Market Overview

The Global Dietary Supplement Market is predicted to be valued at

USD 208.7 billion in 2025 and is expected to grow to

USD 470.3 billion by 2034, registering a compound annual growth rate

(CAGR) of 9.4% from 2025 to 2034.

Dietary supplements are products taken orally that contain nutrients intended to supplement the diet. They may include vitamins, minerals, herbs, amino acids, enzymes, and other beneficial substances. Available in forms like tablets, capsules, powders, or liquids, supplements are used to support overall health, improve nutritional intake, or address specific deficiencies. They are not meant to replace whole foods but can help fill dietary gaps or enhance well-being. While generally safe when used as directed, excessive or inappropriate use may cause side effects. Regulatory standards vary by country, and in many cases, supplements are not as strictly regulated as pharmaceutical drugs.

The global dietary supplements market includes a broad spectrum of products formulated to enhance the intake of vital nutrients such as vitamins, minerals, amino acids, botanical extracts, and enzymes. These supplements are available in multiple formats including capsules, powders, liquids, gummies, and tablets, and cater to a diverse consumer base seeking to improve immunity, boost overall health, and support specific wellness goals. This market serves various needs, ranging from sports nutrition and mental clarity to weight control and age-related health management.

Consumer interest in proactive health maintenance has significantly expanded, particularly in the wake of the global health crisis. Increasing awareness about the benefits of nutrition, a growing aging population, and a rising focus on physical fitness have contributed to the widespread use of health supplements. The shift towards natural wellness solutions and plant-based nutrition continues to influence product development and consumer preferences.

Despite this growth, the industry contends with notable challenges such as inconsistent regulatory standards across countries, concerns about product authenticity, and limited scientific validation in some cases. These factors can affect consumer trust and create barriers for market entry.

Nonetheless, the industry is experiencing exciting progress through innovations in personalized nutrition and data-driven wellness. Advances in

digital health technologies and DNA testing are enabling companies to tailor supplement offerings to individual health profiles. Consumer demand for clean-label products, transparency in sourcing, and clinically supported formulations is shaping new business strategies.

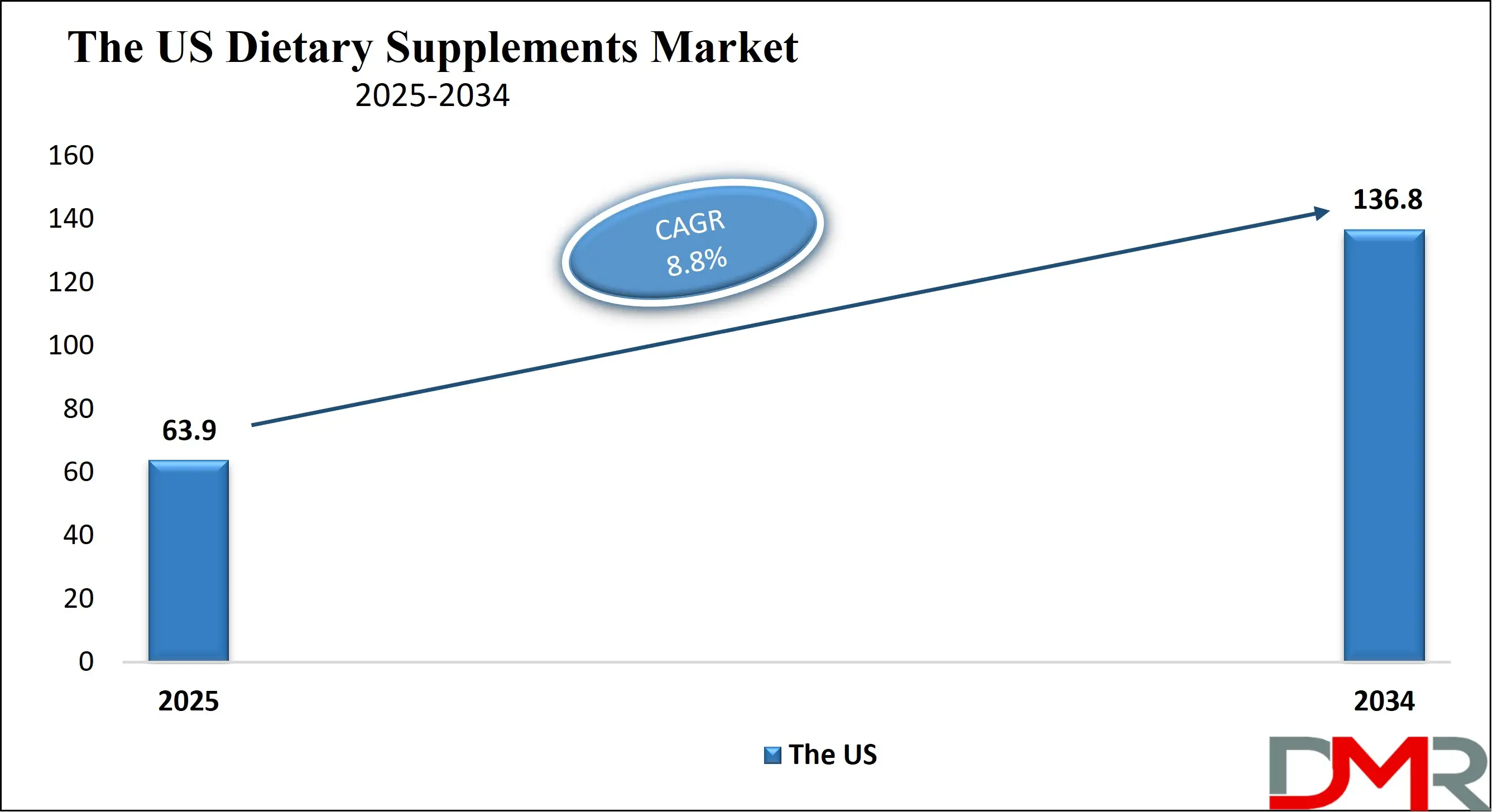

The US Dietary Supplements Market

The US Dietary Supplement market is projected to be valued at

USD 63.9 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds

USD 136.8 billion in 2034 at a

CAGR of 8.8%.

The U.S. dietary supplements market is driven by growing consumer awareness about health and wellness, rising preventive healthcare adoption, and increasing focus on fitness and nutrition. The expanding aging population and a rise in lifestyle-related health concerns have fueled demand for vitamins, minerals, and herbal supplements. Growing interest in immune-boosting and mental wellness supplements further propels the market.

Additionally, the influence of fitness influencers, evolving dietary patterns, and the availability of diverse product formats through both online and retail channels enhance market accessibility and appeal across different age groups and lifestyles, supporting continued industry growth.

The U.S. dietary supplements market is witnessing a strong shift toward personalized nutrition, with consumers seeking tailored supplement plans based on DNA, lifestyle, and health goals. Plant-based and clean-label supplements are gaining popularity as demand for natural and transparent formulations rises.

There is also increasing interest in mood, sleep, and cognitive health supplements, reflecting broader mental wellness trends. Gummies and chewable continue to gain traction due to convenience and taste. E-commerce platforms and subscription-based supplement services are reshaping how consumers access products, while advancements in delivery systems such as liposomal and nano-encapsulation are driving innovation in product efficacy and absorption.

The Japan Dietary Supplements Market

The Japan Dietary Supplement market is projected to be valued at USD 14.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 28.1 billion in 2034 at a CAGR of 7.9%.

In Japan, the dietary supplements market is propelled by a health-focused aging population seeking to maintain independence and manage age-related conditions. Cultural emphasis on preventive care and traditional medicine supports the widespread use of functional foods and nutraceuticals. High consumer trust in scientifically backed products, combined with a strong regulatory framework for food safety and health claims, promotes confidence in supplement efficacy. The popularity of natural and traditional ingredients like green tea, collagen, and turmeric aligns with cultural preferences. Additionally, the integration of supplements into daily routines and rising interest in beauty-from-within products are strengthening market growth.

The Japanese market is seeing increased demand for multifunctional supplements that target areas such as beauty, immunity, and digestion simultaneously. Collagen, hyaluronic acid, and placenta-based supplements remain popular in the beauty and anti-aging segments. Innovations in convenient delivery formats, such as dissolvable films, jelly sticks, and drinkable supplements, are appealing to busy consumers.

There is a growing preference for clean-label and minimally processed products. Digital platforms and health monitoring apps are influencing personalized supplement recommendations. The fusion of traditional Kampo medicine with modern formulations also represents a unique trend, reflecting a blend of heritage and innovation in consumer preferences.

The Europe Dietary Supplements Market

The Europe Dietary Supplement market is projected to be valued at USD 49.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 109.2 billion in 2034 at a CAGR of 9.1%.

The Europe dietary supplements market is primarily driven by a growing aging population concerned with maintaining vitality and managing chronic conditions. Increasing health consciousness and awareness about preventive healthcare are pushing demand for vitamins, probiotics, and herbal supplements. Regulatory support for health claims and ingredient safety further supports consumer trust. Rising vegan and vegetarian populations’ fuel demand for plant-based products, while fitness and sports nutrition trends are encouraging supplement use among younger demographics. The shift toward holistic wellness, including immunity, gut health, and skin health, also plays a crucial role in expanding market adoption across diverse consumer segments.

Europe is experiencing a rise in demand for sustainable, organic, and ethically sourced supplements, driven by eco-conscious consumers. Functional ingredients such as adaptogens, botanicals, and fermented compounds are gaining popularity for their perceived holistic benefits. Customized nutrition and digital wellness platforms offering health assessments are influencing buying behavior.

The trend toward minimalism is encouraging clean-label formulations, free from artificial additives. Innovations in packaging and user-friendly formats like powders, effervescent tablets, and gummies are enhancing consumer convenience. Additionally, cross-sector collaborations between supplement brands and tech or food companies are fostering new product development and expanded market reach.

Dietary Supplements Market: Key Takeaways

- Market Overview: The global dietary supplements market is projected to reach a value of USD 208.7 billion by 2025, with expectations to grow significantly to USD 470.3 billion by 2034, reflecting a compound annual growth rate (CAGR) of 9.4% during the forecast period from 2025 to 2034.

- U.S. Dietary Supplements Market: The U.S. market is anticipated to be valued at USD 63.9 billion in 2025 and is forecasted to grow steadily to USD 136.8 billion by 2034, registering a CAGR of 8.8% over the period.

- Japan Dietary Supplements Market: Japan’s dietary supplements market is expected to be worth USD 14.2 billion in 2025 and projected to grow to USD 28.1 billion by 2034, expanding at a CAGR of 7.9%.

- Europe Dietary Supplements Market: Europe is estimated to reach a market value of USD 49.6 billion in 2025, with anticipated growth to USD 109.2 billion by 2034, representing a CAGR of 9.1% over the forecast period.

- By Type Analysis: Vitamins are forecasted to remain the most dominant category by type, expected to contribute approximately 35.0% of the global market revenue by the end of 2025.

- By Form Analysis: Tablets are set to be the leading form of dietary supplements, projected to account for around 34% of the total market share by 2025

- By Function Analysis: Immune health is anticipated to lead in terms of functional benefits, with an estimated 28.0% share of the global market by 2025.

- By Distribution Channel Analysis: Pharmacies are projected to be the most prominent distribution channel, capturing roughly 32.0% of the total revenue by 2025.

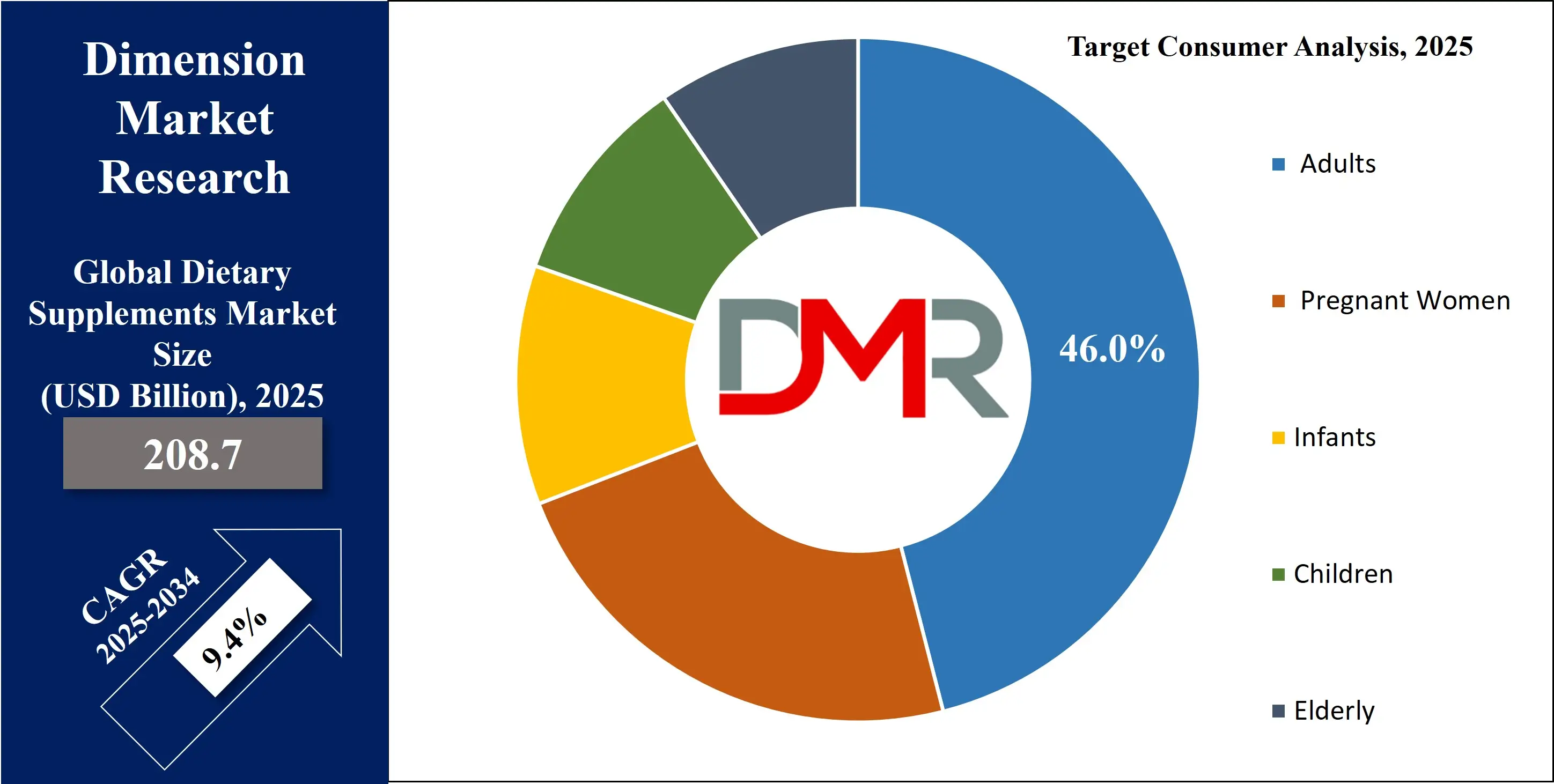

- By Target Consumer Analysis: Adults are expected to remain the primary consumer group, holding the largest share of the market at 46.0% by the end of 2025.

- Regional Share Insights: North America is expected to retain its position as the leading region in the global dietary supplements market, accounting for approximately 36.4% of total revenue by the end of 2025.

Dietary Supplements Market: Use Cases

- Nutritional Deficiency Support: Dietary supplements help bridge nutrient gaps in individuals with inadequate dietary intake, providing essential vitamins, minerals, and nutrients such as iron, calcium, and vitamin D to prevent or treat deficiencies and maintain overall health and wellbeing.

- Immune System Boost: Supplements like vitamin C, zinc, and elderberry are used to strengthen immune defenses, particularly during cold and flu season, reducing susceptibility to infections and aiding in faster recovery from illnesses.

- Sports & Fitness Performance: Athletes and fitness enthusiasts use protein powders, creatine, BCAAs, and electrolyte blends to enhance muscle growth, endurance, recovery, and overall physical performance during intense training or competition.

- Cognitive & Memory Enhancement: Nootropic supplements, including omega-3 fatty acids, ginkgo biloba, and caffeine-based formulas, support mental clarity, concentration, memory retention, and cognitive function, especially for students, professionals, and aging populations.

Dietary Supplements Market: Stats & Facts

- NIH Office of Dietary Supplements: As of 2023, more than 50% of U.S. adults reported using at least one dietary supplement in the past 30 days.

- Centers for Disease Control and Prevention (CDC): Multivitamin-mineral supplements are the most commonly used, with about 24% of adults using them regularly.

- U.S. Food and Drug Administration (FDA): Dietary supplements are regulated as food, not drugs, which means they do not need FDA approval before being marketed.

- Harvard T.H. Chan School of Public Health: Excessive intake of some supplements, such as vitamin A, iron, and vitamin D, can pose health risks, especially when consumed above tolerable upper intake levels.

- National Center for Complementary and Integrative Health (NCCIH): Omega-3 fatty acids (fish oil), probiotics, and melatonin are among the most popular non-vitamin, non-mineral supplements in the United States.

- Johns Hopkins Medicine: Many supplements show little or no benefit in preventing chronic diseases such as heart disease or cancer in otherwise healthy individuals.

- Mayo Clinic: While supplements like calcium and vitamin D may be beneficial for bone health, they are not a substitute for a balanced diet.

- World Health Organization (WHO): Micronutrient deficiencies, which supplements aim to address, affect more than 2 billion people globally, particularly in developing countries.

- Consumer Reports: Some supplements have been found to be contaminated with substances like heavy metals, pesticides, or prescription drugs not listed on the label.

- American Academy of Pediatrics (AAP): Children and adolescents generally do not need vitamin supplements if they are eating a well-balanced diet, with the exception of vitamin D and iron in some cases.

Dietary Supplements Market: Market Dynamic

Driving Factors in the Dietary Supplements Market

Rising Health Consciousness among Consumers

Increasing awareness about preventive health and overall wellness has substantially fueled the global demand for dietary supplements. Consumers are actively turning to nutritional supplements to enhance immunity, aid in weight management, and support cardiovascular, digestive, and mental well-being. Busy lifestyles, inadequate nutrition, and aging populations further drive the need for products such as multivitamins, omega-3 fatty acids, and probiotics.

The pandemic amplified health concerns, boosting the regular use of immune-supporting supplements. Additionally, growing fitness trends and personalized nutrition plans contribute to market expansion. Demand is especially strong in areas like sports nutrition, herbal supplements, and functional foods, with millennials and Gen Z showing a preference for natural and organic alternatives over conventional pharmaceuticals.

Expansion of E-commerce and Online Supplement Retail

The rapid growth of digital retail has transformed how consumers purchase dietary supplements. Online platforms provide a broad selection of products, detailed ingredient information, user reviews, and subscription options for consistent use. E-commerce has allowed supplement brands to effectively reach rural areas and international customers.

Social media and influencer marketing have increased the visibility of wellness and plant-based supplements, particularly in specialized categories such as vegan, gluten-free, and keto-friendly products. Convenient delivery services, discounts, and customizable product bundles encourage repeat buying. Furthermore, online channels serve as effective tools for educating consumers about nutraceutical ingredients like collagen, curcumin, and ashwagandha, aiding market penetration. The growth of Direct-to-Consumer (DTC) sales models has also strengthened customer engagement.

Restraints in the Dietary Supplement Market

Regulatory Challenges and Quality Concerns

Strict and diverse regulations worldwide governing dietary supplements pose significant challenges to market expansion. Variations in rules related to ingredient disclosure, health claims, and dosage limits across different countries create obstacles for product standardization and market entry. Moreover, the circulation of low-quality or counterfeit supplements raises safety issues, reducing consumer confidence.

Limited regulatory oversight, such as by the FDA, on over-the-counter supplements increases the risk of misuse, especially for products containing herbal extracts, caffeine, or nootropic compounds. Frequent regulatory recalls and bans due to contamination or false claims further damage brand reputation. These regulatory complexities hamper innovation and delay the introduction of new dietary supplement formulations, affecting global competitiveness and consumer trust.

High Costs of Premium and Specialized Supplements

High prices of premium dietary supplements containing organic, non-GMO, or clinically validated ingredients restrict affordability for middle- and lower-income consumers. Specialized supplements focused on anti-aging, cognitive support, or athletic recovery require substantial research and development, which drives up production costs.

Additionally, increasing costs of raw materials and supply chain disruptions contribute to higher retail prices. Many consumers are reluctant to commit to long-term supplement use, especially when benefits are not immediate, limiting widespread adoption. Economic inequalities and the lack of health insurance coverage for preventive nutrition also slow market growth in developing regions where price sensitivity remains a key concern.

Opportunities in the Dietary Supplement Market

Innovation in Personalized Nutrition and DNA-based Supplements

The growing focus on personalized healthcare and the advancement of nutrigenomics is unlocking significant potential in the dietary supplements industry. Companies are increasingly offering DNA-based supplements customized to align with an individual’s genetic profile, metabolic rate, and lifestyle factors. Tools such as biometric assessments, gut microbiome evaluations, and AI-driven nutrition platforms are enabling tailored recommendations for addressing vitamin deficiencies, hormonal imbalances, and metabolic needs.

This personalized approach resonates strongly with tech-savvy millennials who prioritize data-driven wellness solutions. As a result, supplement adherence and customer retention improve. Both startups and established companies investing in precision nutrition are well-positioned to capture this emerging, highly specialized market focused on individualized health outcomes.

Growing Demand in Emerging Economies

Ongoing urbanization, increased disposable income, and the expansion of the middle class in regions like Asia-Pacific, Latin America, and Africa are creating lucrative growth opportunities for dietary supplement companies. Growing public awareness of micronutrient deficiencies, lifestyle diseases, and aging-related health issues is driving demand for preventive health products.

Supportive government programs promoting nutritional awareness, including school-based supplement initiatives, further enhance market access. International brands are gaining ground in these developing regions by introducing locally adapted products, cost-effective pricing models, and expanding through pharmacy retail networks. Additionally, social media influencers and the rise of digital healthcare are playing a key role in educating consumers about supplement benefits, accelerating growth in previously underserved markets.

Trends in the Dietary Supplement Market

Shift toward Plant-Based and Clean Label Supplements

There is a rising consumer preference for plant-based dietary supplements that exclude synthetic additives, allergens, and animal-sourced ingredients. This shift is largely influenced by the growing adoption of vegan, vegetarian, and flexitarian diets, alongside heightened ethical and environmental awareness.

The demand for clean label products emphasizes ingredient transparency, featuring simplified formulas, organic sources, and certifications such as USDA Organic, Non-GMO Project Verified, and Gluten-Free. Naturally derived botanicals like turmeric, spirulina, ashwagandha, and maca are increasingly favored for their holistic health benefits. This clean label trend mirrors a broader transformation within the functional foods and nutraceutical sectors, reshaping product innovation and branding across multiple supplement categories.

Rising Adoption of Cognitive and Mood Enhancing Supplements

As awareness of mental health and stress-related conditions increases, the demand for brain-boosting supplements is on the rise. Consumers are turning to cognitive support products aimed at improving focus, reducing stress, and enhancing emotional stability. Nootropic ingredients like L-theanine, GABA, bacopa monnieri, and lion’s mane mushroom are becoming popular among students, working professionals, and older adults.

These supplements are often positioned as natural alternatives to pharmaceutical solutions for mental clarity, mood regulation, and anxiety relief. The movement also aligns with the growing interest in biohacking, where individuals seek to optimize cognitive function. The incorporation of adaptogens and neuroprotective compounds into everyday supplements highlights this evolving trend.

Dietary Supplements Market: Research Scope and Analysis

By Type Analysis

Vitamins are projected to remain the largest revenue-generating type in the global dietary supplements market, commanding about 35.0 % of total sales by the close of 2025. The segment’s leadership is sustained by rising awareness of micronutrient deficiency, expanding geriatric populations, and aggressive fortification initiatives in emerging economies. Multivitamin blends, in particular, benefit from busy lifestyles that favor single-dose convenience.

Regulatory approvals for higher-potency formulas and growing over-the-counter availability further widen the consumer base. In addition, e-commerce platforms are accelerating direct-to-consumer outreach, enabling personalized subscription packs that boost repeat purchases. The convergence of preventive healthcare trends, functional foods crossover, and heightened wellness spending cements vitamins as the most influential pillar within the broader nutraceutical landscape.

Probiotics are expected to register the fastest CAGR through 2025, outpacing all other categories. Surging scientific validation of gut–brain axis benefits, coupled with escalating digestive health concerns tied to processed dietary intake, is propelling demand. Start-ups are introducing spore-forming strains with superior shelf stability, while legacy players reformulate capsules, gummies, and sachets to appeal to vegan, allergen-free niches.

Expansion of cold-chain logistics, clean-label expectations, and synergistic combinations with prebiotic fibers drive product differentiation. Moreover, physicians increasingly recommend probiotic adjuncts during antibiotic therapy, reinforcing clinical credibility. As health-conscious consumers embrace holistic immunity solutions and personalized microbiome testing gains traction, the probiotic segment secures its position as the market’s high-velocity growth engine.

By Form Analysis

Tablets are expected to dominate the global dietary supplements market by the end of 2025, accounting for approximately 34% of the total market share. Their dominance is driven by longer shelf life, cost-efficiency in large-scale production, and ease of packaging. Consumers favor tablets for their dosage precision and multi-ingredient compressibility, especially in multivitamin and mineral blends.

The pharmaceutical-grade finish and extended-release options also enhance bioavailability perception among health-conscious buyers. Additionally, wide availability across retail pharmacies and healthcare outlets reinforces their lead. As clinical nutrition protocols and fitness-oriented regimens integrate supplement tablets, this segment continues to benefit from the widespread shift toward proactive self-care and structured nutrient intake.

Gummies / Chewables are projected to grow at the fastest compound annual growth rate in the dietary supplements market by 2025. Their popularity is surging due to increased consumer interest in flavorful, non-pill alternatives that blend functionality with convenience. Gummy formats cater especially well to pediatric and geriatric demographics, who often struggle with swallowing capsules or tablets.

The rise of plant-based, sugar-free, and allergen-free formulations has also expanded the consumer base. Companies are introducing chewable variants infused with omega-3, collagen, and probiotics, responding to demands for functional versatility. This format's appeal is amplified by direct-to-consumer wellness brands and influencer marketing that position gummies as both lifestyle-friendly and nutrient-dense, fueling rapid adoption across age groups.

By Function Analysis

Immune health is expected to lead the global dietary supplements market by the end of 2025, accounting for approximately 28.0% of the total market share. Growing consumer focus on strengthening the body's natural defenses has driven continuous demand for immunity-boosting supplements. Ingredients like zinc, elderberry, echinacea, and vitamin C are increasingly popular in convenient supplement formats.

This segment benefits from the widespread adoption of preventative wellness practices and personalized health solutions. Moreover, scientific studies supporting immune-enhancing formulations have boosted consumer confidence. The growing overlap between functional foods and dietary supplements, along with innovative product launches from leading brands, further solidifies the immune health segment's strong position across various age groups.

Gut health is anticipated to experience the highest compound annual growth rate through 2025. Increasing rates of digestive issues, food intolerances, and stress-related gastrointestinal problems have heightened consumer awareness of the importance of microbiome balance. Probiotics, prebiotics, and symbiotics are gaining traction for their role in supporting digestive wellness and nutrient absorption.

Research on the gut-brain connection has placed gut health at the forefront of holistic wellness, impacting mood, cognition, and immune function. The rise of clean-label products featuring specific bacterial strains, along with expanded microbiome testing, is driving innovation. This growing interest is especially notable among millennials and health-conscious individuals seeking natural, sustainable digestive support.

By Distribution Channel Analysis

Pharmacies are expected to lead the global dietary supplements market by the end of 2025, capturing around 32.0% of total revenue. This dominance stems from strong consumer confidence in pharmacist-recommended products and the availability of clinically supported formulations. Pharmacies provide a broad selection of high-quality supplements, including prenatal vitamins, therapeutic minerals, and condition-specific nutraceuticals, which help build customer loyalty.

The advantage of face-to-face consultations and access to regulated, effective brands further strengthens their market position. Additionally, prescription-based supplementation and in-store promotions drive consistent customer visits. With increasing emphasis on preventive healthcare and self-management of chronic illnesses, pharmacies remain a trusted and convenient source for reliable dietary supplement solutions.

Meanwhile, the online segment is projected to experience the fastest compound annual growth rate by 2025. Growing adoption of digital health trends, combined with expanding e-commerce networks, fuels significant growth in direct-to-consumer supplement sales. Online stores offer ease of access, a wide variety of products, and user reviews, appealing to diverse age groups.

Subscription services, customized nutrition packs, and social media marketing enhance consumer interaction. The online channel is especially popular for niche products like vegan probiotics, keto supplements, and gluten-free vitamins. Advances in logistics, mobile platforms, and digital health ecosystems are making online retail a key growth driver in the dietary supplements industry.

By Target Consumer Analysis

Adults are expected to be the dominant target consumer in the global dietary supplements market by the end of 2025, accounting for 46.0% of the market share. This segment’s prominence is fueled by increasing health consciousness, urban lifestyle stressors, and growing incidence of lifestyle-related deficiencies. Adults are increasingly seeking preventive healthcare solutions such as antioxidant supplements, immunity boosters, and personalized nutrition packs tailored to work-life balance and fitness routines.

With the rise in wellness tourism, digital health apps, and gym memberships, adult consumers are more inclined to invest in daily supplementation. The availability of gender-specific and age-specific formulations further enhances adoption, supported by strong visibility across pharmacy chains and digital retail channels offering targeted health solutions.

Pregnant women are projected to witness the highest compound annual growth rate by 2025 in the dietary supplements market. Rising awareness about prenatal nutrition, government-backed maternal health initiatives, and increasing recommendations from obstetricians are primary growth catalysts. Key supplements include folic acid, DHA, iron, and calcium, critical for fetal development and maternal immunity.

Digital health platforms are also boosting access to educational content and subscription-based pregnancy care kits. Furthermore, clean-label prenatal vitamins with traceable ingredients and allergen-free claims are attracting first-time mothers in developed and emerging markets alike. As family planning becomes more health-focused and consumers prioritize optimal birth outcomes, this segment benefits from both preventive care trends and increased willingness to spend on premium wellness products.

The Dietary Supplements Market Report is segmented on the basis of the following:

By Type

- Botanicals

- Vitamins

- Vitamin A

- Vitamin B

- Vitamin C

- Vitamin D

- Other Vitamins

- Minerals

- Calcium

- Iron

- Other Minerals

- Amino Acids

- Branched-Chain Amino Acids (BCAAs)

- L-Arginine

- Glutamine

-

- Enzymes

- Probiotics

- Other Types

By Form

- Tablets

- Capsules

- Liquid

- Powder

- Gummies / Chewables

By Function

- Gut Health

- Immune Health

- Sports Nutrition

- Skin Health

- Metabolic Health

- Weight Management

- Bone & Joint Health

- Other Functions

By Distribution Channel

- Pharmacies

- Supermarkets/Hypermarkets

- Health & Wellness Stores

- Online

- Other Distribution Channels

By Target Consumer

- Infants

- Children

- Adults

- Pregnant Women

- Elderly

Regional Analysis

Region with the largest Share

North America is projected to hold the largest share of the global dietary supplements market, with revenue share of

36.4% by the end of 2025. This dominance is primarily attributed to the high consumer awareness of preventive healthcare, robust healthcare infrastructure, and strong purchasing power. The U.S. leads with widespread consumption of multivitamins, omega-3 fatty acids, and specialty supplements targeting immune health and sports nutrition.

A well-established retail landscape spanning pharmacies, supermarkets, and online platforms supports broad product accessibility. Furthermore, the presence of key market players and a strong focus on clean-label, non-GMO, and organic ingredients drive innovation. Rising health concerns related to aging, obesity, and chronic diseases also reinforce supplement adoption among both younger adults and aging populations across North America.

Region with Highest CAGR

Asia-Pacific is expected to register the highest compound annual growth rate (CAGR) in the global dietary supplements market through 2025. Rapid urbanization, rising disposable incomes, and growing awareness of holistic health are major contributors. Countries like China, India, Japan, and South Korea are witnessing a surge in demand for herbal and traditional supplements, probiotics, and personalized nutrition solutions.

The increasing burden of lifestyle-related disorders and a shift toward proactive wellness have accelerated demand for supplements aimed at metabolic health, digestive health, and immunity. E-commerce expansion and government initiatives supporting nutraceutical safety standards are further fueling growth. As consumers across Asia-Pacific seek convenient, natural, and culturally aligned health solutions, the region continues to attract investment and product innovation at an accelerated pace.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The competitive landscape of the global dietary supplements market is highly fragmented and characterized by the presence of numerous international and regional players. Key companies such as Amway, Herbalife Nutrition, Nestlé Health Science, Abbott Laboratories, and Bayer AG lead the market through extensive product portfolios and global distribution networks. These players continuously invest in nutraceutical innovation, clinical research, and strategic partnerships to strengthen their market position.

Manufacturers are focusing on developing clean-label supplements, vegan capsules, and non-GMO formulations to meet evolving consumer preferences. The rise in demand for probiotic blends, digestive health supplements, and immune-support complexes has encouraged companies to diversify their offerings with targeted, condition-specific solutions. Additionally, personalization through AI-driven health assessments and DNA-based nutrition plans is becoming a competitive differentiator.

Digital transformation is also reshaping the landscape, with many brands leveraging e-commerce channels, social media marketing, and subscription-based models to reach broader audiences. Regional players, especially in Asia-Pacific and Latin America, are gaining momentum by offering culturally relevant ingredients and herbal supplements rooted in traditional medicine.

Intense competition, rapid product innovation, and the growing demand for holistic wellness are expected to drive strategic expansions, M&A activities, and new product launches in the dietary supplements industry.

Some of the prominent players in the Global Dietary Supplements Market are:

- Nestlé Health Science S.A.

- Amway (Nutrilite)

- Glanbia Plc (Optimum Nutrition, BSN)

- BASF

- Archer-Daniels-Midland Company (ADM)

- Nature's Sunshine Products Inc.

- Bionovas

- Herbalife Nutrition

- GNC Holdings, Inc.

- Pfizer Inc.

- Abbott Laboratories

- NOW Foods

- USANA Health Sciences, Inc.

- Swisse Wellness

- Solgar, Inc.

- Nature’s Bounty Co.

- The Himalaya Drug Company

- Amneal Pharmaceuticals

- Blackmores Limited

- NutraScience Labs

- Other Key Players

Recent Developments

- In September 2023, Kyowa Hakko partnered with pharmaceutical manufacturer Quifaest to introduce its postbiotic ingredient, IMMUSE, to the Mexican market. This launch marked IMMUSE’s debut in Mexico, representing a major step in expanding its global footprint.

- In August 2023, Nutritional Research Company (NRC) unveiled its Absorbable supplement range designed to support immune health. The product line features three variants: Vitamin C, Vitamin D3 1000 IU, and Vitamin D3 2000 IU.

- In May 2023, Arla Foods Ingredients launched a new solution that enhances protein content in oral nutritional supplements presented as juice-style drinks. These convenient supplements include orange, mango, and strawberry flavors to promote easier consumption.

- In April 2023, IFF introduced Verdigel SC, a vegan softgel capsule technology free from carrageenan. This plant-based innovation integrates smoothly into current manufacturing processes while maintaining the stability and manageability typical of both traditional vegan and animal-based softgel capsules.

- In April 2023, Ayana Bio debuted plant cell-derived health and wellness ingredients—lemon balm and Echinacea, addressing challenges faced in traditional farming of these plants, including issues like adulteration, contamination, pesticide use, inconsistent quality, infections, weather variability, and low levels of active compounds.

- In February 2023, ADM, a global leader in science-driven nutritional solutions, opened a cutting-edge production facility in Valencia, Spain. This expansion aims to meet the growing global demand for probiotics, postbiotics, and other health-promoting products.

- In February 2023, Kyowa Hakko’s postbiotic IMMUSE was incorporated into Comple.med’s new European product, Lactoflor Immuno 200. This formulation, the first in Europe to feature IMMUSE, also contains lactoferrin and Vitamin D3. IMMUSE is a patented postbiotic known for activating plasmacytoid dendritic cells, which in turn stimulate other immune cells.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 208.7 Bn |

| Forecast Value (2034) |

USD 470.3 Bn |

| CAGR (2025–2034) |

9.4% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 63.9 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Botanicals, Minerals, Amino Acids, Enzymes, Probiotics, Other Types), By Form (Tablets, Capsules, Liquid, Powder, Gummies / Chewables), By Function (Gut Health, Immune Health, Sports Nutrition, Skin Health, Metabolic Health, Weight Management, Bone & Joint Health, Other Functions), By Distribution Channel (Pharmacies, Supermarkets/Hypermarkets, Health & Wellness Stores, Online, Other Distribution Channels), By Target Consumer (Infants, Children, Adults, Pregnant Women, Elderly) |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Nestlé Health Science S.A., Amway (Nutrilite), Glanbia Plc (Optimum Nutrition, BSN), BASF, Archer-Daniels-Midland Company (ADM), Nature's Sunshine Products Inc., Bionovas, Herbalife Nutrition, GNC Holdings, Inc., Pfizer Inc., Abbott Laboratories, NOW Foods, USANA Health Sciences, Inc., Swisse Wellness, Solgar, Inc., Nature’s Bounty Co., The Himalaya Drug Company, Amneal Pharmaceuticals, Blackmores Limited, NutraScience Labs, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

The Global Dietary Supplement Market size is estimated to have a value of USD 208.7 billion in 2025 and is expected to reach USD 470.3 billion by the end of 2034.

North America is expected to be the largest market share for the Global Dietary Supplement Market with a share of about 36.4% in 2025.

Some of the major key players in the Global Dietary Supplements Market are Nestlé Health Science S.A., Amway, Glanbia Plc. and many others.

The market is growing at a CAGR of 9.4 over the forecasted period.

The US Dietary Supplement Market size is estimated to have a value of USD 63.9 billion in 2025 and is expected to reach USD 136.8 billion by the end of 2034.