Market Overview

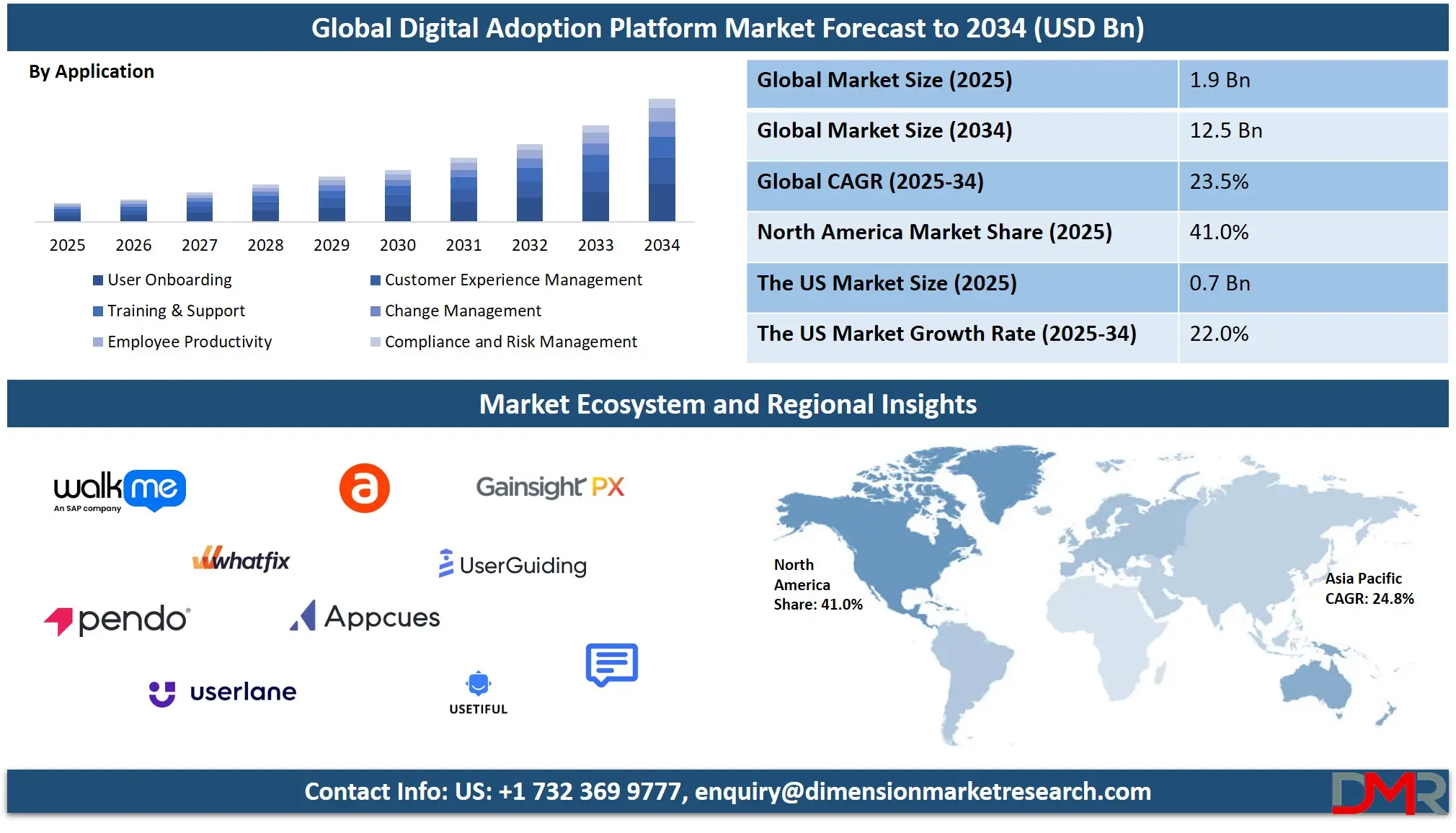

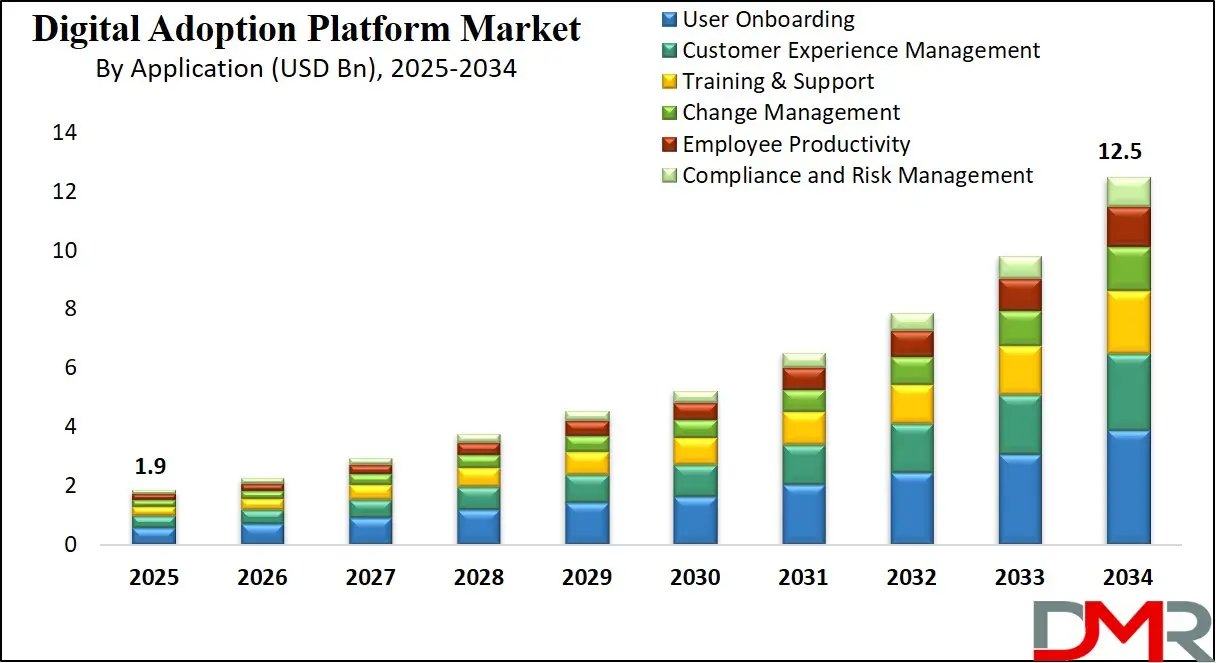

The Global Digital Adoption Platform market is projected to reach USD 1.9 billion in 2025, growing at a CAGR of 23.5%, and is expected to hit USD 12.5 billion by 2034. This growth is fueled by rising demand for user onboarding solutions, in-app guidance tools, and enterprise software adoption optimization.

A digital adoption platform is a software layer integrated within other applications, designed to guide users through complex digital tools and workflows in real-time. These platforms enable users to interact with enterprise software more effectively by providing contextual walkthroughs, tooltips, and in-app guidance tailored to individual user actions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The core purpose of a digital adoption solution is to reduce the learning curve, enhance software utilization, and support digital transformation initiatives across organizations. By delivering personalized and intuitive guidance, digital adoption platforms improve user engagement, streamline onboarding, and help minimize errors and support requests in both customer-facing and employee-centric applications.

The global digital adoption platform market is experiencing robust growth driven by the growing complexity of enterprise software ecosystems and the rising demand for enhanced user experiences. As organizations accelerate their digital transformation journeys, the need for scalable tools that can boost software adoption and employee productivity has become critical.

These platforms play a pivotal role in training, change management, and customer success, especially across sectors such as BFSI, healthcare, retail, and IT. The cloud-based nature of many digital adoption tools also supports remote workforces and ensures seamless integration with SaaS applications, ERP systems, and CRM platforms.

In addition to enterprise needs, the market is further fueled by the growing emphasis on self-service technologies and real-time user support. Businesses are increasingly adopting digital adoption software to improve user onboarding, reduce churn, and optimize digital workflows without relying heavily on traditional training methods.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The proliferation of AI-powered assistance, real-time analytics, and multilingual support is enhancing the value proposition of digital adoption solutions. Moreover, small and medium-sized enterprises are entering the space due to the availability of affordable and easy-to-deploy platforms that can deliver measurable improvements in user engagement and software ROI.

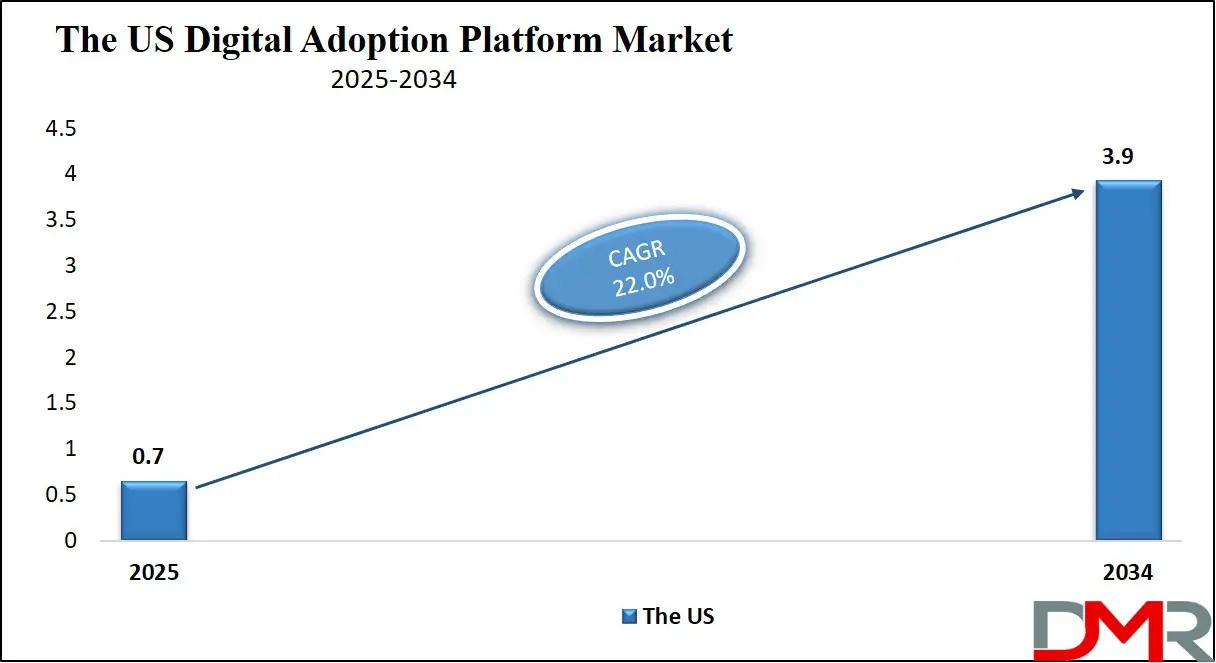

The US Digital Adoption Platform Market

The U.S. Digital Adoption Platform market size is projected to be valued at USD 0.7 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3.9 billion in 2034 at a CAGR of 22.0%.

The United States digital adoption platform market holds a dominant position globally, driven by rapid digital transformation across enterprises and a mature technology ecosystem. U.S.-based organizations are heavily investing in user enablement tools to streamline software onboarding, enhance employee productivity, and reduce support overhead. With widespread deployment of enterprise applications like CRMs, ERPs, and HCM systems, the demand for digital guidance solutions has surged.

Industries such as BFSI, healthcare, retail, and education are leveraging digital adoption tools to optimize internal workflows, accelerate training processes, and improve user engagement. Additionally, the rise of remote work and hybrid environments has intensified the need for real-time, in-app support and self-service capabilities, further fueling market growth.

Moreover, the U.S. market benefits from the presence of leading DAP vendors such as WalkMe, Whatfix, and Pendo, who continuously innovate with AI-driven features like predictive analytics, contextual walkthroughs, and behavior-based segmentation. The region’s strong focus on digital employee experience (DEX), software ROI, and user retention strategies has made digital adoption solutions a strategic priority for large enterprises and SMBs alike.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Government digitization initiatives, compliance-driven industries, and tech-savvy consumer bases also contribute to the growing implementation of onboarding automation and interactive guidance layers. With high SaaS adoption rates and advanced IT infrastructure, the U.S. digital adoption platform market is poised for sustained growth through enterprise expansion, product integrations, and AI-based personalization.

Europe Digital Adoption Platform Market

In 2025, the European digital adoption platform market is estimated to reach a value of USD 490 million, reflecting the region’s strong commitment to digital transformation across the enterprise and public sectors. This substantial market share is driven by the widespread adoption of enterprise applications such as ERP, CRM, and HCM systems across industries like BFSI, manufacturing, retail, and healthcare.

European organizations are increasingly investing in digital adoption solutions to enhance user onboarding, improve software ROI, and ensure compliance with stringent regulatory frameworks such as GDPR. Countries like Germany, the UK, France, and the Nordics are at the forefront of this adoption, benefiting from mature IT infrastructures and a high demand for multilingual, user-centric platforms that can accelerate digital workflows and improve operational efficiency.

With a projected CAGR of 21.8% from 2025 to 2034, Europe’s DAP market is expected to witness sustained growth as digital transformation deepens across both large enterprises and SMEs. The region is also seeing increased demand for employee enablement tools, remote onboarding solutions, and AI-enhanced in-app guidance, particularly in response to evolving work models and skills gaps.

Furthermore, the rise of industry-specific solutions and customizable low-code platforms is attracting mid-sized firms seeking scalable and cost-effective digital adoption strategies. As digital maturity continues to rise and organizations place greater emphasis on user experience and process automation, Europe will remain a key growth hub in the global digital adoption platform landscape.

Japan Digital Adoption Platform Market

In 2025, the digital adoption platform market in Japan is estimated to reach USD 90 million, underscoring the country's growing focus on enterprise digitization and user enablement. Japan’s business ecosystem, known for its structured workflows and high reliance on precision-based software usage, is increasingly embracing digital adoption tools to improve user onboarding, reduce training time, and enhance application efficiency.

Industries such as manufacturing, BFSI, healthcare, and logistics are leading the demand for DAP solutions, especially as they integrate complex enterprise applications like ERP, HRM, and supply chain management systems. Additionally, the need to support older legacy systems while transitioning to cloud-based platforms is driving organizations to adopt DAPs to ease the digital learning curve for employees.

With a projected CAGR of 19.3% from 2025 to 2034, Japan’s DAP market is poised for steady growth as enterprises seek to optimize their software investments and improve workforce productivity. Government-led digital initiatives, such as the “Digital Garden City Nation” vision, are further accelerating the adoption of digital tools in both the public and private sectors.

While cultural preferences for structured onboarding and localized user support present unique challenges, they also create opportunities for DAP vendors offering highly customizable, multilingual, and low-disruption integration capabilities. As Japanese companies continue to balance innovation with precision, the demand for intelligent, data-driven adoption solutions is expected to expand significantly in the years ahead.

Global Digital Adoption Platform Market: Key Takeaways

- Market Value: The global digital adoption platform market size is expected to reach a value of USD 12.5 billion by 2034 from a base value of USD 1.9 billion in 2025 at a CAGR of 23.5%.

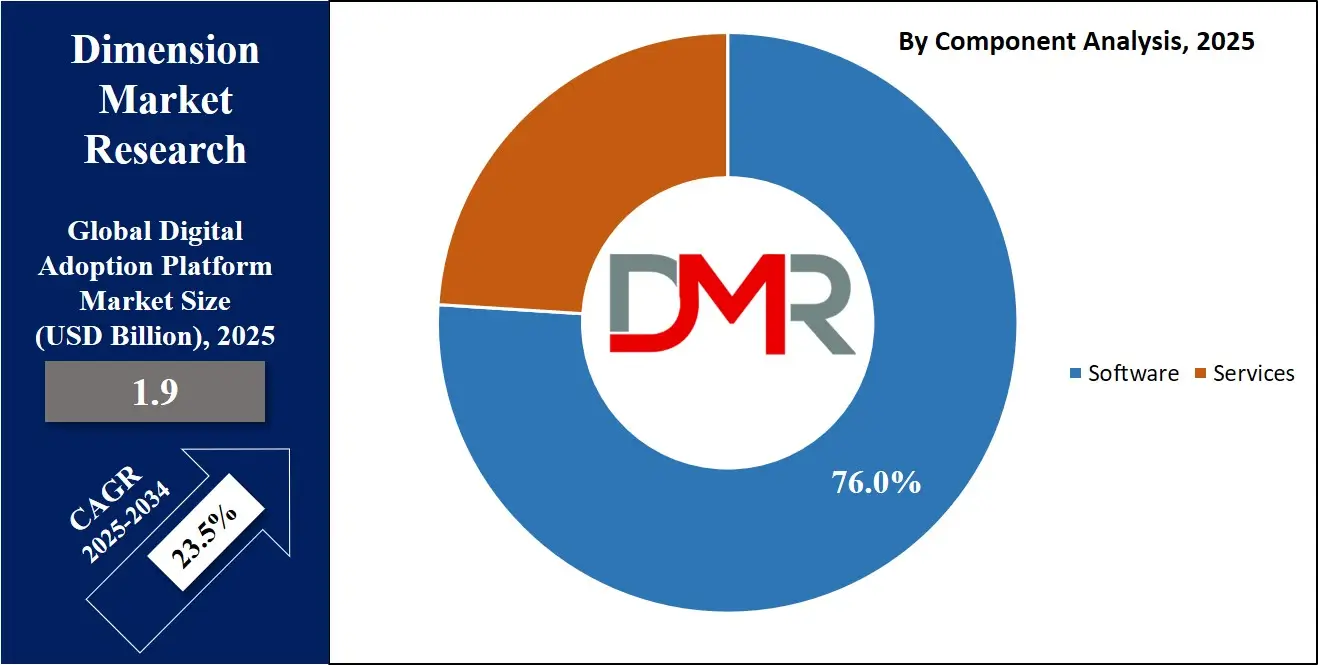

- By Component Segment Analysis: Software components are anticipated to dominate the component segment, capturing 76.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode is expected to maintain its dominance in the deployment mode segment, capturing 84.0% of the total market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will dominate the organization size segment, capturing 69.0% of the market share in 2025.

- By Application Segment Analysis: User Onboarding applications will account for the maximum share in the application segment, capturing 31.0% of the total market value.

- By Industry Vertical Segment Analysis: The BFSI industry is expected to consolidate its dominance in the industry vertical segment, capturing 40.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global digital adoption platform market landscape with 41.0% of total global market revenue in 2025.

- Key Players: Some key players in the global digital adoption platform market are WalkMe, Whatfix, Pendo, Userlane, Apty, Appcues, Gainsight PX, UserGuiding, Usetiful, Intro.js, MyGuide by EdCast, Toonimo, Inline Manual, Chameleon, and Others.

Global Digital Adoption Platform Market: Use Cases

-

Enterprise Software Onboarding and Adoption in BFSI: In the banking and financial services sector, digital adoption platforms are widely used to simplify the onboarding process for complex software such as CRM systems, core banking platforms, and compliance management tools. Financial institutions often struggle with slow software adoption rates due to legacy systems and regulatory complexities. DAPs provide contextual in-app guidance, interactive walkthroughs, and real-time tooltips that help employees complete workflows efficiently without extensive training. This reduces time-to-competency, boosts user engagement, and enhances data accuracy in financial operations. Additionally, these platforms support audit trails and ensure compliance with internal procedures, which is crucial in regulated environments.

- Remote Workforce Enablement and Employee Training: As remote and hybrid work models become standard across industries, enterprises are leveraging digital adoption platforms to onboard and train distributed teams on SaaS tools like Salesforce, Microsoft 365, and Workday. Instead of relying on static documentation or live training sessions, DAPs offer dynamic guidance embedded within the application interface, allowing employees to learn by doing. These platforms help reduce support tickets, accelerate workflow automation, and improve digital fluency. Organizations are also using DAP analytics to identify user friction points and optimize training content, resulting in higher software utilization and employee productivity across geographies.

- Customer Onboarding and Self-Service in SaaS Platforms: For SaaS companies, ensuring smooth customer onboarding is critical for retention and satisfaction. Digital adoption solutions enable businesses to guide new users through application setup, feature discovery, and key tasks using tooltips, progress tracking, and behavioral nudges. By reducing the learning curve, companies can significantly lower customer churn and boost product stickiness. In-app guidance not only empowers users to explore features independently but also decreases dependency on customer support teams. This use case is particularly impactful in competitive industries such as marketing automation, HR tech, and project management software, where customer experience directly influences growth.

- Change Management and Digital Transformation in Healthcare: Healthcare organizations undergoing digital transformation often face resistance to new electronic health record (EHR) systems and clinical software. Digital adoption platforms facilitate smoother transitions by providing step-by-step walkthroughs and automated guidance during and after deployment. Medical staff can quickly adapt to new systems without extensive classroom training, ensuring continuity of care and operational efficiency. Additionally, DAPs help reduce errors in data entry, ensure compliance with HIPAA workflows, and track user progress to identify areas needing additional support. This use case underscores the role of digital guidance tools in managing technological change in highly sensitive and mission-critical environments.

Impact of Artificial Intelligence on Digital Adoption Market

Artificial Intelligence (AI) is significantly transforming the digital adoption platform (DAP) market by enhancing the precision, personalization, and scalability of digital guidance solutions. AI-driven features such as predictive analytics, behavior mapping, and contextual assistance are redefining how enterprises onboard users, monitor engagement, and optimize software usage. By analyzing real-time user interactions, AI enables DAPs to deliver hyper-personalized in-app guidance tailored to individual learning patterns, reducing friction points and boosting user productivity. These capabilities are especially valuable for large organizations with complex software ecosystems, where traditional one-size-fits-all training fails to deliver lasting impact.

Moreover, AI enhances the automation of workflow navigation and support, allowing digital adoption platforms to proactively suggest next steps, detect anomalies in user behavior, and even automate repetitive actions. Natural Language Processing (NLP) and machine learning algorithms are increasingly being used to power chatbots, voice-guided assistance, and automated help desks integrated within DAPs.

These intelligent systems not only improve the user experience but also reduce the burden on IT and support teams. As AI continues to evolve, its integration into digital adoption platforms is expected to drive greater operational efficiency, faster software adoption, and deeper analytics-driven decision-making across industries.

Global Digital Adoption Platform Market: Stats & Facts

- As of 2024, USDS had partnered with 31 federal agencies to modernize digital services.

- By 2024, 230 digital service experts were employed to help improve federal user experiences and workflows.

- U.S. Census Bureau / Trade.gov Report on SME Digital Tools

- In 2022, 16.7% of small businesses (under 500 employees) reported negative profitability impacts from technology updates.

- In manufacturing SMEs, 10.6% sought business advice on digital/IT tools; in retail trade SMEs, it was 8.9%.

Global Digital Adoption Platform Market: Market Dynamics

Global Digital Adoption Platform Market: Driving Factors

Surge in Enterprise Software Adoption across Industries

The growing deployment of complex enterprise software platforms such as ERP, CRM, HRM, and cloud-based collaboration tools is a major driver for digital adoption platforms. As businesses digitize operations, they face significant challenges in onboarding users and ensuring consistent software usage. DAPs address this by offering interactive guidance, reducing training time, and improving user productivity. This trend is especially prominent in sectors like BFSI, healthcare, and retail, where digital transformation is a top priority.

Rising Demand for Enhanced User Experience and Productivity

Organizations are prioritizing user-centric digital strategies to retain customers and maximize workforce efficiency. DAPs enhance the user journey through contextual walkthroughs, real-time assistance, and automated onboarding. These platforms also improve employee productivity by simplifying access to features, reducing learning curves, and minimizing support queries. The need for superior user experience and optimized software training tools is fueling the demand for intelligent digital adoption solutions globally.

Global Digital Adoption Platform Market: Restraints

High Integration Complexity with Legacy Systems

Many organizations still operate on legacy IT systems, making it difficult to seamlessly integrate advanced digital adoption solutions. Compatibility issues, lack of APIs, and outdated infrastructure can hinder real-time in-app guidance and restrict automation capabilities. This technical barrier often leads to extended implementation timelines and increased costs, especially in traditional sectors like government or manufacturing.

Data Privacy and Security Concerns

Digital adoption platforms often collect behavioral and usage data to deliver personalized guidance and analytics. However, concerns around data protection, compliance with regulations like GDPR and HIPAA, and potential breaches may deter adoption, particularly in data-sensitive industries. Companies must invest in secure DAP architectures and transparent data policies to overcome these trust-related limitations.

Global Digital Adoption Platform Market: Opportunities

Expansion in Emerging Markets and SMB Segment

Small and medium-sized enterprises in emerging economies are increasingly embracing cloud applications and SaaS platforms to drive efficiency. With limited IT training resources, these businesses present a strong growth opportunity for cost-effective and lightweight DAP solutions. Vendors offering multilingual support, low-code configurations, and scalable platforms are well-positioned to tap into this underserved segment across Asia-Pacific, Latin America, and the Middle East.

Integration with AI, NLP, and Analytics Capabilities

The integration of AI, machine learning, and natural language processing into digital adoption platforms is creating new growth avenues. These technologies enable predictive user assistance, intelligent chatbot integration, and advanced user behavior analytics. Enterprises are now leveraging AI-enhanced DAPs for smarter user segmentation, proactive recommendations, and automated onboarding workflows, creating a more agile and responsive digital experience.

Global Digital Adoption Platform Market: Trends

Growing Adoption of DAPs in Remote and Hybrid Work Environments

As remote and hybrid work models become the norm, organizations are relying on digital adoption platforms to onboard, train, and support distributed teams. In-app guidance and self-service capabilities are critical in bridging the digital skills gap in decentralized environments. This trend is accelerating DAP deployments across industries, particularly for onboarding employees on communication tools, collaboration platforms, and HR software.

Rise of Industry-Specific and Verticalized DAP Solutions

Vendors are increasingly developing customized DAPs tailored to the needs of specific sectors such as education, healthcare, fintech, and logistics. These industry-specific platforms offer pre-configured workflows, regulatory compliance features, and role-based training modules. Such vertical-focused innovation not only enhances user experience but also accelerates time-to-value for enterprises looking to modernize sector-specific applications.

Global Digital Adoption Platform Market: Research Scope and Analysis

By Component Analysis

In the component segment of the digital adoption platform market, software is projected to dominate with an estimated 76.0% share of the total market in 2025. This dominance is largely attributed to the growing demand for intuitive, user-friendly platforms that provide real-time in-app guidance, automated walkthroughs, and behavioral analytics. Enterprises are investing heavily in these software tools to streamline user onboarding, enhance software training, and reduce support dependency. The scalability and integration capabilities of these platforms make them a preferred choice for businesses adopting complex enterprise applications across functions like HR, CRM, and ERP.

On the other hand, the services segment, while smaller in share, plays a crucial role in ensuring the successful deployment and utilization of digital adoption platforms. This includes consulting, implementation support, system integration, training, and ongoing technical support. As more organizations seek customized DAP solutions to meet specific operational needs, the demand for professional services is growing steadily. These services help businesses configure platforms for optimal use, train internal teams, and analyze user engagement data for continuous improvement. Though not as large as the software component, the services segment adds essential value by enhancing platform effectiveness and accelerating time-to-value.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Deployment Mode Analysis

In the deployment mode segment of the digital adoption platform market, cloud-based solutions are projected to lead significantly, accounting for 84.0% of the total market share in 2025. This dominance is driven by the flexibility, scalability, and cost-effectiveness offered by cloud deployment.

Organizations across various industries prefer cloud-based digital adoption platforms as they support rapid implementation, seamless integration with SaaS applications, and remote accessibility, which is especially vital in today’s hybrid work environments. The cloud model also enables real-time updates, centralized management, and better user analytics, making it ideal for businesses aiming to enhance user experience and software adoption at scale.

While on-premise deployment holds a smaller portion of the market, it continues to be relevant for organizations with stringent data security, regulatory compliance, or infrastructure control requirements. Sectors such as government, defense, and financial services often opt for on-premise digital adoption platforms to maintain internal governance over sensitive user data and application workflows. Though it requires higher upfront investment and dedicated IT resources, on-premise deployment offers greater customization and control, making it suitable for enterprises with complex legacy systems or security-sensitive operations.

By Organization Size Analysis

In the organization size segment of the digital adoption platform market, large enterprises are expected to dominate, capturing 69.0% of the total market share in 2025. This is primarily due to their complex IT environments, widespread use of enterprise software, and greater budgets for digital transformation initiatives.

Large organizations often operate across multiple departments and geographies, making it essential to have robust digital adoption solutions that can streamline user onboarding, enhance workforce productivity, and ensure consistent application usage. These enterprises prioritize employee enablement, software ROI, and process efficiency, all of which are effectively supported by advanced digital adoption platforms with AI-driven insights, analytics, and scalable deployment options.

Meanwhile, small and medium-sized enterprises (SMEs) are gradually growing their adoption of digital adoption platforms, driven by the growing availability of affordable, cloud-based solutions. Although they account for a smaller market share, SMEs are recognizing the value of DAPs in reducing manual training, supporting lean IT teams, and accelerating software learning curves.

As more SMEs shift to cloud applications and SaaS tools for sales, HR, and operations, the need for intuitive and lightweight digital adoption platforms is rising. Vendors offering flexible pricing models and low-code configuration are well-positioned to tap into this emerging demand among smaller businesses aiming to improve digital efficiency without high overhead costs.

By Application Analysis

In the application segment of the digital adoption platform market, user onboarding is projected to hold the largest share, capturing 31.0% of the total market value in 2025. This dominance reflects the critical need for organizations to ensure that new users, whether employees or customers, can quickly and effectively learn to navigate enterprise software and digital tools.

Digital adoption platforms support this need by providing interactive walkthroughs, real-time tooltips, and contextual assistance that guide users through key functions from the moment they first engage with a platform. Effective onboarding not only accelerates time-to-productivity but also reduces training costs, minimizes support queries, and enhances overall software utilization across industries.

Customer experience management is another significant application area within the digital adoption platform market. Organizations are increasingly leveraging DAPs to improve the way users interact with digital products and services, particularly in consumer-facing applications. Through personalized in-app guidance, behavior-triggered prompts, and seamless navigation, these platforms help reduce user frustration, increase feature adoption, and build brand loyalty.

In highly competitive sectors such as e-commerce, fintech, and SaaS, enhancing the customer journey through intuitive digital experiences is a key strategy for reducing churn and driving engagement. As user expectations for seamless digital interactions continue to rise, the role of DAPs in customer experience optimization is becoming increasingly vital.

By Industry Vertical Analysis

In the industry vertical segment of the digital adoption platform market, the BFSI sector is anticipated to consolidate its dominance by capturing 40.0% of the total market share in 2025. Financial institutions, including banks, insurance firms, and investment companies, are increasingly relying on digital adoption platforms to streamline the use of complex software systems such as core banking solutions, risk management tools, and customer relationship management platforms.

Given the highly regulated nature of the industry, DAPs play a crucial role in ensuring compliance, reducing errors, and enhancing employee productivity through real-time, contextual support. Additionally, as customer interactions shift to digital channels, financial firms are adopting DAPs to deliver smooth and secure user experiences, simplify digital onboarding, and improve service accessibility.

In the healthcare sector, the adoption of digital adoption platforms is gaining momentum as hospitals, clinics, and medical institutions continue to digitize their operations. These platforms help medical staff and administrative teams adapt to electronic health record systems, patient management tools, and telemedicine applications with greater ease and efficiency. Healthcare providers benefit from DAPs by accelerating training, reducing reliance on IT support, and improving the accuracy of clinical data input.

Furthermore, digital adoption solutions contribute to better patient outcomes by enabling staff to fully utilize healthcare technologies while adhering to regulatory standards such as HIPAA. The rising emphasis on digital health infrastructure and operational efficiency is expected to drive steady growth of DAPs within this sector.

The Digital Adoption Platform Market Report is segmented on the basis of the following:

By Component

By Deployment Mode

By Organization Size

By Application

- User Onboarding

- Customer Experience Management

- Training & Support

- Change Management

- Employee Productivity

- Compliance and Risk Management

By Industry Vertical

- BFSI

- Healthcare

- Retail & E-commerce

- IT & Telecom

- Education

- Government & Public Sector

- Manufacturing

- Others

Global Digital Adoption Platform Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global digital adoption platform market in 2025, capturing 41.0% of the total market revenue, driven by the region’s advanced digital infrastructure, high enterprise software adoption, and strong presence of leading DAP vendors such as WalkMe, Whatfix, and Pendo.

The widespread implementation of cloud-based applications across industries like BFSI, healthcare, IT, and retail has significantly increased the demand for digital adoption solutions to improve user onboarding, streamline workflow automation, and enhance software ROI. Additionally, the region’s focus on remote workforce enablement, user experience optimization, and digital transformation initiatives further strengthens its dominant position in the global market landscape.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia-Pacific region is projected to witness significant growth in the digital adoption platform market over the coming years, driven by rapid digital transformation across emerging economies such as India, China, Indonesia, and Vietnam. As businesses in the region increasingly adopt cloud-based software, ERP systems, and customer-facing platforms, the demand for user onboarding tools and in-app guidance solutions is accelerating.

Small and medium enterprises are also investing in cost-effective digital adoption tools to improve employee training and customer engagement. Additionally, government-led digital initiatives, expanding internet penetration, and a growing tech-savvy workforce are contributing to the region’s rising adoption of DAPs, positioning Asia-Pacific as one of the fastest-growing markets globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Adoption Platform Market: Competitive Landscape

The global competitive landscape of the digital adoption platform market is characterized by a mix of established players and emerging vendors competing on innovation, user experience, integration capabilities, and industry specialization. Key market leaders such as WalkMe, Whatfix, Pendo, and Userlane dominate through comprehensive product suites, strong enterprise penetration, and robust AI-driven features like predictive analytics and behavioral segmentation.

These companies continuously expand their offerings through strategic partnerships, product enhancements, and global reach. Meanwhile, agile startups like Apty, Appcues, and UserGuiding are gaining traction by catering to niche markets, offering low-code configurations, and providing affordable solutions for SMEs. As the market matures, competition is intensifying around vertical-specific use cases, advanced analytics, and seamless integration with enterprise ecosystems, making innovation and scalability critical differentiators in this dynamic landscape.

Some of the prominent players in the global digital adoption platform market are:

- WalkMe

- Whatfix

- Pendo

- Userlane

- Apty

- Appcues

- Gainsight PX

- UserGuiding

- Usetiful

- Intro.js

- MyGuide by EdCast

- Toonimo

- Inline Manual

- Chameleon

- TTS (TT Knowledge Force)

- Newired

- Lemon Learning

- Helppier

- Zeal

- HelpHero

- Other Key Players

Global Digital Adoption Platform Market: Recent Developments

- March 2025: Whatfix unveiled ScreenSense, a cutting‑edge AI‑driven technology powering its DAP, Mirror, and Product Analytics suite to deliver more intuitive, behavior‑based in‑app guidance and automation.

- March 2025: NICE released CXone Mpower Orchestrator, an end‑to‑end AI automation solution for customer service workflows that enhances front‑office to back‑office orchestration using agentic AI.

- March 2025: Walgreens Boots Alliance agreed to be acquired by Sycamore Partners in a transaction valued at up to USD 23.7 billion, reshaping its access to digital and healthcare platforms, including DAP‑related rights valuation concerns.

- January 2025: Ibexa merged with Raptor, a customer data platform (CDP) and personalization specialist, creating a more integrated digital experience and personalization ecosystem.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 1.9 Bn |

| Forecast Value (2034) |

USD 12.5 Bn |

| CAGR (2025–2034) |

23.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 0.7 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software and Services), By Deployment Mode (Cloud-based and On-Premise), By Organization Size (Large Enterprises and SMEs), By Application (User Onboarding, Customer Experience Management, Training & Support, Change Management, Employee Productivity, and Compliance and Risk Management), and By Industry Vertical (BFSI, Healthcare, Retail & E-commerce, IT & Telecom, Education, Government & Public Sector, Manufacturing, and Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

WalkMe, Whatfix, Pendo, Userlane, Apty, Appcues, Gainsight PX, UserGuiding, Usetiful, Intro.js, MyGuide by EdCast, Toonimo, Inline Manual, Chameleon, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global digital adoption platform market?

▾ The global digital adoption platform market size is estimated to have a value of USD 1.9 billion in 2025 and is expected to reach USD 12.5 billion by the end of 2034.

What is the size of the US digital adoption platform market?

▾ The US digital adoption platform market is projected to be valued at USD 0.7 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 3.9 billion in 2034 at a CAGR of 22.0%.

Which region accounted for the largest global digital adoption platform market?

▾ North America is expected to have the largest market share in the global digital adoption platform market, with a share of about 41.0% in 2025.

Who are the key players in the global digital adoption platform market?

▾ Some of the major key players in the global digital adoption platform market are WalkMe, Whatfix, Pendo, Userlane, Apty, Appcues, Gainsight PX, UserGuiding, Usetiful, Intro.js, MyGuide by EdCast, Toonimo, Inline Manual, Chameleon, and Others.

What is the growth rate of the global digital adoption platform market?

▾ What is the growth rate of the global digital adoption platform market?