The Diesel Power Engine Market involves the design, manufacturing, and utilization of diesel engines across various sectors, including transportation, industrial machinery, and power generation. Diesel engines are renowned for their robustness, fuel efficiency, and longevity, making them a preferred choice for heavy-duty applications in the broader diesel engine industry.

The Diesel Power Engine Market is at a critical juncture, poised between enduring strengths and emerging challenges. Diesel engines remain integral due to their reliability, durability, and fuel efficiency, making them indispensable across transportation, construction, and industrial sectors where high performance is crucial.

However, the market faces increasing pressure from stringent environmental regulations aimed at reducing emissions. This regulatory landscape is catalyzing significant technological advancements, with manufacturers focusing on innovations such as advanced turbocharging, common rail direct fuel injection, and enhanced after-treatment systems to improve fuel efficiency and meet compliance standards.

Regionally, North America and Europe are navigating a complex regulatory environment that shapes market dynamics, driving the adoption of cleaner technologies. In contrast, the Asia Pacific region, particularly China and India, is emerging as a major growth engine. This growth is fueled by rapid industrialization, extensive infrastructure projects, and rising demand for heavy-duty diesel engines in these high-growth economies.

Additionally, there is a noticeable shift towards hybrid and alternative fuel technologies as industries seek to reconcile performance with environmental impact. Diesel engines are increasingly being integrated into hybrid systems, which combine traditional power with renewable energy sources, addressing both operational efficiency and sustainability goals.

Key Takeaways

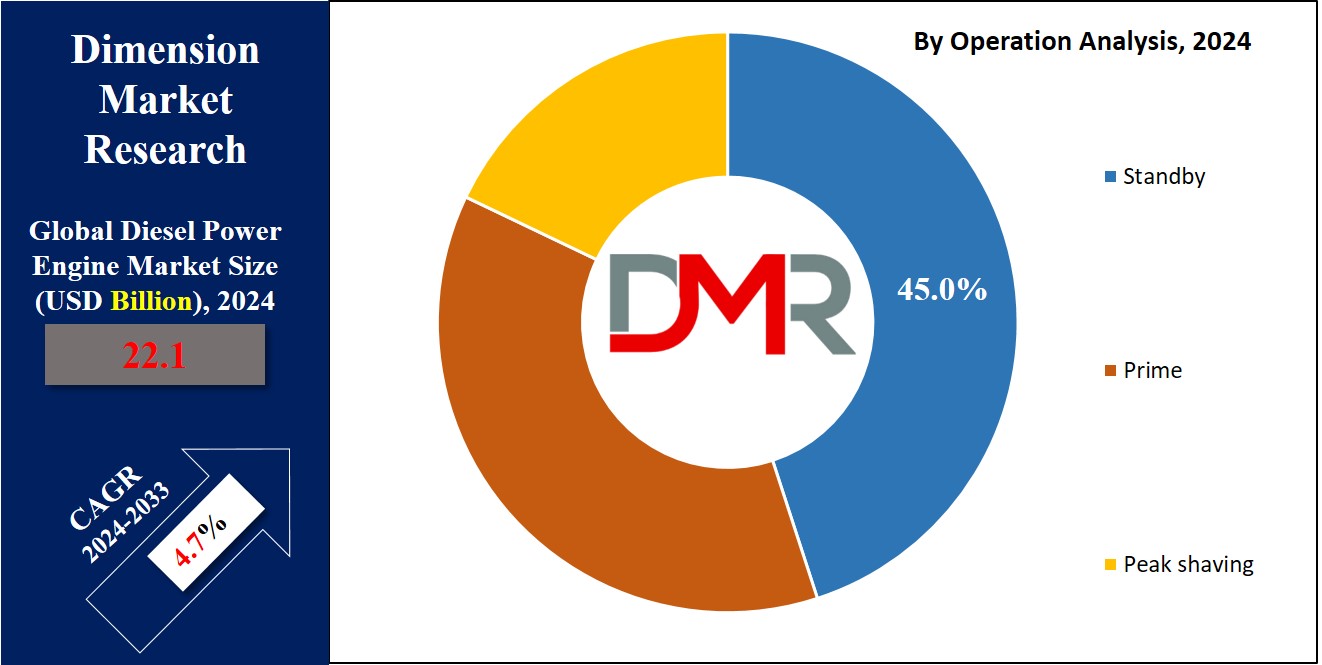

- Market Growth: The diesel power engine market is set to expand from $22.1 billion in 2024 to $33.4 billion by 2033, growing at a CAGR of 4.7%.

- Dominant Region: Asia Pacific holds a 45% market share, driven by rapid industrialization and infrastructure growth.

- Leading Segments: Standby power solutions lead with a 45% share, followed by prime power solutions at 35%.

- Technological Shift: The market is shifting towards cleaner diesel technologies and hybrid systems due to stringent emission regulations.

- Key Players: Major players like Caterpillar Inc. and Cummins Inc. are driving innovation and market leadership.

Use Cases

- Industrial Backup Power: Diesel engines provide reliable backup power for manufacturing and mining, ensuring operations continue during grid outages.

- Remote Power Supply: Ideal for off-grid areas, diesel engines offer consistent power in remote locations lacking reliable electricity.

- Marine Propulsion: Used in ships for propulsion and auxiliary power, diesel engines deliver durability and efficiency in marine environments.

- Hybrid Systems: Diesel engines combined with renewable sources in hybrid setups reduce emissions while ensuring reliable power.

- Emergency Power: Diesel engines serve as standby power for critical infrastructure like hospitals and data centers, maintaining operations during power failures.

Driving Factors

Superior Power-to-Weight Ratio and Energy Efficiency Drive Market Growth

The diesel power engine market benefits significantly from its excellent power-to-weight ratio and energy efficiency. Diesel engines are known for producing impressive power output relative to weight, making them particularly suitable for compact applications requiring high performance while remaining mobile; such as construction, agriculture, and transportation where both space efficiency and power usage efficiency are major concerns.

Diesel engines offer unparalleled energy efficiency compared to their gasoline counterparts, translating to lower operational costs and extended refueling sessions - an invaluable benefit in industries that rely on uninterrupted power supply. Furthermore, their improved fuel economy facilitates use in remote or off-grid locations driving adoption for various applications.

Hybrid Diesel Generators Expand Market Horizons

Hybrid diesel generators have quickly become an emerging trend within the diesel power engine market. Hybrid systems combine diesel engines with renewable energy sources such as solar or wind to offer more eco-friendly and flexible power solutions, helping address environmental concerns by decreasing emissions and fuel consumption while still taking advantage of diesel's reliability and power.

Hybrid power diesel generator sales have experienced steady growth as businesses and governments strive to find a balance between energy efficiency and environmental sustainability. This trend is enabled by advances in hybrid technology as well as investments in cleaner energy solutions. Hybrids bring variety to the diesel engine market by offering products that appeal to multiple applications and customers.

Rising Demand from both Commercial and Residential Sectors Fuels the Diesel Engine Market

Demand from both commercial and residential sectors is having a tremendous effect on the diesel power engine market. Commercially, diesel engines have been widely utilized by industries like construction, mining, and transportation due to their reliable performance in demanding environments like construction sites or mine shafts. Furthermore, their continuous power supply also drives demand in areas with unstable electricity grids or high power needs - an issue that keeps demand for these engines high!

Homeowners in areas prone to power outages have increasingly turned to diesel engines as backup power solutions, particularly where grid reliability is an issue. A combination of increasing awareness about the importance of having reliable backup sources coupled with advancements in engine technology offering quieter and more energy-efficient options has led to greater adoption within residential applications.

Demand from both commercial and residential sectors fuels market growth for diesel power engine markets. Meeting customer requirements while remaining at the forefront of technological developments bodes well for future expansion in this field.

Growth Opportunities

Increase in Renewable Energy Implementation

Integrating diesel power engines with renewable energy sources represents an incredible opportunity. Hybrid systems that combine diesel with solar, wind, and other renewable technologies are increasingly popular as reliable power supplies that reduce emissions and consumption making an impression full statement about global sustainability goals. Such approaches also strengthen diesel's appeal as an energy transition solution because it leverages both its reliability and the environmental advantages offered by renewables simultaneously.

Marine and Shipping Industries Expand

Marine and shipping sectors are expanding steadily, creating positive ripples through the diesel power engine market. Diesel engines are essential to marine propulsion and auxiliary power due to their durability and efficiency; as global trade and shipping activities increase so do demands for reliable marine diesel engines that comply with stringent marine regulations. As demand increases for eco-friendly marine engines with new emission standards compliance creates significant opportunities in this sector.

