Market Overview

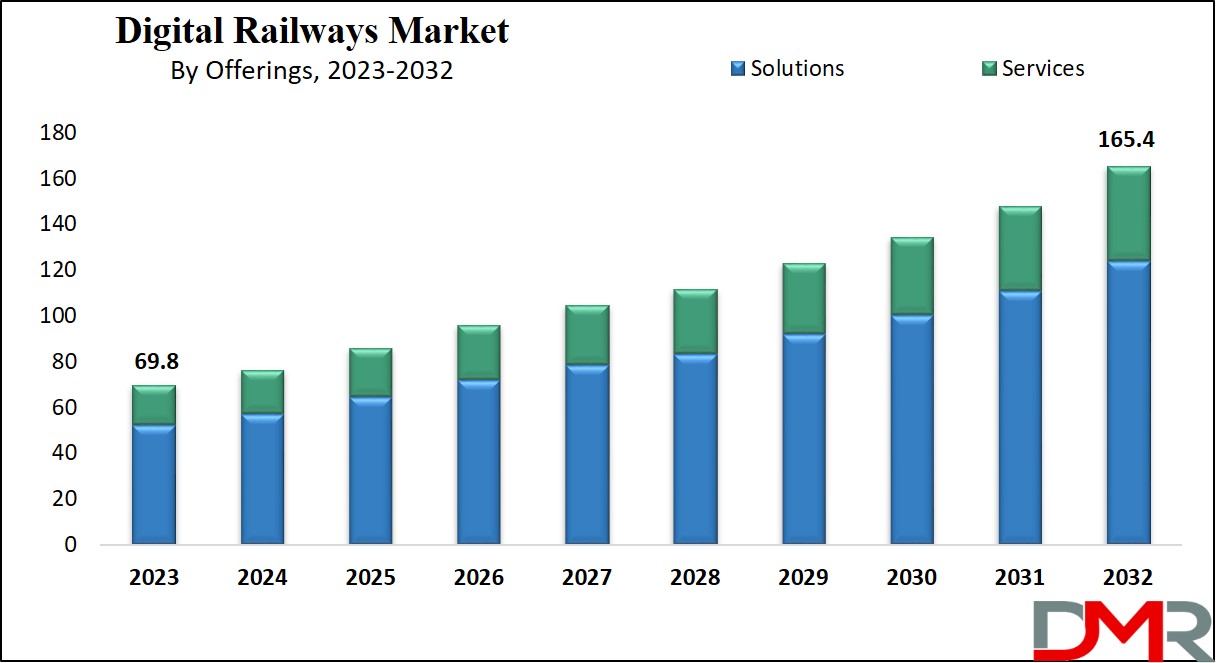

The Global Digital Railways Market is expected to reach a value of

USD 69.8 billion in 2023, and it is further anticipated to reach a market value of

USD 165.4 billion by 2032 at a

CAGR of 10.1%.

In the era of digitalization, the Digital Railway transformation looks to provide rail users with a more adaptive, dynamic, & customized railway experience. Recognized as a major driver of a country's growth, a strong railway network contributes to attracting tourism, improved travel, better trade, & overall economic stability and development. As governments across the world prioritize upgrading & transforming existing railway systems, supporting technological development for these essential improvements.

Key Takeaways

- By Product, the Solution segment takes the lead in 2023 & is anticipated to dominate throughout the forecasted period.

- In addition, the Service segment is expected to have significant growth over the forecasted period.

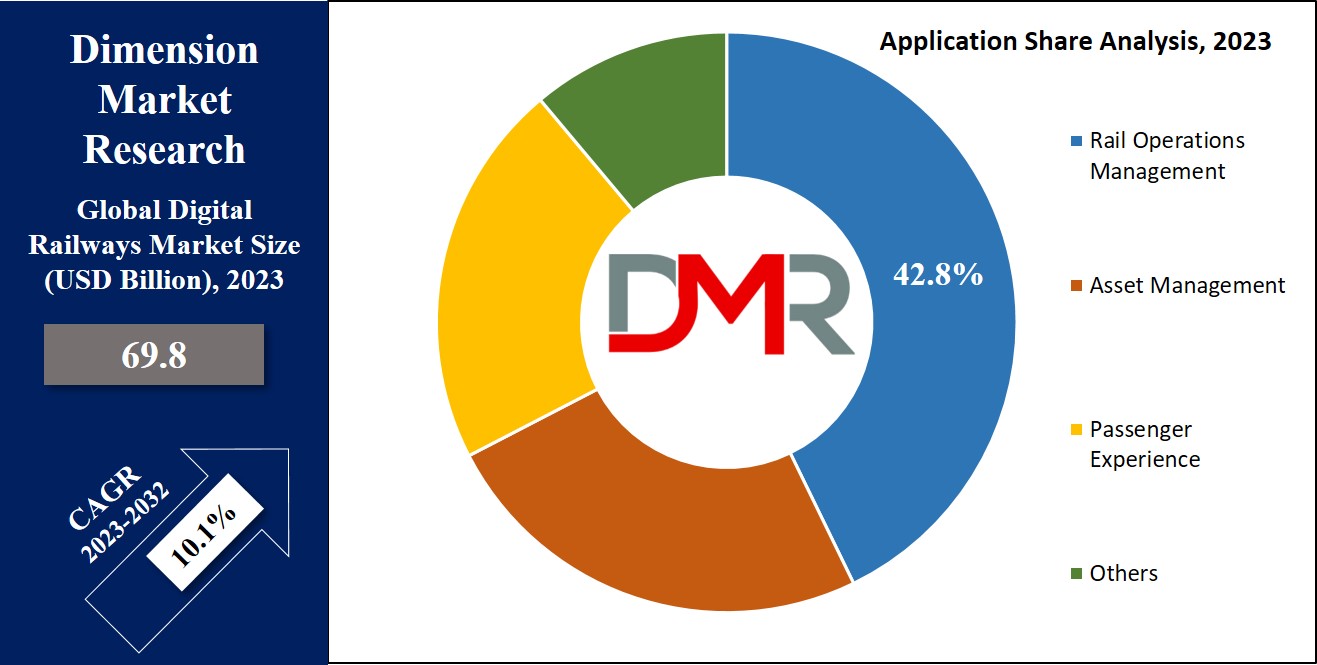

- By Application, Rail Operation Management take the lead & drive the market in 2023

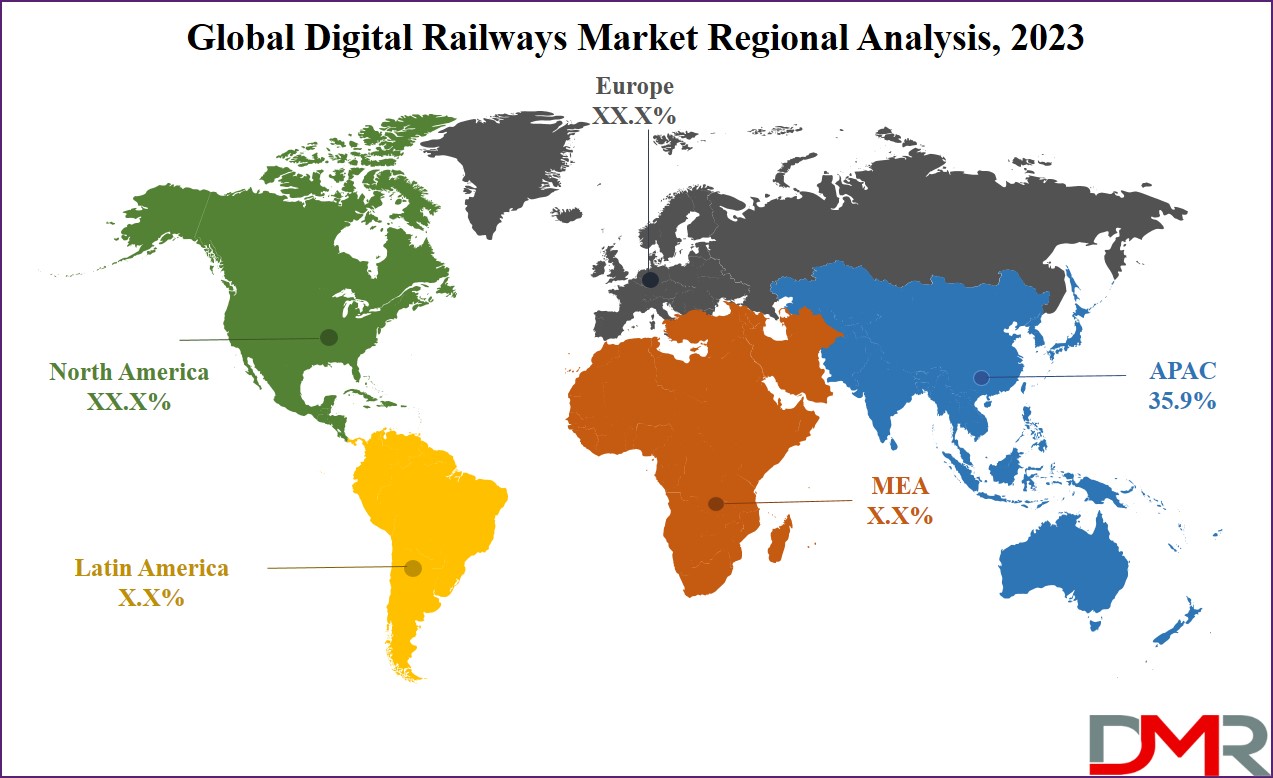

- Asia Pacific has a 35.9% share of revenue in the Global Digital Railways Market in 2023

