The digital storage devices market is rather growing fast all over the world due to the expansion of digital data in virtually all industries. The market is also projected to experience growth in terms of size as demand projections point towards a large growth in the market, seeking solutions in the form of storage services. Some of the key drivers that have been noted include; the usage of data-intensive applications, the emergence of big data, and the use of cloud storage services.

The organizations and end-users both want improved storage devices for the storage and retrieval of data and also, for its security. Market segmentation indicates that there is a clear inclination toward products and services that incorporate SSDs because of their better performance. Also, the developments in data storage technology and the increasing requirement for data storage and protection are boosting the market growth. In conclusion, due to the ever-evolving nature of digital technologies, the global digital storage devices market will be strategically positioned to meet the future’s data storage demands.

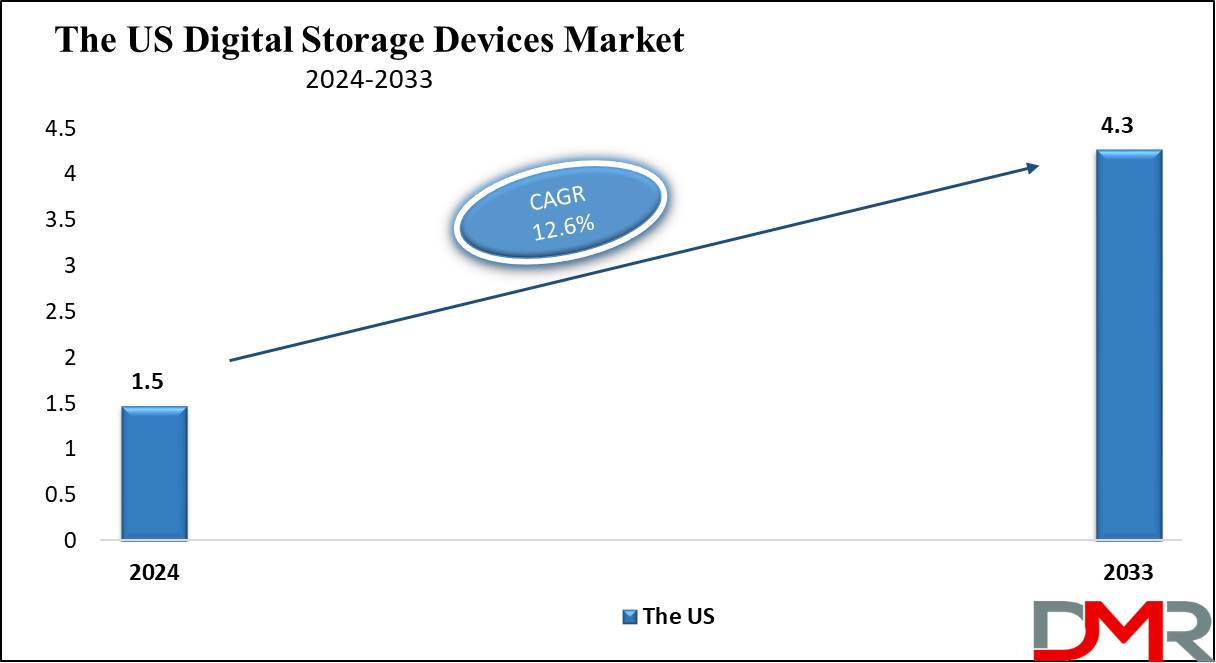

The US Digital Storage Devices Market

The US digital storage device market is expected to be valued at USD 1.5 billion in 2024 which in the upcoming period is anticipated to cross the threshold of USD 4.3 billion in 2033 at a CAGR of 12.6%.

The US Digital Storage Devices Market has seen various developments and shifting trends in this market in the last few years. Advances in technology have led to improved adoption of SSDs over conventional HDDs because of their faster speed, durability, and decreasing costs. The rise in demand for cloud computing and massive data analytics has pushed the need for high-capacity storage solutions.

Edge computing and IoT devices are also contributing to the increase, requiring efficient and reliable storage. Security issues have caused innovations in information encryption and safety which push for greener technology and has resulted in the development of energy-efficient storage devices.

