Dental Bone Graft Substitute Market Overview

The

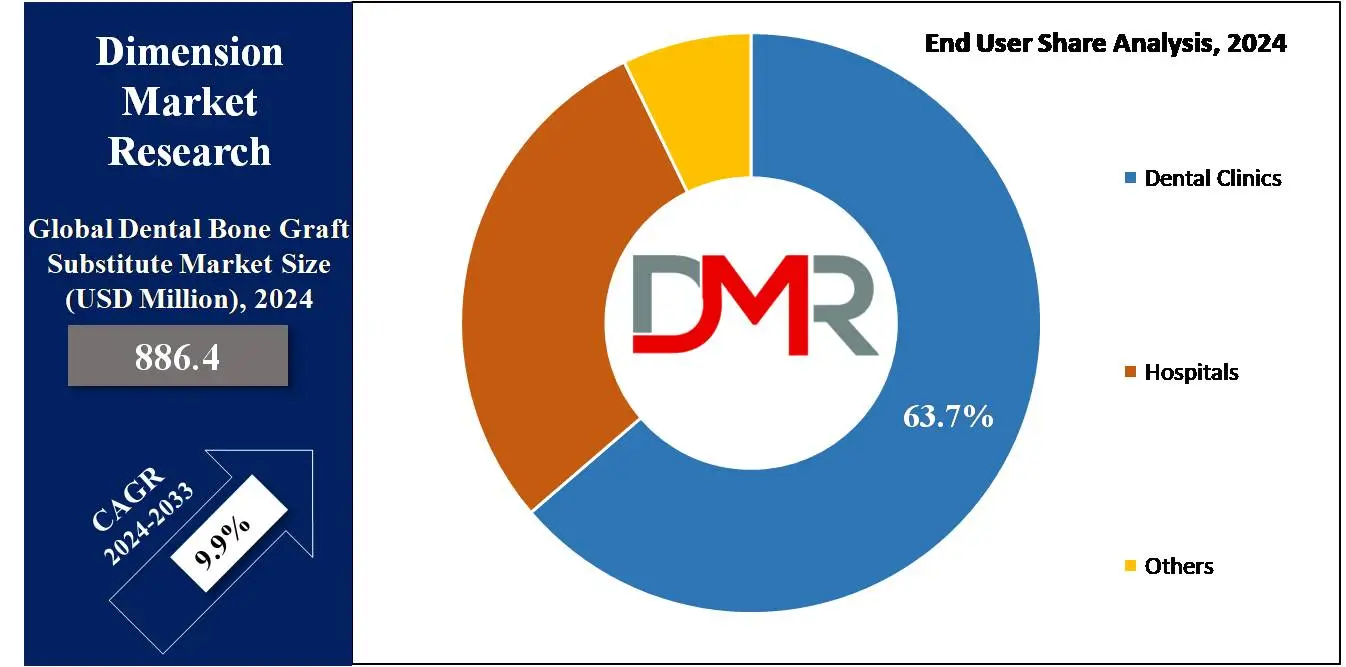

Global Dental Bone Graft Substitute Market is expected to reach a value of

USD 886.4 million by the end of 2024, and it is further anticipated to reach a market value of

USD 2,066.8 million by 2033 at a CAGR of 9.9%.

Bone graft substitutes are commonly used as void fillers. Ideally, the material will resorb and participate in bone remodeling, simply replacing the bone graft substitute over time.

However, all available materials either resorb quickly or more slowly than predicted, and it is, therefore, vital to understand the mechanisms of resorption and the properties that determine the resorption of a specific material. Innovations in

Dental Equipment have also contributed to better handling and placement of these substitutes during surgical procedures.

Further, the popularity of dental implant surgery is rising, driven by advanced techniques like bone grafts and regeneration, with better success rates. Biocompatible synthetic grafts, mainly TCP, drive growth due to superior osteoconductivity. Industry initiatives like new product launches and mergers also impact market revenue positively.

Key Takeaways

- Market Growth: The Dental Bone Graft Substitute Market size is expected to grow by 1,102.0 million, at a CAGR of 9.9% during the forecasted period of 2025 to 2033.

- By Material: The xenograft segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Application: Socket preservation application is expected to lead the Dental Bone Graft Substitute market in 2024

- By End User: The Dental Clinic segment is expected to get the largest revenue share in 2024 in the Dental Bone Graft Substitute market.

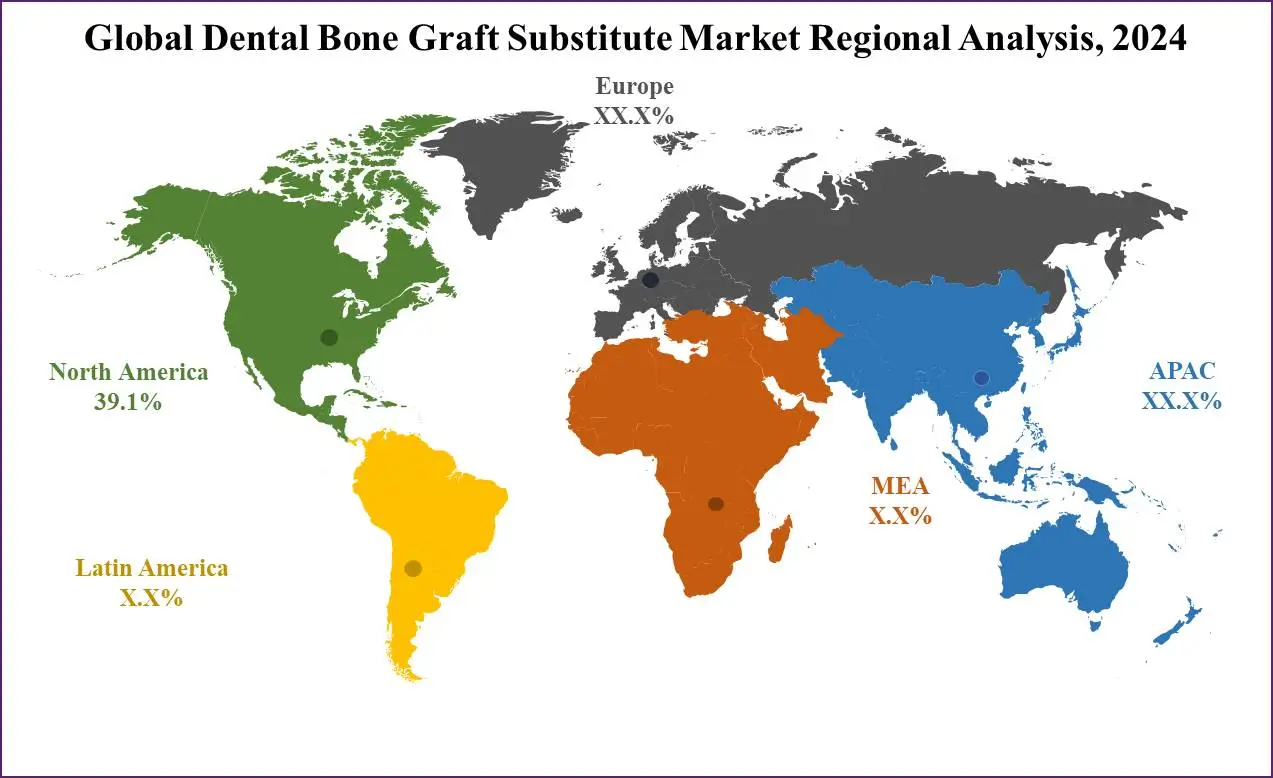

- Regional Insight: North America is expected to hold a 39.1% share of revenue in the Global Dental Bone Graft Substitute Market in 2024.

- Use Cases: Some of the use cases of Dental Bone Graft Substitute include socket preservation, ridge augmentation, and more.