Market Dynamic

The rise in passenger number is driving the need for efficient

transportation solutions, as major countries focus on developing digital railway infrastructure, mainly suited for long-distance travel. Further, government investments in digital railway infrastructure are anticipated to boost market growth. Passenger Information Systems serve as a critical communication link between passengers & transportation operators, providing live information on arrival & departure times, influencing passenger satisfaction alongside factors like system reliability & safety. The Passenger Information System includes route details, live tracking, online connectivity, travel planning, & infotainment, contributing to the market's growth.

However, the railway sector experiences challenges in balancing cost-cutting measures & technological development. The implementation of advanced technology for digital railways sustains higher costs, potentially limiting market growth. In addition, a shortage of trained experts creates a constraint and may challenge the digital railway market's growth during the forecast period.

Driving Factor

Smart transportation systems have emerged as one of the key drivers of digital railways market growth. Governments and private sectors worldwide are investing in digital solutions to increase railway efficiency, safety, and sustainability. Technologies like IoT, AI and

big data analytics optimize train operations, reduce delays and enable predictive maintenance.

Digital railways offer a scalable solution for rising urbanization and rising passenger demands; automated ticketing systems further enhance user experience to drive market growth while environmental concerns drive this adoption trend.

Trending Factors

Integration of

5G technologies and other cutting-edge communication methods is becoming a trend in the digital railways market. 5G networks enable faster data transmission, supporting real-time monitoring, automated train controls and enhanced passenger connectivity. This transformation facilitates advanced features like autonomous train operations and smarter traffic management systems.

Innovative applications like augmented reality for maintenance and virtual reality for passenger entertainment are gaining prominence and responding to a rising need for seamless and high-capacity connectivity among modern railway networks, providing digital transformation opportunities and improving operational efficiencies and passenger satisfaction.

Restraining Factors

Restrictive Factors for Digital Railway Systems Initial costs associated with digital railway implementation present an obstacle that cannot be ignored. Infrastructure challenges also present themselves as an impediment. Modifying legacy railway infrastructure to accommodate modern technologies involves substantial investments in hardware, software, and workforce training. Emerging economies face added difficulties due to limited financial resources and technological expertise.

Integrating digital systems into existing railway networks may present complications, leading to compatibility and operational issues as well as regulatory approval delays and

cybersecurity threats that delay adoption. Such obstacles often prevent railway operators and governments from adopting digital rail technology at an acceptable pace, hindering market expansion.

Opportunity

Expanded Smart City and Green Initiatives Smart city developments and green transportation initiatives present digital railways manufacturers with an intriguing opportunity. Global governments are placing greater importance on sustainable urban mobility by prioritizing investments in energy-efficient rail systems that leverage digital technology and incorporate renewable energy powered trains as part of global carbon neutrality goals.

Public-private partnerships and international funding for smart railway projects create an enabling environment for expansion. Emerging markets, particularly Asia Pacific and Africa, hold immense potential as urbanization and infrastructure development advance rapidly - prompting an increased need for advanced digitalized railway networks.

Research Scope and Analysis

By Offering

The Digital Railway Market is divided into Solutions and Services. In 2023, the Solution segment dominated the market in terms of revenue. As transportation companies face a rise in rail trips, maintaining a better service level allows them to secure & invest in existing infrastructure.

Further, the Services segment is anticipated to experience the fastest growth. These service providers play a vital role in implementing rail solutions, providing benefits like complexities, enhanced rail operations, affordable, improved cash flow, & profitability. Imposing the strategic value of rail solutions, standardized infrastructure, & easy project execution, and railway management system services contribute to the complete growth & efficacy of the digital railway landscape.

By Application

The market is segmented into Passenger Experience, Rail Operations Management, Asset Management, & Others. In 2023, the Railway Operations Management segment emerged as the top revenue generator. Passenger Information Systems play an important role as a communication channel between transportation companies & passengers.

Further, the provision of accurate & timely information on arrival & departure times by operators is a key determinant of passenger satisfaction, complemented by factors like safety, system reliability, & overall aesthetic appeal. Allowing an efficient & dependable flow of information enhances the complete passenger experience, highlighting the significance of Railway Operations Management in meeting the expectations of passengers & optimizing the effectiveness of transportation systems.