Initiatives and Incentives by the Government

Government initiatives and incentives designed to support cleaner technologies provide significant opportunities for the diesel power engine market. Many governments are adopting policies that encourage advanced diesel technologies that reduce emissions while improving fuel efficiency, with incentives like tax breaks, grants, and subsidies helping expand the market by lowering costs and hastening adoption.

Key Trends

Shifting towards Cleaner Diesel Technologies

As environmental regulations tighten globally, there has been an increasingly global emphasis on cleaner diesel technologies. This trend has included adopting advanced emission control systems such as selective catalytic reduction (SCR) and diesel particulate filters (DPF), which help meet stringent environmental standards while meeting market-driven sustainability credentials in an emission-conscious future. The use of such advanced systems makes diesel more competitive and reduces its carbon footprint in an ever more low emission world.

Increased Use in Power Generation

Diesel power engines have seen increased applications in power generation, particularly in areas with unreliable or nonexistent grid infrastructure. Diesel generators play an essential role in providing consistent and stable power to remote or off-grid locations; their use is fueled by frequent power outages or where grid expansion would be impractical.

This is especially critical in sectors like healthcare, where uninterrupted power is vital for

medical devices equipment and data-driven systems supporting the

Healthcare Analytics Market. Additionally, rising emergency backup needs in data centers and other high-priority facilities further contribute to this trend.

Focus on Standby Power Solutions

Due to an increased focus on standby power solutions and the need for reliable backup power sources, diesel engines have become an increasingly popular solution for standby applications. Their durability and quick start-up capability make them particularly ideal in critical infrastructure sectors such as telecom, finance, manufacturing, and other manufacturing businesses where continuous operations are essential. Furthermore, increased emphasis placed on providing uninterrupted power supply during grid failures or emergencies has only served to increase this trend further. This demand further drives demand for high-performing diesel generators.

Restraining Factors

Technological Advancements Pose Competitive Threat

Battery technology advances represent a formidable threat to the diesel power engine market. As lithium-ion and solid-state batteries become more advanced, they have become more competitive against diesel engines for various applications - offering high energy densities, longer lifespans, and lower costs than their diesel counterparts - providing viable options in areas previously dominated by diesel power such as backup power or off-grid solutions.

Over the past decade, battery costs have decreased by approximately 89%. This affordability of energy storage systems is driving adoption across residential, commercial, and industrial settings - as battery technology evolves further it challenges diesel engines as an energy source and offers cleaner alternatives that may become more viable than ever.

Public Perception Impacts Market Adoption

Negative public perception regarding diesel engines significantly hinders their market expansion. Concerns regarding their environmental impacts - specifically their contribution to air pollution and greenhouse gas emissions - have resulted in greater scrutiny and regulatory pressure, while high-profile emissions scandals and increasing awareness of air quality issues have led to an increase in public and governmental demand for cleaner alternatives.

Due to this negative image, emissions regulations have tightened significantly, while electric and hybrid power solutions have seen greater adoption among consumers and businesses alike. Thus, diesel power engine makers face difficulty maintaining market share or expanding into new segments, as both consumers and businesses increasingly prioritize sustainability and environmental responsibility over performance.

This shift is also influencing digital transformation strategies, with industries adopting energy-efficient technologies like the

Hybrid Cloud Market, which optimizes computing resources while reducing carbon footprints—further challenging traditional diesel-dependent sectors to adapt.

Technological Complexity and Costs Hinder Growth

Technological complexity and high costs associated with advanced diesel power engines also hinder their market expansion. Implementation of advanced technologies such as turbocharging, intercooler, and emissions control systems requires significant investments; SCR systems alone may add 10-20% more cost than planned to an engine, impacting its affordability significantly.

Due to their complex nature, these technologies require expert maintenance and operation - further increasing the total cost of ownership - which may dissuade prospective buyers and stall adoption rates of advanced diesel power engines in price-sensitive markets and emerging regions.

Research Scope Analysis

By operation

In 2023, standby power solutions held a dominant share of the Diesel Power Engine Market by Product Type segment, accounting for approximately 45%. This industry trend can be explained by an increasing need for reliable backup power across various sectors like telecom, healthcare, and data centers where uninterrupted supply is paramount. Standby engines were widely chosen due to their robust construction, quick start-up times, and ability to provide power during grid failures or outages, thus cementing their position as leaders within this segment of the market.

Following Standby Power Solutions, Prime Power Solutions accounts for an impressive 35% share in the market. Prime diesel engines are essential in applications requiring continuous power such as remote or off-grid locations where grid connectivity may be intermittent. Growth for this segment has been furthered by increasing infrastructure projects and industrial applications that necessitate reliable and consistent power production.

Peak Shaving has also seen remarkable success, accounting for approximately 20% of the market. This segment addresses the need for diesel engines to manage peak electricity demand by shaving electricity use during times of high grid stress, thus reducing costs and relieving grid strain. Peak shaving solutions' growing adoption by industrial and commercial users is reflective of greater awareness regarding energy efficiency and cost management among them.

By power rating

Below 0.5MW diesel power engines held the largest share in the diesel Power Engine Market with approximately 40% market share. Their dominance can be attributed to their widespread usage across residential applications, small commercial enterprises, and backup power solutions for low-demand scenarios. Their compact size and affordable nature make these engines perfect for applications requiring reliable yet relatively lower power outputs.

0.5-1 MW engines hold approximately 30% market share. Engines in this range are frequently employed in medium-sized commercial applications such as retail operations, small manufacturing units, and larger residential buildings; their balanced power output provides users with reliable energy without incurring high costs associated with larger engines.

Engines producing between 1-2 MW represent approximately 20% of the market. These units are essential to larger commercial operations, industrial facilities, and remote power sources due to their ability to manage heavier loads while remaining cost-efficient - an attribute that supports their role as vital infrastructure or high-demand environments.

The 2-5 MW segment makes up approximately 10% of the market share and includes high-capacity engines used for large industrial processes, large commercial enterprises, and backup systems for major infrastructure projects. Their high power output makes these engines indispensable for applications that demand reliable energy sources.

By speed

In 2023, below 720 RPM held a dominant position in the Diesel Power Engine Market, capturing approximately 50% of the market share. This segment's leadership is largely due to the engines’ suitability for applications requiring low-speed, high-torque operations, such as in standby power systems and heavy-duty machinery. Engines operating at lower RPMs are favored for their durability, reduced wear and tear, and efficiency in delivering consistent power over extended periods, making them ideal for both commercial and industrial use.

The 720-1000 RPM segment follows with a notable market share of around 30%. Engines within this range are commonly employed in applications that balance power output and operational efficiency, including prime power for industrial operations and commercial buildings. The moderate RPM range provides a good compromise between performance and engine longevity, supporting its adoption in diverse settings where reliable, mid-range power is essential.

Engines operating above 1000 RPM account for approximately 20% of the market. These high-speed engines are utilized in applications requiring high power outputs and rapid response times, such as in certain types of marine propulsion and high-performance industrial processes. Their ability to operate at higher speeds enables them to deliver peak power and efficiency in demanding scenarios, although they are less commonly used compared to their lower RPM counterparts.

By End User

Power Utilities were the dominant market segment in 2023 for diesel power engine sales, accounting for roughly 40%. Their dominance can be explained by diesel engines' integral role in providing reliable and continuous power production for large-scale power plants and utility grids, meeting high energy demands across extensive geographical regions while supporting both primary and backup needs, cementing their place as key players within this sector.

Industrial diesel engines hold approximately 35% market share. Diesel engines within this segment are widely utilized by manufacturing facilities, mining operations, and other industrial applications that require robust power solutions that are reliable yet long-lasting. Industrial applications often depend on these durable engines to ensure operational efficiency and continuity within industrial settings.

Commercial operations comprise approximately 15% of the market share for diesel engine sales. Diesel engines are frequently employed in various commercial settings such as retail centers, office buildings, and service industries to provide backup power solutions during peak times or grid failure. Their efficiency makes them an appealing option for many commercial operations.

The Diesel Power Engine Market Report is segmented based on the following:

By operation:

- Standby

- Prime

- Peak shaving

By power rating:

- Below 0.5 MW

- 5-1 MW

- 1-2 MW

- 2-5 MW

- Abovw 2-5 MW

By speed:

- Below 720 RPM

- 720-1000 RPM

- Above 1000 RPM

By End User:

- Power Utilities

- Industrial

- Commercial

- Residential

Regional Analysis

Asia Pacific currently accounts for approximately 45% of the total diesel power engine market worldwide, thanks to rapid industrialization, urbanization, and infrastructure growth within its borders. China, India, and Japan are currently witnessing unprecedented manufacturing sector expansion which has increased their need for reliable power solutions. Furthermore, increasing construction activities, an expanding telecommunications sector, and growing needs for backup power in both residential and commercial spaces have all played a part in fueling diesel power engine markets in this region.

Government initiatives aimed at increasing rural electrification and frequent power outages play a part in driving this high demand for electricity in Asia Pacific, along with its large population and rising energy consumption, further cementing Asia Pacific's leadership role in this market.

North America accounts for around 25% of the market. Its growth is propelled by robust industrial sectors, the use of diesel engines in power generation, and backup power solutions in critical infrastructure sectors; the United States and Canada are major contributors due to their extensive industrial bases that focus on maintaining reliable power systems.

Europe accounts for roughly 20% of the global diesel engine market, driven largely by stringent emission regulations that incentivize technological innovations in diesel engines. German, French, and UK industries rely heavily on them both as primary and backup power sources; their adoption also aligns with Europe's environmental goals, which influences market dynamics.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

2023 marks a crucial turning point in the global diesel power engine market, as each major player brings unique strengths to bear on it. Caterpillar Inc. holds onto its dominant position with an extensive offering of highly efficient, low-emission engines renowned for their performance and reliability across various applications including construction and power generation. Their global distribution network and technological advances in emissions control further solidify this dominance, particularly within North America and Asia Pacific regions.

Cummins Inc. stands out with its commitment to innovation and comprehensive engine solutions for industrial and power generation applications. Their engines are known for their durability and efficiency - meeting market demands for cleaner power sources. Furthermore, their hybrid technologies and emission control systems are poised to meet global regulatory expectations as well as environmental considerations.

Rolls-Royce Holdings plc. And MAN SE both specializes in high-power applications that demand their power, with marine engines from MAN SE offering reliable performance solutions to its marine customers.

Rolls-Royce specializes in producing high-performance engines to serve the marine and aerospace sectors while leading technological innovations. Wartsila Corp., Mitsubishi Heavy Industries Ltd., and Volvo Penta each play an essential part in shaping the market - Wartsila offers diesel engines that combine renewable energy solutions with diesel engines that focus on high-capacity engines while Mitsubishi provides high-capacity engines and Volvo Penta provides marine and off-highway innovations. Hyundai Heavy Industries Co Ltd and Doosan contribute cost-effective and technologically advanced solutions for industrial and marine use that shape its trajectory via innovation and strategic positioning respectively.

Some of the prominent players in the Global Diesel Power Engine Market are:

- Caterpillar Inc.

- Cummins, Inc.

- MAN SE

- Rolls-Royce Holdings plc.

- Wärtsilä Corp.

- Mitsubishi Heavy Industries, Ltd.

- Volvo Penta

- Hyundai Heavy Industries Co., Ltd.

- Doosan

Recent developments

- In June 2022: Hybrid diesel systems were developed with the added integration of renewable source potentials such as solar and wind, reducing emissions and assuring power reliability.

- In October 2022: The use of advanced emission control technologies that included SCR and DPF spread widely across the world to meet very strict global regulations on reducing NOx and particulate emissions.

- In March 2023: The next evolution for turbocharger technology contributed toward enhancing efficiency for diesel engines by increasing power output as well as fuel economy within the context of more stringent emissions.

- In July 2023: A surge in infrastructural development activity across remote and off-grid locations that are far from the main power supply, led by increased demand for diesel engines, brought to light the importance of a reliable power supply.

- In January 2024: The development of hybrid diesel-electric systems to a more advanced level that was achieved by offering better fuel efficiency and reduced emissions marked the increasing attention being paid to sustainable energy solutions.

- In April 2024: The implementation of new emission regulations in Europe and North America served to accelerate the uptake of advanced after-treatment technologies as well as engine designs that incorporate innovation. These were developed with due consideration given toward attaining high levels of environmental safety.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 22.1 billion |

| Forecast Value (2032) |

USD 33.4 billion |

| CAGR (2023-2032) |

4.7% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By operation (Standby, Prime, Peak shaving), By power rating (Below 0.5 MW, 0.5-1 MW, 1-2 MW, 2-5 MW, Abovw 2-5 MW), By speed (Below 720 RPM, 720-1000 RPM, Above 1000 RPM), By End User (Power Utilities, Industrial, Commercial, Residential) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Caterpillar Inc., Cummins, Inc., MAN SE, Rolls-Royce Holdings plc., Wärtsilä Corp., Mitsubishi Heavy Industries, Ltd., Volvo Penta, Hyundai Heavy Industries Co., Ltd., Doosan |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |