Market Overview

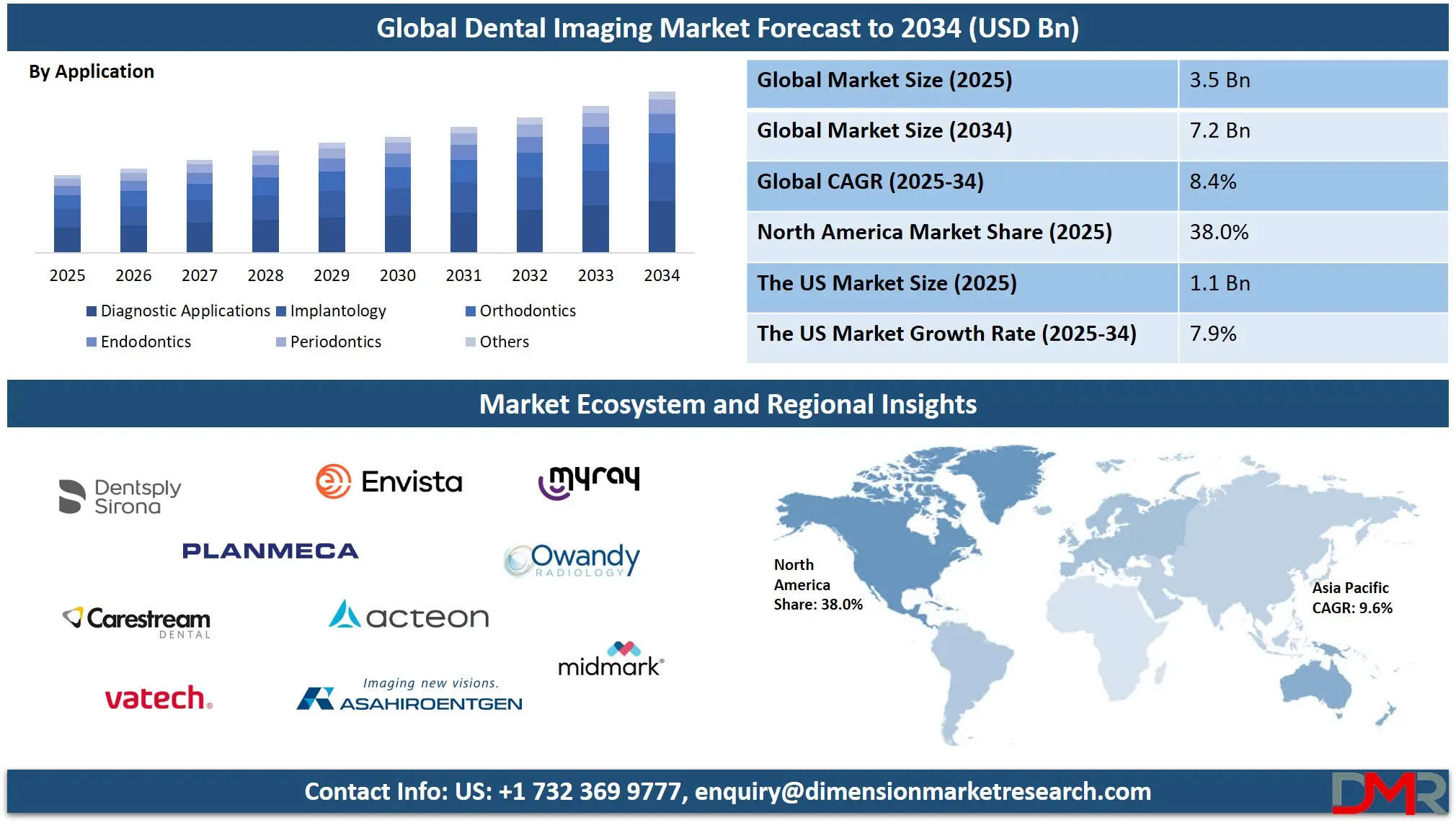

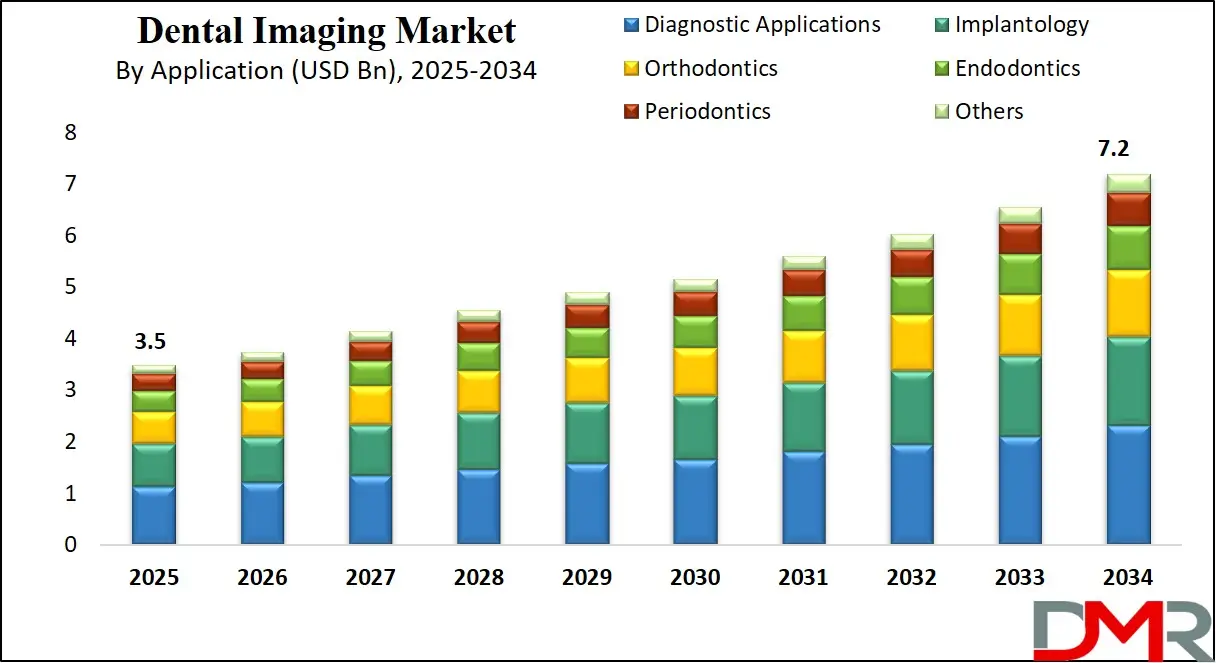

The global dental imaging market is projected to reach USD 3.5 billion in 2025 and is expected to grow at a CAGR of 8.4%, hitting USD 7.2 billion by 2034. This growth is driven by rising demand for digital dental radiography, 3D imaging technologies like CBCT, and growing adoption of advanced intraoral and extraoral imaging systems across dental clinics and hospitals.

Dental imaging refers to the process of creating visual representations of the oral cavity, teeth, jaws, and surrounding structures using various imaging technologies. These visuals aid dental professionals in accurately diagnosing, monitoring, and treating a wide range of dental and maxillofacial conditions. The imaging methods include both two-dimensional and three-dimensional techniques such as intraoral X-rays, panoramic radiography, cone beam computed tomography (CBCT), and optical imaging.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

These diagnostic tools enhance precision in clinical decision-making, support early detection of oral diseases, and play a pivotal role in treatment planning across general dentistry, orthodontics, endodontics, implantology, and oral surgery. With growing emphasis on minimally invasive dentistry and patient-centered care, the demand for advanced, real-time, and radiation-efficient dental imaging solutions is steadily rising.

The global dental imaging market encompasses the production, development, and distribution of imaging devices and software specifically designed for dental diagnostics and treatment planning. This includes a wide array of technologies such as digital radiography systems, CBCT machines, intraoral cameras, and image management software.

The market is driven by a growing global burden of dental diseases, a rising elderly population with complex dental needs, and increased awareness of cosmetic and preventive dentistry. Digital transformation in dental practices, alongside the integration of artificial intelligence and cloud-based image storage, is reshaping the landscape of oral healthcare by making diagnostics faster, safer, and more precise.

As dental clinics and hospitals adopt cutting-edge imaging technologies to improve workflow efficiency and patient outcomes, the market continues to witness strong demand, particularly in emerging economies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Favorable reimbursement policies in developed nations, growing dental tourism in Asia-Pacific, and the expansion of dental service providers are also contributing to market growth. Moreover, strategic partnerships between imaging equipment manufacturers and dental software companies are enabling the development of holistic diagnostic platforms that streamline clinical operations and improve diagnostic accuracy.

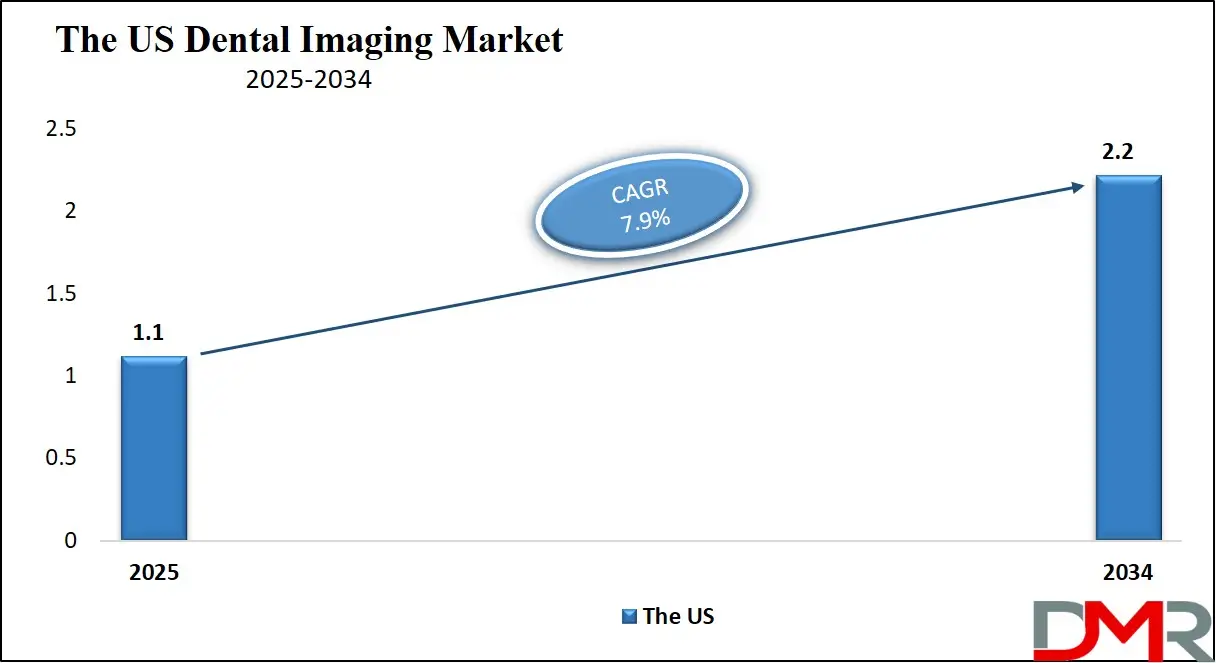

The US Dental Imaging Market

The U.S. Dental Imaging market size is projected to be valued at USD 1.1 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.2 billion in 2034 at a CAGR of 7.9%.

The US dental imaging market stands as one of the most mature and technologically advanced segments globally, driven by the widespread adoption of digital radiography, cone beam computed tomography (CBCT), and AI-integrated dental diagnostic tools. With a strong emphasis on early diagnosis, precision dentistry, and minimally invasive treatment planning, dental professionals in the United States rely on advanced imaging solutions such as intraoral sensors, panoramic X-rays, and 3D CBCT systems to enhance clinical decision-making.

The high prevalence of dental caries, periodontal diseases, and the growing demand for cosmetic dentistry further fuel the need for accurate and efficient imaging techniques. Moreover, federal support for oral health programs and favorable reimbursement structures continue to support the expansion of diagnostic imaging capabilities across both private dental practices and group dental service organizations.

In addition, the presence of key players and frequent technological innovations is significantly influencing the US dental imaging landscape. Companies are investing in AI-powered dental software, digital image management systems, and portable X-ray units to improve workflow efficiency and patient outcomes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market also benefits from a well-established healthcare infrastructure, rising awareness of oral hygiene, and growing integration of electronic dental records (EDR) with imaging platforms. As teledentistry and digital workflow solutions gain traction post-pandemic, demand for cloud-based imaging and remote diagnostics is also rising. Collectively, these factors are propelling the US dental imaging market toward continued growth, positioning it as a benchmark for innovation and quality in dental diagnostics.

Europe Dental Imaging Market

In 2025, the Europe dental imaging market is projected to be valued at approximately USD 900 million. This strong regional presence is driven by widespread integration of advanced digital imaging technologies, including cone beam computed tomography (CBCT), panoramic X-rays, and intraoral scanners across both private practices and public health systems. Countries such as Germany, the United Kingdom, France, and Italy are at the forefront, benefitting from mature dental care infrastructure, favorable healthcare reimbursement schemes, and a growing patient base demanding precision diagnostics for both general and cosmetic dentistry.

Looking ahead, the European market is expected to grow at a compound annual growth rate (CAGR) of 7.2% through 2034. This steady expansion is supported by increased investment in AI-based dental imaging software, rising awareness of preventive oral healthcare, and the ongoing digital transformation of dental clinics.

Additionally, the EU’s focus on improving healthcare quality and accessibility is encouraging the adoption of integrated imaging solutions in underserved and rural areas. Strategic partnerships between imaging technology firms and dental service organizations are also fostering innovation, expanding product offerings, and sustaining long-term market growth across the continent.

Japan Dental Imaging Market

In 2025, the Japan dental imaging market is estimated to be worth approximately USD 170 million. Despite its smaller market size compared to North America and Europe, Japan remains a technologically advanced and mature market. The country's strong focus on precision diagnostics and preventive dental care has led to widespread adoption of intraoral imaging systems, panoramic radiography, and digital sensors in both private clinics and university hospitals.

Urban dental facilities, in particular, have shown high uptake of advanced imaging technologies such as CBCT and AI-enabled diagnostic platforms to improve patient outcomes and treatment planning.

With a projected CAGR of 6.5% from 2025 to 2034, the Japanese dental imaging market is poised for steady growth, fueled by its rapidly aging population and rising demand for complex dental procedures such as implantology and orthodontics.

Government-supported healthcare policies and growing dental tourism in select urban areas are further boosting the need for high-resolution, low-radiation imaging systems. Moreover, local manufacturers and global players continue to collaborate in Japan, driving innovation in portable and software-integrated dental imaging devices that align with the country’s strict regulatory standards and patient care protocols.

Global Dental Imaging Market: Key Takeaways

- Market Value: The global dental imaging market size is expected to reach a value of USD 7.2 billion by 2034 from a base value of USD 3.5 billion in 2025 at a CAGR of 8.4%.

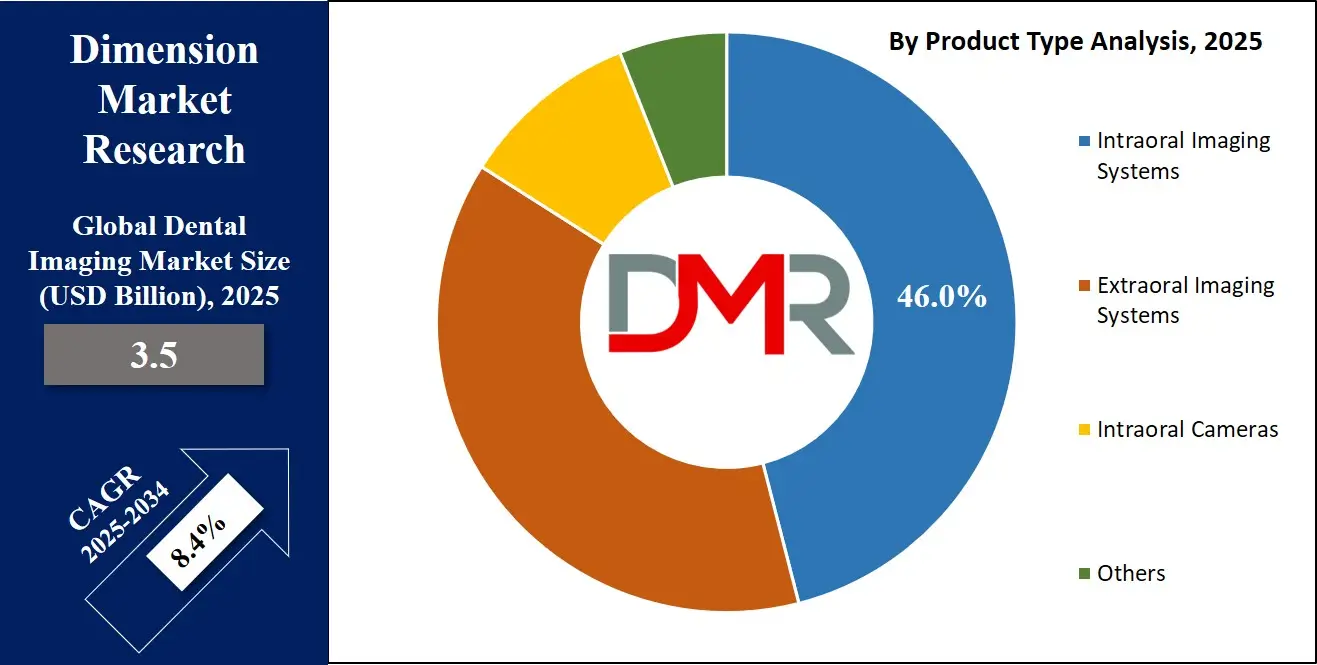

- By Product Type Segment Analysis: Intraoral Imaging Systems are anticipated to dominate the product type segment, capturing 46.0% of the total market share in 2025.

- By Method Segment Analysis: Digital Imaging methods are expected to maintain their dominance in the method segment, capturing 78.0% of the total market share in 2025.

- By Technology Segment Analysis: 2D Imaging technology is expected to consolidate its position in the technology segment, capturing 58.0% of the market share in 2025.

- By Imaging Modality Segment Analysis: X-ray Systems are poised to consolidate their dominance in the imaging modality segment, capturing 35.0% of the total market share in 2025.

- By Application Segment Analysis: Diagnostic Applications will account for the maximum share in the application segment, capturing 32.0% of the total market value.

- By End-User Segment Analysis: Dental Clinics are expected to consolidate their dominance in the end-user segment, capturing 42.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global dental imaging market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global dental imaging market are Dentsply Sirona, Planmeca Group, Carestream Dental, Vatech Co. Ltd., Envista Holdings Corporation, ACTEON Group, Midmark Corporation, Cefla Dental (MyRay), Owandy Radiology, Asahi Roentgen, Genoray Co. Ltd., J. Morita Corporation, PreXion Inc., CurveBeam AI, ImageWorks Corporation, and Others.

Global Dental Imaging Market: Use Cases

- Implant Planning and Surgical Navigation: Dental imaging plays a critical role in pre-operative planning and guided implant surgeries. Cone Beam Computed Tomography (CBCT) provides 3D visualization of jawbone structure, nerve pathways, and sinus locations, enabling accurate assessment of bone density and anatomical risks. These detailed images allow dentists and oral surgeons to plan the precise placement of dental implants, reducing complications and improving long-term outcomes. With digital radiography and surgical navigation software, clinicians can simulate procedures, enhance patient communication, and minimize chair time. This use case highlights the importance of diagnostic imaging in enhancing precision and safety in oral implantology.

- Orthodontic Treatment Planning and Monitoring: In orthodontics, dental imaging technologies such as panoramic X-rays and cephalometric analysis are indispensable for diagnosing malocclusions, assessing jaw alignment, and monitoring tooth movement over time. Intraoral scanners and 3D imaging tools provide accurate impressions and models for creating custom aligners and braces. By integrating digital imaging with orthodontic CAD/CAM systems, orthodontists can design personalized treatment plans and visualize tooth progression in real time. These tools not only improve diagnostic accuracy but also enhance patient engagement and satisfaction by offering visual treatment previews and better clinical outcomes.

- Early Detection of Dental Caries and Periodontal Disease: Early and non-invasive diagnosis of dental diseases is one of the most impactful use cases of advanced dental imaging. Digital intraoral sensors and bitewing radiographs enable clinicians to detect cavities, demineralization, and interproximal caries before they become visible to the naked eye. Similarly, CBCT and periodontal imaging assist in evaluating bone loss, gum health, and the extent of periodontal disease. Optical imaging and near-infrared transillumination technologies are gaining popularity as radiation-free alternatives for early caries detection. These methods improve preventive care by allowing for earlier intervention and less invasive treatments.

- Integration with Cosmetic and Restorative Dentistry: In cosmetic and restorative dentistry, dental imaging enhances treatment planning for procedures such as veneers, crowns, bridges, and full mouth reconstructions. High-resolution digital imaging, combined with intraoral scanners and smile design software, allows dentists to create lifelike simulations of post-treatment outcomes. This visual approach improves treatment accuracy and boosts patient confidence. CBCT scans are also used to evaluate bone structure for grafting procedures and sinus lifts required before restorative work. Imaging technologies thus bridge functional diagnostics and aesthetic dentistry, supporting both clinical excellence and personalized care in smile makeovers.

Impact of Artificial Intelligence on the Dental Imaging Market

Artificial Intelligence (AI) is significantly transforming the dental imaging market by enhancing diagnostic accuracy, streamlining workflows, and enabling predictive treatment planning. AI-powered software can automatically detect and highlight abnormalities such as dental caries, periapical lesions, bone loss, and impacted teeth in digital radiographs and CBCT scans.

This reduces the chances of human error and improves early disease detection, especially in asymptomatic patients. AI algorithms trained on vast datasets can also differentiate between healthy and pathological tissues, ensuring quicker clinical decisions with higher confidence. This integration is especially beneficial in general dentistry, periodontics, endodontics, and oral surgery, where precise imaging interpretation is vital.

Moreover, AI is revolutionizing dental practice efficiency by automating repetitive tasks such as image segmentation, report generation, and archiving of diagnostic images. In orthodontics and implantology, AI assists in treatment simulation by analyzing facial structures and occlusion patterns from 3D images, allowing clinicians to develop customized, data-driven treatment plans.

AI-driven imaging platforms are now being integrated with electronic dental records (EDRs), cloud-based storage, and teledentistry solutions, further enhancing remote diagnostics and collaborative treatment planning. As regulatory approval and clinician adoption grow, AI is poised to become a core driver of innovation and value in the dental imaging industry.

Global Dental Imaging Market: Stats & Facts

- In 2023, 65.5% of adults aged 18 and older in the US had received a dental exam or cleaning within the past year.

- Up to early 2020, 46.0% of children aged 2–19 had untreated or restored dental caries in one or more teeth.

- US Food and Drug Administration (FDA) – Dental CBCT Guidelines

- CBCT systems have been used by dental professionals in the US since the early 2000s, with growing adoption in implant planning, endodontics, and jaw evaluation.

- The FDA issued guidance to minimize unnecessary radiation exposure from dental CBCT, especially in pediatric care.

- Japan Academic and Public Health Surveys

- A 2022 cross-sectional survey conducted across dental clinics in Tokyo and provincial cities highlighted increasing patient familiarity with dental imaging tools, although numerical data for 2023–2025 remains limited.

- Japanese dental practices reported steady adoption of digital radiography, with gradual interest in 3D imaging systems like CBCT, particularly in urban dental centers.

Global Dental Imaging Market: Market Dynamics

Global Dental Imaging Market: Driving Factors

Rising Demand for Digital Dentistry and Radiographic Precision

The shift from traditional film-based imaging to digital radiography is a major driver of the dental imaging market. Digital imaging systems offer real-time image acquisition, lower radiation exposure, and easy integration with dental practice management software. These systems improve diagnostic precision in procedures such as root canal therapy, implantology, and periodontal evaluations. Additionally, the adoption of high-resolution intraoral cameras and panoramic X-rays allows clinicians to detect early-stage dental conditions, enhancing preventive care and clinical outcomes.

Growth in Cosmetic and Restorative Dental Procedures

The growing demand for cosmetic dental treatments, such as veneers, crowns, and smile correction, has accelerated the need for advanced imaging tools that support detailed treatment planning. Technologies like 3D CBCT imaging and intraoral scanners enable dentists to assess facial symmetry, bite alignment, and jawbone structure before performing aesthetic restorations. This growth is further supported by rising disposable income, patient awareness of dental aesthetics, and the popularity of digital smile design systems in private clinics.

Global Dental Imaging Market: Restraints

High Cost of Advanced Imaging Equipment

One of the key restraints in the dental imaging market is the high upfront investment required for purchasing and maintaining advanced imaging devices. Technologies such as CBCT machines, AI-integrated radiographic software, and digital panoramic systems involve significant capital expenditure, which may deter smaller clinics and solo practitioners, especially in emerging economies. Additionally, training costs and the need for specialized staff to operate these systems add to the financial burden.

Data Privacy Concerns and Regulatory Hurdles

As digital dental imaging relies on cloud storage and AI-driven platforms, data security and compliance with patient privacy regulations have become major concerns. In markets like the US and EU, strict regulations such as HIPAA and GDPR mandate robust data encryption and access control, which not all dental practices can easily implement. These concerns may slow down the adoption of digital image sharing and teledentistry workflows, particularly among small-to-medium-sized dental service providers.

Global Dental Imaging Market: Opportunities

Expansion of AI-Powered Diagnostic Platforms

The integration of artificial intelligence into dental imaging presents a significant opportunity for market growth. AI-based platforms can automatically detect caries, lesions, and bone defects from digital X-rays and CBCT scans with high accuracy. These tools not only enhance diagnostic capabilities but also improve workflow efficiency through automated image labeling and cloud-based storage. The growing demand for chairside diagnostics and evidence-based treatment planning positions AI as a disruptive force in modern dental practices.

Increasing Demand in Emerging Markets

Rising oral health awareness, government-supported dental care programs, and the expansion of private dental chains are creating growth opportunities for imaging equipment manufacturers in emerging economies such as India, Brazil, and Southeast Asia. As dental clinics in these regions modernize their infrastructure, the adoption of digital radiography, panoramic X-rays, and intraoral scanners is expected to surge. Moreover, the rise of dental tourism in Asia-Pacific is driving the installation of state-of-the-art diagnostic imaging tools in urban centers and specialty hospitals.

Global Dental Imaging Market: Trends

Rise of Cloud-Based Imaging and Remote Diagnostics

Cloud-based image management systems are becoming popular for storing, sharing, and accessing dental images across multiple locations. These platforms enable dental professionals to collaborate on treatment plans, especially in multi-site dental service organizations and during teledentistry consultations. Integration with EHRs and secure access from mobile devices enhances clinical flexibility and supports remote diagnostics, making cloud technology a major trend in the dental imaging landscape.

Integration of 3D Printing and Imaging for Personalized Dentistry

Another emerging trend is the convergence of dental imaging with 3D printing technologies. High-resolution CBCT scans and intraoral digital impressions are being used to design and fabricate patient-specific dental prosthetics, aligners, and surgical guides. This integration streamlines workflow from diagnostics to treatment delivery and supports the growing demand for precision-based, personalized dental care. It also reduces turnaround times for restorations and enhances patient satisfaction by delivering accurate, custom-fit solutions.

Global Dental Imaging Market: Research Scope and Analysis

By Product Type Analysis

In the dental imaging market, intraoral imaging systems are expected to lead the product type segment, accounting for approximately 46.0% of the total market share in 2025. This dominance is primarily attributed to their widespread use in routine dental examinations, cavity detection, root canal assessments, and periodontal evaluations. Intraoral systems include tools such as intraoral X-ray units, digital sensors, and phosphor storage plates that deliver high-resolution images of individual teeth and surrounding bone structures.

Their compact design, cost-effectiveness, and ability to produce real-time diagnostic images make them highly suitable for private dental clinics and general practitioners. Additionally, the growing demand for digital intraoral sensors that reduce radiation exposure and provide instant image availability is further fueling the adoption of these systems across both developed and emerging markets.

Extraoral imaging systems, while slightly less dominant in overall share, are still a critical component of dental diagnostics, particularly in complex and surgical cases. These systems include panoramic X-rays, cephalometric radiography, and cone beam computed tomography (CBCT), which provide broader views of the entire jaw, sinuses, and temporomandibular joints.

Extraoral systems are particularly valuable in orthodontics, oral surgery, and implant planning, where a full anatomical overview is essential. The rising demand for 3D imaging capabilities and technological advancements such as low-dose radiation and high-definition image resolution are making extraoral imaging systems popular in specialty dental practices and hospitals. Their ability to support advanced treatment planning and surgical accuracy continues to drive their growth within the overall dental imaging equipment market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Method Analysis

In the dental imaging market, digital imaging methods are projected to dominate the method segment by capturing 78.0% of the total market share in 2025. This significant lead is driven by the growing adoption of digital technologies across dental clinics and diagnostic centers for their speed, efficiency, and image clarity. Digital imaging allows for immediate image viewing, easier storage and sharing, and enhanced diagnostic precision through high-resolution outputs.

These systems, which include digital sensors and intraoral scanners, also reduce patient exposure to radiation compared to traditional methods. Integration with electronic dental records and cloud-based platforms further streamlines workflow, making digital imaging the preferred choice for modern dental practices focused on accuracy, patient safety, and operational efficiency.

Analog imaging, while still in use in certain regions and low-resource settings, continues to decline in market relevance due to its limitations. This method involves traditional film-based radiography, which requires chemical processing and longer image turnaround times. Analog systems also pose challenges in terms of storage, image degradation over time, and limited compatibility with digital data management systems.

However, they may still be utilized in small clinics or rural practices where budget constraints and limited access to digital infrastructure make analog a more accessible option. Despite its decreasing presence, analog imaging remains a foundational technology that has supported dental diagnostics for decades, though it is steadily being phased out in favor of faster, safer, and more connected digital solutions.

By Technology Analysis

In the dental imaging market, 2D imaging technology is anticipated to retain its stronghold in the technology segment, capturing around 58.0% of the market share in 2025. This dominance is largely due to its established use in general dental practices for routine diagnostics such as bitewing, periapical, and panoramic radiographs. 2D imaging systems are cost-effective, easy to operate, and provide sufficient diagnostic information for common procedures like cavity detection, periodontal assessments, and monitoring tooth development.

Their widespread availability and integration with digital sensors make them a reliable and accessible solution for dental professionals, especially in high-volume practices. The continued demand for quick, low-cost imaging methods in both urban and rural settings contributes to the sustained relevance of 2D imaging technology in the market.

In contrast, 3D imaging, particularly through cone beam computed tomography (CBCT), is gaining traction for its superior diagnostic capabilities and detailed visualization of dental and maxillofacial structures. This technology offers volumetric scans that allow clinicians to evaluate bone density, nerve pathways, sinus cavities, and root morphology with high precision. CBCT is used in implant planning, orthodontics, endodontics, and oral surgery where detailed anatomical insight is critical for successful outcomes.

Although more expensive than 2D systems, the growing adoption of CBCT is driven by its ability to enhance treatment accuracy and reduce procedural risks. As the cost of 3D imaging equipment continues to decrease and awareness of its clinical benefits rises, the segment is expected to grow steadily, particularly in specialty dental practices and advanced care facilities.

By Imaging Modality Analysis

In the imaging modality segment of the dental imaging market, X-ray systems are expected to maintain their dominant position, accounting for approximately 35.0% of the total market share in 2025. These systems, which include intraoral and extraoral X-rays such as bitewing, periapical, panoramic, and cephalometric radiographs, remain the most commonly used imaging tools in general dentistry.

Their ability to deliver quick, clear, and low-radiation images for detecting cavities, assessing bone loss, and evaluating tooth structure makes them essential for routine dental diagnostics. X-ray systems are widely adopted across both private dental clinics and public healthcare settings due to their cost-effectiveness, compact design, and compatibility with digital imaging software, ensuring their continued relevance in the global market.

Cone Beam Computed Tomography (CBCT), while representing a smaller share compared to traditional X-ray systems, is rapidly growing in importance due to its advanced diagnostic capabilities. CBCT provides three-dimensional images that offer superior detail of dental and maxillofacial structures, allowing clinicians to visualize the exact shape, location, and density of bone and soft tissues.

This modality is utilized in complex procedures such as dental implant placement, endodontic surgeries, and evaluation of temporomandibular joint disorders. Although the initial investment and operational requirements are higher than standard X-ray systems, the clinical value and precision offered by CBCT make it an indispensable tool in specialty dental practices. As technology becomes more accessible and demand for high-precision treatment planning rises, the CBCT segment is poised for substantial growth within the imaging modality landscape.

By Application Analysis

In the application segment of the dental imaging market, diagnostic applications are projected to account for the largest share, capturing around 32.0% of the total market value in 2025. This dominance is attributed to the central role that imaging plays in identifying and monitoring a wide range of oral health conditions such as dental caries, periodontal disease, cysts, tumors, and infections.

Dentists heavily rely on intraoral and extraoral X-rays, panoramic imaging, and digital sensors to obtain clear visuals of the teeth and surrounding bone structures for accurate diagnosis and treatment planning. The growing emphasis on early detection and preventive dental care, integrated with the integration of AI-based tools for enhanced image interpretation, is further reinforcing the use of diagnostic imaging across general and specialty dental practices.

Implantology is another significant application area in the dental imaging market, experiencing consistent growth as dental implants become a preferred solution for tooth replacement. Imaging is critical in every phase of implant procedures from initial assessment and bone mapping to surgical planning and post-operative evaluation.

Cone Beam Computed Tomography (CBCT) has become particularly valuable in this field, offering precise 3D visuals that help clinicians assess bone density, proximity to vital anatomical structures, and implant positioning. The rising demand for image-guided implant surgeries, integrated with increased patient expectations for accurate and aesthetically pleasing outcomes, is driving the adoption of advanced imaging modalities in implantology. As dental implants gain popularity across both developed and emerging markets, the need for reliable, high-resolution imaging tools continues to expand within this segment.

By End-User Analysis

In the end-user segment of the dental imaging market, dental clinics are expected to solidify their leading position by capturing approximately 42.0% of the total market share in 2025. This dominance is driven by the high volume of routine dental visits and diagnostic procedures conducted in private and group dental practices. Dental clinics frequently invest in intraoral sensors, panoramic X-rays, and compact digital imaging systems to support general dentistry, cosmetic treatments, and orthodontic assessments.

The growing adoption of digital radiography, along with increased patient demand for faster and more comfortable diagnostic experiences, has further encouraged clinics to modernize their imaging infrastructure. Additionally, the availability of chairside imaging and integrated image management software makes clinics highly efficient environments for real-time diagnosis and treatment planning.

Hospitals also play a crucial role in the dental imaging market, particularly in complex cases that require multidisciplinary care and advanced imaging technologies. Hospitals are equipped with comprehensive diagnostic setups, including Cone Beam Computed Tomography (CBCT) systems, cephalometric radiography, and image-guided surgical tools, making them well-suited for procedures like maxillofacial surgery, oral cancer screening, and trauma care.

The presence of in-house radiologists and access to centralized imaging departments enable hospitals to offer a broader scope of services compared to smaller dental setups. As dental departments in hospitals expand and collaborate more closely with surgical and oncology units, the use of high-end dental imaging solutions is expected to rise steadily in these settings.

The Dental Imaging Market Report is segmented on the basis of the following:

By Product Type

- Intraoral Imaging Systems

- Extraoral Imaging Systems

- Intraoral Cameras

- Others

By Method

- Digital Imaging

- Analog Imaging

By Technology

- 2D Imaging

- 3D Imaging (CBCT)

By Imaging Modality

- X-ray Systems

- CBCT (Cone Beam Computed Tomography)

- Optical Imaging

- MRI/Ultrasound

- Others

By Application

- Diagnostic Applications

- Implantology

- Orthodontics

- Endodontics

- Periodontics

- Others

By End-User

- Dental Clinics

- Hospitals

- Dental Diagnostic Centers

- Academic & Research Institutes

Global Dental Imaging Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the global dental imaging market in 2025, accounting for approximately 38.0% of total market revenue. This leadership is driven by the widespread adoption of advanced dental technologies such as digital radiography, CBCT, and AI-integrated imaging platforms across both private practices and institutional healthcare settings.

The region benefits from a highly developed dental care infrastructure, a strong presence of leading market players, favorable reimbursement policies, and high patient awareness regarding preventive and cosmetic dental procedures. Additionally, growing investments in research and development, along with the growing integration of cloud-based imaging and electronic dental records, continue to support market expansion throughout the United States and Canada.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is expected to witness the most significant growth in the global dental imaging market over the forecast period. This surge is fueled by growing oral health awareness, rising disposable income, and the rapid expansion of dental clinics and diagnostic centers across emerging economies like India, China, and Southeast Asian countries.

Government initiatives to improve healthcare infrastructure, integrated with the rising demand for cosmetic dentistry and orthodontic treatments, are further boosting the adoption of digital radiography and 3D imaging technologies. Additionally, the growing trend of dental tourism and the influx of international dental chains into the region are contributing to accelerated investments in advanced imaging equipment, positioning Asia-Pacific as the fastest-growing regional market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Dental Imaging Market: Competitive Landscape

The global dental imaging market features a highly competitive landscape, characterized by the presence of several established players and a growing number of technology-driven entrants. Leading companies such as Dentsply Sirona, Planmeca Group, Carestream Dental, and Vatech Co. Ltd. dominate through continuous innovation in digital radiography, CBCT systems, and AI-integrated imaging platforms. These firms compete on the basis of product performance, image resolution, workflow efficiency, and integration with digital dental software.

Additionally, strategic partnerships, mergers, and geographic expansions are common as companies aim to strengthen their global footprint and cater to the rising demand for advanced diagnostic solutions. Meanwhile, mid-sized players and startups are disrupting the space by offering portable, cloud-based, and cost-effective imaging solutions, especially targeted at small clinics and emerging markets. This dynamic competitive environment is fostering rapid technological evolution, enhancing clinical outcomes, and reshaping the future of dental diagnostics.

Some of the prominent players in the global dental imaging market are:

- Dentsply Sirona

- Planmeca Group

- Carestream Dental

- Vatech Co., Ltd.

- Envista Holdings Corporation

- ACTEON Group

- Midmark Corporation

- Cefla Dental (MyRay)

- Owandy Radiology

- Asahi Roentgen

- Genoray Co., Ltd.

- J. Morita Corporation

- PreXion, Inc.

- CurveBeam AI

- ImageWorks Corporation

- Trident S.r.l.

- KaVo Dental

- Belmont Equipment

- 3Shape

- FONA Dental

- Other Key Players

Global Dental Imaging Market: Recent Developments

- July 2025: Carestream Dental rolled out its latest advancements in CBCT imaging, implant planning, intraoral radiology, and AI‑driven imaging software, aimed at enabling dental professionals to expand treatment capabilities with greater diagnostic confidence.

- July 2025: ZimVie, a dental implants company integrally linked to imaging and surgical treatment, was acquired by private equity firm Archimed for approximately USD 730 million, driving its stock up over 120% and drawing attention from major competitors.

- March 2025: Alliedstar introduced its flagship "Sensa" intraoral scanner at IDS 2025, marking a major product expansion beyond previous models and showcasing enhanced digital imaging performance.

- January 2025: VideaHealth, a dental AI imaging startup focused on clinical diagnostics and treatment recommendations, raised USD 40 million in an oversubscribed Series B funding round to fuel expansion and product innovation.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 3.5 Bn |

| Forecast Value (2034) |

USD 7.2 Bn |

| CAGR (2025–2034) |

8.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 1.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Intraoral Imaging Systems, Extraoral Imaging Systems, Intraoral Cameras, and Others), By Method (Digital Imaging and Analog Imaging), By Technology (2D Imaging and 3D Imaging [CBCT]), By Imaging Modality (X-ray Systems, CBCT, Optical Imaging, MRI/Ultrasound, and Others), By Application (Diagnostic Applications, Implantology, Orthodontics, Endodontics, Periodontics, and Others), and By End-User (Dental Clinics, Hospitals, Dental Diagnostic Centers, and Academic & Research Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Dentsply Sirona, Planmeca Group, Carestream Dental, Vatech Co. Ltd., Envista Holdings Corporation, ACTEON Group, Midmark Corporation, Cefla Dental (MyRay), Owandy Radiology, Asahi Roentgen, Genoray Co. Ltd., J. Morita Corporation, PreXion Inc., CurveBeam AI, ImageWorks Corporation, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global dental imaging market?

▾ The global dental imaging market size is estimated to have a value of USD 3.5 billion in 2025 and is expected to reach USD 7.2 billion by the end of 2034.

What is the size of the US dental imaging market?

▾ The US dental imaging market is projected to be valued at USD 1.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.2 billion in 2034 at a CAGR of 7.9%.

Which region accounted for the largest global dental imaging market?

▾ North America is expected to have the largest market share in the global dental imaging market, with a share of about 38.0% in 2025.

Who are the key players in the global dental imaging market?

▾ Some of the major key players in the global dental imaging market are Dentsply Sirona, Planmeca Group, Carestream Dental, Vatech Co. Ltd., Envista Holdings Corporation, ACTEON Group, Midmark Corporation, Cefla Dental (MyRay), Owandy Radiology, Asahi Roentgen, Genoray Co. Ltd., J. Morita Corporation, PreXion Inc., CurveBeam AI, ImageWorks Corporation, and Others.

What is the growth rate of the global dental imaging market?

▾ The market is growing at a CAGR of 8.4 percent over the forecasted period.