Diesel Particulate Filters (DPFs) are made to capture & contain harmful particles present in diesel exhaust emissions, preventing their release into the environment. These filters work by trapping the particles within a specialized filter, which needs regular cleaning to maintain its effectiveness. By capturing & storing these hazardous particles, Diesel Particulate filters play a crucial role in reducing air pollution & promoting cleaner emissions from diesel-powered vehicles & machinery.

The market's expansion is driven by a growing preference for diesel engines over gasoline engines & the introduction of stringent emission regulations worldwide. These factors act as key, propelling the market's growth as industries seek to adhere to environmental norms & reduce harmful particulate emissions from diesel-powered vehicles & equipment. The rise in demand for diesel particulate filters is a response to the increasing focus on clean emissions & sustainable products, marking the market's upward trajectory in the coming years.

Key Takeaways

- Market Size & Share: Global Diesel Particulate Filter Market is expected to attain a value of USD 15 billion in 2023, and it is projected to witness significant growth, reaching USD 31.9 billion by 2032

- Vehicle Type Analysis: The Diesel Particulate Filter Market is led by the passenger vehicle segment, which holds a substantial share of more than 36.8% in market revenue.

- Material Analysis: The ceramic fiber filter category is experiencing rapid growth, primarily due to the increasing emission regulations set by governments in developing countries.

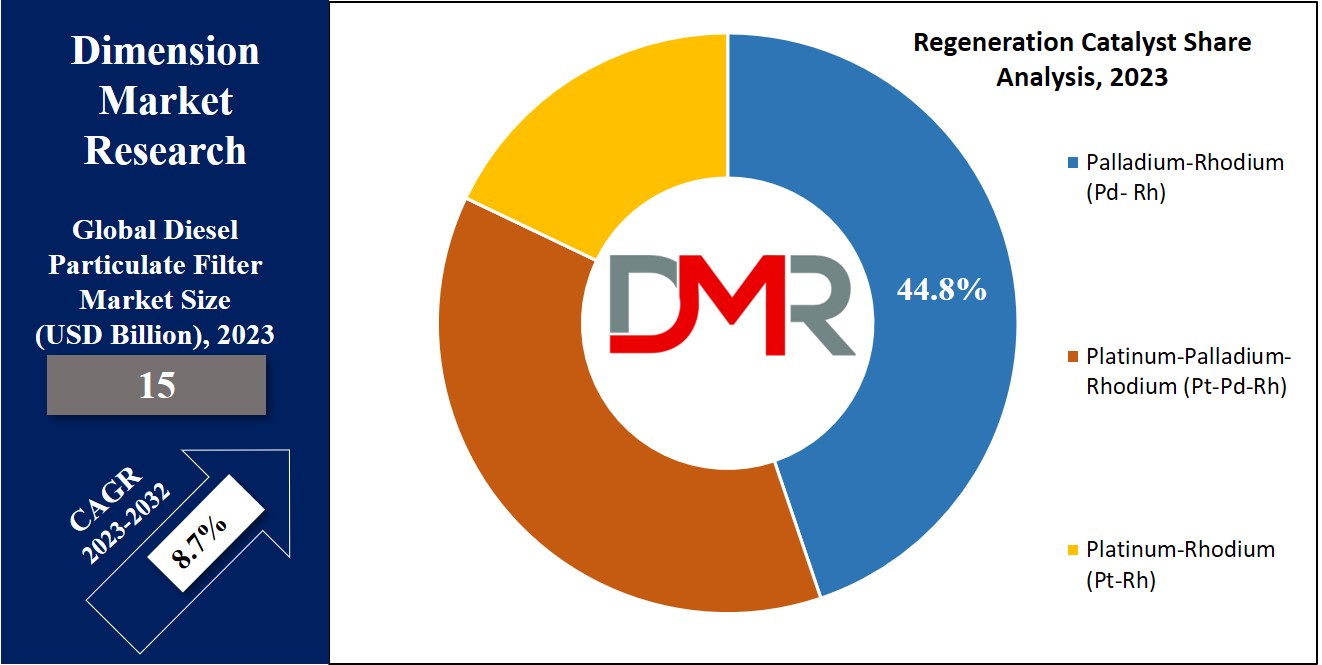

- Regeneration Catalyst Analysis: The palladium rhodium segment currently holds the largest share in the diesel particulate filter (DPF) market and is anticipated to maintain its dominant position till 2032.

- Regional Analysis: Asia Pacific stands out as a prominent market with a share of 34.6% globally in 2023

Use Cases

- Automotive Industry (Passenger & Commercial Vehicles): Used in diesel cars, trucks, and buses to reduce particulate emissions and comply with environmental regulations.

- Construction & Heavy Equipment: Integrated into excavators, loaders, and bulldozers to minimize diesel soot emissions in construction sites and urban projects.

- Marine & Shipping Industry: Applied in diesel-powered ships and boats to meet stringent maritime emission standards and reduce environmental pollution.

- Power Generation & Industrial Machinery: Used in diesel generators and industrial engines to filter soot and improve air quality in factories and power plants.

- Agriculture & Farming Equipment: Installed in tractors, harvesters, and other diesel-based agricultural machinery to comply with emission norms and promote sustainable farming practices.

Market Dynamic

The Global Diesel Particulate Filter (DPF) Market is experiencing significant growth driven by the increasing usage of Diesel Particulate Filter across various sectors, including construction, automotive, & agriculture. Rising pollution concerns & stringent government regulations worldwide have become driving factors for the market's expansion.

The automotive industry, in particular, has emerged as a primary key driver as it increasingly made Diesel particulate filters a standard mark in

diesel engines. With governments making strict emission regulations, vehicle manufacturers are actively focused on minimizing threatening pollutants released by their vehicles, making DPFs a better solution to address this environmental challenge. Consequently, the demand for DPFs is projected to witness substantial growth in upcoming years.

The industrial & construction sectors also play crucial roles in driving the diesel particulate filter market. These industries depend heavily on diesel-powered machinery & vehicles, contributing significantly to particulate emissions. As companies aim to abide by environmental regulations & improve air quality in the areas where they work, the utilization of Diesel particulate filters (DPFs) in these industries is becoming increasingly prevalent.

Technological improvements in Diesel particulate filters have resulted in the development of more efficient & durable filters. Innovations like catalyzed filters, improved filter materials, and active regeneration systems have improved the reliability & performance of DPFs, making them more efficient in storing harmful particles from diesel exhaust emissions.

However, the initial amount of purchasing & installing Diesel particulate filters, essentially to redevelop older diesel vehicles, can act as a barrier for some owners of vehicles. While the market for internal combustion engines remains strong, the growing usage of electric & hybrid vehicles may affect the growth of Diesel particulate filters in the longer term.

As the automotive sector continues to progress with changing customer preferences & environmental safety, the future trajectory of the Diesel particulate filter market will be impacted by the ongoing shift towards cleaner & more sustainable automobile options.

Driving Factors

The diesel particulate filter (DPF) market is propelled by stringent emission standards aimed at reducing harmful pollutants from diesel engines. Euro 6, BS VI and EPA standards mandate installation of DPFs in vehicles to restrict particulate matter emissions; governments around the world enforce these regulations to combat air pollution and protect public health.

Automotive manufacturers use advanced DPF systems to comply; increased adoption of diesel powered vehicles across industries like transportation, construction and agriculture further drives demand as DPFs become necessary in meeting legal and environmental compliance; DPFs become essential in meeting legal and environmental compliance obligations imposed upon them by Euro 6 emission standards or emission requirements.

Trending Factors

Innovative developments in diesel particulate filter technology are revolutionizing the market, with manufacturers investing in developing filters with higher efficiency, durability and reduced maintenance requirements. Trends include the implementation of advanced ceramic materials, coated DPFs for increased regeneration efficiency, and systems compatible with alternative fuels like biodiesel.

Furthermore, digital monitoring solutions designed to monitor real time performance tracking are becoming increasingly popular. These technologies meet consumer demands for cost effective and sustainable solutions while meeting stricter emission standards. Lightweight and compact DPF designs align well with automotive industry emphasis on fuel efficiency and vehicle optimization.

Restraining Factors

The diesel particulate filter market faces challenges due to high maintenance and replacement costs associated with DPF systems. Regeneration services must be regularly performed to prevent clogging and ensure optimal performance, adding operational expenses. In cases where filters become damaged or fail early replacement costs can become prohibitively high for advanced systems which could deter adoption among cost conscious consumers and industries.

Moreover, improper maintenance could reduce vehicle efficiency and increase emissions, negating many benefits offered by DPFs; so cost efficient solutions with reliable aftersales support can address these concerns effectively in this market.

Opportunities

Emerging economies offer enormous growth potential in terms of vehicle ownership, industrialization and adoption of emission regulations. As Asian, Latin American, and African nations prioritize air pollution reduction efforts, they are instituting stricter environmental regulations which in turn fuel demand for DPFs. Furthermore, commercial vehicles in logistics and construction sectors drive market growth in these regions.

Localized production, tailor made solutions for fuel types of various quality, and cost effective options can all help manufacturers tap into these markets. Furthermore, government incentives supporting clean technology adoption offer an attractive environment for market expansion.

Research Scope and Analysis

By Vehicle Type

The Diesel Particulate Filter Market is led by the passenger vehicle segment, which holds a substantial share of

more than 36.8% in market revenue. The dominance of this segment can be attributed to the growing demand for passenger vehicles in both developed and emerging economies, fueled by increasing purchasing power and improving economic conditions.

As consumers in developing nations have higher disposable incomes, there is a rising inclination towards owning passenger vehicles, further propelling the growth of this category. Moreover, stringent emission regulations implemented by various governments have heightened the need for diesel particulate filters in passenger vehicles to curb harmful pollutants from exhaust emissions.

On the other hand, the light commercial vehicle category is witnessing the fastest growth in the market. This rise is driven by the increasing focus on safety regulations for light commercial vehicles, as Government authorities and various companies trying to enhance road safety & reduce environmental impact.

The demand for diesel particulate filters in light commercial vehicles is on the rise as they prove to be effective in reducing particulate matter emissions and complying with strict safety & emission standards. As a result, the light commercial vehicle segment is projected to experience significant growth till 2032.

By Material

Among the various types of diesel particulate filters (DPFs), the silicon carbide wall flow filters segment emerges as the dominant player in the market. The worldwide usage of silicon carbide filters in both heavy & light-duty vehicles has driven their market dominance. Silicon carbide filters are favored for their robustness & efficiency in storing particulate matter from exhaust gases, making them a preferred choice in the automotive sector.

On the other hand, the ceramic fiber filter category is experiencing rapid growth, primarily due to the increasing emission regulations set by governments in developing countries. As these countries strive to fight against environmental pollution & improve the quality of air, there is an increasing focus on stricter emission standards for vehicles.

This surge in emission regulations is driving the demand for ceramic fiber filters as they have high filtration efficiency & provide efficient solutions to meet strict emission requirements. As a result, the ceramic fiber filters segment is anticipated to witness substantial growth in upcoming years.

By Regeneration Catalyst

The palladium rhodium segment currently holds the largest share in the diesel particulate filter (DPF) market and is anticipated to maintain its dominant position till 2032. Nevertheless, the platinum-palladium rhodium segment is projected to witness the highest growth due to its favorable attributes in heavy & medium commercial vehicles.

As strict emission standards are applied globally, there is an increasing focus on reducing harmful pollutants from the exhaust gases of commercial vehicles. This has led to a rise in the adoption of Diesel particulate filters in heavy & medium commercial vehicles. The platinum palladium rhodium segment's growth is driven by its efficiency in effectively capturing & converting particulate matter & harmful gases, thereby enhancing air quality.

With the rising awareness of environmental concerns & the need for cleaner technologies, the utilization of Diesel particulate filters in heavy & medium commercial vehicles is expected to grow substantially till 2032, fueling the growth of the platinum-palladium rhodium segment in the diesel particulate filter market.

By Distribution channel

The Diesel Particulate Filter Market witnessed the highest revenue generation from the Original Equipment Manufacturer (OEM) category, accredited to the continuous improvement of diesel particulate filters that provide lightweight solutions and also save space.

These innovative filters are increasingly incorporated into vehicles during the manufacturing procedures, enhancing their emission control capabilities & meeting strict environmental policies. However, the aftersales category has emerged as the fastest-growing segment in the market, driven by growing environmental concerns & the necessity to redevelop existing vehicles with diesel particulate filters.

The Global Diesel Particulate Filter Market Report is segmented on the basis of the following

By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Off-Highway Vehicles

By Material

- Cordierite Wall Flow Filter

- Silicon Carbide Wall Flow Filter

- Ceramic Fiber Filters

- Others

By Regeneration Catalyst

- Platinum-Rhodium (Pt-Rh)

- Palladium-Rhodium (Pd- Rh)

- Platinum-Palladium-Rhodium (Pt-Pd-Rh)

By Distribution Channel

- OEM (Original Equipment Manufacturer)

- Aftersales

How Does Artificial Intelligence Contribute To Improve Diesel Particulate Filter Market ?

- Predictive Maintenance & Failure Detection: AI (Artificial Intelligence) powered sensors monitor DPF performance in real-time, predicting clogging or failure to prevent costly downtime and repairs.

- Optimized Regeneration Process: Machine learning algorithms adjust the DPF regeneration cycle based on driving conditions, improving fuel efficiency and filter lifespan.

- Enhanced Emission Monitoring & Compliance: AI-driven analytics track diesel emissions and ensure vehicles and industrial machinery comply with stringent environmental regulations.

- Supply Chain & Inventory Optimization: AI forecasts demand and optimizes logistics for DPF components, reducing production costs and preventing supply shortages.

- Material Innovation & Design Optimization: AI accelerates the development of advanced filter materials and coatings that improve soot capture efficiency and durability.

Regional Analysis

Asia Pacific stands out as a prominent market with a share of 34.6% globally in 2023 for Diesel Particulate Filters (DPFs), primarily due to the rise in vehicle sales & the adoption of strict emission standards in the region. In 2022, China, Japan, the United States, & India were identified as the top countries with the highest vehicle sales, resulting in the growing demand for Diesel particulate filters.

As the automotive sector in Asia Pacific continues to progress, governments are focusing on the adoption of sustainable technologies to deal with environmental issues, leading to significant usage of Diesel particulate filters in mining & construction equipment. This adoption helps in getting rid of particulate matter emissions & aligns with the region's commitment to reducing environmental impact & improving air quality.

North America holds a significant position in diesel particulate filter market, after the Asia-Pacific market globally. The growth of the automotive sector, with increased investments & rising disposable income, has positively impacted the market's expansion in this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Major players in the diesel particulate filter market are making significant investments in research and development to expand their product portfolios, driving further growth in the industry. These market participants are also engaging in various strategic initiatives to enhance their global presence, including new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaborations with other organizations. In order to thrive in a competitive and evolving market landscape, the diesel particulate filter industry must offer cost-effective solutions.

Recently, on June 22, Clark introduced its C40-55SD and C60-80D900 series diesel forklifts, featuring capacities ranging from 4 to 8 tons. Equipped with a Kubota Diesel Engine of level 5, these forklifts come with a diesel particulate filter and diesel oxidation catalytic converter, ensuring compliance with emission regulations. This new diesel engine, now available, further showcases the industry's commitment to meeting environmental standards while delivering high-performance solutions for various applications.

Some of the prominent players in the Global Diesel Particulate Filter Market are

Recent Development

- In April 2024, Ogepar signed an agreement to acquire all activities of Hug Engineering, a major DPF and SCR manufacturer, from Forvia, strengthening Ogepar’s emission reduction portfolio. Closing is scheduled for June 2024.

- In June 2025, Lubrizol launched Lubrizol® MF9145V, a diesel fuel additive in China, designed to reduce diesel particulate matter at the source and significantly lower DPF regeneration frequency, resulting in cost and fuel savings for fleet operators.

- In October 2023, MANN+HUMMEL finalized the acquisition of a majority stake in an automotive air filter manufacturer, accelerating their ability to offer integrated DPF solutions and expanding their product portfolio for emissions control.

- In early 2025, Indiana’s DieselWise program announced $750,000 in funding for on-road and non-road clean diesel projects, supporting the use and retrofit of DPFs in high-pollution fleets.

- In May 2025, Lubrizol announced successful field implementation of its MF9145V additive in heavy-duty trucks across China, showing a 25% decrease in DPF regeneration frequency and improved system efficiency.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 15 Bn |

| Forecast Value (2032) |

USD 31.9 Bn |

| CAGR (2023–2032) |

8.7% |

| Historical Data |

2017 – 2022 |

| Forecast Data |

2023 – 2032 |

| Base Year |

2022 |

| Estimate Year |

2023 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Vehicle Type (Passenger Vehicles, LCV, HCV, and Off-Highway Vehicles), By Material (Cordierite Wall Flow Filter, Silicon Carbide Wall Flow Filter, Ceramic Fiber Filters, and Others), By Regeneration Catalyst Type (Pt-Rh, Pd-Rh, Pt-Pd-Rh), By Distribution Channel (OEM, and Aftersales). |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

FORVIA Faurecia, Tenneco Inc., Eberspaecher, Johnson Matthey, Continental AG, Denso Corporation, BOSAL, Umicore, BASF SE, CDTi Advanced Materials, Inc., NGK INSULATORS, LTD and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |