North America and Europe currently lead the Digital Dentistry market due to advanced healthcare systems and higher adoption of digital technologies, while Asia-Pacific should see rapid expansion due to rising healthcare investments and an expanding dental tourism industry. Digital Dentistry industry stands poised for continuous expansion due to continued innovations and rising demands for patient-centric solutions.

Key Takeaways

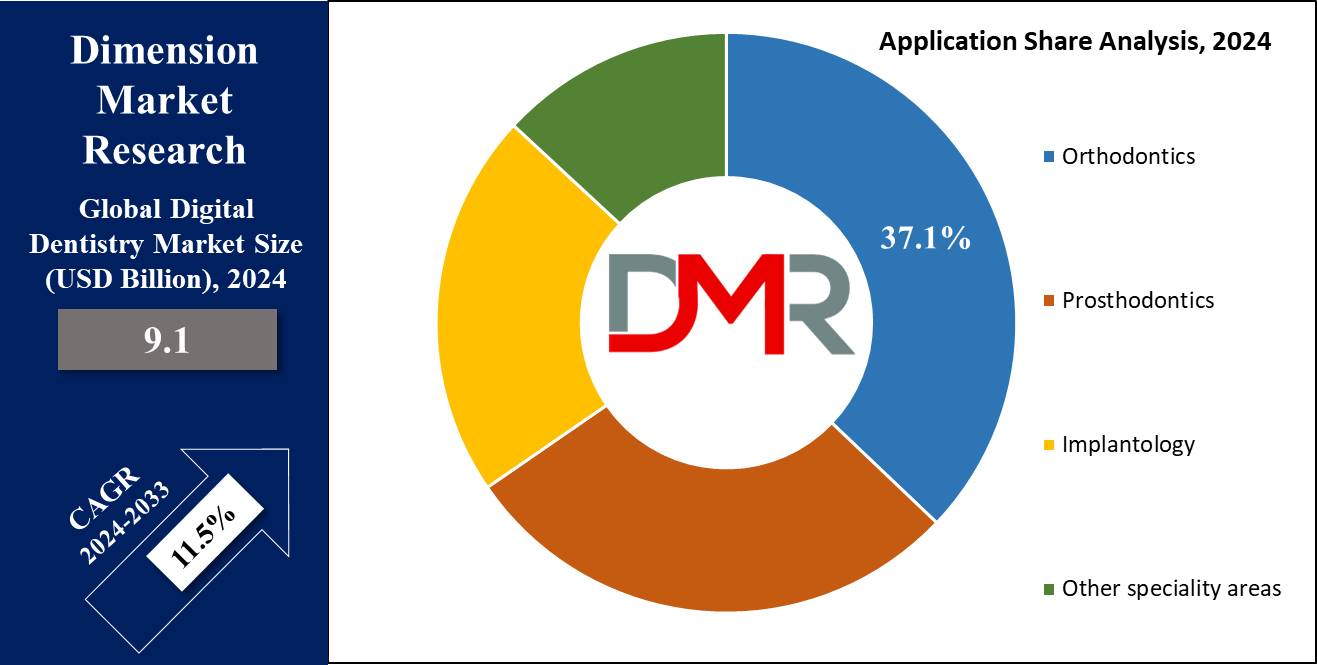

- Digital Dentistry Market reach USD 24.2 Bn in 2033 at a CAGR of 11.5%.

- In 2023, software held a dominant position within the product segment, with CAD/CAM systems and AI-powered diagnostic tools leading adoption across dental practices.

- Diagnostics is the leading application segment, driven by the widespread use of digital imaging and AI-based diagnostic tools for early detection and treatment planning.

- North America leads the global market, holding a 46.2% share in 2023, supported by advanced healthcare infrastructure, high digital adoption rates, and major industry players.

- Technological advancements in dental equipment, such as intraoral scanners, 3D printing, and AI integration, are key growth drivers, enabling greater efficiency, precision, and personalized dental care solutions.

