Market Overview

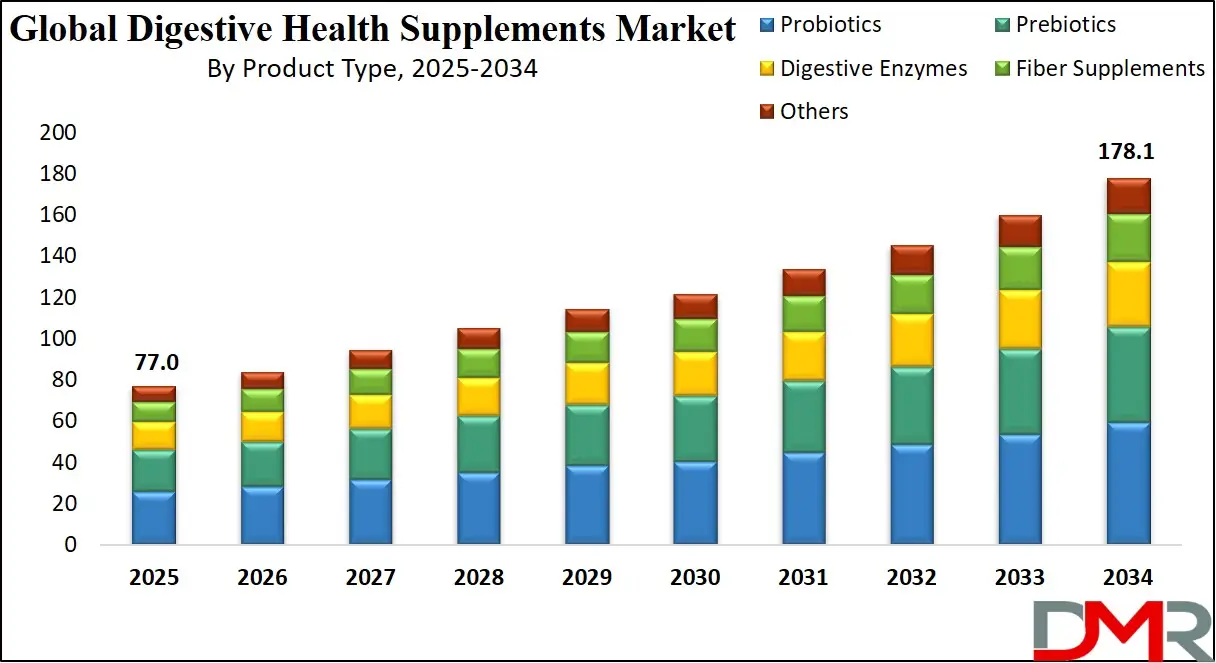

The Global Digestive Health Supplements Market is predicted to be valued at USD 77.0 billion in 2025 and is expected to grow to USD 178.1 billion by 2034, registering a compound annual growth rate (CAGR) of 9.8% from 2025 to 2034.

Digestive health supplements are products designed to support and improve the function of the digestive system. They typically contain ingredients like probiotics, prebiotics, digestive enzymes, fiber, and herbs that aid in digestion, nutrient absorption, and gut balance. These supplements help alleviate issues such as bloating, indigestion, constipation, and irregular bowel movements.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Probiotics promote healthy gut bacteria, while enzymes assist in breaking down food. Often used by individuals with gastrointestinal discomfort or those seeking to maintain gut health, digestive supplements are available in various forms, including capsules, powders, and chewables, and are commonly used as part of a balanced wellness routine.

The global digestive health supplements market encompasses a diverse range of products designed to support and enhance the digestive system's functionality, including probiotics, prebiotics, digestive enzymes, and dietary fibers. These supplements promote gut health, improve nutrient absorption, and alleviate gastrointestinal discomfort, making them increasingly popular across various demographics.

A growing awareness of gut microbiota's role in overall wellness has significantly shifted consumer focus toward preventive healthcare, driving demand for natural digestive health solutions. Busy lifestyles and irregular eating habits have amplified gastrointestinal issues, encouraging the adoption of supplements that offer digestive balance and immune system support. Products such as probiotic capsules, enzyme blends, and fiber-rich powders have gained momentum among health-conscious consumers and individuals with specific dietary needs.

Innovation in formulation, such as time-release capsules and microencapsulation technology, has improved supplement efficacy and shelf stability. Plant-based and allergen-free digestive aids are gaining popularity, especially among vegan and lactose-intolerant consumers. Personalized nutrition and DNA-based supplement plans are emerging as transformative trends, aligning with consumer preferences for tailored wellness solutions.

The market is highly competitive, with leading players like Nestlé Health Science, Amway, NOW Foods, and Herbalife emphasizing clean-label products, strategic acquisitions, and product diversification to expand their footprint. E-commerce platforms are reshaping purchasing patterns, offering convenience and wider product access.

Regulatory frameworks vary across regions, with the U.S. FDA and EFSA playing crucial roles in product approval and labeling. Advancements in gut health research, along with increasing consumer trust in natural and functional supplements, are expected to propel the digestive health supplements market forward.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

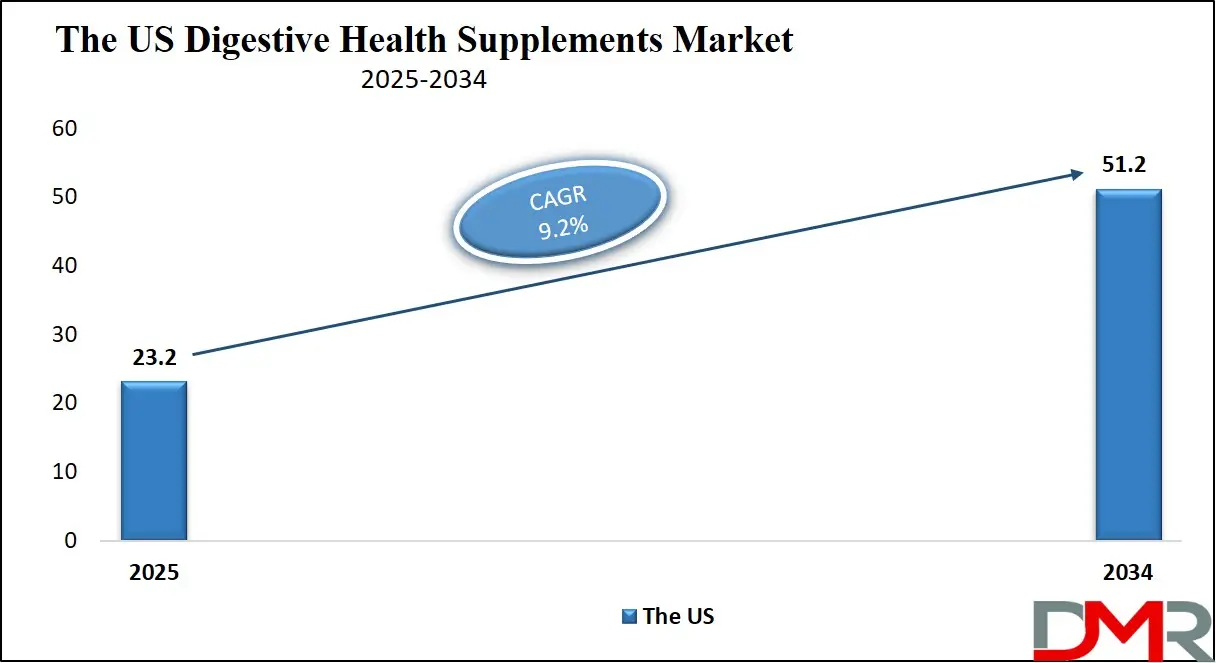

The US Digestive Health Supplements Market

The US Digestive Health Supplements market is projected to be valued at USD 23.2 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 51.2 billion in 2034 at a CAGR of 9.2%.

Growing awareness about gut health and its link to overall wellness is fueling demand for digestive supplements in the US. Consumers are increasingly seeking natural and preventive health solutions, with a rising interest in probiotics, prebiotics, and fiber-based supplements. Busy lifestyles and dietary imbalances are driving individuals to seek convenient ways to improve digestion and immunity.

Additionally, the rise in gastrointestinal disorders and a growing aging population contribute to market growth. The influence of e-commerce and online health platforms also facilitates easy access to these supplements, boosting consumption.

The US market shows a strong shift towards clean-label and organic digestive supplements, reflecting consumer preferences for transparency and natural ingredients. Innovative formulations combining multiple digestive benefits, such as gut microbiome support and immune health, are gaining traction. Personalized nutrition and gut health testing are emerging as key trends, enabling consumers to tailor supplements to individual needs. Plant-based and vegan-friendly options are growing in popularity. Additionally, the integration of digestive health supplements in daily wellness routines, supported by social media and influencer endorsements, is shaping consumer behavior.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Digestive Health Supplements Market

The Japan Digestive Health Supplements market is projected to be valued at USD 6.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 13.4 billion in 2034 at a CAGR of 9.3%.

Japan’s aging population and increasing awareness of digestive health’s role in longevity are key drivers of the market. The cultural emphasis on preventive health and traditional dietary practices encourages consumption of digestive supplements. High consumer trust in scientific research and efficacy supports product adoption.

Moreover, rising lifestyle-related digestive issues due to urbanization and dietary shifts create demand for gut health solutions. Government initiatives promoting health and wellness, along with a strong pharmaceutical and nutraceutical industry presence, also contribute significantly.

Japanese consumers prefer supplements that integrate traditional ingredients like fermented foods and natural extracts with advanced scientific formulations. There is a growing focus on products that support gut microbiota balance and overall wellness, including mental health connections. Convenience-driven formats such as ready-to-consume drinks and powders are popular. Emphasis on safety, quality, and regulatory compliance remains strong. Additionally, innovations in personalized nutrition and functional foods tailored to digestive health needs are emerging. E-commerce and targeted marketing strategies further influence consumer choices.

The Europe Digestive Health Supplements Market

The Europe Digestive Health Supplements market is projected to be valued at USD 20.3 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 47.7 billion in 2034 at a CAGR of 9.9%.

In Europe, increasing consumer focus on preventive healthcare and holistic well-being drives the digestive health supplements market. Growing awareness about the gut-brain axis and its impact on mental health encourages supplement adoption. Rising prevalence of digestive disorders and lifestyle-related health issues also fuels demand. The preference for natural, organic, and sustainably sourced products is strong across European countries. Supportive government regulations and increasing investment in healthcare infrastructure further propel market growth. Moreover, the trend towards healthier eating habits and clean-label products positively impacts supplement consumption.

European consumers are gravitating towards supplements with scientifically validated probiotic strains and multifunctional benefits, such as digestive and immune support. There is growing interest in traditional and herbal digestive remedies combined with modern formulations. Clean-label, allergen-free, and non-GMO supplements are increasingly favored. Sustainability and eco-friendly packaging play significant roles in purchasing decisions. Additionally, digital health technologies and online retail are enhancing consumer engagement and accessibility. Collaborative innovation between brands and research institutions is also shaping the product landscape.

Digestive Health Supplements Market: Key Takeaways

- Market Overview: The global market for digestive health supplements is projected to reach a valuation of USD 77.0 billion in 2025 and is anticipated to expand significantly, hitting USD 178.1 billion by 2034. This growth corresponds to a compound annual growth rate (CAGR) of 9.8% over the forecast period from 2025 to 2034.

- United States Digestive Health Supplements Market: In the United States, the digestive health supplements market is expected to be worth USD 23.2 billion in 2025. It is forecasted to grow steadily, reaching USD 51.2 billion by 2034, with a CAGR of 9.2%.

- Japan Digestive Health Supplements Market: Japan’s digestive health supplements market is anticipated to be valued at USD 6.1 billion in 2025 and is projected to grow to USD 13.4 billion by 2034, reflecting a CAGR of 9.3% during the forecast period.

- Europe Digestive Health Supplements Market: The European digestive health supplements market is expected to be valued at USD 20.3 billion in 2025 and projected to increase to USD 47.7 billion by 2034, growing at a CAGR of 9.9%.

- By Product Type: The probiotics segment is expected to lead the digestive health supplements market, contributing approximately 45.3% of the total revenue by the end of 2025.

- By Form: Capsules are projected to be the dominant form of digestive health supplements globally, accounting for nearly 34.7% of the total market share by 2025.

- By Function: Supplements aimed at maintaining gut microbiota balance are forecasted to lead the market, with a projected revenue share of 36.1% in 2025.

- By Distribution Channel: The B2C distribution channel is set to dominate the global digestive health supplements market, representing around 67.4% of total revenue in 2025.

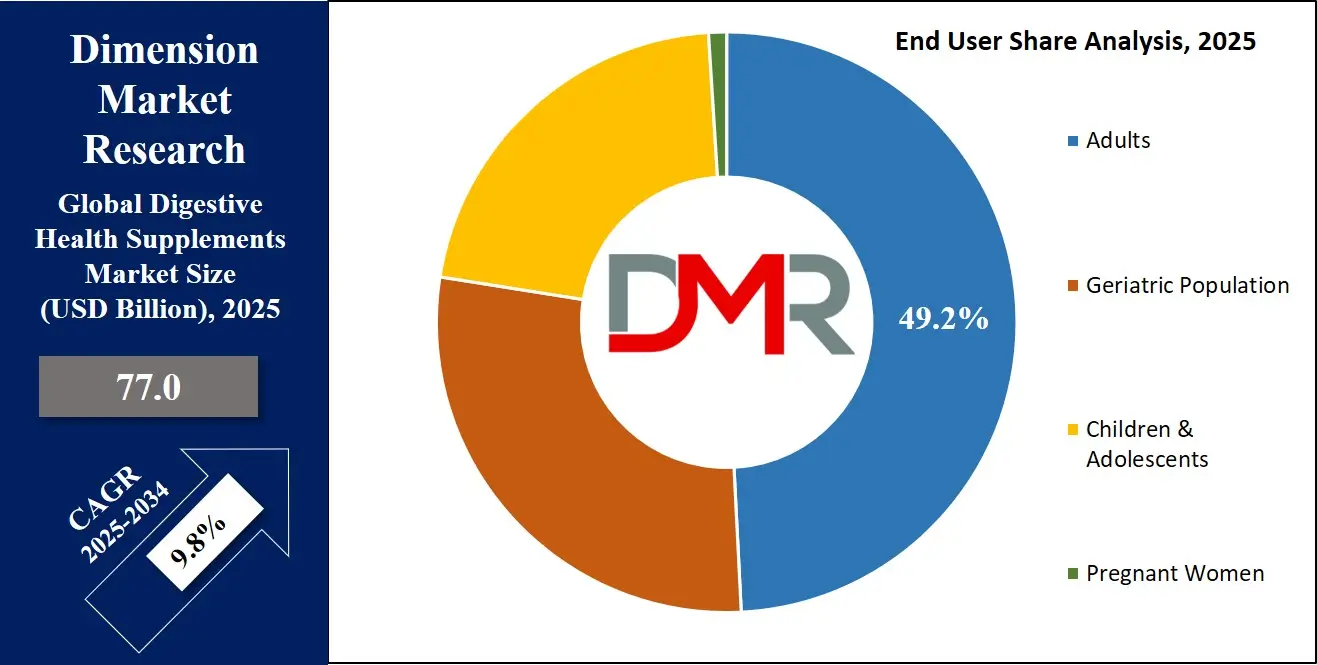

- By End User: Adults are expected to be the primary consumers in this market, holding about 49.2% of the global revenue share in 2025.

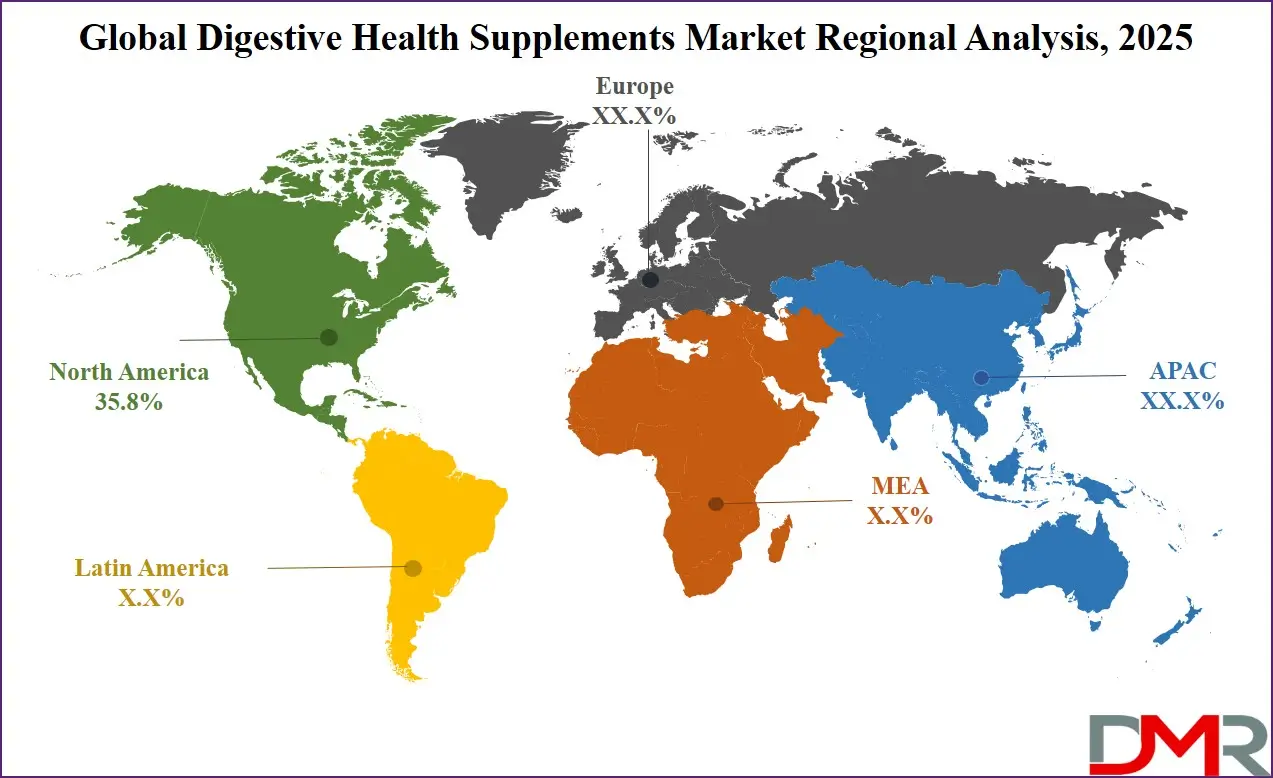

- Leading Region: North America is projected to lead the global digestive health supplements market, commanding approximately 35.8% of the total revenue in 2025.

Digestive Health Supplements Market: Use Cases

- Improving Gut Microbiota Balance: Digestive health supplements like probiotics help restore and maintain a healthy balance of gut bacteria, enhancing digestion, nutrient absorption, and reducing symptoms like bloating, gas, and irregular bowel movements.

- Alleviating Digestive Disorders: Supplements such as digestive enzymes aid individuals with conditions like lactose intolerance, IBS, or acid reflux by breaking down food more efficiently, minimizing discomfort, and supporting overall digestive function.

- Boosting Immune Function: Since a large part of the immune system resides in the gut, digestive health supplements support immune health by promoting a balanced gut environment, helping the body defend against infections and inflammation.

- Enhancing Nutrient Absorption: Certain supplements improve the breakdown and absorption of vitamins and minerals from food, ensuring better nutritional status and preventing deficiencies, especially in individuals with compromised digestion or malabsorption issues.

Digestive Health Supplements Market: Stats & Facts

- Mayo Clinic: Around 60 to 70 million people in the United States suffer from digestive diseases, highlighting the widespread need for digestive health support.

- National Institutes of Health (NIH): Probiotics, a common ingredient in digestive supplements, have been shown in clinical studies to help balance gut bacteria and improve symptoms of irritable bowel syndrome (IBS).

- Harvard Medical School: Digestive enzymes and fiber supplements can aid digestion and promote regular bowel movements, especially in individuals with enzyme insufficiency or low fiber intake.

- Cleveland Clinic: More than half of adults worldwide experience digestive issues such as bloating, constipation, or diarrhea, often leading to increased use of digestive supplements.

- Johns Hopkins Medicine: Maintaining gut health with supplements that support the microbiome can influence not only digestion but also the immune system and mental health.

- WebMD: Over 3 million Americans use probiotics daily, demonstrating the growing popularity of supplements targeting digestive wellness.

- American Gastroenterological Association (AGA): Dietary fiber supplementation is recommended as a first-line approach for managing common digestive problems like constipation and diverticulosis.

- National Center for Complementary and Integrative Health (NCCIH): While digestive supplements show promise, research is ongoing to establish standardized guidelines for their effectiveness and safety.

Digestive Health Supplements Market: Market Dynamic

Driving Factors in the Digestive Health Supplements Market

Increasing Consumer Awareness of Gut Health

Growing consumer awareness about the importance of gut health is a major driving factor for the digestive health supplements market. People are increasingly recognizing the role of a balanced microbiome in overall wellness, leading to a surge in demand for probiotics, prebiotics, and digestive enzyme supplements. The rising prevalence of digestive disorders such as irritable bowel syndrome (IBS), acid reflux, and bloating has pushed consumers to adopt natural and dietary supplements for better digestive function.

Additionally, health-conscious individuals are proactively incorporating digestive health supplements as part of preventive healthcare. This trend is further fueled by digital health information and influencer marketing, making digestive supplements a mainstream wellness product worldwide.

Rising Prevalence of Digestive Disorders

The increasing incidence of digestive health issues like constipation, diarrhea, and inflammatory bowel diseases is propelling the market growth for digestive health supplements. As lifestyles become more hectic, poor dietary habits, stress, and antibiotic use disrupt the gut microbiota balance, increasing demand for probiotic and prebiotic supplements to restore gut flora. Healthcare professionals are recommending dietary supplements as adjunct therapy to conventional treatments, boosting adoption.

Moreover, the aging population with weakened digestive systems contributes to market expansion. These factors are driving investments in product innovation to develop targeted supplements that support digestive enzymes and enhance nutrient absorption, thereby improving overall digestive health and quality of life.

Restraints in the Digestive Health Supplements Market

Regulatory Challenges and Stringent Compliance

One of the significant restraints in the digestive health supplements market is the complex regulatory environment. Regulatory bodies such as the FDA, EFSA, and other international authorities enforce strict guidelines regarding the safety, efficacy, and labeling of dietary supplements, including probiotics and digestive enzymes. Compliance with these regulations requires extensive clinical trials and documentation, increasing the cost and time for product development.

Moreover, varying regulations across different countries complicate market entry for manufacturers. This can limit the availability of innovative digestive health products and slow market growth. Consumers also face confusion due to inconsistent claims and lack of standardized testing methods, hindering trust and widespread adoption of digestive supplements.

Limited Consumer Awareness in Emerging Market

Despite rising global awareness, limited consumer education and low adoption rates in emerging economies act as a restraint for the digestive health supplements market. In many developing regions, people rely heavily on traditional remedies and lack understanding of modern dietary supplements such as probiotics and prebiotics.

Additionally, limited access to healthcare professionals and lower disposable incomes reduce the penetration of digestive health supplements. The absence of strong distribution networks and marketing efforts in these markets also restricts consumer reach. This gap in awareness and accessibility challenges manufacturers to establish a solid foothold and hinders the overall growth potential of the digestive health supplements sector in these regions.

Opportunities in the Digestive Health Supplements Market

Expansion of E-commerce and Online Retail Channels

The rapid growth of e-commerce platforms and online retail channels presents a significant opportunity for the digestive health supplements market. Consumers increasingly prefer the convenience of purchasing dietary supplements such as probiotics, digestive enzymes, and fiber supplements online, which provides access to a wide product variety and detailed information.

Digital marketing and subscription-based models enable personalized supplement recommendations and increased customer retention. Furthermore, online platforms allow direct-to-consumer sales, reducing distribution costs for manufacturers and encouraging competitive pricing. This trend facilitates penetration into untapped markets and enhances consumer engagement, creating a lucrative channel for market expansion and driving revenue growth for digestive health supplement brands globally.

Innovation in Formulations and Product Development

Innovative formulations in digestive health supplements represent a promising growth opportunity. Manufacturers are investing in research to develop multi-strain probiotics, synbiotics (combining probiotics and prebiotics), and enzyme blends tailored to specific digestive conditions. Additionally, the introduction of natural, plant-based, and organic supplements aligns with the rising consumer demand for clean-label products.

Advances in biotechnology enable improved stability, bioavailability, and targeted delivery systems, enhancing supplement efficacy. The growing trend toward personalized nutrition also encourages the creation of customized digestive health supplements based on individual microbiome profiles. These innovations can attract health-conscious consumers and differentiate brands in a competitive market, driving expansion and increasing market share.

Trends in the Digestive Health Supplements Market

Growing Preference for Natural and Organic Digestive Supplements

A notable trend in the digestive health supplements market is the rising consumer demand for natural and organic solutions. People are increasingly turning away from synthetic additives and gravitating toward products formulated with plant-derived fibers, herbal components, and naturally fermented probiotics. This shift reflects a broader preference for clean-label, non-GMO, and allergen-free supplements that promote overall health and wellness.

Factors like organic certification and transparent ingredient sourcing are becoming critical in purchase decisions. As a result, manufacturers are updating their formulations and introducing new products that prioritize sustainability and environmentally friendly practices. This trend is particularly appealing to consumers aiming for sustained digestive health and stronger immunity, shaping innovation and development throughout the industry.

Integration of Digestive Health Supplements with Functional Foods and Beverages

The integration of digestive health supplements into functional foods and beverages is gaining momentum as a key market trend. Probiotics, prebiotics, and digestive enzymes are increasingly incorporated into yogurts, smoothies, nutrition bars, and ready-to-drink health beverages to provide convenient gut health benefits. This blending meets consumer demand for on-the-go wellness solutions and encourages consistent supplement intake.

The rise of fermented food products and fortified snacks also complements this trend, promoting digestive health through everyday diets. Such innovations enable companies to target a broader audience, including younger consumers and fitness enthusiasts, thus expanding the market beyond traditional supplement formats and enhancing consumer engagement with digestive wellness.

Digestive Health Supplements Market: Research Scope and Analysis

By Product Type Analysis

Probiotics segment is predicted to dominate with 45.3% of total revenue share in the digestive health supplements market by the end of 2025. The leading role is due to an increase in knowledge among consumers about gut health, immunity and the positive impact of Lactobacillus and Bifidobacterium. Higher demand for all three is also being driven by the increasing use of functional foods, popularity of fermented dairy and an interest in preventive health care in North America and Europe.

Furthermore, the use of probiotics has become more popular due to doctors confirming their role in gastrointestinal care. Sales are rising in this sector, encouraged by the rise of clean-label supplements and increased interest in personalized nutrition, mainly from people seeking a healthy balance for their microbiomes.

Prebiotics is expected to be the fastest-growing type of digestive health supplement by the close of 2025. Increasing focus on feeding the gut with beneficial bacteria and the benefits of using synbiotics explain this growth trend. Because of increased use in functional foods and drinks and higher awareness regarding their benefits for bones and good digestion, demand for these is expected to surge.

More people in Europe and Asia-Pacific using plant-based and non-GMO products is helping the market grow. Moreover, new ways to add fiber to products and the preference for healthier diets with fiber have highlighted the importance of prebiotic-based supplements in health care.

By Form Analysis

Capsules segment is anticipated to dominate the global digestive health supplements market, holding approximately 34.7% of the total market share by the end of 2025. This form remains preferred due to its precise dosing, extended shelf life, and ease of consumption. Capsules effectively deliver active ingredients like probiotics and digestive enzymes without compromising their potency. Consumers favor them for their rapid absorption and convenience, especially in clinical nutrition and dietary supplement routines.

The increasing adoption of vegan and gelatin-free capsule technologies also supports broader demographic appeal. Moreover, growing interest in gut flora regulation, colon health, and functional gastrointestinal support continues to drive the prominence of capsules in health-focused lifestyles and daily supplementation practices.

The Gummies & Chewables segment is forecasted to register the highest CAGR in the digestive health supplements market by the end of 2025. This surge is fueled by rising demand for palatable, user-friendly formats among children and older adults. Gummies enhance compliance in daily wellness regimens, particularly for individuals averse to swallowing pills.

Innovation in flavoring, texture, and sugar-free formulations has made this format highly attractive in nutraceuticals. The inclusion of gut-friendly ingredients like lactase, fiber blends, and herbal digestive aids has broadened product offerings. Expanding functional confectionery trends, clean-label product development, and demand for digestive comfort solutions are contributing to this segment’s dynamic growth in both developed and emerging health-conscious markets.

By Function Analysis

Gut Microbiota Balance segment is expected to dominate the global digestive health supplements market, capturing approximately 36.1% of the overall revenue share in 2025. This dominance is driven by growing awareness about maintaining a healthy intestinal flora and the role of probiotics and prebiotics in supporting microbiome diversity. Consumers are increasingly adopting gut-targeted supplements to address chronic digestive issues, maintain gastrointestinal equilibrium, and support overall digestive tract health.

The rise of gut-brain axis research and interest in personalized digestive wellness has further propelled the segment. With rising demand for microbiome-enhancing formulations in capsules, powders, and fortified foods, this functional benefit is becoming central to preventive digestive care in daily dietary routines.

The Irritable Bowel Syndrome (IBS) Support segment is projected to witness the highest CAGR in the digestive health supplements market by the end of 2025. This growth is propelled by increasing IBS prevalence globally, coupled with heightened demand for non-prescription remedies and symptom-specific supplements. Formulations featuring enzymes, herbal extracts, and soothing agents are gaining traction among consumers seeking alternatives to pharmaceutical treatments.

Advances in clinical research on natural IBS management, including enzyme blends and plant-based fiber supplements, are supporting this momentum. The preference for gut-soothing nutraceuticals and digestive tract modulators among adults dealing with irregular bowel habits is fueling innovation in this space. Expansion of e-commerce channels has further facilitated access to targeted IBS support products worldwide.

By Distribution Channel Analysis

B2C distribution channel is expected to dominate the global digestive health supplements market, accounting for approximately 67.4% of total revenue in 2025. The widespread consumer demand for over-the-counter digestive support products, including enzyme blends, fiber supplements, and gut-balancing probiotics, is a key growth driver. B2C channels enable direct consumer access to a broad range of gastrointestinal wellness solutions across multiple touchpoints, including online platforms, pharmacies, and health food outlets.

Rising self-care trends and increased awareness of digestive comfort have made it easier for individuals to incorporate these supplements into their daily wellness routines. With growing interest in digestive efficiency, functional nutrition, and at-home preventive health, the B2C segment continues to gain strong traction worldwide.

The B2B distribution channel is projected to record the highest CAGR in the global digestive health supplements market by the end of 2025. This growth is driven by increasing collaboration between supplement manufacturers and institutional buyers such as hospitals, wellness clinics, and functional food producers. Healthcare professionals are increasingly recommending gut health formulations to support recovery, nutrient absorption, and patient well-being.

Meanwhile, food & beverage manufacturers are integrating digestive-friendly ingredients like inulin, lactase, and prebiotic fibers into product lines, responding to demand for enhanced gastrointestinal functionality. As organizations seek scientifically backed digestive support solutions, the B2B market continues to expand through bulk purchasing agreements, clinical nutrition programs, and ingredient innovation across therapeutic and commercial applications.

By End User

Adults segment is expected to dominate the global digestive health supplements market, securing approximately 49.2% of the total revenue share in 2025. This dominance stems from rising gastrointestinal issues such as acid reflux, bloating, and irregular bowel movements among working-age populations. Lifestyle factors, including poor diet, stress, and sedentary behavior, have significantly increased the demand for digestive enzyme supplements, probiotics, and dietary fibers. Adults are increasingly turning to gut health solutions for preventive care and daily digestive comfort.

Additionally, the popularity of functional nutrition and awareness of long-term gastrointestinal wellness have boosted adoption rates among health-focused adults seeking personalized supplement routines to support metabolism, gut lining integrity, and overall digestive function.

The Geriatric Population segment is projected to witness the highest CAGR in the digestive health supplements market by the end of 2025. Age-related digestive decline, including reduced enzyme secretion and impaired nutrient absorption, has driven the elderly to incorporate targeted gastrointestinal aids into their routines. Demand for formulations supporting bowel regularity, microbiota diversity, and nutrient bioavailability is rising among older adults.

Furthermore, the growing prevalence of age-associated conditions such as constipation, lactose intolerance, and gastrointestinal discomfort has led to an increased reliance on gentle yet effective gut health products. The aging global population, combined with enhanced healthcare access and interest in healthy aging, is fueling demand for easily digestible supplements tailored to seniors’ unique gastrointestinal needs.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Digestive Health Supplements Market Report is segmented on the basis of the following:

By Product Type

- Probiotics

- Bacteria-based

- Yeast-based

- Prebiotics

- Fructooligosaccharides (FOS)

- Galactooligosaccharides (GOS)

- Inulin

- Digestive Enzymes

- Protease

- Amylase

- Lipase

- Lactase

- Fiber Supplements

- Psyllium

- Methylcellulose

- Others

- Others

By Form

- Capsules

- Tablets

- Powders

- Gummies & Chewables

- Others

By Function

- Gut Microbiota Balance

- Lactose Intolerance Management

- Indigestion Relief

- Constipation & Bloating Relief

- Gastric Acid Neutralization

- Irritable Bowel Syndrome (IBS) Support

- Immune System Support

By Distribution Channel

- B2C

- Pharmacies & Drug Stores

- Supermarkets & Hypermarkets

- Online Retail

- Health & Wellness Stores

- B2B

- Hospitals & Clinics

- Nutrition & Wellness Centers

- Fitness Centers & Gyms

- Food & Beverage Manufacturers

By End User

- Adults

- Geriatric Population

- Children & Adolescents

- Pregnant Women

Regional Analysis

Region with the largest Share

North America is expected to dominate the global digestive health supplements market, capturing around 35.8% of the total market revenue in 2025. This leading position is largely driven by strong consumer awareness about digestive wellness, the easy availability of high-quality gut health supplements, and the presence of prominent nutraceutical companies. The U.S. is at the forefront, fueled by increasing gastrointestinal issues linked to poor diet and sedentary habits.

A well-established retail network, including drugstores, supermarkets, and digital platforms which ensures broad access to products. Continued advancements in personalized nutrition, clean-label offerings, and immunity-supporting supplements further strengthen North America’s market leadership.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

Asia-Pacific region is projected to record the fastest growth rate in the digestive health supplements market by 2025. This growth is propelled by urbanization, evolving food habits, and rising consumer focus on digestive care in countries like India, China, and Japan. Increasing income levels and health-conscious middle-class consumers are boosting demand for natural and herbal-based supplements. Traditional practices like Ayurveda, Kampo, and Traditional Chinese Medicine are merging with modern delivery formats such as gummies and capsules.

Moreover, expanding e-commerce penetration and public health campaigns promoting gut health are accelerating product adoption across diverse population segments, making Asia-Pacific a key growth hotspot.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global digestive health supplements market is highly competitive, with leading players focusing on innovation, strategic partnerships, and portfolio expansion to gain market share. Key companies such as Nestlé Health Science, Amway, Bayer AG, Herbalife Nutrition, and NOW Foods are actively investing in R&D to develop targeted formulations addressing issues like indigestion relief, gut flora support, and constipation management. These companies are also incorporating advanced delivery systems like delayed-release capsules and fast-acting powders to improve supplement bioavailability.

The competitive landscape is further shaped by emerging startups offering clean-label, plant-based, and allergen-free digestive aids, catering to growing demand for natural gut health solutions. Additionally, regional players in Asia-Pacific and Europe are expanding their presence through online retail and functional food collaborations. Companies are also leveraging clinical studies to validate the efficacy of prebiotics, probiotics, and digestive enzymes, building consumer trust and credibility.

Marketing strategies increasingly focus on personalized nutrition, with brands offering tailored supplement plans based on microbiome analysis and lifestyle data. Sustainability and transparency are also becoming key differentiators in the digestive support supplements space. With growing global emphasis on preventive health and immune resilience, competition is expected to intensify across various product types and distribution channels in the coming years.

Some of the prominent players in the Global Digestive Health Supplements Market are:

- Nestlé S.A.

- Danone S.A.

- Amway Corporation

- Bayer AG

- Abbott Laboratories

- Herbalife Nutrition Ltd.

- NOW Foods

- Nature’s Bounty

- Garden of Life

- Lonza Group Ltd.

- Pfizer Inc.

- BioGaia AB

- Swisse Wellness Pty Ltd.

- Orthomol GmbH

- Blis Technologies Ltd.

- Pharma Nord ApS

- Enervit S.p.A.

- Zenwise Health

- Alimentary Health Ltd.

- Seed Health, Inc.

- Other Key Players

Recent Developments

- In May 2025, Cosmo Pharmaceuticals showcased its commitment to innovation in gastrointestinal care at Digestive Disease Week® 2025, emphasizing advancements in AI-driven endoscopy and gastrointestinal therapeutics. The company actively engaged with leading experts and potential collaborators to drive forward research and development in GI drug innovation.

- In March 2024, the Microbiome & Probiotic R&D & Business Collaboration Forum held in the United States focused on the latest progress in gut health, including probiotics, prebiotics, and the gut-brain axis. The event provided a platform to promote partnerships and collaborative efforts aimed at translating scientific advances into commercial applications.

- In April 2024, Bayer Consumer Health introduced Iberogast, a new plant-based digestive health supplement, to the U.S. market. Featuring a proprietary blend of six herbs, the product is designed to deliver dual-action relief by easing occasional stomach discomfort and supporting overall digestive function through natural ingredients.

- In August 2023, Herbalife launched the Herbalife V line, a collection of plant-based supplements certified USDA Organic, non-GMO, kosher, vegan, and approved by FoodChain ID. The lineup includes protein shakes with 20 grams of plant-based protein, a greens booster made with organic fruits, vegetables, green tea, and superfood powders, an immune support blend with vitamins C and D plus zinc, and a digestive health formula featuring guar fiber and oat.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 77.0 Bn |

| Forecast Value (2034) |

USD 178.1 Bn |

| CAGR (2025–2034) |

9.8% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 23.2 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product Type (Probiotics, Prebiotics, Digestive Enzymes, Fiber Supplements, Others), By Form (Capsules, Tablets, Powders, Gummies & Chewables, Others), By Function (Gut Microbiota Balance, Lactose Intolerance Management, Indigestion Relief, Constipation & Bloating Relief, Gastric Acid Neutralization, Irritable Bowel Syndrome (IBS) Support, Immune System Support), By Distribution Channel (B2C, B2B), By End User (Adults, Geriatric Population, Children & Adolescents, Pregnant Women) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Nestlé S.A., Danone S.A., Amway Corporation, Bayer AG, Abbott Laboratories, Herbalife Nutrition Ltd., NOW Foods, Nature’s Bounty (a Nestlé Health Science brand), Garden of Life (a Nestlé Health Science brand), Lonza Group Ltd., Pfizer Inc., BioGaia AB, Swisse Wellness Pty Ltd. (a H&H Group brand), Orthomol GmbH, Blis Technologies Ltd., Pharma Nord ApS, Enervit S.p.A., Zenwise Health (a Clorox brand), |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Digestive Health Supplements Market?

▾ The Global Digestive Health Supplements Market size is estimated to have a value of USD 77.0 billion in 2025 and is expected to reach USD 178.1 billion by the end of 2034.

Which region accounted for the largest Global Digestive Health Supplements Market?

▾ North America is expected to be the largest market share for the Global Digestive Health Supplements Market with a share of about 35.8% in 2025.

Who are the key players in the Global Digestive Health Supplements Market?

▾ Some of the major key players in the Global Digestive Health Supplements Market are Nestlé S.A., Danone S.A., Amway Corporation and many others

What is the growth rate in the Global Digestive Health Supplements Market?

▾ The market is growing at a CAGR of 9.8% over the forecasted period.

How big is the US Digestive Health Supplements Market?

▾ The US Digestive Health Supplements Market size is estimated to have a value of USD 23.2 billion in 2025 and is expected to reach USD 51.2 billion by the end of 2034.