Market Overview

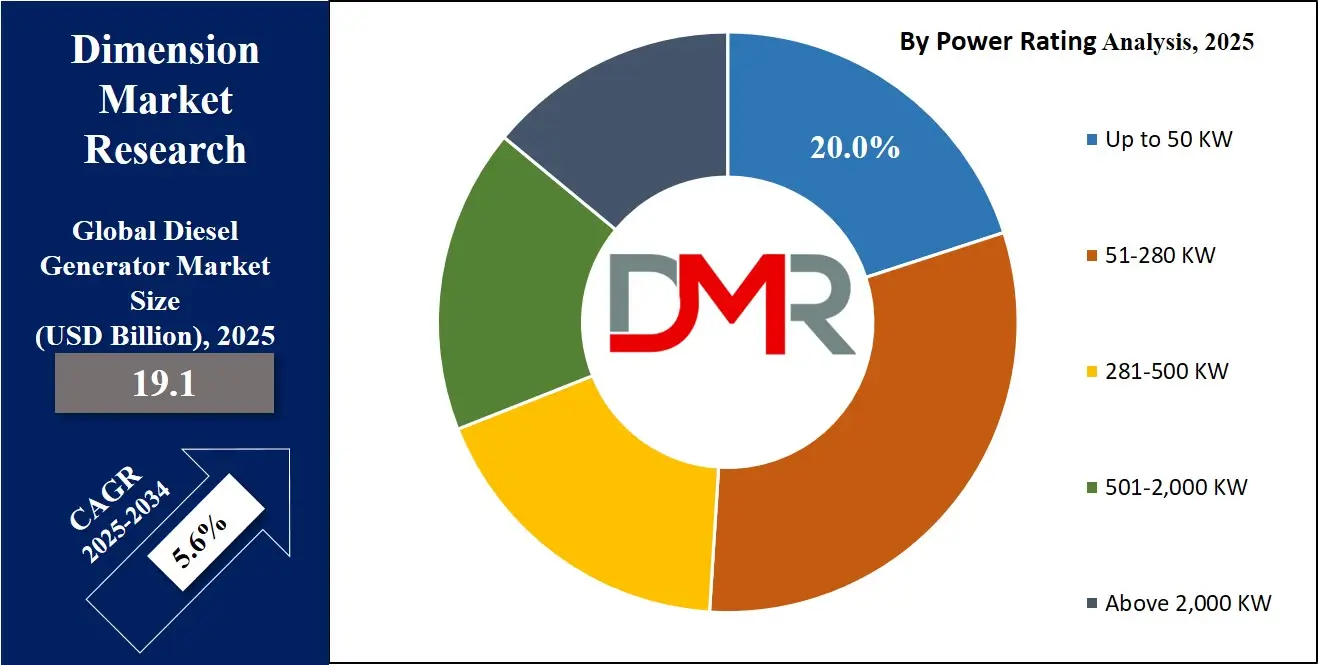

The Global Diesel Generator Market is projected to reach

USD 19.1 billion in 2025 and is expected to grow to

USD 31.3 billion by 2034, registering a

CAGR of 5.6%. This growth is driven by growing demand for reliable backup power solutions, rising industrialization, and infrastructure development across emerging economies.

A diesel generator is a mechanical device that converts the chemical energy of diesel fuel into electrical energy through the process of combustion and electromagnetic induction. It typically consists of a diesel engine and an alternator integrated, providing a reliable source of backup or primary power supply in off-grid or emergency conditions.

These generators are widely used across industries, commercial buildings, data centers, hospitals, and construction sites where a consistent power supply is critical. Known for their fuel efficiency, durability, and scalability, diesel generators are also favored for their ability to operate in remote locations, withstand harsh environments, and run for extended durations with minimal maintenance.

The global diesel generator market continues to witness robust demand, driven by growing energy insecurity, unreliable grid infrastructure in developing economies, and a growing need for backup power across industrial and residential sectors. In regions like Sub-Saharan Africa and parts of Asia, where grid access remains inconsistent, diesel generators serve as a primary power solution, especially in mining operations, manufacturing facilities, and remote construction projects. Moreover, the rising incidence of natural disasters and extreme weather conditions globally is further bolstering the demand for diesel gensets as critical emergency power backup systems.

Urbanization and industrialization trends are accelerating the adoption of diesel-powered generators across commercial establishments and data centers, particularly in fast-developing economies. High power density, low startup time, and scalability in megawatt capacities make these generators suitable for critical applications, such as telecom towers, airports, hospitals, and government facilities. Moreover, technological advancements such as hybrid integration, remote monitoring systems, and enhanced emission control technologies are reshaping the diesel generator landscape, making them more compliant with stringent environmental norms and efficiency standards.

While the market is often scrutinized due to its environmental impact, diesel generators are gradually evolving with innovations in cleaner-burning engines and biodiesel compatibility. Governments and private enterprises are investing in smart diesel generator solutions equipped with IoT-enabled monitoring, predictive maintenance algorithms, and load management capabilities.

As decarbonization pressures mount globally, the market is also witnessing a hybrid shift where diesel units are being paired with battery storage systems and renewable sources to balance reliability and sustainability. This transition marks a new era for the diesel generator market, where performance meets evolving energy demands and regulatory expectations.

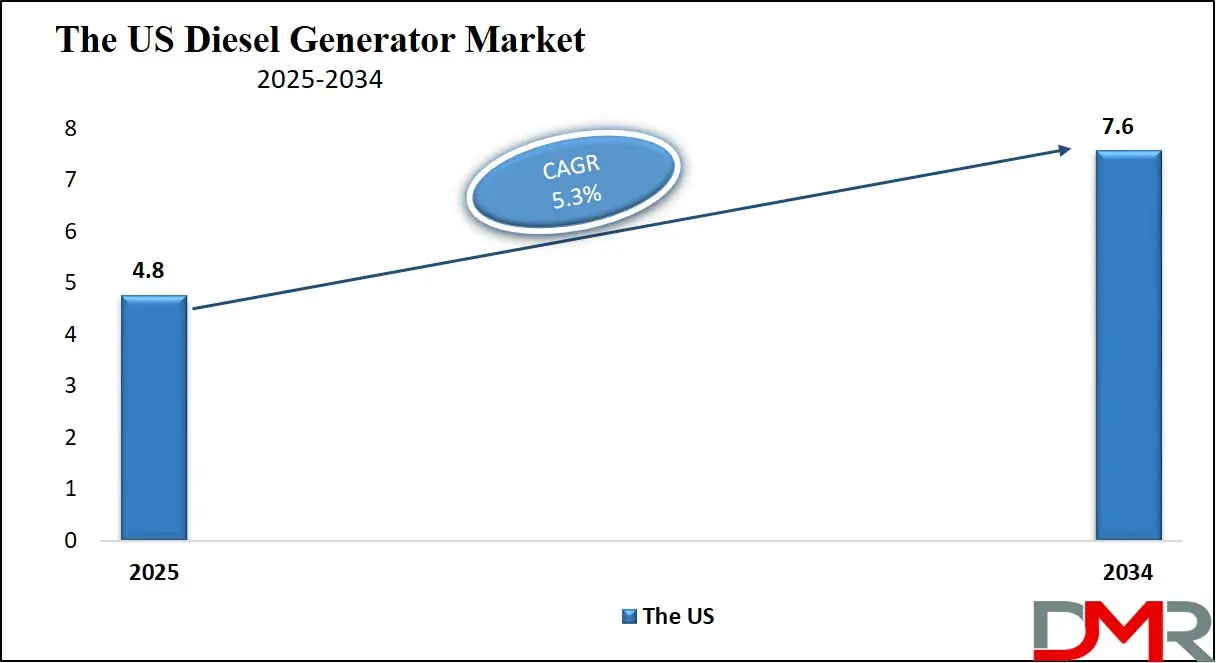

The US Diesel Generator Market

The U.S. Diesel Generator Market size is projected to be valued at USD 4.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 7.6 billion in 2034 at a CAGR of 5.3%.

The U.S. diesel generator market remains a vital component of the countrys energy infrastructure, driven by a consistent need for dependable backup power in sectors such as healthcare, data centers, manufacturing, and emergency services. Frequent extreme weather events, including hurricanes and wildfires, have heightened the demand for standby power systems across residential, commercial, and public sector applications.

Diesel generators are especially valued for their fuel efficiency, rapid startup capabilities, and ability to deliver high power output during prolonged outages. Their widespread deployment in critical facilities like hospitals, telecommunication hubs, and disaster recovery centers underlines their importance in ensuring operational continuity and resilience during grid failures.

Moreover, the rise of remote work, digital transformation, and increased reliance on uninterrupted internet connectivity has led to the growing adoption of diesel gensets in U.S. data centers and IT infrastructure. With the expansion of distributed energy systems and microgrids, diesel-powered backup generators are often integrated alongside solar PV and battery storage to ensure reliability.

Regulatory developments around emissions are pushing manufacturers to invest in cleaner diesel engine technologies, with ultra-low sulfur diesel (ULSD) and Tier 4-compliant models gaining traction. Additionally, sectors such as construction and oil & gas continue to use portable and industrial diesel generators for off-grid power generation, underlining the versatility and enduring relevance of this market in the evolving U.S. energy landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Diesel Generator Market

Europes diesel generator market is projected to reach a value of

2.1 billion USD in 2025, reflecting steady growth fueled by growing industrial automation, infrastructure modernization, and stringent regulations on power reliability and emissions. The regions focus on upgrading aging power infrastructure and the rising demand for backup power in sectors such as manufacturing, healthcare, and telecommunications are significant drivers. Additionally, Europes emphasis on sustainable and energy-efficient solutions is pushing manufacturers to innovate with low-emission diesel generators and hybrid power systems that comply with stringent environmental standards.

The markets moderate compound annual growth rate of 5.1% indicates a balanced expansion driven by both industrial and commercial sectors investing in resilient energy solutions. Governments across Europe are encouraging the adoption of diesel gensets with advanced technologies like remote monitoring, IoT integration, and automated control systems to improve operational efficiency and reduce downtime.

This supportive regulatory landscape, integrated with ongoing investments in renewable energy integration and smart grid initiatives, is shaping a dynamic market environment. As a result, Europe remains a crucial region for manufacturers aiming to deliver cutting-edge, compliant, and reliable diesel power generation solutions.

The Japanese Diesel Generator Market

Japans diesel generator market is expected to reach a valuation of 0.3 billion USD in 2025, reflecting steady demand in a mature and technologically advanced economy. The countrys industrial sector, including manufacturing and infrastructure development, continues to require reliable backup power solutions to mitigate risks from power outages and natural disasters such as earthquakes and typhoons.

Japanese companies and institutions emphasize high efficiency and low emissions, leading to a preference for advanced diesel generators integrated with smart control systems and environmentally friendly technologies. This focus on innovation supports ongoing adoption despite the relatively smaller market size compared to other regions.

With a compound annual growth rate of 3.5%, Japans market growth is moderate but consistent, driven by regulatory measures aimed at improving energy efficiency and reducing carbon footprints. The governments push towards cleaner energy sources and hybrid power systems encourages the integration of diesel generators with renewable energy solutions.

Additionally, Japans aging infrastructure necessitates periodic upgrades, further sustaining demand. Manufacturers operating in this region prioritize cutting-edge features such as IoT connectivity, remote diagnostics, and quieter, more fuel-efficient engines to meet the specific needs of Japanese consumers and maintain competitiveness in this evolving market.

Global Diesel Generator Market: Key Takeaways

- Market Value: The global diesel generator market is expected to reach a value of USD 31.3 billion by 2034 from a base value of USD 19.1 billion in 2025 at a CAGR of 5.6%.

- By Design Segment Analysis: Stationary generators are poised to consolidate their dominance in the design type segment, capturing 53.8% of the total market share in 2025.

- By Power Rating Model Segment Analysis: 51-280 KW power rating is anticipated to maintain its dominance in the power rating segment, capturing 31.0% of the total market share in 2025.

- By Application Segment Analysis: Standby Power applications are expected to dominate the application segment, capturing 70.5% of the market share in 2025.

- By End-User Segment Analysis: Industrial Users are anticipated to maintain their dominance in the end-user segment, capturing 41.9% of the total market share in 2025.

- Regional Analysis: Asia Pacific is anticipated to lead the global diesel generator landscape with 52.6% of total global market revenue in 2025.

- Key Players: Some key players in the global diesel generator market are Caterpillar Inc., Cummins Inc., Kohler Co., Generac Holdings Inc., MTU Onsite Energy (Rolls-Royce Power Systems), Atlas Copco, Mitsubishi Heavy Industries Ltd., Wärtsilä Corporation, Honda Motor Co., Ltd., Doosan Corporation, Perkins Engines Company Ltd., Hyundai Heavy Industries Co., Ltd., FG Wilson, Himoinsa S.L., Kirloskar Oil Engines Ltd., Mahindra Powerol, Yanmar Co., Ltd., Baudouin (Weichai Group), SDMO Industries (KOHLER SDMO), Ashok Leyland Ltd, and Other Key Players.

Global Diesel Generator Market: Use Cases

- Data Centers and IT Infrastructure: Data centers require constant, uninterrupted power to safeguard sensitive information and ensure seamless data processing. Diesel generators serve as essential backup systems in these high-demand environments, offering rapid response times and long-duration power supply during grid failures. Equipped with high-efficiency processors and integrated with smart load-sharing technology, modern diesel gensets ensure redundancy and uptime through automatic transfer switches (ATS) and real-time monitoring systems. Tier 4-compliant models are preferred to meet emission regulations while still delivering scalable power, making them a critical part of power reliability strategies in colocation centers, cloud facilities, and enterprise IT setups.

- Remote Construction and Mining Operations: In off-grid industrial settings such as mining sites and remote construction zones, diesel generators provide the primary power source for heavy machinery, lighting systems, and temporary housing. These environments often lack access to centralized electricity, and diesel gensets—known for their rugged design and fuel efficiency—enable 24/7 operations. Advanced diesel generator models used in these sectors include high-torque engines, sound-attenuated enclosures, and digital controllers for improved fuel management and maintenance scheduling. Their portability and reliability make them indispensable in geographies with limited infrastructure and fluctuating power needs.

- Healthcare and Emergency Services: Hospitals, clinics, and emergency response centers rely on diesel generators to ensure life-saving equipment remains functional during outages. These backup generators are connected to critical systems such as ventilators, surgical theaters, and ICU monitors via automatic switching mechanisms, activating within seconds of a power failure. High-capacity standby diesel generators, often supported by dual-fuel configurations, offer redundancy and ensure compliance with strict healthcare regulations. Incorporating IoT-based diagnostic tools and low-noise engine blocks, they are optimized for both urban hospitals and mobile medical units, reinforcing public safety and healthcare delivery during crises.

- Residential and Commercial Real Estate: With growing grid instability in both developed and developing economies, residential and commercial buildings are adopting compact diesel generators to mitigate power outages. Small to mid-size diesel gensets are commonly used in apartment complexes, retail spaces, and office buildings to power elevators, lighting, and HVAC systems. Integrated with smart automation systems and remote control panels, these units provide users with efficient energy management. Developers also favor diesel-powered backup systems for new smart building designs due to their cost-effectiveness, longevity, and compatibility with hybrid energy setups that include solar and battery storage.

Global Diesel Generator Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- Diesel generators contribute significantly to backup power in critical infrastructure across the U.S.

- Approximately 40% of U.S. commercial buildings rely on backup generators, many powered by diesel.

- Diesel generator usage spikes during grid outages, with industrial and healthcare sectors leading demand.

International Energy Agency (IEA)

- Diesel generators provide over 30% of off-grid power supply in developing countries.

- In regions with unstable electricity grids, diesel gensets serve as a primary energy source for nearly 60% of small industries.

- IEA projects that diesel generators will remain vital in remote areas despite rising renewable penetration until at least 2030.

European Environment Agency (EEA)

- The transport and industrial sectors are the largest consumers of diesel generator power in Europe.

- Diesel gensets account for approximately 15% of standby power installations in EU industrial facilities.

- Emissions standards for diesel generators have tightened by over 25% in the last decade across Europe.

Japan Ministry of Economy, Trade and Industry (METI)

- Diesel generators are integral in Japans disaster resilience plans, especially in hospitals and data centers.

- Over 70% of critical facilities in Japan maintain diesel generator systems for emergency power.

- Government incentives support the upgrade to high-efficiency diesel generators with smart control technologies.

India Ministry of Power

- Diesel generators account for about 12% of Indias total backup power capacity.

- In rural and remote areas, over 50% of power backup installations use diesel gensets.

- The government is encouraging cleaner diesel technologies to reduce particulate emissions in urban centers.

China National Energy Administration (NEA)

- Diesel generators are widely used in Chinas manufacturing sector for continuous power supply during grid disruptions.

- Approximately 20% of small and medium enterprises (SMEs) rely on diesel gensets for uninterrupted operations.

- NEA promotes hybrid systems combining diesel generators with solar power in remote and off-grid regions.

South African Department of Energy

- Diesel generators supply around 25% of backup power in South Africas mining industry.

- Frequent grid instability results in a growing market for portable and stationary diesel gensets.

- Government programs are underway to improve fuel efficiency standards for diesel generator sets.

Australian Energy Regulator (AER)

- Diesel generators are commonly used in remote mining and agricultural operations in Australia.

- Nearly 35% of regional and off-grid power installations include diesel gensets as a primary or backup source.

- Regulatory frameworks encourage the integration of diesel generators with renewable energy sources to reduce the carbon footprint.

United Nations Environment Programme (UNEP)

- Diesel generators contribute significantly to greenhouse gas emissions in developing countries.

- UNEP supports initiatives promoting cleaner diesel technologies and hybrid power systems.

- Policies are advancing globally to phase out older, high-emission diesel gensets in favor of more efficient models.

World Bank Energy Sector

- Diesel generator installations have increased by 15% over the past five years in emerging markets.

- World Bank funding supports diesel-to-renewable hybrid projects to improve energy access and reduce pollution.

- Diesel gensets remain critical in regions with unreliable grids, accounting for 40% of installed power capacity in off-grid zones.

Global Diesel Generator Market: Market Dynamics

Global Diesel Generator Market: Driving Factors

Increasing Demand for Reliable Backup Power in Critical Infrastructure

The growing dependence on uninterrupted power in sectors like healthcare, data centers, telecom, and emergency response has significantly driven the adoption of diesel generators. Diesel gensets offer high reliability, quick start-up, and long operational duration, making them ideal for backup power solutions in mission-critical facilities. In regions facing frequent natural disasters or unstable grid infrastructure, such as parts of Asia and North America, diesel generators are being integrated into emergency preparedness protocols, ensuring resilience and power continuity during outages.

Expansion of Industrialization in Emerging Economies

Rapid industrial growth in countries across Asia-Pacific, Latin America, and Africa is amplifying the demand for off-grid and supplemental power sources. Industries such as mining, oil & gas, and construction in remote areas rely on industrial diesel generators to power heavy machinery and temporary infrastructure. The durability, fuel efficiency, and scalability of these generators make them indispensable in locations where grid access is limited or unreliable, further boosting the market's expansion in developing economies.

Global Diesel Generator Market: Restraints

Stringent Emissions Regulations and Environmental Concerns

Government-imposed environmental regulations aimed at reducing greenhouse gas emissions are posing challenges to the diesel generator market. Regulatory bodies in the U.S., EU, and parts of Asia require compliance with Tier 4 and Euro Stage V standards, pushing manufacturers to invest heavily in emission control technologies. The environmental impact of diesel gensets, particularly carbon and NOx emissions, has prompted criticism, resulting in a gradual shift toward cleaner alternatives such as gas-powered or hybrid generator systems.

Rising Fuel Costs and Maintenance Overheads

Fluctuations in diesel fuel prices and growing operational costs associated with maintenance, especially for older generator fleets, serve as significant restraints. Compared to renewable or battery-powered alternatives, diesel generators involve higher long-term expenses due to refueling, lubrication, and engine servicing. For budget-conscious sectors like small businesses and residential users, these costs can deter adoption, particularly as solar-battery systems become more affordable and accessible.

Global Diesel Generator Market: Opportunities

Integration with Renewable and Hybrid Energy Systems

One of the most promising opportunities lies in the integration of diesel generators with solar panels, battery storage, and smart energy management systems. These hybrid configurations offer enhanced fuel efficiency, load balancing, and reduced environmental impact. Microgrid developers and remote installations are combining diesel gensets with renewables to optimize performance and reduce emissions. This approach is opening new market avenues, especially in off-grid villages, military bases, and island economies.

Technological Advancements in Smart Generator Systems

Advances in generator control technologies, IoT-based monitoring, and predictive maintenance platforms are transforming diesel generators into smarter, more efficient systems. Features such as automatic load sharing, real-time diagnostics, and remote control interfaces are helping end-users reduce downtime and improve operational efficiency. These innovations are particularly attractive to commercial users managing large generator fleets, enabling cost-effective performance tracking and lifecycle management.

Global Diesel Generator Market: Trends

Growing Demand for Portable and Mobile Diesel Generators

With the rise of temporary infrastructure needs in events, disaster recovery, and mobile healthcare units, portable diesel generators are gaining traction. These compact units offer quick deployment, ease of transport, and sufficient power output for short- to medium-term applications. Increasing use in military operations, film production, and mobile medical services highlights this emerging trend in both developed and developing regions.

Shift toward Bio-Diesel and Alternative Fuels

To address environmental concerns while maintaining the benefits of diesel generators, the market is witnessing a gradual shift toward bio-diesel-compatible engines and alternative fuels like HVO (Hydrotreated Vegetable Oil). Manufacturers are launching gensets designed to run efficiently on cleaner fuels without compromising power output or engine durability. This trend aligns with global decarbonization efforts and offers a transitional path for industries looking to reduce their carbon footprint without fully abandoning diesel technology.

Global Diesel Generator Market: Research Scope and Analysis

By Design Analysis

In the design segment of the global diesel generator market, stationary generators are expected to solidify their dominance by capturing 53.8% of the total market share in 2025. This dominance is largely attributed to their widespread use across industries such as manufacturing, data centers, healthcare, oil and gas, and large-scale commercial infrastructure. Stationary diesel generators are permanently installed units designed to deliver high-capacity power output for extended durations.

Their robust build, high efficiency under continuous load, and compatibility with advanced load management systems make them ideal for mission-critical operations where downtime is not an option. These generators are often integrated with automatic transfer switches and remote monitoring technologies, enabling seamless operation during grid failures. Their scalability and adaptability for both prime and standby power applications further reinforce their position in large industrial ecosystems.

On the other hand, portable diesel generators serve a different set of requirements, catering to mobility and temporary power needs. While they hold a smaller share of the market, their relevance is steadily growing in construction sites, remote field operations, disaster response, and event management. Portable units offer the flexibility to be easily transported, deployed, and stored, making them a vital asset in locations without fixed infrastructure or where intermittent power is required. Advancements in lightweight materials, compact engine design, and improved fuel efficiency are enhancing the usability of these generators.

Moreover, their rising adoption among residential users and small businesses for backup power during grid outages, particularly in regions prone to natural disasters, is contributing to incremental demand. While not designed for high-load, long-duration use like stationary units, portable diesel gensets continue to carve out a niche in dynamic and mobile environments.

By Power Rating Analysis

In the global diesel generator market, the 51–280 kW power rating segment is anticipated to sustain its leading position, accounting for 31.0% of the total market share in 2025. This mid-range power band offers an optimal balance between capacity, efficiency, and cost, making it highly suitable for a broad range of applications across commercial, industrial, and institutional sectors. These diesel generators are widely used in hospitals, telecom infrastructure, educational institutions, small-scale manufacturing plants, and office complexes where consistent and reliable backup power is essential.

Their compatibility with both prime and standby applications allows for flexibility in usage, while integration with load management systems and digital controllers enhances performance monitoring. Additionally, as smart grid limitations and unpredictable weather events increase the need for dependable power continuity, the demand for this capacity band continues to grow, especially in urban and semi-urban settings.

In contrast, the 281–500 kW power rating segment caters to higher-load demands typically associated with large industrial facilities, data centers, utility support systems, and energy-intensive sectors such as oil and gas, mining, and water treatment plants. These heavy-duty diesel generators are engineered for high-endurance performance, capable of supporting large machinery and complex operations that require uninterrupted electricity for extended periods. Their robust design includes high-efficiency engines, advanced cooling mechanisms, and sophisticated control systems to ensure optimal performance under heavy loads.

While this segment commands a smaller share than the mid-range, its strategic importance is significant, particularly in critical infrastructure and remote site operations. With rising investments in infrastructure development, industrial automation, and power-intensive technologies, the 281–500 kW category is witnessing growing demand from both emerging and developed economies aiming to boost energy resilience.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

In the global diesel generator market, standby power applications are expected to dominate the application segment, capturing

70.5% of the total market share in 2025. This commanding presence is driven by the widespread necessity for reliable backup power in sectors such as healthcare, commercial buildings, data centers, telecommunications, and critical infrastructure. Standby diesel generators are designed to automatically activate when the main grid fails, ensuring an immediate and uninterrupted power supply.

These systems are typically integrated with automatic transfer switches and remote monitoring capabilities, enabling swift transitions during outages. Their importance has surged in response to the growing frequency of natural disasters, grid instability, and power supply shortages in both developed and emerging regions. Moreover, rising regulatory mandates and business continuity requirements are prompting enterprises to invest in robust standby systems that guarantee operational resilience and prevent financial losses due to downtime.

Meanwhile, peak shaving applications represent a strategic and relevant use case within the diesel generator market. In this context, diesel generators are employed to manage and reduce energy consumption during peak demand periods, when utility rates are typically at their highest. By generating on-site power during these intervals, businesses can avoid demand charges, reduce electricity bills, and ease pressure on the main grid. Peak shaving is particularly valuable in industrial and large commercial facilities with variable load profiles, where energy cost optimization is a key operational objective.

The use of diesel generators for this purpose often involves integration with energy management systems and load forecasting software to ensure precise control and minimal fuel wastage. While peak shaving commands a smaller share compared to standby power, its role is gaining traction as organizations seek to enhance energy efficiency, reduce operational expenses, and contribute to grid stability amidst fluctuating power demands.

By End-User Analysis

In the global diesel generator market, industrial users are projected to sustain their leading position in the end-user segment, accounting for 41.9% of the total market share in 2025. The high demand from this segment is driven by the critical need for uninterrupted power supply in operations such as mining, manufacturing, oil and gas extraction, and water treatment. Diesel generators are extensively deployed across industrial settings for both prime and backup power needs, especially in regions with inadequate grid infrastructure or frequent power outages.

Their robust performance under heavy loads, long operational lifespan, and adaptability to various environmental conditions make them indispensable in heavy-duty industrial applications. Additionally, with the growing automation and electrification of industrial processes, there is a heightened reliance on continuous and high-capacity power support, further reinforcing the importance of diesel generators in this sector. Innovations such as low-emission engines, remote monitoring capabilities, and integration with industrial energy management systems are also enhancing the efficiency and appeal of diesel gensets among industrial users.

The commercial sector also plays a vital role in the diesel generator landscape, encompassing facilities such as office buildings, hospitals, educational institutions, retail complexes, and hospitality venues. In these environments, diesel generators are primarily used for standby power to ensure business continuity during grid failures and natural disasters. The growing digitalization of operations, from data management to customer service platforms, has made power reliability a top priority for commercial establishments.

Moreover, regulatory requirements around emergency backup systems, especially in healthcare and public infrastructure, are driving consistent demand for diesel generators. As commercial buildings adopt smart technologies, there is a growing trend toward integrating diesel gensets with building management systems and real-time performance analytics. Though the power demands in this segment are generally lower than in industrial settings, the need for reliability, safety, and compliance makes diesel generators a critical investment for commercial entities globally.

The Diesel Generator Market Report is segmented on the basis of the following:

By Design

By Power Rating

- Up to 50 KW

- 51-280 KW

- 281-500 KW

- 501-2,000 KW

- Above 2,000 KW

By Application

- Standby Power

- Peak Shaving

- Prime & Continuous Power

By End-User

- Industrial

- Utilities/ Power Generation

- Oil & Gas

- Construction

- Manufacturing

- Mining & Metals

- Marine

- Other Industrial End Users

- Commercial

- IT & Telecom

- Healthcare

- Other Commercial End Users

- Residential

Global Diesel Generator Market: Regional Analysis

Region with the Largest Revenue Share

Asia Pacific is anticipated to lead the global diesel generator market, accounting for

52.6% of the total global market revenue in 2025. This dominance is fueled by rapid urbanization, expansive industrialization, and ongoing infrastructure development across countries such as China, India, Indonesia, and Vietnam. The regions growing demand for reliable backup power in sectors like construction, manufacturing, healthcare, and telecommunications is driving significant adoption of diesel generators.

Additionally, frequent power outages, unstable grid infrastructure in rural and semi-urban areas, and rising investments in commercial real estate contribute to the regions elevated demand. Government-led initiatives in energy resilience, combined with growing data center footprints and smart city projects, are further accelerating market expansion. The availability of low-cost manufacturing, advancements in generator efficiency, and the strong presence of domestic and international manufacturers continue to solidify Asia Pacifics leadership position in the global diesel generator landscape.

Region with significant growth

The MEA region is projected to witness the highest CAGR in the global diesel generator market during the forecast period, driven by the regions growing demand for reliable and decentralized power solutions. With many countries facing chronic power shortages, grid unreliability, and growing energy requirements from expanding urban centers, the adoption of diesel generators is accelerating across sectors such as construction, mining, oil and gas, and telecommunications.

Infrastructure development initiatives, particularly in Gulf Cooperation Council (GCC) nations and emerging African economies, are further propelling the need for standby and prime power systems. Additionally, off-grid industrial operations and remote commercial facilities continue to rely heavily on diesel gensets due to limited grid access. Government efforts to bolster energy security, support for hybrid solutions combining diesel with renewable energy, and heightened investment in economic diversification are expected to sustain strong growth in this region over the coming years.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Diesel Generator Market: Competitive Landscape

The global competitive landscape of the diesel generator market is characterized by the presence of both multinational corporations and regional players, each vying for technological edge, market expansion, and customer loyalty. Leading companies such as Caterpillar Inc., Cummins Inc., Kohler Co., and Generac Power Systems dominate the market with extensive product portfolios, strong brand recognition, and well-established global distribution networks. These firms continue to invest heavily in R&D to improve fuel efficiency, reduce emissions, and integrate digital technologies such as remote monitoring and predictive maintenance systems into their diesel gensets.

Meanwhile, regional manufacturers in Asia and the Middle East are gaining ground by offering cost-competitive and customized solutions suited for local grid and climate conditions. Strategic partnerships, acquisitions, and expansion into emerging markets remain key tactics to enhance market share. The competition is also intensifying around hybrid and low-emission models, as companies respond to stricter environmental regulations and the rising demand for cleaner, more efficient power backup solutions.

Some of the prominent players in the Global Diesel Generator Market are:

- Caterpillar Inc.

- Cummins Inc.

- Kohler Co.

- Generac Holdings Inc.

- MTU Onsite Energy (Rolls-Royce Power Systems)

- Atlas Copco

- Mitsubishi Heavy Industries Ltd.

- Wärtsilä Corporation

- Honda Motor Co., Ltd.

- Doosan Corporation

- Perkins Engines Company Ltd

- Hyundai Heavy Industries Co., Ltd.

- FG Wilson

- Himoinsa S.L.

- Kirloskar Oil Engines Ltd.

- Mahindra Powerol

- Yanmar Co., Ltd.

- Baudouin (Weichai Group)

- SDMO Industries (KOHLER SDMO)

- Ashok Leyland Ltd.

- Other Key Players

Global Diesel Generator Market: Recent Developments

- March 2025: Caterpillar Inc. acquired a majority stake in a leading renewable hybrid power solutions provider to expand its clean energy portfolio.

- December 2024: Cummins Inc. completed the acquisition of a European diesel engine manufacturer to strengthen its footprint in the region.

- August 2024: Kohler Co. acquired a technology startup specializing in IoT-enabled remote monitoring systems for diesel generators.

- May 2024: Generac Power Systems acquired a commercial and industrial diesel generator manufacturer to enhance its product range.

- January 2024: Mitsubishi Heavy Industries expanded its power generation division by acquiring a diesel genset manufacturer in Southeast Asia.

- October 2023: FG Wilson, a subsidiary of Caterpillar, acquired a regional diesel generator service provider to boost after-sales support in the Middle East.

- July 2023: Cummins Inc. acquired a battery storage and hybrid power system firm to diversify its energy solutions beyond traditional diesel generators.

- February 2023: Atlas Copco acquired a company specializing in mobile diesel generator sets to expand its portable power offerings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 19.1 Bn |

| Forecast Value (2034) |

USD 31.3 Bn |

| CAGR (2025–2034) |

5.6% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 4.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Design (Stationary, Portable), By Power Rating (Up to 50 KW, 51-280 KW, 281-500 KW, 501-2,000 KW, Above 2,000 KW), By Application (Standby Power, Peak Shaving, Prime & Continuous Power), and By End-User (Industrial, Commercial, Residential) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Caterpillar Inc., Cummins Inc., Kohler Co., Generac Holdings Inc., MTU Onsite Energy (Rolls-Royce Power Systems), Atlas Copco, Mitsubishi Heavy Industries Ltd., Wärtsilä Corporation, Honda Motor Co., Ltd., Doosan Corporation, Perkins Engines Company Ltd., Hyundai Heavy Industries Co., Ltd., FG Wilson, Himoinsa S.L., Kirloskar Oil Engines Ltd., Mahindra Powerol, Yanmar Co., Ltd., Baudouin (Weichai Group), SDMO Industries (KOHLER SDMO), Ashok Leyland Ltd, and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global diesel generator market?

▾ The global diesel generator market size is estimated to have a value of USD 19.1 billion in 2025 and is expected to reach USD 31.3 billion by the end of 2034.

What is the size of the US diesel generator market?

▾ The US diesel generator market is projected to be valued at USD 4.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 7.6 billion in 2034 at a CAGR of 5.3%.

Which region accounted for the largest global diesel generator market?

▾ Asia Pacific is expected to have the largest market share in the global diesel generator market, with a share of about 52.6% in 2025.

Who are the key players in the global diesel generator market?

▾ Some of the major key players in the global diesel generator market are Caterpillar Inc., Cummins Inc., Kohler Co., Generac Holdings Inc., MTU Onsite Energy (Rolls-Royce Power Systems), Atlas Copco, Mitsubishi Heavy Industries Ltd., Wärtsilä Corporation, Honda Motor Co., Ltd., Doosan Corporation, Perkins Engines Company Ltd., Hyundai Heavy Industries Co., Ltd., FG Wilson, Himoinsa S.L., Kirloskar Oil Engines Ltd., Mahindra Powerol, Yanmar Co., Ltd., Baudouin (Weichai Group), SDMO Industries (KOHLER SDMO), Ashok Leyland Ltd, and Other Key Players.

What is the growth rate of the global diesel generator market?

▾ The market is growing at a CAGR of 5.6 percent over the forecasted period.