Use Cases

- CAD/CAM Restorations: Dentists use computerized design and manufacturing technology (CAD/CAM) to design and fabricate crowns, bridges, and veneers quickly in one visit - shortening treatment time significantly.

- 3D Printing for Custom Prosthetics: 3D printers can create highly precise dental implants, dentures and aligners tailored specifically to individual patient requirements thus improving comfort and fit.

- Intraoral Scanners for Digital Impressions: Intraoral scanners capture digital impressions quickly and comfortably, replacing traditional molds while improving patient comfort and diagnostic accuracy.

- AI-Powered Diagnosis: AI can aid dentists in quickly and accurately recognizing early signs of oral diseases, increasing diagnostic precision.

- Teledentistry Integration: Dentists may utilize digital tools integrated with tele-dentistry platforms for remote consultation with patients and diagnosis and treatment planning services.

Driving Factors

Technological Advancements in Dental Equipment: Enhancing Precision and Efficiency

CAD/CAM systems, 3D printing technology and intraoral scanners continue to drive growth of Digital Dentistry markets worldwide. Innovative dental technologies enable increased accuracy in diagnostics, treatment planning and the creation of prosthetic dental restorations. For example, CAD/CAM technology reduces manual errors when placing restorations thereby improving fit and functionality. 3D printing offers improved customization and production times for dental implants, crowns and bridges while intraoral scanners improve imaging precision and patient comfort. Such technological progress plays a pivotal role in streamlining clinical workflows which contributes to increased adoption by dental professionals as well as contributing to market expansion overall.

Growing Geriatric Population: Increase in Demand for Dental Services

As global populations age and, particularly those living in developed regions, demand for dental services grows simultaneously. Aging adults tend to suffer more frequently from tooth loss, periodontal diseases and edentulism; complex solutions like implants, dentures and crowns may become necessary as dental issues emerge in older individuals. Digital Dentistry market is well equipped to meet these demands with its advanced tools that enhance accuracy and efficiency of treatments. CAD/CAM technology facilitates rapid production of precise dental prosthetics while digital imaging assists with early diagnosis and personalized treatment plans. A growing elderly population provides one key driver of market expansion; particularly in North America and Europe where healthcare infrastructure supports advanced dental services.

Rising Prevalence of Dental Disorders Drive Demand for Effective Solutions

Global dental disorders such as tooth decay, periodontal diseases and malocclusion have contributed significantly to the global Digital Dentistry market growth. According to World Health Organization estimates, approximately 3.5 billion people suffer from oral diseases worldwide. Digital dentistry provides effective solutions to address such concerns, with technologies such as 3D imaging and CAD/CAM systems offering faster diagnosis and treatment than ever. Digital platforms, for instance, can expedite the design and manufacturing process for braces or aligners to treat malocclusion more quickly - improving patient outcomes and satisfaction while meeting growing patient need. As more dental disorders emerge and require innovative solutions - driving widespread adoption of digital dentistry tools worldwide - digital dentistry tools become an important solution.

Growth Opportunities

Development of Affordably Digital Solutions: Unlocking Growth Potential in Unexploited Markets

2023 is forecasting significant opportunities in digital dentistry thanks to cost-effective digital dentistry solutions that offer businesses of all sizes greater affordability. Manufacturers introducing more cost-efficient CAD/CAM systems, 3D printers and intraoral scanners is expanding access for previously underserved market segments while simultaneously decreasing financial barriers associated with initial investments; such innovations should help accelerate adoption rates across more practices, particularly emerging markets where affordability may remain an impediment to adoption of such tools.

Integrating Tele-dental Platforms: Expanding Remote Care Services

Integration of digital dentistry tools and tele-dentistry platforms will represent an excellent growth opportunity in 2023. Such platforms allow dental professionals to provide remote consultations, virtual diagnoses, and treatment planning without needing in-person visits from patients - improving access to dental care in underserved or rural areas while increasing patient convenience. With the expansion of telehealth technologies like TeleDentistry platforms becoming a greater factor than ever in driving market expansion; being able to integrate digital dental solutions will become essential.

