Market Overview

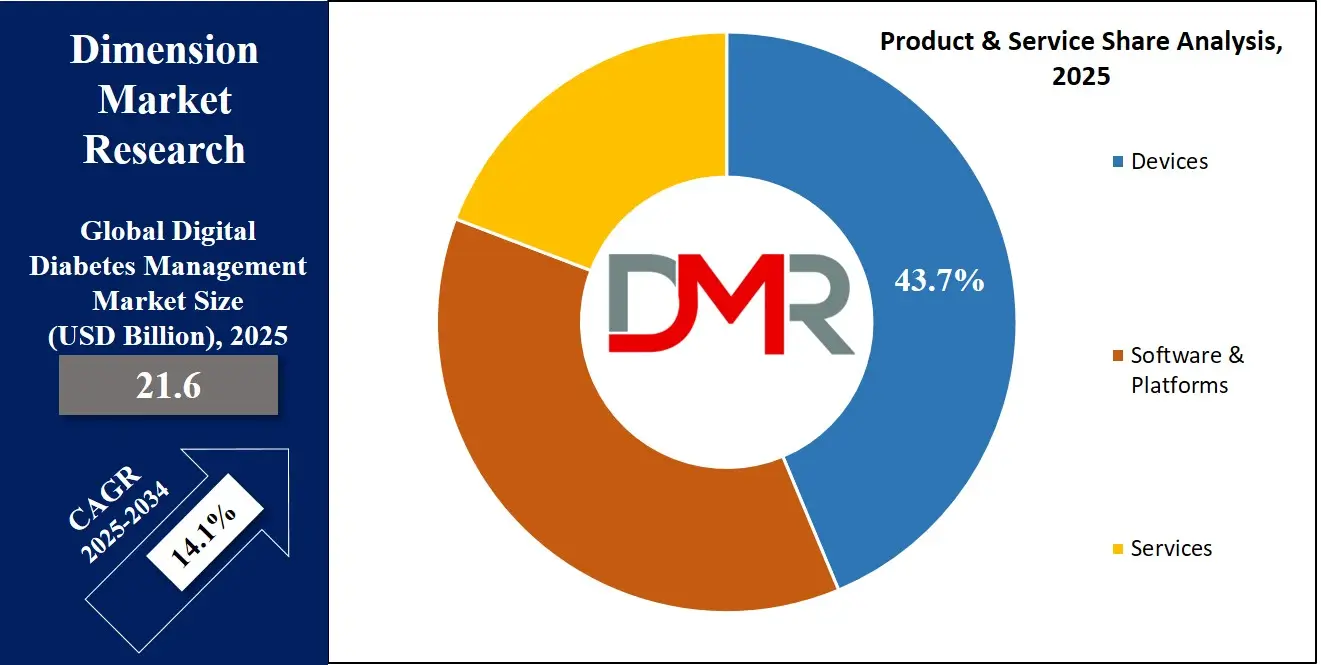

The Global Digital Diabetes Management Market is predicted to be valued at

USD 21.6 billion in 2025 and is expected to grow to

USD 71.0 billion by 2034, registering a compound annual growth rate

(CAGR) of 14.1% from 2025 to 2034.

The global digital diabetes management market is experiencing exponential expansion, driven by increasing diabetes prevalence, rising smartphone penetration rates, and advances in

digital health technologies. According to the International Diabetes Federation, over 537 million adults were living with diabetes as of 2021 with this number expected to climb further by 2030 fuelling demand for connected devices and real-time monitoring solutions; specifically continuous glucose monitoring systems and smart insulin delivery devices which offer real-time control with reduced complications, thus improving patient care outcomes while streamlining care delivery efficiencies.

One major trend shaping the market is integrating AI and

machine learning technologies into digital platforms for personalized diabetes management. Companies are creating AI-powered apps and software platforms that analyze patient data to offer tailored insights and recommendations, while cloud-based patient monitoring services have seen tremendous uptake since COVID-19 became widespread.

Emerging economies present significant market opportunities where mobile health infrastructure is growing quickly, such as those experiencing rapid elderly population increases and growing awareness around diabetes self-care solutions. Strategic collaborations between tech firms and healthcare providers are driving innovation while widening access to digital care models. However, this market faces limitations such as high device costs, limited reimbursement in some regions, concerns over data privacy, and interoperability among others.

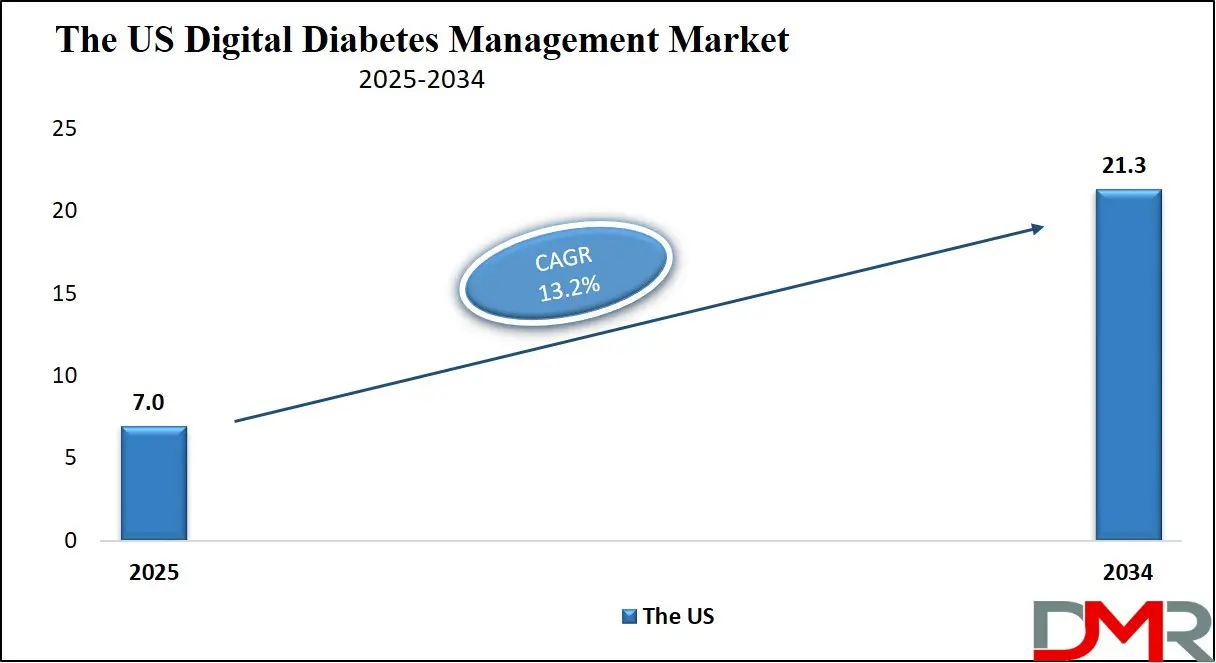

The US Digital Diabetes Management Market

The US Digital Diabetes Management Market is projected to be valued at USD 7.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.3 billion in 2034 at a CAGR of 13.2%.

The U.S. digital diabetes management market stands out as a global innovation leader due to the country's advanced healthcare infrastructure, high adoption of digital technologies, and an ever-increasing diabetic population. According to the Centers for Disease Control and Prevention (CDC), over 37 million Americans are diabetic, with millions more at risk. An aging population and increased awareness about preventive healthcare provide ample market potential that drives the market forward.

Market activity includes widespread adoption of smart glucose monitoring systems, insulin pumps and mobile health applications such as Dexcom's SmartGlyco Monitoring Solution; Insulet's Digital Blood Sugar Solution and Abbott Laboratories' FDA-approved digital solutions have seen great traction with users, wearable technology platforms allow them to track blood glucose levels more closely as alerts can be set and data shared for proactive care from wearable technology platforms and wearable platforms.

U.S. healthcare reform initiatives benefit greatly from favorable reimbursement environments and regulatory support, including Medicare's coverage for CGMs and FDA fast-track pathways for digital therapeutics, which have expedited their uptake. Furthermore, value-based care models encourage providers to implement technologies that improve outcomes while cutting costs.

Data integration and interoperability remain focus area, with initiatives designed to streamline data sharing between devices and electronic health records (EHRs). With its tech-savvy population, high smartphone penetration rate, robust research ecosystem, and robust research and development ecosystem, the U.S. market should remain at the forefront of healthcare's digital revolution by investing in personalized and predictive diabetes solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Global Digital Diabetes Management Market: Key Takeaways

- Global Market Size Insights: The Global Digital Diabetes Management Market size is estimated to have a value of USD 21.6 billion in 2025 and is expected to reach USD 71.0 billion by the end of 2034.

- The US Market Size Insights: The US Digital Diabetes Management Market is projected to be valued at USD 7.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.3 billion in 2034 at a CAGR of 13.2%.

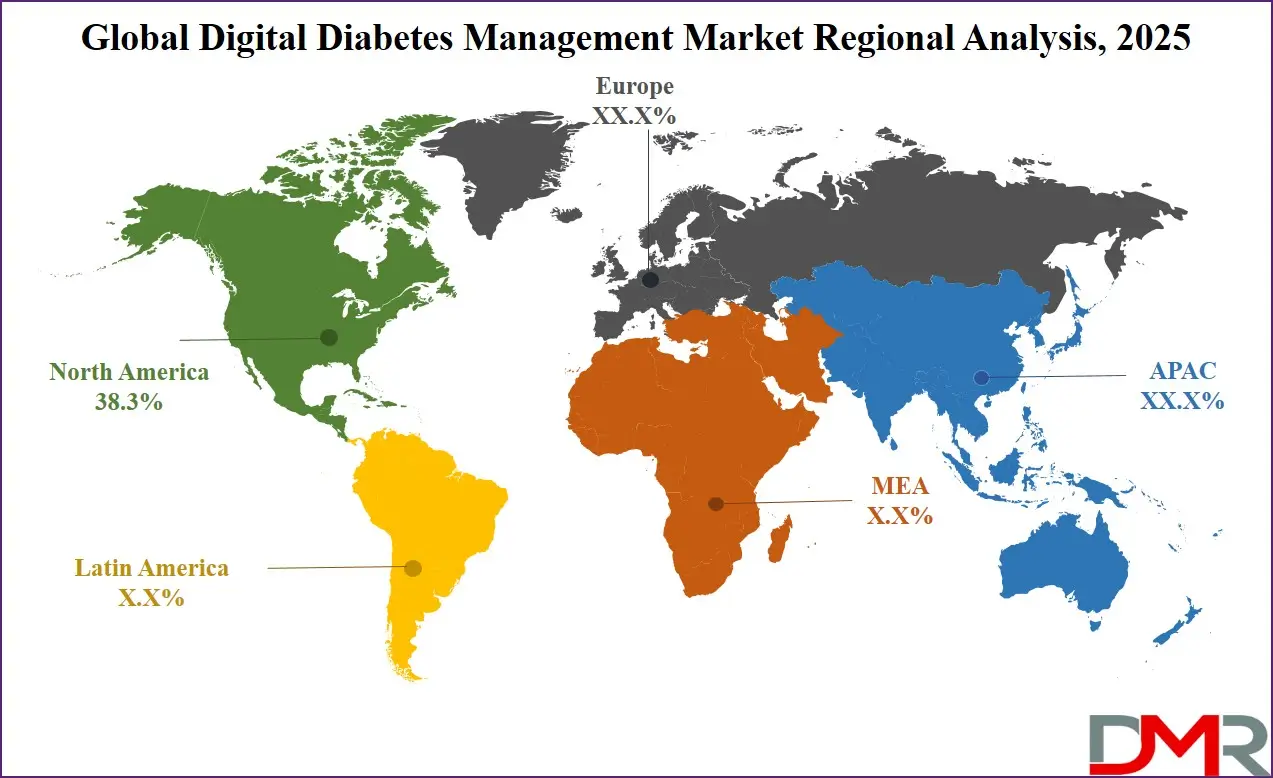

- Regional Analysis: North America is expected to have the largest market share in the Global Digital Diabetes Management Market, with a share of about 38.8% in 2025.

- Key Players Insights: Some of the major key players in the Global Digital Diabetes Management Market are Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd, Dexcom Inc., Ascensia Diabetes Care Holdings AG, Tandem Diabetes Care Inc., Insulet Corporation, B. Braun Melsungen AG, and many others.

- The Global Market Growth Rate: The market is growing at a CAGR of 14.1 percent over the forecasted period of 2025.

Global Digital Diabetes Management Market: Use Cases

- Remote Glucose Monitoring: CGM systems linked to mobile applications allow patients and caregivers to track blood glucose trends in real time, providing better glycemic control while decreasing hospital visits.

- AI-Driven Insulin Dosing: Insulin pens equipped with AI enable users to optimize insulin delivery by monitoring past glucose levels, food intake patterns, and physical activity patterns.

- Digital Coaching Programs: App-based coaching provides personalized guidance on diet, exercise, and medication adherence for patients to make better lifestyle decisions.

- Telehealth Consultations: Digital platforms facilitate virtual consultations between patients and endocrinologists, providing timely interventions while decreasing in-person appointments.

- Data-Driven Clinical Research: Aggregated anonymized patient data collected by digital platforms provides clinical trials with anonymized patient information, which enables researchers to detect treatment efficacy trends more rapidly and identify treatment efficacy trends faster.

Global Digital Diabetes Management Market: Stats & Facts

- According to the IDF Diabetes Atlas 2025, approximately 590 million adults (20–79 years) globally are living with diabetes, representing 11.1% or 1 in 9 of the adult population, with over 40% undiagnosed.

- Based on IDF projections (2025), the global diabetes burden is expected to increase by 46%, reaching 853 million people about 1 in 8 adults by 2050 due to demographic and lifestyle changes.

- As reported by the IDF Diabetes Atlas 2025, more than 90% of individuals with diabetes have type 2 diabetes, primarily driven by factors like urbanization, ageing, physical inactivity, and increasing overweight and obesity rates.

- The IDF Diabetes Atlas 2025 states that approximately 589 million adults aged 20–79 were living with diabetes worldwide in 2024, underscoring the disease’s ongoing global expansion and public health impact.

- According to the IDF Diabetes Atlas 2025, over 81% of people with diabetes reside in low- and middle-income countries, reflecting major disparities in access to prevention, early diagnosis, and sustained treatment resources.

- As per WHO data (2022), 14% of adults aged 18+ had diabetes in 2022, up from 7% in 1990, indicating a doubling in global prevalence over just three decades due to shifting health patterns.

