Market Overview

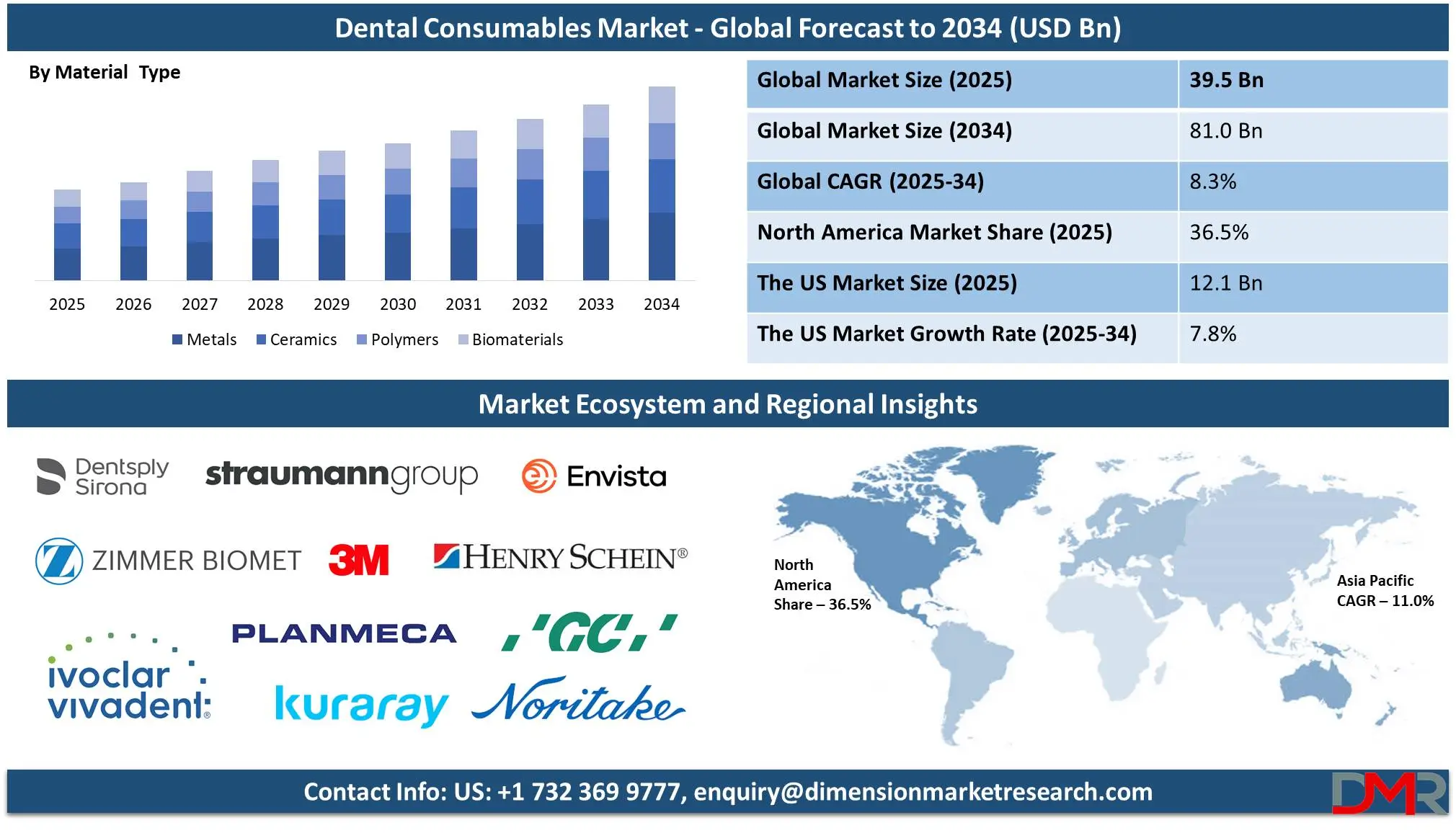

The Global Dental Consumables Market is predicted to be valued at USD 39.5 billion in 2025 and is expected to grow to USD 81.0 billion by 2034, registering a CAGR of 8.3% from 2025 to 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global dental consumables market is growing rapidly because people are more focused on oral

healthcare and the number of older patients is increasing, and many patients choose cosmetic dental procedures. The dental restoratives market, along with the implant and endodontic supply market, expands because low and middle-income countries show rising rates of dental caries and periodontal diseases, which trigger patient requirements for these treatments.

The dental field is experiencing an evolving transformation toward digital dentistry and minimally invasive procedures that generate a combination of CAD and CAM technology adoption in dental practices, with the rise of bioactive materials supporting tissue growth. Clear aligners and self-ligating brackets have redesigned orthodontic treatment approaches because adults now choose discreet dental options for their alignment needs. Advancements in dental preventive healthcare and OTC products that include whitening kits, together with fluoride varnishes, continue to gain momentum due to customers emphasizing dental aesthetics.

Even with its ongoing success, the market has stumbling obstacles ahead. The high expense of dental treatments, combined with deficient dental personnel and expensive treatment costs, prevents market expansion in developing countries. The process of obtaining regulatory approval and compliance for new materials, together with new devices, extends product introduction times.

The dental industry is set to experience promising growth opportunities in Asia-Pacific and Latin America because their healthcare infrastructure keeps advancing while dental tourism booms. The global market for dental appliances will experience more growth due to government and private funding increases and rising consumer costs for dental aesthetics.

The US Dental Consumables Market

The US Dental Consumables Market is projected to be valued at USD 12.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.8 billion in 2034 at a CAGR of 7.8%.

Dental consumables in the U.S. hold the position of the world's largest market because Americans devote substantial healthcare funds to dental care, while having advanced dental technology and complete coverage under insurance. Frequent dental care requirements by American seniors aged 65 and above continue driving market expansion because this demographic now exceeds 55 million people.

The U.S. benefits from a well-established dental care infrastructure, with a high number of practicing dentists per capita and widespread availability of advanced procedures. The high need for quality consumables such as CAD/CAM restorations, along with esthetic orthodontics and biomaterials needed in periodontal surgeries, represents substantial market demand. Aesthetic preoccupations within the market have driven up market demand for teeth whitening products and veneers, and clear aligners.

The market benefits from two different population drivers at the same time. Both the boomer generation that is aging and younger people are fueling market growth through restorative healthcare requirements and cosmetic and preventive service needs. The market benefits from growing household spending power and extensive

dental insurance coverage because these factors accelerate market acceptance rates.

The U.S. is experiencing modernizing transformations throughout its territory. 3D-printed crowns and digital dentistry, and advanced whitening technology appear throughout the dental practice more frequently. The dental consumables market faces two main challenges due to high treatment expenses as well as insufficient dental staff in rural areas. The U.S. dental consumables market will maintain its worldwide dominance because of continuous innovation combined with government backing and patient interest in oral healthcare.

Global Dental Consumables Market: Key Takeaways

- The Global Market Size Insights: The Global Dental Consumables Market size is estimated to have a value of USD 39.5 billion in 2025 and is expected to reach USD 81.0 billion by the end of 2034.

- The US Market Size Insights: The US Dental Consumables Market is projected to be valued at USD 12.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.8 billion in 2034 at a CAGR of 7.8%.

- Regional Analysis: North America is expected to have the largest market share in the Global Dental Consumables Market, with a share of about 36.5% in 2025.

- Key Players: Some of the major key players in the Global Dental Consumables Market are Dentsply Sirona, Straumann Group, Envista Holdings, 3M Company, Zimmer Biomet, Henry Schein, Ivoclar Vivadent, and many others.

- The Global Market Growth Rate Insights: The market is growing at a CAGR of 8.3% over the forecasted period of 2025.

Global Dental Consumables Market: Use Cases

- Dental Implants for Tooth Replacement: Dental implants serve as an enduring tooth replacement method that strengthens both mouth function and oral beauty. This segment has become notable because older North American and European demographic groups are choosing dentures, which drives their rapid market growth.

