Market Overview

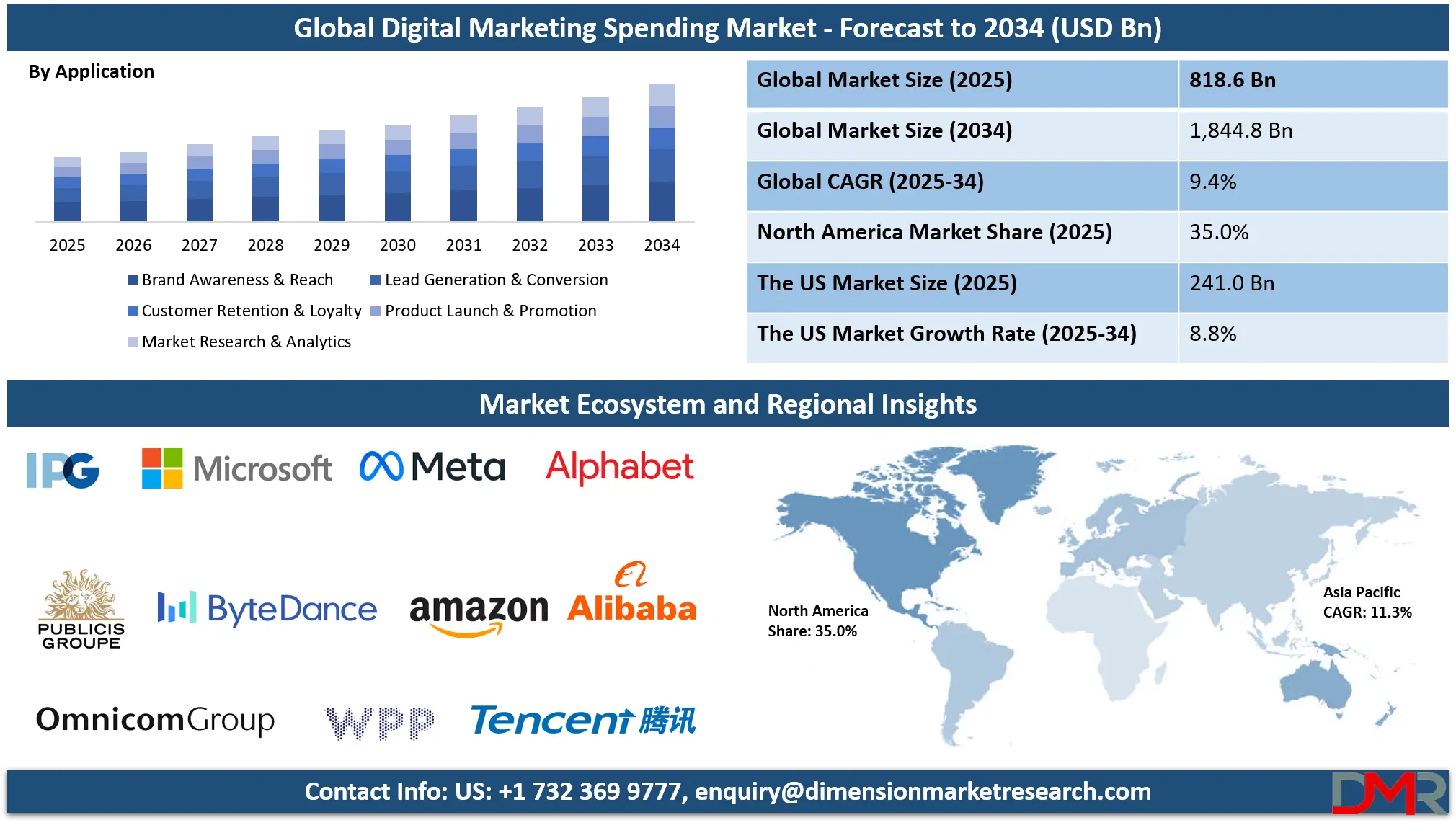

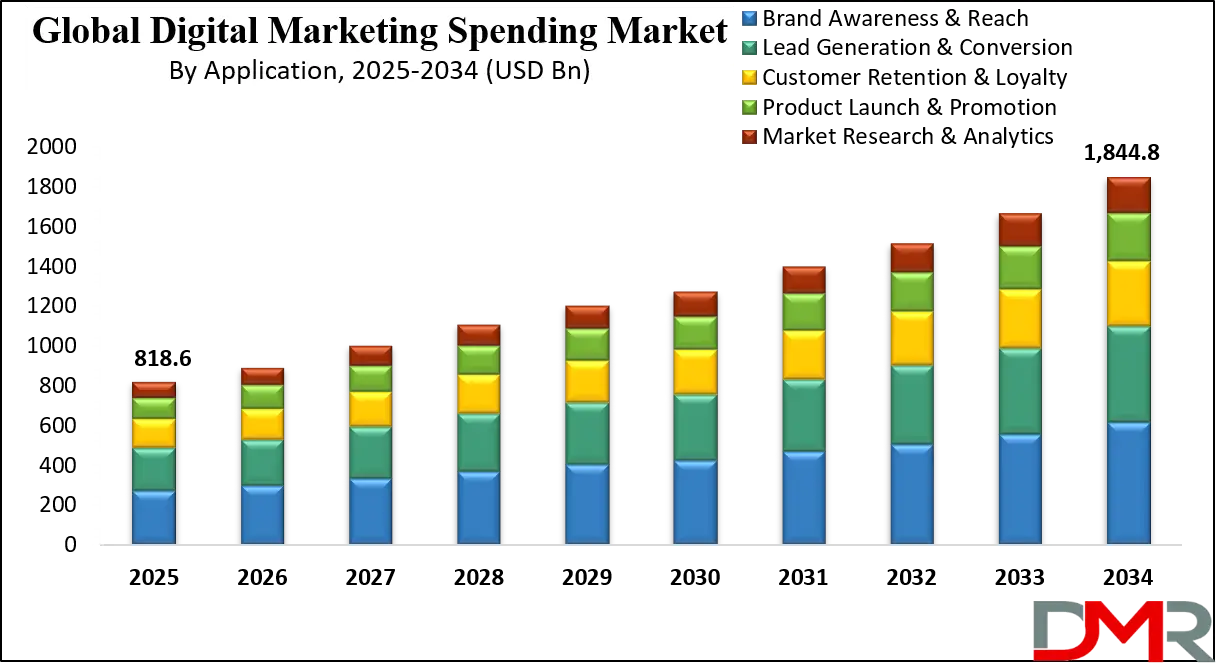

The Global Digital Marketing Spending Market is anticipated to reach USD 818.6 billion in 2025 and is forecast to expand at a CAGR of 9.4% between 2025 and 2034, reaching approximately USD 1,844.8 billion by 2034, driven by rising investments in online advertising, data-driven marketing, social media campaigns, search engine marketing, programmatic advertising, influencer marketing, and AI-powered customer engagement solutions across industries. The market's rapid growth is driven by the accelerating shift from traditional to digital channels, the proliferation of internet and smartphone users, and the increasing demand for personalized, data-driven customer engagement.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Digital marketing enables brands to reach global audiences through AI-driven targeting, omnichannel campaigns, and real-time performance analytics, supporting businesses in both mature and emerging markets where digital consumption is soaring. The model addresses the evolving challenges of customer acquisition and retention in a fragmented media landscape, helping brands optimize return on investment (ROI) through measurable strategies.

Technological advancements, including AI and machine learning for predictive analytics, programmatic ad buying, advanced CRM integration, interactive video content, and immersive AR/VR experiences, are transforming the market into a highly automated and personalized ecosystem. Integration of big data analytics for customer segmentation, behavior tracking, and cross-channel attribution is reshaping marketing effectiveness.

Growing business investment in digital transformation, e-commerce expansion, and the rise of direct-to-consumer (DTC) models further accelerate global adoption. However, barriers such as data privacy regulations, ad-blocking technologies, talent shortages in digital skills, and measurement fragmentation remain. Despite these limitations, the convergence of martech innovation, AI automation, and shifting consumer behavior positions digital marketing spending as a central driver of global business growth through 2034.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Digital Marketing Spending Market

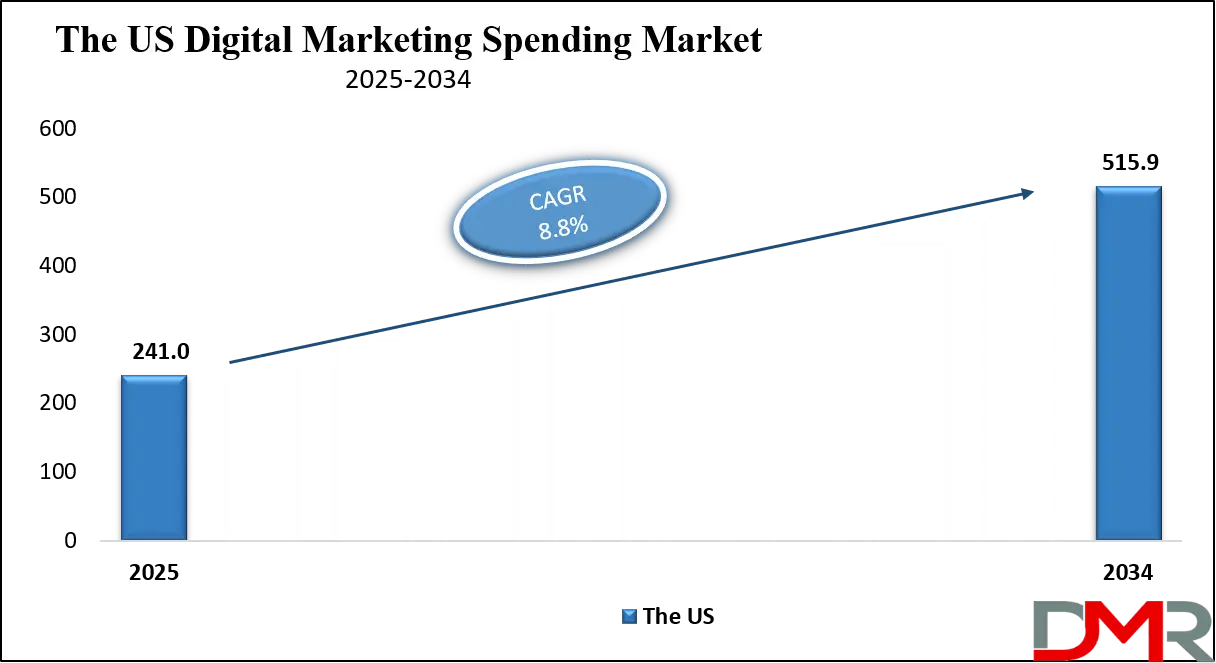

The U.S. Digital Marketing Spending Market is projected to reach USD 241.0 billion in 2025 and grow at a CAGR of 8.8%, reaching USD 515.9 billion by 2034. The U.S. leads global adoption due to its mature digital ecosystem, high consumer digital literacy, and dominance of major tech platforms and brands.

More than 90% of U.S. businesses utilize digital marketing, fueling demand for sophisticated strategies across search, social, and programmatic advertising. Leading corporations and SMBs are increasing budgets for AI-powered marketing automation, personalized content, and omnichannel customer journeys. Major platforms such as Google, Meta, Amazon, and Microsoft continuously innovate their advertising offerings, integrating advanced AI and measurement tools.

U.S. regulatory frameworks, including evolving data privacy laws, shape investment in compliant first-party data strategies. Meanwhile, national trends such as the growth of retail media networks, connected TV (CTV) advertising, and influencer marketing are reshaping allocation across digital channels.

The rapid rise of AI-generated content, real-time bidding (RTB), customer data platforms (CDPs), and privacy-centric measurement solutions continues to redefine the U.S. marketing landscape, positioning the country as a global leader in digital advertising innovation and spending.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The Europe Digital Marketing Spending Market

The Europe Digital Marketing Spending Market is projected to be valued at approximately USD 163.7 billion in 2025 and is projected to reach around USD 369.0 billion by 2034, growing at a CAGR of about 9.4% from 2025 to 2034. Europe's growth is anchored by strong digital infrastructure, high internet penetration, and stringent data privacy regulations that drive investment in compliant martech solutions.

Countries such as the U.K., Germany, France, Italy, and the Nordic region have widely adopted programmatic advertising, social commerce, and content marketing, driven by multi-national brands and a robust e-commerce sector. The GDPR and ePrivacy Directive have catalyzed innovation in privacy-first marketing, first-party data utilization, and contextual targeting.

Europe's diverse and digitally-savvy consumer base, combined with high mobile usage and cross-border e-commerce, further drives digital marketing uptake. Funding through digital transformation initiatives and the growth of regional tech hubs supports adoption of AI in marketing, advanced analytics, and unified customer experience platforms.

Brands and agencies increasingly deploy omnichannel strategies, retail media, and sustainable digital advertising practices. With strong regulatory frameworks, high digital maturity, and investment in personalized engagement, Europe remains one of the most advanced and competitive regions in digital marketing.

The Japan Digital Marketing Spending Market

The Japan Digital Marketing Spending Market is projected to be valued at USD 52.4 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 118.1 billion in 2034 at a CAGR of 9.4%.

The Japan Digital Marketing Spending Market represents one of the most mature and technologically advanced markets globally, driven by high internet penetration, widespread smartphone adoption, and a digitally savvy consumer base. .

Japan’s digital marketing ecosystem is characterized by strong investments in search advertising, display ads, social media marketing, video advertising, and data-driven performance marketing. E-commerce growth, the increasing use of AI-powered analytics, and personalized marketing strategies are key factors accelerating spend. Major domestic platforms, along with global players such as Google, Meta, and Amazon, play a central role in shaping campaign strategies.

The market growth is supported by continued digital transformation across industries including retail, automotive, finance, and entertainment. Additionally, Japan’s aging population is encouraging brands to adopt omnichannel and mobile-first approaches to reach diverse demographic segments effectively.

Global Digital Marketing Spending Market: Key Takeaways

- Strong Global Market Growth Outlook: The Global Digital Marketing Spending Market is expected to be valued at USD 1.25 billion in 2025 and is projected to reach USD 1,844.8 billion by 2034, showcasing rapid expansion supported by the irreversible shift to digital commerce and engagement.

- High CAGR Driven by Digital Transformation: The market is expected to grow at an impressive CAGR of 9.4% from 2025 to 2034, fueled by accelerated investment in AI and automation, the growth of e-commerce and social commerce, and the need for measurable marketing ROI.

- Strong Growth Trajectory in the United States: The U.S. Digital Marketing Spending Market stands at USD 241.0 billion in 2025 and is projected to reach USD 515.9 billion by 2034, expanding at a CAGR of 8.8% due to robust digital infrastructure, high advertiser maturity, and continuous platform innovation.

- North America Maintains Regional Dominance: North America is expected to capture approximately 35% of the global market share in 2025, supported by the concentration of major tech firms, high digital ad spend per capita, and early adoption of emerging channels like CTV and retail media.

- Rapid Advancement in Marketing Technologies: Innovations including AI-powered personalization, programmatic advertising, advanced analytics platforms, and immersive ad formats are significantly accelerating the efficiency, targeting, and scalability of digital marketing campaigns.

- Growing Investment in Customer Experience Boosts Adoption: Rising competition for consumer attention, the shift to first-party data strategies, and the demand for personalized omnichannel journeys are driving sustained investment in digital marketing capabilities across industries.

Global Digital Marketing Spending Market: Use Cases

- E-commerce Brand Activation: Online retailers use targeted social media ads, search engine marketing, and influencer partnerships to drive traffic, conversions, and customer loyalty.

- Programmatic Brand Campaigns: Automated ad buying across display, video, and CTV enables real-time bidding and audience-based targeting at scale, optimizing reach and frequency.

- Content Marketing & SEO: Brands invest in valuable content creation and search optimization to attract organic traffic, build authority, and support the customer journey from awareness to decision.

- Customer Retention & Email Automation: Personalized email sequences, triggered by behavior, enhance customer lifetime value through nurturing, cross-selling, and re-engagement.

- Localized Mobile Marketing: Geo-targeted push notifications, in-app ads, and mobile search campaigns connect brick-and-mortar businesses with nearby consumers in real-time.

Global Digital Marketing Spending Market: Stats & Facts

IAB UK (Industry Body – UK Digital Advertising Association)

- UK digital advertising spend in 2024 was USD 45.1 billion.

- UK digital ad spend grew 13% year-on-year in 2024.

- UK digital ad spend is projected to reach USD 57.2 billion by 2026.

- UK digital ad spend in H1 2025 reached USD 23.7 billion.

- Search advertising accounted for 44% of UK digital ad investment.

- Video advertising represented 23% of UK digital ad spend.

- Online retail media ad spend in the UK reached USD 1.9 billion in H1 2025.

IAB Europe (Pan-European Industry Body)

- Europe’s digital advertising market exceeded USD 129.6 billion in 2024.

IAB / PwC Internet Advertising Revenue Report (Industry Body – Global / US)

- Global digital advertising revenue reached USD 259 billion in 2024.

- Global digital advertising revenue grew 15% year-on-year in 2024.

IPSOS (Industry Organization – India Digital Advertising)

- India’s digital advertising spend reached USD 4.9 billion in FY 2024–25.

- Digital media accounted for 41% of total advertising spend in India.

- Social media advertising captured 30% of India’s digital ad spend.

- Paid search advertising in India grew 32% year-on-year.

- FMCG and e-commerce together contributed 67% of India’s digital ad spend growth.

Global Digital Marketing Spending Market: Market Dynamic

Driving Factors in the Global Digital Marketing Spending Market

Rise of E-commerce and Digital Consumerism

The exponential growth of online shopping, accelerated by the pandemic, is a major driver for digital marketing investment. Consumers now research, compare, and purchase predominantly through digital channels. Brands must maintain a constant, personalized presence across search, social, and marketplaces to compete. This demands increased spending on performance marketing, social commerce integrations, and seamless omnichannel experiences to drive conversion and loyalty.

Technology Innovation and AI Adoption

Digital marketing is being revolutionized by AI and machine learning, which enable hyper-personalization, predictive analytics, automated bidding, and real-time optimization. Technologies like customer data platforms (CDPs), advanced attribution modeling, and generative AI for content creation are making marketing more efficient and effective. This drives increased spending as companies invest in martech stacks to gain a competitive advantage and improve ROI.

Restraints in the Global Digital Marketing Spending Market

Data Privacy and Regulatory Compliance

Evolving global data privacy laws (GDPR, CCPA, etc.) and the deprecation of third-party cookies create significant challenges for targeting and measurement. Compliance requires costly technological adjustments, shifts to first-party data, and new targeting methods, which can initially reduce reach and increase operational complexity, potentially restraining budget growth in the short term.

Ad Fatigue and Channel Saturation

Consumers are increasingly experiencing ad overload, leading to banner blindness, ad-blocking usage, and negative brand perception. Rising costs-per-click (CPC) in crowded channels like social media and search also pressure marketing efficiency. This necessitates higher spend for the same results or forces brands to constantly seek newer, more expensive emerging channels.

Opportunities in the Global Digital Marketing Spending Market

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and Africa represent major growth opportunities due to rapidly growing internet and smartphone penetration, a burgeoning middle class, and underpenetrated digital advertising landscapes. Localized strategies leveraging mobile-first platforms, influencer networks, and regional social media offer high-growth potential for global and local brands.

Adoption of Immersive and Interactive Formats

The growth of connected TV (CTV), augmented reality (AR), virtual reality (VR), and interactive video advertising offers new avenues for engagement. These formats command higher CPMs and offer novel ways to capture attention, providing opportunities for brands to differentiate and increase share of voice, thus driving new budget allocation.

Trends in the Global Digital Marketing Spending Market

AI-Powered Personalization at Scale

The use of AI to deliver individualized marketing messages, product recommendations, and dynamic creative across all touchpoints is becoming standard. This trend moves beyond segmentation to true one-to-one marketing, improving customer experience and conversion rates, and justifying increased investment in data and AI capabilities.

The Rise of Retail Media Networks

E-commerce platforms and large retailers (Amazon, Walmart, Tesco) are monetizing their first-party data and site traffic by offering advertising space to third-party brands. This high-intent, closed-loop channel is attracting significant budget reallocation from traditional digital channels due to its proven performance and access to valuable purchase data.

Global Digital Marketing Spending Market: Research Scope and Analysis

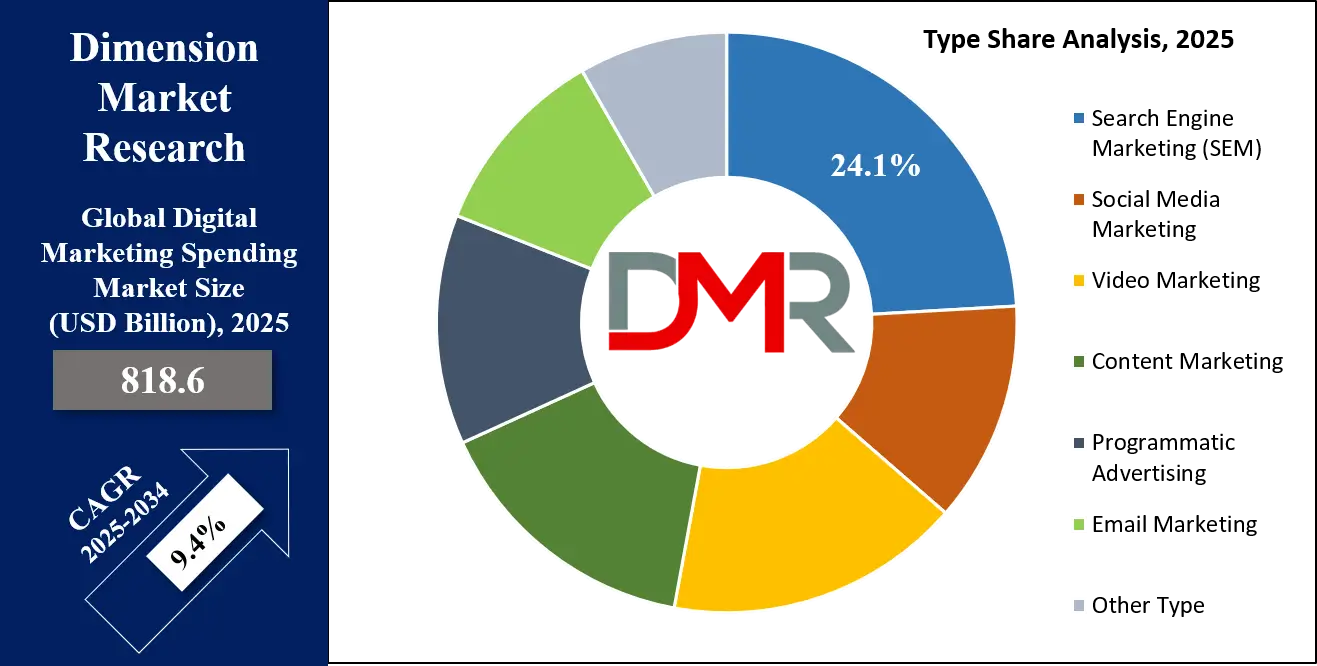

By Type Analysis

Search Engine Marketing (SEM) is projected to maintain its dominance of the global market throughout the forecast period. This supremacy is rooted in its foundational role as a high-intent, demand-capture channel. SEM, encompassing both paid search advertising (PPC) and the organic investment of Search Engine Optimization (SEO), is where consumers actively express commercial needs. Businesses across every vertical, from e-commerce and B2B services to local retail, allocate substantial budgets to compete for visibility on search engine results pages (SERPs) of Google, Bing, and increasingly,

Amazon. Its dominance is continuously reinforced by platform innovation, such as AI-powered smart bidding, the expansion of local search and map-based ads, and the seamless integration of shopping ads that bridge search and purchase. The channel's inherent measurability, direct connection to conversions, and critical role in the e-commerce funnel ensure it remains the largest and most essential segment, commanding the single biggest share of digital marketing budgets through 2034.

Social Media Marketing ranks as the unequivocal second-largest type segment, driven by the unparalleled scale of global user bases, incredibly granular targeting capabilities derived from rich user data, and the accelerating integration of commerce functionalities directly within social platforms.

Its strength is dual-purpose: it is paramount for brand building, community engagement, and viral storytelling, while simultaneously evolving into a powerful performance-driven channel for lead generation and direct sales via shoppable posts and in-app checkout. The continuous introduction of new formats (Reels, Stories, live shopping) and the dominance of platforms like Meta, TikTok, and YouTube in daily consumer attention guarantee its position as a massive and non-negotiable component of the marketing mix.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Application Analysis

Brand Awareness & Reach is poised to be the largest application segment by allocated spend. Establishing a dominant digital presence and achieving top-of-funnel visibility remains a primary strategic objective for the vast majority of businesses, from startups to global conglomerates. This segment includes large-scale video campaigns on YouTube and CTV, expansive display advertising networks, and broad-reach social media initiatives designed to build brand equity and mental availability.

Investment here is fueled by the intense competition for consumer attention in an oversaturated digital landscape and the understanding that strong brand building lowers the cost and increases the effectiveness of downstream performance activities. The rapid growth of high-engagement, brand-safe environments like Connected TV (CTV) and Digital Out-of-Home (DOOH) provides new, scalable avenues for impactful brand campaigns, further solidifying this segment's leading position.

Lead Generation & Conversion stands as the critical second-largest application segment, representing the engine of measurable business growth for most advertisers. This is the domain of performance marketing, where spending is directly tied to specific, actionable outcomes such as form fills, app downloads, phone calls, and online sales.

Key tactics include Search Engine Marketing (SEM) for high-intent keywords, lead generation ads on social platforms, targeted email marketing automation sequences, and affiliate marketing programs. The relentless focus on ROI, efficiency, and optimization within this segment drives continuous investment in analytics, attribution technology, and AI-powered bidding tools to maximize the return on every dollar spent.

By End User Analysis

Retail & E-commerce is anticipated to dominate the market as the largest end-user sector. This sector is inherently digital and operates in a hyper-competitive, low-margin environment where customer acquisition efficiency is paramount. Pure-play e-commerce companies spend aggressively on performance channels (SEM, social retargeting) to drive traffic and conversions.

Omnichannel retailers invest heavily in digital marketing not only to drive online sales but also to increase foot traffic to physical stores through localized mobile marketing and click-and-collect promotions. The continuous, structural growth of online shopping globally, coupled with the sector's pioneering adoption of emerging channels like retail media networks and social commerce, ensures that Retail & E-commerce remains the single most significant and innovative source of digital marketing expenditure.

BFSI (Banking, Financial Services & Insurance) represents the second-largest end-user segment. Digital marketing is crucial for this sector in acquiring customers for digital banking apps, credit cards, insurance products, loan services, and investment platforms. Marketing strategies in BFSI must balance high-performance lead generation with the imperative of building trust, security, and regulatory compliance.

This leads to significant spending on a mix of targeted performance ads, high-quality educational content marketing, and brand campaigns that establish credibility. The intense competition from both traditional banks and agile fintech disruptors fuels continuous and substantial digital investment.

The Global Digital Marketing Spending Market Report is segmented on the basis of the following:

By Type

- Search Engine Marketing (SEM)

- Social Media Marketing

- Video Marketing

- Content Marketing

- Programmatic Advertising

- Email Marketing

- Other Type

By Application

- Brand Awareness & Reach

- Lead Generation & Conversion

- Customer Retention & Loyalty

- Product Launch & Promotion

- Market Research & Analytics

By End User

- Retail & E-commerce

- BFSI

- Healthcare & Pharma

- Automotive

- Travel & Hospitality

- Telecom & IT

- Media & Entertainment

- Other End User

Impact of Artificial Intelligence in the Global Digital Marketing Spending Market

- AI for Predictive Audience Targeting: AI analyzes vast datasets to predict consumer behavior and identify high-value audience segments, optimizing ad spend and improving campaign relevance and conversion rates.

- Programmatic Advertising Optimization: AI algorithms automate real-time bidding, ad placement, and creative selection, maximizing ROI and efficiency across display, video, and CTV campaigns.

- Dynamic Creative Optimization (DCO): AI generates and tests thousands of ad creative variations in real-time, personalizing messages, images, and CTAs for different audience segments to boost engagement.

- AI-Driven Customer Journey Analytics: AI maps and predicts the customer journey across channels, attributing value to each touchpoint and enabling budget reallocation to the most influential marketing activities.

- Chatbots & Conversational Marketing: AI-powered chatbots provide instant customer service, qualify leads, and guide users through the sales funnel, blending marketing and sales functions seamlessly.

Global Digital Marketing Spending Market: Regional Analysis

Region with the Largest Revenue Share

North America is projected to dominate the Global Digital Marketing Spending Market, capturing approximately 35.0% of the global market share by the end of 2025. This leadership position is driven by a confluence of powerful, self-reinforcing factors. The region is home to the global headquarters of the dominant digital advertising platforms Google, Meta, Amazon, and Microsoft whose innovations and policies disproportionately shape the worldwide market.

It possesses the world's most mature and sophisticated digital advertising ecosystem, characterized by high advertiser literacy, advanced martech adoption, and a culture of data-driven decision-making. The United States, in particular, benefits from a large, high-spending consumer base with exceptional digital engagement levels and early, widespread adoption of next-generation channels like Connected TV (CTV) and retail media networks. Strong, sustained investment in marketing technology innovation, data analytics, and performance marketing by both Fortune 500 enterprises and SMBs solidifies North America's position at the forefront of both spending and strategic sophistication.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

Region with the Highest CAGR

The Asia-Pacific region holds the highest Compound Annual Growth Rate (CAGR) and is decisively poised to achieve the largest absolute market share in digital marketing spending during the forecast period. This trajectory is fueled by the region's unparalleled scale and dynamism: a massive, young, and digitally-native population; explosive e-commerce growth that outpaces the rest of the world; and rapid, deep smartphone adoption that makes mobile the primary digital interface.

Countries like China and India are not just large markets but digital marketing powerhouses with unique, self-contained ecosystems dominated by local platform giants (Alibaba, Tencent, ByteDance). Government-led digitalization initiatives (e.g., Digital India, China's Internet+ strategy), a rapidly expanding middle class with growing disposable income, and increasing internet penetration across Southeast Asia are collectively fueling unprecedented annual growth in digital ad investment. APAC's unique blend of scale, innovation, and growth momentum makes it the undisputed engine for global market expansion.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Marketing Spending Market: Competitive Landscape

The Global Digital Marketing Spending Market is characterized as highly fragmented and intensely competitive, comprising a diverse and interlinked ecosystem of several key player categories. At the pinnacle are the global technology and platform "walled gardens" primarily Google, Meta, Amazon, and Microsoft which collectively dominate a significant majority of global digital ad revenue through their control of search, social, e-commerce search, and major programmatic ecosystems. They compete fiercely by continuously innovating their advertising products, integrating deeper AI and commerce capabilities, and developing new measurement tools.

Major global holding companies and agency networks WPP, Omnicom, Publicis Groupe, Interpublic Group (IPG), and Dentsu play an indispensable role as strategic partners and executors for large advertisers. They compete by building integrated service offerings that combine data, technology, creative, and media buying at scale, investing heavily in proprietary tech stacks and strategic consulting to retain and grow client spend.

A critical and rapidly evolving segment consists of specialized marketing technology (martech) and advertising technology (adtech) vendors. Companies like Salesforce (Marketing Cloud), Adobe (Experience Cloud), The Trade Desk, HubSpot, and Shopify provide the essential software platforms that enable brands to manage customer relationships, orchestrate campaigns, analyze data, and execute programmatic buying. Their innovation directly influences how and where marketing budgets are allocated and optimized.

Some of the prominent players in the Global Digital Marketing Spending Market are:

- Google LLC (Alphabet Inc.)

- Meta Platforms, Inc.

- Amazon.com, Inc.

- Microsoft Corporation

- Alibaba Group Holding Limited

- ByteDance Ltd. (TikTok)

- Tencent Holdings Ltd.

- WPP plc

- Omnicom Group Inc.

- Publicis Groupe

- Interpublic Group (IPG)

- Dentsu Group Inc.

- Salesforce, Inc.

- Adobe Inc.

- The Trade Desk, Inc.

- HubSpot, Inc.

- Shopify Inc.

- Pinterest, Inc.

- Snap Inc.

- Twitter, Inc.

- Other Key Players

Recent Developments in the Global Digital Marketing Spending Market

- November 2025: Google launches Gemini-powered campaign suite

Google introduced a comprehensive, AI-driven campaign management suite powered by its next-generation "Gemini" model. The suite offers fully automated creative generation from text prompts, predictive budget allocation across channels, and enhanced performance forecasting, aiming to reshape the efficiency and strategic approach to SEM and display advertising for millions of advertisers.

- October 2025: Meta announces advanced AI shopping ads

Meta unveiled its next-generation AI shopping ad products, which can automatically generate dynamic product catalogs, create engaging video ads from static product images, and use predictive algorithms to identify users with the highest likelihood to purchase, significantly aiming to boost ROI for e-commerce advertisers on its platforms.

- October 2025: IAB Annual Leadership Meeting highlights cookieless future

The Interactive Advertising Bureau's (IAB) 2025 Annual Leadership Meeting became a focal point for the industry's accelerated transition. Major brands, agencies, and tech providers announced substantial increased budgets dedicated to building first-party data infrastructure, testing contextual targeting solutions, and implementing new identity frameworks, marking a pivotal shift in investment strategy.

- September 2025: Amazon expands its retail media network to offline attribution

Amazon Advertising significantly expanded its measurement capabilities by integrating its platform with major third-party point-of-sale (POS) systems. This breakthrough allows CPG and other brands to measure the direct impact of their digital ads on Amazon on in-store sales at partner retailers, attracting a major reallocation of traditional trade and brand marketing budgets.

- August 2025: The Trade Desk launches Kokai AI platform globally

The leading independent demand-side platform (DSP), The Trade Desk, launched its ambitious "Kokai" AI platform worldwide. Kokai offers advertisers enhanced AI-powered optimization, planning, and forecasting tools for the open internet, strengthening competition with walled gardens and prompting increased investment in programmatic advertising outside of Google and Meta.

- July 2025: Salesforce and Microsoft deepen marketing cloud integration

A landmark partnership deepened the integration between Salesforce Marketing Cloud and Microsoft Advertising. The collaboration enables unified customer journey orchestration, allowing marketers to seamlessly activate CRM data for targeting and measurement across Microsoft's search, display, and LinkedIn advertising networks, driving increased enterprise spending on integrated platform ecosystems.

- June 2025: Cannes Lions 2025 spotlights generative AI in creative

The Cannes Lions International Festival of Creativity served as a global stage for the transformative impact of generative AI on advertising creative. Major agency networks unveiled new AI-powered content studios and campaign development tools, signaling a massive industry shift that is beginning to redirect creative production budgets and in-house capabilities.

- April 2025: TikTok Shop advertising API opens globally

The global release of TikTok Shop's fully-featured Advertising API allowed brands and agencies to automate, scale, and optimize performance marketing campaigns directly within the TikTok app. This technical milestone led to an immediate and significant surge in social commerce ad spend on the platform as brands integrated it into core e-commerce strategies.

- March 2025: Connected TV (CTV) ad spending surpasses USD 50 billion globally

Industry reports from groups like Magna and GroupM confirmed that global CTV ad spending officially surpassed the USD50 billion annual mark. This milestone, driven by viewer migration to streaming and the platform's advanced targeting, triggered a major and ongoing budget reallocation from traditional linear television to digital video and CTV channels.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 818.6 Bn |

| Forecast Value (2034) |

USD 1,844.8 Bn |

| CAGR (2025–2034) |

9.4% |

| The US Market Size (2025) |

USD 241.0 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Type (Search Engine Marketing (SEM), Social Media Marketing, Video Marketing, Content Marketing, Programmatic Advertising, Email Marketing, and Other Types), By Application (Brand Awareness & Reach, Lead Generation & Conversion, Customer Retention & Loyalty, Product Launch & Promotion, and Market Research & Analytics), By End User (Retail & E-commerce, BFSI, Healthcare & Pharma, Automotive, Travel & Hospitality, Telecom & IT, Media & Entertainment, and Other End Users) |

| Regional Coverage |

North America – US, Canada; Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA |

| Prominent Players |

Google LLC (Alphabet Inc.), Meta Platforms, Inc., Amazon.com, Inc., Microsoft Corporation, Alibaba Group Holding Limited, ByteDance Ltd. (TikTok), Tencent Holdings Ltd., WPP plc, Omnicom Group Inc., Publicis Groupe, Interpublic Group (IPG), Dentsu Group Inc., Salesforce, Inc., Adobe Inc., The Trade Desk, Inc., HubSpot, Inc., Shopify Inc., Pinterest, Inc., Snap Inc., Twitter, Inc., and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

How big is the Global Digital Marketing Spending Market?

▾ The Global Digital Marketing Spending Market size is estimated to have a value of USD 1.25 billion in 2025 and is expected to reach USD 1,844.8 billion by the end of 2034.

What is the growth rate in the Global Digital Marketing Spending Market?

▾ The market is growing at a Compound Annual Growth Rate (CAGR) of 9.4 percent over the forecasted period from 2025 to 2034.

What is the size of the US Digital Marketing Spending Market?

▾ The US Digital Marketing Spending Market is projected to be valued at USD 241.0 billion in 2025. It is expected to witness subsequent growth, reaching USD 515.9 billion in 2034, expanding at a CAGR of 8.8% during the forecast period.

Which region accounted for the largest Global Digital Marketing Spending Market?

▾ North America is expected to have the largest market share in the Global Digital Marketing Spending Market, accounting for approximately 35.0% of the total global share in 2025.

Who are the key players in the Global Digital Marketing Spending Market?

▾ Some of the major key players in the Global Digital Marketing Spending Market are Google LLC, Meta Platforms, Inc., Amazon.com, Inc., Microsoft Corporation, Alibaba Group, WPP plc, Omnicom Group Inc., Salesforce, Inc., Adobe Inc., and The Trade Desk, Inc., among many others.