Market Overview

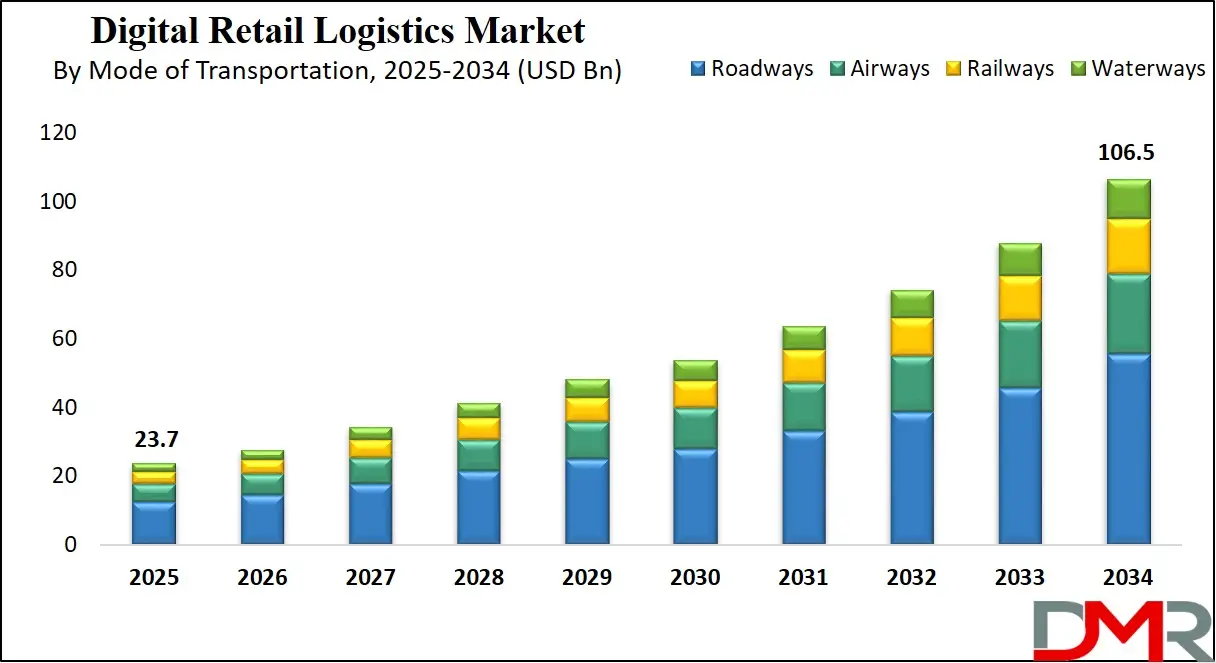

The global digital retail logistics market is projected to reach

USD 23.7 billion in 2025 and is expected to grow at a

CAGR of 18.1%, hitting

USD 106.5 billion by 2034. This growth is driven by rising e-commerce adoption, demand for real-time supply chain visibility, and advancements in AI-powered logistics, cloud-based fulfillment, and last-mile delivery solutions.

Digital retail logistics refers to the integration of digital technologies into the logistics processes that support online and omnichannel retail operations. It encompasses the end-to-end management of goods movement, including inventory management, order fulfillment, warehousing, and last-mile delivery, all orchestrated through advanced digital systems. The aim is to create a seamless and responsive supply chain that aligns with the dynamic demands of modern retail consumers.

Digital tools such as cloud-based warehouse management systems, AI-driven route optimization, and real-time tracking platforms enable retailers to reduce delivery times, lower operational costs, and improve customer satisfaction. With the growing complexity of retail operations across multiple sales channels, digital retail logistics has become essential for maintaining a competitive advantage and ensuring business continuity.

The global digital retail logistics market has grown rapidly in recent years due to the explosion of e-commerce and shifting consumer expectations for fast and flexible delivery. Retailers are investing in smart logistics solutions to manage growing order volumes, handle reverse logistics efficiently, and offer real-time visibility across supply chains. From predictive analytics for demand planning to robotics in fulfillment centers, these innovations are reshaping how goods are stored, picked, and delivered. The widespread adoption of mobile shopping and the evolution of same-day delivery services have further driven the need for digital-first logistics infrastructure that can support scale and agility.

As retailers expand globally and seek to enhance customer experiences, the demand for integrated logistics platforms is expected to rise significantly. Emerging markets in Asia-Pacific, the Middle East, and Latin America are witnessing rapid digitization of retail logistics, driven by increased smartphone penetration and improved transport networks. Moreover, sustainability concerns are pushing companies to adopt green logistics technologies such as electric delivery fleets and route optimization software. As a result, the global digital retail logistics market is positioned as a critical enabler of the next phase of retail evolution, offering scalable, automated, and customer-centric supply chain solutions.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The US Digital Retail Logistics Market

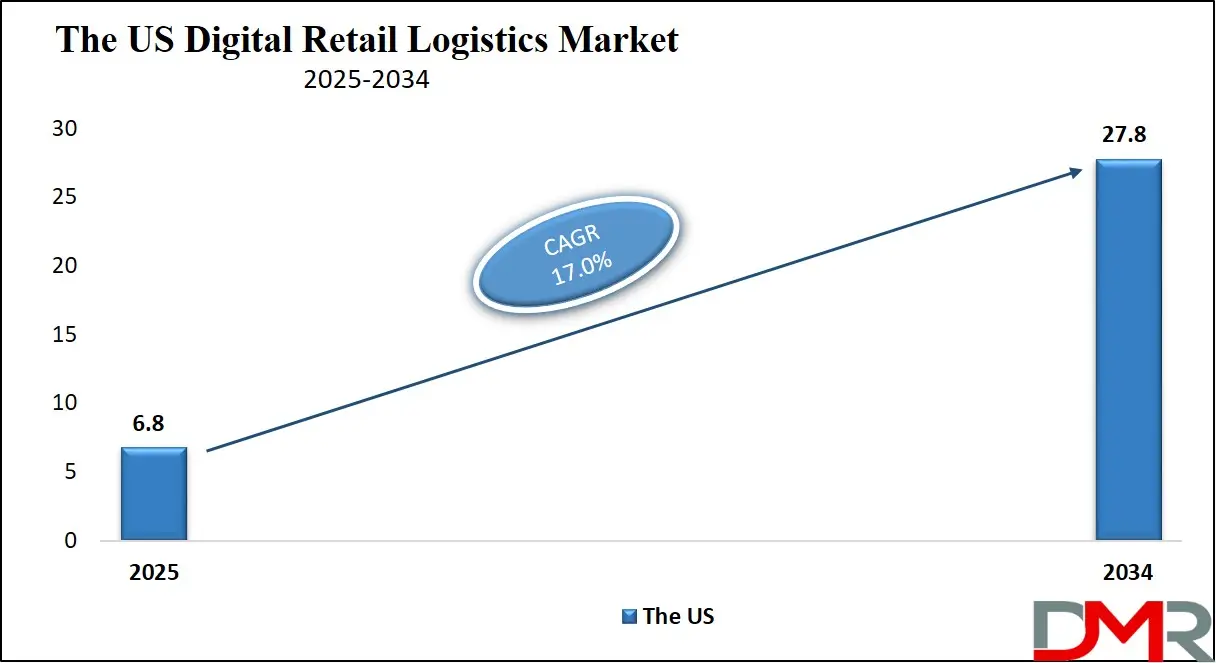

The U.S. Digital Retail Logistics Market size is projected to be valued at

USD 6.8 billion in 2025. It is further expected to witness subsequent growth in the upcoming period, holding

USD 27.8 billion in 2034 at a

CAGR of 17.0%.

The U.S. digital retail logistics market is undergoing a significant transformation as retailers prioritize faster, more efficient, and customer-centric delivery experiences. With consumers expecting seamless online and omnichannel interactions, logistics providers and retail enterprises are turning to advanced technologies such as warehouse automation, predictive analytics, and AI-enabled inventory management to meet evolving demands. Cloud-based logistics platforms, integrated order management systems, and data-driven route optimization have become central to streamlining supply chain workflows across vast distribution networks. The growing focus on last-mile delivery efficiency is also accelerating the adoption of micro-fulfillment centers, localized distribution hubs, and real-time tracking tools that enhance transparency and responsiveness.

A strong digital infrastructure, robust transportation networks, and a mature e-commerce ecosystem have positioned the U.S. as a leader in digital retail logistics innovation. Retailers are leveraging robotics, IoT-enabled fleet monitoring, and supply chain visibility platforms to minimize disruptions and improve delivery accuracy. The growth of direct-to-consumer models and the rise of same-day and next-day shipping expectations are further encouraging logistics modernization across sectors, including fashion, electronics, grocery, and health & beauty. Additionally, sustainability concerns are pushing U.S. retailers to invest in green logistics initiatives, such as electric delivery vehicles and smart packaging, reinforcing the shift toward agile and environmentally responsible supply chain operations.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

The European Digital Retail Logistics Market

Europe’s digital retail logistics market is estimated to reach a value of approximately

USD 5.2 billion in 2025, reflecting its significant role in the global logistics ecosystem. The region benefits from a mature e-commerce sector, well-established transportation infrastructure, and widespread adoption of advanced logistics technologies. Key factors driving this market size include the rapid growth of online retail across countries like the UK, Germany, and France, integrated with growing consumer demand for faster and more reliable delivery services. European retailers and logistics providers are heavily investing in automation, warehouse management systems, and AI-driven transportation solutions to optimize supply chain efficiency and reduce operational costs.

The market in Europe is also expected to grow at a healthy CAGR of around 14.0% over the forecast period, underpinned by ongoing digital transformation initiatives and regulatory support for sustainable logistics practices. Innovations such as electric delivery vehicles, IoT-based real-time tracking, and predictive analytics are gaining traction, enabling companies to meet evolving customer expectations and improve environmental performance. Furthermore, the rise of omnichannel retailing and last-mile delivery solutions tailored to urban centers is creating new growth opportunities. As a result, Europe’s digital retail logistics market is poised for robust expansion, driven by both technological advancements and shifting consumer behaviors.