Additionally, the growing recognition of 5G networks is anticipated to reinforce the demand for storage solutions to address the widespread amounts of statistics generated. Key gamers specializing in this region are focusing on R&D to introduce cutting-edge products, and mergers and acquisitions are common as companies strive to improve their market position.

Key Takeaways

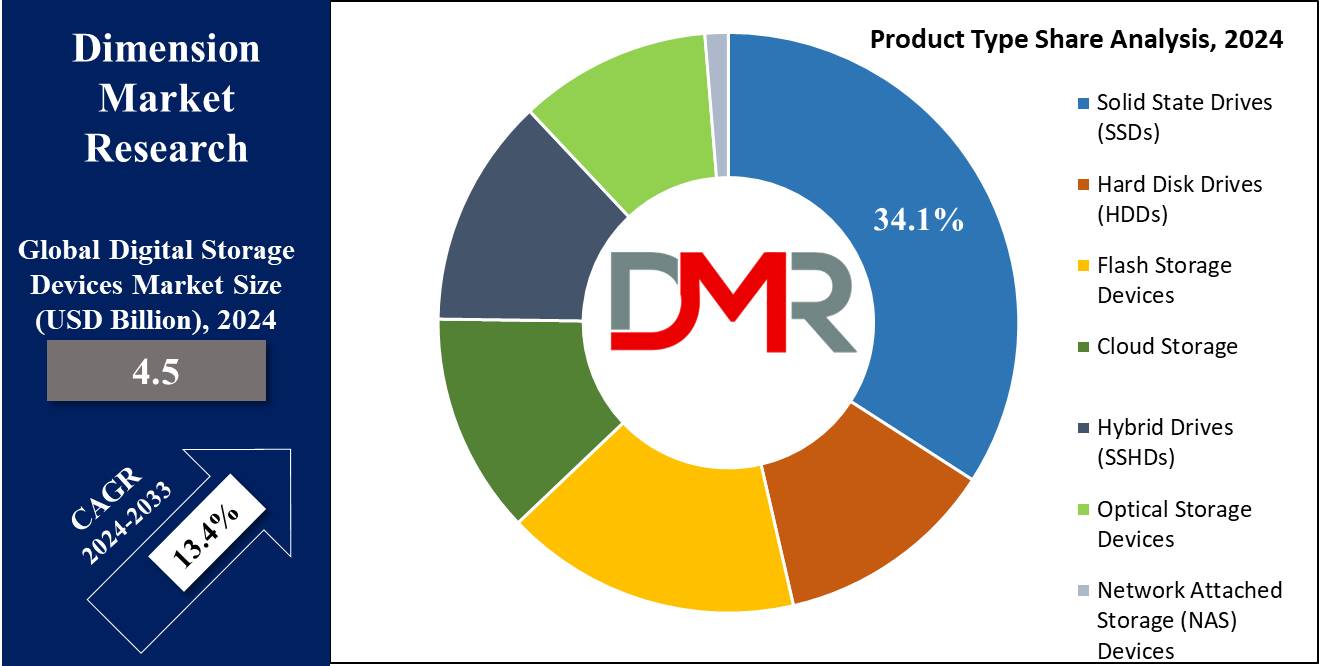

- Market Size: The global digital storage devices market is expected to grow from USD 4.5 billion in 2024 to USD 14.0 billion by 2033, at a CAGR of 13.4%.

- By Product Type Segment Analysis: In the global digital storage devices market, solid-state drives are projected to dominate the product type segment as they hold 34.1% of the market share in 2024.

- By Capacity Segment Analysis: 1 TB to 5 TB emerged as the primary capacity segment of digital storage devices as it is projected to hold 39.2% of the market share in 2024.

- By Application Segment Analysis: Business storage is expected to dominate this segment as it commands the highest market share in this market in 2024.

- By End User Analysis: Consumer electronics is projected to dominate this market as it holds the highest market share of about 34.2% in 2024.