The Digital Railways Market Report is segmented on the basis of the following:

By Offering

By Application

- Rail Operations Management

- Passenger Experience

- Asset Management

- Others

Regional Analysis

The Asia Pacific region secured a significant 35.9% revenue share in the Digital Railway Market, reflecting its promising position, which is also expected for the fastest growth in the digital railway industry, driven by rise in adoption of new technologies, growth in investments in digital transformation, & robust GDP development across Asia Pacific countries, which is particularly notable in major economies like China, India, Australia, Korea, Singapore, and Hong Kong, where higher investments are being made in technological transformation initiatives.

As a result, Asia Pacific is expected to maintain its dominance, holding the largest share of the Digital Railway Market throughout the forecasted period, showcasing the region's essential role in shaping the landscape of digital rail advancements.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The global digital railways market is characterized by intense competition, with many players competing for market share, as players are focused on developing innovative solutions to improve railway operations, safety, & passenger experience. Further, the competitive environment is driven by technological development, strategic partnerships, & a continual race to provide affordable & sustainable digital solutions that meet the changing needs of the rail industry.

In September 2022, Huawei introduced its Future Railway Mobile Communication System solution during InnoTrans 2022 & the 9th Huawei Global Rail Summit in Berlin, Germany, which focuses on enhancing reliability & safety, playing an essential role in the digital transformation of the rail industry. By giving importance to better efficiency in railway operations, the company looks to contribute to the development of the sector via innovative communication systems customized to the changing needs of modern rail transportation.

Some of the prominent players in the global Digital Railways Market are:

- Nokia

- Indra

- Siemens

- Cisco

- IBM

- ABB

- Huawei

- Thales

- Alstom

- Hitachi

- Other Key Players

COVID-19 Pandemic & Recession: Impact on the Global Digital Railways Market:

The COVID-19 pandemic & the following economic recession have significantly influenced the global digital railways market. The travel restrictions & social distancing measures implemented to restrict the spreading of the virus led to a decrease in passenger demand for rail services. Further, the economic recession allowed budget constraints for infrastructure projects, impacting the investment in digital railway technologies. However, even after these challenges, the pandemic highlighted the importance of digitalization in the rail sector, driving a growing awareness of the demand for advanced technologies to improve efficiency, safety, & passenger experience. Further, as the economies recover, there is a potential for a high focus on digital railways as a strategic investment for modernizing transportation infrastructure & adapting to changing global challenges.

Recent Development

- In August 2022, ABB & Red Hat, an American software company, created a strategic partnership, that allows businesses using ABB's process automation & industrial software to easily & quickly scale using Red Hat's robust enterprise platforms & application services based on Red Hat Enterprise Linux, which facilitates the containerization & virtualization of automation software through Red Hat OpenShift, providing higher flexibility in hardware deployment, customized to the specific requirements of each application.

- In September 2022, displayed at InnoTrans 2022, Siemens Xcelerator, the new digital business platform, was developed to encourage a strong ecosystem for higher digital transformation & promoting sustainable mobility. Further, targeting the rail industry, the platform allows the integration of live data into the digital realm, enhancing train usage, which promises better efficiency, comfort, & mutual benefits for both passengers & operators.

- In April 2022, Thales & SMRT Trains, a Singaporean rail operator, entered an MoU, which includes the exchange of engineering knowledge & rail expertise across different sectors, as both companies aim to utilize digital technologies like AI & data analytics to unlock the complete potential of diagnostic data generated within existing signaling & rail systems.

Report Details

| Report Characteristics |

| Market Size (2023) |

USD 69.8 Bn |

| Forecast Value (2033) |

USD 165.4 Bn |

| CAGR (2024-2033) |

10.1% |

| Historical Data |

2017– 2022 |

| Forecast Data |

2024 – 2033 |

| Base Year |

2023 |

| Estimate Year |

2024 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Offering (Solutions and Services), By Application (Rail Operations Management, Passenger Experience, Asset Management, and Others) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia- Pacific– China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA

|

| Prominent Players |

Nokia, Indra, Siemens, Cisco, IBM, ABB, Huawei, Thales, Alstom, Hitachi, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Digital Railways Market size is estimated to have a value of USD 69.8 billion in 2023 and is

expected to reach USD 165.4 billion by the end of 2032.

Asia Pacific has the largest market share for the Global Digital Railways Market with a share of about

35.9% in 2023.

Some of the major key players in the Global Digital Railways Market are Nokia, Indra, Siemens, and

many others.

The market is growing at a CAGR of 10.1 percent over the forecasted period.