A digital banking platform acts as a complete software solution for financial institutions, using various online and

services for their customers, which is important in modern banking operations, allowing customers to conduct many financial transactions & activities digitally, ranging from account management to fund transfers, bill payments, and even loan applications.

Different from traditional online banking, digital banking platforms use processes like API integration, automation, and web-based services to design & deliver digital banking solutions. By easily connecting banking services with other financial offerings, these platforms drive cross-institutional services, providing customers with a smoother, more efficient, and overall digital banking experience.

Customers can easily manage many financial services, like virtual cards, digital wallets, and remote deposits, using tablets, smartphones, and other online channels. Despite the convenience they provide, concerns about data security & privacy breaches remain relevant, fueling the imperative for strict security protocols and robust

Customer Data Platform integration within the banking sector to safeguard sensitive customer information and records

As per Compare Banks, the Digital Banking Platform Market demonstrates significant growth driven by evolving consumer preferences and technological advancements. In 2023, more than 90% of British individuals engaged with online banking services, underscoring its ubiquity.

Contactless payments have surged, accounting for 37% of all transactions in 2022, with 83% of consumers actively using this technology. Younger demographics are key adopters, as 24% of consumers now maintain a digital-only bank account, rising to 50% for those aged 18–24, though only 12% use it as their primary account.

Millennials lead app-based banking adoption at 64%, while just 2% of Gen Z opt for in-branch banking. Quality of experience remains critical, with 81% identifying it as a decisive factor for online banking services. Additionally, smartphone payments gained traction among over-55s, with 16% increasing usage in 2020. By 2022, 67% of consumers preferred online banking for daily requirements, signaling a paradigm shift in financial behavior.

Further, banks can capitalize on the digital transformation by adopting customizable and easily deployable solutions customized to digital banking platforms. Interactive mobile banking websites & applications play a major role in improving customer service and encouraging client loyalty. With the growing demand for smartphones, the number of digital banking consumers is expected to grow, further expanding the need for strong digital banking platform solutions. As financial institutions adapt to meet changing customer needs & preferences, the digital banking landscape constantly evolves, focusing on the importance of agile & innovative digital solutions to drive future growth and competitiveness in the banking sector.

Key Takeaways

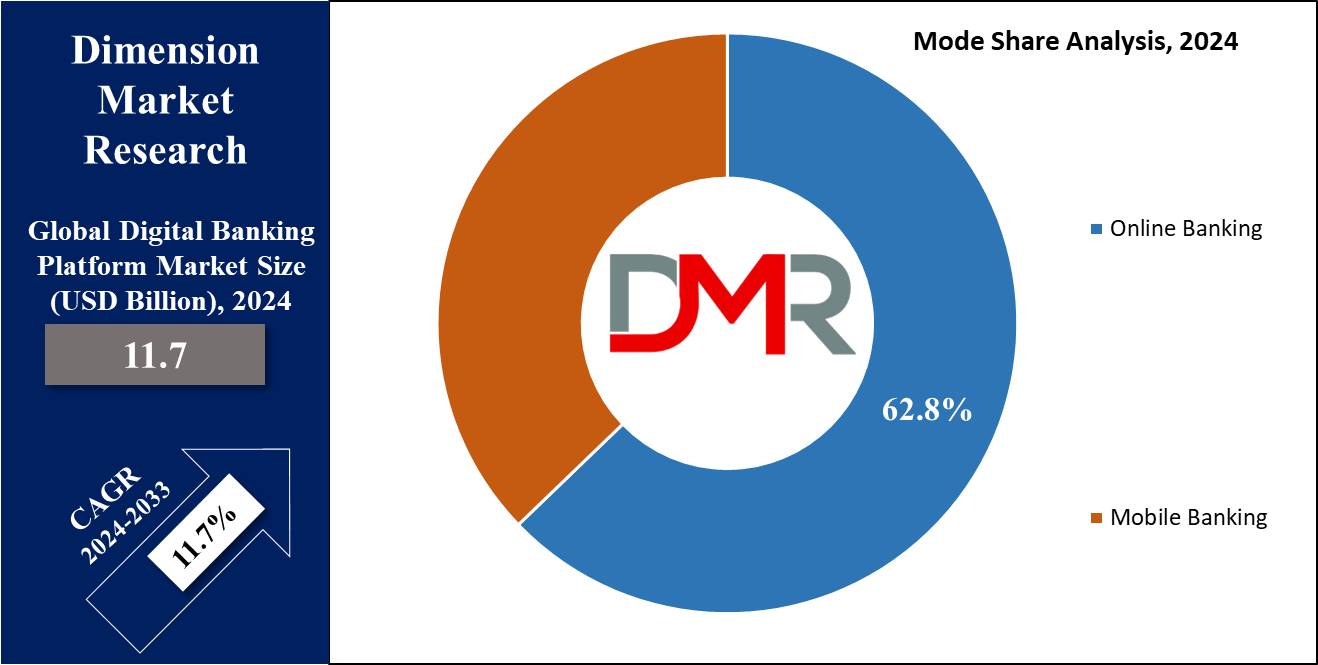

- Market Growth: The Digital Banking Platform Market size is expected to grow by 18.5 billion, at a CAGR of 11.7% during the forecasted period of 2025 to 2033.

- By Component: The platform segment is expected to lead in 2024 with a major & is anticipated to dominate throughout the forecasted period.

- By Deployment: On-premise is expected to get the largest revenue share in 2024 in the Digital Banking Platform market.

- By Mode: Online Banking mode of deployment is expected to lead the Digital Banking Platform market in 2024

- By Type: Investment banking segment is expected to get the largest revenue share in 2024 in the Digital Banking Platform market.