Customized Dental Services to Meet Rising Demand for Tailored Solutions

Digitized dentistry is at the vanguard of this movement toward personalized dental care, creating custom aligners, implants, and prosthetics tailored specifically for individual patient needs using technologies like CAD/CAM systems and 3D printing. Such customization increases patient satisfaction while simultaneously improving clinical results- creating one of digital dentistry's key growth areas.

Dental Education and Training: Preparing the Next Generation

Digital simulation tools and e-learning platforms have revolutionized dental education, offering opportunities for training the next generation of dentists on digital technologies. By including advanced training on digital tools into curriculums, the market can ensure it will have access to skilled dental practitioners able to deploy cutting-edge procedures as part of future growth projections.

Key Trends

Green Dentistry: Adopting Sustainability Through Digital Solutions

2023 sees an increasing global shift toward eco-friendly practices that is driving digital dentistry solutions that reduce waste and the adoption of eco-friendly processes such as paperless workflows and digital impressions, to minimize their environmental footprint and contribute to green movements like Zero Waste initiatives. By eliminating physical molds, film x-rays, paper records and physical molds as unnecessary measures in dentistry practices - digital dentistry becomes an indispensable player in global sustainability goals and appeals directly to ecologically aware patients and providers - offering growth potential in markets worldwide.

Moving Toward AI-Powered Solutions: Maximizing Precision and Efficiency

Artificial Intelligence (AI) has made an indelible mark on digital dentistry by revolutionizing diagnostic accuracy, treatment planning and patient management. AI solutions are increasingly used to analyze radiographs, detect early signs of oral diseases and predict treatment outcomes with greater accuracy. By 2023, its integration into dental workflows will become even more widespread, helping dentists make informed decisions while offering personalized care - ultimately driving market expansion further.

Increased Use of Intraoral Scanners: Enhancing Patient Experience and Outcomes

Intraoral scanners for digital impression capture is becoming more widely utilized in 2023, providing highly accurate and detailed images of patients' teeth while replacing traditional molds that were often uncomfortable and time consuming. Thus, intraoral scanners are improving patient comfort, decreasing appointment times, and optimizing treatment outcomes.

Laser Dentistry: Precision and Minimality of Intervention

Laser-based dental tools have grown increasingly popular as a result of their precision and minimally invasive nature, increasing in 2023 adoption for soft and hard tissue treatments with quicker recovery times and reduced complications for patients - furthering patient-centric healthcare initiatives as a key growth driver in digital dentistry market.

Restraining Factors

Initial Costs of Digital Equipment Can Prevent Widespread Adoption

Digital dental equipment - such as CAD/CAM systems, 3D printers and intraoral scanners - has high upfront costs associated with purchase and implementation, which may prevent widespread adoption. Small to mid-sized dental practices represent a large share of the market; yet often struggle to justify a return on investment (ROI). Given their extensive capital needs, such practices often struggle to justify an acceptable ROI. Small practices may find the cost of purchasing and running a CAD/CAM machine prohibitively costly; smaller practices may find this obstacle hard to surmount. Although these technologies provide long-term benefits in terms of improved efficiency and patient outcomes, their initial expense often limits adoption rates in emerging markets or regions with less developed healthcare infrastructures. As such, this high cost remains one of the main obstacles limiting access to transformative technologies for dental professionals across many markets.

Limited Reimbursement Policies: Suffocating Patient Interest in Digital Solutions

Insurance policies often don't cover dental procedures to the full extent, with several digital dentistry services like 3D imaging, restorations and implantology often excluded from standard reimbursement policies. Financial differences place a strain on patients, discouraging them from opting for more costly digital dental treatments. Lacking adequate reimbursement schemes in both developed and emerging markets, inadequate reimbursement schemes impede patient demand while being an obstacle for market expansion. As one example, limited coverage for advanced digital procedures - such as same-day crowns made using CAD/CAM technology - restricts patient access. Without more expansive reimbursement policies in place, digital dentistry will likely remain limited among cost-conscious patients and providers.