Use Cases

- Tooth Implant Preparation: Dental bone graft substitutes are utilized to augment bone density in the jaw to provide a stable foundation for dental implants, allowing successful implantation.

- Socket Preservation: Following tooth extraction, bone graft substitutes are used to preserve the bone structure in the socket area, protecting against bone loss and maintaining the integrity of surrounding teeth.

- Ridge Augmentation: Graft substitutes are employed to improve the height or width of the jaw ridge, addressing bone deficiencies created by trauma, infection, or congenital issues, thereby supporting the proper placement of dental prosthetics.

- Periodontal Defect Repair: In cases of periodontal disease where bone loss has occurred around teeth, bone graft substitutes help in regenerating lost bone tissue, promoting periodontal tissue regeneration, and enhancing overall oral health.

Dental Bone Graft Substitute Market Dynamics

Driving Factors

Increasing Dental Implant SurgeriesThe growth in demand for

dental implant procedures globally is a major driving factor for the dental bone graft substitutes market. As more people look for dental implants to address tooth loss, the need for bone grafting materials to enlarge bone density for successful implantation also increases.

Growing Aging PopulationThe global demographic switch towards an aging population is driving the number of dental issues like bone loss and periodontal diseases. Further, there is an increase in the need for dental bone graft substitutes to support procedures like ridge augmentation and socket preservation, driving market growth. Interestingly, this aging trend also influences dietary preferences, fueling demand in sectors like

Meat Substitute markets due to health considerations.

Opportunities

Expanding Medical TourismThe rise in popularity of

medical tourism, mainly in regions like the Asia Pacific, provides a major opportunity for the global dental bone graft substitutes market. Patients traveling abroad for dental procedures contribute to the need for bone graft materials, mainly in countries offering high-quality care at lower costs.

Technological Advancements

Ongoing developments in dental technology, like the development of new

biomaterials and less invasive surgical techniques, provide opportunities for innovation in the dental bone graft substitutes market. Companies investing in R&D to improve the efficacy, safety, and affordability of graft materials stand to capitalize on emerging trends and gain a competitive edge.

Restraint Factors

Strict Regulatory RequirementsThe presence of strict regulatory guidelines in key markets like South Korea and Australia creates a restraint to the global dental bone graft substitutes market. Obeying regulations like approval from authorities like the Korean Food and Drug Administration (KFDA) and the Therapeutic Goods Administration (TGA) in Australia can create barriers to market entry and product commercialization.

Limited Reimbursement Policies

Inadequate or limited refund policies for dental procedures, including bone grafting surgeries, in certain regions can impact market growth. Patients may face financial barriers to accessing these procedures, impacting the adoption of dental bone graft substitutes and overall market demand.

Trends

Rise in Digital Dentistry

The adoption of digital dentistry, including technologies like 3D printing and computer-aided design/computer-aided manufacturing (CAD/CAM), is a recent trend shaping the global dental bone graft substitutes market. These technologies allow for accurate customization of graft materials and enhance treatment outcomes by supporting more accurate surgical planning and implant placement.

Focus on Biomaterial Innovations

There is a high focus on biomaterial innovations in the field of dental bone graft substitutes, with research aimed at developing biocompatible materials that promote faster bone regeneration and integration. Development in bioactive ceramics, growth factors, and tissue engineering techniques are driving the development of next-generation graft materials with better properties for better clinical outcomes.

Dental Bone Graft Substitute Market Research Scope and Analysis

By Material

The dental bone graft substitutes market is categorized by product into autograft, xenograft, allograft, synthetic material, and others, with xenografts expected to dominate revenue share in 2024. Xenografts, derived from animal sources like bovines, notably exemplified by Bio-Oss, are looking into new product launches by industry leaders to enhance market penetration. Further, synthetic materials are expected to experience the highest growth due to superior osteoconductivity, hardness, & lower disease transmission risk in comparison to xenografts and allografts.

Also, many synthetic types like ceramic, polymer-based, and BMPs are available, with a focus on biocompatibility to reduce adverse reactions. Synthetic grafts use HAP and TCP to demonstrate improved biocompatibility, while polymer-based variants exhibit promising biocompatibility.

Industry strives are ongoing to develop new products with better biocompatibility, bioactivity, and mechanical properties, reflecting a commitment to advancing dental bone graft technology and meeting changing market demands.

By Product

Bio-Oss plays a major role in driving the growth of the global dental bone graft substitutes market. As one of the most commonly used xenograft materials, Bio-Oss is derived from bovine bone and exhibits excellent osteoconductive properties, supporting the natural regeneration of bone tissue in dental procedures. Its biocompatibility and structural similarity to human bone make it a first choice among dental practitioners for socket preservation, ridge augmentation, and implant bone regeneration.

The broad adoption of Bio-Oss is driven by its well-known track record of success in promoting bone growth and integration, creating better clinical outcomes and patient satisfaction.

Moreover, the constant innovation and refinement of Bio-Oss by manufacturers contribute to its prominence in the market, as it remains at the forefront of development in dental bone graft substitutes. As dental implant surgeries and related procedures continue to rise globally, Bio-Oss's role as a reliable and effective graft material is expected to further support market growth in the future.

By Mechanism

Osteoconduction plays a major role in driving the growth of the global dental bone graft substitutes market. This mechanism includes providing a scaffold or framework that allows the ingrowth of new bone tissue.

By serving as a supportive structure, osteoconductive materials provide the natural regeneration of bone, promoting successful integration with surrounding tissue, which is particularly important in dental procedures where bone graft substitutes are used to augment bone density for procedures like dental implants.

As the need for dental implant surgeries grows across the world, the importance of effective bone graft substitutes with strong osteoconductive properties becomes evident. Manufacturers are thus aiming to develop materials with better osteoconduction capabilities to meet the growing needs of dental professionals and patients alike.

In addition, development in biomaterials and tissue engineering techniques is further driving innovation in this aspect, supporting constant growth and development within the dental bone graft substitutes market.

By Application

In the application segment of dental bone graft substitutes includes Ridge Augmentation, Sinus Lift, Periodontal Defect Regeneration, Implant Bone Regeneration, and Socket Preservation, the rise of synthetic bone materials has mainly fueled the adoption of socket preservation procedures, expected to seize a major share in 2024. Socket preservation focuses on minimizing bone loss post-tooth extraction, benefits from increasing dental implant surgeries, and growing oral health awareness.

Further, the sinus lift segment is expected to experience the fastest growth, while Ridge Augmentation will retain a significant revenue share due to its quick recovery and less painful nature, appealing for achieving successful implant placement and long-term survival.

Ridge augmentation additionally allows alveolar volume gain, further driving demand. Commonly used in grafting materials like Puros by Zimmer Biomet, Bio-Oss by Osteohealth, and INFUSE bone graft by Medtronic, reflecting a diverse array of options catering to many procedural needs in the dental bone graft substitutes market.

By End User

The dental clinic as an end-user segment is set to emerge as the leader in revenue generation in 2024, driven by the higher popularity of dental graft surgeries. Dental clinics provide convenience and access to skilled surgeons, specializing in safer and faster same-day procedures compared to hospitals. The expansion of private dental and specialty clinics, along with a strong network of manufacturing companies targeting clinics through direct sales, contributes to their prominence.

In addition, the hospital segment is expected to have significant growth, supported by a complete range of reconstructive procedures and collaborations with insurance companies for effective refunds. Some hospitals, often self-funded and connected with tissue banks, prioritize top-notch services, attracting a higher footfall than clinics due to their varied service offerings and established insurance partnerships.

The Dental Bone Graft Substitute Market Report is segmented based on the following:

By Material

- Autograft

- Allograft

- Demineralized Bone Matrix

- Others

- Xenograft

- Synthetic

- Others

By Product

- Bio OSS

- Osteograf

- Grafton

- Others

By Mechanism

- Osteoconduction

- Osteoinduction

- Osteopromotion

- Osteogenesis

By Application

- Ridge Augmentation

- Sinus Lift

- Periodontal Defect Regeneration

- Implant Bone Regeneration

- Socket Preservation

By End User

- Hospitals

- Dental clinics

- Others

Dental Bone Graft Substitute Market Regional Analysis

North America is set to lead the global dental bone graft substitutes market with a 39.1% revenue share in 2024, due to growth in target population and increasing dental implant surgeries. Also, Europe follows closely and is expected for significant growth ahead. In addition, the Asia Pacific region is expected to show the highest growth in the coming years owing to factors like expanding medical tourism and government initiatives.

However, strict regulations in countries like South Korea & Australia create challenges for market entry, needing approval from authorities like the Korean Food and Drug Administration (KFDA) & Therapeutic Goods Administration (TGA). However, even after these hurdles, medical tourism in India and China for dental procedures continues to drive market growth. Moreover, the availability of resources supporting the development of advanced products at lower costs is prompting the establishment of more manufacturing facilities in these countries.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Dental Bone Graft Substitute Market Competitive Landscape

The global dental bone graft substitutes market has intense competition among key players competing for market share. Companies are aiming at strategic initiatives like product innovation, strategic collaborations, and geographic expansion to gain a competitive edge. In addition, investments in R&D for advanced biomaterials and surgical techniques are driving competitiveness.

Market players are also looking into regulatory challenges and adapting to changes in payment policies in key regions to maintain market position. Overall, the competitive landscape is characterized by a dynamic interplay of innovation, partnerships, and regulatory compliance efforts among industry participants.

Some of the prominent players in the Global Dental Bone Graft Substitute Market are

- Dentsply Sirona

- Zimmer Biomet

- Orthogen

- ti Surgical

- Medtronic

- Dentium Co Ltd

- Johnson & Johnson

- Young Innovations

- BEGO GmbH

- Lifenet Health

- Other Key Players

Recent Developments

- In July 2023, Carmell Therapeutics Corporation announced the execution of a definitive agreement and plan of merger with Flagstaff-based Axolotl Biologix, a regenerative medicine company developing products for active soft tissue repair, aesthetics and orthopedic indications.

- In January 2023, Alpha Healthcare Acquisition Corp. III announced the launch of a definitive business combination agreement with Carmell Therapeutics Corporation, a Phase 2-stage biotechnology platform company creating allogeneic plasma-based biomaterials for bone & soft tissue healing indications.

Dental Bone Graft Substitute Market Report Details

| Report Characteristics |

| Market Size (2024) |

USD 886.4 Mn |

| Forecast Value (2033) |

USD 2,066.8 Mn |

| CAGR (2024-2033) |

9.9% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Material (Autograft, Allograft, Xenograft, Synthetic, and Others), By Product (Bio OSS, Osteograf, Grafton, and Others), By Mechanism (Osteoconduction, Osteoinduction, Osteopromotion, and Osteogenesis), By Application (Ridge Augmentation, Sinus Lift, Periodontal Defect Regeneration, Implant Bone Regeneration, and Socket Preservation), By End User (Hospitals, Dental clinics, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Dentsply Sirona, Zimmer Biomet, Orthogen, Rti Surgical, Medtronic, Dentium Co Ltd, Johnson & Johnson, Young Innovations, BEGO GmbH, Lifenet Health, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Dental Bone Graft Substitute Market size is estimated to have a value of USD 886.4 million in 2024 and is expected to reach USD 2,066.8 million by the end of 2033.

North America is expected to have the largest market share in the Global Dental Bone Graft Substitute Market with a share of about 39.1% in 2024.

Some of the major key players in the Global Dental Bone Graft Substitute Market are Dentsply Sirona, Zimmer Biomet, Orthogon, and many others.

The market is growing at a CAGR of 9.9 percent over the forecasted period.