Market Overview

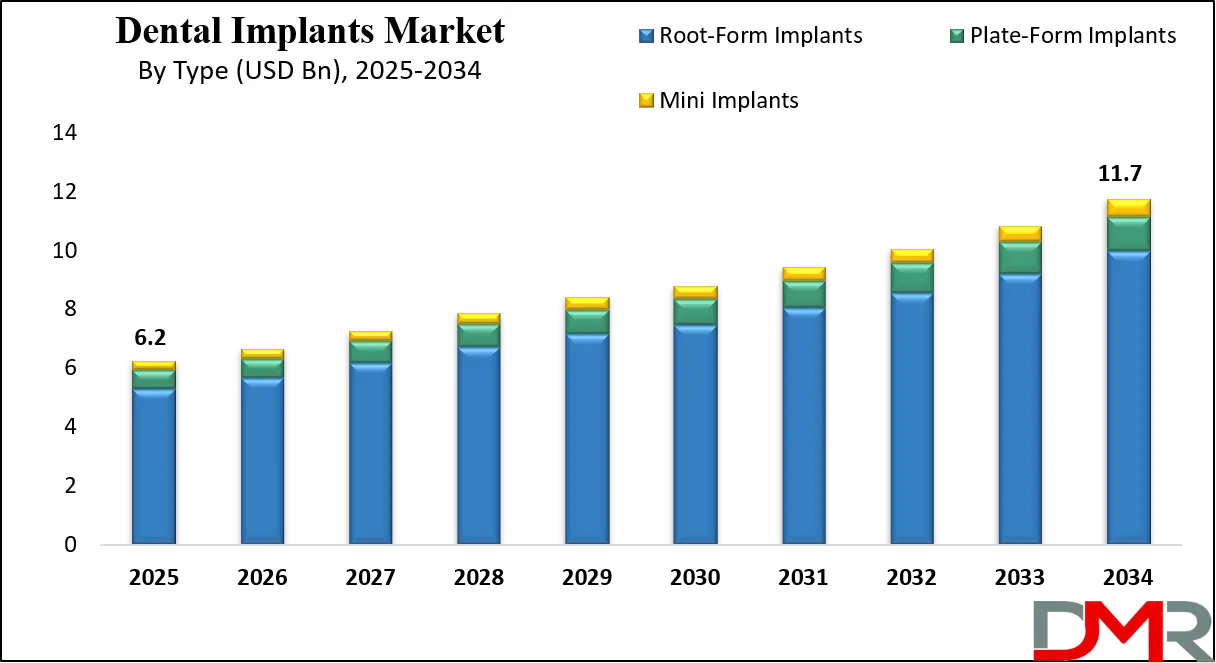

The global dental implants market is projected to reach USD 6.2 billion in 2025 and grow to USD 11.7 billion by 2034, expanding at a CAGR of 7.3%. This growth is driven by rising demand for tooth replacement solutions, advancements in implant materials, and increased adoption of cosmetic and restorative dental procedures.

Dental implants are artificial tooth roots surgically placed into the jawbone to support prosthetic teeth such as crowns, bridges, or dentures. Made primarily from biocompatible materials like titanium or zirconia, these implants fuse with the bone through a process known as osseointegration, ensuring a stable and durable foundation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

They are widely used in restorative and cosmetic dentistry to replace missing teeth, restore oral functionality, and improve facial aesthetics. Dental implants not only enhance chewing efficiency and speech but also help in preserving jawbone density and preventing adjacent teeth from shifting, offering a long-term solution compared to traditional dentures or bridges.

The global dental implants market is experiencing strong growth due to rising edentulism rates, an aging population, and growing demand for advanced dental restoration solutions. The surge in cosmetic dentistry, integrated with technological advancements in implant design and materials, has significantly improved clinical outcomes and patient satisfaction. Additionally, growing awareness about oral health, the availability of minimally invasive surgical procedures, and the expansion of dental tourism in countries like India, Mexico, and Thailand are driving the adoption of dental implants globally.

Another key factor contributing to market expansion is the rise in disposable incomes and the shift toward value-based dental care, especially in emerging economies. The integration of digital technologies such as 3D printing, CAD/CAM systems, and guided implant surgery is also transforming treatment precision and workflow efficiency for dental professionals. As healthcare infrastructure improves globally and more insurers begin to offer partial reimbursement for dental implant procedures, the market is expected to witness sustained momentum over the coming years.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Dental Implants Market

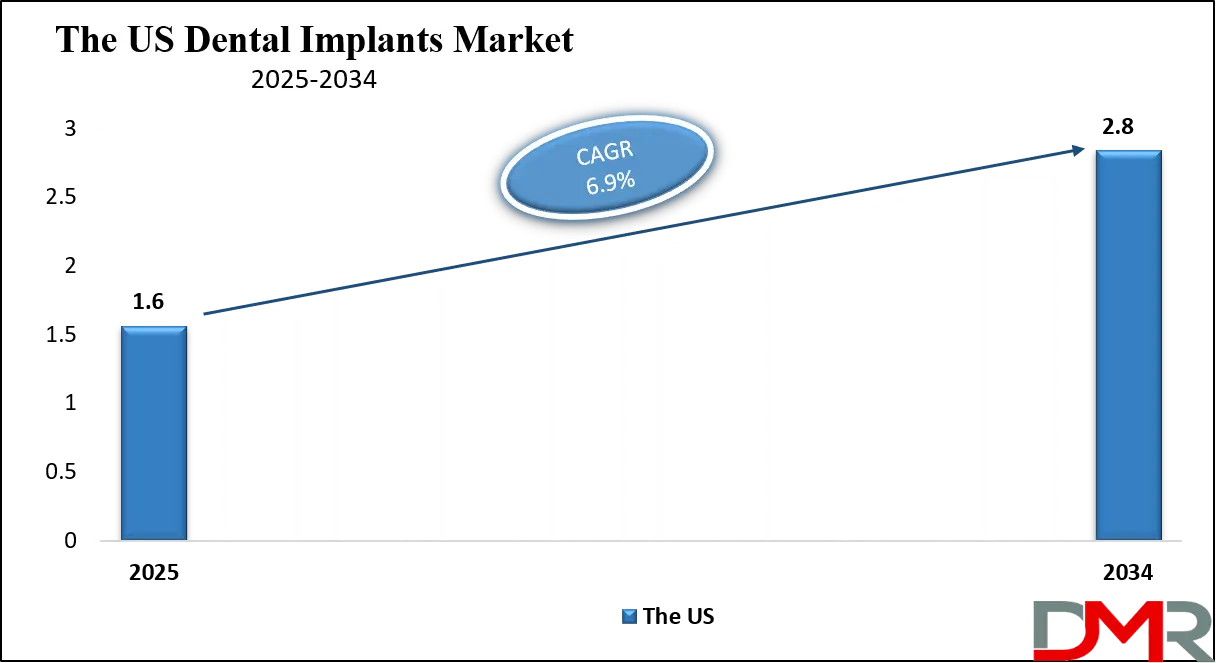

The U.S. Dental Implants market size is projected to be valued at USD 1.6 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 2.8 billion in 2034 at a CAGR of 6.9%.

The United States dental implants market holds a significant share of the global landscape, driven by a combination of advanced dental care infrastructure, high patient awareness, and growing demand for restorative and aesthetic dental solutions. The prevalence of tooth loss among the aging population, along with lifestyle factors such as poor oral hygiene, smoking, and chronic conditions like diabetes and periodontal disease, continues to drive the need for tooth replacement options.

Dental implants are favored over conventional dentures and bridges due to their superior durability, natural appearance, and ability to preserve jawbone structure. Moreover, the widespread use of digital dentistry tools such as intraoral scanners, CAD/CAM systems, and 3D-printed surgical guides has enhanced precision and efficiency in implant placement procedures across dental clinics and specialty centers.

In addition, favorable reimbursement trends, rising disposable income, and the growing availability of minimally invasive implant techniques are fueling market expansion across the U.S. Dental professionals are also witnessing growing patient preference for zirconia and ceramic implants, particularly for anterior tooth restorations due to aesthetic benefits.

Major players in the U.S. market, such as Straumann, Zimmer Biomet, and Dentsply Sirona, continue to innovate with customizable implant systems and digitally integrated workflows to meet the evolving needs of both clinicians and patients. As the population continues to age and focus on oral health rises, the U.S. dental implants market is expected to see sustained growth, supported by robust research, technological adoption, and expanding insurance coverage for dental restoration procedures.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe Dental Implants Market

Europe is projected to hold a leading position in the global dental implants market, with its market value estimated to reach USD 2.4 billion in 2025. This dominance is driven by well-established dental care systems, a high concentration of trained implantologists, and strong adoption of restorative and cosmetic dental procedures.

Countries such as Germany, Switzerland, France, and Italy contribute significantly to the region’s market share due to widespread awareness of oral health, a high number of dental clinics per capita, and strong patient willingness to invest in advanced treatments like single-tooth implants, full arch restorations, and zirconia implants. The growing elderly population, many of whom seek long-term solutions for tooth loss, is another key factor fueling implant demand across the continent.

The European dental implants market is expected to grow at a steady CAGR of 6.8% from 2025 to 2034, supported by ongoing technological innovation and digital integration in clinical workflows. The growing use of CAD/CAM systems, guided implant surgeries, and AI-driven diagnostics is streamlining procedures and improving clinical outcomes.

Additionally, favorable reimbursement scenarios in select countries, along with rising dental tourism in Eastern Europe, are making implants more accessible to a broader patient base. Manufacturers across the region are also investing in product development, material innovation, and clinician education, reinforcing Europe’s leadership in shaping global trends in implant dentistry.

Japan Dental Implants Market

Japan's dental implants market is estimated to reach USD 200 million in 2025, reflecting the country’s strong demand for advanced dental restoration solutions. This market share is primarily driven by Japan’s aging population, one of the largest in the world, where a significant portion of adults over 65 experience partial or complete tooth loss. The cultural emphasis on health, hygiene, and aesthetic appearance has further encouraged the adoption of dental implants over traditional dentures.

In addition, Japanese consumers typically prefer high-quality, long-lasting treatments, which has contributed to the growing preference for root-form and zirconia implants across both public and private dental settings.

The market in Japan is forecasted to grow at a CAGR of 5.9% from 2025 to 2034, supported by advancements in minimally invasive implantology, growing use of digital dentistry tools, and continuous innovation by domestic manufacturers. The country boasts a highly developed healthcare infrastructure with modern dental clinics and access to cutting-edge implant systems.

Moreover, government-led initiatives for improving oral health among the elderly, combined with rising awareness and availability of premium aesthetic dental procedures, are further fueling growth. As technology integration accelerates and consumer awareness increases, Japan is poised to remain a significant and steadily expanding contributor to the global dental implants market.

Global Dental Implants Market: Key Takeaways

- Market Value: The global dental implants market size is expected to reach a value of USD 11.7 billion by 2034 from a base value of USD 6.2 billion in 2025 at a CAGR of 7.3%.

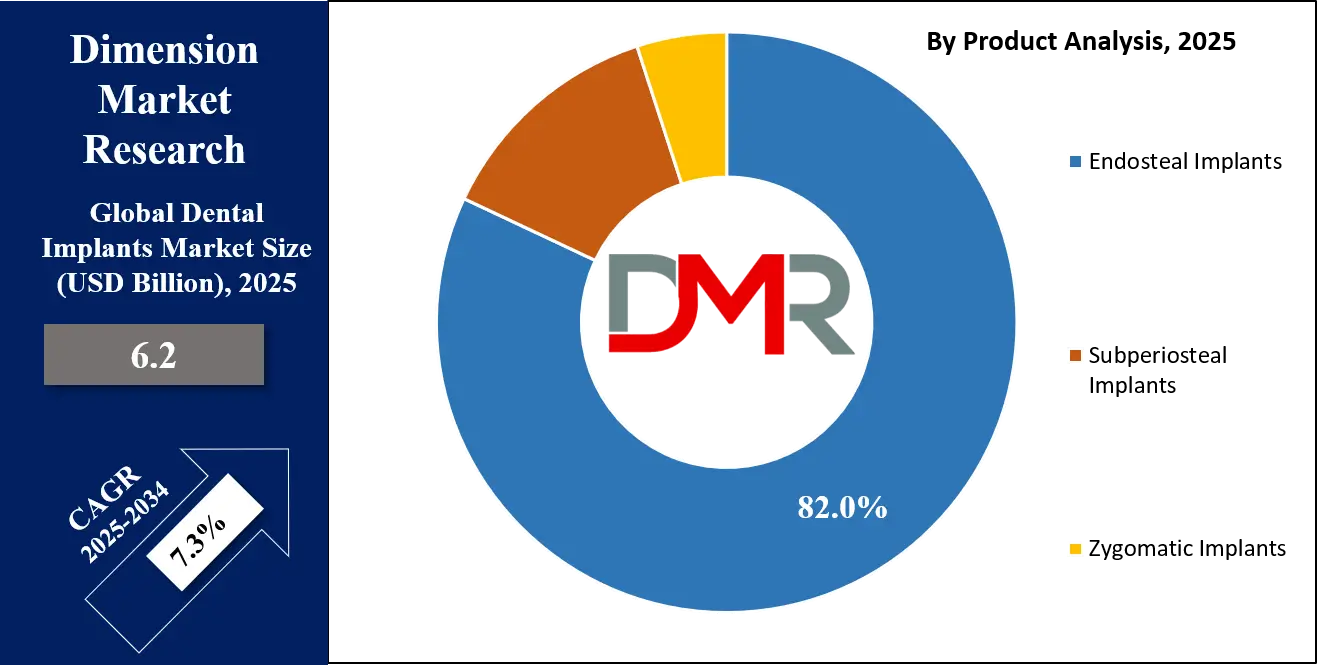

- By Product Segment Analysis: Endosteal Implants are anticipated to dominate the product segment, capturing 82.0% of the total market share in 2025.

- By Material Segment Analysis: Titanium Implants materials are expected to maintain their dominance in the material segment, capturing 92.0% of the total market share in 2025.

- By Design Segment Analysis: Tapered Implant design is poised to consolidate its dominance in the design segment, capturing 70.0% of the market share in 2025.

- By Type Segment Analysis: Root-Form Implants will dominate the type segment, capturing 85.0% of the market share in 2025.

- By Procedure Type Segment Analysis: Single Tooth Replacement will account for the maximum share in the procedure type segment, capturing 37.0% of the total market value.

- By Age Group Segment Analysis: Adults (35–64 Years) will hold the maximum market share in the age group segment, capturing 54.0% of the market share in 2025.

- By End User Segment Analysis: Dental Clinics are expected to consolidate their dominance in the end user segment, capturing 65.0% of the market share in 2025.

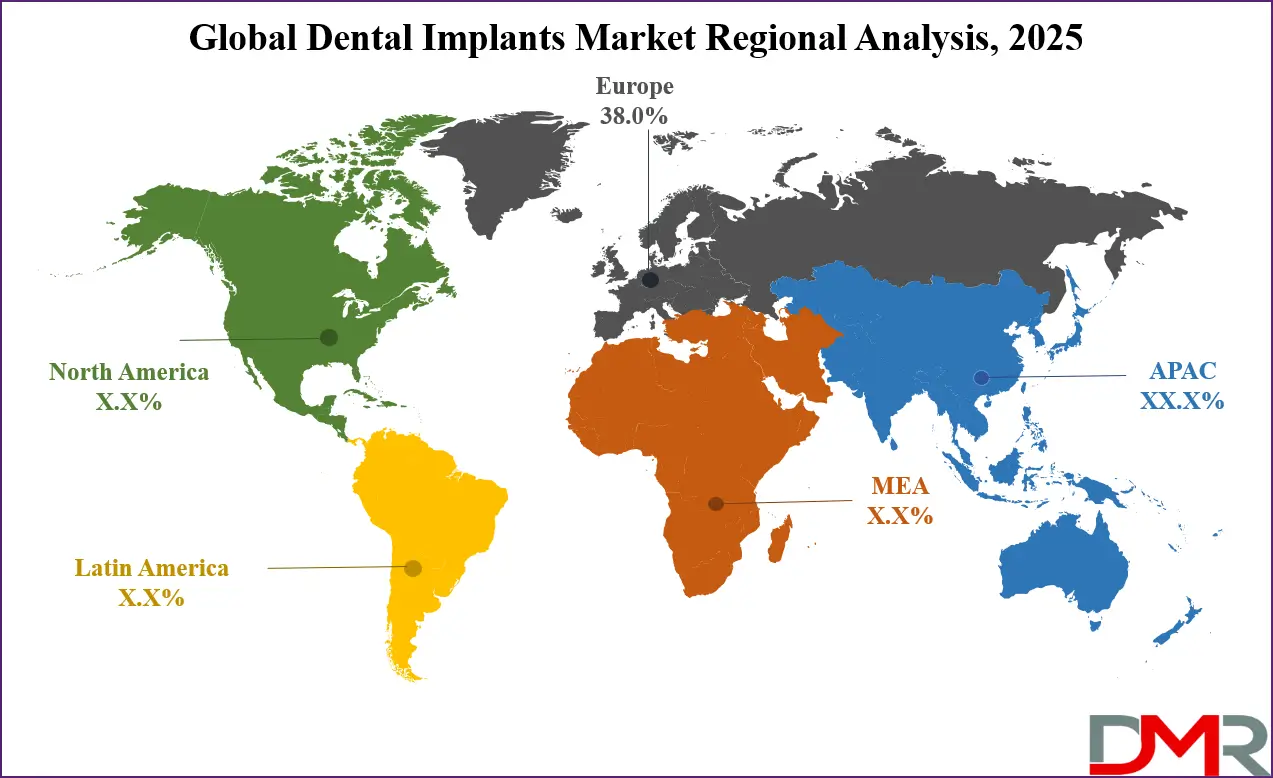

- Regional Analysis: Europe is anticipated to lead the global dental implants market landscape with 38.0% of total global market revenue in 2025.

- Key Players: Some key players in the global dental implants market are Straumann Group, Dentsply Sirona, Zimmer Biomet, Nobel Biocare (Envista Holdings), Envista Holdings Corporation, Osstem Implant Co., Ltd., Henry Schein, Inc., BioHorizons IPH, Inc., Bicon, LLC, Megagen Implant Co., Ltd., Southern Implants, and Others.

Global Dental Implants Market: Use Cases

- Full Mouth Reconstruction for Edentulous Patients: Full mouth reconstruction is one of the most transformative use cases of dental implants, particularly for completely edentulous patients (those with no natural teeth). In these cases, multiple implants are strategically placed to support a full arch prosthesis, commonly known as implant-supported dentures. This approach eliminates the need for removable dentures, improving chewing efficiency, speech clarity, and facial aesthetics. Elderly patients often opt for this procedure due to age-related tooth loss and bone resorption. The use of titanium implants facilitates long-term osseointegration, ensuring durability and minimal bone loss over time. This solution is especially prominent in North America and Western Europe, where access to advanced restorative dental care is widespread and insurance reimbursement is improving.

- Single Tooth Replacement with Immediate Loading Implants: One of the most common and rapidly growing applications in the dental implants market is the replacement of a single missing tooth using immediate loading implants. Patients who lose a tooth due to trauma, decay, or periodontal disease often prefer implants over bridges as they do not require adjacent teeth to be filed down. This method uses advanced CAD/CAM technology and 3D imaging to place the implant and crown in a single visit, reducing healing time and enhancing patient satisfaction. Immediate loading is gaining traction in urban dental clinics, especially in markets like the U.S., South Korea, and Germany, where aesthetic dental treatments are in high demand and patients prioritize minimally invasive solutions with fast results.

- Implant Use in Orthodontic Anchorage and Prosthetic Retention: Beyond traditional tooth replacement, dental implants are used in orthodontic anchorage and prosthetic retention cases. In orthodontics, mini dental implants serve as temporary anchorage devices (TADs) to provide fixed points for tooth movement, especially in complex malocclusions. In prosthodontics, implants help stabilize overdentures and partial dentures, offering improved retention and comfort. This use case is highly valuable for elderly individuals or those with congenital oral anomalies. The ability of implants to deliver predictable results through stable bone integration has made them a preferred solution in specialized dental centers and academic hospitals, where complex cases are managed with interdisciplinary approaches.

- Cosmetic and Aesthetic Dentistry in High-Income Markets: In high-income countries such as the United States, Canada, Japan, and the UAE, cosmetic dental implants are used for aesthetic restorations. Patients often seek dental implants not only to restore function but also to improve the appearance of their smiles. Zirconia implants, known for their white color and biocompatibility, are widely adopted in the anterior (front) regions for aesthetic enhancement. These procedures are often part of comprehensive smile makeover treatments that include teeth whitening, veneers, and gum contouring. Dental professionals in luxury practices emphasize digital smile design, 3D facial scanning, and minimally invasive implant placement to meet patient expectations for beauty and natural appearance. The rise of dental tourism in aesthetic hubs like Turkey, Hungary, and Thailand further demonstrates this growing use case.

Impact of Artificial Intelligence on the Dental Implants Market

Artificial Intelligence (AI) is significantly transforming the global dental implants market by enhancing clinical precision, workflow efficiency, and treatment personalization. One of the most notable applications is in AI-powered dental imaging and diagnostics, where machine learning algorithms can automatically detect oral anomalies, assess bone density, and identify optimal implant sites using 3D CBCT (Cone Beam Computed Tomography) scans. This reduces diagnostic errors and enables faster, more accurate treatment planning. AI also plays a key role in virtual implant simulations, allowing dentists to visualize outcomes in advance and improve the accuracy of implant placement procedures.

In addition, AI-driven platforms are revolutionizing predictive analytics and patient management. Algorithms can analyze vast datasets, including patient history, bone morphology, and occlusal patterns to recommend customized implant types and predict potential complications. This supports minimally invasive procedures and reduces chair time, leading to improved patient satisfaction.

AI-assisted CAD/CAM systems further streamline the design and fabrication of prosthetics, ensuring precise fitting and alignment. As AI becomes more integrated into digital dentistry workflows, it not only improves clinical outcomes but also enhances practice efficiency, cost-effectiveness, and scalability, making dental implant procedures more accessible and patient-centric across both developed and emerging markets.

Global Dental Implants Market: Stats & Facts

World Health Organization (WHO)

- As of 2023, oral diseases affect approximately 3.5 billion people worldwide, with tooth loss being one of the most prevalent conditions.

- Severe periodontal diseases, a major cause of tooth loss, affect around 1 billion people globally.

- In the 65–74 age group, up to 30% of people are edentulous in some countries.

- The WHO projects that by 2030, edentulism rates will rise due to aging populations in both high- and middle-income countries.

- WHO highlights that implant procedures are less accessible in low-income countries, contributing to inequality in oral health outcomes.

Centers for Disease Control and Prevention (CDC, USA)

- In 2023, nearly 26% of adults aged 65 or older in the US had complete tooth loss, a key demographic for dental implant candidates.

- Around 46% of adults aged 30 or older in the US had signs of gum disease, which is a leading cause of tooth loss and implant indication.

- As of 2024, more than 120 million Americans are estimated to have at least one missing tooth.

- By 2025, the CDC estimates that edentulism will affect over 18 million adults aged 65 and above in the US.

- The percentage of implant-supported tooth replacements among older adults is projected to increase by over 50% between 2020 and 2030.

OECD (Organisation for Economic Co-operation and Development)

- In 2023, Germany, Sweden, and Switzerland had some of the highest rates of implant procedures per capita in the OECD bloc.

- The average dental expenditure per person in OECD countries reached USD 275 in 2024, with implants making up a rising share of restorative costs.

- In Japan and Korea, more than 40% of private dental expenditures among elderly patients in 2023 went toward prosthetic or implant-related treatments.

- OECD data shows that by 2025, implant procedures are expected to rise by 30–35% in aging OECD countries due to increased longevity and oral health awareness.

- Out-of-pocket payments for dental implants remain high, averaging 75% of total implant cost in many OECD nations.

European Commission (EC Health and Digital Executive Agency)

- In 2023, over 60% of adults aged 55–74 in Europe had at least one missing tooth.

- Dental implants were among the top 5 elective outpatient procedures performed across the EU in 2024.

- The Commission reported a 15% increase in dental implant insurance claims across public health systems in Europe between 2022 and 2024.

- By 2025, the EC estimates that implant-based restorations will account for 40% of prosthetic dentistry costs in Western Europe.

- Digital dentistry and implant workflows were adopted in over 70% of clinics in Germany, France, and Italy by the end of 2024.

Ministry of Health, Labour and Welfare (Japan)

- In 2023, more than 50% of Japanese adults over 65 had received a prosthetic or implant-based dental intervention.

- The Japanese government projected in 2024 that implant demand will grow by 5.9% annually through 2034.

- By 2025, Japan is expected to perform over 1.2 million implant-related procedures annually, a 25% increase from 2020.

- As of 2023, over 30,000 dental clinics in Japan were certified to perform implant surgeries.

- National dental insurance coverage remains limited for implants, contributing to a high rate of private spending in Japan’s dental sector.

UK NHS and Public Health England

- In 2023, over 20% of adults aged 65+ in the UK had no natural teeth, leading to increased demand for permanent replacements like implants.

- The NHS reported a 30% year-on-year rise in private implant procedures between 2022 and 2024.

- By 2025, implant-related consultations in England are projected to increase by over 40% compared to 2019 levels.

- Dental implant courses and certification programs saw a 60% rise in enrollment among UK dentists between 2021 and 2024.

- Public Health England noted a growing trend toward zirconia and ceramic implants, especially among patients aged 45 to 60.

Global Dental Implants Market: Market Dynamics

Global Dental Implants Market: Driving Factors

Rising prevalence of tooth loss and periodontal diseases

A major factor propelling the dental implants market is the growing number of individuals suffering from tooth loss due to dental caries, trauma, and periodontal conditions. The elderly population is especially prone to edentulism, while younger adults are also affected by poor oral hygiene, smoking, and chronic illnesses such as diabetes. Dental implants provide a permanent and natural-looking solution, offering superior chewing function and bone preservation through osseointegration. As awareness about restorative dental solutions grows, the demand for implant procedures is steadily growing across both developed and emerging regions.

Technological advancements in implant design and surgical planning

Innovations in digital dentistry are enhancing the precision and success of implant treatments. Technologies like 3D cone beam computed tomography, computer-aided design and manufacturing, and AI-assisted treatment planning are transforming implantology workflows. These tools enable highly accurate placement, reduce surgical complications, and facilitate same-day tooth replacement procedures. The shift toward minimally invasive surgeries and customized implant-supported restorations is also contributing to improved patient satisfaction and broader clinical adoption.

Global Dental Implants Market: Restraints

High cost of dental implant procedures

Despite their long-term benefits, dental implants remain a cost-prohibitive option for many patients. Expenses include diagnostic imaging, surgical intervention, abutment placement, and prosthetic restoration, making it unaffordable for large populations without insurance or subsidy. In several countries, dental implants are classified as cosmetic and are not covered by public healthcare programs, which restricts access to advanced tooth replacement solutions. This economic barrier continues to limit the growth potential of the market, particularly in low-income regions.

Shortage of trained professionals in implant dentistry

Performing successful dental implant surgeries requires specialized skills and training in both surgical techniques and prosthetic integration. In many parts of the world, especially in rural and developing areas, there is a lack of skilled oral surgeons and implantologists. Limited access to continuing education and hands-on training restricts the ability of general dentists to offer implant procedures. This shortage affects service delivery and slows down the adoption of implants as a mainstream dental solution.

Global Dental Implants Market: Opportunities

Growth of dental tourism in emerging economies

The global dental implants market is benefiting from the rising popularity of dental tourism in countries such as India, Thailand, Turkey, and Mexico. These nations offer high-quality dental implant treatments at a fraction of the cost seen in North America and Europe, attracting patients from abroad. Clinics in these regions are equipped with modern technologies and internationally trained dentists, making them competitive with Western dental practices. As more patients seek affordable yet advanced care, the dental tourism segment is expected to be a key growth catalyst.

Rising preference for aesthetic and metal-free implant materials

There is growing demand for zirconia implants, especially in anterior tooth replacements where visual appearance is critical. Unlike traditional titanium implants, zirconia offers a metal-free alternative that blends better with natural teeth and gums. It also appeals to patients with metal sensitivities or those seeking holistic dental solutions. As more individuals prioritize smile aesthetics, the market is witnessing a growing shift toward cosmetic implantology and personalized treatment options.

Global Dental Implants Market: Trends

Integration of artificial intelligence in implant planning

Artificial intelligence is becoming an integral part of digital implant workflows. AI-driven software helps in analyzing radiographs, planning optimal implant placement, and predicting treatment outcomes. This not only improves surgical accuracy but also reduces the chances of failure and shortens recovery time. The growing adoption of AI in diagnostics and planning is a key trend enhancing the efficiency of implant procedures and improving clinical decision-making.

Shift toward minimally invasive and flapless implant surgeries

There is a growing preference among patients and dentists for minimally invasive implant placement techniques. Flapless surgeries, guided implant systems, and laser-assisted procedures are gaining traction due to their benefits, such as reduced pain, minimal bleeding, faster healing, and fewer post-operative complications. These techniques also improve the overall patient experience, making dental implants more acceptable among individuals who were previously hesitant due to surgical fears.

Global Dental Implants Market: Research Scope and Analysis

By Product Analysis

Endosteal implants are expected to remain the most widely used type in the dental implants market, accounting for approximately 82.0% of the total market share in 2025. These implants are surgically placed directly into the jawbone and are typically shaped like small screws, cylinders, or blades. Their popularity stems from their high success rate, strong osseointegration with the bone, and suitability for a wide range of patients with adequate jawbone density.

Endosteal implants are commonly used for single-tooth replacements, bridges, and full-arch restorations, making them a versatile option in modern implantology. The widespread availability of advanced imaging tools and digital planning software has further enhanced the precision and success of endosteal implant procedures, reinforcing their dominant position in the market.

On the other hand, subperiosteal implants serve as an alternative for patients who lack sufficient bone height or volume and are not ideal candidates for bone grafting. Instead of being placed within the jawbone, these implants rest on top of the bone but underneath the gum tissue.

They consist of a metal framework with posts that protrude through the gums to support the prosthetic teeth. While less common than endosteal implants, subperiosteal implants are valuable for patients with severe bone resorption or those seeking a less invasive option. Their usage has declined over the years due to advancements in bone grafting techniques and zygomatic implants, but they still represent an important niche for specific clinical indications where traditional implants are not feasible.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Material Analysis

Titanium implants are projected to continue leading the material segment of the dental implants market, accounting for nearly 92.0% of the total market share in 2025. Titanium has long been the material of choice in implant dentistry due to its exceptional biocompatibility, high strength-to-weight ratio, and proven ability to integrate with the jawbone through osseointegration. These implants offer long-term durability and stability, making them suitable for a wide range of clinical applications, from single-tooth replacements to full-arch reconstructions.

Additionally, titanium implants are available in various surface treatments and coatings that enhance bone adhesion and promote faster healing. Their compatibility with digital treatment planning and CAD/CAM workflows further supports their widespread adoption across dental clinics and hospitals globally.

Zirconium implants, while representing a smaller share of the market, are gaining attention as a promising alternative for patients seeking metal-free or more aesthetically pleasing implant solutions. Composed of zirconia, a high-strength ceramic, these implants offer a natural tooth-like color, making them ideal for anterior placements where appearance is critical. Zirconium implants are also favored by individuals with metal allergies or sensitivities, as well as by those who prefer holistic or biologically friendly dental materials.

Although they currently hold a limited share compared to titanium, the growing demand for cosmetic dental procedures and biocompatible materials is expected to support the gradual adoption of zirconium implants in specialized and aesthetic-focused practices. Ongoing advancements in ceramic implant manufacturing and clinical validation are further contributing to their expanding presence in the global market.

By Design Analysis

Tapered implant designs are projected to dominate the design segment of the dental implants market, accounting for around 70.0% of the total market share in 2025. These implants are conical in shape, closely mimicking the natural anatomy of tooth roots, which allows them to be placed more effectively in areas with limited bone volume or adjacent tooth structures. Their tapered form provides greater initial stability, especially in immediate implant placements and softer bone densities, by compressing the surrounding bone during insertion.

This enhances primary fixation and supports successful osseointegration. Tapered implants also facilitate minimally invasive procedures and are preferred in aesthetic zones due to their compatibility with narrow spaces and angled placements. The design has become a standard in many dental practices because it adapts well to a wide range of clinical scenarios and supports faster healing with reduced surgical complications.

Parallel-walled implants, also known as cylindrical implants, retain a smaller share of the market but remain relevant for specific clinical applications. These implants have a uniform diameter throughout their length, providing a consistent surface area for bone contact. They are generally used in areas with dense bone where achieving primary stability is less challenging.

Parallel-walled implants offer easier surgical control during placement and are less likely to exert excessive pressure on the bone, reducing the risk of cortical bone compression or microfractures. While their use is more limited compared to tapered implants, they continue to be a reliable choice in cases requiring precise implant positioning, especially in posterior regions with favorable bone conditions.

By Type Analysis

Root-form implants are expected to lead the type segment of the dental implants market, securing approximately 85.0% of the total market share in 2025. These implants are designed to replicate the natural shape of a tooth root and are inserted directly into the jawbone, where they undergo osseointegration to provide a stable foundation for prosthetic restorations. Root-form implants are highly versatile and suitable for a wide range of clinical scenarios, including single-tooth replacements, bridges, and full-arch reconstructions.

Their design allows for optimal load distribution, promoting long-term durability and patient comfort. The widespread availability of tapered and cylindrical root-form designs, integrated with advancements in digital implantology and guided surgery, has made them the most commonly used type in modern dental practices globally.

Plate-form implants, although representing a smaller portion of the market, play a crucial role in specific clinical conditions where bone width is severely compromised. These implants have a flat, elongated shape, making them ideal for placement in narrow jaw ridges where traditional root-form implants cannot be accommodated without extensive bone grafting.

Plate-form implants are typically used in the anterior mandible or in cases where patients are not suitable candidates for invasive bone augmentation procedures. While their usage has declined with the emergence of advanced grafting techniques and mini-implants, they continue to serve as a viable solution in complex or anatomically challenging cases, offering an alternative method for achieving implant-supported restorations when conventional approaches are not feasible.

By Procedure Type Analysis

Single tooth replacement is projected to account for the largest share in the procedure type segment of the dental implants market, capturing around 37.0% of the total market value in 2025. This procedure is most commonly performed when an individual loses a single tooth due to trauma, decay, or periodontal disease. It involves placing a single dental implant followed by the attachment of a custom-made crown that closely matches the natural tooth.

Patients prefer this method over traditional dental bridges because it does not require the adjacent teeth to be filed down, thereby preserving the natural tooth structure. With the growing demand for minimally invasive and aesthetic dental solutions, single tooth implants are performed in both general and specialist practices. Advancements in immediate loading protocols and digital workflows have further streamlined the treatment process, enhancing patient satisfaction and clinical outcomes.

Multiple tooth replacement is another important segment within the market, designed for patients missing several adjacent teeth. This procedure typically involves the placement of two or more implants to support a fixed dental bridge or partial prosthesis. It offers a stable and permanent alternative to removable partial dentures, improving chewing ability and speech while preventing bone loss in the affected areas.

Multiple tooth replacement is commonly used in the posterior region where chewing forces are greater, and implant-supported bridges provide better function and longevity. The procedure is particularly beneficial for middle-aged and elderly patients who seek a long-term solution for partial edentulism. As awareness and accessibility to advanced implant solutions increase, multiple tooth replacement is gaining traction as a preferred treatment option in comprehensive restorative care.

By Age Group Analysis

Adults aged between 35 and 64 years are expected to dominate the age group segment in the dental implants market, accounting for approximately 54.0% of the total market share in 2025. This age group is most commonly affected by partial tooth loss due to factors such as untreated dental caries, periodontal disease, and accidental trauma. Many individuals in this demographic are in their peak earning years and are inclined toward investing in permanent, aesthetically pleasing, and functional dental restorations.

The growing awareness of oral health, the desire for improved quality of life, and access to advanced dental care technologies have contributed to the rising adoption of dental implants among adults. Moreover, this group is more likely to seek out preventive and restorative dental procedures, making them a key target segment for dental professionals and implant manufacturers.

The elderly population aged 65 years and above also represents a significant portion of the dental implants market, as they are more prone to complete edentulism and require full-mouth or multiple tooth replacement solutions. With growing life expectancy and the rising focus on active aging, more seniors are opting for implant-supported dentures and full arch restorations to regain oral function and confidence. Many elderly patients prefer implants over removable dentures due to their stability, comfort, and ability to prevent further bone resorption.

Although some may face limitations related to bone density or systemic health conditions, advancements in grafting techniques, mini implants, and zygomatic implants have expanded treatment options for this group. As the global elderly population continues to grow, their contribution to the dental implants market is expected to increase steadily.

By End User Analysis

Dental clinics are anticipated to maintain a dominant position in the end user segment of the dental implants market, capturing approximately 65.0% of the total market share in 2025. This is largely due to the growing number of private dental practices offering specialized implantology services with advanced equipment and trained professionals. Dental clinics typically provide a more patient-centric environment, shorter wait times, and personalized treatment plans, making them the preferred choice for routine and elective procedures such as single tooth implants and aesthetic restorations.

The integration of digital dentistry tools like CAD/CAM systems, intraoral scanners, and guided surgery protocols within clinics has further improved treatment precision and patient satisfaction. Moreover, with the rising awareness of oral health and cosmetic dentistry, more patients are turning to dental clinics for implant-based solutions due to their accessibility, affordability, and convenience.

Hospitals, while holding a smaller share compared to dental clinics, continue to play a critical role in the dental implants market, especially for complex or high-risk cases. Hospitals are often equipped with comprehensive surgical facilities and multidisciplinary teams that can manage patients requiring extensive bone grafting, zygomatic implants, or procedures under general anesthesia. They are also the preferred settings for individuals with underlying medical conditions or compromised oral anatomy that necessitate advanced surgical care.

In addition, teaching hospitals and academic institutions contribute to research, innovation, and training in implant dentistry. As dental departments in hospitals expand their services and collaborate with implant manufacturers to adopt cutting-edge technologies, their role in delivering specialized implant treatments is expected to grow steadily, particularly in urban centers and emerging healthcare systems.

The Dental Implants Market Report is segmented on the basis of the following:

By Product

- Endosteal Implants

- Subperiosteal Implants

- Zygomatic Implants

By Material

- Titanium Implants

- Zirconium Implants

By Design

- Tapered Implants

- Parallel-Walled Implants

By Type

- Root-Form Implants

- Plate-Form Implants

- Mini Implants

By Procedure Type

- Single Tooth Replacement

- Multiple Tooth Replacement

- Full Mouth Reconstruction

- Others

By Age Group

- Adults (35-65 Years)

- Elderly (65+ Years)

- Young Adults (18-34 Years)

By End User

- Dental Clinics

- Hospitals

- Academic & Research Institutes

Global Dental Implants Market: Regional Analysis

Region with the Largest Revenue Share

Europe is projected to lead the global dental implants market in 2025, capturing approximately 38.0% of the total market revenue. This dominance is attributed to the region's well-established dental care infrastructure, high awareness of oral health, and a growing elderly population with growing needs for tooth replacement solutions. Countries such as Germany, Switzerland, France, and Italy have a strong presence of leading implant manufacturers and a high number of skilled dental professionals specializing in implantology.

Additionally, favorable reimbursement policies, widespread adoption of digital dentistry, and a rising demand for aesthetic dental procedures have fueled market growth across the continent. The growing focus on preventive and restorative dental care, combined with the region’s strong healthcare systems, continues to position Europe as the frontrunner in the global dental implants industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is expected to witness the most significant growth in the global dental implants market over the forecast period, driven by rising disposable incomes, improving healthcare infrastructure, and growing awareness of advanced dental restoration options. Countries such as China, India, South Korea, and Japan are seeing a surge in demand for dental implants due to growing incidences of tooth loss, a rapidly aging population, and a growing focus on cosmetic dentistry.

The expansion of dental tourism in countries like Thailand and India, offering high-quality treatments at competitive costs, is further accelerating market expansion. Additionally, the rising number of trained dental professionals, adoption of digital technologies, and increased investment by global implant manufacturers in the region are contributing to the market’s rapid growth, making Asia Pacific a key area of opportunity in the dental implants industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Dental Implants Market: Competitive Landscape

The global competitive landscape of the dental implants market is characterized by the presence of several well-established players competing on the basis of innovation, product quality, clinical outcomes, and global reach. Companies such as Straumann Group, Dentsply Sirona, Zimmer Biomet, and Envista Holdings dominate the market through extensive product portfolios, strong brand reputation, and strategic partnerships with dental professionals and academic institutions. These market leaders continuously invest in research and development to introduce advanced implant systems, surface modifications, and digital dentistry solutions that enhance precision and patient outcomes.

At the same time, regional players like Osstem Implant, Neobiotech, and Megagen are rapidly expanding their footprint by offering cost-effective solutions and entering emerging markets with localized manufacturing and training initiatives. The competitive environment is further intensified by mergers and acquisitions, global expansion strategies, and collaborations aimed at integrating AI technologies and minimally invasive surgical techniques, creating a dynamic and innovation-driven ecosystem within the dental implants industry.

Some of the prominent players in the global dental implants market are:

- Straumann Group

- Dentsply Sirona

- Zimmer Biomet

- Nobel Biocare (Envista Holdings)

- Envista Holdings Corporation

- Osstem Implant Co., Ltd.

- Henry Schein, Inc.

- BioHorizons IPH, Inc.

- Bicon, LLC

- Megagen Implant Co., Ltd.

- Southern Implants

- Neobiotech Co., Ltd.

- Keystone Dental Group

- Adin Dental Implant Systems Ltd.

- Alpha-Bio Tec Ltd.

- MIS Implants Technologies Ltd.

- Dentium Co., Ltd.

- T-Plus Implant Tech Co., Ltd.

- Cortex Dental Implants Industries Ltd.

- Avinent Implant System

- Other Key Players

Global Dental Implants Market: Recent Developments

- May 2024: Straumann Group introduced its next-generation BLX Implant System with enhanced surface technology and digital compatibility, designed to offer superior primary stability and faster osseointegration for immediate loading cases.

- February 2024: Osstem Implant launched the TS III Active Implant Series, engineered for improved insertion torque and optimal performance in soft bone, targeting high-growth markets in Asia and Latin America.

- October 2023: Envista Holdings completed the acquisition of Osteogenics Biomedical, a U.S.-based provider of regenerative dental solutions, to strengthen its dental implants and biomaterials portfolio.

- August 2023: Henry Schein announced the acquisition of Biotech Dental Group, a leading French manufacturer of dental implants and aligners, aiming to expand its presence in the European implantology market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 6.2 Bn |

| Forecast Value (2034) |

USD 11.7 Bn |

| CAGR (2025–2034) |

7.3% |

| The US Market Size (2025) |

USD 1.6 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product (Endosteal Implants, Subperiosteal Implants, Zygomatic Implants), By Material (Titanium Implants, Zirconium Implants), By Design (Tapered Implants, Parallel-Walled Implants), By Type (Root-Form Implants, Plate-Form Implants, Mini Implants), By Procedure Type (Single Tooth Replacement, Multiple Tooth Replacement, Full Mouth Reconstruction, Others), By Age Group (Adults 35–65 Years, Elderly 65+ Years, Young Adults 18–34 Years), and By End User (Dental Clinics, Hospitals, Academic & Research Institutes) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Straumann Group, Dentsply Sirona, Zimmer Biomet, Nobel Biocare (Envista Holdings), Envista Holdings Corporation, Osstem Implant Co., Ltd., Henry Schein, Inc., BioHorizons IPH, Inc., Bicon, LLC, Megagen Implant Co., Ltd., Southern Implants, and Others |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global dental implants market?

▾ The global dental implants market size is estimated to have a value of USD 6.2 billion in 2025 and is expected to reach USD 11.7 billion by the end of 2034.

What is the size of the US dental implants market?

▾ The US dental implants market is projected to be valued at USD 1.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 2.8 billion in 2034 at a CAGR of 6.9%.

Which region accounted for the largest global dental implants market?

▾ Europe is expected to have the largest market share in the global dental implants market, with a share of about 38.0% in 2025.total.

Who are the prominent players in the Global Dental Implant Market?

▾ Some of the major key players in the global dental implants market are Straumann Group, Dentsply Sirona, Zimmer Biomet, Nobel Biocare (Envista Holdings), Envista Holdings Corporation, Osstem Implant Co., Ltd., Henry Schein, Inc., BioHorizons IPH, Inc., Bicon, LLC, Megagen Implant Co., Ltd., Southern Implants, and Others.

What is the growth rate of the global dental implants market?

▾ The market is growing at a CAGR of 7.3 percent over the forecasted period.