Market Overview

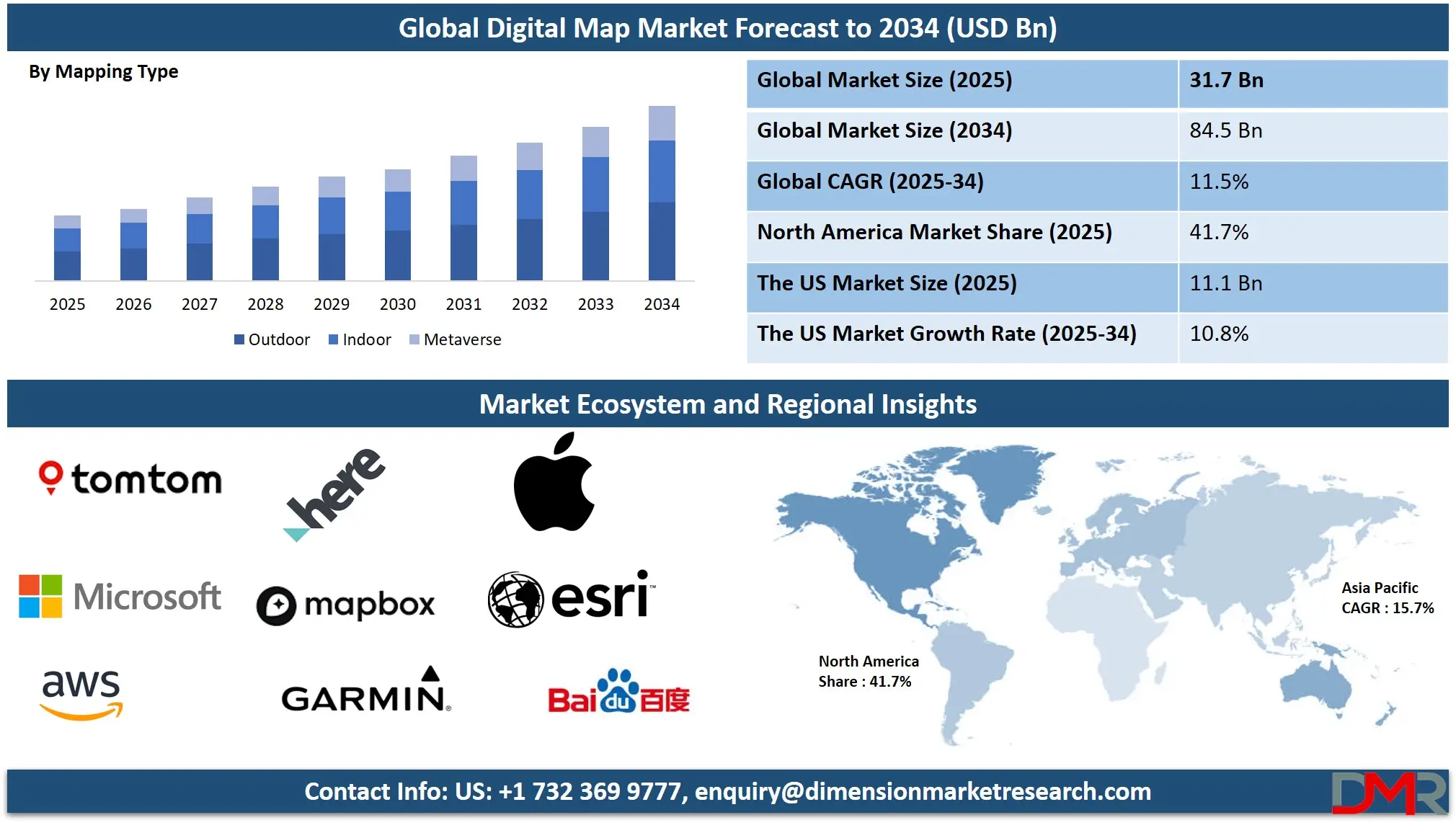

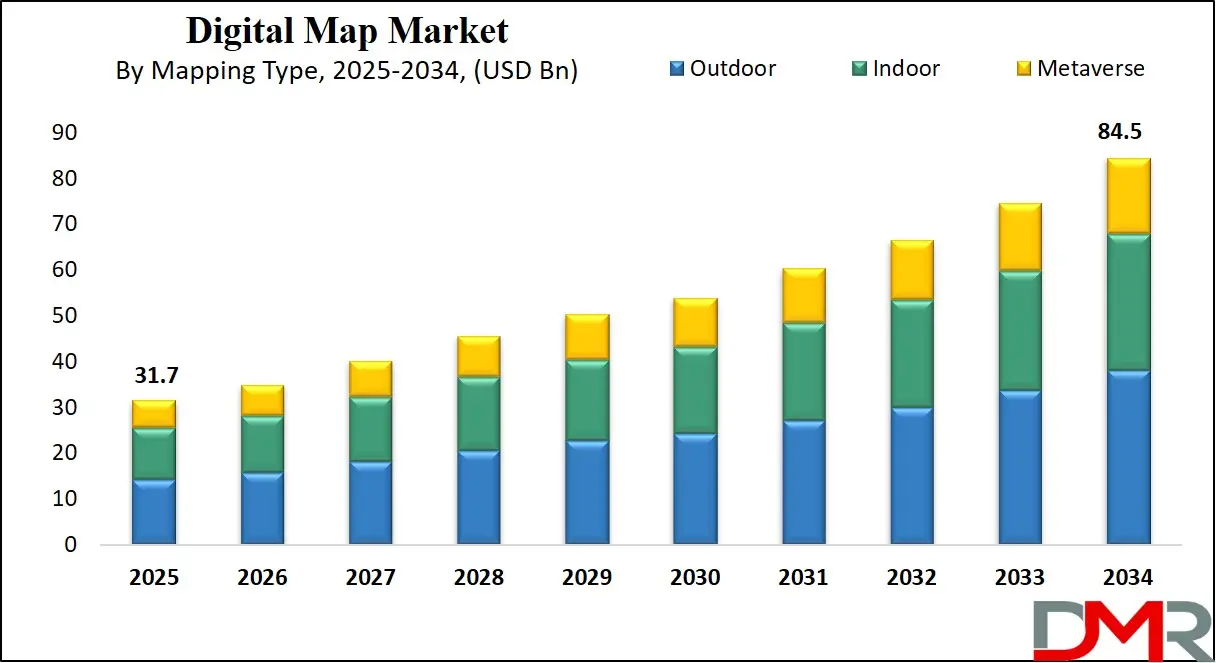

The Global Digital Map Market is predicted to be valued at USD 31.7 billion in 2025 and is expected to grow to USD 84.5 billion by 2034, registering a compound annual growth rate (CAGR) of 11.5% from 2025 to 2034.

A digital map is an electronic representation of geographical areas, displaying spatial information through data-driven visuals. Unlike traditional paper maps, digital maps offer interactive features such as zooming, panning, and real-time updates. They are created using satellite imagery, GPS data, and geographic information systems (GIS), providing accurate and detailed information on roads, terrain, landmarks, and infrastructure.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Digital maps are widely used in navigation systems, urban planning, logistics, location-based services, and autonomous vehicles. They support route optimization, traffic monitoring, and geospatial analysis, enhancing decision-making and operational efficiency across various industries. These maps are accessible via smartphones, computers, and embedded systems.

The global digital map market is experiencing strong growth, driven by increasing demand for real-time mapping and geospatial analytics across industries. Businesses and governments are integrating digital cartography into their operations to enhance planning, navigation, and decision-making. Advancements in satellite imagery and GPS technology further support market expansion.

Automotive and transportation sectors are major contributors to the digital map market. With the rise of connected vehicles and autonomous driving systems, there is a heightened need for precise, up-to-date mapping data. Turn-by-turn navigation, traffic alerts, and route optimization rely heavily on high-resolution digital maps embedded within vehicle systems and mobility apps.

The proliferation of smartphones and mobile applications has significantly boosted the adoption of digital mapping platforms. Location-based services, geotagging, ride-hailing apps, and on-demand delivery systems all depend on real-time map APIs. Companies are investing in advanced mapping solutions that offer interactive, customizable, and cloud-based map services to improve customer experiences.

Emerging technologies like artificial intelligence, machine learning, and Internet of Things are transforming the capabilities of digital maps. Predictive mapping, dynamic updates, and indoor mapping are gaining traction in sectors like retail, logistics, infrastructure, and urban development. The integration of GIS software and remote sensing technologies enables precise spatial analysis and visual storytelling, driving market innovation.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Overall, the digital map market is poised for dynamic evolution as industries shift towards automation and data-driven insights. Market players are focusing on innovation, partnerships, and intelligent mapping tools to gain a competitive edge in an increasingly connected global economy.

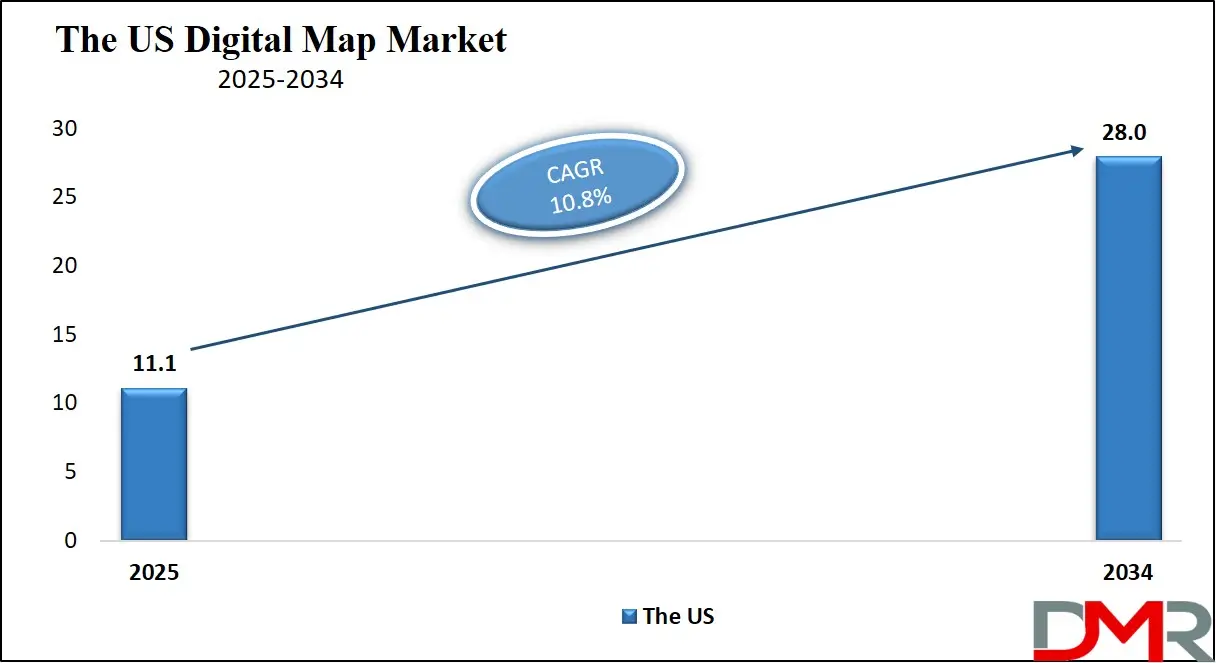

The US Digital Map Market

The US Digital Map Market is projected to be valued at USD 11.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 28.0 billion in 2034 at a CAGR of 10.8%.

The U.S. digital map market is driven by the widespread adoption of advanced navigation systems in autonomous vehicles and connected cars. The integration of GPS and GIS technologies in logistics, infrastructure planning, and defense systems supports precise route optimization and location intelligence.

Additionally, increasing investments in smart city development, public safety, and environmental monitoring have accelerated demand for high-resolution, real-time mapping solutions. Key industries such as retail, real estate, and telecommunications rely heavily on geospatial data analytics for strategic decision-making. The government's support for digital infrastructure projects further enhances the deployment and use of mapping technologies across various applications and sectors.

A major trend in the U.S. digital map market is the integration of artificial intelligence and machine learning to deliver real-time updates and predictive traffic insights. There is a growing emphasis on high-definition (HD) and 3D mapping to enhance experiences in autonomous driving and virtual simulations. The use of crowdsourced data from mobile apps and social platforms is also gaining traction.

Mapping platforms are evolving into multi-layered systems combining satellite imagery, IoT sensors, and real-time geospatial analytics. Additionally, collaborations between mapping service providers and tech giants are shaping innovative solutions tailored to urban mobility and personalized location-based services.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Japan Digital Map Market

The Japan Digital Map Market is projected to be valued at USD 2.1 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 5.2 billion in 2034 at a CAGR of 10.0%.

In Japan, the digital map market is primarily driven by the country’s advanced transportation infrastructure and its commitment to smart mobility solutions. The adoption of intelligent transport systems (ITS) and autonomous vehicle testing has created strong demand for precise and real-time digital mapping services.

Moreover, Japan's susceptibility to natural disasters has led to increased deployment of geospatial solutions for disaster risk management and urban planning. Integration of digital maps in sectors like logistics, robotics, and public safety has also expanded due to the country’s tech-savvy population. Government initiatives promoting digital transformation and innovation are key enablers for market expansion.

A prominent trend in Japan’s digital map market is the rise of high-definition mapping for autonomous navigation in both urban and rural regions. The integration of augmented reality (AR) into digital mapping applications is also gaining popularity, particularly in tourism and retail. There is increased use of real-time, location-based services in last-mile delivery and smart city management.

Japan is also witnessing the adoption of digital twin technologies, combining digital maps with real-world data to simulate infrastructure and disaster response scenarios. Partnerships between local governments and private tech firms are fostering innovation in geospatial analytics and mapping-as-a-service platforms.

The Europe Digital Map Market

The Europe Digital Map Market is projected to be valued at USD 5.6 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 14.3 billion in 2034 at a CAGR of 11.0%.

The Europe digital map market is driven by growing investments in smart mobility, transportation infrastructure, and urban development projects. Governments and private entities are leveraging digital mapping technologies for route optimization, energy planning, and environmental monitoring. The rise of electric vehicles and intelligent transport systems across the continent increases the need for precise geospatial data.

Additionally, demand from industries such as tourism, logistics, and agriculture fuels adoption of location-based services. The European Union’s strong regulatory framework and emphasis on data standardization and interoperability support the use of digital maps in cross-border transport, environmental compliance, and public sector modernization.

In Europe, digital mapping is evolving with advancements in AI-based geospatial analytics and satellite imagery integration. The trend of open-source and collaborative mapping platforms is gaining momentum, promoting transparency and innovation. High-definition maps are being widely adopted for use in autonomous vehicles and drone navigation. There is a growing focus on privacy-centric location services, aligned with GDPR guidelines.

Additionally, digital maps are being increasingly used in renewable energy planning and climate modeling. Countries are incorporating 3D city modeling and digital twins into infrastructure projects to visualize development impacts. Public-private partnerships continue to drive technology adoption across diverse applications.

Digital Map Market: Key Takeaways

- Market Overview: The global digital map market is projected to reach a value of USD 31.7 billion in 2025 and is expected to expand significantly to USD 84.5 billion by 2034, growing at a compound annual growth rate (CAGR) of 11.5% over the forecast period.

- U.S. Digital Map Market: In the United States, the digital map market is estimated to be worth USD 11.1 billion in 2025. It is expected to experience steady growth, reaching USD 28.0 billion by 2034, at a CAGR of 10.8%.

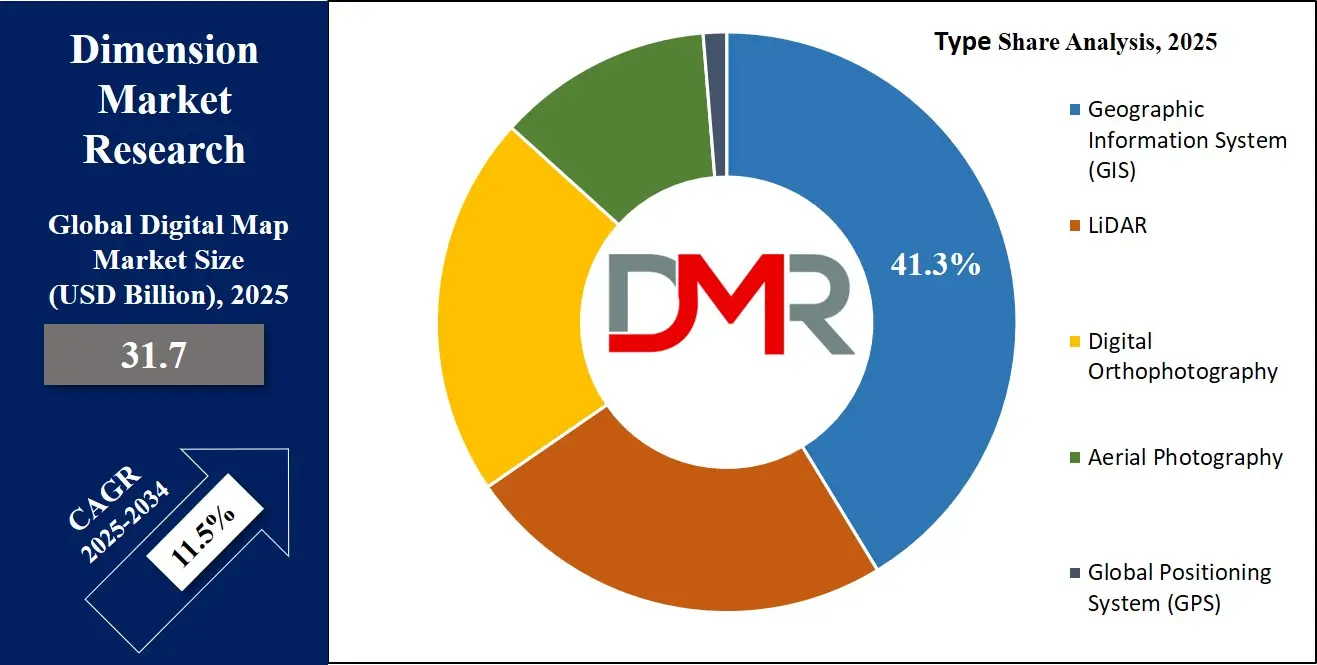

- By Type: Among the various types, the Geographic Information System (GIS) segment is expected to lead the global market by the end of 2025, contributing approximately 41.3% to the total revenue.

- By Service: The Development & Integration segment is anticipated to be the most prominent in terms of service offerings, accounting for nearly 47.8% of the global market revenue by 2025.

- By Mapping Type: Outdoor mapping is projected to be the leading segment under mapping type, representing around 66.4% of the market share by the close of 2025.

- By Application: Routing and navigation applications are forecasted to dominate the market landscape by 2025, making up roughly 52.6% of the total revenue.

- By End User: The automotive sector is poised to hold the largest share among end users, expected to account for about 34.9% of the global digital map market revenue by the end of 2025.

- Leading Region: North America is set to maintain its dominance in the global digital map market, contributing approximately 41.7% of the total market share by 2025.

Digital Map Market: Use Cases

- Autonomous Vehicle Navigation: Digital maps are essential for self-driving vehicles, providing real-time lane-level guidance, obstacle detection, and traffic data. These maps integrate GPS, HD mapping, and sensor data to ensure precise routing, enhancing safety and reducing travel time in urban and highway driving environments.

- Disaster Management & Emergency Response: Emergency services utilize digital maps for real-time tracking, route optimization, and damage assessment during natural disasters. These tools help in coordinating rescue operations, mapping flood zones or fire lines, and accessing critical infrastructure data to accelerate emergency response and recovery.

- Logistics and Fleet Management: Digital maps help logistics companies manage fleets efficiently by optimizing delivery routes, tracking vehicle locations, and minimizing fuel consumption. Real-time traffic updates and geofencing features improve punctuality and resource allocation, enhancing operational efficiency and customer satisfaction.

- Urban Planning and Infrastructure Development: Urban planners and engineers use digital maps to design transportation systems, utilities, and zoning layouts. By integrating geospatial data, planners can visualize land use, population density, and future growth areas, enabling smarter, data-driven infrastructure development.

- Tourism and Location-Based Services: Tourism apps use digital maps to guide travelers to landmarks, hotels, restaurants, and attractions. Enhanced with AR and geotagged content, these maps improve user experience by offering detailed, personalized, and real-time recommendations based on the tourist's location and preferences.

Digital Map Market: Stats & Facts

- Google states that its Google Maps app has over 1 billion monthly active users, making it one of the most used digital mapping services worldwide.

- Apple reported during WWDC that Apple Maps covers over 200 countries and regions and offers Look Around (street-level view) in more than 30 cities globally.

- OpenStreetMap Foundation revealed that its community has contributed over 10 billion GPS points, with more than 9 million registered users and continuous editing by over 1.5 million active contributors.

- NASA highlights that its Landsat satellites have been capturing Earth images for digital mapping for over 50 years, generating more than 10 million scenes accessible to the public.

- HERE Technologies claims its HD Live Map data covers over 55 million kilometers of roadways globally and supports over 100 million vehicles with navigation and safety services.

- TomTom confirmed that its digital maps power over 600 million devices globally and that it processes billions of GPS points daily to keep maps updated.

- Esri (Environmental Systems Research Institute) states its ArcGIS platform is used by over 350,000 organizations worldwide, with 75% of Fortune 500 companies integrating GIS mapping into operations.

- Uber disclosed it collects over 100 terabytes of geospatial data daily to support its ride-hailing and food delivery services through digital mapping.

- Facebook (Meta) released its AI-assisted digital map project which mapped over 95% of Africa’s roads using computer vision and satellite imagery in collaboration with Mapillary.

- U.S. Geological Survey (USGS) provides digital topographic maps through the National Map program, with over 18 million downloads of historical and current maps since 2015.

- Microsoft through its Azure Maps platform integrates data from over 500 million real-time sensors and sources for location-based services and digital mapping solutions.

- Waze, owned by Google, states that its real-time digital map is updated by over 140 million monthly users, with more than 40 billion kilometers driven per month for map accuracy.

- Garmin reports that its GPS-based digital navigation systems cover over 200 countries, with more than 30,000 junction views and millions of points of interest (POIs) integrated in its mapping systems.

- National Oceanic and Atmospheric Administration (NOAA) maintains nautical digital maps and updates over 1,000 electronic navigational charts (ENCs) for U.S. waters to support safe maritime travel.

- UN World Food Programme uses digital maps to coordinate relief in 80+ countries, mapping over 200,000 routes and locations for humanitarian logistics using GIS platforms.

Digital Map Market: Market Dynamic

Driving Factors in the Digital Map Market

Surge in Demand for Location-Based Services

The growing reliance on location-based services across sectors like retail, transportation, tourism, and emergency services is a major driving force in the digital map market. Businesses increasingly use geospatial data to enhance customer engagement, enable targeted advertising, and optimize delivery routes.

Moreover, consumers rely heavily on real-time navigation systems for commuting, ride-sharing, and local discovery. The widespread adoption of smartphones and wearable devices equipped with GPS further accelerates the use of interactive mapping solutions. Companies are also integrating digital cartography into mobile apps to deliver personalized experiences, propelling demand. As industries strive to boost operational efficiency, the strategic use of digital maps becomes indispensable.

Rising Integration with Autonomous Vehicles and Smart Mobility

The advancement of autonomous driving technologies and connected vehicles has significantly fueled the demand for high-precision 3D digital maps. These maps provide critical layers of information—such as traffic signals, road curvature, and lane-level navigation, that are vital for vehicle autonomy.

Digital maps also support Advanced Driver Assistance Systems (ADAS) and intelligent transportation systems, enhancing road safety and traffic flow. With the emergence of smart cities, real-time traffic data, GIS platforms, and dynamic routing algorithms are being adopted by mobility providers and public agencies alike. This evolution toward smart mobility ecosystems ensures continued growth and innovation in the digital mapping landscape.

Restraints in the Digital Map Market

Data Privacy Concerns and Regulatory Barriers

The collection and use of real-time location data from users raises significant concerns around data privacy and compliance. Many governments have imposed strict data localization and protection regulations, limiting the operational scope of digital mapping services. In regions with stringent privacy laws, such as GDPR in Europe, companies face challenges in storing and processing geospatial intelligence.

Furthermore, real-time tracking applications risk breaching individual privacy, leading to potential legal disputes and reputational damage. These factors can slow the adoption of location analytics platforms and complicate partnerships between mapping service providers and third-party app developers, thereby restraining market expansion.

High Cost of Data Collection and Map Maintenance

Building and maintaining accurate digital maps is resource-intensive, requiring continual updates using satellite imagery, aerial surveys, and LiDAR-based mapping systems. High-resolution 3D mapping especially demands significant investment in sensors, cloud storage, and data analytics infrastructure. For smaller players and new entrants, the cost of acquiring and processing cartographic data can be prohibitive.

Additionally, ensuring global coverage involves logistical complexities and the need to collaborate with regional mapping authorities or telecom providers. These financial and technical barriers limit market accessibility and pose challenges for continuous innovation in the digital cartography ecosystem.

Opportunities in the Digital Map Market

Expansion of Smart Infrastructure and Urban Planning Initiatives

Governments and private sectors are investing heavily in smart city development, opening up vast opportunities for digital map integration in urban planning, infrastructure monitoring, and traffic management. The use of GIS mapping software and spatial data analytics helps planners visualize city layouts, utility networks, and construction progress.

Mapping platforms also aid in simulating disaster response strategies, waste management, and environmental sustainability efforts. As smart city frameworks evolve, digital maps will be embedded in systems for real-time surveillance, energy optimization, and transportation route planning, creating new growth avenues for location intelligence solutions.

Growing Adoption in AR/VR and Gaming Applications

The convergence of augmented reality (AR), virtual reality (VR), and geolocation technology is transforming the digital map market, particularly in gaming, tourism, and education. Immersive apps like AR-based navigation tools or location-aware games depend on 3D spatial mapping and real-world object overlays. These applications demand precise terrain and topographic mapping, enabling hyper-contextual experiences.

Tourism companies use AR-enhanced maps for interactive guides, while educational institutions adopt them for virtual field trips. The increasing popularity of the metaverse and spatial computing environments promises expanded opportunities for digital mapping providers to cater to experiential tech trends.

Trends in the Digital Map Market

Shift toward Real-Time, Cloud-Based Mapping Solutions

The transition from static maps to dynamic, cloud-hosted digital mapping platforms is a significant trend. These solutions allow for continuous updates, real-time traffic visualization, and integration with APIs for customized user experiences. Cloud GIS systems are now being deployed to manage vast spatial datasets efficiently, enabling cross-platform access.

Enterprises leverage these tools for fleet tracking, disaster response, and supply chain optimization. The cloud model enhances scalability, data security, and multi-user collaboration, making it attractive to businesses of all sizes. This shift underscores the movement toward intelligent, connected mapping systems aligned with broader digital transformation goals.

Rise of Crowdsourced and Open-Source Mapping Platforms

User-generated content and open mapping communities like OpenStreetMap are revolutionizing the way maps are created and updated. These platforms rely on crowdsourced geospatial inputs, allowing contributors to add, edit, and validate location data in real time. This approach ensures hyper-local accuracy and faster updates in remote or rapidly changing environments.

Organizations and developers benefit from customizable map layers without the licensing costs associated with proprietary providers. As open-source digital cartography gains credibility, it fosters innovation in sectors like humanitarian aid, civic engagement, and disaster relief. This trend democratizes access to mapping technology and stimulates diverse use cases.

Digital Map Market: Research Scope and Analysis

By Type Analysis

The Geographic Information System (GIS) segment is anticipated to dominate the global digital map market by the end of 2025, accounting for approximately 41.3% of the total revenue share. This dominance is driven by widespread adoption across sectors such as smart city planning, environmental monitoring, and land-use mapping. The increasing need for spatial analysis, 3D mapping, and urban infrastructure management continues to fuel GIS demand.

Government initiatives, integration with remote sensing technologies, and the proliferation of location-based services in commercial and public sectors also enhance market penetration. With real-time mapping capabilities and compatibility with geospatial data analytics, GIS remains an indispensable tool in digital cartography, elevating its significance in the evolving global mapping ecosystem.

The LiDAR segment is expected to register the highest compound annual growth rate (CAGR) in the digital map market by 2025, driven by advancements in autonomous navigation, topographic mapping, and forestry analysis. LiDAR technology offers superior accuracy and resolution in terrain modeling, making it ideal for 3D simulation and elevation data collection.

The rising deployment of unmanned aerial vehicles (UAVs) and demand for precision mapping in infrastructure and disaster management are key growth enablers. Industries like mining, telecom, and renewable energy increasingly leverage LiDAR’s high-density point cloud generation for efficient spatial data processing. As innovation in sensor miniaturization and cost reduction advances, LiDAR's integration into real-time mapping solutions is set to accelerate significantly.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Service Analysis

The Development & Integration segment is projected to dominate the global digital map market by the end of 2025, capturing approximately 47.8% of the total revenue share. This segment’s dominance is attributed to the increasing need for real-time mapping solutions across industries such as autonomous driving, urban development, and fleet tracking. As enterprises adopt spatial intelligence and geospatial software platforms, demand for seamless system integration and custom map development continues to rise.

Additionally, the growing complexity of smart infrastructure and the use of interactive mapping in logistics and utilities enhance the value of tailored deployment services. The integration of digital twin technology and scalable map infrastructure further strengthens the segment’s leading position in the evolving market landscape.

The Support & Maintenance segment is expected to witness the highest CAGR in the digital map market by 2025, owing to the growing emphasis on system performance, data accuracy, and continuous software updates. As businesses depend on geolocation tools for operations like asset monitoring and delivery route optimization, the demand for proactive support frameworks is surging.

Frequent updates of spatial datasets, API maintenance, and security patching are crucial in sectors like defense, agriculture, and emergency response. The rise of subscription-based mapping platforms and managed services in GIS further drives growth. This segment plays a critical role in ensuring uninterrupted access to real-time digital cartography, increasing its strategic importance across data-driven enterprises and public sector projects.

By Mapping Type Analysis

The Outdoor mapping segment is projected to dominate the global digital map market by the end of 2025, securing approximately 66.4% of the overall market share. Its leadership is driven by widespread utilization in transportation networks, satellite navigation systems, and geographic modeling. Outdoor digital mapping plays a critical role in sectors such as tourism, civil engineering, and autonomous mobility, where real-time terrain visualization and route planning are essential.

The expansion of GPS-enabled applications and government initiatives in infrastructure digitization further contribute to its dominance. With growing demand for precise topographic representation and spatial data visualization in large-scale projects, outdoor mapping continues to hold a central role in the evolving digital geolocation ecosystem.

The Metaverse mapping segment is anticipated to experience the highest CAGR in the digital map market by the end of 2025, propelled by the rapid advancement of immersive technologies and 3D geospatial modeling. As industries adopt extended reality (XR) for simulation, digital commerce, and smart environment planning, the need for high-fidelity virtual maps grows exponentially.

This segment enables real-time spatial rendering and interactive navigation within synthetic environments, making it vital for next-generation applications in gaming, virtual tourism, and digital twins. The convergence of spatial computing, blockchain-enabled assets, and AI-based rendering techniques is further accelerating the deployment of metaverse-integrated mapping platforms across commercial and enterprise-level ecosystems.

By Application Analysis

The Routing and Navigation segment is expected to dominate the global digital map market by the end of 2025, accounting for approximately 52.6% of the total revenue share. This dominance is driven by increasing reliance on GPS-based applications for vehicle routing, last-mile delivery optimization, and real-time traffic management. Navigation platforms are widely used in ride-hailing, logistics, aviation, and marine sectors for dynamic route planning and fuel efficiency.

Integration of artificial intelligence with pathfinding algorithms enhances predictive capabilities, further elevating adoption. The surge in connected vehicles and smart mobility solutions significantly contributes to the segment’s expansion. Routing and navigation continue to form the backbone of location intelligence services in both commercial and consumer digital mapping environments.

The Asset Tracking segment is projected to register the highest CAGR in the digital map market by the end of 2025, driven by the rising demand for real-time visibility and inventory monitoring across multiple industries. This segment supports fleet telematics, cargo tracing, and mobile workforce management, enabling seamless operational control.

Advancements in IoT-enabled sensors, cloud integration, and edge computing are transforming asset intelligence platforms, making digital mapping a core component. With growing adoption in construction, manufacturing, and utilities, asset tracking leverages spatial accuracy to improve productivity and reduce operational risks. The push for supply chain transparency and predictive maintenance further boosts the need for geospatial monitoring tools, accelerating this segment's growth trajectory globally.

End User Analysis

The Automotive segment is anticipated to dominate the global digital map market by the end of 2025, capturing approximately 34.9% of the total revenue share. The rising integration of advanced navigation systems in connected vehicles, electric cars, and autonomous driving platforms drives this leadership. Automotive manufacturers are increasingly embedding high-definition mapping software for real-time traffic analysis, adaptive routing, and hazard detection.

Enhanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication rely heavily on geospatial data for safe and efficient mobility. As demand for smart mobility infrastructure accelerates, digital mapping becomes indispensable in facilitating seamless transportation experiences and optimizing vehicular performance, solidifying the automotive segment's stronghold in the global geolocation solutions landscape.

The Infrastructure Development and Construction segment is projected to register the highest CAGR in the digital map market by the end of 2025, driven by increasing adoption of location-enabled tools for land surveying, urban planning, and project management. Construction firms leverage spatial visualization for site analysis, zoning compliance, and risk mitigation.

twins, 3D terrain models, and BIM integration are reshaping infrastructure workflows, making mapping tools vital for project execution and monitoring. The rising focus on smart cities and sustainable development also enhances demand for geospatial planning tools. With the increased digitization across the construction value chain, this segment is poised for rapid growth, enabling efficient decision-making and enhancing operational accuracy through advanced mapping applications.

The Digital Map Market Report is segmented on the basis of the following:

By Type

- Geographic Information System (GIS)

- LiDAR

- Digital Orthophotography

- Aerial Photography

- Global Positioning System (GPS)

By Service

- Consulting

- Development & Integration

- Support & Maintenance

By Mapping Type

By Application

- Asset Tracking

- Geo-positioning and Geocoding

- Routing and Navigation

- Others

By End User

- Automotive

- Military & Defense

- Mobile Devices

- Enterprise Solutions

- Logistics, Travel, and Transportation

- Infrastructure Development and Construction

- Others

Regional Analysis

Region with the largest Share

North America holds the largest share in the global digital map market, accounting for approximately 41.7% by the end of 2025. The region's dominance is attributed to the widespread adoption of advanced navigation systems, strong presence of key mapping solution providers, and rapid deployment of autonomous vehicle technologies. The U.S. leads in real-time mapping innovations across transportation, defense, and infrastructure sectors. High investment in geospatial intelligence, smart mobility platforms, and integration of IoT with location-based services further fuels growth.

Additionally, North America's robust regulatory framework and support for digital transformation across industries contribute to its leading position. The region continues to be a global hub for cutting-edge mapping software, sensor integration, and satellite-based positioning technologies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with Highest CAGR

The Asia-Pacific region is projected to register the highest CAGR in the global digital map market by the end of 2025, driven by increasing urbanization, infrastructure expansion, and smart city initiatives. Countries like China, India, Japan, and South Korea are rapidly adopting geospatial solutions across transportation planning, construction, and public safety.

The growth of ride-hailing platforms, e-commerce logistics, and real-time navigation apps also significantly boosts digital mapping demand. With rising investments in autonomous vehicle development and mobile-based location intelligence, the region is witnessing an accelerated shift toward digital mapping technologies. Government-backed initiatives supporting satellite imaging, 3D mapping, and GIS integration are propelling the region to become a major player in the global location data ecosystem.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Impact of Artificial Intelligence in the Digital Map Market

- Enhanced Map Accuracy and Real-Time Updates: Artificial intelligence significantly boosts the accuracy of digital maps by processing massive datasets from satellite imagery, sensors, and crowdsourced content. AI algorithms can detect changes such as new roads or traffic patterns in real-time, ensuring that maps stay updated without manual intervention, which is critical for navigation systems.

- Predictive Traffic and Route Optimization: AI-powered digital maps can predict traffic congestion, weather disruptions, or roadblocks based on historical data and live inputs. These predictive capabilities help logistics providers, commuters, and emergency services make informed decisions, improving travel efficiency and reducing delays and fuel consumption.

- Autonomous Systems Enablement: AI plays a crucial role in creating high-definition maps for autonomous vehicles. It interprets sensor data, classifies road elements, and continuously learns from driving environments. This empowers self-driving systems to make real-time navigational decisions, enhancing vehicle safety and adapting to dynamic road conditions.

- Contextual and Personalized Mapping: With AI, digital maps are becoming more personalized and context-aware. They can analyze user behavior, preferences, and usage patterns to suggest relevant points of interest, optimal routes, or even preferred travel modes. This customization improves user experience and supports smarter city living and travel planning.

Competitive Landscape

The competitive landscape of the global digital map market is characterized by the presence of established players and emerging innovators focusing on advanced geospatial solutions. Key companies such as Google LLC, Apple Inc., HERE Technologies, TomTom International, and Esri dominate the space through continuous investments in real-time navigation systems, high-definition mapping, and AI-powered cartographic tools. These players are expanding their geographic footprint by partnering with automotive manufacturers, logistics providers, and smart infrastructure developers.

Strategic collaborations, acquisitions, and technological advancements in satellite imaging, LiDAR data processing, and GIS platforms are driving competitive intensity. Companies are focusing on enhancing user experience through interactive map visualization, 3D terrain modeling, and dynamic routing algorithms. The integration of cloud-based mapping APIs, IoT-enabled asset tracking, and indoor mapping services has further intensified competition.

Additionally, the rising demand for location-based analytics, urban mobility planning, and augmented reality applications is prompting vendors to innovate continuously. Startups are entering the market with niche offerings in the metaverse mapping and drone-based data acquisition segments. As demand grows across sectors like defense, agriculture, and e-commerce, market participants are prioritizing scalable, secure, and data-rich mapping ecosystems to maintain a competitive edge in this rapidly evolving geospatial intelligence landscape.

Some of the prominent players in the Global Digital Map Market are:

- Google LLC

- Apple Inc.

- HERE Technologies

- TomTom International BV

- Esri

- Mapbox

- Microsoft Corporation

- Amazon Web Services, Inc.

- Garmin Ltd.

- Baidu, Inc.

- NavInfo Co., Ltd.

- Zenrin Co., Ltd.

- OpenStreetMap Foundation

- Nearmap Ltd.

- DigitalGlobe, Inc.

- Alibaba Group

- Telenav, Inc.

- INRIX, Inc.

- Maxar Technologies

- AutoNavi Holdings Ltd.

- Other Key Players

Recent Developments

- In March 2025, HERE Technologies unveiled an AI-powered real-time traffic prediction layer for its digital maps, enhancing route planning and navigation accuracy across logistics, automotive, and smart city applications.

- In February 2025, Google announced enhanced indoor Live View navigation for malls, airports, and stadiums using AR on Google Maps, expanding its immersive digital mapping capabilities.

- In June 2024, TomTom launched a next-generation open digital map platform in collaboration with Microsoft and Amazon, aimed at accelerating the development of location-based services and autonomous vehicle navigation.

- In May 2024, Esri released ArcGIS Reality, a digital mapping solution using drone and aerial imagery to create high-resolution 3D maps for city planning, infrastructure, and environmental monitoring.

- In October 2024, Mapbox introduced advanced weather visualization tools in its mapping SDK, integrating real-time meteorological data layers to support aviation, agriculture, and logistics applications.

- In November 2024, Baidu Maps integrated generative AI for voice-based navigation and personalized route suggestions, improving user engagement in China's highly competitive digital map market.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 31.7 Bn |

| Forecast Value (2034) |

USD 84.5 Bn |

| CAGR (2025–2034) |

11.5% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 11.1 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Geographic Information System (GIS), LiDAR, Digital Orthophotography, Aerial Photography, Global Positioning System (GPS)), By Service (Consulting, Development & Integration, Support & Maintenance), By Mapping Type (Indoor, Outdoor, Metaverse), By Application (Asset Tracking, Geo-positioning and Geocoding, Routing and Navigation, Others), By End User (Automotive, Military & Defense, Mobile Devices, Enterprise Solutions, Logistics, Travel, and Transportation, Infrastructure Development and Construction, Others) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Google LLC, Apple Inc., HERE Technologies, TomTom International BV, Esri, Mapbox, Microsoft Corporation, Amazon Web Services, Inc., Garmin Ltd., Baidu, Inc., NavInfo Co., Ltd., Zenrin Co., Ltd., OpenStreetMap Foundation, Nearmap Ltd., DigitalGlobe, Inc., Alibaba Group, Telenav, Inc., INRIX, Inc., Maxar Technologies, AutoNavi Holdings Ltd., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Digital Map Market?

▾ The Global Digital Map Market size is estimated to have a value of USD 31.7 billion in 2025 and is expected to reach USD 84.5 billion by the end of 2034.

Which region accounted for the largest Global Digital Map Market?

▾ North America is expected to be the largest market share for the Global Digital Map Market with a share of about 41.7% in 2025.

Who are the key players in the Global Digital Map Market?

▾ Some of the major key players in the Global Digital Map Market are Google LLC, Apple Inc., HERE Technologies, and many others.

What is the growth rate in the Global Digital Map Market?

▾ The market is growing at a CAGR of 11.5% over the forecasted period.

How big is the US Digital Map Market?

▾ The US Digital Map Market size is estimated to have a value of USD 11.1 billion in 2025 and is expected to reach USD 28.0 billion by the end of 2034.