Research Scope and Analysis

By Product

Software was the clear market leader in 2023 within the product segment of the Digital Dentistry market, due to the rising adoption of advanced digital tools by global dental practices. Dental software solutions including CAD/CAM software, practice management systems and AI diagnostic tools have become essential tools in streamlining workflows, improving diagnostic accuracy and patient management - not to mention enhanced patient management - so the shift toward cloud platforms and AI applications only increased this segment's growth as it allows seamless integration with other digital dental technologies and enhanced decision-making processes for dentists themselves.

Equipment accounts for a major chunk of the Digital Dentistry market, comprising products like intraoral scanners, 3D printers, milling machines and laser systems. A key trend seen in 2023 was intraoral scanners' increasing adoption - featuring precise digital impression capture compared to more traditional methods - due to their accuracy, efficiency and ability to improve patient comfort. 3D printers too are becoming popular due to their use in fabricating custom prosthetics and orthodontic devices and offering more bespoke care options than ever.

By Application

Diagnostics held the leading market position within the application segment of the digital dentistry market in 2023 due to the rising demand for sophisticated digital tools that improved the accuracy and efficiency of dental care delivery. Digital radiography, intraoral scanners and AI-powered diagnostic software have become popular tools for early diagnosis of dental conditions with more precise imaging and analysis capabilities. These tools assist clinicians in more accurately diagnosing issues like caries, periodontal diseases and malocclusion, leading to improved treatment results. Furthermore, artificial intelligence (AI)-enhanced diagnostic tools help physicians quickly detect dental pathologies - further propelling this segment's significant expansion.

Therapeutic applications comprise an impressive share in 2023's application segment, including treatments enabled by digital technologies like CAD/CAM systems, 3D printing and laser dentistry. Therapeutic applications have seen strong expansion within areas like dental restorations, orthodontics and implantology due to increasing use of digital tools like CAD/CAM technology for crown creation as well as 3D printing revolutionizing custom aligners dentures implants production; additionally laser dentistry is growing more popular due to its precision, reduced patient discomfort levels and faster recovery rates than its competition.

The Digital Dentistry Market Report is segmented based on the following:

By Product

By Application

- Diagnostics

- Therapeutics

- Other Applications

By Specialty Areas

- Orthodontics

- Prosthodontics

- Implantology

- Other speciality areas

By End users

- Dental Laboratories

- Dental Hospitals and Clinics

- Other end users

Regional Analysis

North America held 46.2% of the digital dentistry market share worldwide in 2023. This success can be attributed to advanced healthcare infrastructure, high adoption rates for digital technologies and significant investments made in R&D; specifically in the US with its strong presence of key industry players and robust

dental services industry as well as favorable reimbursement policies and increasing patient demand for minimally invasive procedures as key drivers in its market position.

Europe is the second-largest market, driven by increasing government initiatives promoting digital healthcare and awareness of advanced dental treatments. Germany, France and the UK lead adoption of CAD/CAM systems, 3D printing technology and digital radiography - as do their aging populations that require regular dental check-ups - further driving market expansion.

Asia-Pacific region is projected to experience rapid market expansion during this forecast period due to increasing healthcare expenditure, awareness of digital dental technologies and growing dental tourism markets such as China, Japan and India. Furthermore, expanding dental infrastructure coupled with government initiatives promoting digital healthcare solutions contribute to this region's rapid expansion.

Middle East & Africa markets are experiencing gradual expansion due to improved healthcare infrastructure and an increasing emphasis on digital solutions, especially within UAE and South Africa. Latin American markets, with Brazil and Mexico serving as key examples, have experienced moderate expansion as demand for advanced dental treatments increases along with increasing prevalence rates in those regions.

By Region

North America

Europe

- Germany

- U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

Dentsply Sirona leads with their comprehensive product offerings for CAD/CAM systems, 3D printing technologies and imaging. Their focus on innovation and integration across digital workflows reinforce their competitive edge further. Likewise, Danaher Corporation continues its leadership position through their cutting-edge diagnostic and treatment solutions in imaging as well as orthodontics.

Carestream Health, Inc. stands out for its digital imaging and intraoral scanner solutions, making a notable impactful contribution in diagnostics segment of market. Meanwhile, key players like Institut Straumann AG's dental implants and prosthetics division is making use of digital workflows for personalized patient care that improves treatment outcomes, as Henry Schein continues to serve worldwide dental professionals with digital equipment and software solutions.

3Shape A/S and Align Technology, Inc. are key players in the orthodontic space with their expertise in 3D scanning technology and aligner systems like Invisalign; respectively. 3M Company and Planmeca Oy are innovative players within this market due to their restorative materials innovations as well as imaging technologies; Ivoclar Vivadent AG, Zimmer Biomet Holdings Inc, Patterson Companies Inc, Kuraray Noritake Dental Inc and Roland DG Corporation provide additional specialized areas like dental ceramics or milling technologies respectively.

Some of the prominent players in the Global Digital Dentistry Market are:

- Dentsply Sirona

- Danaher Corporation

- Carestream Health, Inc.

- Institut Straumann AG

- Henry Schein, Inc.

- KaVo Dental

- 3Shape A/S

- Align Technology, Inc.

- 3M Company

- Planmeca Oy

- Ivoclar Vivadent AG

- Zimmer Biomet Holdings, Inc.

- Patterson Companies, Inc.

- Kuraray Noritake Dental Inc.

- Roland DG Corporation

Recent developments

- 3Shape made its digital integration efforts available to lab professionals via its TRIOS 5 intraoral scanner, 3Shape Unite platform, TRIOS Share patient engagement app and studio apps in March 2023. Together these will streamline lab workflow and simplify digital integration processes.

- In 2023, 3Shape (Denmark) acquired LabStar (US) to expand and manage businesses more effectively, offering dental labs innovation, customer service excellence and numerous opportunities in digital dentistry. The acquisition has already brought numerous improvements.

- BEGO GMBH Co., KG announced in February 2022 a partnership agreement with Whip Mix so end users of Whip Mix VeriBuild and VeriEKO 3D printers could utilize Bego's VarseoSmile Crownplus and VarseoSmile Temp 3D printing materials on these 3D printers.

- Imagoworks Inc unveiled in November 2022 an AI-powered online dental CAD module known as 3Dme Crown that automatically generates crown prosthesis designs tailored specifically to each patient's oral environment. This cutting-edge tool, part of their 3Dme suite, promises an innovative user experience by customising crown designs according to individual patients' oral environments.

- DEXIS launched their Intraoral Scanner portfolio (DEXIS IS) in October 2022, featuring several intraoral solutions and digital diagnostic tools designed to cover every scanning step in dental operations.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 9.1 Bn |

| Forecast Value (2032) |

USD 24.2 Bn |

| CAGR (2023-2032) |

11.5% |

| Historical Data |

2018 – 2023 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Product(Software, Equipment), By Application(Diagnostics, Therapeutics, Other), By Specialty Areas(Orthodontics, Prosthodontics, Implantology, Other speciality areas), By End users(Dental Laboratories, Dental Hospitals and Clinics, Other) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Dentsply Sirona, Danaher Corporation, Carestream Health, Inc., Institut Straumann AG, Henry Schein, Inc., KaVo Dental, 3Shape A/S, Align Technology, Inc., 3M Company, Planmeca Oy, Ivoclar Vivadent AG, Zimmer Biomet Holdings, Inc., Patterson Companies, Inc., Kuraray Noritake Dental Inc., Roland DG Corporation |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |