They include modules like claims processing, policy management, regulatory compliance, billing, reinsurance management, and premium accounting, delivering a unified solution. Moreover, digital insurance platforms also provide policyholders with a user-friendly portal for convenient remote access to customer databases, facilitating a smoother insurance experience.

Global Digital Insurance Platform markets are experiencing explosive growth due to growing customer demands for simple yet user-friendly insurance services. Cloud solutions and digital transformation in the insurance sector are major contributors, offering insurers opportunities for improved customer experiences as well as operational efficiencies thanks to automation and advanced analytics.

Technological advances such as AI,

machine learning and blockchain are opening up exciting prospects in digital insurance. Insurers are adopting these technologies to enhance fraud detection capabilities, streamline claims processing procedures and personalize offerings. Furthermore, companies using data analytics tools are better understanding customer behaviour so as to develop tailored policies tailored specifically for individuals, whether in

Cyber Insurance, Term Insurance, or specialized products linked to Digital Health services.

Digital insurance platforms in emerging markets have seen exponential market expansion as their usage spreads further and financial inclusion improves, drawing more consumers towards digital insurance services and mobile internet connectivity increases. There is tremendous opportunity in Asia-Pacific and African regions where middle classes have emerged along with increasing demands for accessible financial products and services.

Key Takeaways

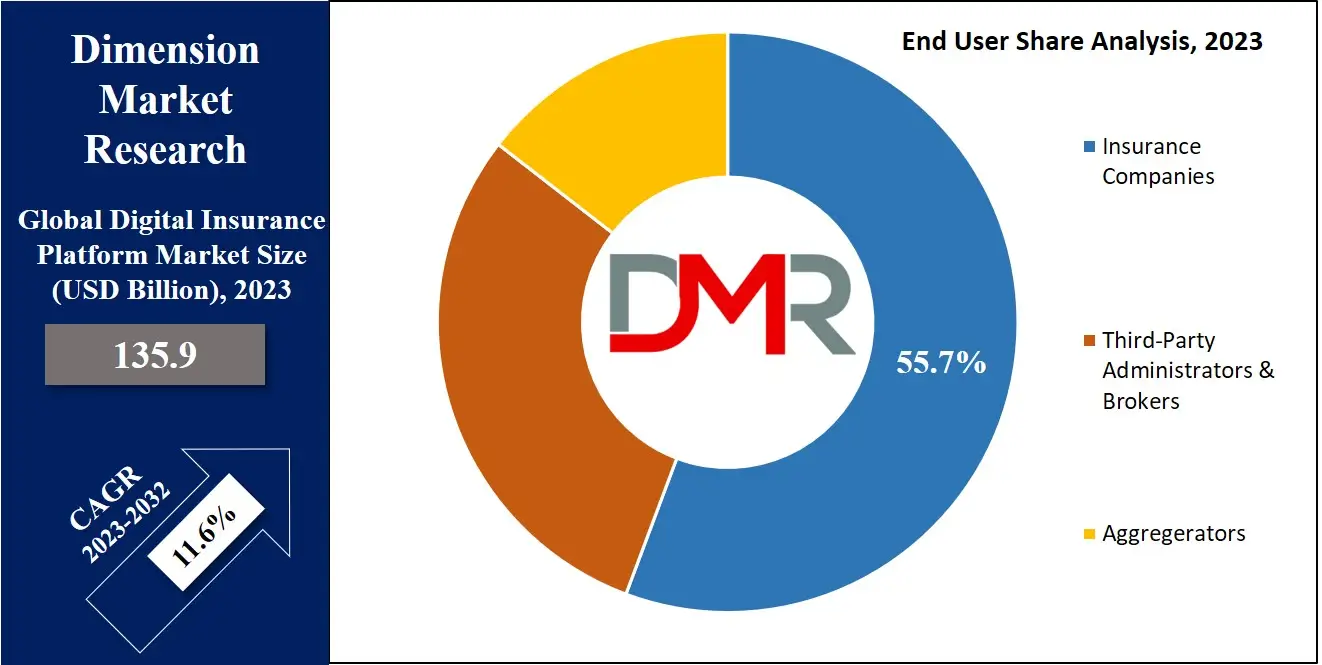

- Market Growth: The global digital insurance platform market is projected to grow from USD 135.9 billion in 2023 to USD 365.8 billion by 2032, at a CAGR of 11.6%.

- Tech Integration: Adoption of AI, machine learning, and blockchain enables insurers to improve fraud detection, streamline claims, and offer personalized products efficiently.

- Cloud Solutions: Cloud-based digital transformation is driving improved customer experiences and operational efficiency for insurers through automation and advanced analytics.

- Consumer Focus: A shift from product-centric to consumer-centric models is increasing demand for platforms that support easy, user-friendly digital insurance services.

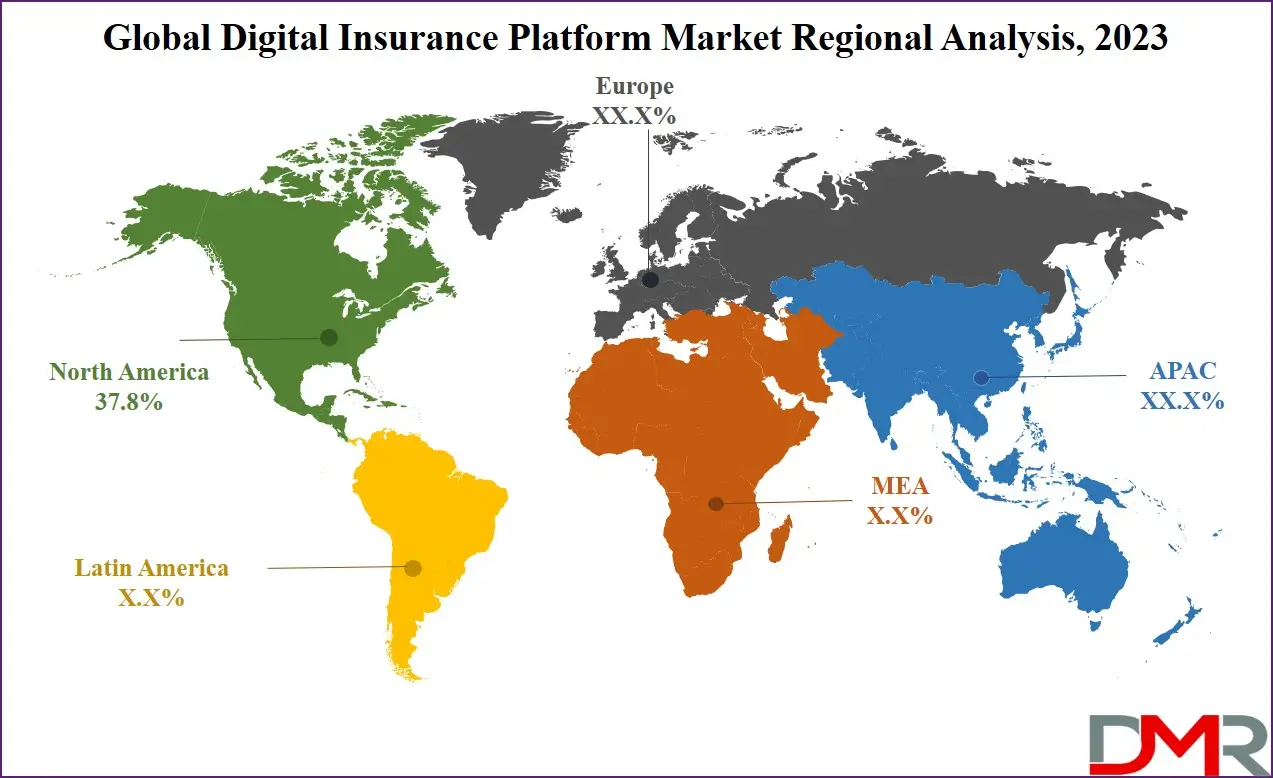

- Regional Trends: North America leads the market with a 37.8% share, while Asia-Pacific is expected to grow rapidly due to increased digital adoption and financial inclusion.

- Industry Challenges: Major obstacles include integrating new platforms with legacy systems and a shortage of skilled professionals in the sector.

- Competitive Moves: Key players are forming partnerships and strategic alliances to expand portfolios, as seen in partnerships like Majesco and Microsoft for enhanced cloud solutions.

Use Cases

- Fraud Detection Automation: Integration of AI and machine learning enables insurers to automate fraud detection, reducing manual effort and improving claim approval speed for both customers and companies.

- Personalized Policy Offers: Leveraging customer data analytics, insurers can deliver tailored policy recommendations to individuals, enhancing customer satisfaction and increasing product uptake.

- Automotive Insurance Innovation: Telematics and advanced digital tools in automotive insurance help insurers dynamically price premiums and manage risk based on real-time vehicle and driver data.

- Remote Self-Service Portals: Digital insurance platforms provide customers with user-friendly portals for remote access to policies, claims, and service requests, improving accessibility and efficiency.

- Cloud-Based Operations: Insurance companies can streamline operations and speed up market expansion by deploying scalable, cloud-based platforms that support rapid digital transformation.

- Consulting-Led Implementations: Enterprises use consulting services to oversee complex digital platform integrations, allowing them to focus on core business and ensure successful digital adoption.

In addition, rising awareness among insurers about digital channels, technological advancements, & the growing use of scalable cloud-based digital solutions are contributing to the market's growth. Insurers are looking to access broader market segments & expand into emerging markets, providing further opportunities for market growth.

However, challenges related to integrating insurance platforms with legacy systems and a shortage of skilled workforce are significant challenges that may hinder the market's progress.

Research Scope and Analysis

By Professional Service

In terms of professional services, the market is divided into three categories: Consulting, Implementation, and Support & Maintenance, many enterprises are showing a strong preference for consulting services, which is driven by the ability of managed service providers to look into & maintain digital platforms effectively, including complex integrations with Digital Banking Platforms and

Customer Data Platforms.

By entrusting these tasks to experts, enterprises can shift their focus towards honing their core competencies & primary business activities, which streamlines the management of digital platforms, enabling enterprises to optimize their efficiency & performance while ensuring that these platforms are well-maintained & up-to-date. In essence, the emphasis on consulting services allows businesses to concentrate on what they do best, while experts handle the important task of managing their digital platforms, including support for evolving products such as Cyber Insurance and

Digital Health solutions.

By Application

The market is divided into various applications, like Home & Commercial Buildings, Automotive & Transportation, Consumer Electronics & Industrial Machines, Business & Enterprise, and Others. In 2023, the Automotive & Transportation segment stands out as a key application for insurance companies to promote their products, which is primarily due to the industry's embracement of advanced technologies like telematics &

artificial intelligence, which improves operational efficiency & the introduction of innovative channels for insurance services.

Further, the rise in the frequency of road accidents has generated a growth in the need for insurance coverage among consumers. In essence, the Automotive & Transportation sector emerges as a significant market space where insurance companies are aiming their efforts, driven by technological advancements & the increase in the need for insurance protection in the face of growing road accidents, with potential overlaps into

Digital Banking Platforms and data-driven insights from Customer Data Platforms for personalized offers such as Term Insurance.

By End User

The global digital insurance market is segmented by end-users into three categories, which are Insurance Companies, Third-Party Administrators & Brokers, and Aggregators. Among these, the Insurance Companies are anticipated to experience significant growth in the forecasted period, which can be attributed to the transformative capabilities of digital insurance platforms, which allow insurers to transition from conventional methods to digital interfaces. By doing so, they can provide customized solutions to customers at lesser expenses.

Further, these platforms improve operational efficiency by expediting claim settlements, & they also look into the expansion of insurance companies' operations through comprehensive, end-to-end services, which is set to benefit the most from the advantages that digital insurance platforms bring to the table.

The Digital Insurance Platform Market Report is segmented on the basis of the following:

By Professional Service

- Consulting

- Implementation

- Support & Maintenance

By Application

- Automotive & Transportation

- Home & Commercial Buildings

- Business & Enterprise

- Consumer Electronics & Industrial Machines

- Others

By End User

- Insurance Companies

- Third-Party Administrators & Brokers

- Aggregators

Regional Analysis

North America commands the largest share,

accounting for 37.8% of the Global Digital Insurance Platform Market in 2023, which is primarily attributed to the region's growing awareness & adoption of insurance services, driven by its huge population. In addition, the presence of several insurance providers in North America contributes to its market dominance.

Also, the Asia Pacific region is anticipated to show significant growth in the coming years, owing to the integration of social media & payment platforms that facilitate targeted marketing of insurance, resulting in increasing customer engagement & expanding opportunities for the industry.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The digital insurance platform market experiences a fragmented nature, with several key players in the market. To stay competitive, these companies are forming partnerships & making strategic acquisitions to expand their product portfolios, which helps them offer more comprehensive solutions & secure a lasting edge in the industry.

In September 2023, Majesco, a key player in cloud-based insurance software, & Microsoft announced a strategic alliance to catalyze experiencing digital transformation in the insurance sector, which is made to provide insurers with the tools & infrastructure needed to facilitate their long-term digital evolution. By incorporating the capabilities of Microsoft Cloud & Analytics, the partnership aims to provide insurers with a scalable & secure intelligent cloud environment, ultimately empowering both companies & their customers to thrive in the digital age.

Some of the prominent players in the global Digital Insurance Platform Market are:

- IBM Corp

- Oracle Corp

- Mindtree Ltd

- Majesco

- Microsoft Corp

- Oscar Insurance

- Pegasystems

- DXC Technology

- EIS Group Inc

- SAP SE

- Other Key Players

Recent Developments

- In March 2025, Munich Re Group and ERGO Group AG completed the full $2.6 billion acquisition of NEXT Insurance, embedding the digital insurer into ERGO’s global operations.

- In January 2025, Lazada and Peak3 announced a joint venture launching a digital insurance platform serving Southeast Asia, expanding property, casualty, accident, and health insurance offerings.

- In June 2024, Sapiens International launched its next-generation, AI-powered digital insurance platform, focusing on automation and smarter business decisions for insurers.

- In August 2024, CoverGo launched “CoverGo Distribution,” an AI-powered insurance distribution platform enabling omni-channel sales for insurers, MGAs, and brokers globally.

- In September 2024, Pouch Insurance introduced “Goodie,” an AI-powered tool offering 24/7 customer access and multilingual support, enhancing automation for insurance agents.