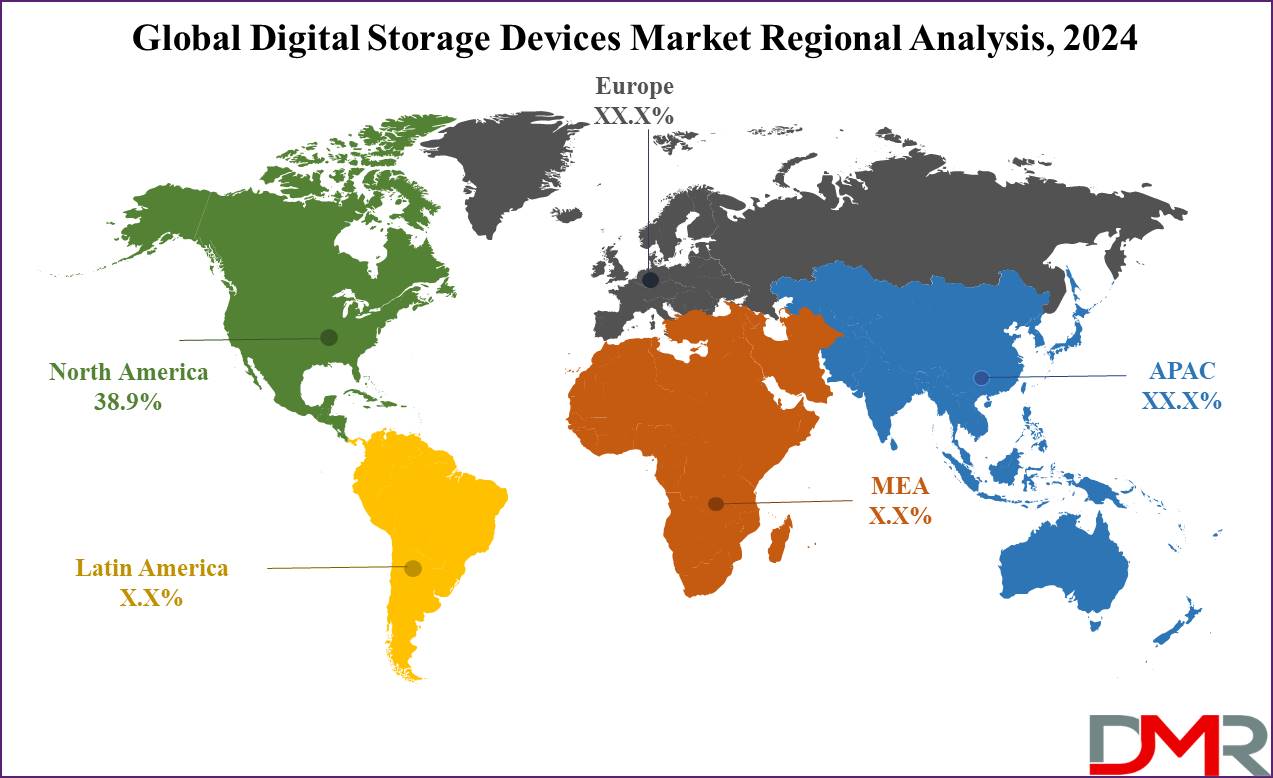

- Regional Analysis: North America is projected to dominate the global digital storage devices market as it holds 38.9% of the market share in 2024.

Use Cases

- Data Centers: Data centers require high-capacity, reliable storage solutions to manage & process substantial quantities of data, ensuring seamless operations and quick access to information.

- Personal Storage: Consumers use digital storage devices which include SSDs, HDDs, and USB drives to save private data, along with photos, films, and a file, making sure data is readily available and secure.

- Enterprise Backup: Businesses depend on robust storage devices for data backup and recovery, protecting crucial information from data loss and ensuring commercial business continuity.

- Gaming: High-overall performance SSDs and external drives are crucial for game enthusiasts to keep and quickly access large game files, enhancing the gaming revel with faster load times.

Market Dynamic

Trends

Adoption of NVMe SSDsOne of the emerging tendencies in the market of digital storage is the transition to NVMe SSDs (Non-Volatile Memory Express). NVMe SSDs provide much higher data throughput and significantly lower access times in comparison with SATA SSDs. This performance increase is especially important for purposes like high-frequency trading, data processing and analysis, and real-time games. The NVMe protocol connects to the high-speed PCIe bus to offer faster read and write into the media, and thus enhance the system performance, making it more suitable for consumers and even more for business applications.

Cloud Storage IntegrationThe use of cloud-connected with Local Device Storage services is getting popular rapidly. Cloud hybrid storage systems are where businesses put together pre- and post-cloud, on-site, and client storage systems. This is due to the need to improve data manageability and the necessity for efficient disaster recovery strategies. Hybrid storage models provide opportunities to categorize storage and still obtain all the advantages of cloud storage as well as satisfy the variety of storage demands.

Growth Drivers

Big Data and AnalyticsThe constantly increasing volumes of big data and the pressure for the generation of real-time analytics call for the need for efficient storage solutions. Organizations within diverse sectors are incorporating the use of

big data analysis in the course of their operations. Due to social media, IoT devices, and enterprise applications, the amount of data generated daily is large and needs proper storage, culminating in market growth.

Digital TransformationIt is due to the burgeoning growth of the digital ecosystem across industries as the demand for stout, stable, and high-capacity storage devices for digital-oriented processes and data-driven environments. Organizations are integrating strategies such as digital EC to improve productivity and efficiency as well as improve competitiveness. As businesses transition to cloud computing,

artificial intelligence, and the Internet of Things (IoT) the market requires sophisticated storage solutions for these technologies.

Growth Opportunities

IoT Devices

Due to the increasing number of IoT devices data storage becomes a critical issue thus generating opportunities for storage for the data collected. Internet of Things devices are embedded in numerous industries such as healthcare, manufacturing, and smart cities which have helped contribute to the increase in data production. Sophisticated storage technologies that ensure high performance, elasticity, and resiliency are crucial to deal with data from IoT peripherals, which has the potential to foster the storage market’s growth drastically.

Edge ComputingThe advent of edge computing means the need for localized storage systems that warrant low latency and high performance, which presents improved prospects for enhanced storage systems. Edge computing can be defined as the processing of data at a closer range to the point where the actual data is being created to minimize latency and bandwidth consumption. It remains highly important for applications where latency between the operation and the results is critical, like self-driving cars, smart power stations, and the roboticization of industries. These applications require storage solutions that can support

edge computing there are future storage solutions that can address these needs hence fueling the market.

Restraints

High Costs of Advanced Storage SolutionsThe potential expenses connected with detailed storage technologies like NVMe SSDs can be a challenge to broad utilization notably to small, and medium business organizations. However, the initial cost of the high-capacity, high-speed storage solutions may be a big put-off for organizations that are working with limited funds. This cost factor can affect the rate of adoption and the extent to which the market is absorbed hence has an impact on the market penetration, especially for products with sensitive price level segments.

Data Security Concerns

The threat of escalating data piracy and security issues remains a factor that affects, or at least creates an issue of storing the devices’ market, since adequate data security measures can always contribute toward a rise in expenses. When used in distributed environments that are cloud and network-based, the solutions become targets for cybercrimes and data thefts. The use of security measures like encryption, access controls, and periodic security enhancements are critical to any storage solution but will also increase the total cost and system complexity.

Research Scope and Analysis

By Product Type

Solid State Drives (SSDs) are projected to dominate the digital storage devices market as they hold 34.1% of the market share in 2024 due to their numerous advantages over traditional Hard Disk Drives (HDDs). SSDs offer significantly faster data read and write speeds, leading to quicker boot times, faster file transfers, and overall improved system performance. This speed advantage is particularly crucial in applications requiring high performance, such as gaming, professional content creation, and enterprise environments. Also, SSDs are more reliable and durable because they do not have a head movement and a mechanical arm, thereby they are less affected by mechanical failures and data loss.

Due to these factors, they can power laptops, ultrabooks, and other portable devices because they are small and don’t cause a lot of heat. Moreover, the new technologies of SSD have contributed to raising storage sizes and decreasing the prices that affect the demand from a wide range of customers from individuals to companies. Hence, SSDs have earned their place as the go-to contender for storage services and devices in personal as well as business applications, pushing their competition further toward the background.

By Capacity

The 1 TB to 5 TB capacity segment is expected to dominate the digital storage devices market due to its balance of storage space and affordability, meeting the needs of both individual consumers and businesses. In terms of personal usage, this capacity range is more than enough to accommodate vast collections of pictures and videos, and large game and application libraries which are growing in size with time consuming more and more disk space. In business environments, this capacity is capable of storing adequate amounts of operational data, documents, and backup files without raising the need to spend heftier sums.

It also follows the capacity demand of some SMEs, departments, and divisions of large corporations that require large storage but not of the magnitude that enterprises demand. The 1 TB to 5 TB is also seen in the external hard disk and NAS devices due to these it is more portable for backing up data and sharing the data. In other words, by the criteria of cost, performance, and storage, this capacity segment is quite ideal, which has led to its acceptance in the market space.

By Application

Business storage is projected to dominate the digital storage devices market based on application due to the critical need for reliable, scalable, and secure storage solutions in enterprise environments. Data centers, enterprise backup, and archiving systems require high-capacity storage devices to manage and store vast amounts of data generated by businesses. The rise of big data analytics, IoT, and digital transformation initiatives has led to an explosion of data, further driving the demand for robust business storage solutions. Enterprises need to ensure data availability, integrity, and security to support their operations and decision-making processes.

Network-attached storage (NAS) devices, cloud storage, and high-performance SSDs are essential for meeting these requirements. Additionally, regulatory compliance and data protection regulations mandate businesses to maintain accurate and secure data records, adding to the need for reliable storage solutions. As businesses continue to generate and rely on digital data, the business storage segment will remain a dominant force in the market.

By End User

Consumer electronics is anticipated to dominate the digital storage devices market due to the massive and growing demand for personal data storage solutions. The proliferation of smartphones, tablets, laptops, gaming consoles, and other digital devices has led to an exponential increase in the amount of digital content generated by individuals. Consumers require reliable and high-capacity storage solutions to store their photos, videos, music, applications, and other digital files. Additionally, the rise of high-definition and 4K content, as well as the increasing popularity of video streaming and gaming, necessitates larger storage capacities and faster data access speeds.

The trend towards digitalization and the integration of smart home devices further boost the demand for consumer storage solutions. SSDs, USB flash drives, and external hard drives are particularly popular among consumers for their ease of use, portability, and performance. As digital lifestyles continue to evolve, the consumer electronics segment remains a significant driver of growth in the digital storage devices market.

The Digital Storage Devices Market Report is segmented on the basis of the following

By Product Type

- Solid State Drives (SSDs)

- SATA SSDs

- NVMe SSDs

- M.2 SSDs

- PCIe SSDs

- Hard Disk Drives (HDDs)

- Internal HDDs

- External HDDs

- Flash Storage Devices

- USB Flash Drives

- Memory Cards

- Flash Drives

- Cloud Storage

- Hybrid Drives (SSHDs)

- Optical Storage Devices

- Network Attached Storage (NAS) Devices

By Capacity

- Less than 500 GB

- 500 GB to 1 TB

- 1 TB to 5 TB

- Above 5 TB

By Application

- Personal Storage

- Business Storage

- Data Centers

- Enterprise Backup

- Archiving

- Gaming Storage

- Media & Entertainment Storage

- Education & Research Storage

By End-user

- Consumer Electronics

- Personal Use

- Gaming

- Entertainment

- Enterprise Storage

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Industrial

- Manufacturing

- Energy

- Healthcare

- Automotive

Regional Analysis

North America is projected to dominate the global digital storage devices market as it is

anticipated to hold 38.9% of the market share in 2024 which is further forested to show subsequent growth in the upcoming period of 2024 to 2033 as well. Several factors have led North America to capture the largest share of the global digital storage devices market. Companies in the area are enthusiasts of technological innovation, particularly in the aspect of data storage, as evidenced mostly by the establishment of large data centers. The fact that leading storage device manufacturers and technology giants like Western Digital, Seagate, and Intel are located in the region guarantees continued delivery of innovative technologies.

Also, North America is technologically advanced when it comes to using IT infrastructure hence high IT penetration making almost all the consumer and business individuals adopt the digital storage devices. The increasing pressures resulting from new and evolving applications dependent on data along with big data integration and cloud services have exerted more pressure towards the realization of enhanced storage facilities in the same region.

Also, legal implementation procedures for data security and privacy including GDPR and CCPA make organizations purchase dependable storage devices. The high disposable income and technological awareness of the consumers are also an important factor that has elevated the North American region to such a prominent position in the digital storage devices market.

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Competitive Landscape

The digital storage device market is very competitive at the global level due to the advancement of current technology and new technological inventions that result in an increased need for data storage solutions. Some of the major players involved in the production of hard disk drives are Western Digital, Seagate Technology, Samsung, and Intel they have a wide range of products with better technologies. These companies commit a lot of capital to research and innovation of new and enhanced storage devices for instance high – high-density SSDs, advanced Hard drives, Cloud Storage, and others.

Competition in the market is also provided by new entrants that target specific clients or provide specific types of storage solutions. Joint ventures, alliances, joint ventures, and acquisitions are all popular because organizations seek to increase their market share as well as their range of products and services offered. Also, the specifics of modern business such as data security concerns, the necessity to handle large data volumes, and IoT devices prompt companies to create appropriate storage solutions. The rivalry is keener, constant development, partnerships, and the adaptation of products and services to the consumer and enterprise storage needs are evident.

Some of the prominent players in the Global Digital Storage Devices Market are

- Lenovo

- SanDisk Corporation

- Transcend Information

- Sony Corporation

- Seagate Technology

- Toshiba Corporation

- Western Digital

- Kingston Technology

- Intel Corporation

- Samsung Electronics

- Violin Systems

- DDN IntelliFlash

- Silk (Formerly Kaminario)

- Nutanix

- Other Key Players

Recent Developments

June 2024

- Western Digital announced the release of its new line of UltraStar DC HC650 20TB hard drives, aimed at improving data center storage capacities with higher density and lower power consumption.

- Samsung introduced its latest 990 Pro SSDs with PCIe 5.0 interface, offering significant speed improvements for gaming and professional workloads.

May 2024

- Seagate Technology launched its new MACH.2 multi-actuator hard drives, providing double the performance of traditional HDDs and targeting enterprise data centers.

- Kingston Technology released a new series of high-capacity DataTraveler Max USB 3.2 Gen 2 flash drives, offering up to 1TB storage capacity for portable and high-speed data transfer.

April 2024

- Toshiba unveiled its new MG10 Series of 20TB HDDs, featuring Conventional Magnetic Recording (CMR) technology to meet the growing demand for cloud-scale and enterprise storage.

- Micron Technology announced the expansion of its Crucial P5 Plus NVMe SSD lineup, delivering enhanced performance for gaming and content creation.

December 2023

- Intel introduced the Optane H20 SSDs, combining Optane Memory technology with QLC 3D NAND to deliver faster performance and improved storage efficiency for laptops and desktops.

- SanDisk released its Extreme Pro portable SSD V2, offering up to 4TB capacity and enhanced durability for on-the-go storage solutions.

November 2023

- Western Digital expanded its WD_BLACK portfolio with the addition of new external SSDs designed for gamers, including the WD_BLACK P50 Game Drive SSD with USB 3.2 Gen 2x2 interface.

- ADATA launched its new Premier Pro microSDXC UHS-I memory cards with up to 512GB capacity, targeting high-resolution video recording and fast data transfer needs.

October 2023

- Samsung announced the mass production of its 1TB V-NAND-based microSD cards, the highest capacity in the industry, suitable for smartphones, tablets, and other portable devices.

- Crucial introduced its X9 Pro Portable SSDs, delivering high-speed data transfer rates and robust security features for professionals and content creators.

September 2023

- Seagate Technology revealed its IronWolf Pro 20TB hard drives, optimized for NAS (Network Attached Storage) environments, enhancing storage reliability and performance.

- Lexar launched the Professional CFexpress Type B Card DIAMOND Series, providing superior performance for professional photographers and videographers.