- Clear Aligners in Adult Orthodontics: The transparent plastic teeth aligners serve as an undetectable removable option, which benefits adult patients who need discreet orthodontic treatment. Recent advancements in digital impression systems and at-home treatment models have caused worldwide growth in their popularity, which has expanded orthodontic care availability.

- Endodontic Files for Root Canal Therapy: Endodontic files are essential in endodontic treatments for cleaning and shaping root canals during procedures, with increasing demand driven by increasing incidences of pulp infections and dental caries, particularly among urban populations consuming sugar-rich diets, leading to their rise.

- Teeth Whitening Kits for Cosmetic Dentistry: Over-the-counter teeth whitening kits have become an increasingly popular solution as consumers search for affordable in-home solutions to enhance their smile. They have proven popular worldwide as cosmetic self-care becomes mainstream.

- Dental Sealants for Pediatric Cavity Prevention: Dental sealants are applied to children's molars to protect them against decay and cavities, with public health programs both in North America and Europe encouraging their usage as an economical preventative solution for long-term oral health concerns.

Global Dental Consumables Market: Stats & Facts

- According to the American Academy of Implant Dentistry (AAID), more than 35 million Americans are missing all of their teeth in at least one jaw, if not both, while another 15 million people have lost one or more teeth and replaced them with dental bridges.

- As per the American Association of Oral and Maxillofacial Surgeons (AAOMS), approximately 69% of Americans aged 35 to 44 have lost at least one permanent tooth, and by age 74, 26% of adults will have lost all of their permanent teeth.

- According to the National Institute of Dental and Craniofacial Research (NIDCR), comprehensive data is available on tooth loss demographics and statistics, highlighting increasing tooth loss prevalence with age and varying across socio-economic and racial groups.

- Based on data from the American Academy of Implant Dentistry (AAID), nearly 3 million Americans have received a dental implant, and this number continues to grow by about 500,000 annually.

- According to the Journal of Oral Implantology, the success rate of dental implants is reported at 98%, which is significantly higher than other dental procedures, such as crowns (50%-80% over 10 years) and root canal therapies.

- NCBI Bookshelf, dental implants demonstrate a high long-term success rate exceeding 97% over 10 years, offering superior outcomes compared to conventional fixed dental prostheses. This durability is largely attributed to their biocompatibility, osseointegration capabilities, and reduced mechanical complications, making them a preferred solution for tooth replacement.

- NCBI Bookshelf, dental implants provide multiple clinical advantages, including decreased risk of caries and endodontic problems in adjacent teeth, improved maintenance of bone at the edentulous site, and reduced sensitivity of surrounding teeth. These benefits collectively enhance long-term oral health and patient satisfaction with implant-supported restorations.

Global Dental Consumables Market: Market Dynamics

Driving Factors in the Global Dental Consumables Market

Increasing Prevalence of Dental Disorders

The global burden of dental diseases, especially dental caries, periodontitis, and tooth loss, continues growing across developed and developing regions. According to the WHO, untreated dental caries in permanent teeth is the most common health condition globally, affecting an estimated 2.5 billion people. This widespread prevalence drives consistent demand for restorative materials, endodontic tools, and prosthetic consumables. Lifestyle-related factors such as increased sugar consumption, tobacco use, and poor oral hygiene are aggravating oral health issues, particularly in urban populations.

Moreover, a lack of regular dental checkups in many regions leads to more advanced-stage treatments, requiring extensive use of dental consumables like root canal sealers, implants, and crowns. Governments and health organizations are launching oral health awareness programs to counter this trend, indirectly boosting early diagnosis and treatment rates. Consequently, the mounting oral disease burden is a strong and sustained growth driver for the global dental consumables market.

