Market Overview

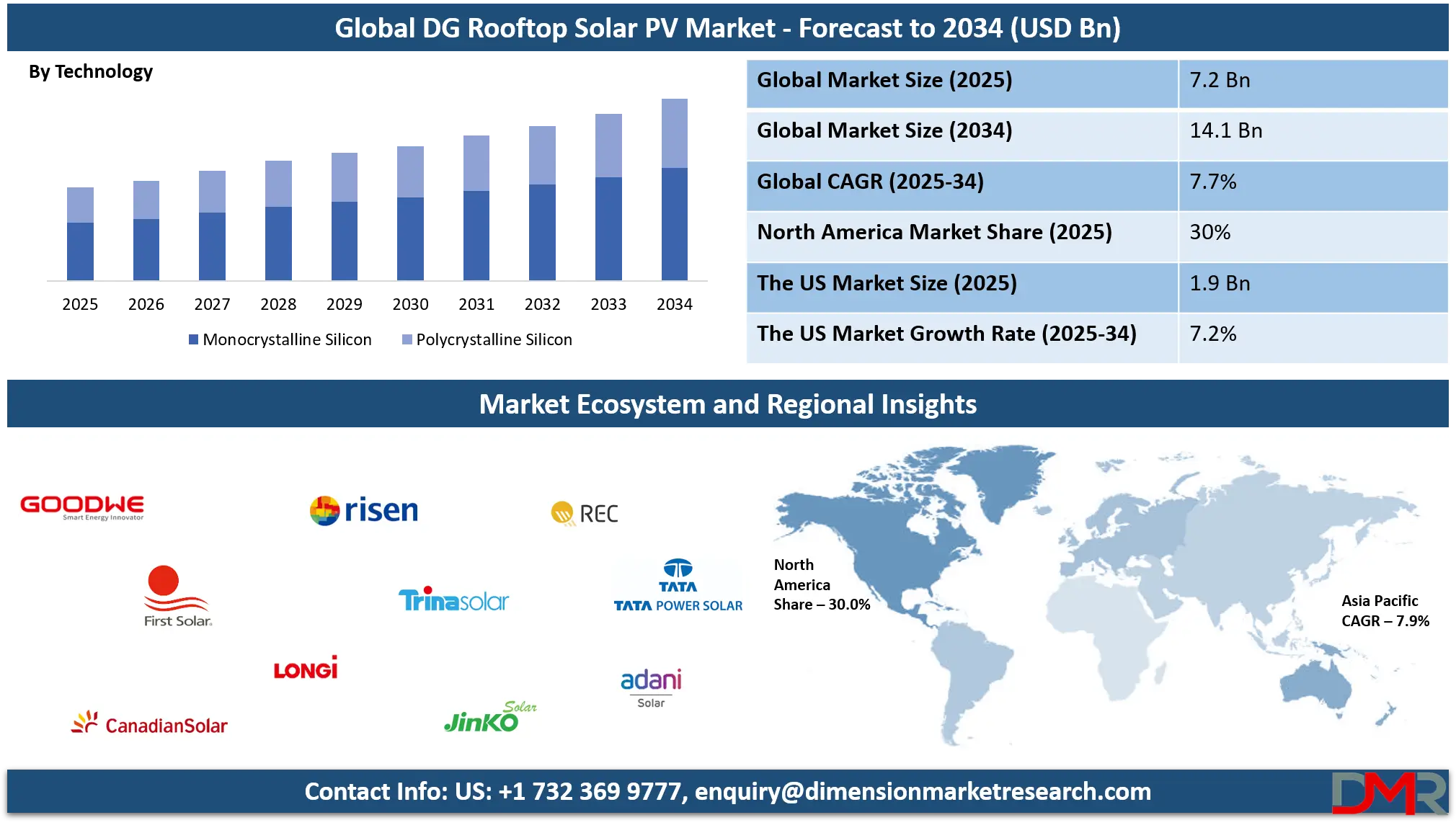

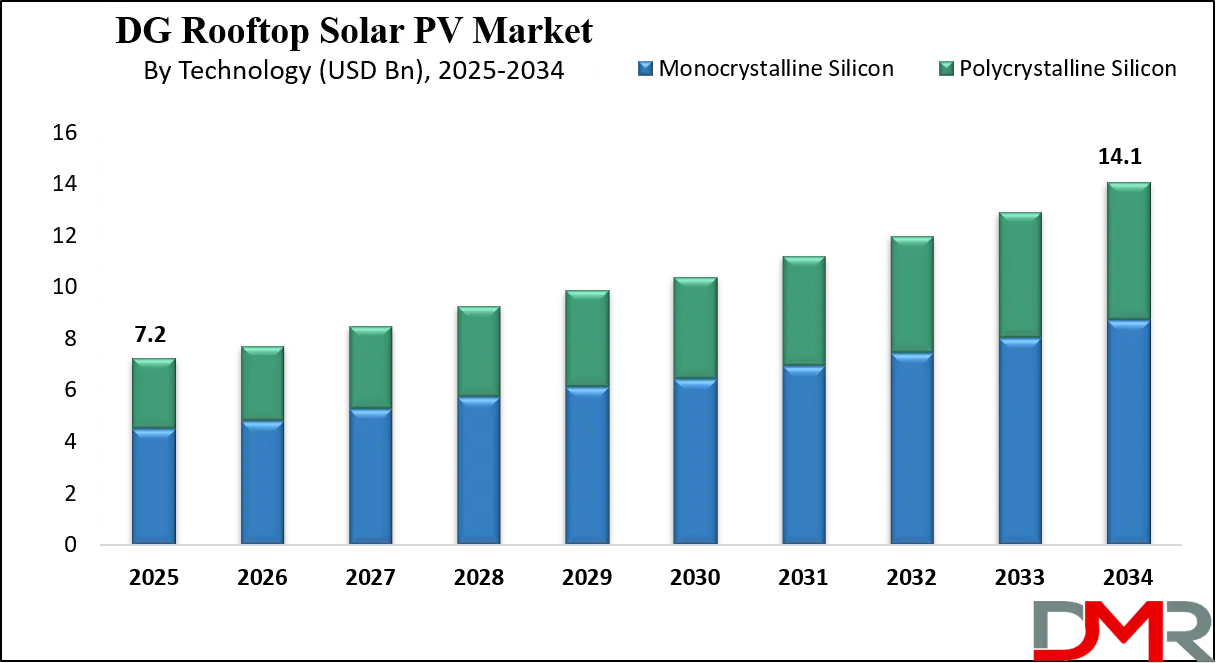

The Global DG Rooftop Solar PV Market size is projected to reach USD 7.2 billion in 2025 and grow at a compound annual growth rate of 7.7% to reach a value of USD 14.1 billion in 2034.

DG Rooftop Solar PV refers to distributed generation photovoltaic systems installed on the rooftops of residential, commercial, and industrial buildings to generate electricity at or near the point of consumption. These systems typically include solar modules, inverters, mounting structures, and increasingly energy storage and monitoring solutions. DG rooftop solar plays a critical role in decentralizing power generation, reducing transmission losses, and improving grid reliability while supporting national decarbonization and energy security objectives. Its modular nature allows scalable deployment across diverse building types, making it a key component of modern distributed energy systems.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The market is shaped by rapid declines in solar module prices, improved conversion efficiencies, and the rising cost of grid electricity. Rooftop solar has become an economically viable option for consumers seeking long-term energy cost stability and reduced dependence on utilities. Digitalization, smart inverters, and advanced energy management systems are improving system performance and operational transparency, accelerating adoption across both developed and emerging economies.

Structural shifts toward self-consumption, net-metering optimization, and hybrid solar-plus-storage configurations are redefining rooftop solar economics. Urban sustainability initiatives, corporate renewable commitments, and electrification trends are further reinforcing the market’s role within the broader renewable energy and distributed power generation landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US DG Rooftop Solar PV Market

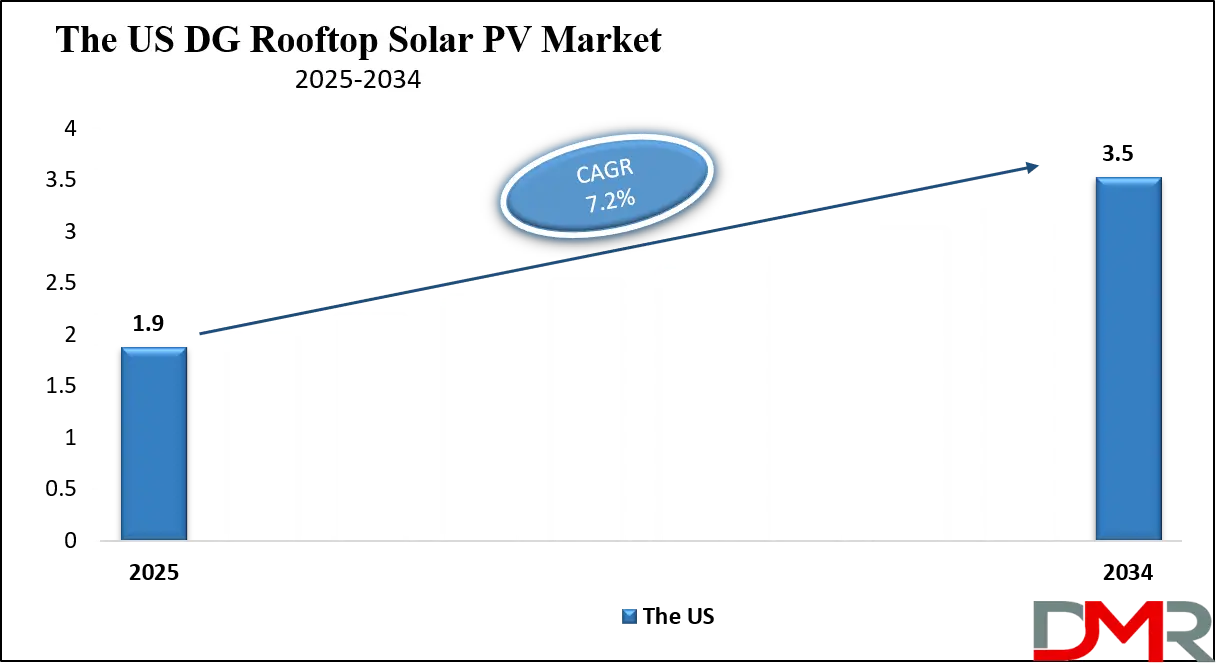

The US DG Rooftop Solar PV Market size is projected to reach USD 1.9 billion in 2025 at a compound annual growth rate of 7.2% over its forecast period.

The United States DG Rooftop Solar PV market is driven by strong federal tax credits, state-level incentives, and rising retail electricity tariffs. Residential adoption remains significant, while commercial and industrial rooftops represent a growing share due to corporate decarbonization goals and energy cost management strategies. Net-metering frameworks, virtual power plants, and community solar initiatives continue to encourage decentralized installations. The presence of a mature installer ecosystem, financing innovation, and advanced grid infrastructure further supports steady market expansion across states.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Europe DG Rooftop Solar PV Market

Europe DG Rooftop Solar PV Market size is projected to reach USD 1.8 billion in 2025 at a compound annual growth rate of 7.3% over its forecast period.

Europe’s DG Rooftop Solar PV market is shaped by ambitious climate targets, building energy performance regulations, and renewable energy mandates. Countries such as Germany, the Netherlands, and Italy remain key contributors, particularly in commercial and industrial segments. While subsidy rationalization in some regions has slowed residential growth, policy alignment under climate and energy transition frameworks continues to support long-term adoption. Integration of rooftop solar with energy storage and smart grids is gaining traction as Europe prioritizes energy resilience and grid flexibility.

Japan DG Rooftop Solar PV Market

Japan DG Rooftop Solar PV Market size is projected to reach USD 504.0 million in 2025 at a compound annual growth rate of 7.0% over its forecast period.

Japan’s DG Rooftop Solar PV market benefits from high electricity prices, land scarcity, and strong government support for distributed generation. Residential rooftops dominate installations, supported by incentive programs and mechanisms that compensate for surplus power. Commercial buildings and small industrial facilities are increasingly adopting rooftop solar combined with battery storage to enhance energy security. Technological innovation, high system efficiency standards, and urban energy resilience strategies position Japan as a stable and innovation-driven market for rooftop solar.

DG Rooftop Solar PV Market: Key Takeaways

- Market Growth: The DG Rooftop Solar PV Market size is expected to grow by USD 6.4 billion, at a CAGR of 7.7%, during the forecasted period of 2026 to 2034.

- By Product Type: The monocrystalline silicon segment is anticipated to get the majority share of the DG Rooftop Solar PV Market in 2025.

- By End User: The residential segment is expected to get the largest revenue share in 2025 in the DG Rooftop Solar PV Market.

- Regional Insight: Asia Pacific is expected to hold a 38.0% share of revenue in the Global DG Rooftop Solar PV Market in 2025.

- Use Cases: Some of the use cases of DG Rooftop Solar PV include residential energy generation, commercial cost optimization, and more.

DG Rooftop Solar PV Market: Use Cases

- Residential Energy Generation: Rooftop PV enables households to reduce electricity bills, achieve partial energy independence, and contribute to clean energy goals.

- Commercial Cost Optimization: Offices, malls, and commercial complexes deploy rooftop solar to stabilize energy expenses and meet sustainability commitments.

- Industrial Power Support: Manufacturing units use rooftop solar to offset peak loads, manage operational costs, and reduce carbon footprints.

- Backup & Microgrid Systems: Solar rooftop systems integrated with storage support backup power, microgrids, and local energy resilience.

Stats & Facts

- International Energy Agency reports global installed solar PV capacity exceeded 2.2 terawatts in 2024.

- U.S. Department of Energy data indicates rooftop solar accounted for over 40% of distributed solar installations in 2025.

- European Commission statistics show rooftop solar contributed nearly 45% of new solar capacity additions in the EU in 2024.

- Japan Ministry of Economy, Trade and Industry reports residential rooftop solar penetration surpassed 30% of suitable households in 2025.

- International Renewable Energy Agency data confirms crystalline silicon technology represented over 70% of rooftop PV deployments in 2025.

Market Dynamic

Driving Factors in the DG Rooftop Solar PV Market

Cost Reduction and Technology Advancement

Continuous improvements in module efficiency, manufacturing scale, and supply chain optimization have significantly reduced rooftop solar system costs. Smart inverters, digital monitoring platforms, and predictive maintenance tools enhance system reliability and performance. The declining cost of lithium-ion batteries further strengthens rooftop solar economics by enabling energy storage and self-consumption. These advancements collectively shorten payback periods and improve return on investment, making rooftop solar increasingly attractive for residential, commercial, and industrial users.

Government Policies and Sustainability Commitments

Supportive regulatory frameworks, including tax incentives, feed-in tariffs, and renewable portfolio standards, are major growth catalysts. Governments integrate rooftop solar targets into climate action plans and urban sustainability policies. Corporate renewable energy commitments and ESG compliance requirements also drive demand for onsite generation. Stable policy support improves investment confidence and accelerates deployment across diverse end-use sectors.

Restraints in the DG Rooftop Solar PV Market

Cost Reduction and Technology Advancement

Continuous improvements in module efficiency, manufacturing scale, and supply chain optimization have significantly reduced rooftop solar system costs. Smart inverters, digital monitoring platforms, and predictive maintenance tools enhance system reliability and performance. The declining cost of lithium-ion batteries further strengthens rooftop solar economics by enabling energy storage and self-consumption. These advancements collectively shorten payback periods and improve return on investment, making rooftop solar increasingly attractive for residential, commercial, and industrial users.

Government Policies and Sustainability Commitments

Supportive regulatory frameworks, including tax incentives, feed-in tariffs, and renewable portfolio standards, are major growth catalysts. Governments integrate rooftop solar targets into climate action plans and urban sustainability policies. Corporate renewable energy commitments and ESG compliance requirements also drive demand for onsite generation. Stable policy support improves investment confidence and accelerates deployment across diverse end-use sectors.

Opportunities in the DG Rooftop Solar PV Market

Solar-Plus-Storage Expansion

The integration of battery storage with rooftop solar presents a major growth opportunity by enabling energy independence, peak shaving, and backup power. Storage enhances grid resilience and supports participation in demand response and virtual power plant programs, creating new revenue streams for system owners.

Innovative Financing Models

OPEX-based models such as power purchase agreements, leasing, and community solar programs reduce upfront costs and broaden market access. Green financing instruments and sustainability-linked investments further support large-scale rooftop deployments across commercial and industrial sectors.

Trends in the DG Rooftop Solar PV Market

Digitalization and Smart Energy Management

Advanced monitoring, AI-enabled analytics, and IoT integration allow real-time performance optimization and predictive maintenance. These technologies improve system efficiency, reduce downtime, and enhance user engagement.

Hybrid and Multi-Energy Systems

Rooftop solar is increasingly deployed alongside storage, EV charging, and other renewable sources. Hybrid systems improve energy reliability, optimize consumption, and expand rooftop solar’s role within integrated energy ecosystems.

Impact of Artificial Intelligence in DG Rooftop Solar PV Market

- Predictive Maintenance: AI identifies performance anomalies early, minimizing downtime and repair costs.

- Energy Forecasting: Machine learning improves generation and consumption predictions using weather and load data.

- Smart Storage Control: AI optimizes battery charging and discharging for cost and grid efficiency.

- Design Optimization: AI accelerates system layout and capacity planning for maximum output.

- Customer Energy Insights: AI personalizes energy usage recommendations and improves customer engagement.

Research Scope and Analysis

By Technology Analysis

Monocrystalline silicon dominates the DG rooftop solar PV market due to its superior efficiency, higher power output per square meter, and longer operational lifespan compared to other technologies. In 2025, this segment accounted for 62% of the total market share, largely driven by strong adoption in residential and commercial rooftops where space constraints make high-efficiency modules essential. Continuous technological advancements have improved cell architecture, enhanced low-light performance, and reduced degradation rates, ensuring consistent long-term energy generation. Additionally, declining production costs and economies of scale have narrowed the price gap with alternative technologies, reinforcing monocrystalline silicon as the preferred choice for premium rooftop installations focused on maximizing energy yield and return on investment.

Polycrystalline silicon represents the fastest-growing segment within the DG rooftop solar PV market due to its relatively lower manufacturing costs and suitability for large commercial and industrial rooftop installations. While traditionally less efficient than monocrystalline modules, ongoing improvements in manufacturing processes have significantly enhanced energy output and reliability. These efficiency gains, combined with competitive pricing, make polycrystalline silicon an attractive option for price-sensitive markets and projects with ample rooftop space.

Commercial buildings and industrial facilities increasingly adopt this technology to balance upfront investment with acceptable performance levels. As cost pressures remain a key decision factor, polycrystalline silicon continues to gain traction, especially in emerging economies and large-scale rooftop deployments.

By Capacity Analysis

The residential segment led the DG rooftop solar PV market with a 46% share in 2025, driven by rising household electricity costs, supportive incentive programs, and growing awareness of clean energy benefits. Rooftop solar enables homeowners to significantly reduce monthly power bills while achieving partial energy independence from the grid. Increasing adoption of smart meters, mobile monitoring applications, and home battery storage systems has further enhanced the value proposition for residential users. These systems allow households to optimize energy consumption, store excess power, and improve resilience during grid outages. As urbanization and sustainability awareness continue to rise, residential rooftop solar remains a cornerstone of distributed generation growth.

The commercial segment is the fastest-growing capacity category, supported by corporate sustainability targets, favorable financing structures, and the need for long-term energy cost stability. Offices, retail complexes, educational institutions, and healthcare facilities increasingly deploy rooftop solar to reduce operational expenses and demonstrate environmental responsibility. Power purchase agreements and leasing models make adoption more accessible by minimizing upfront capital requirements.

Additionally, commercial rooftops offer larger surface areas, allowing for optimal system sizing and improved economies of scale. As businesses face increasing pressure to comply with ESG standards and manage energy risks, commercial rooftop solar installations are expanding rapidly across both developed and emerging markets.

By Grid Connectivity Analysis

On-grid DG rooftop solar PV systems dominated the market with a 68% share in 2025, primarily due to favorable net-metering policies and lower overall system costs. These systems allow users to export surplus electricity back to the grid, improving project economics and reducing payback periods. On-grid configurations are particularly attractive in urban and semi-urban areas with reliable grid infrastructure. The absence of battery storage reduces initial investment, making these systems accessible to a wider customer base. Regulatory frameworks that support grid interconnection and energy credit mechanisms continue to strengthen the dominance of on-grid rooftop solar across residential and commercial segments.

Hybrid DG rooftop solar PV systems are expanding rapidly as they combine grid connectivity with battery storage, offering enhanced flexibility and energy security. These systems enable users to store excess solar power for use during peak demand periods or grid outages, making them particularly attractive in regions with unstable electricity supply.

Declining battery costs and advancements in energy management software have accelerated hybrid adoption across residential, commercial, and industrial applications. Hybrid systems also support load optimization and peak shaving, improving overall energy efficiency. As resilience and self-consumption become higher priorities, hybrid rooftop solar systems are increasingly viewed as a future-ready solution.

By Ownership/Business Model

CAPEX-based rooftop solar installations accounted for 57% of the market in 2025, driven by the long-term financial benefits of system ownership. Residential homeowners and industrial users favor this model as it offers complete control over energy generation assets and maximizes lifetime cost savings. Although the upfront investment is higher, CAPEX systems deliver predictable returns through reduced electricity bills and potential revenue from surplus power exports. Declining equipment costs and access to financing options have further supported adoption. For consumers with stable capital availability, CAPEX remains the preferred model due to its strong return on investment and asset ownership advantages.

OPEX-based models are the fastest-growing ownership segment, particularly within the commercial sector, due to minimal upfront costs and predictable energy pricing. Under power purchase agreements or leasing arrangements, third-party developers install, own, and maintain the rooftop solar systems, allowing customers to pay only for the electricity consumed. This model reduces financial risk and operational complexity for businesses while enabling immediate access to clean energy. OPEX structures are especially attractive for offices, retail chains, and multi-site enterprises seeking scalable solar adoption. As financing innovation increases, OPEX models continue to gain momentum globally.

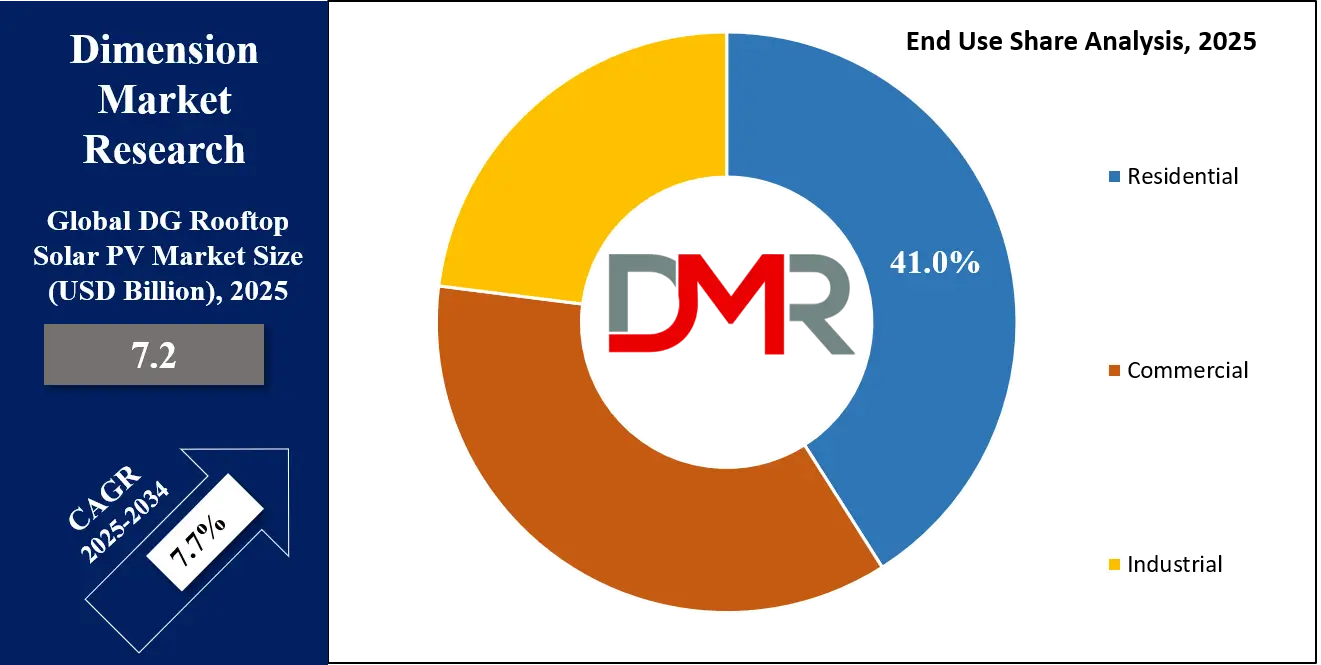

By End Use Analysis

Residential applications accounted for a 41% market share in 2025, supported by favorable incentive programs, growing environmental awareness, and rising electricity prices. Homeowners increasingly view rooftop solar as a long-term investment that enhances property value while reducing dependence on grid power. The integration of digital monitoring tools and battery storage has further improved system attractiveness by offering greater control over energy usage. Government-led rooftop solar programs and simplified installation processes continue to support residential adoption. As consumers prioritize energy independence and sustainability, residential rooftops remain a key contributor to overall market growth.

The commercial and industrial segment is growing rapidly as businesses prioritize ESG compliance, operational cost reduction, and energy reliability. Large rooftop spaces in factories, warehouses, and commercial buildings provide ideal conditions for high-capacity installations. Companies increasingly deploy rooftop solar to hedge against electricity price volatility and meet internal carbon reduction targets. Integration with energy storage and demand management systems enhances operational efficiency and resilience. As corporate sustainability reporting becomes more stringent, commercial and industrial users are expected to play an increasingly significant role in driving DG rooftop solar PV market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The DG Rooftop Solar PV Market Report is segmented on the basis of the following:

By Technology

- Monocrystalline Silicon

- Polycrystalline Silicon

By Capacity

- Residential (<10 kW)

- Commercial (10–100 kW)

- Industrial (>100 kW)

By Grid Connectivity

By Ownership / Business Model

- CAPEX (Customer-Owned)

- OPEX (PPA / Leasing)

By End Use

- Residential

- Commercial

- Offices

- Retail & Commercial Complexes

- Industrial

- Manufacturing Facilities

- Warehouses & Logistics

Regional Analysis

Leading Region in the DG Rooftop Solar PV Market

Asia-Pacific dominated the DG rooftop solar PV market with a 38% share in 2025, driven by rapid urbanization, expanding electricity demand, and strong government support for distributed renewable energy systems. Countries such as China, Japan, and India are at the forefront due to favorable policy frameworks, incentive schemes, and well-established solar manufacturing ecosystems. High population density and increasing commercial construction create ideal conditions for rooftop installations across residential and commercial buildings.

Additionally, rising retail electricity prices and grid congestion in urban areas encourage consumers to adopt rooftop solar for cost savings and energy reliability. The region also benefits from strong domestic supply chains, skilled labor availability, and continuous technological innovation, reinforcing Asia-Pacific’s leadership position in the global DG rooftop solar PV market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Fastest Growing Region in the DG Rooftop Solar PV Market

The Middle East & Africa region is the fastest-growing DG rooftop solar PV market, supported by abundant solar irradiation, rising electricity consumption, and increasing focus on energy diversification. Governments across the region are implementing renewable energy policies, incentive programs, and net-metering frameworks to reduce dependence on fossil fuels. Commercial and industrial users are leading adoption, particularly in sectors such as logistics, manufacturing, and retail, where electricity costs are significant.

Rooftop solar is also gaining traction as a solution to grid reliability challenges in several countries. Declining system costs, improved financing mechanisms, and growing private-sector participation are accelerating rooftop solar deployment, positioning the region as a high-growth market with strong long-term potential.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The DG rooftop solar PV market is moderately fragmented, with competition driven by cost leadership, technological innovation, and service differentiation rather than brand dominance. Companies focus on improving module efficiency, expanding financing options, strengthening installer networks, and investing in digital platforms. Entry barriers include capital requirements, regulatory compliance, and supply chain capabilities. Strategic partnerships, local market customization, and investment in R&D remain key strategies for sustaining competitive advantage.

Some of the prominent players in the global DG Rooftop Solar PV are:

- LONGi Green Energy Technology

- Trina Solar

- JinkoSolar

- Canadian Solar

- JA Solar

- First Solar

- Hanwha Qcells

- Risen Energy

- REC Group

- Adani Solar

- Tata Power Solar

- Vikram Solar

- Sungrow

- Huawei Digital Power

- SMA Solar Technology

- Growatt

- GoodWe

- Enphase Energy

- SolarEdge Technologies

- Other Key Players

Recent Developments

- In July 2025, SolarEdge Technologies and Solar Landscape unveiled an agreement for the supply of SolarEdge's U.S. manufactured solar technology for over 500 commercial rooftop projects across multiple states, to be built in 2025 and 2026. Also, the company’s domestically manufactured solar technology allow developers like Solar Landscape to meet demand for U.S.-manufactured solutions while optimizing project timelines through a localized supply chain.

- In April 2025, Brazilian utility Celesc announced that it has put into commercial operation a 1-MW distributed generation (DG) solar park in the state of Santa Catarina. According to the utility, the Videira PV farm is part of its strategy to expand its power generation mix, leaning towards renewable sources. The energy credit generated by the facility will be used to offset the electricity bills of Santa Catarina state schools, generating up to 10% in savings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 7.2 Bn |

| Forecast Value (2034) |

USD 14.1 Bn |

| CAGR (2025–2034) |

7.7% |

| The US Market Size (2025) |

USD 1.9 Bn |

| Historical Data |

2019 – 2023 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Technology (Monocrystalline Silicon and Polycrystalline Silicon), By Capacity (Residential (<10 kW), Commercial (10–100 kW), and Industrial (>100 kW)), By Grid Connectivity (On-Grid, Off-Grid, and Hybrid), By Ownership / Business Model (CAPEX (Customer-Owned) and OPEX (PPA / Leasing)), By End Use (Residential, Commercial, and Industrial) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

LONGi Green Energy Technology, Trina Solar, JinkoSolar, Canadian Solar, JA Solar, First Solar, Hanwha Qcells, Risen Energy, REC Group, Adani Solar, Tata Power Solar, Vikram Solar, Sungrow, Huawei Digital Power, SMA Solar Technology, Growatt, GoodWe, Enphase Energy, SolarEdge Technologies, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global DG Rooftop Solar PV Market?

▾ The Global DG Rooftop Solar PV Market size is expected to reach USD 7.2 billion by 2025 and is projected to reach USD 14.1 billion by the end of 2034

Which region accounted for the largest Global DG Rooftop Solar PV Market?

▾ Asia Pacific is expected to have the largest market share in the Global DG Rooftop Solar PV Market, with a share of about 38.0% in 2025.

How big is the DG Rooftop Solar PV Market in the US?

▾ The US DG Rooftop Solar PV market is expected to reach USD 1.9 billion by 2025.

Who are the key players in the DG Rooftop Solar PV Market?

▾ Some of the major key players in the Global DG Rooftop Solar PV Market include LONGi, Adani, Tata Power, and others

What is the growth rate in the Global DG Rooftop Solar PV Market?

▾ The market is growing at a CAGR of 7.7 percent over the forecasted period.