative disc disease is a key restraint in the growth of the market. For instance, spinal fusion surgery and artificial disc replacement are two expensive procedures. Mainly, they involve the use of the hospital, sophisticated surgical instruments, and considerable after-surgery care. Even pharmacological treatments, especially newer biologic drugs, are very costly and beyond the reach of many patients, especially in developing regions. There is also not much coverage provided by the insurance companies for these treatments, and hence, the expenses become very high to be afforded by the patient.

Stringent Regulatory Requirements

The market for treating degenerative disc disease is highly regulated, which slows the entry of new treatments or products onto the market. Both the FDA in the US and the EMA in Europe maintain strict policies for testing and approval of new therapies; while such regulations help safeguard patient safety, they also hinder the commercialization processes of new therapies or medical devices.

Research Scope and Analysis

By Treatment Type

Pharmacological treatments (drugs) are projected to dominate this segment as they hold 61.9% of the market share in 2024. Pharmacological treatments dominate the degenerative disc disease treatment market, due to being widely available and easy to utilize. Pain relievers include medications like acetaminophen and nonsteroidal anti-inflammatory drugs such as ibuprofen or naproxen that provide immediate relief of disc degeneration-related discomfort.

These solutions often act as the initial solution. Drugs from this class typically provide fast relief of pain and inflammation. Muscle relaxants like Cyclobenzaprine or Baclofen can help ease spasms associated with degenerative disc disease.

Oral steroids such as prednisone or dexamethasone may be prescribed temporarily to decrease acute inflammation and pain, while opioid-based treatments, or narcotics, may be administered when other forms of medication can't manage chronic discomfort effectively. Opioids are effective, but prescription and use are closely regulated given the chances of dependency.

Overall, pharmacological treatments remain dominant in this space because they provide a non-invasive and relatively inexpensive means of symptom management, desirable both for the patients and the practitioners.

By Route of Administration

The oral route of administration is projected to exert its dominance in comparison to other modes of administration as it holds 66.7% of the market share in 2024 because of convenience and ease of use, which is better accepted by patients. The medications for the treatment of degenerative disc disease are normally in the form of tablets, capsules, and liquids.

These are the most common forms of treatment that can be easily self-administered without the need for healthcare professionals. Patients like oral medications because they are not invasive, or painful like injections or topical applications. In addition, oral pain relievers, and muscle relaxants among others are readily available and can be taken at home, thus convenient for long-symptom management of degenerative disc disease.

The market analysis also indicates that oral medications form the first line of treatment prescribed by healthcare providers, especially for managing mild to moderate pain associated with disc degeneration.

Their dominance in this segment is also based on the fact that oral medications are quite familiar to both patients and healthcare providers. Besides, a wide range of oral medications that are available over the counter and by prescription can guarantee effective treatment for patients according to their diagnoses.

By Disease Indication

The mid-stage segment dominates the degenerative disc disease treatment market since it is that phase wherein symptoms become more pronounced and require more intensive management. The general most cardinal symptoms in the middle stage of degenerative disc disease include continuous pain and loss of mobility with discomfort increases, which makes treatment important to maintain quality of life.

Mostly, patients at this stage of the disease are beyond the stage wherein over-the-counter medications and conservative approaches can be effective. The latter is also likely to prescribe much stronger pharmacological treatments, such as muscle relaxants and oral steroids, even opioids, which effectively manage pain and inflammation. By mid-stage, additional non-surgical methods may no longer be effective, and patients may more seriously consider advanced treatment options to include surgeries like spinal fusion or artificial disc replacement.

The mid-stage treatment market size is further driven by a rise in the availability of orthobiologic therapies, where cell-based therapies and gene therapies bring new avenues for more severe stages of degenerative disc disease. These breakthrough treatments are, therefore, the most desirable treatments for mid-stage patients to prevent disease progression and improve prognosis. Notably, dominance within the mid-stage segment is jointly driven by the increasing need for more aggressive and comprehensive treatment methods to manage accelerating symptoms of degenerative disc disease.

By End User

Hospitals are projected to dominate the degenerative disc disease treatment market due to their ability to offer fully-rounded care, more sophisticated treatment, and the availability of medical specialists. Hospitals remain the primary venue for procedures such as spinal fusion, artificial disc replacement, or advanced diagnostic testing, thus representing an essential component in the management of severe degenerative disc disease.

Care of a patient with mid to late-stage degenerative disc disease is properly multi-disciplinary, incorporating specialists in orthopedic surgery, pain management, and physical therapy, usually coordinated in a hospital environment. Hospitals have the infrastructure to provide a broad range of treatment modalities-from pharmacologic treatments through advanced orthobiologic treatments to implantable devices.

The presence of emergency cases and complications during the treatment of degenerative disc disease further justifies the market share held by hospitals. Also, for patients with grave symptoms, hospitals represent immediate contact points. This leads to early diagnosis and timely interventions aimed at managing the progress of the disease. Interest in obtaining hospital-based care also emanates from the confidence instilled in patients to the effect that such facilities will offer quality, specialized care not possible at outpatient clinics or ambulatory surgical centers.

The Global Degenerative Disc Disease Treatment Market Report is segmented based on the following

By Treatment Type

Pharmacological Treatments (Drugs)

- Pain Relievers

- Acetaminophen

- Non-steroidal anti-inflammatory Drugs (NSAIDs)

- Muscle Relaxants

- Oral Steroids

- Narcotics (Opioids)

- Short-Acting Opioids

- Morphine

- Oxycodone

- Hydrocodone

- Tramadol

- Long-Acting Opioids

- Others

Orthobiologic Treatments

- Biomolecular/Gene Therapy

- Gene Editing

- Gene Therapy Vectors

- Cell-Based Therapy

- Mesenchymal Stem Cells (MSCs)

- Induced Pluripotent Stem Cells (iPSCs)

- Tissue-Based Therapy

- Allografts

- Autografts

- Xenografts

- Tissue-Engineered Products

- Synthetic Scaffolds

- Bioactive Molecules

Medical Devices

- Implantable Devices

- Spinal Fusion Devices

- Artificial Discs

- External Devices

- Back Braces

- Electrical Nerve Stimulation Devices

By Route of Administration

- Oral

- Injectable

- Intravenous (IV)

- Intramuscular (IM)

- Subcutaneous (SC)

- Topical

By Disease Indication

- Early Stage

- Mid Stage

- Late Stage

By End User

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

- Others

Regional Analysis

North America is projected to dominate the global degenerative disc disease treatment market as it holds 37.9% of the market share in 2024, driven by several key factors that make the region a hub in the industry. This includes high prevalence within the aging population in the US and Canada, functioning as a major force in driving the treatment prospects. A large part of the population shows symptoms of disc degeneration; hence, the demand for effective treatment modalities is very high.

Also, the leading market players being located in the North American region set the pace of this region. Truly pioneering treatments that comprise advanced treatments through medical devices, and pharmacological and orthobiologic therapies are being dispensed by the companies operating in this market. Thus, with a strong emphasis on research and development, backed up by huge investments in healthcare infrastructure, North America is guaranteed to remain right at the center of state-of-the-art treatments.

Coupled with this, the well-developed health infrastructure of the region opens options for patients to choose between minimally invasive surgery and personalized medicine approaches. Advanced diagnostic capability and an increasing adaptation toward new technologies further show promise for this region.

Additionally, the North American region has favorable reimbursement policies and strong consumer purchasing power in support of the growth of the degenerative disc disease treatment market. Hence, this consolidated North America's position as the leading region within the global market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Various players are present in the competitive landscape of degenerative disc disease treatment, each of which aims at strengthening its market position through innovation, strategic partnerships, and expansion of product portfolios.

Companies operating in the space include Medtronic, Johnson & Johnson, Zimmer Biomet, and Stryker, among others. These companies are at the forefront of developing advanced medical devices, including spinal fusion devices and artificial discs, which play an integral role in the treatment of degenerative disc disease.

Beyond medical devices, pharmaceutical entities such as Pfizer and Eli Lilly represent two of the biggest names in the development and commercialization of new pharmacological treatments designed to manage pain and inflammation associated with disc degeneration. The market is also cracking with nascent activity in the orthobiologic segment, wherein Mesoblast and Vericel Corporation spearhead cell-based and gene therapies.

These companies utilize mergers and acquisitions to enhance their market share and attain new technologies. Various companies, in conjunction with institutes and universities, are also accelerating efforts to develop new treatments for different cancers. The competitive landscape meanwhile remains dynamic, with continuous innovation by companies seeking to edge out one another and address the unmet needs of patients with degenerative disc disease.

Some of the prominent players in the Global Degenerative Disc Disease Treatment Market are

- Medtronic plc

- Johnson & Johnson

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

- NuVasive, Inc.

- Globus Medical, Inc.

- Orthofix International N.V.

- DePuy Synthes (a subsidiary of Johnson & Johnson)

- Spinal Elements, Inc.

- Aesculap Implant Systems, LLC

- Integra LifeSciences Holdings Corporation

- Xtant Medical Holdings, Inc.

- Alphatec Spine, Inc.

- K2M Group Holdings, Inc.

- Other Key Players

Recent Developments

- August 2024: Medtronic launched its next-generation spinal fusion device, which incorporates advanced materials designed to enhance fusion rates and reduce postoperative complications. This device represents a significant advancement in the treatment of degenerative disc disease, offering patients improved outcomes and quicker recovery times.

- July 2024: Pfizer announced the FDA approval of a novel oral anti-inflammatory drug specifically designed to target inflammation in patients with mid-stage degenerative disc disease. This drug has shown promising results in clinical trials, offering a new option for managing chronic pain associated with disc degeneration.

- June 2024: Zimmer Biomet entered into a strategic partnership with the University of California to develop a new gene therapy aimed at treating early-stage degenerative disc disease. This collaboration leverages the university’s cutting-edge research capabilities and Zimmer Biomet’s expertise in medical device development to create a potentially groundbreaking treatment.

- May 2024: Stryker completed the acquisition of a leading orthobiologic company, BioTech Innovations, to expand its portfolio of cell-based therapies and tissue-engineered products. This acquisition positions Stryker as a leader in the growing orthobiologic segment of the degenerative disc disease treatment market.

- April 2024: Johnson & Johnson introduced a new generation of artificial discs, which feature enhanced durability and biomechanics designed to mimic the natural movement of the spine more closely.

- March 2024: Vericel Corporation reported positive phase III clinical trial results for its new cell-based therapy, aimed at regenerating damaged disc tissue in late-stage degenerative disc disease patients. The therapy demonstrated significant improvements in pain relief and disc function, paving the way for regulatory submission.

- February 2024: Mesoblast announced the approval of its mesenchymal stem cell therapy in the European Union, making it the first cell-based treatment approved for mid-stage degenerative disc disease in the region.

- January 2024: Eli Lilly launched its new pain management drug, specifically designed for long-term management of chronic pain in degenerative disc disease patients. This drug is part of Eli Lilly’s broader strategy to address the growing demand for effective and safe pain management solutions.

- December 2023: Spinal Innovations Inc. received FDA clearance for its novel implantable spinal device that provides real-time monitoring of spinal fusion progress. This device is expected to revolutionize postoperative care and improve outcomes for patients undergoing spinal fusion surgery.

- November 2023: The University of Cambridge, in collaboration with a leading biotech firm, published groundbreaking research on a new tissue-engineering approach for intervertebral disc regeneration.

Report Details

|

Report Characteristics

|

| Market Size (2024) |

USD 34.0 Bn |

| Forecast Value (2033) |

USD 66.2 Bn |

| CAGR (2024-2033) |

7.7% |

| Historical Data |

2018 – 2023 |

| The US Market Size (2024) |

USD 10.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Treatment Type (Pharmacological Treatments (Drugs), Orthobiologic Treatments, and Medical Devices), By Route of Administration (Oral, Injectable, and Topical), By Disease Indication (Early Stage, Mid Stage, and Late Stage), By End User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Medtronic plc, Johnson & Johnson, Stryker Corporation, Zimmer Biomet Holdings Inc., NuVasive Inc., Globus Medical Inc., Orthofix International N.V., DePuy Synthes, Spinal Elements Inc., Aesculap Implant Systems LLC, Integra LifeSciences Holdings Corporation, Xtant Medical Holdings Inc., Alphatec Spine Inc., K2M Group Holdings Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |