The Diesel Fuel Water Separator Market encompasses systems and technologies developed to extract water and contaminants from diesel fuel, thus optimizing quality and ensuring its proper function in diesel engines. Such separators are critical components in industries relying heavily on diesel engines, such as transportation, agriculture, and industrial sectors.

The Diesel Fuel Water Separator Market is set for significant expansion, due to increasing consumer demands for enhanced fuel efficiency and stringent regulatory standards. These systems, are essential in protecting engine performance and lowering maintenance costs across industries like transportation, agriculture, and industrial manufacturing. This is similar to how financial risk management in the Fintech Market ensures long-term stability by protecting systems from inefficiencies and disruptions.

Current market dynamics reveal an increased emphasis on operational reliability and engine longevity as companies look to reduce risks associated with fuel contamination, such as corrosion and reduced combustion efficiency. Advanced water separators address these concerns while aligning with wider industry trends toward greater environmental sustainability and regulatory compliance.

Likewise, significant technological advances are taking place that aim to enhance separation efficiency as well as ease of integration into existing fuel management systems. These technological shifts resemble the rise of digital payment infrastructure in the Fintech Market, where seamless integration and compliance drive adoption.

Key Takeaways

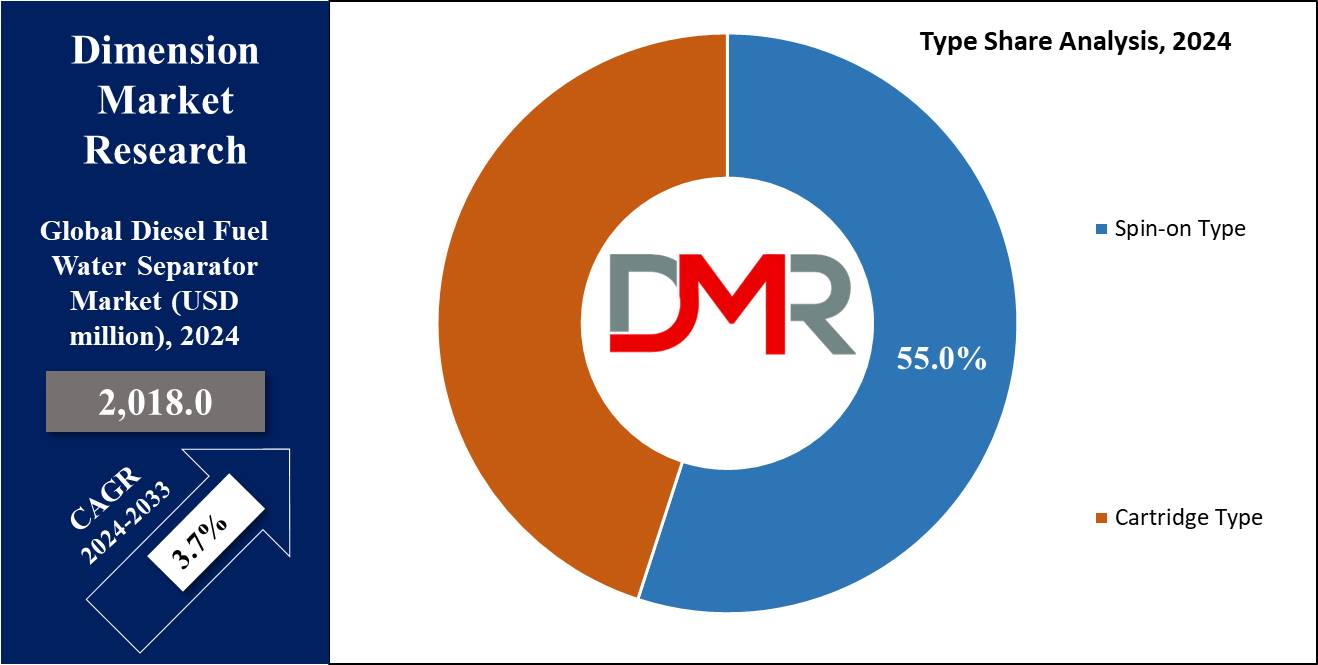

- Market Expansion: The Diesel Fuel Water Separator Market is set to grow from USD 1,941.15 million in 2024 to USD 3,507.54 million by 2033, with a CAGR of 3.7%, driven by rising fuel efficiency needs and regulatory pressures.

- Segment Leadership: Spin-on Type separators lead the market with a 55% share in 2023, appreciated for their ease of use. On-road vehicles dominate the application segment with a 60% share, highlighting their critical role in commercial transport.

- Growth Drivers: Key factors include industrialization, the rise of hybrid power diesel generators, and major infrastructure investments, all boosting the demand for efficient fuel management systems.

- Market Constraints: Challenges include safety issues with diesel fuel handling, environmental concerns about diesel emissions, and the growing appeal of alternative power technologies.

- Trends: Emphasis on emission control technologies and increased demand for small marine engines are shaping the market, necessitating advanced filtration solutions to meet evolving standards.

Use Cases

- Industrial Machinery: Diesel fuel water separators protect industrial equipment by removing contaminants, ensuring reliable operation, and reducing maintenance costs in sectors like construction and manufacturing.

- Transportation Fleet: In trucks and buses, these separators enhance fuel quality and engine performance, crucial for fleet efficiency and regulatory compliance.

- Hybrid Generators: For hybrid diesel generators combining diesel with renewable energy, separators maintain fuel cleanliness, supporting efficiency and longevity in sectors like telecom and healthcare.

- Infrastructure Projects: In large-scale infrastructure projects, separators ensure diesel fuel quality for construction equipment, preventing downtime and meeting environmental standards.

- Marine Engines: For small marine engines in recreational and commercial vessels, separators ensure reliable operation by maintaining clean fuel in challenging maritime conditions.

Driving Factors

Industrialization and Urbanization Fuel Market Demand

Rapid industrialization and urbanization are driving significant market demand for diesel Fuel Water Separators. As countries rapidly industrialize and urbanize, diesel-powered machinery and equipment have seen increased use across various sectors such as construction, manufacturing, and transport. As diesel engine usage skyrockets, its increasing use has only compounded the need for efficient fuel management solutions like water separators to help preserve engine performance and minimize downtime. Urban areas, with their dense infrastructure and high vehicle densities, compound this demand further for diesel fuel separators to guarantee optimal quality fuel and operational reliability for commercial and public transport systems.

Hybrid Power Diesel Generators Support Market Growth

Hybrid power diesel generators have become an essential factor in fueling market expansion for diesel fuel water separators. Hybrid generators that combine diesel engines with alternative energy sources have rapidly grown in popularity due to their improved fuel efficiency and reduced emissions.

These hybrid systems rely heavily on diesel engines, necessitating advanced fuel filtration technologies to maximize quality fuel delivery and engine longevity. As hybrid generators become increasingly prevalent across industries such as telecom, healthcare, and remote locations, their deployment requires effective diesel fuel water separators to safeguard the performance and reliability of hybrid power systems from contamination issues.

The growing

Healthcare Analytics Market further underscores the need for reliable power solutions, as data-driven healthcare facilities depend on uninterrupted electricity to maintain critical analytics systems. Hybrid generators ensure continuous power for hospitals and clinics, supporting real-time healthcare analytics while advanced fuel filtration protects these systems from operational disruptions caused by contaminated diesel fuel.

An Increase in Investments into Infrastructure Development Projects Drive Market Demand

Rising investments in infrastructure development projects are fueling the expansion of the Diesel Fuel Water Separator Market. Infrastructure projects of any scale - roads, bridges, and urban transit systems included - often necessitate using diesel-powered construction equipment and machinery on an extensive scale.

Due to their scale and intensity, projects of this size require comprehensive fuel management solutions to ensure continuous operations while mitigating maintenance issues. As governments and private entities invest heavily in infrastructure development, the demand for diesel fuel water separators increases exponentially; driven by large-scale operations requiring reliable equipment that is compliant with environmental regulations.

Growth Opportunities

Rising popularity of hybrid power diesel generators

Hybrid Power Diesel Generators The advent of hybrid-power diesel generators represents an impressive growth opportunity in the diesel fuel water separator market. These hybrid systems, which combine diesel engines and renewable energy sources, have become increasingly popular due to their improved fuel efficiency and reduced environmental impact.

As industries and commercial sectors increasingly utilize high-power generators for their operational requirements, demand for high-performance fuel filtration systems continues to surge. Diesel fuel water separators play an essential role in the optimal performance of hybrid systems by effectively eliminating contaminants that contaminate their fuel supply, thus contributing to greener and more cost-efficient energy solutions.

Government Regulations

Strict government regulations regarding emissions and fuel quality further drive market opportunity. Governments worldwide are adopting stringent standards to curb emissions and minimize environmental impact, prompting more businesses to adopt technologies to ensure compliance. Diesel fuel water separators play a pivotal role in helping businesses meet these regulations by maintaining high-quality and cost efficient fuel quality to support compliance efforts while lowering penalties risk.

The growing

Biofuel Market also aligns with these regulatory trends, as biofuels—often blended with conventional diesel require advanced filtration to prevent engine damage and ensure optimal combustion efficiency. By integrating effective fuel water separators, industries can meet both traditional diesel and biofuel compliance standards, supporting cleaner energy transitions while adhering to environmental mandates.

Expansion of the Diesel Engine Market

The growth of the diesel engine market offers another great opportunity. Diesel engines continue to be widely utilized across applications ranging from transportation and construction to agriculture, increasing demand for effective fuel management systems such as reliable diesel fuel water separators to ensure engine longevity and operational reliability.

The expanding

Agriculture Biotechnology Market further drives this demand, as advanced farming equipment powered by diesel engines plays a crucial role in precision agriculture and biotech-driven crop production. Reliable fuel filtration is essential to protect these high-performance engines from water and contaminants, ensuring seamless operation in genetically modified crop cultivation, automated irrigation systems, and other biotech-dependent agricultural processes.

Key Trends

Power Generation Sector Leadership

The power generation industry remains an influential player in the Diesel Fuel Water Separator Market. As global energy consumption changes, there has been an emphasis on maintaining the reliability and efficiency of diesel-powered generators used for providing backup power or supporting critical infrastructure.

Demand for robust diesel fuel water separators stems from their need to maintain fuel quality in high load/high demand environments while simultaneously preventing contamination - reinforcing its status as a market force. Power generation facilities continue investing in advanced separation technologies to increase performance while simultaneously decreasing maintenance costs further strengthening this sector's significant influence on market trends.

Focus on Emission Control Technologies

2023 is witnessing an increased interest in emission control technologies. Governments worldwide are adopting stringent emissions regulations to combat environmental pollution, prompting governments and fuel filtration manufacturers alike to adopt advanced filtration systems such as diesel fuel water separators to meet regulatory compliance. Such separation technologies must also integrate seamlessly into sustainable practices for full compliance and support of sustainable practices.

Demand for Small Marine Engines

Rising demand for small marine engines is another prominent market trend. Used both recreationally and commercially, small marine engines require effective fuel management systems to ensure reliable operation and prevent any fuel-related issues from emerging. Leisure boating and small maritime activities increase leisure boating needs that necessitate fuel water separators that specifically suit these engines' unique characteristics; their proliferation also points out how these solutions have become widely applied across a wide variety of engine types as well as specific market requirements.

Restraining Factors

Potential Safety Risks Associated with Storage and Handling

Storage and handling risks related to diesel fuel hurt the Diesel Fuel Water Separator Market. Diesel fuel poses serious fire hazards that necessitate stringent storage and handling protocols for its safekeeping. Due to these risks, sophisticated safety systems and fuel management solutions that include effective water separators must be employed to minimize potential accidents and ensure safe operations.

Although comprehensive safety solutions are a necessity for market participants, their implementation may present unique challenges and costs to implement them effectively. Companies must invest in rigorous safety standards and technologies that may hinder overall market expansion by raising entry barriers or operational expenses. Technologies, which can affect overall market growth by raising entry barriers and operational costs.

Concerns over the Environmental Impact of Diesel Engines

Concerns regarding the environmental impact of diesel engines represent another key impediment to the growth of the Diesel Fuel Water Separator Market. Diesel engines are well known for emitting higher levels of pollutants compared with alternative power sources like electric and hydrogen-powered engines, respectively.

As global awareness about climate change and environmental degradation increases, there has been an increasing push for cleaner energy solutions. A shift towards greener technologies could lessen demand for diesel engines and, consequently, diesel fuel water separators. According to recent studies, diesel engines contribute approximately 30% of transportation emissions - emphasizing the urgency for cleaner alternatives - potentially impacting traditional filtration solutions market share.

Availability of Alternative Power Generation Technologies

The availability and adoption of alternative power generation technologies, such as renewable energy sources and advanced hybrid systems, act as a restraint on the Diesel Fuel Water Separator Market. Technologies like solar panels, windmills, and battery storage are seen as viable alternatives to diesel due to their lower environmental impact and long-term cost benefits. Renewable energy sector growth projections show a compound annual rate of 8 percent during this decade, signaling an increasingly prominent role away from diesel-based power production.

Research Scope Analysis

By Type

Spin-on Type held the highest market share among product type segments for diesel fuel water separators in 2023 at 55%. Its success in this segment can be attributed to its ease of installation and maintenance which appealed to users across various applications; additionally, its efficient removal of water and particulates from diesel fuel made it an attractive option in both standard operational environments as well as demanding operating environments.

However, cartridge-type separators accounted for 35% of the market share. Cartridge Type separators are widely acclaimed for their superior filtration efficiency and ability to manage higher fuel volumes - which make them particularly suitable for high-performance engines and heavy machinery.

Their focus on fine filtration and durability also appeals to industries where precise fuel management is important such as industrial applications or high-end automotive systems; although their market share compared with Spin-on Type was smaller overall. Nonetheless, Cartridge Type remains a go-to choice when advanced filtration capabilities are required; even though its market share is smaller compared with Spin-on Type.

10% of the market is represented by other product types, including tailored or customized solutions that specifically address industry needs. This segment represents an emerging interest in tailored filtration systems with advanced features designed for niche applications that serve specific industry requirements - showing just how diverse market needs really can be.

By Application

In 2023, On-Road Vehicles held a significant 60% market share of the Diesel Fuel Water Separator Market by application type segment. This strong performance underscores the critical need for effective fuel management in on-road applications where diesel engines are widely utilized such as trucks, buses, and commercial vehicles requiring emissions regulations compliance; due to this emphasis on maintaining high-quality fuel for optimal engine performance and compliance driving demand for these separators in this segment.

Off-road vehicles held an impressive 30% share of the market, representing agricultural machinery, construction equipment, and other diesel-powered off-road vehicles that operate under demanding conditions. Off-road vehicles require durable fuel separators that can withstand tough operating environments while guaranteeing engine efficiency - thus contributing to this segment's strong market presence.

10% of the market can be divided up between various niche applications and vehicles that fall under "Other." This category represents niche uses where diesel fuel water separators are utilized such as marine engines or power generation units; its smaller market share only serves to highlight their numerous applications across sectors and underscore their ongoing innovation of tailored filtration solutions.

The Diesel Fuel Water Separator Market Report is segmented based on the following:

By Type

- Spin-on Type

- Cartridge Type

By Application

- On-Road Vehicles

- Off-Road Vehicles

- Other

Regional Analysis

North America: The North American Diesel Fuel Water Separator Market is projected to experience significant expansion, with the U.S. set to lead in terms of market share and advanced industrial base. Between 2024-2031, the U.S. is predicted to lead this market due to high automotive sector fuel injection system demand coupled with stringent government regulations for emissions control.

North America held a 22.7% share in global sales during 2023; due to substantial investments made into transportation infrastructure and industrial applications combined with robust regulatory frameworks - its continued market growth should only accelerate in the coming years!

Europe: Europe is projected to experience rapid market expansion during this period, driven by environmental regulations and efforts to reduce diesel engine emissions. Europe was estimated to account for approximately 21.3% of the global market in 2023; its share increased as more diesel-based vehicles were manufactured and technological advances made available through filtration systems contributed significantly. Germany, France, and the UK led this expansion through proactive regulatory measures and industrial investments respectively.

Asia Pacific held a significant 25.4% market share for diesel fuel water separators worldwide in 2023, which it expected to maintain due to rapid industrialization, urbanization, and heavy reliance on diesel-powered machinery in sectors like transportation, agriculture, and construction. Asia Pacific market growth will be propelled forward by increasing diesel vehicle production coupled with new advancements in fuel management technology; key countries like China India Japan Southeast Asia all play key roles in driving this phenomenon forward through major infrastructure projects and industrial activities.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Parker Hannifin remains a dominant force in the diesel fuel water separator market, drawing upon its extensive engineering capabilities to craft cutting-edge filtration solutions. Renowned for their reliability and advanced technology, Parker Hannifin's separators are designed to increase both engine performance and fuel quality, meeting industry standards without fail - making them the first choice of many applications that utilize them.

Cummins integrates its fuel water separators into an extensive line of diesel engines to reflect its strategic focus on optimizing engine performance and emissions control. Leveraging advanced filtration technology combined with their vast engine design experience, Cummins delivers solutions that ensure optimal engine protection and fuel efficiency - positioning themselves as key players in the market.

MANN+HUMMEL and Bosch are also major players, with MANN+HUMMEL known for its comprehensive filtration solutions that remove contaminants and water from diesel fuel, helping engines last longer while cutting maintenance costs. Bosch leverages technological expertise to offer cutting-edge filtration systems meeting high-performance standards; both companies' dedication to innovation and quality has cemented their positions as leading players in the global diesel fuel water separator market.

Some of the prominent players in the Global Diesel Fuel Water Separator Market are:

- Parker Hannifin

- Cummins

- MANN+HUMMEL

- Denso

- Bosch

- Mahle

- Donaldson

- Hefei Wal Fuel Systems

- Guangxi Watyuan

- SuZhou Difite

- Bengbu Jinwei

- Zhejiang Universe

Recent developments

- In 2022, February: Advanced filtration technologies were introduced, enhancing the efficiency of water removal and reducing operational costs.

- In 2022, August: New high-durability materials were developed, increasing the lifespan and reliability of separators in extreme operating conditions.

- In 2023, April: Integration of smart sensors into separators allowed for real-time monitoring and predictive maintenance, reducing unexpected failures.

- In 2023, October: Innovations in separator design led to reduced size and weight, facilitating easier installation and integration in compact engine spaces.

- In 2024, January: Improved eco-friendly models were launched, aligning with stricter environmental regulations and enhancing fuel quality while minimizing waste.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 1,941.15 million |

| Forecast Value (2032) |

USD 3,507.54 million |

| CAGR (2023-2032) |

3.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Type (Spin-on Type, Cartridge Type), By Application(On-Road Vehicles, Off-Road Vehicles, Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Parker Hannifin, Cummins, MANN+HUMMEL, Denso, Bosch, Mahle, Donaldson, Hefei Wal Fuel Systems, Guangxi Watyuan, SuZhou Difite, Bengbu Jinwei, Zhejiang Universe |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |