Market Overview

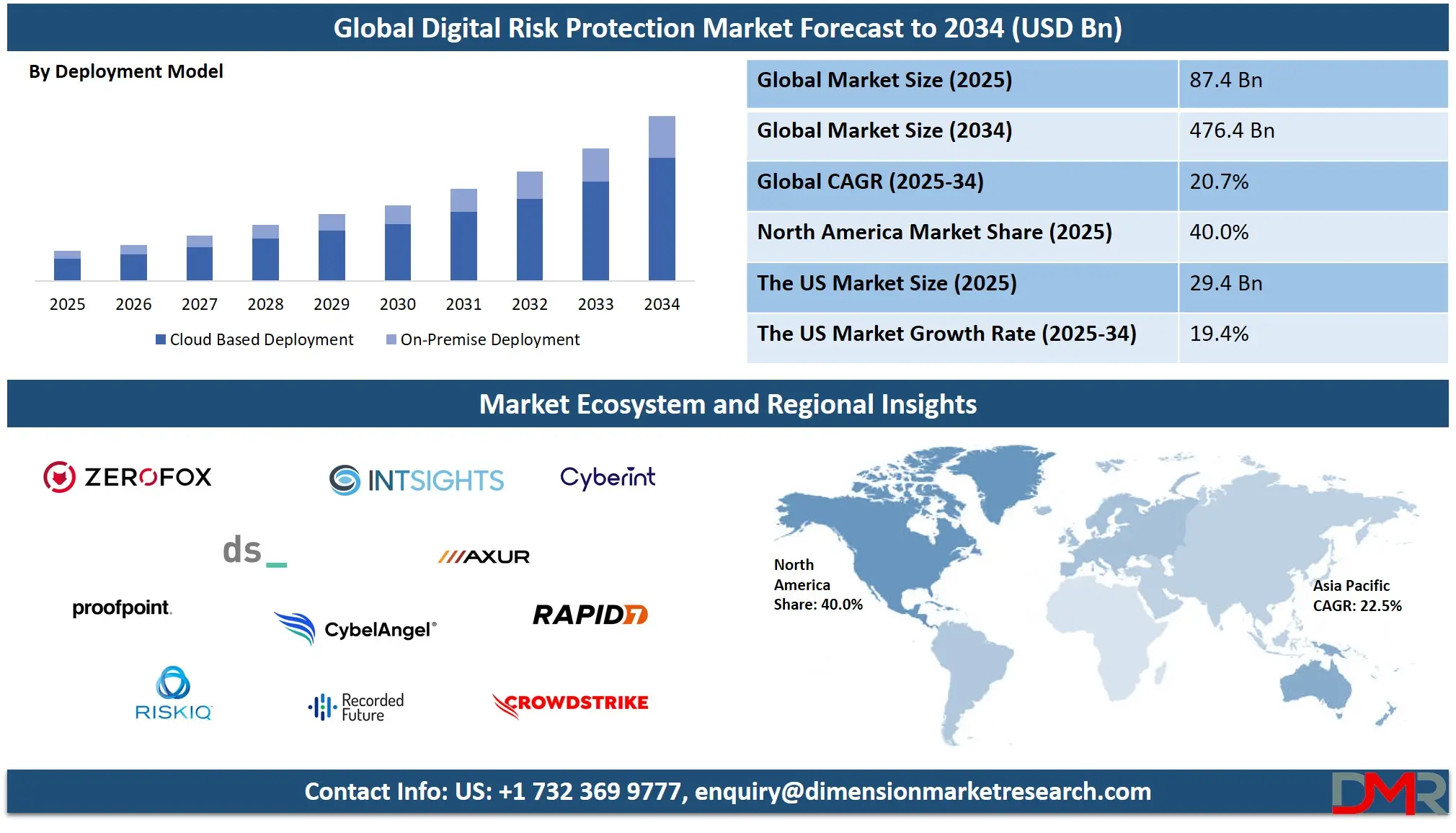

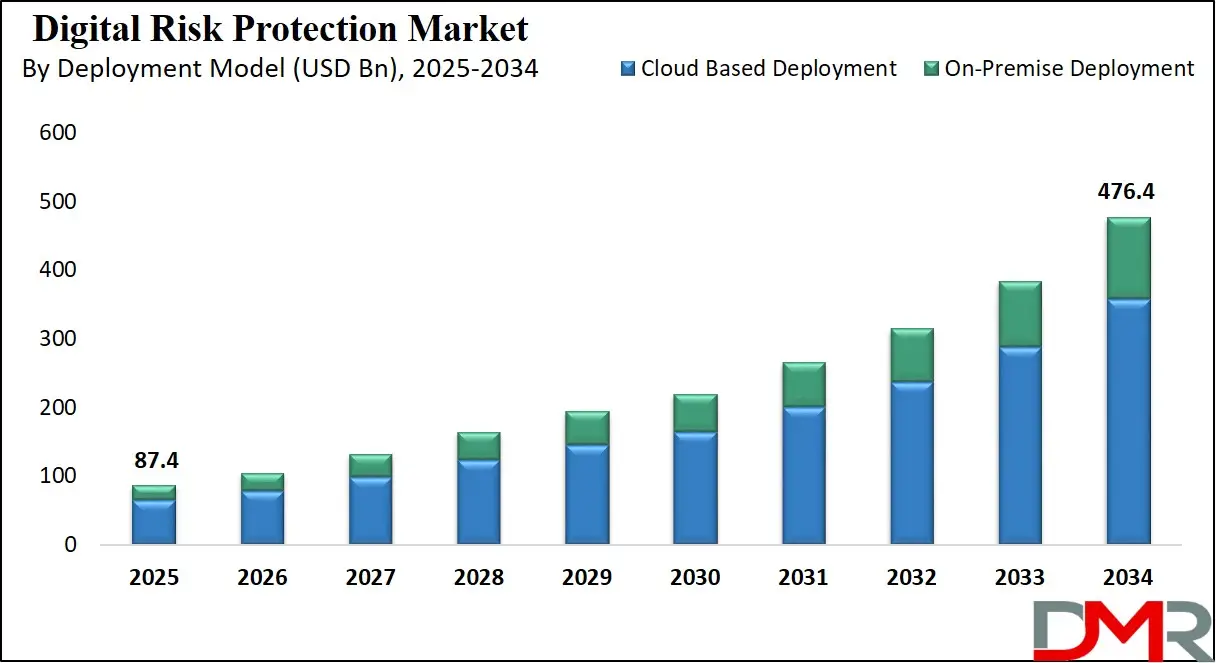

The global Digital Risk Protection market is projected to reach USD 87.4 billion in 2025 and is expected to grow rapidly to USD 476.4 billion by 2034, registering a strong CAGR of 20.7%. This growth reflects rising demand for external threat intelligence, brand protection solutions, dark web monitoring, data leakage detection, and proactive digital risk management as enterprises expand their online presence and face increasingly sophisticated cyber threats.

Digital Risk Protection refers to a set of advanced cybersecurity capabilities designed to identify monitor and mitigate threats that originate outside an organization’s traditional security perimeter. It focuses on safeguarding digital assets such as brand identity customer data intellectual property executive profiles and digital infrastructure across open web deep web and dark web environments.

DRP solutions continuously scan online sources for malicious activities including phishing campaigns credential leaks impersonation fake domains and unauthorized data exposure while providing real time alerts and automated response workflows. By extending visibility beyond internal networks Digital Risk Protection helps businesses stay resilient against evolving cybercriminal tactics and strengthens their overall digital trust posture.

The global Digital Risk Protection market encompasses technology platforms and managed services that enable organizations to detect analyze and respond to external cyber risks across distributed digital ecosystems. This market is being shaped by rising digital transformation expanding cloud adoption and increased exposure of enterprises to internet facing assets which create more avenues for cyberattacks.

Growing dependence on online platforms mobile applications third party integrations and remote workforce tools has further accelerated the need for proactive threat intelligence brand monitoring and data leakage prevention. Enterprises across banking telecommunications government healthcare and retail sectors are investing heavily in DRP solutions to safeguard customer trust and meet regulatory compliance requirements.

The market continues to grow as organizations realize that traditional perimeter security alone cannot counter modern cyberthreats that originate outside their networks. Increasing incidents of brand misuse executive impersonation fraud campaigns and dark web trading of stolen data are pushing companies to adopt DRP capabilities for early threat identification and rapid remediation. The integration of artificial intelligence automated threat analytics and external attack surface visibility is transforming how businesses assess risk posture and fortify their online presence. The rising frequency of credential theft and phishing attacks is also fueling demand for comprehensive DRP platforms that help enterprises strengthen digital resilience on a global scale.

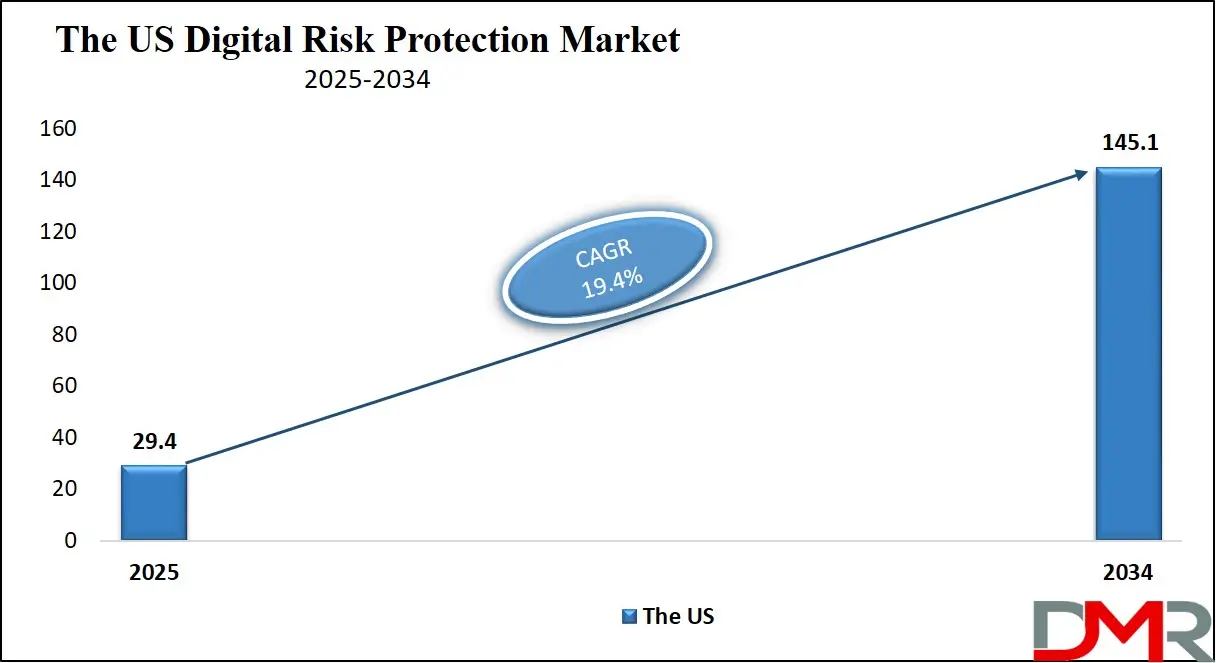

The US Digital Risk Protection Market

The U.S. Digital Risk Protection market size is projected to be valued at USD 29.4 billion by 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 145.1 billion in 2034 at a CAGR of 19.4%.

The United States Digital Risk Protection market is expanding rapidly as enterprises face escalating external cyber threats across social media platforms, cloud environments, mobile applications, and open web ecosystems. US organizations are increasingly adopting DRP solutions to safeguard brand reputation, monitor the dark web, detect credential leaks, and prevent impersonation attacks targeting customers and executives.

Growing digital transformation initiatives across banking, e commerce, healthcare, federal agencies, and technology firms have significantly increased the nation’s exposure to internet facing risks. This has driven demand for external threat intelligence, real time phishing detection, data leakage identification, and domain monitoring tools that help organizations strengthen cyber resilience and comply with tightening security and privacy regulations.

Market growth in the US is further fueled by the surge in sophisticated cybercrime activities including ransomware campaigns, account takeover attempts, social engineering exploits, and deepfake enabled fraud. Companies are investing heavily in AI powered DRP platforms that provide comprehensive monitoring of the deep web and dark web, automated response workflows, and continuous assessment of external attack surfaces. The rise of remote work, third party integrations, and digital supply chain vulnerabilities has intensified the need for proactive digital risk management practices. With strong government support for cybersecurity modernization and heightened awareness of brand misuse and online fraud, the US Digital Risk Protection market is set to remain a dominant global contributor over the coming decade.

Europe Digital Risk Protection Market

The Europe Digital Risk Protection market is projected to reach approximately USD 21.0 billion in 2025, driven by increasing digital adoption, growing online transactions, and rising exposure of enterprises to external cyber threats. Financial institutions, government agencies, and large enterprises are investing heavily in DRP solutions to protect brand reputation, monitor the dark web, detect credential leaks, and prevent phishing attacks. The presence of strict data protection regulations such as GDPR has further accelerated the adoption of advanced threat intelligence and automated monitoring platforms, making Europe one of the key regions contributing to the global DRP market.

The market is expected to grow at a CAGR of 18.0%, reflecting strong demand for AI powered threat detection, social media risk monitoring, and external attack surface management across industries. Cloud based deployments are gaining preference due to scalability and cost efficiency, while services such as managed monitoring, takedown support, and threat analysis are increasingly sought after by mid sized and large enterprises. Continuous innovation by key vendors in brand protection, dark web surveillance, and automated remediation is further supporting market expansion, positioning Europe as a significant growth region in the global Digital Risk Protection landscape.

Japan Digital Risk Protection Market

The Japan Digital Risk Protection market is projected to reach approximately USD 4.4 billion in 2025, driven by the rapid digitalization of enterprises, increasing e commerce adoption, and growing reliance on cloud services and mobile applications. Organizations across banking, technology, retail, and government sectors are investing in DRP solutions to protect sensitive data, monitor social media and digital channels, detect credential leaks, and prevent brand impersonation. Rising cybercrime incidents, including phishing campaigns, online fraud, and deep web threats, have further reinforced the need for robust external threat intelligence and proactive risk mitigation strategies.

The market in Japan is expected to grow at a CAGR of 15.0%, reflecting increasing demand for AI powered monitoring, automated threat detection, and external attack surface visibility. Cloud based deployments are gaining traction due to flexibility, cost efficiency, and real time threat analysis capabilities. Additionally, managed services offering continuous monitoring, takedown assistance, and expert threat investigation are helping mid sized and large enterprises enhance their cyber resilience. Strategic initiatives by local and international vendors, combined with heightened regulatory focus on data protection, are driving sustained growth of the DRP market in Japan.