The Japanese Digital Retail Logistics Market

Japan digital retail logistics market is projected to reach approximately USD 1.8 billion in 2025, reflecting steady growth fueled by the country’s strong focus on technology adoption and efficient supply chain management. Japan’s well-developed infrastructure, combined with a tech-savvy population, supports the widespread use of digital solutions in retail logistics. Companies in Japan are implementing automation, robotics, and AI-powered systems in warehouses and transportation networks to enhance accuracy, speed, and reliability. Additionally, the rise of e-commerce and consumer demand for fast, flexible delivery options are key drivers expanding the digital logistics market across urban and suburban regions.

The market in Japan is expected to grow at a CAGR of about 12.0%, supported by continuous innovation and government initiatives promoting smart logistics and sustainable transportation. The integration of Internet of Things (IoT) devices for real-time tracking and predictive analytics is helping businesses optimize inventory management and reduce delivery times. Furthermore, as consumer expectations shift toward personalized and same-day delivery services, Japanese retailers and logistics providers are investing in last-mile delivery technologies and eco-friendly solutions. This combination of advanced technology and evolving market needs positions Japan’s digital retail logistics sector for consistent and robust growth in the coming years.

Global Digital Retail Logistics Market: Key Takeaways

- Market Value: The global digital retail logistics market size is expected to reach a value of USD 106.5 billion by 2034 from a base value of USD 23.7 billion in 2025 at a CAGR of 18.1%.

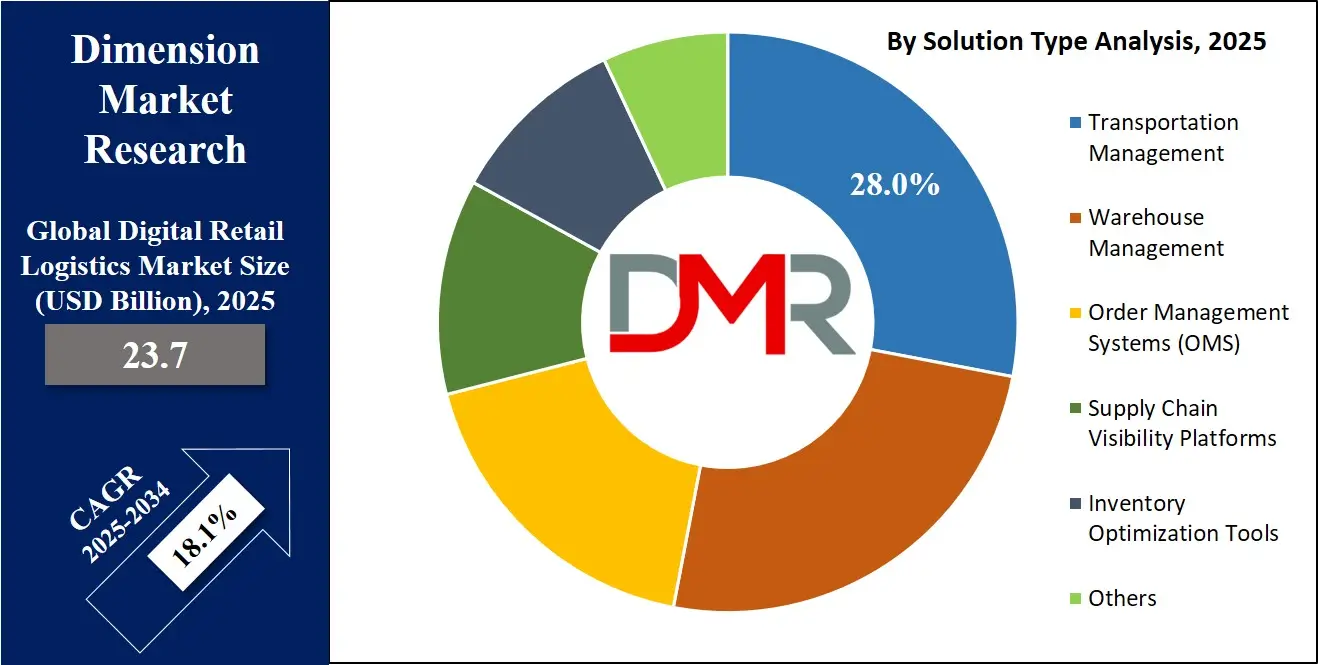

- By Solution Type Segment Analysis: Transportation Management solutions are poised to consolidate their dominance in the solution type segment, capturing 28.0% of the total market share in 2025.

- By Mode of Transportation Segment Analysis: Roadways are expected to dominate the mode of transportation segment, capturing 52.0% of the total market share in 2025.

- By Deployment Mode Segment Analysis: Cloud-based deployment mode will lead the deployment mode segment, capturing 66.0% of the market share in 2025.

- By Technology Segment Analysis: AI/ML and Predictive Analytics are anticipated to maintain their dominance in the technology segment, capturing 24.0% of the total market share in 2025.

- By Business Model Segment Analysis: B2C – Business-to-Consumer models are projected to lead the business model segment, capturing 61.0% of the total market share in 2025.

- Regional Analysis: North America is anticipated to lead the global digital retail logistics market landscape with 34.0% of total global market revenue in 2025.

- Key Players: Some key players in the global digital retail logistics market are Amazon, DHL, FedEx, UPS, Maersk, DB Schenker, XPO, GXO, JD.com, Alibaba, Shopify, Flexport, SAP, Oracle, Manhattan Associates, Blue Yonder, and other key players.

Global Digital Retail Logistics Market: Use Cases

- Optimizing Last-Mile Delivery with AI and Real-Time Tracking: In the highly competitive retail landscape, last-mile delivery has become a critical differentiator for customer satisfaction. Digital retail logistics leverages AI-powered route optimization and real-time tracking technologies to enhance delivery efficiency and reduce costs. By analyzing traffic patterns, weather conditions, and delivery windows, AI algorithms create dynamic routes that minimize delays and fuel consumption. Real-time shipment tracking offers customers full visibility into their orders, improving transparency and trust. These technologies enable logistics providers to handle complex delivery scenarios such as multiple drop-offs, same-day shipping, and contactless deliveries, meeting rising consumer expectations for speed and convenience. Additionally, predictive analytics can forecast potential disruptions and suggest alternate routes, further enhancing reliability.

- Enhancing Warehouse Operations through Automation and Robotics: Warehouse management plays a pivotal role in ensuring timely order fulfillment in digital retail logistics. Automated guided vehicles (AGVs), robotic picking systems, and AI-based inventory management solutions are transforming traditional warehouses into smart fulfillment centers. These technologies enable faster processing of large order volumes while reducing human error and operational costs. Integration of Internet of Things (IoT) sensors provides real-time data on inventory levels, equipment status, and environmental conditions, allowing proactive maintenance and efficient space utilization. By implementing these innovations, retailers can maintain high accuracy in stock replenishment, optimize storage layouts, and accelerate the picking and packing process to meet growing e-commerce demand.

- Implementing Cloud-Based Supply Chain Visibility Platforms: Global retail supply chains are complex, spanning multiple geographies and involving numerous stakeholders. Cloud-based supply chain visibility platforms provide an integrated digital ecosystem that connects manufacturers, logistics providers, warehouses, and retailers. These platforms offer end-to-end tracking, data analytics, and collaborative tools that enhance decision-making and operational transparency. By leveraging cloud computing, companies can scale their logistics infrastructure rapidly while maintaining security and compliance. Enhanced visibility allows businesses to identify bottlenecks, reduce lead times, and improve inventory turnover. Furthermore, the availability of real-time data facilitates agile responses to market fluctuations, demand spikes, and supply disruptions, which are essential for maintaining customer satisfaction and competitive advantage.

- Driving Sustainable Logistics through Green Technologies: Sustainability is becoming a key priority in digital retail logistics as companies strive to reduce their environmental footprint. Adoption of green logistics technologies, including electric delivery vehicles, energy-efficient warehouses, and eco-friendly packaging, helps reduce carbon emissions across the supply chain. Route optimization software minimizes fuel consumption by planning efficient delivery paths, while smart warehouse designs incorporate renewable energy sources and waste reduction systems. Additionally, blockchain technology is being used to enhance transparency around sustainable sourcing and carbon tracking. By integrating these sustainable practices into their logistics operations, retailers not only comply with regulatory requirements but also appeal to environmentally conscious consumers, driving brand loyalty and long-term business growth.

Global Digital Retail Logistics Market: Stats & Facts

- U.S. Department of Transportation (USDOT)

- Road freight accounts for over 70% of total freight tonnage transported annually in the U.S.

- Over 90% of e-commerce shipments in the U.S. are delivered via parcel carriers or last-mile delivery providers.

- Investments in smart transportation systems have reduced delivery times by up to 20% in pilot regions.

- The U.S. government allocated USD 1.2 billion in 2023 for advanced logistics technology development, including AI and IoT integration.

- European Commission – Mobility and Transport

- Road transport is responsible for moving 75% of goods by volume across the EU.

- EU member states have committed to reducing CO2 emissions from freight transport by 30% by 2030 through green logistics initiatives.

- More than 60% of warehouses in the EU are now implementing automated or semi-automated systems.

- The EU’s Digital Transport and Logistics Forum reported a 25% increase in the adoption of digital freight corridors since 2021.

- Japan Ministry of Land, Infrastructure, Transport and Tourism (MLIT)

- Japan’s logistics sector contributes approximately 7% to the country’s GDP.

- 80% of all retail goods in Japan are transported via road logistics networks.

- Automated warehouses in Japan have increased operational efficiency by 35% since 2020.

- The Japanese government launched a Smart Logistics initiative in 2022, aiming to digitize 90% of freight operations by 2030.

- China Ministry of Transport

- Road freight accounts for 85% of total freight volume in China.

- China’s e-commerce parcel delivery volume surpassed 60 billion parcels in 2023.

- The government has invested over USD 3 billion in smart logistics infrastructure development over the past five years.

- IoT adoption in logistics operations grew by 40% annually between 2021 and 2024.

- United Nations Conference on Trade and Development (UNCTAD)

- Cross-border e-commerce accounted for nearly 30% of total global e-commerce transactions in 2023.

- Digitalization of logistics has reduced average shipment delays by 15% worldwide since 2020.

- Over 50% of global trade shipments are now tracked using real-time digital tracking systems.

- The UN has encouraged member states to increase public investment in digital logistics platforms to enhance trade efficiency.

- Australian Government – Department of Infrastructure, Transport, Regional Development and Communications

- Road freight constitutes approximately 85% of all freight movements by volume in Australia.

- Investment in digital supply chain technologies increased by 22% annually from 2020 to 2024.

- Over 70% of Australian retailers have adopted cloud-based logistics management systems.

- Last-mile delivery innovations have reduced urban delivery times by 18% in major Australian cities.

- UK Department for Transport

- Road freight transport in the UK carried 1.8 billion tonnes of goods in 2023.

- Adoption of AI-powered route optimization systems in UK logistics firms increased by 35% over the past three years.

- The UK government has set a target to electrify 50% of freight vehicles by 2035.

- Over 60% of UK warehouses will implement real-time inventory tracking technologies by 2024.

- Canadian Ministry of Transport

- E-commerce logistics shipments grew by 28% annually between 2021 and 2024 in Canada.

- The Canadian government invested CAD 500 million in smart transportation initiatives, including IoT-enabled freight tracking, from 2022 to 2025.

Global Digital Retail Logistics Market: Market Dynamics

Global Digital Retail Logistics Market: Driving Factors

Rapid Growth of E-commerce and Omnichannel RetailThe surge in online shopping and omnichannel retail strategies has significantly accelerated the demand for digital retail logistics solutions. Retailers are integrating their online and offline channels, necessitating seamless inventory management, real-time order processing, and efficient last-mile delivery services. This shift is driving investments in cloud-based warehouse management systems, AI-powered demand forecasting, and automated fulfillment centers. The growing consumer preference for faster delivery options, such as same-day and next-day shipping, is further fueling the adoption of smart logistics technologies that enhance supply chain responsiveness and operational agility.

Advancements in Artificial Intelligence and IoT Technologies

Cutting-edge technologies like artificial intelligence, machine learning, and Internet of Things devices are transforming traditional logistics into smart, data-driven ecosystems. AI algorithms optimize route planning, predict demand fluctuations, and enable dynamic inventory management, thereby reducing costs and enhancing delivery accuracy. IoT sensors provide real-time monitoring of goods, vehicles, and warehouse conditions, ensuring greater transparency and traceability throughout the supply chain. These technological innovations enable logistics providers to improve operational efficiency, reduce delays, and offer personalized delivery experiences, which are crucial for meeting modern retail demands.

Global Digital Retail Logistics Market: Restraints

High Implementation Costs and Integration Challenges

Despite the benefits of digital retail logistics, the high costs associated with deploying advanced technologies and integrating them with existing legacy systems pose significant challenges. Small and medium-sized retailers often face budget constraints that limit their ability to invest in automation, AI, and cloud platforms. Additionally, the complexity of integrating disparate systems across multiple supply chain partners can lead to data silos and operational inefficiencies. This slows down digital transformation efforts and impacts scalability, especially for companies operating across diverse geographies with varying technological maturity.

Data Security and Privacy Concerns

As digital retail logistics relies heavily on cloud computing, IoT, and big data analytics, concerns around data security and privacy have become prominent. Cybersecurity threats such as data breaches, ransomware attacks, and unauthorized access can compromise sensitive customer and operational information. Retailers and logistics providers must adhere to stringent regulations and implement robust security protocols to protect their networks and maintain consumer trust. The fear of data vulnerability sometimes delays the adoption of advanced logistics technologies, limiting the market’s full growth potential.

Global Digital Retail Logistics Market: Opportunities

Expansion in Emerging Markets and Cross-Border E-commerce

Emerging economies in Asia-Pacific, Latin America, and the Middle East present lucrative opportunities for digital retail logistics growth. Increasing internet penetration, smartphone adoption, and expanding middle-class populations are fueling e-commerce expansion in these regions. Cross-border e-commerce further drives demand for efficient logistics solutions that can handle complex customs processes, multi-modal transportation, and last-mile delivery in underserved areas. Investing in regional logistics infrastructure and digital platforms tailored to local needs can unlock significant market potential and enhance global supply chain connectivity.

Integration of Sustainable and Green Logistics Practices

The rising focus on environmental sustainability offers a substantial growth avenue for digital retail logistics. Companies are adopting green logistics technologies such as electric vehicles, energy-efficient warehouses, and eco-friendly packaging to reduce their carbon footprints. The integration of route optimization software and carbon tracking through blockchain enhances operational efficiency while supporting sustainability goals. Retailers that emphasize environmentally responsible logistics practices can differentiate themselves in the market, appeal to eco-conscious consumers, and comply with evolving regulatory frameworks.

Global Digital Retail Logistics Market: Trends

Adoption of Robotics and Automation in Fulfillment Centers

Automation and robotics are becoming standard features in modern warehouses and distribution centers, transforming the way retailers manage order fulfillment. Automated picking systems, conveyor belts, and autonomous mobile robots increase throughput and accuracy while reducing labor costs. This trend is driven by the need to handle growing e-commerce order volumes and the demand for faster delivery times. The integration of these technologies with AI and IoT enables real-time monitoring and adaptive workflow management, creating highly efficient and scalable logistics operations.

Growing Use of Blockchain for Supply Chain Transparency

Blockchain technology is gaining traction as a tool for enhancing transparency and traceability in digital retail logistics. By creating immutable and decentralized records of shipments, transactions, and product provenance, blockchain helps combat counterfeiting, fraud, and supply chain inefficiencies. It also facilitates secure data sharing among multiple stakeholders, enabling better collaboration and trust. The use of smart contracts automates payments and compliance processes, streamlining logistics workflows and reducing administrative burdens.

Global Digital Retail Logistics Market: Research Scope and Analysis

By Solution Type Analysis

Transportation management solutions are emerging as the leading component within the solution type segment of the digital retail logistics market, projected to capture 28.0% of the total market share in 2025. This growth is being driven by the growing need for efficient, technology-driven management of goods movement across complex retail supply chains. As e-commerce continues to expand, retailers are adopting transportation management systems (TMS) to streamline routing, optimize carrier selection, and reduce freight costs. These platforms leverage artificial intelligence and machine learning to provide real-time tracking, predictive delivery updates, and advanced route planning, which are essential for handling the surge in same-day and next-day delivery expectations. Additionally, TMS integrates with ERP and warehouse systems, improving cross-functional visibility and enhancing overall supply chain coordination.

Warehouse management is another crucial segment that plays a foundational role in digital retail logistics, especially as fulfillment speed and accuracy become key competitive factors. Warehouse management systems (WMS) enable retailers and logistics providers to maintain real-time visibility over inventory, automate picking and packing processes, and manage labor more effectively. With the rise of micro-fulfillment centers and regional distribution hubs, WMS platforms help businesses execute multi-location inventory strategies and ensure order accuracy. These systems are powered by robotics, IoT sensors, and cloud technology, allowing for agile operations that scale with demand fluctuations. As consumers demand faster delivery and real-time stock availability, efficient warehouse operations supported by robust WMS tools have become indispensable to modern retail logistics strategies.

ℹ

To learn more about this report –

Download Your Free Sample Report Here

By Mode of Transportation Analysis

Roadways are projected to dominate the mode of transportation segment in the digital retail logistics market, accounting for approximately

52.0% of the total market share in 2025. This dominance is largely attributed to the flexibility, cost-efficiency, and extensive infrastructure that road transport offers for e-commerce and omnichannel fulfillment. Roadways enable direct-to-consumer deliveries, which are critical for last-mile logistics, the most time-sensitive and expensive segment of the supply chain.

Whether it's local deliveries within urban areas or cross-state shipments, road transport provides the agility needed to meet growing customer expectations for fast and reliable shipping. Additionally, advancements in GPS tracking, fleet management software, and route optimization technologies have enhanced operational efficiency, enabling real-time shipment visibility and reduced transit times. As digital retail continues to scale, road transport will remain the backbone of fulfillment, especially in regions with high population density and mature logistics infrastructure.

Airways, on the other hand, play a pivotal role in facilitating fast, long-distance transportation of high-priority or high-value goods. While not as dominant as roadways in terms of volume, air freight is essential for meeting expedited delivery demands and supporting global e-commerce operations. Digital retail brands often rely on air transport to ensure quick replenishment of stock, especially for cross-border shipments or time-sensitive product launches.

The integration of digital tools such as air cargo tracking systems, AI-driven demand forecasting, and customs automation platforms has further enhanced the efficiency of air logistics. Although more expensive than road or sea transport, airways are indispensable for ensuring delivery speed, particularly for premium products, fashion retail, and electronics. As consumers expect faster global shipping options, the strategic role of air transport in the digital retail logistics ecosystem continues to grow.

By Deployment Mode Analysis

Cloud-based deployment is expected to lead the deployment mode segment of the digital retail logistics market, capturing an estimated 66.0% of the total market share in 2025. This strong dominance is driven by the growing demand for scalability, flexibility, and real-time access to logistics data. Cloud-based logistics platforms allow retailers and logistics providers to streamline operations across multiple locations, integrate various supply chain functions, and access centralized dashboards without the need for heavy IT infrastructure investments. These solutions support seamless updates, remote monitoring, and integration with emerging technologies like AI, IoT, and blockchain, enabling faster decision-making and improved supply chain responsiveness. As digital retail grows more complex, cloud deployment empowers businesses to adapt quickly to shifting consumer demands, optimize resources in real time, and maintain high levels of service continuity with lower operational risk.

On-premises deployment, while more traditional, still holds relevance in the digital retail logistics market, especially for large enterprises with strict data security, compliance, or customization requirements. These solutions are installed locally within an organization's IT infrastructure, offering complete control over data, system configurations, and access protocols.

For companies operating in regulated industries or regions with limited cloud infrastructure, on-premises systems provide greater autonomy and can be fine-tuned for specific logistics workflows. However, they typically require higher upfront capital investment, dedicated IT support, and longer deployment timelines. Despite these limitations, on-premises deployment continues to serve niche needs where performance consistency, proprietary system integration, and in-house data governance are prioritized.

By Technology Analysis

AI/ML and Predictive Analytics are expected to retain their leadership in the technology segment of the digital retail logistics market, capturing around 24.0% of the total market share in 2025. This dominance is largely fueled by the need for data-driven decision-making, real-time operational intelligence, and enhanced forecasting accuracy across the retail supply chain. Artificial intelligence and machine learning algorithms help optimize routing, manage inventory fluctuations, predict delivery delays, and automate demand planning.

These technologies empower logistics managers to respond proactively to disruptions, allocate resources more efficiently, and personalize the customer experience. Predictive analytics plays a vital role in anticipating product demand, planning warehouse capacity, and improving order accuracy, which are all essential for managing high-volume e-commerce environments. As the retail sector continues to embrace intelligent automation, AI and predictive tools are becoming central to logistics strategies that prioritize speed, efficiency, and agility.

IoT and Real-time Tracking technologies are also transforming digital retail logistics by enhancing visibility, transparency, and control across the supply chain. IoT-enabled devices such as smart sensors, RFID tags, and GPS trackers allow businesses to monitor the movement and condition of goods in transit and storage. These technologies deliver real-time data on temperature, humidity, location, and potential delays, enabling logistics providers to take immediate corrective actions. Real-time tracking improves customer satisfaction by offering accurate delivery updates and ETA notifications.

Moreover, it helps reduce theft, loss, and damage by enhancing shipment security. In warehouse settings, IoT devices assist in asset tracking, equipment monitoring, and process automation, making operations more efficient. As customer expectations for traceability and on-demand delivery updates grow, IoT and real-time tracking systems are becoming essential for enabling end-to-end supply chain visibility in digital retail logistics.

By Business Model Analysis

Business-to-Consumer (B2C) models are projected to dominate the business model segment of the digital retail logistics market, accounting for approximately 61.0% of the total market share in 2025. This growth is being driven by the explosive expansion of e-commerce, mobile shopping, and omnichannel retail platforms that connect retailers directly to end consumers. In the B2C logistics model, speed, convenience, and last-mile delivery performance are critical.

Consumers now expect same-day or next-day delivery, real-time order tracking, flexible return options, and personalized delivery experiences. To meet these expectations, logistics providers are leveraging AI-driven order routing, cloud-based inventory systems, and last-mile optimization tools. The B2C segment is also witnessing high investments in automated fulfillment centers, micro-warehousing, and digital delivery platforms, which are reshaping how goods move from retailers to customers in both urban and suburban markets.

Business-to-Business (B2B) logistics, while not as dominant in market share, plays a vital role in sustaining the broader retail ecosystem. In this model, logistics operations are geared toward larger-scale, recurring transactions between manufacturers, wholesalers, and retailers. B2B logistics emphasizes efficiency in bulk transportation, inventory management, procurement processes, and contract-based deliveries. The focus here is on accuracy, reliability, and supply chain coordination rather than rapid last-mile execution.

Technologies such as ERP-integrated transportation management systems, predictive analytics for demand planning, and IoT-enabled asset tracking are widely used to ensure seamless B2B logistics. While B2B may not demand the same delivery speed as B2C, the stakes are high in terms of volume, value, and relationship-driven service continuity. As digital transformation expands in wholesale and enterprise retail, the B2B logistics model continues to evolve with automation, real-time data sharing, and platform-based logistics ecosystems.

The Digital Retail Logistics Market Report is segmented on the basis of the following

By Solution Type

- Transportation Management

- Warehouse Management

- Order Management Systems (OMS)

- Supply Chain Visibility Platforms

- Inventory Optimization Tools

- Others

By Mode of Transportation

- Roadways

- Airways

- Railways

- Waterways

By Deployment Mode

- Cloud-based

- On-Premise

- Hybrid

By Technology

- AI/ML and Predictive Analytics

- IoT & Real-time Tracking

- Robotics & Automation

- Cloud Computing & APIs

- AR/VR, Digital Twins

- Blockchain

By Business Model

- Business-to-Business (B2B)

- Business-to-Customer (B2C)

- Customer-to-Customer (C2C)

Global Digital Retail Logistics Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global digital retail logistics market in 2025, capturing 34.0% of total market revenue due to its mature e-commerce ecosystem, advanced technological infrastructure, and high consumer demand for fast, reliable delivery services. The region benefits from widespread adoption of cloud-based logistics platforms, AI-driven supply chain optimization, and real-time tracking technologies across retail and logistics enterprises. Additionally, the presence of major industry players, expansive road networks, and a strong last-mile delivery infrastructure further supports market leadership. With continued growth in omnichannel retail, investments in warehouse automation, and innovations in predictive logistics, North America remains at the forefront of digital transformation in retail logistics.

Region with significant growth

The Asia Pacific region is projected to witness the highest CAGR in the global digital retail logistics market during the forecast period, driven by the rapid expansion of e-commerce, rising internet penetration, and growing smartphone usage across emerging economies like India, China, and Southeast Asia. The region’s growing middle-class population and demand for faster, more reliable delivery services are fueling investments in advanced logistics technologies, including AI-powered fulfillment, IoT-based tracking, and cloud-enabled supply chain management. Moreover, government initiatives to boost digital infrastructure and the rise of cross-border e-commerce are accelerating the digitalization of retail logistics operations, positioning Asia Pacific as the fastest-growing region in this evolving market landscape.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Retail Logistics Market: Competitive Landscape

The global competitive landscape of the digital retail logistics market is characterized by a dynamic mix of global logistics giants, technology providers, and e-commerce leaders striving to enhance speed, visibility, and efficiency across the supply chain. Companies such as Amazon, DHL, FedEx, UPS, and Maersk are leveraging advanced technologies like AI, machine learning, IoT, and cloud-based platforms to strengthen their logistics capabilities and offer end-to-end digital solutions. Meanwhile, software firms like SAP, Oracle, Manhattan Associates, and Blue Yonder are enabling digital transformation through integrated warehouse and transportation management systems.

