Market Overview

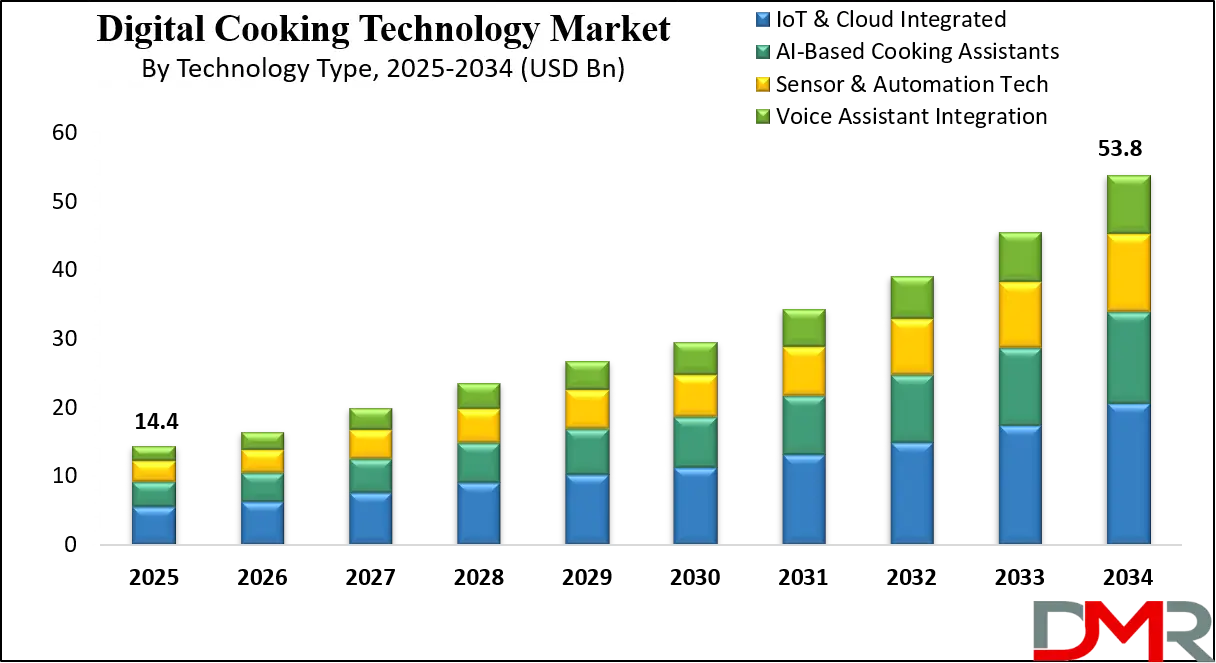

The global digital cooking technology market is projected to reach USD 14.4 billion in 2025 and is expected to grow at a CAGR of 15.8%, hitting USD 53.8 billion by 2034. Growth is driven by growing demand for smart kitchen appliances, IoT-enabled cooking solutions, and AI-integrated culinary technologies.

ConDigital cooking technology integrates smart systems, sensors, connectivity solutions, and automation into everyday cooking appliances, allowing users to manage, monitor, and optimize food preparation with precision and convenience. These technologies include Wi-Fi and Bluetooth-enabled cooktops, AI-powered ovens, voice-controlled microwaves, and app-based cooking assistants. They enable real-time temperature control, cooking alerts, personalized recipe suggestions, and remote access through smartphones or smart home systems. The evolution of digital cooking appliances aims to enhance energy efficiency, promote healthy eating habits, and simplify kitchen tasks while ensuring consistent culinary outcomes.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global digital cooking technology market has been witnessing rapid growth due to growing consumer inclination toward connected kitchen environments and smart home ecosystems. Factors such as rising urbanization, evolving lifestyles, and the growing demand for convenience in food preparation are driving the adoption of intelligent cooking devices. Technological advancements in sensors, IoT platforms, and AI-based cooking interfaces have transformed conventional appliances into multifunctional, user-friendly systems that appeal to tech-savvy homeowners and professional chefs alike. This market also benefits from rising awareness about energy conservation and the preference for low-emission appliances, especially in developed economies.

Emerging markets such as India, China, and Southeast Asia are becoming key growth engines for the digital cooking technology industry, supported by rising disposable income and growing penetration of internet-enabled appliances. Meanwhile, North America and Europe continue to dominate in terms of revenue due to early technology adoption and a strong base of premium kitchen appliance brands. Companies are also focusing on integrating voice assistants, adaptive cooking algorithms, and cloud-based analytics into their offerings to gain a competitive advantage. As smart kitchen innovations accelerate, the global market is expected to see significant expansion across residential and commercial segments alike.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Digital Cooking Technology Market

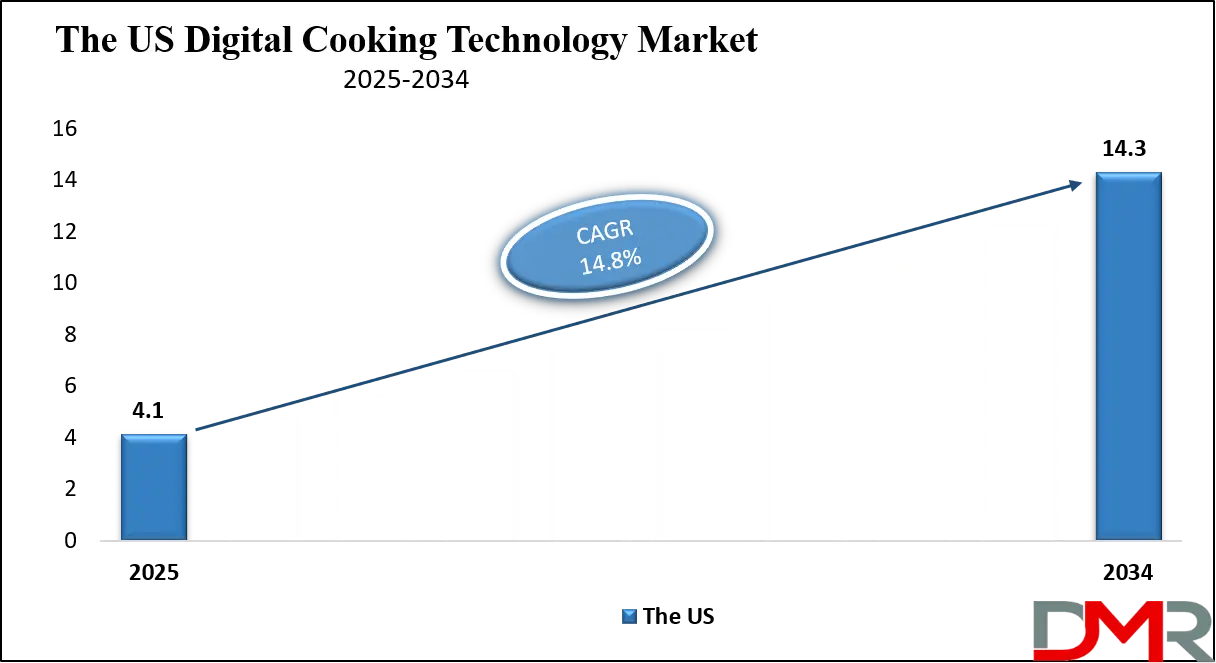

The U.S. Digital Cooking Technology Market size is projected to be valued at USD 4.1 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 14.3 billion in 2034 at a CAGR of 14.8%.

The U.S. digital cooking technology market is at the forefront of smart kitchen innovation, driven by strong consumer demand for connected home solutions and advanced culinary convenience. American households are adopting intelligent cooking appliances such as Wi-Fi-enabled ovens, touch-control cooktops, and app-integrated microwaves that offer remote access, automated settings, and real-time monitoring. Tech-savvy users are embracing AI-powered recipe recommendations and precision temperature control, which streamline cooking processes and ensure consistent results. The widespread use of smart home ecosystems like Amazon Alexa and Google Assistant has further fueled interest in voice-activated kitchen appliances, making hands-free operation a standard feature in modern U.S. kitchens.

Moreover, the U.S. market is benefiting from a growing trend toward energy-efficient and health-focused cooking solutions. Consumers are seeking digital air fryers, steam ovens, and induction cookers that support healthy meal preparation while reducing energy consumption. The rise in home cooking, particularly post-pandemic, has reinforced the need for multifunctional and user-friendly smart appliances that blend performance with ease of use.

Manufacturers are also responding with innovative product lines featuring cloud connectivity, machine learning algorithms, and smart diagnostics. With a strong foundation in consumer electronics, high-speed internet infrastructure, and a mature e-commerce ecosystem, the U.S. remains a leading hub for digital culinary advancements and next-gen kitchen technology.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Digital Cooking Technology Market

Europe's digital cooking technology market is estimated to reach USD 3.7 billion in 2025, representing a significant 25.7% share of the global market. This growth is being driven by a rising appetite for smart kitchen appliances across key countries such as Germany, France, the UK, and the Nordic nations. Consumers are drawn to digitally connected cooking devices that offer energy efficiency, remote operability, and seamless integration with broader smart home ecosystems. The regional emphasis on sustainability and energy regulations has further incentivized the shift from traditional to intelligent cooking solutions, especially those equipped with IoT, AI-based automation, and voice-command functionalities.

Moreover, premium brands and appliance makers in Europe are continuously launching technologically advanced models, which are further accelerating consumer adoption.

Looking ahead, the European market is poised to grow at a strong CAGR of 14.6% from 2025 to 2034. The presence of a well-established retail infrastructure, growing broadband connectivity, and evolving culinary habits are collectively contributing to this momentum. Additionally, heightened awareness around time-saving and health-oriented cooking practices is fueling demand for devices such as smart ovens, induction cooktops, and digital air fryers.

Supportive government initiatives promoting energy-efficient appliances, along with aggressive R&D investments by leading manufacturers, are expected to further strengthen the region’s position as a key innovation hub for digital kitchen technologies. As smart home penetration continues to rise across urban and suburban households, Europe will remain a pivotal region shaping the future of digital cooking.

The Japan Digital Cooking Technology Market

Japan’s digital cooking technology market is projected to reach USD 700 Million in 2025, reflecting its status as a mature but steadily expanding segment within the global landscape. Japanese consumers are well known for their early adoption of compact, high-performance home appliances that cater to space-conscious urban living. This cultural preference, combined with a strong affinity for automation and precision cooking, has driven demand for advanced digital kitchen solutions such as multi-functional cookers, smart rice cookers, and AI-integrated ovens. The presence of local giants like Panasonic, Sharp, and Zojirushi further bolsters market activity through continuous innovation and product refinement tailored to domestic tastes and preferences.