Global Digital Risk Protection Market: Key Takeaways

- Market Value: The global Digital Risk Protection market size is expected to reach a value of USD 476.4 billion by 2034 from a base value of USD 87.4 billion in 2025 at a CAGR of 20.7%.

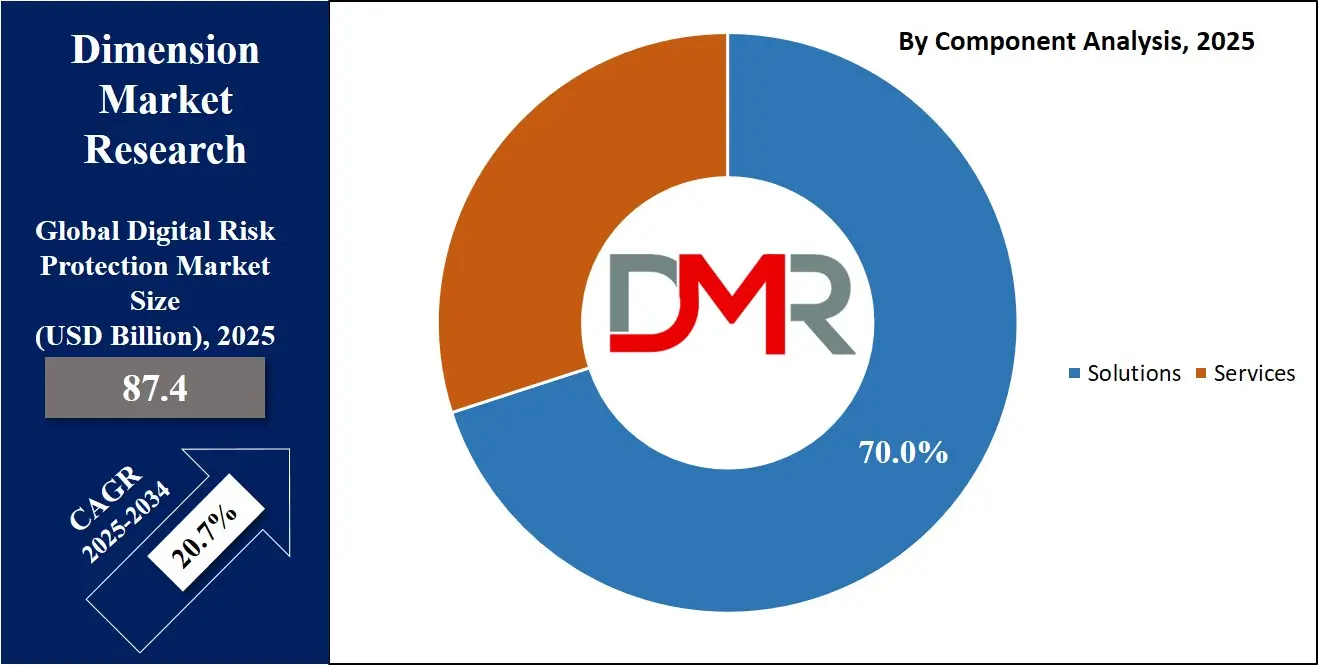

- By Component Segment Analysis: Solutions are expected to maintain their dominance in the component segment, capturing 70.0% of the total market share in 2025.

- By Deployment Model Segment Analysis: Cloud-Based Deployment is anticipated to dominate the deployment model segment, capturing 75.0% of the total market share in 2025.

- By Primary Risk Type Segment Analysis: Brand and Reputation Protection will dominate the primary risk type segment, capturing 25.0% of the market share in 2025.

- By Organization Size Segment Analysis: Large Enterprises will account for the maximum share in the organization size segment, capturing 65.0% of the total market value.

- By Industry Vertical Segment Analysis: Banking and Financial Services will dominate the industry vertical segment, capturing 20.0% of the market share in 2025.

- Regional Analysis: North America is anticipated to lead the global Digital Risk Protection market landscape with 40.0% of total global market revenue in 2025.

- Key Players: Some key players in the global Digital Risk Protection market are ZeroFOX, Digital Shadows, Proofpoint, RiskIQ, IntSights, CybelAngel, Cyberint, Axur, Recorded Future, CrowdStrike, Rapid7, Trellix (formerly FireEye), Microsoft, Cisco, Palo Alto Networks, and Others.

Global Digital Risk Protection Market: Use Cases

- Brand Protection and Impersonation Detection: Enterprises use Digital Risk Protection platforms to continuously monitor the open web, social networks, app stores, and rogue domains for brand misuse, executive impersonation, counterfeit pages, and phishing campaigns. DRP tools identify unauthorized use of logos, fake profiles, cloned websites, and fraudulent ads that damage customer trust. Real time alerts, takedown support, and automated remediation help organizations protect brand integrity and reduce the risk of reputation loss across global digital channels.

- Dark Web Monitoring and Credential Exposure Detection: Organizations rely on DRP solutions to scan deep web and dark web forums, marketplaces, and encrypted communities for stolen credentials, breached data, and leaked intellectual property. This use case enables early detection of compromised accounts, insider threats, and criminal discussions related to targeted attacks. By integrating external threat intelligence and automated analytics, enterprises strengthen digital risk management and prevent account takeover or fraud before it escalates.

- External Attack Surface Visibility and Vulnerability Discovery: Digital Risk Protection platforms provide continuous surveillance of internet facing assets such as cloud workloads, APIs, mobile apps, and third party integrations. These tools identify shadow IT, misconfigured services, exposed databases, expired certificates, and high risk vulnerabilities that attackers can exploit. Continuous external scanning helps security teams gain holistic visibility into their external attack surface and prioritize actions to reduce cyber exposure across distributed digital environments.

- Social Media Risk Monitoring and Fraud Prevention: DRP solutions track social media platforms, messaging apps, and online communities for malicious posts, misinformation campaigns, customer scam attempts, and harmful content targeting a brand. This use case is essential for industries with high customer engagement such as retail, banking, telecom, and entertainment. Automated monitoring helps organizations quickly respond to fraudulent promotions, scam messages, and fake announcements, preserving digital trust and reducing operational risk.

Impact of Artificial Intelligence on the global Digital Risk Protection market

Artificial intelligence is having a transformative impact on the global Digital Risk Protection market, reshaping how organizations detect, analyze, and respond to external cyber threats. AI enhances DRP platforms by automating large scale data collection across the open web, social media, deep web, and dark web, enabling faster identification of phishing campaigns, fake domains, brand impersonation attempts, and leaked credentials. Machine learning models improve threat classification accuracy, reduce false positives, and provide predictive analytics that forecast emerging risks before they impact digital assets. This shift from reactive monitoring to proactive threat anticipation significantly strengthens digital risk management for enterprises.

AI driven automation also improves response speed and operational efficiency. Intelligent algorithms can instantly correlate threat indicators, prioritize high risk alerts, and trigger automated takedown processes for malicious domains or counterfeit profiles. Natural language processing enhances analysis of criminal forums and multilingual threat discussions, while computer vision identifies fraudulent logos, fake ads, and impersonated brand content at scale. As cybercriminals increasingly use AI to launch more sophisticated attacks, the adoption of AI powered DRP solutions becomes essential for maintaining brand integrity, safeguarding customer trust, and securing internet facing ecosystems across global industries.

Global Digital Risk Protection Market: Stats & Facts

- UK Department for Science, Innovation and Technology (DSIT) / Home Office — Cyber Security Breaches Survey 2025

- In 2025, 43% of UK businesses reported experiencing some kind of cyber security breach or attack in the past 12 months.

- In the same period, 30% of UK charities reported having experienced a cyber breach or attack.

- UK Government: Cyber Security Breaches Survey (2024)

- About 50% of UK businesses and 32% of UK charities reported a cyber security breach or attack in the preceding 12 months.

- For medium businesses the proportion was as high as 70%, and for large businesses 74%.

- Among all reported breach types, 84% of businesses (and 83% of charities) experienced phishing attacks.

- Federal Bureau of Investigation (FBI) / Internet Crime Complaint Center (IC3) — 2024 Internet Crime Report

- In 2024, the IC3 received 859,532 complaints of suspected internet‑enabled crime.

- Reported losses in 2024 exceeded USD 16.6 billion, a 33% increase compared to 2023.

- Cyber‑enabled fraud accounted for around 83% of total losses, with 333,981 complaints and USD 13.7 billion in losses.

- European Union Agency for Cybersecurity (ENISA) — Threat Landscape “Finance Sector” Report (Jan 2023–Jun 2024)

- ENISA documented 488 publicly reported cyber‑incidents affecting the European finance sector.

- Traditional banking institutions accounted for 46% (301 incidents).

- The finance sector ranked among the top three most targeted sectors during this period, after public administration and transportation.

Global Digital Risk Protection Market: Market Dynamics

Global Digital Risk Protection Market: Driving Factors

Rising External Threat Landscape and Brand Impersonation Attacks

The surge in phishing campaigns, fake domains, executive impersonation, and counterfeit social media profiles is driving strong demand for Digital Risk Protection solutions. As organizations expand their online footprint across cloud platforms, mobile apps, and digital marketplaces, they face higher exposure to external cyber risks. DRP platforms provide real time monitoring, dark web intelligence, and brand protection analytics, making them essential for safeguarding customer trust and preventing large scale reputational damage.

Growth in Digital Transformation and Internet Facing Assets

Enterprises across banking, telecom, healthcare, and retail are accelerating digital transformation, which increases the number of publicly accessible digital assets. Cloud workloads, third party integrations, SaaS systems, and e commerce platforms create expanded attack surfaces. This shift fuels adoption of DRP tools that deliver attack surface visibility, threat intelligence correlation, and proactive risk mitigation to strengthen cyber resilience across distributed environments.

Global Digital Risk Protection Market: Restraints

High Complexity of Managing External Threat Intelligence

Despite strong demand, many organizations struggle with the complexity of analyzing massive threat data collected from the open web, deep web, and dark web. Limited in house expertise, integration challenges, and the need for continuous monitoring can slow DRP adoption. Smaller enterprises often find it difficult to translate threat intelligence into actionable insights, which restrains market penetration.

Concerns Regarding False Positives and Data Accuracy

Digital Risk Protection platforms must analyze vast and unstructured datasets, which can sometimes result in inaccurate alerts or false positives. Overloaded security teams may experience alert fatigue, reducing operational efficiency. Ensuring consistent data quality, contextualized intelligence, and reliable detection remains a major challenge that impacts deployment confidence among enterprises.

Global Digital Risk Protection Market: Opportunities

Expansion of AI Powered Automated Threat Detection

Artificial intelligence creates a major opportunity for enhancing DRP capabilities by enabling automated phishing detection, brand misuse identification, and predictive threat analytics. Advanced machine learning, natural language processing, and image recognition can significantly improve accuracy and real time response. Vendors leveraging AI for dark web monitoring, fraud detection, and domain takedowns are positioned for strong market growth.

Increasing Adoption of DRP Solutions in Emerging Markets

Countries in Asia Pacific, Latin America, and the Middle East are rapidly digitizing their financial systems, e commerce sectors, and government services, increasing exposure to cyber risks. Rising cybercrime activity and new data protection regulations are opening opportunities for DRP vendors to offer localized threat intelligence, multilingual monitoring, and affordable cloud based platforms for fast growing enterprises.

Global Digital Risk Protection Market: Trends

Integration of DRP with External Attack Surface Management

A key market trend is the convergence of Digital Risk Protection with external attack surface management solutions. Organizations are seeking unified platforms that provide domain monitoring, cloud exposure detection, shadow IT identification, and dark web analytics under one ecosystem. This integrated approach enhances visibility and supports proactive digital risk mitigation.

Growing Demand for Social Media Threat Intelligence and Deepfake Detection

With the explosion of online engagement, organizations face increasing risks from social media fraud, misinformation, fake endorsements, and AI generated deepfake content. DRP vendors are introducing advanced monitoring tools that analyze social channels in real time and detect fraudulent multimedia assets. This trend is reshaping brand security strategies across industries with high customer interaction.

Global Digital Risk Protection Market: Research Scope and Analysis

By Component Analysis

Solutions are expected to maintain their dominance in the component segment, capturing nearly 70% of the global market in 2025 as enterprises increasingly adopt advanced DRP platforms to protect their expanding digital ecosystems. With growing exposure across cloud environments, mobile apps, social media, and third party networks, organizations prioritize software solutions that deliver real time external threat intelligence, brand protection, dark web monitoring, domain discovery, phishing detection, and external attack surface visibility. These automated and scalable capabilities reduce manual security workloads, enhance early risk identification, and strengthen overall digital resilience, making solutions the preferred choice for large and mid sized enterprises seeking comprehensive protection.

Services in the Digital Risk Protection market continue to represent a significant supporting segment as many organizations rely on expert guidance to interpret complex external threat intelligence. Professional and managed DRP services provide threat investigation, 24×7 monitoring, multilingual analysis, takedown assistance, and tailored incident response support for companies that lack in house cyber expertise. Although services hold a smaller share compared with solutions, their importance is rising due to the growing sophistication of cyberattacks and the need for continuous vigilance across global digital channels. As a result, the services segment is expected to grow steadily as enterprises seek specialized support to enhance operational efficiency and maintain an effective digital risk management posture.

By Deployment Model Analysis

Cloud based deployment is expected to dominate the Digital Risk Protection market with a projected 75% share in 2025 driven by its scalability, rapid implementation, and ability to process massive volumes of external threat intelligence in real time. As enterprises expand their online presence across cloud platforms, SaaS ecosystems, and remote work environments, cloud delivered DRP solutions enable faster detection of phishing attacks, brand impersonation, data leaks, and dark web activity without requiring heavy infrastructure investments. The flexibility of cloud architecture supports continuous updates, AI-powered analytics, and automated monitoring across global digital channels, making it the preferred model for organizations seeking agility, lower operational costs, and high performance external threat visibility.

On premise deployment continues to hold relevance for organizations with strict data governance requirements, highly sensitive environments, or regulatory mandates that limit external data processing. Industries such as government, defense, and banking often prefer on premise DRP solutions to maintain full control over threat intelligence workflows and internal data storage. Although this model accounts for a smaller share compared with cloud deployment, it remains important for enterprises that prioritize customized security configurations, internal compliance policies, or isolated network environments. However, the high maintenance costs, slower scalability, and limited real time processing capabilities of on premise systems are expected to contribute to its gradual decline as more enterprises shift toward flexible cloud based DRP platforms.

By Primary Risk Type Analysis

Brand and reputation protection is expected to lead the primary risk type segment with a 25% share in 2025 as organizations increasingly prioritize safeguarding their online identity and customer trust in a highly digital environment. With the rise of fake domains, counterfeit social media accounts, impersonated executive profiles, and fraudulent advertisements, enterprises rely heavily on DRP platforms to detect and remove harmful content that can damage their brand image. Continuous monitoring of social networks, web mentions, app stores, and digital marketplaces helps businesses quickly respond to misinformation, unauthorized logo usage, and scam campaigns. The growing impact of brand related cyber threats on customer engagement, revenue, and corporate credibility has made this segment the most critical focus area for companies globally.

Dark web monitoring and credential exposure detection represent another key segment as organizations face escalating risks from stolen passwords, leaked databases, compromised employee accounts, and criminal activities on hidden forums. DRP solutions equipped with dark web surveillance tools scan marketplaces, encrypted communication channels, and hacker communities to identify sensitive information associated with an enterprise. Early detection of credential leaks, breached records, or upcoming attack discussions helps companies prevent account takeover attempts, targeted phishing campaigns, and large scale data breaches. As attackers increasingly trade corporate access details and confidential data on underground platforms, demand for advanced credential risk detection continues to surge, positioning this segment as a vital component of modern digital risk management.

By Organization Size Analysis

Large enterprises are expected to capture nearly 65% of the total market value in 2025 because they face extensive digital exposure across global operations, cloud infrastructures, customer platforms, and third party ecosystems. With large volumes of sensitive data, complex supply chains, and high brand visibility, these organizations are prime targets for phishing attacks, impersonation scams, data leaks, and dark web activity. As a result, large enterprises invest heavily in advanced Digital Risk Protection platforms that provide real time external threat intelligence, continuous social media monitoring, domain discovery, and automated takedown capabilities. Their higher cybersecurity budgets, compliance requirements, and need for enterprise grade scalability further strengthen the dominance of this segment.

Small and medium enterprises are steadily increasing their adoption of Digital Risk Protection solutions as they become more vulnerable to external cyber threats while transitioning to cloud based tools, e commerce platforms, and digital customer engagement models. Although SMEs operate with limited security teams and tighter budgets, the rise in credential theft, online fraud, brand misuse, and supply chain risks has pushed them to seek cost effective DRP platforms and managed security services. Simplified deployment, affordable cloud subscriptions, and AI driven automation make DRP solutions accessible for smaller businesses that need continuous monitoring without heavy infrastructure investment. As awareness of digital risks grows, SMEs are expected to contribute significantly to future market expansion despite holding a smaller share today.

By Industry Vertical Analysis

The banking and financial services sector is expected to dominate the industry vertical segment with a 20% share in 2025 due to its high exposure to cyber threats and sensitive financial data. Financial institutions face constant risks from phishing attacks, account takeovers, online fraud, data breaches, and brand impersonation, making Digital Risk Protection solutions critical for safeguarding customer trust and regulatory compliance. DRP platforms enable continuous monitoring of social media, mobile banking applications, online portals, and the dark web to detect suspicious activity, prevent fraud, and protect intellectual property. The increasing reliance on digital banking services and fintech innovations has further accelerated the adoption of external threat intelligence, automated alerting, and proactive risk mitigation in this sector.

The IT and telecommunications industry also represents a significant segment as companies in this space manage vast digital infrastructures, cloud environments, and high volumes of customer data, which make them attractive targets for cybercriminals. DRP solutions help these organizations monitor unauthorized access attempts, phishing campaigns, brand misuse, data leaks, and supply chain vulnerabilities. Continuous external attack surface visibility and proactive threat intelligence are crucial for preventing service disruptions, safeguarding customer information, and maintaining corporate reputation. The growing demand for managed services, cloud adoption, and AI powered threat analytics in IT and telecom is driving strong investment in Digital Risk Protection platforms across this sector.

The Digital Risk Protection Market Report is segmented on the basis of the following:

By Component

By Deployment Model

- Cloud-Based Deployment

- On-Premise Deployment

By Primary Risk Type

- Brand and Reputation Protection

- Dark Web Monitoring and Credential Exposure Detection

- Data Leakage and Intellectual Property Discovery

- Social Media Risk Monitoring and Phishing Detection

- Fraud Detection and Account Takeover Prevention

- Mobile Application Security and Supply Chain Risk Monitoring

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Industry Vertical

- BFSI

- IT & Telecommunications

- Retail and E-commerce

- Government and Defense

- Healthcare and Pharmaceutical

- Energy and Utilities

- Media and Entertainment

- Other Industries

Global Digital Risk Protection Market: Regional Analysis

Region with the Largest Revenue Share

North America is expected to lead the global Digital Risk Protection market with a 40% share of total revenue in 2025, driven by high digital adoption, stringent cybersecurity regulations, and the presence of numerous large enterprises with extensive online operations. Organizations across banking, technology, healthcare, and government sectors are increasingly investing in DRP solutions to monitor brand misuse, detect credential leaks, prevent phishing attacks, and gain visibility into dark web activities. Advanced cloud infrastructure, widespread AI adoption for threat intelligence, and a mature cybersecurity ecosystem make North America the most prominent and dynamic region in the global market, with strong demand for proactive digital risk management and external attack surface monitoring.

Region with significant growth

The Asia Pacific region is expected to witness significant growth in the Digital Risk Protection market due to rapid digital transformation, expanding e commerce and fintech sectors, and increasing internet penetration. Organizations across China, India, Japan, and Southeast Asia are increasingly exposed to phishing attacks, data breaches, brand impersonation, and social media fraud, driving demand for proactive DRP solutions. Rising awareness of cybersecurity regulations, adoption of cloud based platforms, and the need for external threat intelligence and dark web monitoring are fueling market expansion. Emerging enterprises are leveraging cost effective and AI powered DRP platforms to enhance digital resilience and protect customer trust, positioning the region as a high growth opportunity.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Risk Protection Market: Competitive Landscape

The global Digital Risk Protection market is highly competitive, featuring a mix of specialized cybersecurity vendors, large technology firms, and managed service providers. Companies such as ZeroFOX, Digital Shadows, Proofpoint, RiskIQ, IntSights, and CybelAngel lead with advanced brand protection, dark web monitoring, and external threat intelligence capabilities, while major technology players like Microsoft, Cisco, Palo Alto Networks, and Trend Micro integrate DRP solutions within broader security ecosystems. Vendors are increasingly differentiating through AI powered analytics, real time monitoring, automated takedown services, and cloud based deployment options. Strategic partnerships, mergers and acquisitions, and continuous innovation in threat detection, social media monitoring, and external attack surface management are key drivers shaping the competitive landscape and strengthening the market position of leading players globally.

Some of the prominent players in the global Digital Risk Protection market are:

- ZeroFOX

- Digital Shadows

- Proofpoint

- RiskIQ

- IntSights

- CybelAngel

- Cyberint

- Axur

- Recorded Future

- CrowdStrike

- Rapid7

- Trellix (formerly FireEye)

- Microsoft

- Cisco

- Palo Alto Networks

- Trend Micro

- Fortinet

- F-Secure

- SafeGuard Cyber

- Exabeam

- Other Key Players

Global Digital Risk Protection Market: Recent Developments

- Sep 2025: ZeroFOX announced a strategic partnership with Swisscom to deliver intelligence‑driven managed security solutions for Swisscom’s clients, extending Digital Risk Protection services across new regions and enhancing real-time threat detection and brand protection capabilities.

- May 2025: Check Point Software Technologies acquired Israeli exposure‑management cybersecurity firm Veriti, bringing Veriti’s automated threat‑exposure remediation capabilities into Check Point’s portfolio — a move signalling growing consolidation around external risk‑detection and external attack surface management platforms.

- Mar 2025: ReliaQuest secured over USD 500 million in funding, raising its valuation to USD 3.4 billion. This capital infusion is intended to accelerate the expansion of its AI‑powered GreyMatter platform, aimed at delivering automated threat detection, investigation and response for enterprises.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 87.4 Bn |

| Forecast Value (2034) |

USD 476.4 Bn |

| CAGR (2025–2034) |

20.7% |

| The US Market Size (2025) |

USD 29.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Solutions, Services), By Deployment Model (Cloud-Based Deployment, On-Premise Deployment), By Primary Risk Type (Brand and Reputation Protection, Dark Web Monitoring and Credential Exposure Detection, Data Leakage and Intellectual Property Discovery, Social Media Risk Monitoring and Phishing Detection, Fraud Detection and Account Takeover Prevention, Mobile Application Security and Supply Chain Risk Monitoring), By Organization Size (Large Enterprises, Small and Medium Enterprises), and By Industry Vertical (BFSI, IT & Telecommunications, Retail and E-commerce, Government and Defense, Healthcare and Pharmaceutical, Energy and Utilities, Media and Entertainment, Other Industries) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

ZeroFOX, Digital Shadows, Proofpoint, RiskIQ, IntSights, CybelAngel, Cyberint, Axur, Recorded Future, CrowdStrike, Rapid7, Trellix (formerly FireEye), Microsoft, Cisco, Palo Alto Networks, and Others. |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days and 5 analysts working days respectively. |

Frequently Asked Questions

The global Digital Risk Protection market size is estimated to have a value of USD 87.4 billion in 2025 and is expected to reach USD 476.4 billion by the end of 2034.

The US Digital Risk Protection market is projected to be valued at USD 29.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 145.1 billion in 2034 at a CAGR of 19.4%.

North America is expected to have the largest market share in the global Digital Risk Protection market, with a share of about 40.0% in 2025.

Some of the major key players in the global Digital Risk Protection market are ZeroFOX, Digital Shadows, Proofpoint, RiskIQ, IntSights, CybelAngel, Cyberint, Axur, Recorded Future, CrowdStrike, Rapid7, Trellix (formerly FireEye), Microsoft, Cisco, Palo Alto Networks, and Others.

The market is growing at a CAGR of 20.7 percent over the forecasted period.