The market is highly competitive, with players focusing on strategic partnerships, acquisitions, and innovation in last-mile delivery, real-time tracking, and predictive analytics to meet the growing demands of B2C and B2B customers. As consumer expectations continue to evolve and digital commerce scales globally, the intensity of competition is expected to increase, driving continuous innovation across all tiers of the logistics value chain.

Some of the prominent players in the global digital retail logistics market are:

- Amazon

- DHL

- FedEx

- UPS

- Maersk

- DB Schenker

- XPO

- GXO

- JD.com

- Alibaba

- Shopify

- Flexport

- SAP

- Oracle

- Manhattan Associates

- Blue Yonder

- Körber

- Project44

- FourKites

- Walmart

- Other Key Players

Global Digital Retail Logistics Market: Recent Developments

- Product Launches

- May 2025: Kmart announced plans to construct a 100,000-square-meter Omnichannel Fulfilment Centre at Moorebank’s Intermodal Precinct, aiming to enhance its logistics operations and improve supply chain efficiency.

- April 2025: Goodman Group revealed its strategy to develop automated, robotic warehouses, leveraging AI to revolutionize its logistics infrastructure and meet the growing demand for efficient supply chain solutions.

- Mergers and Acquisitions

- January 2025: DHL Supply Chain acquired Inmar Supply Chain Solutions, a move that expanded DHL's reverse logistics capabilities, including product remarketing and recall management, solidifying its position in the North American market.

- January 2025: DCP Capital Partners agreed to acquire Sun Art Retail Group Limited from Alibaba for USD 1.58 billion, reflecting a strategic shift in Alibaba's focus towards its core business areas.

- Funding Events

- May 2025: Portless, a logistics startup specializing in fast shipping from China, secured USD 18 million in Series A funding led by Commerce Ventures, aiming to expand its operations and adapt to changing trade regulations.

- May 2025: Fleetx, a Gurugram-based logistics SaaS startup, raised ₹113 crore in a funding round led by Indiamart and Beenext, intending to enhance its product development and expand its technological offerings.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 23.7 Bn |

| Forecast Value (2034) |

USD 106.5 Bn |

| CAGR (2025–2034) |

18.1% |

| Historical Data |

2019 – 2024 |

| The US Market Size (2025) |

USD 6.8 Bn |

| Forecast Data |

2025 – 2033 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors, etc. |

| Segments Covered |

By Solution Type (Transportation Management, Warehouse Management, Order Management Systems, Supply Chain Visibility Platforms, Inventory Optimization Tools, Others), By Mode of Transportation (Roadways, Airways, Railways, Waterways), By Deployment Mode (Cloud-based, On-Premise, Hybrid), By Technology (AI/ML & Predictive Analytics, IoT & Real-time Tracking, Robotics & Automation, Cloud Computing & APIs, AR/VR & Digital Twins, Blockchain), and By Business Model (B2B, B2C, C2C). |

| Regional Coverage |

North America – US, Canada;

Europe – Germany, UK, France, Russia, Spain, Italy, Benelux, Nordic, Rest of Europe;

Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC;

Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America;

Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, Rest of MEA

|

| Prominent Players |

Amazon, DHL, FedEx, UPS, Maersk, DB Schenker, XPO, GXO, JD.com, Alibaba, Shopify, Flexport, SAP, Oracle, Manhattan Associates, Blue Yonder, and other key players. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user),

Multi-User License (Up to 5 Users), and

Corporate Use License (Unlimited User) along with free report customization equivalent to

0 analyst working days, 3 analysts working days, and 5 analysts working days respectively.

|

Frequently Asked Questions

How big is the global digital retail logistics market?

▾ The global digital retail logistics market size is estimated to have a value of USD 23.7 billion in 2025 and is expected to reach USD 106.5 billion by the end of 2034.

What is the size of the US digital retail logistics market?

▾ The US digital retail logistics market is projected to be valued at USD 6.8 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 27.8 billion in 2034 at a CAGR of 17.0%.

Which region accounted for the largest global digital retail logistics market?

▾ North America is expected to have the largest market share in the global digital retail logistics market, with a share of about 34.0% in 2025.

Who are the key players in the global digital retail logistics market?

▾ Some of the major key players in the global digital retail logistics market are Amazon, DHL, FedEx, UPS, Maersk, DB Schenker, XPO, GXO, JD.com, Alibaba, Shopify, Flexport, SAP, Oracle, Manhattan Associates, Blue Yonder, and other key players.

What is the growth rate of the global digital retail logistics market?

▾ The market is growing at a CAGR of 18.1 percent over the forecasted period.