- WHO (2022) reports that 59% of adults aged 30+ with diabetes were not taking diabetes medications in 2022, with treatment gaps most severe in low- and middle-income countries lacking robust healthcare access.

- According to WHO (2021), diabetes directly caused 1.6 million deaths, with 47% of these deaths occurring before age 70, highlighting its premature mortality burden globally, particularly in underdiagnosed and undertreated populations.

- WHO (2021) also notes that 530,000 kidney disease deaths were caused by diabetes, while elevated blood glucose contributed to approximately 11% of all cardiovascular-related deaths globally, making diabetes a leading secondary health threat.

- As per WHO’s 2021 report, while overall noncommunicable disease mortality declined by 20% from 2000 to 2019, deaths specifically attributable to diabetes have risen, countering trends in cardiovascular, cancer, and respiratory disease outcomes..

Global Digital Diabetes Management Market: Market Dynamics

Driving Factors in the Global Digital Diabetes Management Market

Increasing Global Diabetes Prevalence and Rising AwarenessThe increase in global prevalence is one of the primary drivers behind digital diabetes management solutions. As predicted by the International Diabetes Federation, according to projections by 2045 the number of people living with diabetes will have skyrocketed from 537 million today in 2021 to 783 million in 2030 due to factors including increasing life spans, lifestyle choices such as sitting for too long at work or not eating healthily enough, as well as rising obesity levels and an ageing population.

As such, healthcare systems worldwide are evolving towards preventive and home-based models of care to better handle this growing burden of diabetes. Digital tools have played an instrumental role in this transition by providing early detection, continuous monitoring, and real-time management capabilities for diabetic patients. Awareness campaigns by governments and non-profits, such as World Diabetes Day, highlight the significance of self-management and regular monitoring of blood sugar.

Such campaigns are supported by social media and online education tools that increase public understanding about digital solutions, their outcomes, and how they improve them. With increasing acceptance for these digital interventions from both healthcare professionals and patients alike, digital interventions are increasing market growth significantly.

Expansion of Reimbursement Policies and Regulatory Approvals

The other key growth factor is the increase in supportive reimbursement policies and regulatory backing for digital diabetic management solutions. Several nations, particularly in Europe and North America, are adding CGMs, diabetes management apps, and insulin pumps to the coverage of their insurance schemes. For example, Medicare in the United States now covers CGM devices for its eligible members, thus enhancing access among seniors.

Furthermore, the U.S. FDA has established expedited review channels for digital therapeutics and mobile health applications, facilitating quicker market access for innovations. Likewise, the European Union's MDR promotes the safe application of digital technologies while harmonizing approvals among member states. Such enabling frameworks are lowering costs for patients and motivating providers to embrace digital tools. They also create confidence in consumers about the safety and effectiveness of authorized products. As more governments see the economic and clinical value of digital diabetes management, reimbursement environments change to favor its continued growth.

Restraints in the Global Digital Diabetes Management Market

High Cost of Advanced Digital Devices and Limited Access in Low-Income Regions

Analysis has shown that these devices are very expensive to acquire, including continuous glucose monitors (CGMs), intelligent insulin pumps, and combined mobile platforms. These devices are expensive to obtain, including continuous glucose monitors (CGMs), intelligent insulin pumps, and combined mobile platforms. These devices frequently necessitate not just the initial investment but also recurring expenses for sensors, batteries, and app subscriptions, which could be financially unsustainable to patients who have low incomes or no insurance coverage.

Public health systems in most low- and middle-income countries (LMICs) cannot subsidize such technologies, and reimbursement programs are limited or nonexistent. Also, limited awareness, digital competency, and infrastructure, notably stable internet connectivity, hamper adoption. Even among developed economies, within rural, older, or socioeconomically disadvantaged groups, some differences can make it difficult to access or utilize such devices. This digital divide widens health inequities and restricts the possible digital contributions in areas where they are needed most, holding back overall market penetration.

Data Privacy Concerns and Interoperability Issues

The increased focus on data-enabled solutions in managing digital diabetes has created strong worries regarding data interoperability, privacy, and security. Health devices and platforms access sensitive health data, such as glucose readings, medication plans, diet journals, and physical activity routines. If this information were to be violated or used unjustly, very serious consequences ensue, from loss of patient trust to a lawsuit. Regulatory systems like GDPR in Europe and HIPAA in the United States require rigorous compliance, yet most new digital solutions are placed in regulatory limbo or lack strong encryption methodologies.

In addition, interoperability problems between devices, applications, and electronic health records (EHRs) make care coordination difficult. Vendors employ proprietary data formats and connectivity standards that do not facilitate easy information exchange between platforms. This fragmentation forces healthcare providers to rely on fragmentary or disconnected data, which affects clinical decision-making. Until there are uniform standards and robust data governance, these issues will continue to constrain adoption and investor confidence.

Opportunities in the Global Digital Diabetes Management Market

Expansion into Emerging Markets with Untapped Potential

Growing markets in Asia-Pacific, Latin America, and the Middle East provide a large growth opportunity for digital diabetes management providers. These regions are witnessing a steep rise in diabetes prevalence due to urbanization, lifestyle changes, and genetic predispositions. However, access to quality diabetes care remains limited, particularly in rural and low-income populations. The increasing penetration of smartphones and mobile internet, even in remote areas, creates a viable channel for delivering digital health solutions. Local governments are investing in telehealth infrastructure and public-private partnerships to address chronic disease management gaps.

These markets can be tapped by companies through the provision of low-cost, scalable digital solutions that fit the linguistic, cultural, and economic environments of these markets. For instance, app-based blood glucose monitoring software with local language support or offline capabilities can enhance usage. Entry into these markets not only responds to a key healthcare need but also sets companies up for sustained revenue growth in the face of slowing demand in mature markets.

Rising Demand for Personalized and Preventive Healthcare Models

The move towards preventive rather than reactive healthcare is driving intense demand for individualized diabetes management solutions. Consumers are increasingly looking for products that provide real-time feedback, behavior monitoring, and personalized recommendations based on individual biometrics and lifestyle patterns. This phenomenon is especially common among younger patients and technology-conscious patients who believe in autonomy and data-driven health.

Digital platforms that collate data from wearable devices, food diary logs, activity logs, and insulin use can produce rich patient profiles. These can then be utilized to provide ultra-personalized interventions and alerts, enabling behavioral modification and continuous engagement. In addition, employers and insurers are starting to provide digital diabetes prevention programs as part of well-being packages to minimize long-term healthcare expenses. As this ecosystem expands, collaborations between technology companies, insurers, and healthcare providers are opening up new revenue streams and service models. Those companies that innovate on personalization and preventive care will be well-placed to take advantage of this changing demand.

Trends in the Global Digital Diabetes Management Market

Integration of AI and Predictive Analytics in Diabetes ManagementA leading trend in the global digital diabetes management market is the use of

artificial intelligence (AI) and predictive analytics in diabetes care platforms. Such technologies are revolutionizing traditional care patterns by facilitating immediate interpretation of the data obtained through continuous glucose monitoring (CGMs), insulin pumps, and phone apps. By using predictive formulas, hypo- and hyperglycemic incidents can now be predicted hours beforehand, enabling treatment by patients or healthcare professionals preemptively. Trends in blood sugar, exercise, food intake, and insulin injection are analyzed and interpreted by AI-based platforms providing adaptive and adaptive suggestions.

This promotes more stringent glycemic control and greater patient engagement. Furthermore, AI facilitates remote monitoring of patients and notifies doctors to intervene when abnormalities occur. As Glooko, IBM Watson, and DreaMed develop these technologies further, AI is fast becoming the cornerstone of smart diabetes care. These intelligent systems not only facilitate individual self-management but also offer clinicians population-level insights, enhancing disease surveillance and outcomes at a larger level.

Rising Adoption of Mobile Health (mHealth) and Cloud-Based Platforms

The widespread use of smartphones and connectivity through the internet has resulted in extensive use of mobile health (mHealth) apps and cloud platforms in digital diabetes care. The applications make the users in charge of glucose tracking, recording meals, measuring activity, and contacting healthcare providers anywhere. Cloud-based solutions allow effortless syncing of data across different devices such as CGMs, smart insulin pens, and fitness trackers, so that data is stored securely and accessed remotely by patients and physicians alike.

This real-time, networked system minimizes care fragmentation and allows for a more integrated view of the patient's health. Major players are making investments in intuitive, easy-to-use interfaces to drive adoption rates, particularly among older adults and low-digital-literacy individuals. In addition, cloud platforms enable interoperability with electronic health records (EHRs), helping to support enhanced clinical decision-making and enable collaborative care. This mHealth revolution is transforming diabetes care from reactive to proactive, enhancing adherence and outcomes while lowering healthcare expenditures.

Global Digital Diabetes Management Market: Research Scope and Analysis

By Product & Service Analysis

Devices are projected to be the leaders in the global digital diabetes management market because of their pivotal role in real-time tracking, accurate management, and self-management of diabetic patients. These are Continuous Glucose Monitors (CGMs), smart insulin pumps, smart insulin pens, and blood glucose meters, all of which are the pillars of contemporary diabetes care. With the increasing need for more stringent glycemic control and prompt intervention in hypo- or hyperglycemic events, devices provide unparalleled functionality and timeliness in the management of diabetes. The real-time information collected by these devices allows both patients and clinicians to make informed choices about diet, exercise, and medication dosage.

The rise of smart and interconnected devices has further added to this dominance. Wireless connectivity through Bluetooth or Wi-Fi is now a standard feature in most digital devices, allowing them to easily integrate with smartphones and cloud platforms and enable remote monitoring and information exchange. Dexcom, Abbott, and Medtronic are among the firms that have introduced highly accurate, easy-to-use devices that not only enhance patient compliance but also minimize the risk of long-term complications.

In addition, regulatory clearances and supportive reimbursement policies in developed markets are also boosting access to premium devices. The increasing popularity of patient-centric models of care also highlights devices as critical instruments to empower patients to self-manage their condition. As technology continues to advance, devices are outstripping software-only or service-based offerings when it comes to usability, scalability, and direct health impact, thus cementing their top position in the digital diabetes management ecosystem.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Patient Type Analysis

Type 2 diabetes is projected to prevail in the global digital diabetes management market mainly based on its dominance globally. The International Diabetes Federation (IDF) explains that more than 90% of all diabetes cases diagnosed are Type 2, impacting over 460 million individuals globally. Such broad prevalence equates to a greater addressable market for digital solutions against Type 2 diabetes management.

In contrast to Type 1 diabetes, which usually needs insulin therapy from the beginning, Type 2 diabetes is treated with a wider range of interventions such as lifestyle changes, oral drugs, and, in certain instances, insulin therapy. This variety of treatment options renders digital solutions, especially mobile health apps, glucose meters, and diet-tracking software, extremely pertinent for Type 2 patients. Digital platforms provide overall support for dietary management, physical activity tracking, medication taking, and behavioral guidance, all of which are necessary for Type 2 management.

Furthermore, the progressive nature of Type 2 diabetes often requires continuous tracking and refinement of care approaches. This makes an ongoing demand for digital platforms that can facilitate early detection, disease progression tracking, and facilitate on-time therapeutic interventions. The world's aging population and lifestyle risk factors, like a sedentary lifestyle and obesity, are also contributing to increasing cases of Type 2 diabetes. Therefore, physicians and tech companies are going more and more towards this segment with their solutions and outreach programs. With its sheer size and diversity of management requirements, Type 2 diabetes remains the biggest growth driver in the digital management of diabetes.

By Device Type Analysis

Portable devices are anticipated to hold the highest share in the global digital diabetes management market because they are affordable, portable, and accessible to the masses. The portable devices, encompassing the traditional blood glucose monitors, portable continuous glucose monitors, and mobile-detectable diagnostic devices, comprise the frontline digital monitoring for diabetics all over the world. Their straightforward interface, small size, and simplicity of use make them particularly suitable for self-monitoring in clinical and non-clinical environments, especially among newly diagnosed patients or those with Type 2 diabetes not requiring complex insulin therapy.

When compared to wearable technology like CGMs or insulin patches, handheld devices are much cheaper, making them more popular in both emerging and developed economies. They are capable of providing real-time blood glucose levels with little in the way of infrastructure and become the sole option in areas with scarce healthcare resources. Some of the latest handheld devices come with Bluetooth connectivity, making it possible for patients to upload data to mobile apps and cloud-based platforms for improved tracking and reporting.

In addition, handheld devices are widely prescribed by medical practitioners because of their established accuracy and ease of use. The companies have also kept refining these devices by adding faster reading times, smaller sample sizes, and memory capabilities for storing previous results. This renders them accessible to everyone, including the elderly. With escalating global prevalence of diabetes and rising demand for self-monitoring, handheld supremacy is further enhanced by the capacity of these devices to deliver efficient, intuitive, and affordable monitoring, filling the gap between traditional testing and sophisticated digital environments.

By End User Analysis

Hospitals are poised to control the global digital diabetes management market by end user because of their extensive setup, enhanced diagnostic capabilities, and availability of a wide range of digital diabetes devices. Since they are the first point of contact for both diagnosis and chronic care management, hospitals leverage a vast range of integrated devices like CGMs, smart insulin pumps, and cloud-based monitoring systems to deliver personalized treatment plans. By integrating patient information from various sources like laboratory tests, wearable technology, and mobile applications, they can deliver a complete picture of diabetes care.

Furthermore, hospitals also enjoy institutional collaborations with device companies and

digital health platforms that enable the early adoption of advanced technologies. They tend to be the first to adopt government-backed programs and reimbursement schemes that encourage the utilization of digital health solutions. Inpatient facilities often need intensified glucose monitoring, particularly for patients who are to undergo surgery or have diabetes complications, thus increasing device usage in hospitals.

Furthermore, hospitals are also centers for specialist care, such as endocrinology and diabetes clinics, making them essential for advanced therapy modifications, ongoing monitoring, and patient education. The centralized aspect of hospital care, combined with experienced staff and access to integrated data platforms, guarantees their continued preeminence as central stakeholders in digital diabetes management delivery.

The Global Digital Diabetes Management Market Report is segmented on the basis of the following

By Product & Service

- Devices

- Smart Glucose Meters

- Continuous Glucose Monitoring (CGM) Systems

- Smart Insulin Pens

- Smart Insulin Pumps / Closed-Loop Pumps & Smart Insulin Patches

- Smart Blood Glucose Meters

- Smart CGM Devices

- Software & Platforms

- Diabetes & Blood Glucose Tracking Apps

- Obesity & Diet Management Apps

- Digital Diabetes Management Apps

- Weight & Diet Management Apps

- Cloud-Based Data Platforms & AI Analytics

- Data Management Software & Platforms

- Services

- Patient Support Services

- Remote Diabetes Management Services

- Subscription-based Data Monitoring Services

By Device Type

- Handheld Devices

- Wearable Devices

By Patient Type

- Type 1 Diabetes

- Type 2 Diabetes

By End User

- Hospitals

- Home Settings / Self-Home Healthcare

- Diabetes Specialty Clinics

- Academic & Research Institutes

- Diagnostic Centers & Clinics

Global Digital Diabetes Management Market: Regional Analysis

Region with the Highest Market Share in the Global Digital Diabetes Management Market

North America is anticipated to dominate this market as it holds 38.3% of the total revenue by the end of 2025. North America leads the Global Digital Diabetes Management Market based on its superior healthcare infrastructure, early technology adoption in medicine, and high prevalence of diabetes. The U.S. alone boasts one of the world's highest rates of diabetes, with more than 37 million diagnosed cases, fueling persistent demand for digital solutions. Government efforts such as the FDA's Digital Health Innovation Action Plan and supportive reimbursement schemes have motivated the adoption of continuous glucose monitors (CGMs), smart insulin pens, and connected mobile apps into standard care.

Top regional incumbents like Dexcom, Medtronic, and Abbott Laboratories have launched innovative technologies, providing sustained innovation and availability. Also, high smartphone and internet penetration enable large-scale usage of mobile healthcare apps, remote patient monitoring, and AI-based insights for managing diabetes. Also increasing is collaboration between healthcare providers and digital healthcare startups that enable enhanced chronic disease management through data-driven treatment strategies.

The presence of an insurance environment as well as lenient regulation strengthens North America's dominance within the market as patients and providers receive a powerful convergence of ease of use, clinical precision, as well as capability for real-time intervention.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR in the Digital Diabetes Management Market

Asia-Pacific is expected to grow at the highest CAGR in the Global Digital Diabetes Management Market because of a rapidly increasing diabetic population, enhancing middle-class healthcare awareness, and escalating use of mobile and wearable technologies. India and China are seeing critical growth in the incidence of diabetes because of urbanization, changes in lifestyle, and dietary patterns. This growing patient pool offers tremendous opportunities for scalable digital health solutions.

The expansion of mobile phones and online connectivity in the emerging markets has driven the evolution of mobile healthcare applications and telemedicine platforms specially designed for managing diabetes. Furthermore, regional governments are investing in digital health infrastructure as part of national healthcare schemes and public-private partnerships. Domestic tech startups are also beginning to unveil low-cost AI-based diabetes care solutions appropriate for regional issues, such as limited endocrinologist availability and specialist medical care. As awareness and affordability increase, and as more international companies launch in these regions with a localized approach, Asia-Pacific is set for exponential growth of digital diabetes usage, driving the growth of this region.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Diabetes Management Market: Competitive Landscape

The Global Digital Diabetes Management Market is highly competitive and features a mix of established medical device manufacturers, pharmaceutical giants, and emerging digital health startups. Leading players such as Abbott Laboratories, Medtronic plc, Dexcom, Inc., and F. Hoffmann-La Roche Ltd dominate the device segment through innovations in continuous glucose monitoring systems, smart insulin pumps, and mobile-integrated monitoring solutions. These companies invest heavily in R&D and regularly launch technologically advanced, user-centric products to maintain market leadership.

Pharmaceutical firms like Novo Nordisk, Eli Lilly, and Sanofi S.A. are expanding into digital health through partnerships with tech firms to develop connected insulin delivery systems and companion apps. Digital health platforms such as Glooko, Inc., DarioHealth Corp., and One Drop offer integrated software solutions for personalized diabetes management, leveraging AI, cloud data analytics, and real-time feedback.

The market is also seeing increased merger and acquisition activity aimed at creating comprehensive digital ecosystems. For instance, device makers are acquiring software platforms to offer all-in-one diabetes solutions. Competitive differentiation increasingly depends on usability, interoperability with electronic health records, data accuracy, and remote monitoring capabilities. As the market matures, companies focusing on ecosystem integration and patient-centric innovation are expected to gain a strategic advantage.

Some of the prominent players in the Global Digital Diabetes Management Market are:

- Abbott Laboratories

- Medtronic plc

- F. Hoffmann-La Roche Ltd

- Dexcom, Inc.

- Ascensia Diabetes Care Holdings AG

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- B. Braun Melsungen AG

- Eli Lilly and Company

- Novo Nordisk A/S

- Sanofi S.A.

- Ypsomed Holding AG

- Glooko, Inc.

- DarioHealth Corp.

- Agamatrix, Inc

- LifeScan, Inc.

- Senseonics Holdings, Inc.

- One Drop (Informed Data Systems Inc.)

- Becton, Dickinson and Company (BD)

- GlucoMe (now part of Rimidi)

- Other Key Players

Recent Developments in the Global Digital Diabetes Management Market

- March 2025: Medtronic plc announced a strategic partnership with Teladoc Health to integrate its Guardian™ 4 CGM system with Teladoc’s digital platform, enabling real-time remote monitoring and AI-enhanced virtual diabetes coaching. The collaboration aims to expand Medtronic’s digital footprint in chronic disease management by leveraging behavioral analytics and telehealth delivery models.

- February 2025: Dexcom, Inc. unveiled the Dexcom G8 prototype at the Advanced Technologies & Treatments for Diabetes (ATTD) Conference 2025 in Paris. The next-gen CGM incorporates predictive analytics and seamless smartphone integration, offering a 20% smaller sensor size and enhanced cloud-based data sharing capabilities for clinicians and caregivers.

- January 2025: Sanofi S.A. completed the acquisition of Happify Health’s digital therapeutics division, strengthening its presence in digital diabetes behavior management. The acquisition enhances Sanofi’s AI-enabled platform for Type 2 diabetes patients, offering mental health and lifestyle modification support alongside pharmacological treatments.

- December 2024: Insulet Corporation announced a USD100 million R&D investment to develop Omnipod® Horizon 2.0, the next generation of its automated insulin delivery system. The investment will focus on machine learning capabilities for adaptive insulin dosing and integration with third-party fitness trackers.

- November 2024: At the MEDICA Trade Fair 2024 in Düsseldorf, Roche Diabetes Care showcased its updated mySugr app with voice-command capabilities and advanced analytics for insulin dosage prediction. The launch emphasized interoperability with EHRs and CGMs for personalized glycemic control.

- October 2024: Eli Lilly and Company entered a digital health alliance with Ypsomed Holding AG to co-develop a connected insulin pen platform targeting global Type 2 diabetes markets. The device will offer Bluetooth-enabled dosing logs and integrate with diabetes management apps and cloud-based dashboards for physicians.

- September 2024: Glooko, Inc. raised USD60 million in a Series D funding round led by Novo Holdings. The investment will expand its predictive data analytics platform and AI-powered personalized care engine across the U.S., Europe, and emerging Asian markets.

- August 2024: One Drop (Informed Data Systems Inc.) announced a collaboration with Apple HealthKit, enabling real-time syncing of glucose, activity, and nutrition data for holistic diabetes management via iPhones and Apple Watches. The partnership aims to enhance engagement among tech-savvy Type 2 diabetes users.

- July 2024: Ascensia Diabetes Care partnered with BioIntelliSense to pilot a biosensor-integrated version of the Contour® Diabetes app, enabling multi-parameter tracking including glucose, respiratory rate, and heart rate. The pilot targets elderly and comorbid diabetic populations in long-term care settings.

- June 2024: Tandem Diabetes Care completed its acquisition of Sugarmate, a leading diabetes data visualization startup. The acquisition strengthens Tandem’s app ecosystem and supports real-time data synchronization with insulin pump therapy platforms.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 21.6 Bn |

| Forecast Value (2034) |

USD 71.0 Bn |

| CAGR (2025–2034) |

14.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 7.0 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Product & Service (Devices, Software & Platforms, Services), By Device Type (Handheld Devices, Wearable Devices), By Patient Type (Type 1 Diabetes, Type 2 Diabetes), By End User (Hospitals, Home Settings/Self-Home Healthcare, Diabetes Specialty Clinics, Academic & Research Institutes, Diagnostic Centers & Clinics). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd, Dexcom Inc., Ascensia Diabetes Care Holdings AG, Tandem Diabetes Care Inc., Insulet Corporation, B. Braun Melsungen AG, Eli Lilly and Company, Novo Nordisk A/S, Sanofi S.A., Ypsomed Holding AG, Glooko Inc., DarioHealth Corp., Agamatrix Inc., LifeScan Inc., Senseonics Holdings Inc., One Drop (Informed Data Systems Inc.), Becton, Dickinson and Company (BD), and GlucoMe (now part of Rimidi), and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the Global Digital Diabetes Management Market?

▾ The Global Digital Diabetes Management Market size is estimated to have a value of USD 21.6 billion in 2025 and is expected to reach USD 71.0 billion by the end of 2034.

What is the size of the US Digital Diabetes Management Market?

▾ The US Digital Diabetes Management Market is projected to be valued at USD 7.0 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 21.3 billion in 2034 at a CAGR of 13.2%.

Which region accounted for the largest Global Digital Diabetes Management Market?

▾ North America is expected to have the largest market share in the Global Digital Diabetes Management Market, with a share of about 38.8% in 2025.

Who are the key players in the Global Digital Diabetes Management Market?

▾ Some of the major key players in the Global Digital Diabetes Management Market are Abbott Laboratories, Medtronic plc, F. Hoffmann-La Roche Ltd, Dexcom Inc., Ascensia Diabetes Care Holdings AG, Tandem Diabetes Care Inc., Insulet Corporation, B. Braun Melsungen AG, and many others.

What is the growth rate in the Global Digital Diabetes Management Market in 2025?

▾ The market is growing at a CAGR of 14.1 percent over the forecasted period of 2025.