Market Overview

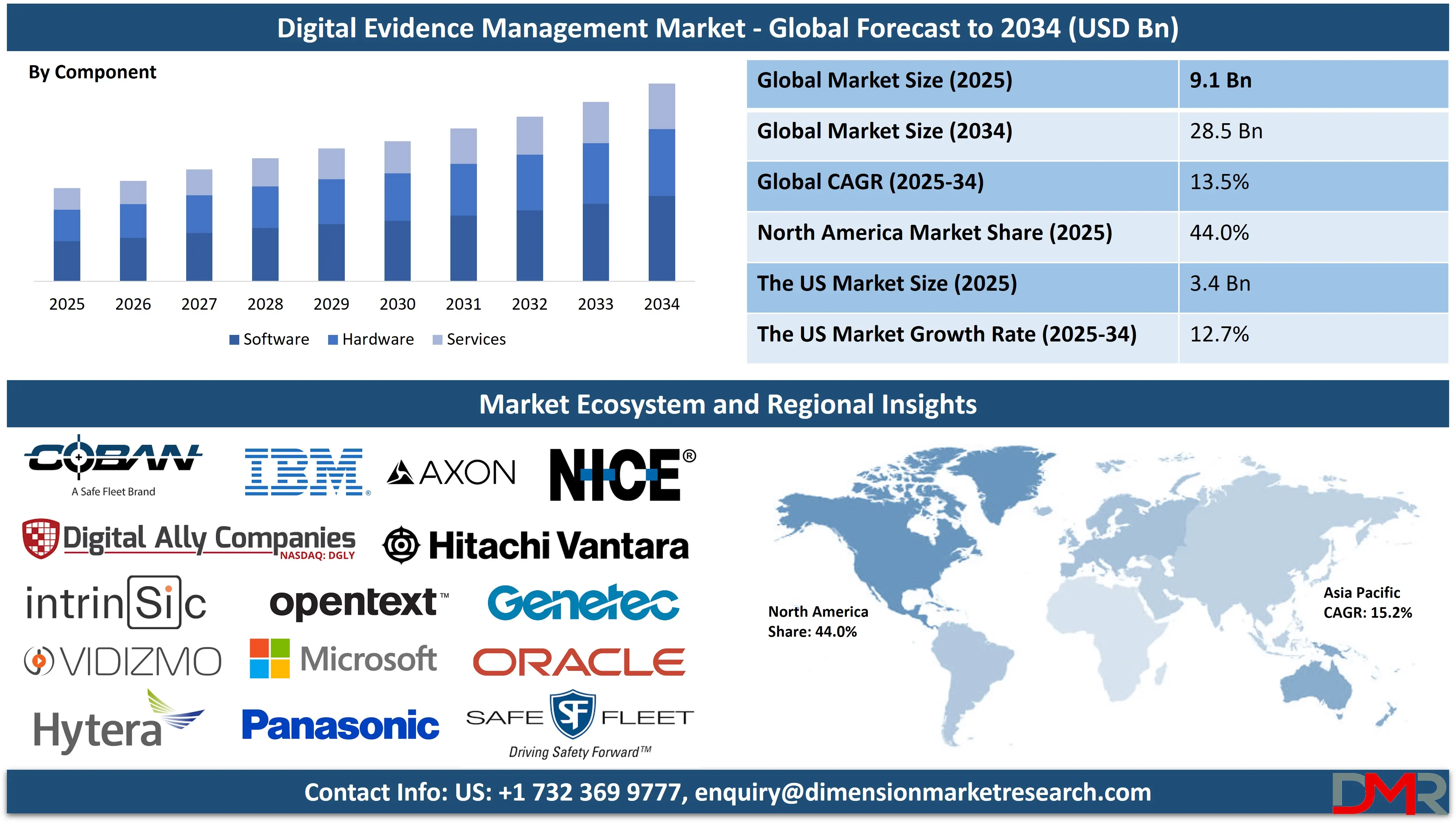

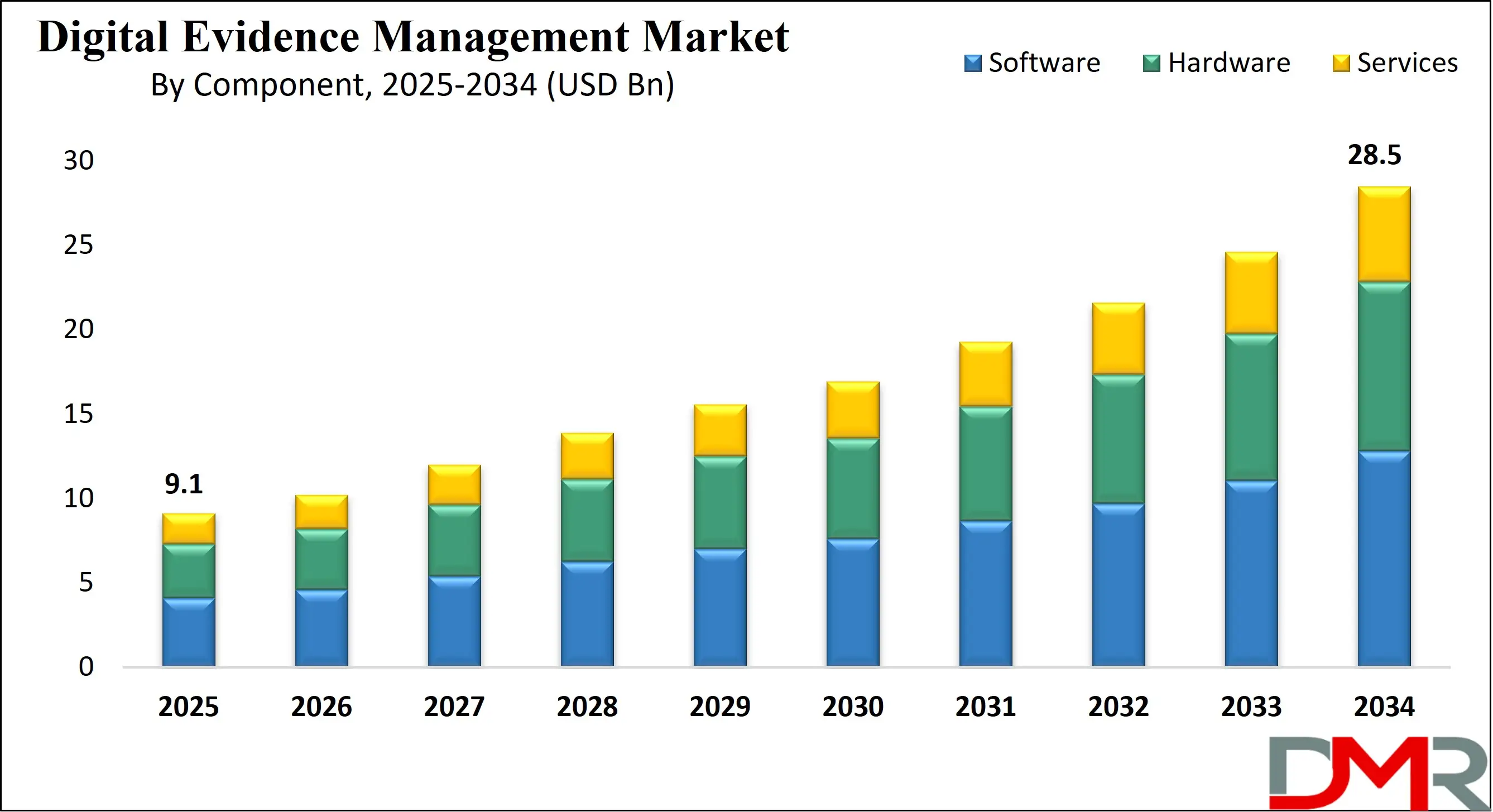

The Global Digital Evidence Management Market is projected to attain a value of USD 9.1 billion in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 13.5% through 2034, ultimately reaching USD 28.5 billion. This accelerated growth is fueled by the increasing demand for advanced digital investigation platforms, secure evidence storage systems, and tamper-proof documentation tools among law enforcement agencies, legal institutions, and public safety organizations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The global digital evidence management market is witnessing a major shift as public safety agencies, police departments, and judicial systems transition from manual processes to intelligent, digital-first evidence ecosystems. This shift is largely driven by the proliferation of digital devices involved in crimes, the widespread deployment of body-worn cameras, and the rising need for platforms that support secure, centralized storage of diverse digital assets such as video footage, images, audio recordings, text files, and biometric inputs. As digital investigations expand in volume and complexity, organizations are embracing evidence lifecycle solutions that provide real-time access, forensic-grade integrity, metadata indexing, and compliance with audit trails.

Advanced technologies like artificial intelligence and machine learning are playing a transformative role in digital evidence workflows by enabling auto-tagging, facial detection, voice recognition, and intelligent search within massive video datasets. In parallel, blockchain-based solutions are increasingly used to establish an immutable, transparent chain of custody, minimizing the risk of tampering and ensuring courtroom admissibility. Cloud-native digital vaults are also gaining traction, offering elastic scalability, multi-agency access, and seamless integration with case management tools and digital forensics software.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Despite its upward trajectory, the market faces hurdles including stringent data protection laws, interoperability issues among legacy systems, and the rising threat of cyberattacks targeting sensitive law enforcement data. Additionally, legal inconsistencies in evidence admissibility across jurisdictions present a challenge for international collaboration. Still, the evolution toward integrated digital evidence environments, coupled with smart automation and secure sharing protocols, positions this market at the forefront of digital justice transformation.

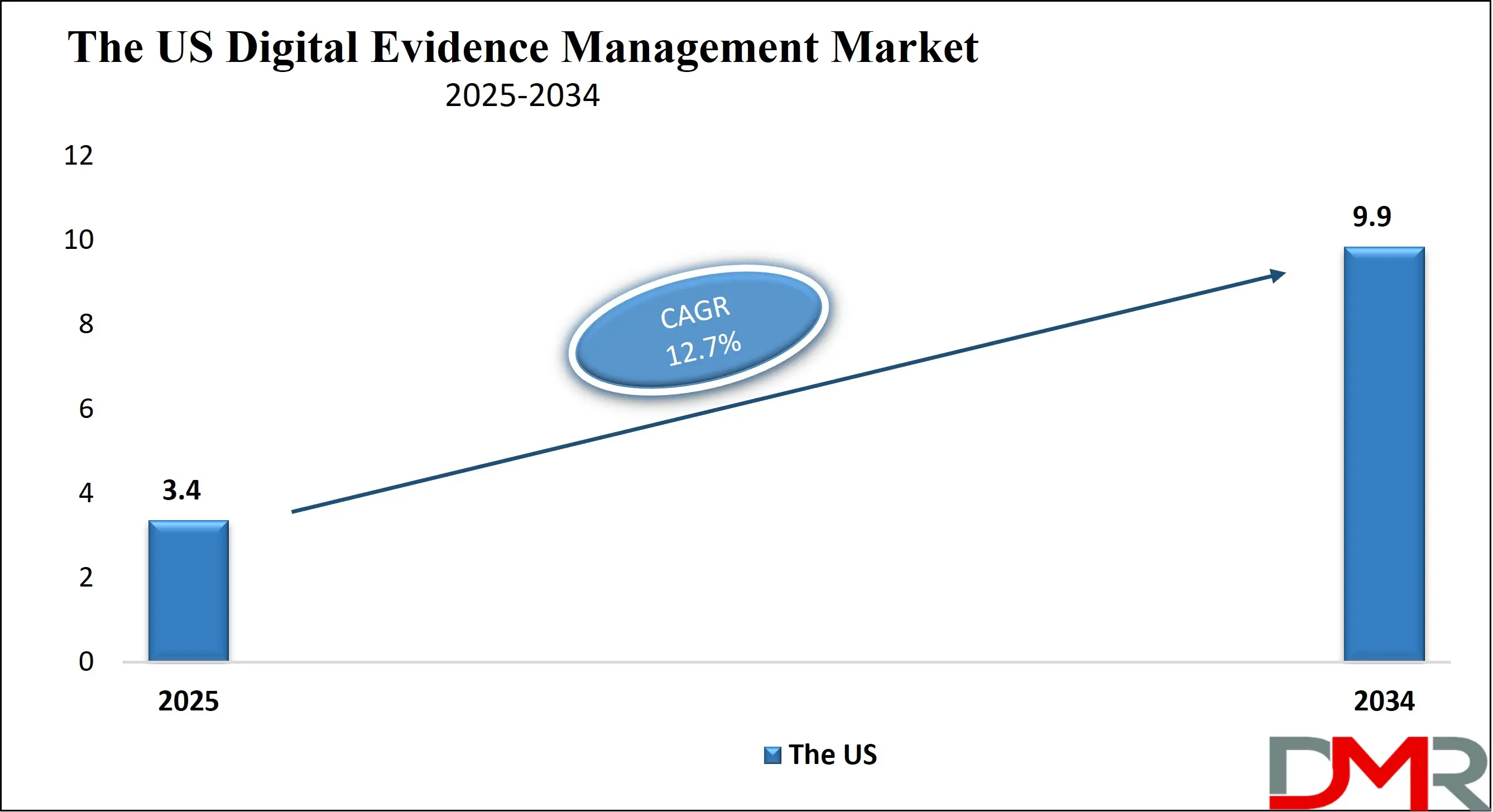

The US Digital Evidence Management Market

The US Digital Evidence Management Market is projected to reach USD 3.4 billion in 2025 at a compound annual growth rate of 12.7% over its forecast period.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. digital evidence management market is reinforced by an expansive law enforcement network, widespread adoption of surveillance technologies, and proactive federal initiatives in evidence modernization. According to the U.S. Bureau of Justice Statistics, over 18,000 law enforcement agencies operate in the country, many of which are increasingly dependent on body-worn cameras and digital case management systems. The FBI’s Digital Evidence Policy and the Department of Justice’s emphasis on electronic discovery and e-litigation frameworks signal a major institutional shift toward digital-first evidence practices.

The demographic and operational scale of the U.S. plays a pivotal role in shaping demand. With a population exceeding 330 million and urban police departments servicing dense, high-crime areas, the need for robust digital infrastructure to store and review vast volumes of video, audio, and image evidence is intensifying. Moreover, state and municipal governments are aligning with national guidance, such as the National Institute of Standards and Technology (NIST) digital evidence protocols, to ensure chain-of-custody compliance.

A unique U.S. advantage lies in its public safety grants system, such as the Edward Byrne Memorial Justice Assistance Grant Program, which funds technological upgrades, including digital evidence platforms. Additionally, the increasing collaboration between law enforcement and tech vendors fosters scalable innovation, particularly in AI-based evidence redaction and real-time access to surveillance footage. The market also benefits from the country’s legal standardization of digital evidence under the Federal Rules of Evidence, streamlining admissibility criteria and supporting broader digital transformation across federal and state agencies.

The Europe Digital Evidence Management Market

The Europe Digital Evidence Management Market is estimated to be valued at USD 1.3 billion in 2025 and is further anticipated to reach USD 4.0 billion by 2034 at a CAGR of 13.0%.

The European digital evidence management market is characterized by a growing need for interoperability across borders, data protection compliance under the General Data Protection Regulation (GDPR), and increasing adoption of digital policing strategies. According to Europol and the European Commission’s internal security publications, over 60% of criminal investigations today involve digital evidence, prompting strong demand for secure evidence lifecycle management solutions. Agencies are aligning with European Cybercrime Centre (EC3) guidelines for digital forensic integrity and evidence-sharing across jurisdictions.

Europe’s demographic structure, with highly urbanized countries like Germany, France, and the UK, drives the need for large-scale surveillance video management and cloud-based evidence repositories. Judicial bodies across the EU are adopting digital court frameworks, incorporating e-filing, video testimony, and digitized case records to accelerate trial processes. A core advantage in Europe is its supranational collaboration through the Schengen Information System (SIS), which supports cross-border intelligence and evidence tracking among EU law enforcement bodies.

Despite opportunities, challenges include stringent privacy laws, fragmented national legal frameworks, and high compliance burdens, especially in countries with decentralized policing systems. However, these hurdles are gradually being addressed through EU-led harmonization initiatives and funding programs like the Internal Security Fund (ISF), which promotes technology modernization in member states.

The integration of AI in digital forensics and blockchain in evidence chain management is gaining ground in cities implementing smart policing. Digital transformation across Europe’s justice systems is fostering a market shift from manual archives to integrated platforms supporting evidence analytics, legal workflow automation, and secure, collaborative investigations.

The Japan Digital Evidence Management Market

The Japan Digital Evidence Management Market is projected to be valued at USD 546.0 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 1,410.0 million in 2034 at a CAGR of 11.0%.

Japan’s digital evidence management market is advancing steadily, supported by a highly digitized infrastructure, robust legal frameworks, and increased focus on cybercrime prevention. According to Japan’s National Police Agency (NPA), cybercrime cases have exceeded 12,000 annually in recent years, with a growing percentage involving social media, video surveillance, and digital document evidence. This surge has catalyzed the need for centralized evidence storage and analytical tools to manage growing data volumes from body-worn cameras, in-vehicle systems, and forensic imaging.

Japan’s demographic advantage lies in its urban density and surveillance coverage. Cities like Tokyo and Osaka employ thousands of high-definition cameras, generating terabytes of visual data daily. The Ministry of Justice (MOJ) and courts are gradually integrating digital transformation strategies, enabling prosecutors and legal staff to access secured evidence platforms and AI-enhanced review tools. Additionally, Japan’s Criminal Procedure Code was revised to include provisions for digital case materials, paving the way for digitized evidence workflows.

However, traditional systems and legacy protocols still dominate in some prefectures, leading to challenges in scalability and system integration. Concerns around data breaches, rigid chain-of-custody requirements, and conservative legal interpretations of admissibility limit rapid innovation.

Nonetheless, the Japanese government’s push for digital transformation in governance and policing under the "Digital Agency" initiative is expected to elevate investments in secure, cloud-based evidence platforms. Police modernization programs, cyber forensics development, and inter-agency collaborations are helping transition Japan’s public safety and justice sectors toward efficient, evidence-driven, digital-first ecosystems.

Global Digital Evidence Management Market: Key Takeaways

- Global Market Size Insights: The Global Digital Evidence Management Market size is estimated to have a value of USD 9.1 billion in 2025 and is expected to reach USD 28.5 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Digital Evidence Management Market is projected to be valued at USD 3.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.9 billion in 2034 at a CAGR of 12.7%.

- Regional Insights: North America is expected to have the largest market share in the Global Digital Evidence Management Market with a share of about 44.0% in 2025.

- Key Players Insights: Some of the major key players in the Global Digital Evidence Management Market are Motorola Solutions, Axon, NICE Ltd., Panasonic, IBM, Oracle, Microsoft, Genetec, Hitachi Vantara, and many others.

Global Digital Evidence Management Market: Use Cases

- Police Body Camera Footage Review: Police departments use evidence management platforms to automatically upload and tag video footage from body-worn cameras, enabling secure review, redaction, and integration into ongoing investigations while ensuring chain-of-custody tracking.

- Digital Forensics in Cybercrime Investigations: Digital forensic experts utilize DEM systems to collect and analyze seized devices and online activity data, helping trace cybercriminals across email, social media, and digital footprint evidence.

- Courtroom Digital Evidence Presentation: Judicial bodies employ digital platforms to present securely stored evidence, videos, documents, and images through courtroom displays, ensuring tamper-proof access and compliance with electronic evidence protocols.

- Insurance Fraud Detection: Insurance companies adopt digital evidence platforms to analyze video or document-based claims, using AI-powered evidence verification tools to detect staged accidents, manipulated photos, or false declarations.

- Emergency Response Collaboration: Public safety departments integrate DEM systems to pool digital media surveillance videos, drone footage, and emergency calls into a central interface, enhancing coordination and rapid incident resolution during disasters or civil unrest.

Global Digital Evidence Management Market: Stats & Facts

U.S. Bureau of Justice Statistics (BJS)

- Over 18,000 law enforcement agencies operate across the United States.

- Nearly 50% of local police departments in the U.S. had acquired body-worn cameras as of the most recent national equipment survey.

- Around 80% of large police departments (serving 500,000+ residents) use dashboard cameras and digital evidence systems.

Federal Bureau of Investigation (FBI)

- The FBI’s Internet Crime Complaint Center (IC3) received over 880,000 cybercrime complaints in a single year, with losses exceeding USD 12.5 billion, much of which involves digital evidence collection.

- The FBI maintains a Digital Evidence Policy Guide, which standardizes digital evidence handling across its national operations.

National Institute of Standards and Technology (NIST)

- NIST has published over 50 guidelines and technical reports related to digital forensics and digital evidence preservation under its Digital Evidence and Computer Forensics programs.

- The NIST Digital Evidence Workshop highlighted chain-of-custody authentication and file integrity validation as top technological challenges for law enforcement.

U.S. Department of Justice (DOJ)

- The DOJ's Office of Justice Programs supports over 200 digital evidence training initiatives through the National Computer Forensics Institute and other partnerships.

- Federal digital evidence storage systems must comply with CJIS Security Policy v5.9, covering encryption, access logs, and audit trails.

Europol (European Union Agency for Law Enforcement Cooperation)

- More than 60% of criminal investigations in the EU involve some form of digital evidence (audio, video, images, or device logs).

- Europol’s European Cybercrime Centre (EC3) supports cross-border digital evidence sharing across 27 EU member states.

UK Home Office

- The UK Home Office has distributed funding to equip over 94% of police forces in England and Wales with body-worn video cameras.

- Evidence from body-worn cameras is admissible in over 90% of UK court proceedings involving violent crimes.

Japan National Police Agency (NPA)

- Japan registered over 12,000 cybercrime cases in recent years, with increasing use of digital forensic labs across all 47 prefectures.

- NPA standard procedures now mandate digital chain-of-custody documentation for all electronically stored evidence submitted to prosecutors.

INTERPOL (International Criminal Police Organization)

- INTERPOL operates a Digital Forensics Lab that supports 194 member countries in processing cross-border digital evidence.

- INTERPOL’s guidelines highlight that video surveillance and image data represent the most frequently exchanged formats of digital evidence between international law enforcement agencies.

Global Digital Evidence Management Market: Market Dynamics

Driving Factors in the Global Digital Evidence Management Market

Rise in Digital and Cyber-Enabled Crime Globally

The surge in cybercrime, online fraud, digital harassment, and tech-facilitated criminal activities has significantly increased the demand for effective digital evidence management systems. As society becomes more digitally interconnected, criminal investigations increasingly require handling complex digital artifacts such as emails, social media content, IP logs, encrypted messages, and surveillance data.

According to international law enforcement bodies like INTERPOL and Europol, the majority of crimes now involve at least one form of digital evidence. Consequently, there is a growing emphasis on advanced evidence platforms that can ingest, index, and analyze multi-source digital data while maintaining forensic integrity.

Government Initiatives for Law Enforcement Modernization

Governments across the globe are actively investing in law enforcement modernization, driving rapid adoption of digital evidence management platforms. Programs such as the U.S. Department of Justice’s “Body-Worn Camera Policy Implementation Program,” the UK Home Office’s digital policing strategy, and the European Union’s Internal Security Fund have allocated millions toward deploying advanced surveillance, forensics, and digital record systems.

These initiatives are motivated by growing public demand for police accountability, court efficiency, and streamlined legal processes. Digital evidence platforms play a vital role in meeting these goals by enabling real-time video access, transparent chain-of-custody documentation, and interoperable case management.

Restraints in the Global Digital Evidence Management Market

Data Privacy Regulations and Legal Complexities

One of the most critical restraints facing the digital evidence management market is the complex regulatory environment governing data privacy and evidence admissibility. Stringent laws such as the General Data Protection Regulation (GDPR) in the EU, the California Consumer Privacy Act (CCPA), and numerous national cybersecurity acts dictate how digital evidence must be collected, stored, processed, and shared. These laws vary widely by jurisdiction, making cross-border evidence sharing legally risky and procedurally complex.

Non-compliance may result in evidence being rendered inadmissible in court or lead to hefty penalties against law enforcement agencies. Legal frameworks also require strict access control, audit logging, and encryption standards, increasing deployment complexity and cost. Additionally, digital evidence often involves third-party data (e.g., bystanders in bodycam videos), further complicating consent and redaction requirements.

Interoperability Challenges across Legacy Systems

Interoperability remains a major barrier to the adoption and scalability of digital evidence management platforms, particularly within multi-agency environments. Many public safety and legal institutions operate legacy infrastructure that lacks compatibility with modern evidence systems, including outdated file formats, storage systems, and case management software. This fragmentation prevents seamless data exchange between departments, increases the risk of evidence misplacement, and hinders unified chain-of-custody tracking.

Efforts to modernize often require expensive system overhauls, retraining of personnel, and careful migration of archived digital evidence resources that many smaller jurisdictions cannot afford.

Additionally, different agencies often follow distinct evidence classification protocols, naming conventions, and metadata structures, making standardized data integration difficult. The absence of universally adopted interoperability standards across vendors and government bodies further exacerbates the problem.

Opportunities in the Global Digital Evidence Management Market

Expansion into Civil Litigation and Corporate Compliance Markets

While digital evidence management has traditionally focused on criminal justice applications, there is a significant growth opportunity in civil litigation and corporate compliance. Law firms, insurance companies, financial institutions, and internal audit teams increasingly deal with high volumes of digital content during investigations, arbitration, and regulatory reviews. These stakeholders require reliable, tamper-proof systems to manage electronic discovery (e-discovery), video interviews, emails, compliance records, and contractual documents.

As regulatory bodies tighten governance rules, corporations must be prepared to demonstrate transparent data handling, respond to whistleblower reports, and furnish court-admissible evidence. Digital evidence platforms offer centralized data repositories, user access control, activity logs, and audit trails, all of which are critical in meeting legal standards.

Increasing Adoption in Emerging Economies and Smart Cities

Emerging markets in Asia-Pacific, Latin America, and Africa present untapped opportunities for digital evidence management due to growing urbanization, public safety demands, and digital governance initiatives. As governments in these regions invest in smart city programs, integrating surveillance, traffic enforcement, emergency response, and crime prevention systems, the need for centralized evidence platforms becomes critical.

Law enforcement agencies in countries like India, Brazil, and South Africa are implementing body-worn camera initiatives and digital policing tools supported by international aid and public-private partnerships. Simultaneously, these countries face challenges like overburdened courts, limited forensic capacity, and infrastructure gaps, making cloud-based and mobile-accessible evidence solutions particularly attractive. Furthermore, regional police academies and judicial training centers are now incorporating digital evidence handling into curricula, reflecting long-term market readiness.

Trends in the Global Digital Evidence Management Market

Integration of AI and Machine Learning in Evidence Analytics

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way digital evidence is processed and analyzed. Law enforcement agencies are increasingly adopting AI-driven solutions to streamline evidence review by automating facial recognition, speech-to-text transcription, object detection, and sentiment analysis from vast video and audio files. These technologies not only reduce the time spent on manual reviews but also enhance accuracy and pattern detection in high-volume investigations.

For instance, AI tools can automatically blur faces in body-worn camera footage to comply with privacy laws or detect tampered video segments to ensure evidence authenticity. As digital content becomes more complex and unstructured, AI-enabled analytics are becoming indispensable for managing evidence across diverse sources such as smartphones, surveillance cameras, and cloud-based repositories.

Shift Toward Cloud-Based and Federated Evidence Platforms

There is a growing shift from on-premises storage to cloud-based and federated platforms for digital evidence management. This trend is largely driven by the increasing volume and variety of digital evidence, including high-definition video, 3D reconstructions, and biometric datasets that require scalable, flexible, and accessible infrastructure. Cloud-native platforms offer law enforcement agencies and prosecutors enhanced accessibility to evidence across jurisdictions, departments, and even mobile devices, enabling real-time collaboration without compromising data security.

Moreover, federated systems allow for decentralized data control while maintaining centralized search and analytics capabilities, which is critical for multi-agency coordination in large-scale investigations. These platforms also enable better chain-of-custody documentation, automated metadata tagging, and seamless integration with digital forensics tools. The trend is reinforced by government mandates to modernize justice infrastructure and by the operational need to maintain business continuity during emergencies like pandemics.

Global Digital Evidence Management Market: Research Scope and Analysis

By Component Analysis

The software segment is projected to dominate the global digital evidence management market due to its central role in enabling end-to-end evidence processing from ingestion and cataloging to storage, analysis, and retrieval. These platforms are equipped with advanced features such as AI-based tagging, facial recognition, license plate detection, speech-to-text conversion, and metadata management, all of which are critical in law enforcement and judicial workflows. Unlike hardware, which is often limited to bodycams, servers, or storage devices, software offers long-term scalability and flexibility, aligning with agencies' evolving evidence needs. Cloud-native software applications offer built-in encryption, role-based access, and digital audit trails that ensure evidence integrity and compliance with jurisdictional standards.

Additionally, software vendors frequently provide interoperability with existing criminal justice systems such as RMS (Records Management Systems) and CAD (Computer-Aided Dispatch), making integration seamless. With the sheer volume and complexity of digital evidence generated from multiple sources, such as surveillance cameras, mobile devices, and social media software solutions that offer intuitive dashboards, evidence linking, case association, and automatic alerts that streamline case processing. The increasing use of digital files over physical ones also reinforces software's dominance, especially as courts transition to digital submissions.

Moreover, periodic updates and modular expansions make software platforms more adaptive to changing policy landscapes and technological standards. As agencies face pressure to improve case outcomes, uphold chain-of-custody standards, and enhance operational efficiency, the demand for powerful, centralized digital evidence management software continues to outpace hardware and services, cementing its lead in the component segment.

By Deployment Mode Analysis

Cloud-based deployment is expected to emerge as the dominant model in the digital evidence management market due to its unmatched scalability, cost-efficiency, and real-time accessibility. As public safety and law enforcement agencies generate massive volumes of digital evidence ranging from video files and audio recordings to biometric scans and digital documents, the limitations of on-premises infrastructure in terms of scalability, storage capacity, and maintenance have become more evident. Cloud-based platforms enable agencies to expand storage on demand, allowing dynamic management of growing repositories without costly hardware upgrades.

Cloud models also support secure, remote access for authorized personnel, which is particularly crucial for geographically distributed operations, mobile response units, and inter-agency collaboration. Data is encrypted both in transit and at rest, with backup redundancies that ensure disaster recovery and data resilience. Furthermore, cloud platforms simplify software updates and integration of new features like AI-assisted indexing or blockchain-based audit trails, reducing the burden on IT teams.

Many government agencies and municipalities are also leveraging cloud procurement through government-backed initiatives and compliance-certified providers, which makes deployment quicker and compliant with national standards such as CJIS (Criminal Justice Information Services) in the U.S. The cost-effectiveness of cloud subscriptions versus capital-intensive on-premise setups also attracts small and medium law enforcement departments with constrained budgets.

Additionally, hybrid work environments and remote judicial processes post-COVID have further cemented the relevance of cloud-based deployments. Overall, the demand for instant access, scalability, and operational flexibility positions cloud-based solutions as the preferred deployment mode across the global market.

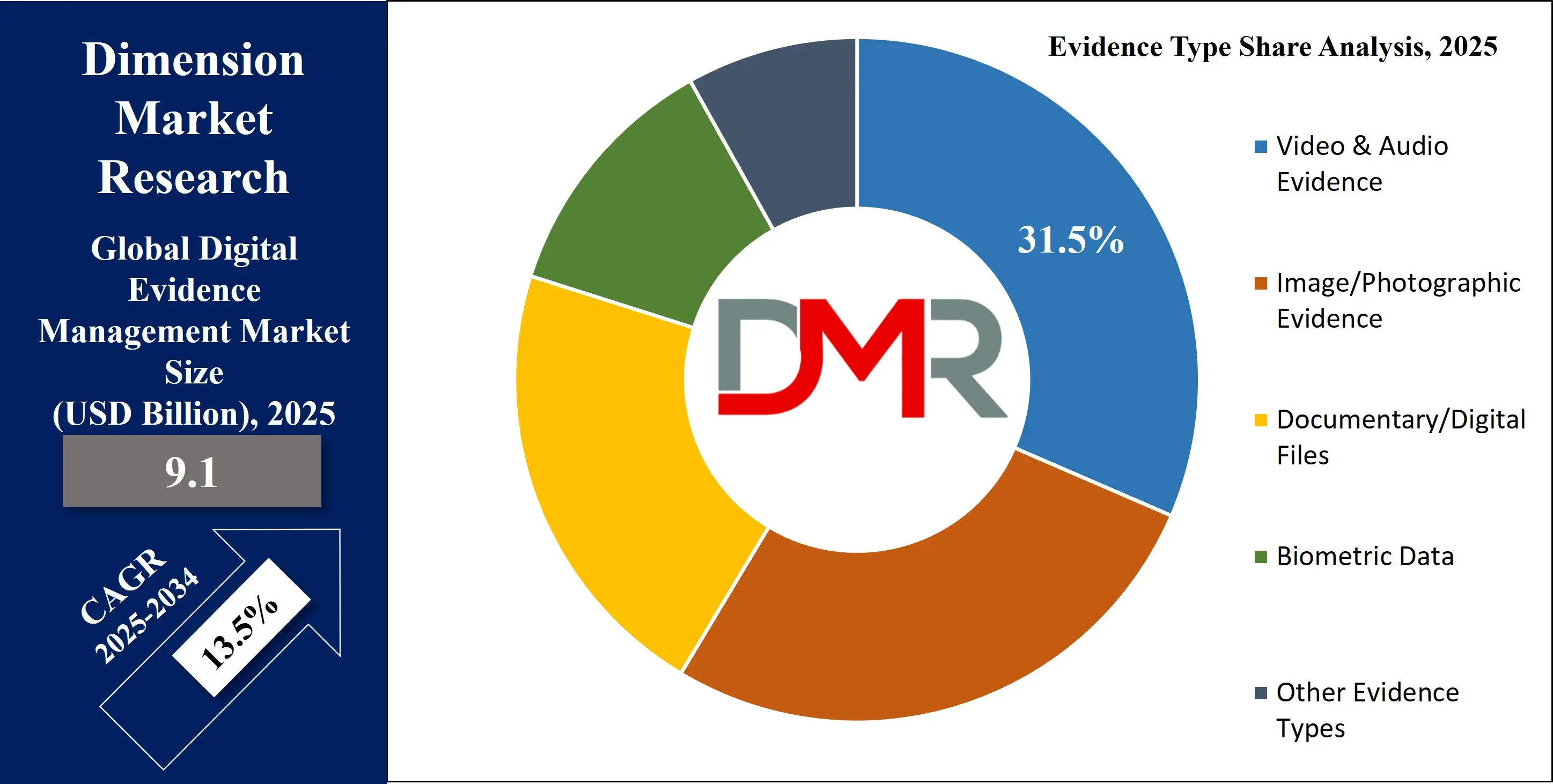

By Evidence Type Analysis

Video and audio evidence are poised to represent the dominant evidence type in the digital evidence management market, largely due to the explosive adoption of body-worn cameras, dashboard cams, surveillance footage, and interview room recordings in both policing and legal environments. Video files offer irrefutable visual records of incidents, providing compelling courtroom evidence that enhances the integrity of testimony and investigation accuracy. Police departments, prosecutors, and defense attorneys heavily rely on high-definition video and synchronized audio to assess suspect behavior, reconstruct events, and validate timelines.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Furthermore, many judicial systems have introduced mandates for recording interrogations and officer-public interactions to promote accountability and transparency, further driving adoption. Video and audio content, however, require extensive storage and smart indexing tools, which digital evidence platforms readily provide through tagging, metadata enrichment, speech-to-text conversion, and facial recognition.

These technologies help users pinpoint critical moments in lengthy recordings, accelerating case preparation and courtroom presentation. Additionally, video and audio are used in a broader array of legal scenarios, from traffic violations and public disorder to domestic violence and commercial fraud, making them universally relevant across jurisdictions. Their admissibility in courts and impact on case outcomes make them highly valued evidence types.

As smart city infrastructure expands globally and surveillance becomes more ubiquitous, the volume of video/audio evidence is expected to surge, requiring more robust management systems. Ultimately, the immediacy, visual clarity, and forensic value offered by video and audio formats solidify their leading role in digital evidence ecosystems.

By End User Analysis

Law enforcement agencies are anticipated to hold the dominant share in the digital evidence management market, primarily due to their foundational role in collecting, handling, and processing digital evidence across criminal investigations, traffic enforcement, surveillance, and public safety operations. These agencies generate vast amounts of evidence through body-worn cameras, dashboard cams, CCTV systems, drone surveillance, and mobile phone extractions. With increased adoption of technology and policy mandates emphasizing police accountability and transparency, digital evidence management solutions have become indispensable tools for law enforcement departments globally.

These platforms facilitate secure storage, timestamped access logs, chain-of-custody management, and AI-assisted evidence correlation, all vital features for upholding judicial integrity. Law enforcement agencies also face mounting pressure to ensure rapid and accurate evidence sharing with prosecutors, courts, and sometimes the public, necessitating centralized systems that minimize manual handling and the risk of data loss or tampering.

In high-crime areas or large jurisdictions, the need to handle hundreds of terabytes of digital content daily makes these platforms not just useful but critical to operational efficiency. Governments are also directing significant funding and legislative focus toward modernizing police IT infrastructure, further accelerating digital transformation within these institutions.

Many agencies now seek real-time access to evidence while on patrol or during investigations, pushing the demand for cloud-based and mobile-integrated platforms. Moreover, inter-agency collaboration, particularly across state, federal, or cross-border task forces, relies heavily on digital evidence management tools. Given their front-line status and growing digital workflow demands, law enforcement agencies remain the leading end users in this space.

The Global Digital Evidence Management Market Report is segmented on the basis of the following:

By Component

- Software

- Evidence Collection & Storage

- Evidence Sharing/Collaboration

- Evidence Analytics and Visualization

- Chain of Custody Management

- Hardware

- Body-Worn Cameras

- In-vehicle Video Recorders

- Digital Evidence Kiosks

- Storage Devices

- Services

- Digital Investigation and Consulting

- System Integration

- Training & Support

- Managed Services

By Deployment Mode

- Cloud-Based

- On-Premises

- Hybrid

By Evidence Type

- Video & Audio Evidence

- Image/Photographic Evidence

- Documentary/Digital Files

- Biometric Data

- Other Evidence Types

By End User

- Law Enforcement Agencies

- Judicial Bodies, & Courts

- Prosecutors & Defense Attorneys

- Public Safety & Emergency Services

- Transportation Authorities

- Insurance Companies

- Other End Users

Impact of Artificial Intelligence in the Global Digital Evidence Management Market

- Automated Evidence Tagging and Categorization: AI enhances operational efficiency by automating the classification and tagging of digital evidence, such as videos, documents, and images. Through natural language processing (NLP) and machine vision algorithms, AI systems can identify objects, extract metadata, and label content in real-time. This reduces manual effort, accelerates investigation timelines, and improves evidence accessibility for law enforcement and legal entities.

- Facial and Object Recognition in Video Evidence: Advanced AI-based recognition technologies allow systems to detect, recognize, and track faces, vehicles, weapons, or suspicious behavior in video footage. This is especially valuable for body-worn cameras and surveillance systems where hours of footage must be analyzed. AI facilitates the swift identification of suspects and enhances the evidentiary value of visual data in criminal proceedings.

- Predictive Analytics and Crime Pattern Analysis: AI algorithms can process historical digital evidence data to identify recurring crime patterns, detect anomalies, and anticipate future incidents. Predictive modeling empowers agencies to allocate resources more effectively and adopt proactive public safety strategies, enhancing situational awareness and decision-making.

- Natural Language Processing for Textual Evidence: NLP enables AI to analyze large volumes of textual data such as emails, chat logs, and court documents. AI-driven tools can highlight relevant conversations, detect keywords, and extract insights, significantly aiding digital forensics teams in cases involving financial fraud, cybercrime, or harassment.

- Chain of Custody and Integrity Monitoring: AI systems can monitor digital evidence access, alterations, and transfers in real-time, reinforcing the chain of custody. By logging each action and flagging anomalies or unauthorized access, AI helps ensure data integrity, which is critical for evidence admissibility in court.

- AI-Powered Redaction and Privacy Compliance: AI tools can automatically redact sensitive personal information from digital evidence such as faces, license plates, and voice data before disclosure. This supports privacy compliance with regulations like GDPR or HIPAA while preserving the usability of the remaining evidence for public or judicial scrutiny.

Global Digital Evidence Management Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to dominate the global digital evidence management market as it holds 44.0% of the total market revenue by the end of 2025, due to its early adoption of advanced law enforcement technologies, robust digital infrastructure, and the presence of leading technology providers. The region benefits from strong governmental investments in public safety and justice modernization programs.

Agencies like the FBI, Department of Justice, and local police departments across the U.S. and Canada have significantly increased funding for digital investigation tools, including cloud storage, body-worn camera systems, and AI-driven forensic software. This has enabled law enforcement to manage vast volumes of digital evidence efficiently, ranging from surveillance videos to biometric and textual records.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The U.S. is particularly ahead in deploying body-worn cameras across thousands of police departments. According to the Bureau of Justice Statistics, over 80% of large police departments in the U.S. now use body cameras, generating immense amounts of digital data requiring structured storage and retrieval systems. Additionally, North America has a mature cloud ecosystem supported by major players such as Microsoft Azure, AWS, and IBM, enabling secure and scalable deployment of evidence management platforms.

Moreover, favorable legal frameworks like the Federal Rules of Evidence, combined with an increasing emphasis on transparency and accountability in law enforcement, drive demand for tamper-proof and chain-of-custody-compliant systems.

Region with the Highest CAGR

Asia Pacific is projected to register the highest CAGR in the digital evidence management market, driven by the rapid digitalization of law enforcement, increasing crime rates, and governmental initiatives toward modernizing security infrastructure. Emerging economies such as India, China, Indonesia, and Malaysia are witnessing a surge in cybercrimes, digital frauds, and public safety challenges, necessitating investments in advanced evidence handling systems. Unlike the mature but saturated markets of the West, Asia Pacific presents vast untapped potential with a growing focus on digital governance and judicial reform.

A major catalyst is the integration of body-worn cameras and surveillance systems into routine policing across several APAC countries. For example, Indian police forces are increasingly equipping officers with video recording tools, and Singapore has rolled out AI-driven analytics to extract actionable insights from digital data. Additionally, initiatives like China’s “Smart Policing” program focus on integrating cloud, AI, and IoT to enhance surveillance and evidence documentation processes.

The region's thriving technology sector also supports rapid software innovation, especially in countries like South Korea, Japan, and Australia. Domestic vendors are developing cost-effective, scalable, and AI-enabled digital evidence platforms that cater to local languages and legal standards, enhancing adoption in mid- and lower-tier cities.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Evidence Management Market: Competitive Landscape

The global digital evidence management market features a moderately consolidated competitive landscape, with a blend of established technology firms, specialized digital forensics vendors, and niche solution providers. Leading players such as Axon Enterprise Inc., Motorola Solutions, NICE Ltd., IBM Corporation, Microsoft Corporation, OpenText Corporation, and Cognitec Systems have established strong footholds by offering end-to-end solutions that integrate video surveillance, data analytics, evidence storage, and courtroom-ready chain-of-custody systems.

Axon, for example, dominates the body-worn camera segment and provides an integrated digital evidence platform known as Axon Evidence, widely used by police departments in North America and Europe. NICE Ltd. focuses on real-time evidence analytics and cloud-based public safety solutions. Meanwhile, IBM and Microsoft offer scalable and secure cloud infrastructure to store and manage digital evidence, often in partnership with law enforcement agencies. These vendors prioritize AI and machine learning to automate evidence categorization, facial recognition, and tamper detection.

Emerging players in Asia-Pacific and Latin America are disrupting the market with localized solutions, particularly in video surveillance integration and real-time alert systems. Startups are focusing on cloud-native platforms, edge analytics, and cost-effective bodycam systems that cater to small- and mid-sized agencies. Strategic collaborations between tech vendors and law enforcement agencies are intensifying, as are investments in R&D and cybersecurity enhancements to maintain evidence integrity.

The market is also witnessing increased activity in mergers, acquisitions, and product innovation, signaling a shift toward platform unification, enhanced usability, and AI-driven forensic intelligence, pivotal factors that shape competitive advantage in this evolving industry.

Some of the prominent players in the Global Digital Evidence Management Market are

- Motorola Solutions

- Axon (formerly TASER International)

- NICE Ltd.

- Panasonic Holdings Corporation

- IBM Corporation

- Oracle Corporation

- Microsoft Corporation

- Genetec Inc.

- Hitachi Vantara

- Opentext Corporation

- Hytera Communications

- Vidizmo LLC

- Cellebrite

- Reveal Media

- WatchGuard Video (a Motorola Solutions company)

- Coban Technologies

- QueTel Corporation

- Digital Ally Inc.

- Safe Fleet

- Intrensic

- Other Key Players

Recent Developments in the Global Digital Evidence Management Market

- July 2025: Axon launched an advanced AI-powered video evidence review solution to streamline redaction, automate suspect identification, and expedite evidence validation. This system is being integrated into law enforcement agencies across North America to reduce manual processing time and improve transparency and compliance in handling body-worn camera and surveillance footage.

- June 2025: Panasonic entered a strategic collaboration with a U.S. law enforcement agency to pilot its next-generation cloud-native digital evidence platform. The solution provides end-to-end encryption, scalable storage, and real-time access for prosecutors and investigators, addressing challenges in evidence centralization, especially for body cam and in-vehicle video data.

- May 2025: NICE Systems acquired a forensic AI analytics startup based in Israel to strengthen its capabilities in predictive video tagging, document analysis, and biometric metadata extraction. The acquisition is aimed at expanding its AI-driven evidence management suite and accelerating automation across investigative workflows in high-profile criminal and civil cases.

- April 2025: At the Global Police Tech Expo in London, Motorola Solutions unveiled its new real-time command center software featuring integrated digital evidence modules. The system allows officers and analysts to access incident-related media, GPS data, and digital files on a unified dashboard, improving multi-agency coordination and rapid decision-making.

- March 2025: Genetec announced regional expansion of its digital evidence solutions in Asia-Pacific, collaborating with Singapore’s homeland security division and Australian law enforcement. The deployments aim to build secure, interoperable evidence-sharing systems, particularly focusing on urban surveillance and incident response through video, documents, and biometric data management.

- February 2025: IBM revealed a multi-million-dollar investment in developing blockchain-based digital evidence tracking tools during the Smart Public Safety Conference. The initiative targets chain-of-custody authentication, tamper-proof storage, and real-time audit trails, addressing growing concerns about evidence tampering and data integrity across jurisdictions.

- January 2025: Hitachi Vantara began trial deployment of its secure AI-enabled biometric evidence platform in partnership with Japanese police departments. The platform uses facial recognition and fingerprint data to link suspects to digital case files, aiming to reduce human error and ensure compliance with Japan’s strict data protection standards.

- December 2024: NICE Systems formalized a partnership with Interpol to pilot cross-border digital evidence exchange frameworks. The project involves creating GDPR-compliant, jurisdiction-aware modules that allow investigators from different countries to share encrypted files while preserving metadata and maintaining forensic chain of custody.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 9.1 Bn |

| Forecast Value (2034) |

USD 28.5 Bn |

| CAGR (2025–2034) |

13.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 3.4 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Component (Software, Hardware, Services), By Deployment Mode (Cloud-Based, On-Premises, Hybrid), By Evidence Type (Video & Audio, Image/Photographic, Documentary/Digital Files, Biometric Data, Other Types), and By End User (Law Enforcement Agencies, Judicial Bodies & Courts, Prosecutors & Defense Attorneys, Public Safety & Emergency Services, Transportation Authorities, Insurance Companies, Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Motorola Solutions, Axon, NICE Ltd., Panasonic, IBM, Oracle, Microsoft, Genetec, Hitachi Vantara, OpenText, Hytera, Vidizmo, Cellebrite, Reveal Media, WatchGuard Video, Coban Technologies, QueTel, Digital Ally, Safe Fleet, and Intrensic, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Digital Evidence Management Market?

▾ The Global Digital Evidence Management Market size is estimated to have a value of USD 9.1 billion in 2025 and is expected to reach USD 28.5 billion by the end of 2034.

What is the growth rate in the Global Digital Evidence Management Market in 2025?

▾ The market is growing at a CAGR of 13.5 percent over the forecasted period of 2025.

What is the size of the US Digital Evidence Management Market?

▾ The US Digital Evidence Management Market is projected to be valued at USD 3.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 9.9 billion in 2034 at a CAGR of 12.7%.

Which region accounted for the largest Global Digital Evidence Management Market?

▾ North America is expected to have the largest market share in the Global Digital Evidence Management Market with a share of about 44.0% in 2025.

Who are the key players in the Global Digital Evidence Management Market?

▾ Some of the major key players in the Global Digital Evidence Management Market are Motorola Solutions, Axon, NICE Ltd., Panasonic, IBM, Oracle, Microsoft, Genetec, Hitachi Vantara, and many others.