Growing Aging Population and Edentulism

Global population aging is one of the key drivers of economic expansion; elderly individuals, in particular, face greater risks related to dental issues like tooth loss, bone resorption, and periodontal disease than younger generations. Dentures, abutments, implants, and tissue conditioners are in high demand among this demographic; in developed regions like North America, Europe, and parts of East Asia, over 20% of people already aged 65+ reside. Many individuals in their mid-30s require ongoing dental care for prosthetics and implants; additionally, life expectancies continue to increase, which extends the timeframe in which individuals require functional teeth as well as aesthetic solutions from dentists.

Older adults tend to be more willing and financially capable of investing in long-term restorative and cosmetic dental treatments, particularly those offered in states with strong healthcare insurance penetration or support from public providers. With an anticipated sharp rise in elderly populations over the coming two decades, this demographic trend will provide continued momentum to the dental consumables industry.

Restraints in the Global Dental Consumables Market

High Cost of Advanced Dental Treatments and Consumables

Dentist awareness may increase, yet cost remains an obstacle, particularly in low and middle-income countries. Dental treatments remain costly. Advanced procedures, including dental implants, veneers, and root canal treatments, require high-grade ceramics, specialty instruments, and proprietary bonding agents - consumables which can be costly. An implant in the United States typically costs USD 3,000-5,000 without insurance, an amount that many cannot afford without assistance from family and friends.

Even in more developed markets, high out-of-pocket costs discourage patients from opting for preventative or elective treatments altogether, therefore impacting demand. Insurance coverage for cosmetic or prosthetic procedures is often inadequate or nonexistent, making adoption even harder in emerging markets. Furthermore, clinics in these markets may have trouble affording premium dental consumables necessary to provide cutting-edge materials and techniques; hence, cost remains one of the biggest obstacles to market adoption. Without more inclusive pricing strategies or expanded insurance policies, this challenge remains paramount in driving greater market adoption.

Limited Access to Skilled Dental Professionals in Underserved Regions

Access to qualified dentists varies significantly around the world, which poses a barrier to expanding dental consumable markets. Rural and remote regions across Africa, South Asia, and Latin America often struggle with shortages of dentists, hygienists, and specialists trained to use advanced consumables. Lack of trained personnel results in low procedural volume and usage of high-end consumables such as implants, CAD/CAM restorations, and endodontic systems, even when demand exists.

This shortage hinders product adoption as well as patient treatment plans. Poor dental education infrastructure and government assistance exacerbate this situation further; without sufficient trained dental professionals in place, demand for consumables remains stagnant despite disease burden or consumer awareness. Tele-dentistry and mobile clinics may offer solutions, yet these technologies remain in their infancy stages and cannot support complex procedures. Closing this skills gap through training programs, incentives, and policy initiatives will be instrumental to unleashing the true potential of the global dental consumables market.

Opportunities in the Global Dental Consumables Market

Expansion of Dental Tourism in Emerging Markets

Dental tourism has quickly emerged as an attractive growth avenue in emerging markets such as India, Thailand, Mexico, Turkey, and Hungary. These countries provide high-quality dental procedures--including implants, prosthetics, orthodontics, and aesthetic treatments--at significantly reduced prices compared to North America and Western Europe. International patients seeking affordable dental treatment while on vacation have driven up demand for various dental consumables in these countries, creating increased competition in supply and increasing consumer prices for such items as floss.

Governments and private providers in these regions have invested significantly in creating world-class dental clinics with accredited facilities to attract international clientele. English-speaking professionals and internationally trained dentists in these countries are increasing the credibility and reach of services provided. As more middle-income patients from Western states turn to dental tourism for services like impression materials, bleaching agents, and prosthetic accessories.

Rising Demand for Preventive and At-Home Dental Care Products

Preventive care and at-home dental consumables are emerging as fast-growing segments driven by Demand for preventive and at-home dental consumables has experienced fast expansion due to increased health consciousness, busy lifestyles, and technological innovations. Sealants, fluoride varnishes, demineralization pastes, and anti-sensitivity agents are widely utilized as tools to combat tooth decay and maintain oral hygiene. At the same time, over-the-counter products like whitening strips, custom night guards, electric toothbrushes, and specialty dental floss have gained in popularity for both their convenience and cosmetic benefits.

The COVID-19 pandemic has further accelerated the trend toward self-care among consumers, prompting more proactive approaches to oral hygiene from individuals. Manufacturers are responding by developing user-friendly home-use formulations that offer safe and effective care solutions. E-commerce platforms and digital marketing have made preventive dentistry products more available and accessible worldwide, even to rural or underserved areas. As consumers become more inclined to implement preventive strategies to lower future dental expenses, market players could experience substantial growth potential from this segment of dentistry products.

Trends in the Global Dental Consumables Market

Digital Dentistry Integration and CAD/CAM Adoption

Digital dentistry has already made waves in the dental consumables landscape. Dental professionals have begun adopting CAD/CAM systems, digital impressions, and 3D printing technologies as ways to streamline workflows, shorten treatment times, and increase restoration precision. Utilizing these technologies enables same-day crowns, bridges, veneers, and inlays, leading to increased patient satisfaction and clinic efficiency. As dental practices transition towards digital systems, their demand for consumables such as milling blocks, impression materials, and bonding agents continues to surge.

This trend is further reinforced by the increasing availability of cost-effective digital tools with favorable reimbursement models in developed markets. Manufacturers have invested significantly in digital-compatible consumables and partnered with tech firms to accelerate product innovation. Furthermore, dental schools are providing digital dentistry training programs and equipping new professionals with modern tools, which has spurred long-term market expansion.

Cosmetic Dentistry and Esthetic-Driven Demand

An increasing global emphasis on physical appearance and self-image has given rise to significant increases in demand for aesthetic dental treatments, particularly cosmetic dental procedures. Consumers increasingly desire teeth whitening agents, clear aligners, veneers, and restorative solutions that offer natural-looking results. Not limited to wealthy demographics, middle-income populations in emerging economies are also investing in cosmetic dental care driven by social media influence and awareness campaigns.

As minimally invasive aesthetic procedures gain in popularity, they also fuel increased demand for advanced consumables like enamel-friendly whitening strips and clear resin filling materials. Market responses include innovative formulations and biocompatible materials with esthetically superior options, making cosmetic dentistry procedures elective and with out-of-pocket costs. Furthermore, with aesthetic awareness growing across age groups and regions, cosmetic dentistry will remain a significant force driving consumables innovation and volume sales.

Global Dental Consumables Market: Research Scope and Analysis

By Product Type Analysis

The dental implants market leads the product type segment in the global dental consumables market because patients consider them to be the best choice for long-term use and practical advantages compared to regular prosthetic devices. Implants stand superior to bridge and denture solutions because they provide enduring tooth replacements with a natural feeling that advances both mastication efficiency and facial attractiveness. Their superior effect lasts long-term, which has positioned them as the top preference for senior citizens, particularly in nations where edentulism occurs frequently among elderly citizens.

The escalating rates of diabetes and periodontal conditions at a worldwide level drive the need for dependable dental restorative solutions because these diseases result in tooth loss. Dental implants stop bone deterioration while other options do not; thus, they maintain facial structure, which provides substantial health and cosmetic advantages.

Advanced implantology technologies, along with 3D imaging and guided surgery systems and biocompatible coatings, both increase the success rates and lower complications following the treatment to enhance its accessibility. The application of minimally invasive methods together with flapless techniques shortens patient healing times and leads to higher patient comfort levels, resulting in better overall satisfaction.

The increase in dental tourism has created additional demand for dental implants because certain nations provide cost-effective procedures of high quality. Market players develop new implant designs specifically for different bone densities and clinical needs, which enhances product innovation across the market.

The increasing awareness about oral health prevention and favorable reimbursement regulations in specific regions drives early treatment options that lead patients to consider implant procedures. The revenue and market expansion of dental implants make them the top-performing segment of dental consumables.

By Material Type Analysis

The dental consumables market shows dominance by metals because of their blend of excellent durability and mechanical strength, and economic benefits. Manufacturing dental implants and orthodontic appliances, as well as crowns, primarily utilizes titanium and stainless steel, and cobalt-chromium alloys since these are traditional materials commonly found in dental prosthetics.

Titanium keeps its status as the leading material for dental implants because of its high compatibility with human tissue and its ability to unite perfectly with bone, and its corrosion resistance, establishing long-term durability and protection for patients.

Nickel-titanium-based files perform exceptionally well as endodontic instruments between teeth due to their high level of flexibility and low risk of failure from fatigue. These materials provide exact treatment of root canals while minimizing the chance for instrument failure inside the canal, which leads to better clinical success rates for patients.

Medical brackets, together with arch wires and buccal tubes, prevail in orthodontics due to their powerful tensile capacity and their ability to adjust to multiple force levels. Metal components provide greater cost value than ceramic or polymer-based alternatives, which allows them to reach more patients, especially in developing nations.

The load-bearing and foundational requirements of medical procedures depend on metals since ceramics and polymers continue to establish themselves mostly in cosmetic treatments. Fabrics of these materials prove simple, while their capability to work with CAD/CAM milling and their digital workflow integration offers greater practicality.

The existing research, along with regulatory approvals, makes metal-based products a dependable solution for manufacturers as well as dental clinicians. Based on the ongoing surge in implant and complex restoration needs, the dental industry depends on metals as a permanent market leader for dental consumable products.

By End Use Analysis

The global dental consumables market's end-use segment is primarily controlled by hospitals because they provide specialized infrastructure as well as multidisciplinary specialist teams and facilities to conduct complex dental procedures in a single location. Hospitals maintain their status as comprehensive healthcare institutions because they contain all the most current dental technologies and operational equipment needed for high-end treatments, including implants and advanced implant procedures, and full-mouth rehabilitation, among other sophisticated dental surgeries. Such facilities enhance medical procedures by delivering better efficiency and exactness alongside superior patient safety measures, thus becoming the preferred provider for standard and expert dental services.

Healthcare facilities process dental emergency patients and trauma patients extensively through their use of consumable products, including dental burs, bonding agents, sutures, impression materials, and hemostats. Hospitals can accept patients with complex dental needs or comorbidities because they provide both inpatient care and medical oversight, together with anesthesiology services.

Hospitals enter government healthcare schemes and insurance programs, and institutional tender competitions, which enable bulk dental consumable purchases for lower costs and stable product availability. Cooperation between academic departments and research units at hospitals promotes more rapid adoption of innovative consumables as well as their use of advanced materials and techniques.

Public and government healthcare facilities across underserved rural regions of developing nations function as main dental service providers, which lets them keep substantial market control. The increasing demand for advanced dental treatments will continue to boost hospital dental care provision and their dental materials usage, thus ensuring their control of this market segment.

The Global Dental Consumables Market Report is segmented on the basis of the following

By Product Type

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Dental Prosthetics

- Crowns

- Bridges

- Three-unit Bridges

- Four-unit Bridges

- Maryland Bridges

- Cantilever Bridges

- Dentures

- Complete Dentures

- Partial Dentures

- Abutments

- Temporary Abutments

- Definitive Abutments

- Veneers

- Inlays & Onlays

- Orthodontics

- Brackets

- Archwires

- Anchorage Appliances

- Bands & Buccal Tubes

- Miniscrews

- Ligatures

- Elastomeric Ligatures

- Wire Ligatures

- Endodontics

- Endodontic Files (Root Canal Treatment)

- Stainless Steel Files

- Alloy Files

- Obturators

- Permanent Endodontic Sealers

- Periodontics

- Dental Sutures

- Dental Hemostats

- Teeth Whitening Products

- Other Product Type

By Material Type

- Metals

- Ceramics

- Polymers

- Biomaterials

By End-Use

- Hospitals

- Dental Clinics

- Other End-User

Global Dental Consumables Market: Regional Analysis

Region with the Highest Market Share in the Global Dental Consumables Market

North America is projected to hold the dominant share in the global dental consumables market as it commands over 36.5% of the market share by the end of 2025. The dental consumables market is led by North America because this region benefits from strong healthcare facilities, an excellent understanding of oral health, and wide adoption of state-of-the-art dental technology.

The United States Secures the Lead in Dental Consumables Consumption Because It Holds Many Dental Professionals and Practices Together With Dental Servicing Organizations that Perpetually Demand Dental Implants, Along With Orthodontic Systems and Teeth Whitening Products. A significant portion of elderly people suffering from dental disorders, such as tooth decay and periodontal diseases, and edentulism, drives up the total consumption of dental material restoratives and prevention.

The growth of premium and high-quality dental consumables receives additional support from favorable reimbursement systems and high dental insurance coverage, alongside strong purchasing power.

Favorable reimbursement policies, high dental insurance coverage, and strong purchasing power further The adoption of premium and high-quality dental consumables gets accelerated by reimbursement policies that are favorable together with high dental insurance coverage and strong purchasing power.

The North American region displays leadership in digital dental technology adoption and minimally invasive treatments, thus resulting in substantial market demand for CAD/CAM-compatible materials and advanced endodontic sealants, as well as biocompatible implants. The market position of this region becomes stronger because of its major market players and continuous product development activity. The growth of Mexico’s dental tourism and the U.S. border states' dental sector drives overall expansion within the region.

Region with the Highest CAGR in the Dental Consumables Market

The dental consumables market in Asia-Pacific will experience its fastest growth rate because emerging economies China, India, and Indonesia, as well as Vietnam, along with increased healthcare infrastructure and rising dental awareness benefit market expansion. Consumers under 35 years old, combined with rising middle-class numbers and beauty obsession, drive the market for orthodontic devices and teeth-whitening items.

The region witnesses increased numbers of dental tourism patients coming for quality, affordable dental care in Thailand, India, and Malaysia. Various APAC governments are supporting oral health programs by establishing additional dental care services for communities without enough medical facilities.

Dental clinics are expanding throughout the region, while the rise in dental practitioners and manufacturing within the area lowers the price point for dental supplies to become more easily available to consumers.

Product penetration continues to grow because global manufacturers form strategic alliances with regional businesses to develop the market. APAC demonstrates rapid dental consumable market expansion due to these factors, which make it the fastest-growing region in this sector.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Dental Consumables Market: Competitive Landscape

The global market for dental consumables features a fierce competition structure with significant multinational corporations and established regional manufacturers that form part of the competitive field. The market leadership of Dentsply Sirona and Straumann Group and 3M and Danaher Corporation, and Ivoclar Vivadent, along with GC Corporation, ensures market dominance through their wide product ranges as well as strategic alliances and international sales networks.

Key organizations use mergers and acquisitions as a primary growth strategy to boost technical abilities and develop their worldwide business operations. The combination of dental implant companies with both software technology and imaging technology entities enables the development of comprehensive solutions for value-based care. The market introduces sustainable and patient-safe materials with global health compliance as companies prioritize eco-friendly product development.

Manufacturers based in the Asia-Pacific region contribute crucially through their supply of cost-effective items that match the regulatory standards of their specific regions. The competitive environment generates innovation while pricing together with distribution efficiency emerge as vital competitive factors.

Some of the prominent players in the Global Dental Consumables Market are

- Dentsply Sirona

- Straumann Group

- Envista Holdings Corporation

- 3M Company

- Zimmer Biomet

- Henry Schein, Inc.

- Ivoclar Vivadent

- GC Corporation

- Kuraray Noritake Dental Inc.

- COLTENE Group

- Septodont

- VOCO GmbH

- Ultradent Products, Inc.

- SHOFU Inc.

- Planmeca Group

- Young Innovations, Inc.

- Bicon, LLC

- BEGO GmbH & Co. KG

- Den-Mat Holdings, LLC

- Keystone Dental, Inc.

- Other Key Players

Recent Developments in the Global Dental Consumables Market

- March 2025: Envista Holdings announced a strategic investment in AI-driven dental imaging startup Visident AI to enhance chairside diagnostic accuracy and optimize prosthetic planning workflows across its product ecosystem. The investment demonstrates Envista's intention to integrate AI technologies into both consumables and equipment components of its business operations.

- January 2025: The Straumann Group successfully acquired GalvoSurge Dental AG, which provides implant decontamination solutions to the market. The acquisition enables Straumann to broaden its peri-implantitis management offerings, which belong to the dental implant consumables sector.

- November 2024: At the Greater New York Dental Meeting (GNYDM) 2024, 3M Oral Care introduced their advanced universal resin cement technology, which simplifies both indirect restorations and enables double usage on ceramics with metal-based substrates.

- September 2024: Through its partnership with Carbon Inc., Dentsply Sirona developed modern printable dental materials for use in splints, surgical guides, and esthetic temporaries, which helped the company establish stronger positions in digital dentistry and additive consumables.

- August 2024: GC Corporation introduced "G-CEM ONE Universal" cement to European and Asia-Pacific markets for optimizing indirect restorations and addressing consumer needs in simplified and aesthetic solutions.

- June 2024: Ivoclar Vivadent participated in the International Dental Show (IDS) Asia 2024, showcasing innovations in esthetic restorative materials, including nano-hybrid composites and self-adhesive resin cements tailored for high-strength CAD/CAM restorations.

- April 2024: Henry Schein, Inc. announced a capital infusion into Celeritas Dental Solutions, a growing North American DSO (Dental Service Organization), aimed at expanding the distribution of preventive consumables such as sealants, prophy pastes, and fluorides across community clinics.

- February 2024: Coltene Group finalized a merger with Micro-Mega (a subsidiary of Satelec/Acteon Group), boosting Coltene’s endodontic consumables portfolio, especially in rotary instrumentation, sealers, and obturation materials for global markets.

- December 2023: VOCO GmbH introduced a chairside “Bioactive Flowable Composite” at the Dubai AEEDC 2023 conference, designed for preventive and pediatric applications, reinforcing its product innovation track in minimally invasive dentistry.

Report Details

|

Report Characteristics

|

| Market Size (2025) |

USD 39.5 Bn |

| Forecast Value (2034) |

USD 81.0 Bn |

| CAGR (2025-2034) |

8.3% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 12.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product Type (Dental Implants, Dental Prosthetics, Orthodontics, Endodontics, Periodontics, Teeth Whitening Products, Other Product Type), By Material Type (Metals, Ceramics, Polymers, Biomaterials), By End-Use (Hospitals, Dental Clinics, Other End-User) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Dentsply Sirona, Straumann Group, Envista Holdings, 3M Company, Zimmer Biomet, Henry Schein, Ivoclar Vivadent, GC Corporation, Kuraray Noritake, COLTENE Group, Septodont, VOCO GmbH, Ultradent Products, SHOFU Inc., Planmeca Group, Young Innovations, Bicon LLC, BEGO GmbH, Den-Mat Holdings, Keystone Dental, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Dental Consumables Market?

▾ The Global Dental Consumables Market size is estimated to have a value of USD 39.5 billion in 2025 and is expected to reach USD 81.0 billion by the end of 2034.

What is the size of the US Dental Consumables Market?

▾ The US Dental Consumables Market is projected to be valued at USD 12.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 23.8 billion in 2034 at a CAGR of 7.8%.

Which region accounted for the largest Global Dental Consumables Market?

▾ North America is expected to have the largest market share in the Global Dental Consumables Market, with a share of about 36.5% in 2025.

Who are the key players in the Global Dental Consumables Market?

▾ Some of the major key players in the Global Dental Consumables Market are Dentsply Sirona, Straumann Group, Envista Holdings, 3M Company, Zimmer Biomet, Henry Schein, Ivoclar Vivadent, and many others.

What is the growth rate in the Global Dental Consumables Market in 2025?

▾ The market is growing at a CAGR of 8.3% over the forecasted period of 2025.