With an anticipated CAGR of 13.2% from 2025 to 2034, Japan’s digital cooking technology market is expected to experience healthy growth, propelled by the growing digitization of households and aging population dynamics that favor convenience-based appliances. The integration of IoT-enabled features that support remote monitoring, voice assistance, and automated cooking cycles aligns well with Japan’s tech-driven lifestyle.

Moreover, smart city initiatives, widespread internet connectivity, and environmentally conscious consumers are reinforcing the transition to energy-efficient, connected kitchen devices. As consumers continue to prioritize time-saving solutions without compromising food quality or safety, Japan is likely to remain a key innovation hotspot within the global digital cooking ecosystem.

Global Digital Cooking Technology Market: Key Takeaways

- Market Value: The global digital cooking technology market size is expected to reach a value of USD 53.8 billion by 2034 from a base value of USD 14.4 billion in 2025 at a CAGR of 15.8%.

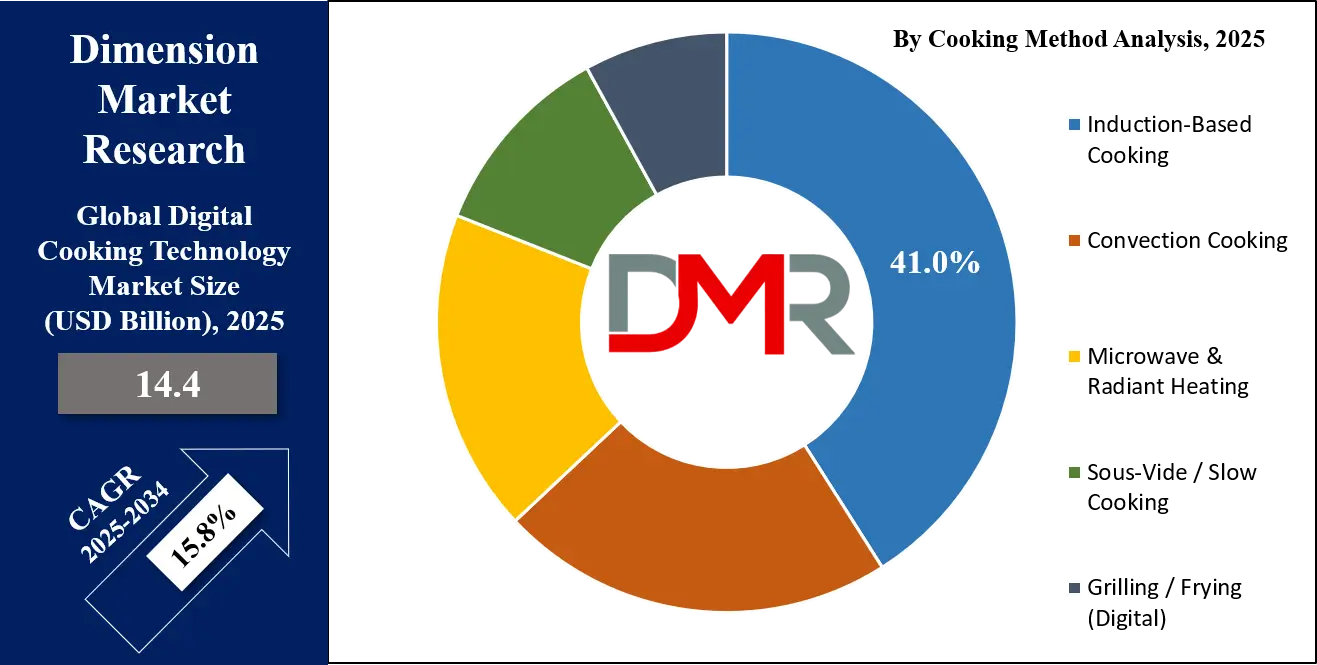

- By Cooking Method Segment Analysis: Induction-Based Cooking methods are poised to consolidate their dominance in the cooking method segment, capturing 41.0% of the total market share in 2025.

- By Product Type Segment Analysis: Smart Ovens are anticipated to maintain their dominance in the product type segment, capturing 32.0% of the total market share in 2025.

- By Connectivity Segment Analysis: Wi-Fi-enabled devices are expected to maintain their dominance in the connectivity segment, capturing 54.0% of the total market share in 2025.

- By Technology Segment Analysis: IoT & Cloud Integrated technologies will lead in the technology segment, capturing 38.0% of the market share in 2025.

- By Distribution Channel Segment Analysis: Online Retail channels are poised to consolidate their market position in the distribution channel segment, capturing 47.0% of the total market share in 2025.

- By Application Segment Analysis: The Residential Use industry is anticipated to maintain its dominance in the application segment, capturing 67% of the total market share in 2025.

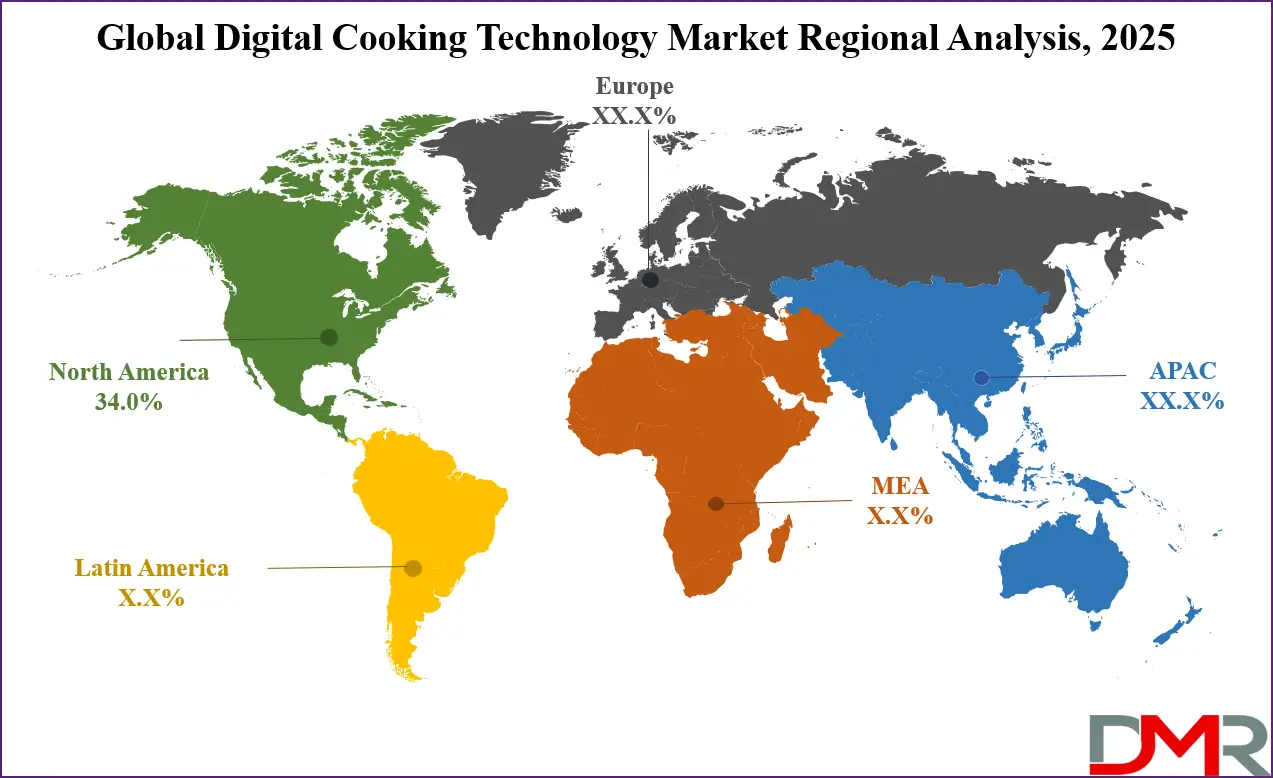

- Regional Analysis: North America is anticipated to lead the global digital cooking technology market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some key players in the global digital cooking technology market are Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players.

Global Digital Cooking Technology Market: Use Cases

- Smart Meal Preparation in Connected Homes: In modern connected households, digital cooking appliances are revolutionizing everyday meal preparation. Users can control smart ovens, cooktops, and microwaves remotely using smartphone apps, allowing them to preheat appliances, monitor cooking progress, or receive notifications when meals are ready. These appliances often integrate with voice assistants like Amazon Alexa or Google Home, enabling hands-free control for multitasking during cooking. AI-powered cooking algorithms also suggest personalized recipes based on dietary preferences, available ingredients, and cooking history, enhancing both convenience and nutritional planning. This use case reflects the shift toward intuitive and intelligent cooking solutions that streamline time management while offering a customized culinary experience.

- Precision Cooking in Professional Kitchens: Commercial kitchens in restaurants, hotels, and catering services are adopting digital cooking technologies for enhanced consistency, efficiency, and food quality. Precision cooking tools such as sous-vide machines, smart grills, and temperature-regulated ovens ensure that dishes are cooked to exact specifications, minimizing waste and maximizing flavor. Automated timers, sensor-based heat controls, and IoT-enabled monitoring systems allow chefs to maintain consistency across large volumes of orders without compromising quality. This use case showcases how smart culinary devices are supporting foodservice businesses in maintaining high standards, optimizing workflow, and meeting evolving customer expectations for taste and presentation.

- Health-Conscious Cooking with Smart Appliances: Digital cooking technology is playing a critical role in promoting health-conscious eating habits. Devices like digital air fryers, steam ovens, and smart slow cookers are enabling consumers to prepare low-fat, nutrient-rich meals with minimal effort. Many smart appliances come with built-in health-tracking apps or recipe integrations that focus on calorie counting, balanced meals, and dietary restrictions such as gluten-free or keto-friendly options. This functionality appeals to fitness enthusiasts, diabetics, and families seeking healthier lifestyles. By combining automation, real-time cooking data, and personalized nutrition, this use case highlights the intersection of smart cooking and wellness in both urban and suburban households.

- Energy-Efficient Smart Kitchens in Sustainable Living Spaces: As sustainability becomes a priority, digital cooking technologies are contributing to eco-friendly kitchen practices. Smart induction cooktops and energy-optimized ovens consume significantly less power compared to traditional appliances. Features such as auto shut-off, eco-modes, and energy usage tracking via mobile apps help users manage electricity consumption efficiently. These appliances also support zero-waste cooking by reducing overcooking and spoilage. In smart homes and green buildings, digital kitchens are integrated into broader home automation systems, enabling synchronized control of energy usage, ventilation, and appliance scheduling. This use case demonstrates how the digital cooking ecosystem aligns with global sustainability goals and green living trends.

Global Digital Cooking Technology Market: Stats & Facts

U.S. Energy Information Administration (EIA)

- Residential electricity consumption for cooking accounts for approximately 2.5% of total household energy use in the U.S.

- Energy-efficient electric cooking appliances can reduce energy consumption by up to 30% compared to conventional gas cooktops.

- Over 45% of U.S. households own at least one smart kitchen appliance as of 2023.

- Demand response programs, including smart appliance integration, are projected to reduce peak load by 5-10% by 2030.

- The adoption rate of induction cooktops increased by 15% between 2018 and 2023.

European Environment Agency (EEA)

- The average European household spends around 5% of its total electricity consumption on cooking.

- Energy labeling directives have increased sales of energy-efficient cooking appliances by 25% since 2015.

- Induction cooking appliances account for 35% of new electric stove sales across the EU as of 2023.

- Over 20 million smart kitchen devices were registered in European homes by 2024.

- EU member states aim to reduce kitchen appliance energy consumption by 15% by 2030 under current regulations.

Japan Ministry of Economy, Trade and Industry (METI)

- Japan’s household penetration of IoT-enabled cooking devices reached 18% in 2023.

- Induction heating cooktops represent over 50% of electric cooking devices sold domestically.

- Japanese consumers reduced average cooking energy use per meal by 12% between 2017 and 2022.

- Smart kitchen appliance exports grew at an annual rate of 9% from 2018 to 2023.

- Government subsidies covered up to 30% of the cost of energy-efficient kitchen appliances in rural areas in 2023.

China National Bureau of Statistics (NBS)

- In 2023, urban households in China had a 22% adoption rate of smart cooking appliances.

- The annual production of induction cookers in China surpassed 40 million units in 2023.

- Electricity consumption for cooking in urban households has decreased by 8% over the past five years due to smart appliance adoption.

- Smart kitchen appliances contributed to a 6% reduction in residential energy peak demand in 2023.

- China aims to increase IoT appliance penetration to 50% of urban households by 2030.

Australian Department of Industry, Science and Resources

- By 2024, approximately 28% of Australian homes had integrated smart kitchen devices, including cooking appliances.

- Induction cooktops are forecast to grow at 12% annually through 2028 due to energy efficiency incentives.

- Cooking appliance energy consumption comprises 4% of total residential electricity use nationwide.

- Government programs have funded the installation of over 100,000 smart cooking devices in low-income households since 2020.

- 35% of new kitchen appliance sales in Australia are digital-enabled models as of 2023.

UK Department for Business, Energy & Industrial Strategy (BEIS)

- UK households reduced gas stove usage by 10% between 2019 and 2023, favoring electric smart alternatives.

- Energy efficiency standards for cooking appliances saved the equivalent of 1.5 million tonnes of CO2 emissions in 2022.

- Over 3 million smart ovens and cooktops were sold in the UK from 2020 to 2023.

- The average smart kitchen appliance reduces cooking time by 20% compared to conventional models.

- Government research supports expanding smart appliance integration in affordable housing projects by 2025.

Global Digital Cooking Technology Market: Market Dynamics

Global Digital Cooking Technology Market: Driving Factors

Rising Adoption of Smart Home Ecosystems

The growing integration of smart home devices with connected kitchens is a major growth driver for the digital cooking technology market. Consumers are seeking seamless interoperability between their cooking appliances and home automation platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit. This trend encourages the adoption of Wi-Fi and Bluetooth-enabled ovens, cooktops, and microwaves that offer remote control, voice commands, and personalized cooking experiences. Enhanced user convenience, real-time cooking monitoring, and automation significantly boost consumer interest, making smart kitchen solutions an essential component of modern digital lifestyles.

Growing Consumer Demand for Convenience and Efficiency

Busy lifestyles and evolving eating habits are pushing consumers towards digital cooking appliances that reduce cooking time and complexity. Features such as automated cooking programs, AI-driven recipe suggestions, and precise temperature control help users achieve consistent culinary results with minimal effort. These smart devices also promote energy efficiency through optimized heating and intelligent power management, aligning with consumers’ growing awareness of sustainability and cost savings. The demand for multifunctional and user-friendly kitchen gadgets continues to expand the market for intelligent cooking technology globally.

Global Digital Cooking Technology Market: Restraints

High Initial Cost of Advanced Cooking Appliances

Despite the benefits, the relatively high price of digital cooking devices compared to conventional appliances limits adoption, especially in emerging markets. The integration of sensors, connectivity modules, and AI algorithms contributes to increased manufacturing costs, which are passed on to consumers. This pricing barrier restricts the accessibility of smart cooking technologies to price-sensitive segments and slows market penetration in regions with lower disposable incomes.

Concerns over Data Privacy and Cybersecurity

With digital cooking devices connected to the internet and integrated with smart home networks, cybersecurity and data privacy concerns have emerged as potential restraints. Users worry about unauthorized access to their devices or personal information, which could compromise safety or lead to data breaches. Manufacturers need to invest in robust encryption, secure firmware updates, and user education to mitigate these risks and build consumer trust in IoT-enabled kitchen appliances.

Global Digital Cooking Technology Market: Opportunities

Expansion in Emerging Markets with a Growing Middle Class

Emerging economies such as India, Southeast Asia, and Latin America offer significant growth potential for digital cooking technology due to growing urbanization, rising disposable incomes, and greater internet penetration. The expanding middle-class consumer base in these regions is becoming more receptive to smart home innovations, including connected kitchen appliances. Market players can capitalize on this opportunity by offering cost-effective, localized products and partnering with regional e-commerce platforms for wider distribution.

Integration of Artificial Intelligence and Machine Learning

The adoption of AI and machine learning in cooking technology is opening new avenues for innovation and differentiation. Smart ovens and cooktops equipped with AI can learn user preferences, optimize cooking cycles, and provide adaptive recipes tailored to dietary restrictions or ingredient availability. This technology enhances user experience by delivering precision cooking and reducing trial-and-error in meal preparation. Investing in AI-powered features presents a lucrative opportunity for manufacturers to capture tech-savvy consumers and professional chefs seeking advanced culinary tools.

Global Digital Cooking Technology Market: Trends

Voice-Controlled and Hands-Free Cooking Appliances

Voice assistant integration is becoming a standard feature in the digital cooking landscape, enabling hands-free operation and multitasking convenience. Consumers are using voice commands to preheat ovens, adjust cooking times, or search for recipes while cooking. This trend enhances kitchen ergonomics and accessibility, especially for elderly or differently-abled users, and strengthens the connection between smart kitchens and broader smart home ecosystems.

Focus on Sustainable and Energy-Efficient Cooking Solutions

Sustainability is a growing priority among consumers, prompting demand for energy-saving cooking appliances such as induction cooktops and convection ovens with eco-modes. Manufacturers are incorporating features like real-time energy consumption tracking, auto shut-off functions, and smart scheduling to reduce power usage and carbon footprint. This trend aligns with global environmental goals and encourages the adoption of digital cooking technologies that support green living practices.

Global Digital Cooking Technology Market: Research Scope and Analysis

By Cooking Method Analysis

Induction-based cooking methods are rapidly gaining prominence within the digital cooking technology market, expected to hold a significant 41.0% share of the total market in 2025. This surge in dominance is primarily due to the energy efficiency, precise temperature control, and faster heating capabilities that induction cooktops offer compared to traditional gas or electric stoves. The safety features associated with induction cooking, such as cool-to-touch surfaces and automatic shut-off, further enhance consumer appeal.

Additionally, induction technology aligns well with the growing demand for smart kitchen appliances that support connected home ecosystems, enabling users to control and monitor cooking processes remotely through apps or voice assistants.

Convection cooking is another vital segment within the market, known for its ability to cook food evenly and efficiently by circulating hot air around the food using built-in fans. This cooking method has become popular in digital ovens and smart ranges, as it significantly reduces cooking times and ensures consistent heat distribution, resulting in better texture and flavor of baked or roasted dishes. Convection cooking appliances often come equipped with programmable settings and sensor-based adjustments, allowing for precise control and integration with digital platforms. The growing consumer preference for versatile and time-saving cooking solutions is driving the adoption of convection cooking technology, complementing the growth of induction methods in modern kitchens.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Product Type Analysis

Smart ovens are expected to continue leading the product type segment in the digital cooking technology market, capturing an estimated 32.0% of the total market share in 2025. Their dominance can be attributed to their advanced features such as Wi-Fi connectivity, app control, voice assistant integration, and AI-driven cooking programs that allow users to cook meals with greater precision and convenience. These ovens often come equipped with sensors that monitor temperature, humidity, and cooking progress in real time, ensuring consistent and high-quality results. The versatility of smart ovens, which support multiple cooking modes like baking, roasting, and steaming, makes them highly appealing to both everyday consumers and culinary enthusiasts looking for efficient and intuitive kitchen solutions.

Smart cooktops are also an important segment within the product category, gaining traction due to their sleek design, energy efficiency, and enhanced safety features. These cooktops utilize technologies such as induction heating combined with digital controls that allow for precise temperature adjustments and faster cooking times. Smart cooktops often offer touch-screen interfaces, app connectivity, and compatibility with smart home ecosystems, enabling users to monitor and control cooking remotely or through voice commands. Their ability to provide a seamless cooking experience with added convenience and energy savings makes smart cooktops a complementary and growing segment alongside smart ovens in the evolving digital kitchen landscape.

By Connectivity Analysis

Wi-Fi-enabled devices are projected to dominate the connectivity segment of the digital cooking technology market, capturing around 54.0% of the total market share in 2025. This prominence is driven by the widespread availability of high-speed internet and the growing consumer preference for appliances that offer seamless remote access and control through smartphones and smart home platforms. Wi-Fi connectivity allows users to monitor cooking progress, adjust settings, receive notifications, and even download recipes or firmware updates from anywhere, providing a highly interactive and convenient cooking experience. The ability to integrate with popular voice assistants and other smart home devices further enhances the appeal of Wi-Fi-enabled cooking appliances in connected kitchen ecosystems.

Bluetooth-enabled devices also play a significant role in this segment, offering a more localized and energy-efficient connectivity option. These devices are typically designed for short-range communication, enabling users to connect their smartphones or tablets directly to cooking appliances within the home environment.

Bluetooth technology supports features like wireless temperature monitoring, cooking alerts, and control of basic functions without requiring constant internet access. Its ease of pairing and lower power consumption make it suitable for certain kitchen gadgets such as smart thermometers, grills, and smaller appliances. Although Bluetooth-enabled devices capture a smaller market share compared to Wi-Fi, they remain important for users seeking straightforward, reliable, and cost-effective connectivity solutions in digital cooking technology.

By Technology Analysis

IoT and cloud-integrated technologies are set to lead the technology segment of the digital cooking technology market, expected to capture around 38.0% of the market share in 2025. These technologies enable cooking appliances to connect seamlessly to the internet, allowing for real-time data exchange, remote monitoring, and control through cloud platforms. This connectivity facilitates enhanced functionality such as automatic software updates, data-driven cooking optimizations, and integration with other smart home devices.

Cloud-based systems also allow manufacturers to collect usage data, enabling predictive maintenance and personalized user experiences. The ability to access recipes, cooking instructions, and appliance diagnostics remotely greatly enhances user convenience and appliance performance, making IoT and cloud integration a critical driver in the evolution of smart kitchens.

AI-based cooking assistants represent an innovative sub-segment within this technology landscape, utilizing artificial intelligence and machine learning algorithms to elevate the cooking experience. These assistants can analyze user preferences, dietary restrictions, and cooking habits to provide tailored recipe recommendations and optimize cooking settings automatically. By learning from previous cooking cycles, AI assistants improve accuracy and consistency, reducing trial and error in meal preparation.

They often incorporate voice recognition for hands-free interaction and can adapt cooking processes in real time based on sensor feedback. This intelligent automation not only simplifies complex culinary tasks but also promotes healthier and more efficient cooking, positioning AI-based assistants as a key growth area in the digital cooking technology market.

By Distribution Channel Analysis

Online retail channels are expected to solidify their dominance in the distribution channel segment of the digital cooking technology market, capturing approximately 47.0% of the total market share in 2025. This growth is fueled by the growing penetration of e-commerce platforms, rising consumer preference for digital shopping, and the convenience of browsing a wide range of smart kitchen appliances from home. Online channels allow consumers to compare features, read reviews, and access exclusive discounts or bundled offers, making them a preferred choice for tech-savvy buyers.

Additionally, brands are investing in direct-to-consumer (DTC) websites and collaborating with major e-commerce marketplaces to enhance product visibility, ensure swift delivery, and offer post-purchase support, further accelerating the shift toward online purchasing.

Specialty stores also play a vital role in the distribution of digital cooking technology, especially for consumers seeking hands-on experience and expert guidance before making a purchase. These stores focus exclusively on home appliances and kitchen electronics, offering curated selections of advanced products with demonstrations and personalized customer service.

Specialty retailers often provide detailed information about appliance functionality, installation support, and usage tips, which can be especially valuable for first-time buyers of smart cooking devices. While they represent a smaller share of the market compared to online platforms, specialty stores continue to attract consumers who prioritize in-store engagement, quality assurance, and post-sale services in their buying journey.

By Application Analysis

The residential use segment is projected to remain the dominant application area in the digital cooking technology market, capturing around 67% of the total market share in 2025. This growth is driven by the growing adoption of smart kitchen appliances among households seeking greater convenience, efficiency, and personalization in daily cooking routines. Features such as remote monitoring, automated cooking presets, voice control, and AI-driven recipe suggestions are especially appealing to busy families and health-conscious individuals. Rising urbanization, the expansion of smart home ecosystems, and growing awareness of energy-efficient appliances are further encouraging homeowners to upgrade traditional kitchens with digital solutions that simplify cooking and enhance the overall home experience.

In parallel, the commercial use segment is steadily gaining traction as restaurants, hotels, cloud kitchens, and catering services invest in digital cooking technologies to streamline operations and maintain consistent food quality. Commercial kitchens benefit from precision cooking systems, connected ovens, and AI-powered tools that can manage large volumes with minimal supervision.

These smart appliances help reduce waste, improve safety, and optimize energy consumption, all of which are crucial in high-demand, professional cooking environments. As the foodservice industry becomes tech-driven, the demand for scalable, intelligent cooking solutions continues to grow, making commercial applications a key contributor to the evolving smart kitchen landscape.

The Digital Cooking Technology Market Report is segmented on the basis of the following:

By Cooking Method

- Induction-Based Cooking

- Convection Cooking

- Microwave & Radiant Heating

- Sous-Vide/ Slow Cooking

- Grilling/ Frying (Digital)

By Product Type

- Smart Ovens

- Smart Cooktops

- Connected Microwaves

- Smart Cookware & Utensils

- Precision Cookers

- Smart Grills & Fryers

- Others

By Connectivity

- Wi-Fi Enabled Devices

- Bluetooth Enabled Devices

- Other Protocols

By Technology

- IoT & Cloud Integrated

- AI-Based Cooking Assistants

- Sensor & Automation Tech

- Voice Assistant Integration

By Distribution Channel

- Online Retail

- Specialty Stores

- Supermarkets/Hypermarkets

- Direct Sales

By Application

- Residential Use

- Commercial Use

Global Digital Cooking Technology Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global digital cooking technology market in 2025, accounting for 34.0% of total global market revenue. This dominance is driven by the high penetration of smart home technologies, a tech-savvy consumer base, and strong purchasing power across the United States and Canada. The region benefits from a mature e-commerce infrastructure, widespread internet access, and early adoption of IoT-enabled kitchen appliances.

Additionally, leading market players based in North America continue to introduce innovative product lines with advanced features such as voice control, AI integration, and cloud connectivity, further fueling consumer demand. Growing awareness around energy efficiency and convenience is also encouraging households to transition from traditional to digital cooking solutions, reinforcing the region’s leadership in this evolving market.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with significant growth

The Asia Pacific region is projected to register the highest CAGR in the global digital cooking technology market during the forecast period. Rapid urbanization, rising disposable incomes, and a growing middle-class population are driving the adoption of smart kitchen appliances across countries like China, India, Japan, and South Korea. Consumers in this region are drawn to tech-enabled cooking solutions that offer convenience, energy efficiency, and connectivity with mobile apps and smart home systems.

Furthermore, expanding internet penetration, the proliferation of e-commerce platforms, and aggressive marketing by regional and global brands are accelerating market growth. Government initiatives promoting energy-efficient and smart appliances are also contributing to the strong demand across both urban and semi-urban areas in the Asia Pacific.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Cooking Technology Market: Competitive Landscape

The global competitive landscape of the digital cooking technology market is characterized by the presence of both established multinational corporations and innovative startups competing to capture consumer attention through technological advancement, product differentiation, and strategic partnerships. Leading players such as Samsung Electronics, LG Electronics, Whirlpool Corporation, and Electrolux AB dominate the market with expansive product portfolios, strong distribution networks, and ongoing investments in AI, IoT, and cloud integration.

At the same time, emerging companies like June Life, Tovala, and Anova Culinary are reshaping the competitive dynamics with niche offerings that emphasize user experience, automation, and personalization. The market is witnessing a steady rise in collaborations between appliance manufacturers and tech firms to accelerate innovation and offer smart, connected solutions. Continuous R&D, sustainability initiatives, and a focus on enhancing consumer convenience are central to the evolving strategies as players vie for leadership in a rapidly digitizing kitchen ecosystem.

Some of the prominent players in the global digital cooking technology market are:

- Samsung Electronics

- LG Electronics

- Whirlpool Corporation

- Panasonic Corporation

- Electrolux AB

- Haier Smart Home

- Breville Group

- GE Appliances

- Bosch (BSH Hausgeräte GmbH)

- Miele & Cie. KG

- Xiaomi Corporation

- Tovala

- June Life, Inc.

- Sub-Zero Group, Inc.

- Sharp Corporation

- Koninklijke Philips N.V.

- Anova Culinary

- Gourmia

- Robam Appliances

- Instant Brands

- Other Key Players

Global Digital Cooking Technology Market: Recent Developments

Product Launches

- November 2024: Anova introduced the Precision Oven 2.0, a countertop convection and steam combi oven featuring a high-definition interior camera that identifies food and suggests optimal cooking modes and temperatures. The oven supports various cooking methods, including baking, roasting, air frying, dehydrating, and sous vide, enhancing versatility for home cooks.

- September 2024: Gourmia made its European debut at IFA 2024, unveiling three innovative kitchen appliances designed to revolutionize home cooking. These products aim to enhance cooking efficiency and user experience, marking Gourmia's expansion into the European market.

Mergers and Acquisitions

- September 2024: Linked Eats, a provider of third-party delivery revenue management software for restaurants, acquired Sauce Technologies, a company specializing in AI-powered solutions for digital ordering. This acquisition aims to enhance Linked Eats' platform by incorporating Sauce Technologies' features in marketing automation and demand forecasting.

- August 2024: Wonder, a food-delivery startup, acquired media company Tastemade for approximately USD 90 million. This acquisition is part of Wonder's strategy to create an all-encompassing "mealtime super app" that includes takeout, delivery, meal kits, content production, and advertising.

Funding Events

- April 2025: GrubMarket, an AI-powered technology enabler in the American food supply chain industry, raised approximately USD 50 million in a Series G funding round. The funds will support GrubMarket's growth and AI initiatives, solidifying its position as the largest private food technology company in the U.S.

- March 2024: Wonder secured USD 700 million in a Series C funding round, followed by an additional USD 250 million in November, totaling USD 950 million for the year. These funds are intended to support Wonder's expansion and development of its "mealtime super app."

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 14.4 Bn |

| Forecast Value (2034) |

USD 53.8 Bn |

| CAGR (2025–2034) |

15.8% |

| The US Market Size (2025) |

USD 4.1 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Cooking Method (Induction-Based Cooking, Convection Cooking, Microwave & Radiant Heating, Sous-Vide/Slow Cooking, Grilling/Frying (Digital)), By Product Type (Smart Ovens, Smart Cooktops, Connected Microwaves, Smart Cookware & Utensils, Precision Cookers, Smart Grills & Fryers, Others), By Connectivity (Wi-Fi Enabled Devices, Bluetooth Enabled Devices, Other Protocols), By Technology (IoT & Cloud Integrated, AI-Based Cooking Assistants, Sensor & Automation Tech, Voice Assistant Integration), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets/Hypermarkets, Direct Sales), and By Application (Residential Use, Commercial Use) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the global digital cooking technology market?

▾ The global digital cooking technology market size is estimated to have a value of USD 14.4 billion in 2025 and is expected to reach USD 53.8 billion by the end of 2034.

What is the size of the US digital cooking technology market?

▾ The US digital cooking technology market is projected to be valued at USD 4.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14.3 billion in 2034 at a CAGR of 14.8%.

Which region accounted for the largest global digital cooking technology market?

▾ North America is expected to have the largest market share in the global digital cooking technology market, with a share of about 34.0% in 2025.

Who are the key players in the global digital cooking technology market?

▾ Some of the major key players in the global digital cooking technology market are Samsung Electronics, LG Electronics, Whirlpool Corporation, Panasonic Corporation, Electrolux AB, Haier Smart Home, Breville Group, GE Appliances, Bosch (BSH Hausgeräte GmbH), Miele & Cie. KG, Xiaomi Corporation, Tovala, June Life Inc., and Other Key Players

What is the growth rate of the global digital cooking technology market?

▾ The market is growing at a CAGR of 15.8 percent over the forecasted period.