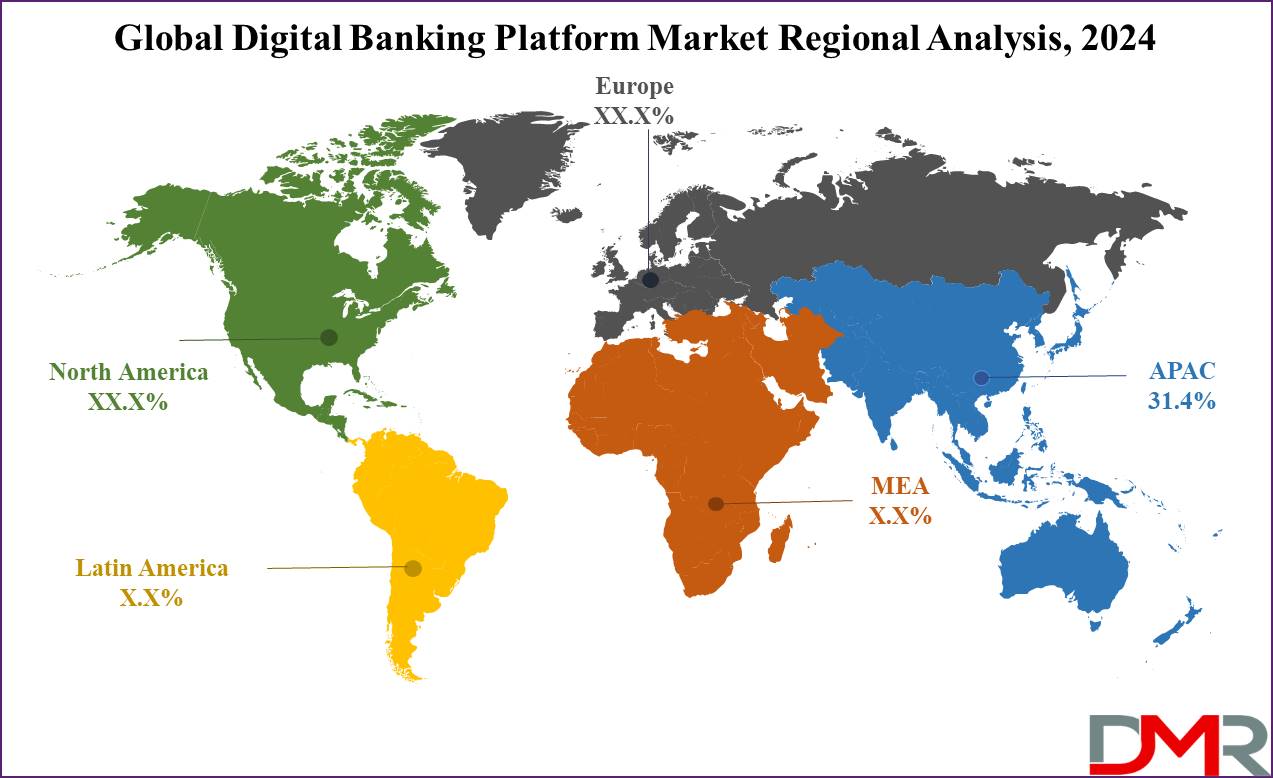

- Regional Insight: Asia Pacific is expected to hold a 31.4% share of revenue in the Global Digital Banking Platform Market in 2024.

- Use Cases: Some of the use cases of digital banking platforms include mobile banking apps, digital wallet integration, and more.

Use Cases

- Mobile Banking App: The digital banking platform provides a mobile application that enables users to manage their finances on the go. Users can check their view transaction history, and account balances, transfer money between accounts, pay bills, deposit checks remotely using mobile check deposits, and receive real-time alerts for account activity, which use case improves convenience for users by providing access to banking services anytime, anywhere, using their smartphones.

- Online Account Opening: The platform allows users to open new accounts entirely online, without the demand to visit a physical branch. Through a streamlined and user-friendly interface, individuals can fill out account applications, submit needed documents electronically, and verify their identities remotely, which appeals to digital-savvy customers who prefer the convenience of opening accounts from the comfort of their homes or offices, saving time & eliminating the demand for paper-based processes.

- Personalized Financial Management: Using data analytics & machine learning algorithms, the digital banking platform provides personalized financial management tools to assist user’s budget, saving, and investing more effectively. By analyzing users' transaction history, spending patterns, & financial goals, the platform provides customized recommendations, like setting savings goals, creating budgets, optimizing investment portfolios, and suggesting appropriate financial products or services, which allows users to make informed decisions about their finances & achieve their long-term financial objectives.

- Digital Wallet Integration: The platform integrates a digital wallet feature that helps users store payment cards, loyalty cards, & digital currencies securely on their smartphones. Users can make contactless payments in-store or online, using near-field communication (NFC) technology or QR codes. In addition, the digital wallet may support peer-to-peer (P2P) payments, allowing users to send and receive money instantly from friends, family, or businesses, which improves convenience and security for users by removing the need to carry physical cards or cash and minimizing the risk of fraud through tokenization and encryption technologies.

Market Dynamic

The growing demand for easy & convenient banking experiences is driving the digital banking platform market forward, as the customers in the current date want banking services that match their fast-paced lives, enabling them to handle transactions & manage money wherever they are, without depending on traditional bank branches. Digital banking platforms meet this need by providing online portals, mobile apps, and simple interfaces that give quick access to account details, money transfers, & bill payments.

Customers love the convenience of digital banking, so financial institutions are investing in enhancing their digital tools to keep up. Further, developments in technology are also pushing the digital banking platform market ahead. In addition, new technologies like

machine learning, AI, biometrics, and blockchain have the potential to revolutionize banking.

These innovations make digital banking platforms more attached, personalize services based on what customers prefer, process transactions faster, and provide insights from data to assist in better decisions. With technology always changing, banks in the

AI in Banking know they have to keep up to meet customer needs, work more efficiently, and stay competitive.

However, some challenges could slow down market growth. The high cost of installing & maintaining advanced digital banking systems is one concern. Further, compliance issues with digital lending platforms could also hold back the adoption of digital banking platforms. In addition, the rise in cybercrime & cyber-attacks poses a significant threat, potentially limiting revenue growth in the digital banking platform market in the coming years.

Research Scope and Analysis

By Component

The platform segment is anticipated to continue its dominance in the digital banking platform market in 2024, maintaining a significant revenue share. Concurrently, the services segment is forecasted to experience notable growth during the projection period. Since the emergence of fintech, major tech corporations have spearheaded reforms and developed novel platforms for business operations, prompting banks to embark on digital transformation journeys. To meet evolving client demands and introduce innovative products, banks are increasingly embracing digital technologies and leveraging their benefits to the fullest extent.

Further, the transition of financial services to the cloud provides an opportunity to enhance customer-centric strategies, reduce barriers to entry in the sector, & expand access to banking solutions. Further, it opens opportunities for the creation of new service packages that support scale, data, and technology. Also, there's potential for quick and more accessible data access, support regulatory reporting, risk mitigation, and the identification of anomalies in risk management processes, which highlights the industry's commitment to using technological advancements to improve operational efficiency, regulatory compliance, and the complete customer experience in the digital banking landscape.

By Deployment

On-premises deployment is anticipated to dominate the global digital banking platform market in 2024, which meets the specific needs of financial institutions that prioritize maintaining control & security over their systems and data. Many banks, mainly larger ones, prefer on-premises solutions due to strict regulatory compliance mandates & concerns regarding data privacy. By hosting the digital banking platform within their own data centers, banks have complete authority over their IT infrastructure & information, providing confidence in handling sensitive customer data. Further, on-premises deployment provides large customization options, enabling banks to tailor the digital banking platform to fit their unique business processes & needs. A further hands-on approach appeals to institutions looking for greater control over their digital transformation, driving the growth of this segment.

Also, the cloud segment is expected to have the highest growth during the forecast period. Cloud & Software as a Service (SaaS) adoption is important for the future success of inclusive banking initiatives. Although developing an inclusive banking environment creates challenges, the advantages of Cloud and SaaS solutions are substantial, mainly for communities with limited access to financial services. Embracing cloud technology enables for greater flexibility, scalability, and accessibility, allowing financial institutions to extend their services to underserved populations more effectively. Thus, the expected expansion of the cloud segment shows a higher recognition of its major role in fostering financial inclusivity and innovation within the banking industry.

By Mode

In terms of mode, the digital banking platform is categorized into online banking and mobile banking. Online banking is expected to come out as the largest segment in the global digital banking platform market in 2024. Online banking supports a broad array of services through digital channels, enabling financial institutions to meet customer needs efficiently. With the higher adoption of smartphones, tablets, and internet connectivity, customers highly demand smooth access to their accounts & banking services online.

Digital banking platforms fulfill this demand by providing user-friendly interfaces for conducting transactions, accessing account information, making payments, and managing finances remotely. The convenience & accessibility of online banking has changed customer preferences, with an increase in the number of users favoring digital channels over traditional banking methods. Further, financial institutions prioritize investing in strong digital banking platforms to remain competitive, improve customer experiences, and capitalize on the expanding trend of online banking, allowing them to enhance their market presence and reach a wider customer base.

By Type

Investment banking as a type is expected to dominate the global digital banking platform market in 2024, holding a substantial revenue share of 38.9% which also drive the market growth. With the reopening of international markets after COVID-19, the investment banking sector experienced significant growth in activity. Many investment banks have created their operations from office locations & have started scheduling limited in-person client meetings due to the help of digital banking solutions.

To adapt to this changing landscape, investment banks are changing their deal origination techniques by incorporating hybrid conference strategies & using the latest technologies. Further, the retail banking segment is expected to experience high growth while maintaining a significant market share throughout the forecast period. The banking industry experiences both challenges & opportunities due to the growth of digital banking, the emergence of new technologies, the convergence of industrial ecosystems, and the growing focus on innovation.

Customers are highly turning to digital platforms & fintech solutions, leading to a fragmentation of traditional ties for basic financial services like loans, deposits, payments, and investments. For instance, data from Invest India reported that the Unified Payments Interface (UPI) in India, with 323 participating banks as of 2022, has supported over 5.9 billion monthly transactions making more than USD 130 billion, which highlights the need for retail banks to adapt quickly to changing consumer preferences & technological development to remain competitive in the changing banking industry.

The Digital Banking Platform Market Report is segmented on the basis of the following:

By Component

- Platform

- Services

- Professional Service

- Managed Service

By Deployment

By Mode

- Online Banking

- Mobile Banking

By Type

- Investment Banking

- Corporate Banking

- Retail Banking

Regional Analysis

Asia Pacific is set to lead the regional market for digital banking platforms, capturing the largest

market share of 31.4% in 2024, as well as demonstrating the highest growth potential throughout the forecast period. The digital banking market in Asia is highlighting a major expansion, driven by the coming out of new digital firms that are modifying the sector and revolutionizing banking experiences for individuals & businesses alike. As the need for mobile & online banking alternatives grows, there's exceptional potential for both established players & new-entrant to excel, mainly with regulators allocating more licenses & setting standards for a new era of banking innovation.

Further, North America has also a significant share of the market, using its advanced technological infrastructure, higher internet connectivity, and a large base of tech-savvy consumers. The region's strong economy and well-established banking sector further contribute to the growth of digital banking platforms. Given the highly competitive financial services landscape, banks in North America constantly look to innovative strategies to attract & retain customers.

Further, digital banking platforms provide a strategic advantage by allowing these institutions to deliver advanced digital services, personalized experiences, and smooth access to financial products across multiple channels. The growing adoption of mobile banking & the increasing demand for contactless and online transactions in North America has driven the need for special digital banking solutions. In addition, the region's high focus on digital transformation and customer-centric banking practices solidify its position and help in the expansion of digital banking platforms market.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global digital banking market is characterized by several players ranging from established financial institutions to emerging fintech startups. Established banks use their brand reputation and large customer base to maintain market share, while large fintech companies disrupt traditional banking models with innovative technologies & customer-centric approaches.

Technology giants also play a major role, providing digital solutions that integrate easily with everyday life. Moreover, regulatory changes & evolving customer preferences constantly reshape the competitive landscape, driving leading and newcomers as same to invest in digital capabilities and enhance customer experiences to stay ahead in this dynamic market.

Some of the prominent players in the global Digital Banking Platform Market are

Recent Developments

- In March 2024, Temenos announced that the Cooperative Bank of Oromia, which is one of the largest banks in Ethiopia launched CoopApp & CoopApp Alhuda on Temenos Digital (Infinity), providing a modern digital experience for conventional and Islamic banking with better personalization for over 12 million customers.

- In February 2024, Monex USA announced a collaboration with Q2’s Digital Banking Platform through the Q2 Partner Accelerator Program, which enables financial institutions to work directly with Monex USA & benefit from its global payments and risk-hedging solutions.

- In October 2023, HDFC Bank launched a digital banking platform named XpressWay, which focuses on providing a quick, paperless, and self-service banking experience to the bank’s customers. With more than 30 banking products & over 14 services, it provides a range of financial offerings, from personal loans to credit cards & savings accounts.

- In October 2023, IndusInd Bank introduced its digital banking application, INDIE targeting 10 million customers within the next three years. The app's important role in increasing the bank's customer base from 33 million to a projected 45 million. Reflecting a shift from product-driven to customer-centric strategies, it provides a suite of adaptable financial solutions customized to individual client requirements.

- In July 2023, Citi launched a new platform, CitiDirect Commercial Banking, mainly to address the demand of Citi Commercial Bank (CCB) clients, and plans to meet the changing global needs of these clients by providing a single-entry point digital platform, which brings together Citi’s global products & services into a single digital platform, providing clients with a 360° consolidated view of their Citi banking relationship across Loans, Cash, Trade, FX, Servicing and Onboarding.

- In April 2023, Liberty Bank has launched Alkami’s cloud-based digital banking platform, which allows Liberty Bank to use data and provide better-personalized communication channels for both its retail & business banking customers, which provides the bank with long-term integrations. Further, it will also help the bank to add a “major portion” of its customer base, about 150,000, and convert to Alkami’s single platform for business, retail, and mobile banking.