Market Overview

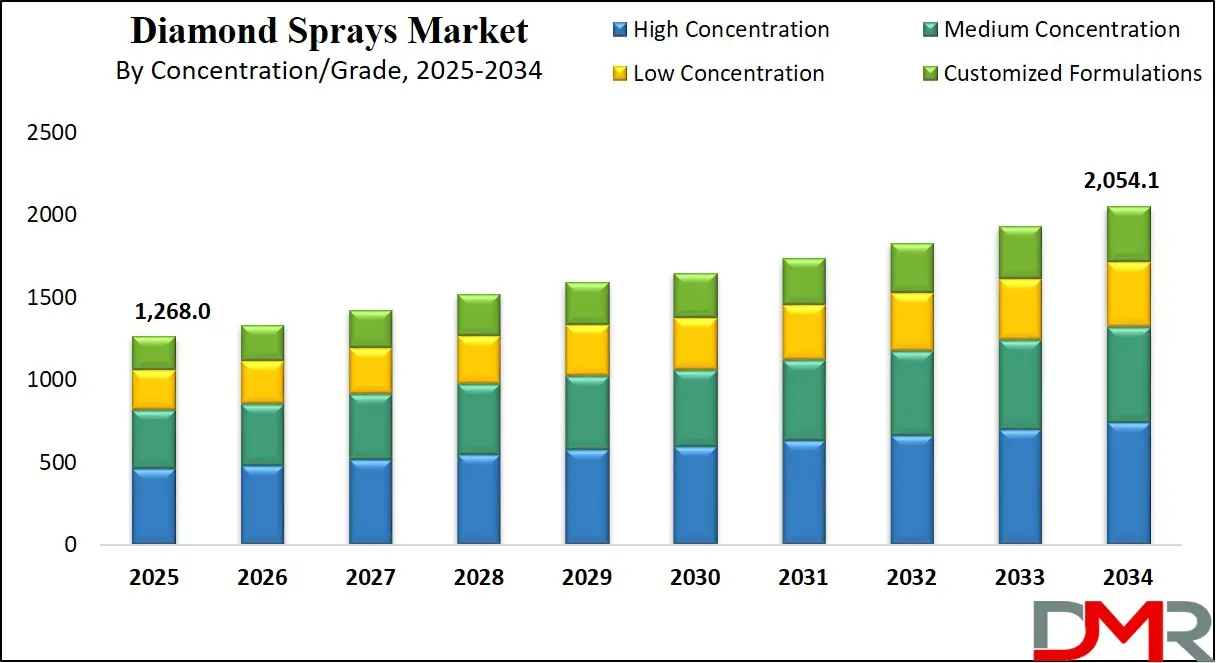

The Global Diamond Sprays Market size is projected to reach

USD 1,268.0 million in 2025 and grow at a compound annual growth rate of

5.5% from there until 2034 to reach a value of

USD 2,054.1 million.

The global market for diamond sprays demonstrates consistent development due to increasing requirements for precise polishing procedures across industries such as electronics and aerospace and healthcare, and automotive. Diamond sprays achieve high-value surface finishing on hard materials because of their exceptional thermal conductivity and diamond's exceptional hardness. The market shift toward high-performance components and miniaturized electronics represents an opportunity for manufacturers to use diamond sprays as their solution to achieve defect-free results.

Two major trends now shape the market toward nano diamond spray usage for small surface finishing operations and the choice of synthetic materials because these offer higher quality at lower costs. The growing investment in automated operations alongside customized spray development creates distinctive products that deliver competitive advantages to manufacturers. Asian-Pacific markets, together with those in the Middle East, provide new business prospects because industrial facilities continue to develop their precision manufacturing capabilities.

Various restraining factors affect the marketplace. Market restrictions stem from the high material prices and restricted diamond supply, combined with obstacles posed by ecological standards that govern waste disposal and abrasive substances preparation. Smaller companies experience struggles when attempting to expand operations beyond established manufacturers who offer entire technical assistance packages together with worldwide distribution systems.

The market demonstrates promising future development prospects because customers need high-precision components, which benefits multiple business areas, and technological innovations in materials science match industry demands alongside the shift towards environmentally friendly manufacturing methods. The market demand will increase because of technological advances in dispersion systems and automated polishing systems that improve worldwide implementation of this technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Diamond Sprays Market

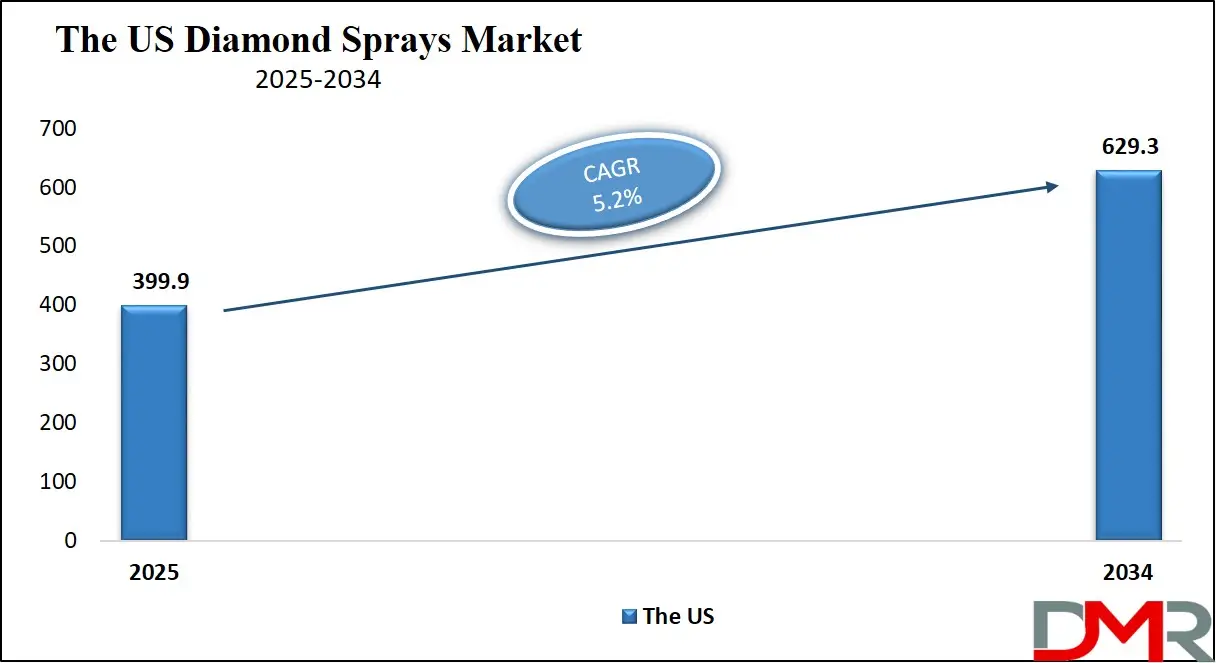

The US Diamond Sprays Market size is projected to be valued at

USD 399.9 million in 2025 and is forecasted to grow at a

CAGR of 5.2% from 2025 to 2034, reaching

USD 629.3 million by 2034.

The U.S. diamond spray market expands as more industries within aerospace, healthcare, and electronics choose diamond spray solutions and advance through innovative applications. Since its infrastructure is mature, along with its high industrial standards, this nation positions itself at the forefront of finishing solutions for precise applications. Aerospace hubs, together with semiconductor production facilities located in California and Texas, generate substantial market need for the industry.

High-grade diamond polishing solutions maintain a steady market demand as domestic policy incentives drive both the revival of chip manufacturing and the medical device production sectors. The automotive industry transition to electric vehicles and advanced sensors creates new surface treatment opportunities with high-performance requirements.

The U.S. maintains a population-based advantage by hosting professional employees combined with effective institutions and advanced technological systems. New-generation polishing solutions became available to companies because they invested in environmentally friendly spray formulations through this advancement. Innovation of spray distribution methods, as well as diamond particle utilization and new hybrid composition development, continues through domestic research and development efforts.

The U.S. continues to hold its global competitive position through automated manufacturing processes, along with stringent regulatory standards and tailored solutions for specific market segments, even though operations are costly. Key players and OEMs, as well as suppliers, together form a robust supply chain that contributes to market expansion.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Diamond Sprays Market

The global diamond sprays market size is expected to be valued at approximately

USD 223.17 million in 2025 and is projected to reach

USD 323.18 million by 2034, growing at a

CAGR of 4.2% during the forecast period.

The diamond spray market in Europe relies on high-precision production sectors, which include automotive components and optics, and aerospace parts. The expertise in engineering, metalworking, and surface technology that Germany, together with Switzerland and France, possesses makes them major consumers of diamond-based polishing systems. Automotive sector innovation, along with aerospace Original Equipment Manufacturers (OEMs), has made diamond sprays strongly established in the European industrial environment.

European companies focus on sustainability and compliance standards that have accelerated the market demand for high-performance and environmentally friendly diamond spray formulations. The market expansion benefits from electric vehicle production and digital infrastructure development because these emerging sectors need components and parts that meet precision standards.

Europe enjoys a strong demand advantage through its skilled technical staff alongside its extraordinary record in producing precisely manufactured goods. Regional suppliers gain market leverage through their ability to be near end-users and maintain strong European logistics systems and strict quality standards.

Industry limitations regarding chemical composition restrictions, together with environmental protection criteria, work as impediments to product development and cause additional costs for manufacturing companies. Small new companies, along with smaller firms, face particularly intense market competition because of market fragmentation.

The market shows continuing strength in its regional customer base with heightened demand across optics segments and aerospace operations, as well as precision tool sectors. The diamond sprays market will grow sustainably through European research initiatives backed by cross-border partnerships, which will help Europe maintain its position as a top global market participant.

The Japan Diamond Sprays Market

The Japan Diamond Sprays Market is projected to reach USD 76.08 million in 2025 at a compound annual growth rate of 4.8% over its forecast period.

The diamond spray sector in Japan exists to deliver ultra-precision polishing technology toward three key industrial segments, including electronics, optics, and automobiles. Japan depends on state-of-the-art abrasive systems to fulfill its performance standards, which focus on semiconductors, sensors, and specialty glass as well as micro-manufacturing surface perfection.

Diamond sprays play an essential role in surface roughness reduction for precise finishes that extend electronic equipment lifespans in the leading Japanese miniaturized electronics and imaging equipment market sector. The medical and automotive industries in Japan demand advanced polishing solutions because of the increasing importance of electric vehicles and artificial intelligence in medical devices.

Japan maintains superior demographics through its high-skilled workforce, which combines with its traditional commitment to producing high-quality manufacturing products. The aging population of Japan remains productive because the nation relies on automated systems combined with robotic technology, together with its Kaizen operational culture, to evolve precise abrasive products, including diamond sprays.

The Japanese market excels by merging superior manufacturing practices with research-related advancements to succeed in the global market. Organizations build relationships between universities and research facilities to enhance spray functionality and nano-dispersion methods, as well as application solution development.

The market faces two main problems: worker deficits, along with restricted natural resource availability, lead organizations to both automate operations with robots and replace items with synthetic duplicates. The market challenges prompted Japanese industries to create advanced process optimization solutions, which maintained their status as global leaders of fine abrasive technologies while ensuring continuous diamond spray market demand.

Global Diamond Sprays Market: Key Takeaways

- The Global Market Size Insights: The Global Diamond Sprays Market size is estimated to have a value of USD 1,268.0 million in 2025 and is expected to reach USD 2.054.1 million by the end of 2034.

- The US Market Size Insights: The US Diamond Sprays Market is projected to be valued at USD 399.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 629.3 million in 2034 at a CAGR of 5.2%.

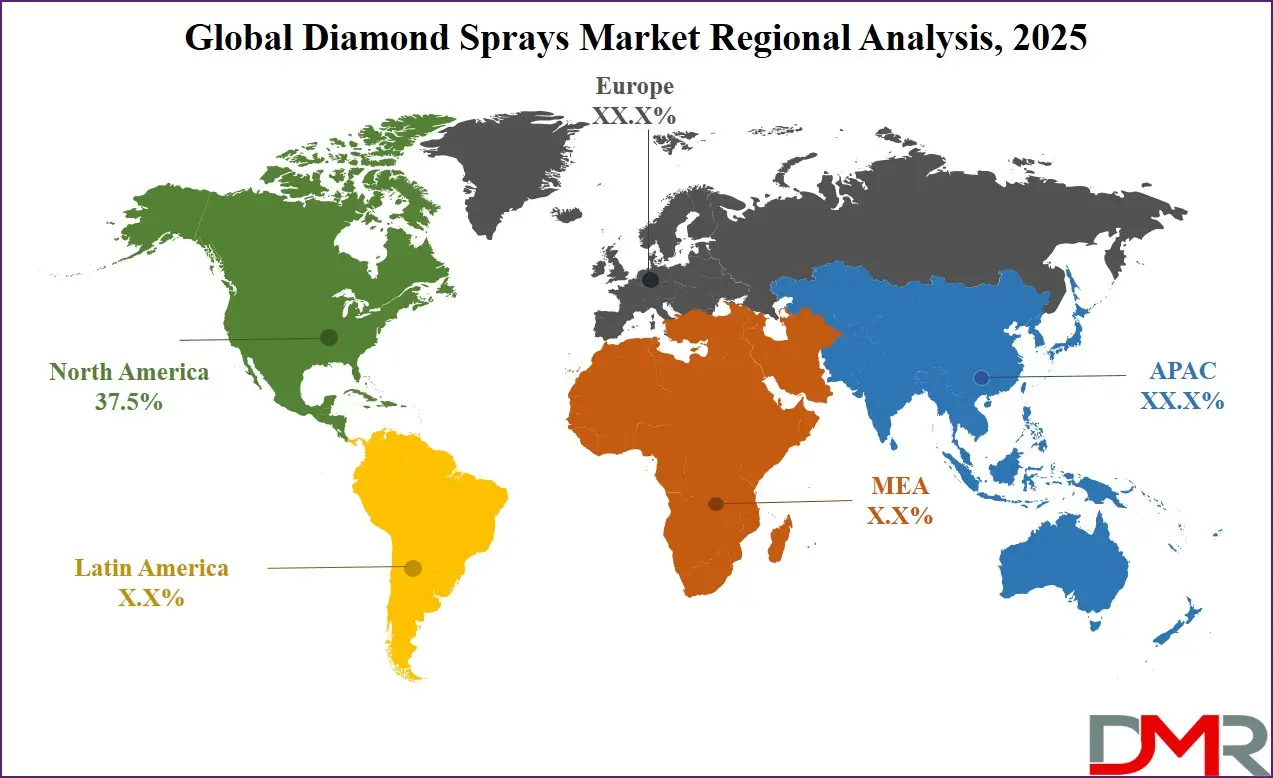

- Regional Insights: North America is expected to have the largest market share in the Global Diamond Sprays Market with a share of about 37.5% in 2025.

- Key Players Insights: Some of the major key players in the Global Diamond Sprays Market are Engis, Saint-Gobain, Hyperion, Iljin, Tomei, Microdiamant, Lapmaster Wolters, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 5.5 percent over the forecasted period of 2025.

Global Diamond Sprays Market: Use Cases

- Semiconductor Wafer Polishing: Premium-grade silicon wafers often use diamond sprays for producing smooth flat surfaces that assist in manufacturing high-end microchip products. The engineering process results in superior circuit precision and higher yield rates to fulfill the expanding needs of next-generation semiconductor components for 5G and AI processor applications.

- Medical Implant Finishing: Orthopedic implants, together with surgical instruments, receive polishing treatment through diamond sprays to create surfaces that are smooth and bio-compatible. The use of diamond sprays in medical implant applications results in surface smoothing, which facilitates better implant integration and prevents infections, and maintains top safety requirements in essential medical contexts.

- Precision Optics Manufacturing: The polished structures of lenses, together with prisms and mirrors, achieve superior quality using diamond sprays for ultra-glide and imperfection-free surfaces. The materials receive exceptional clarity and precise transmission of light because of diamond sprays in medical imaging applications and high-precision scientific instruments.

- Aerospace Component Polishing: Structural components that receive diamond spray treatment acquire better resistance to fatigue while also lasting longer. Aerodynamic efficiency depends on proper polishing techniques, which minimize micro-cracks because they enhance both aircraft performance and safety conditions.

- Jewelry and Gemstone Finishing: The polishing technique known as diamond sprays offers precise finishing for gemstones together with metal settings which results in improved brilliance as well as surface smoothness. The finishing procedure enables top-quality luxurious surfaces while optimizing lavish appearance in luxury jewelry products.

Global Diamond Sprays Market: Market Dynamics

Driving Factors in the Global Diamond Sprays Market

Expansion of Electronics and Semiconductor Manufacturing GloballyThe semiconductor along electronics sectors demonstrate rapid worldwide growth, which acts as a primary fuel for expansion. The microchips and production components require diamond sprays for wafer-level polishing and lens fabrication, and heat dissipation applications to maintain defect-free outcomes. The global pursuit of autonomous chip manufacturing, including the CHIPS Act in the U.S. and semiconductor stimulus initiatives in Taiwan, South Korea, and India, will boost the market demand for diamond sprays as high-precision materials.

These sprays reduce manufacturing errors while extending tool operational lifetime, which makes them essential for both fab plants and precision assembly lines. The combination of AI with IoT systems and 5G technologies will boost the necessity for powerful, small-sized chips, leading to increased strategic value of diamond sprays throughout manufacturing operations.

Increased Demand in Aerospace and Automotive Components Finishing

The aerospace sector, along with automotive, uses diamond sprays to manage crucial components in demanding environments because of essential requirements, including peak performance and resistance to fatigue, and endurance. Aerospace manufacturers use diamond sprays to polish small-scale components, which helps reduce friction and supports aerodynamic requirements, along with decreasing crack formation.

Diamond sprays are used in EVs together with other automotive applications to boost the operational performance of powertrain elements and thermal interface components, and high-wear automotive components. Manufacturers currently use diamond-based formulations in their advanced finishing technologies to address both performance requirements and regulatory criteria because global aviation is rising after COVID, and EV sales volumes are increasing. The demand for reliable, scaled-up solutions from these industries establishes diamond sprays as a crucial component in present-day production methods.

Restraints in the Global Diamond Sprays Market

High Production Costs and Price Sensitivity Across End-Use Sectors

Diagonal sprays provide top performance but remain unaffordable for many small and medium enterprises that operate in metalworking or local electronics production and emphasize cost-reduction. The manufacturing process of monocrystalline and nano-diamond formulations requires sophisticated manufacturing methods and strict quality controls, which makes their prices exceed those of traditional polishing agents. The high costs of diamond sprays prevent widespread use in areas where buying prices remain the most crucial factor in purchasing decisions.

Operation costs rise due to both the need for regular maintenance and the frequent necessity to reapply the material. Specialized application systems together with a skilled labor force require investments by companies that want to use diamond sprays, but this initial capital allocation elevates their expenses. The cost-related challenges create obstacles for the adoption of diamond sprays beyond premium-driven and precision applications.

Limited Awareness and Technical Expertise in Developing Markets

Usage of diamond spray faces strenuous challenges due to inadequate awareness and technical capability about this material in developing markets. Developing economies maintain their dependence on conventional abrasives because many of their industries lack awareness about diamond sprays' benefits, despite advanced manufacturing sectors successfully using them. To effectively utilize diamond sprays, one needs specific knowledge about concentrations, together with application techniques and compatibility with different substrates.

Potential users find it difficult to adopt diamond sprays even though they offer long-term benefits because they lack access to proper training, together with support infrastructure. The absence of technological understanding creates two major hindrances that prevent market growth since it restricts both small business adoption and production plant innovation adoption in developing economic zones.

Opportunities in the Global Diamond Sprays Market

Surge in Medical and Biomedical Device Applications

The surface finishing sector of medical devices represents an extensive business opportunity for diamond sprays because they enable better performance of orthopedic implants and surgical tools, and diagnostic instruments. The application of diamond sprays provides surgical equipment administrators with ultra-smooth biocompatible surfaces that block bacterial growth and enhance implant integration and wear resistance.

The expanding healthcare facility network, including Europe's aging population segment and Japan and China, sets off a rising demand for resilient medical devices. Regulatory mandates extending device service lives at the same time as increased use of minimally invasive surgical techniques drive industries to adopt advanced polishing technologies for improved precision. The implementation of diamond sprays by medical manufacturers enables them to boost their market position through improved products with fewer postoperative difficulties.

Emerging Market Penetration in Asia-Pacific and Latin America

Indian and Vietnamese markets, alongside Brazilian and Mexican infrastructure projects, establish profitable conditions for diamond spray manufacturers to grow. These geographic areas demonstrate advancing automotive sectors along with electronics manufacturing and metalworking facilities, as well as precise tooling businesses that serve as the main diamond spray consumer markets. The governments of various locations have started producing products domestically to decrease imports while extending invitations to multinational organizations that wish to collaborate through local branches or partnership ventures.

The adoption of advanced finishing methods and affordable workforce possibilities enables regional producers to change traditional abrasives for diamond spray solutions. The restructuring of this market creates durable business prospects for global firms, together with regional companies.

Trends in the Global Diamond Sprays Market

Shift Toward Nano-Diamond Formulations in High-Tech Applications

The market shows a clear development pattern toward nano-diamond spray formulations because researchers value these options for their superior surface uniformity combined with thermal conductivity and chemical stability traits. The super-small diamond particles perform exceptionally well for precision surface treatment and protective coating requirements of semiconductor manufacturing tools and optical elements, and medical tools.

The electronics and medical sectors have experienced growing device miniaturization, which leads to a demand surge for atomic-level, precisely controlled materials that also maintain smoothness. Nano-diamond sprays provide next-generation microchips and surgical devices with three critical features that include strong bonding properties and lower friction, and better compatibility with biological systems. Modern technological developments toward nanoscale engineering, along with increasing nanomaterial R&D investments, supply worldwide momentum, particularly through Japanese, German, and American sectors.

Sustainable and Lab-Grown Diamond Use is Rising

Traditional diamond mining issues regarding environment and ethics have led manufacturers as well as end-users to consider lab-grown diamonds in their purchases. Isotopic diamonds fashioned by chemical vapor deposition (CVD) or high-pressure high-temperature (HPHT) methods present both uniform quality standards and environmental conservation. Manufacturers across North America and Europe, together with their leading industries, prefer synthetic diamond sprays because they have adopted environmentally friendly procurement procedures.

These alternatives gain greater popularity because of intensified examinations that focus on corporate sustainability reporting, together with ESG compliance requirements. Consumer demand for high-end finishing materials, especially luxury items and sustainable jewelry, supports brand equity because of the adoption of this trend.

Global Diamond Sprays Market: Research Scope and Analysis

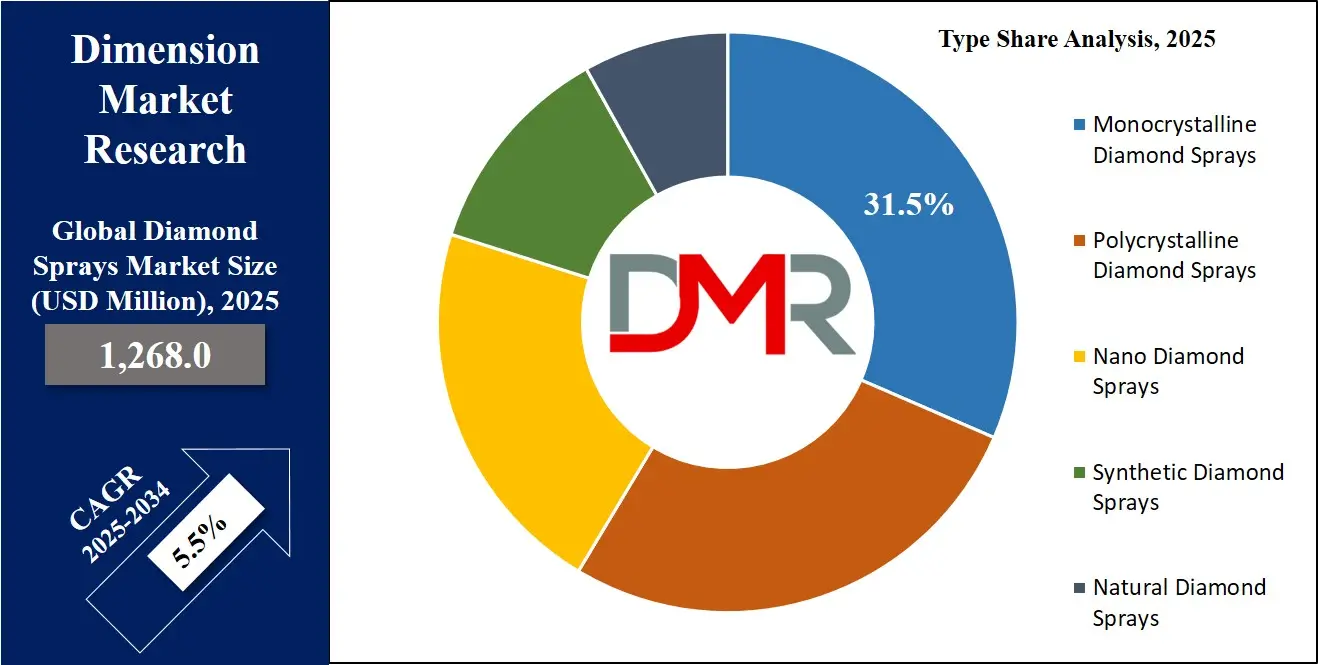

By Type Analysis

Monocrystalline diamond sprays are poised to dominate the market with the highest market share in 2025. Monocrystalline diamond sprays rule the market because they create consistent structures and show great hardness alongside superior cutting and polishing abilities. This production technique creates diamond particles from single-crystal diamond substances suitable for applications that require precise, high-precision finishing across industrial sectors. Their durability in maintaining precise edges throughout longer timeframes enables the production of smooth surfaces that efficiently remove materials while protecting lower layers during semiconductor and optical, and medical industry processing.

Monocrystalline diamonds present superior durability during mechanical procedures because the number of grain boundaries in their structure remains minimal when compared to both synthetic and polycrystalline diamond production methods. Their particular composition renders them perfect for demanding applications that need tight dimensional precision. When combined with their exceptional thermal conductivity and chemical inert properties, they lead to enhanced performance within harsh temperature environments and chemically active conditions for better output.

The aerospace sector, together with electronics and optics, requires monocrystalline sprays because perfect surface quality enables defect-free results. The market adoption is supported by their demonstrated ability to polish both tough and delicate materials, including ceramics, along with tungsten carbide and stainless steel. The market dominance of monocrystalline diamond sprays in North America, as well as Japan and parts of Europe, grows stronger because these sprays achieve higher manufacturing efficiency under tighter tolerances and enhanced systemic throughput.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Concentration/Grade Analysis

High-concentration diamond sprays lead the market due to their superior performance in demanding industrial applications where maximum cutting, grinding, or polishing efficiency is essential. These formulations contain a greater volume of diamond particles per unit volume, significantly enhancing abrasion capability and ensuring consistent, aggressive material removal across a wide range of surfaces.

In sectors like automotive, aerospace, semiconductors, and medical devices, where parts must meet stringent quality standards and minimal surface roughness, high-concentration sprays offer a clear advantage. They enable quicker processing times and reduce the number of polishing passes required, improving throughput and lowering labor and operational costs in high-volume manufacturing environments. For example, when polishing turbine blades or silicon wafers, high concentration ensures uniform results across the entire component, reducing variability and increasing final product reliability.

Furthermore, high-concentration formulations are especially valuable when dealing with hard substrates such as ceramics, hardened metals, or synthetic gemstones. Their higher cutting force minimizes the risk of under-polishing or residue buildup, both of which can compromise end-product quality.

Even though they come at a premium cost, their ability to deliver results faster with fewer reapplications offsets the initial investment. Additionally, advancements in suspension technology and diamond dispersion are improving the stability and longevity of high-concentration sprays, making them more cost-effective over time. With increasing emphasis on productivity and precision across industries, high-concentration diamond sprays are the preferred choice for quality-focused manufacturers and finishers worldwide.

By Application Analysis

The abrasives and polishing segment is expected to maintain leadership in the diamond sprays market because diamond produces the smoothest possible high-precision finishes on countless materials. High-performance finishing applications lean toward diamond sprays because of their exceptional durability combined with exceptional heat transport properties, which make grinding and cutting, and lapping operations carry out effectively within industrial manufacturing.

The market selects diamond sprays as its preferred finish solution because they excel at producing flawless surfaces for critical surface-sensitive industrial applications. The precise control of surface textures becomes achievable through diamond sprays because they allow manufacturers to manufacture products with extreme minimum roughness, attributed to advanced applications. Surface defects measuring below one micrometer can affect product functionality in semiconductor as well as optics manufacturing, thus requiring immediate attention.

Diamond sprays bring numerous benefits to abrasives and polishing operations because of their flexible applications. Different diamond spray options become available because manufacturers can choose from various particle sizes and concentration levels to match the requirements of special applications, which need distinct treatments like mirror finishing or material ablation. The operational efficiency rises because diamond sprays incorporate extended tool durability, together with minimal material waste and improved reliability.

Diamond sprays show versatile capabilities to work on automated systems along with manual tools, which boosts their value in production lines and specialized customized production applications. Global industries use diamond sprays to keep their competitive position in polishing technology because they require precision and limited tolerance, and refined product aesthetics.

By End-Use Industry Analysis

The diamond sprays market is anticipated to be dominated by the electronics and semiconductors industry because this sector needs perfect finishes and precise surfaces, and minimal defects. The electronics and semiconductors industry heavily depends on diamond sprays during chemical mechanical planarization (CMP) processes that require atomic flatness for silicon wafers before additional fabrication steps. During microchip production, any imperfection of the surface will damage conductivity and signal transmission performance as well as heat dissipation capacities; thus, diamond sprays perform essential polishing functions for maintaining yield and performance.

Reductions in the scale and complexity of integrated circuits demand precision surface finishing down to nanometer dimensions, which manufacturers need to implement. The high level of uniformity achieved by diamond sprays makes them the optimal solution for dielectric and copper layers and advanced packaging substrate surface finishing. Diamond sprays maintain their stability under high temperatures, which leads to operational reliability during lengthy fabrication cycles of semiconductors.

The worldwide increase in smartphone, 5G device, electric vehicle, and artificial intelligence system production, together with consumer electronic products, resulted in substantial growth of semiconductor manufacturing capacity. National fabrication facilities that pursue domestic production establish diamond sprays as essential advanced materials since they fulfill demands in quality as well as production volumes for semiconductor materials. Phone manufacturers and electric vehicle makers drive demand in the critical market regions of South Korea and Taiwan, and Japan alongside the United States.

Diamond sprays serve as key materials for electronics manufacturing when they finish both connectors and LED substrates and sensor components as well as process wafers. Technology advancement will lead to an increased demand for pure high-performing diamond sprays in the manufacturing sector.

The Global Diamond Sprays Market Report is segmented on the basis of the following

By Type

- Monocrystalline Diamond Sprays

- Polycrystalline Diamond Sprays

- Nano Diamond Sprays

- Synthetic Diamond Sprays

- Natural Diamond Sprays

By Concentration/Grade

- High Concentration

- Medium Concentration

- Low Concentration

- Customized Formulations

By Application

- Abrasives & Polishing

- Cutting Tool Enhancement

- Electronics and Semiconductors

- Medical Devices

- Metallurgy

- Automotive and Aerospace Components

- Jewelry and Gemstone Finishing

By End-Use Industry

- Electronics & Semiconductors

- Healthcare

- Automotive

- Aerospace

- Metalworking

- Jewelry

Global Diamond Sprays Market: Regional Analysis

Region with the Highest Market Share in the Global Diamond Sprays Market

North America is expected to dominate the global diamond sprays market as it holds

37.5% of the total revenue by the end of 2025. The diamond sprays market will be largely dominated by North America because the region operates a well-developed, technologically advanced base for electronics, aerospace, medical devices, and automotive manufacturing. Leading semiconductor fabrication facilities, along with precision optics manufacturers operating in the United States, heavily depend on ultra-fine polishing solutions that these companies obtain from domestic operations. The CHIPS and Science Act has stimulated domestic chip production, which requires additional processing with high-grade diamond sprays for CMP operations.

The specifications demanded by the medical device and aerospace industries in North America include biocompatibility and corrosion resistance features that diamond sprays deliver flawlessly. Industrial innovation and research and development investments receive large-scale government backing from the region because it collaborates with academic institutions and businesses, and industry.

Organizations include sustainable along with synthetic diamond formulations into their products to fulfill environmental standards, as this trend increases the need for premium items. The combination of robotic facilities and expert labor forces makes North America the leading market for revenue generation in this industry.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR in the Global Diamond Sprays Market

Asia Pacific is projected to register the highest CAGR because of fast industrial development and government backing for domestic production and electronic systems, and automotive market expansion. The countries of China, South Korea, Taiwan, Japan, and India are using substantial investments in precision manufacturing capability because diamond sprays function as essential elements in wafer polishing operations and tool-making, along with optics finishing needs.

The region stands as a manufacturing hub because its low labor costs meet an increasing consumer electronics demand while offering better export possibilities. High-grade diamond sprays are experiencing developing application opportunities because of the expanding medical device sector operating in Japan and South Korea. Advanced finishing technology implementation has increased through local markets due to global competition pressure. The high-growth nature of the market receives a boost from strategic partnership initiatives and localized manufacturing by global companies, which accelerates its expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Diamond Sprays Market: Competitive Landscape

The global diamond sprays market is moderately consolidated with a mix of global players and specialized regional manufacturers competing across quality, innovation, and application-specific solutions. Leading companies like Engis Corporation, Saint-Gobain, NanoDiamond Products (NDP), Hyperion Materials & Technologies, and Lapmaster Wolters offer comprehensive diamond slurry and spray solutions tailored to semiconductors, optics, and precision tooling industries.

These players focus on advanced formulations, including monocrystalline, polycrystalline, and nano-diamond sprays to meet diverse surface finishing demands. Product development, proprietary suspension technologies, and particle uniformity are key differentiators. Strategic moves such as mergers, acquisitions, and R&D investments are common, with firms emphasizing customization and high-concentration grades for critical applications.

Regional manufacturers in Asia-Pacific and Europe are gaining traction by offering cost-effective alternatives and focusing on niche applications like gemstone finishing or metalworking. Companies are also aligning with sustainability trends by adopting synthetic diamond production and eco-friendly dispersing agents.

The competition intensifies as industries demand faster throughput, tighter tolerances, and higher yield rates. Continuous innovation, end-user education, and after-sales support are becoming vital for market leadership, especially as the technology ecosystem evolves rapidly across electronics, aerospace, and medical sectors.

Some of the prominent players in the Global Diamond Sprays Market are

- Engis Corporation

- Saint-Gobain

- Hyperion Materials & Technologies

- Iljin Diamond

- Tomei Diamond Co., Ltd.

- Microdiamant AG (now part of Pureon)

- Lapmaster Wolters

- Kemet Global Ltd.

- Asahi Diamond Industrial Co., Ltd.

- Element Six (De Beers Group)

- CR GEMS Diamond

- Zhongnan Diamond Co., Ltd.

- Huanghe Whirlwind Co., Ltd.

- Tyrolit Group

- Advanced Abrasives Corporation

- Hans Superabrasive Material Co., Ltd.

- Beijing Worldia Diamond Tools Co., Ltd.

- JINGLING Industrial Co., Ltd.

- Fujimi Incorporated

- Zhengzhou Sino-Crystal Diamond Co., Ltd.

- Other Key Players

Recent Developments in the Global Diamond Sprays Market

- January 2025: The GJEPC signed an MoU with De Beers during IIJS Signature 2025 in Mumbai to boost India’s diamond sector through initiatives like the Retail Alliance, aiming to enhance domestic retail and exports.

- February–March 2025: The Indian Aerosols Expo 2025 in Mumbai showcased innovations in sprays across sectors including personal care, automotive, and coatings, with seminars discussing trends and technologies driving growth in the aerosol and diamond spray markets.

- December 2024: bauma CONEXPO INDIA 2024 hosted over 1,000 global brands at Greater Noida, spotlighting construction and mining sector advancements including high-performance coating and surface treatment solutions relevant to the diamond sprays industry.

- November 2024: The Coating & Painting Industry Expo 2024 in New Delhi emphasized advancements in paints, adhesives, and surface protection solutions, fostering collaboration across coatings and diamond-based surface treatment technologies for industrial applications.

- November 2024: The Educate, Enlighten, Empower Global Conference in Mumbai featured sessions on coatings and materials by experts, focusing on innovation and sustainability in surface finishing, including diamond-based sprays for industrial and construction sectors.

- September 2024: ADEX India Bond Expo 2024 in New Delhi focused on adhesives, sealants, and bonding technologies, offering a platform for integrating diamond-enhanced materials into bonding and precision surface finishing markets.

- September 2024: Pidilite showcased “Materials, Spaces & Emotions” at AD Design Show 2024 in Mumbai, exploring sensory materials in architecture and highlighting the role of ultra-fine finishes enabled by diamond-based surface treatments.

- July 2024: The CARATS Surat Diamond Expo 2024 featured loose and lab-grown diamonds, technology, and tools, attracting over 10,000 visitors and achieving ₹125 crores in business, reinforcing Surat’s global role in the diamond ecosystem.

- April 2024: AUM DACRO COATINGS joined India Fastener Show 2024 in New Delhi, unveiling eco-friendly zinc flake coatings and exploring collaborations on advanced protective surface technologies, including those involving diamond-based industrial spray coatings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1,269.0 Mn |

| Forecast Value (2034) |

USD 2,054.1 Mn |

| CAGR (2025–2034) |

5.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 399.9 Mn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Monocrystalline, Polycrystalline, Nano, Synthetic, Natural Diamond Sprays), By Concentration (High, Medium, Low, Customized), By Application (Abrasives & Polishing, Cutting Tool Enhancement, Electronics, Medical Devices, Metallurgy, Automotive & Aerospace, Jewelry Finishing), By End-Use Industry (Electronics, Healthcare, Automotive, Aerospace, Metalworking, Jewelry) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Engis, Saint-Gobain, Hyperion, Iljin, Tomei, Microdiamant, Lapmaster Wolters, Kemet, Asahi, Element Six, CR GEMS, Zhongnan, Huanghe Whirlwind, Tyrolit, Advanced Abrasives, Hans, Worldia, JINGLING, Fujimi, and Sino-Crystal., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Diamond Sprays Market?

▾ The Global Diamond Sprays Market size is estimated to have a value of USD 1,268.0 million in 2025 and is expected to reach USD 2.054.1 million by the end of 2034.

What is the size of the US Diamond Sprays Market?

▾ The US Diamond Sprays Market is projected to be valued at USD 399.9 million in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 629.3 million in 2034 at a CAGR of 5.2%.

Which region accounted for the largest Global Diamond Sprays Market?

▾ North America is expected to have the largest market share in the Global Diamond Sprays Market, with a share of about 37.5% in 2025.

Who are the key players in the Global Diamond Sprays Market?

▾ Some of the major key players in the Global Diamond Sprays Market are Engis, Saint-Gobain, Hyperion, Iljin, Tomei, Microdiamant, Lapmaster Wolters, and many others.

What is the growth rate in the Global Diamond Sprays Market in 2025?

▾ The market is growing at a CAGR of 5.5 percent over the forecasted period of 2025.