Market Overview

The Global Digital Tokens Market is anticipated to reach USD 16.1 billion in 2025, driven by advancements in blockchain technology, decentralized finance (DeFi), and tokenized real-world assets (RWAs). The market is expected to expand at a robust compound annual growth rate (CAGR) of 22.8% from 2025 to 2034, reaching a projected value of USD 102.0 billion by 2034.

Growth is fueled by the increasing adoption of AI-driven smart contracts and automated market makers, rising demand for digital securities and utility tokens, and the integration of tokenization in traditional finance and supply chain management. Additionally, expanding applications in payments, asset management, and identity verification sectors, coupled with the growing availability of scalable blockchain protocols and regulatory-compliant token standards, are expected to further accelerate market expansion globally.

The global landscape for digital tokens is experiencing a profound transformation, moving beyond cryptocurrencies into the core of digital asset ecosystems and institutional finance. A significant trend is the shift towards institutional-grade tokenization, where financial institutions are establishing in-house digital asset divisions to create and manage tokenized securities and funds.

This decentralization of financial services accelerates transaction settlements and improves asset liquidity by providing fractional ownership of previously illiquid assets. Concurrently, the technology is advancing into central bank digital currencies (CBDCs), where research and pilot programs focus on creating sovereign digital money, though this remains largely in the developmental and regulatory phase. The integration of artificial intelligence with token issuance platforms is also emerging, optimizing token economics and automating compliance processes through smart contracts.

The market's expansion is fueled by substantial opportunities in decentralized finance, particularly in crafting yield-generating protocols and liquidity pools that offer unparalleled returns and functionality compared to traditional financial solutions. The payments industry has become a major adopter, leveraging the technology for the fast, secure, and low-cost cross-border settlement of transactions, which has revolutionized remittance workflows.

Furthermore, the ongoing development of novel, interoperable token standards, including advanced cross-chain bridges and privacy-focused tokens, opens new avenues for creating financial products that integrate better with global regulatory frameworks. These innovations are poised to address complex challenges in capital markets and trade finance, providing solutions that were previously unimaginable.

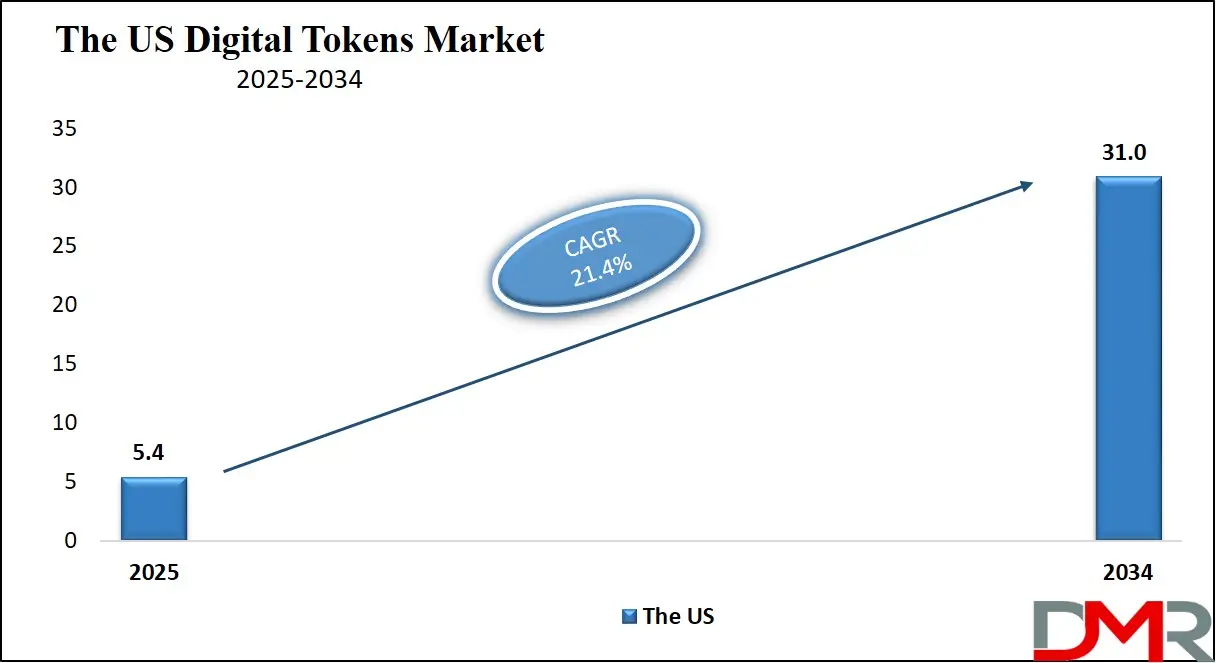

The US Digital Tokens Market

The US Digital Tokens Market is projected to reach USD 5.4 billion in 2025 at a compound annual growth rate of 21.4% over its forecast period.

The United States maintains a leadership position in the digital asset landscape, a status fortified by substantial private investment and an evolving regulatory framework. Agencies like the Securities and Exchange Commission (SEC) actively shape the market through enforcement actions and guidance, providing clarity for asset issuers and having already approved several Bitcoin and Ethereum-based financial products in recent years.

The Commodity Futures Trading Commission (CFTC) has pioneered specific regulatory pathways for crypto derivatives, providing a structured environment for trading venues. This proactive stance from federal bodies creates a stable, though cautious, environment for technological advancement and commercial investment in the sector. The presence of world-leading financial and technology institutions, including BlackRock and Fidelity, further drives institutional adoption through the launch of spot Bitcoin ETFs and the establishment of dedicated digital asset custody services that directly serve investor demand.

A significant structural advantage for the U.S. market is its deep and mature capital markets, a trend documented by the Federal Reserve. This financial infrastructure predicts a substantial increase in the tokenization of traditional assets such as treasury bonds, real estate, and private equity, which in turn drives demand for compliant digital token solutions. The need for secure, transparent, and efficient systems for issuing, trading, and settling these tokenized assets is rising in direct correlation.

Furthermore, the high level of venture capital and institutional investment, as reported by industry analysts, indicates a system capable of funding advanced, albeit sometimes speculative, technologies. This financial capacity, combined with a growing body of use cases demonstrating the value of digital tokens in reducing settlement times and enabling new business models, is encouraging more financial institutions to integrate this technology into their standard operations, ensuring continued market growth.

The Europe Digital Tokens Market

The Europe Digital Tokens Market is estimated to be valued at USD 1.9 billion in 2025 and is further anticipated to reach USD 8.1 billion by 2034 at a CAGR of 16.5%.

The European digital tokens ecosystem is characterized by strong collaboration between public regulators, central banks, and industry, guided by a comprehensive regulatory framework. The European Securities and Markets Authority (ESMA) and the new Markets in Crypto-Assets (MiCA) regulation provide a stringent set of requirements for the issuance and trading of digital tokens, ensuring high standards of investor protection and market integrity across member states. This is supported by significant innovation from the European Central Bank (ECB) and national central banks, which are actively exploring a digital euro and its implications for the financial system. Major financial centers, such as London and Frankfurt, are exploring the cost-benefit analysis of deploying distributed ledger technology for specific capital market applications, which is critical for guiding widespread adoption and interoperability standards.

Europe's financial structure, as analyzed by the European Banking Authority, presents a clear driver for the digital token sector. The region has a highly integrated but complex cross-border payment system, leading to a higher demand for efficient, low-cost settlement solutions. This creates a pressing need for innovative, blockchain-based payment and asset transfer systems that can improve the efficiency of the single market. The strong tradition of public-private partnership prevalent across the continent is increasingly focused on regulatory clarity, seeking technologies that can enhance financial stability and consumer protection. The presence of a highly skilled fintech workforce and a dense network of specialized financial institutions facilitates the development and application of complex tokenized solutions, from digital bonds in Germany to tokenized trade finance platforms in France, positioning Europe as a critical and advanced market for digital token innovation.

The Japan Digital Tokens Market

The Japan Digital Tokens Market is projected to be valued at USD 780 million in 2025. It is further expected to witness subsequent growth in the upcoming period, holding USD 3,550 million in 2034 at a CAGR of 18.1%.

Japan's foray into digital assets is heavily influenced by its status as an early adopter of cryptocurrency regulation, a reality extensively documented by the Japanese Financial Services Agency (FSA). This has created a structured and growing market for utility tokens and security tokens, particularly in payments and asset management. In response, the Japanese government has strategically prioritized blockchain and Web3 through national initiatives, with agencies funding projects that bridge the gap between academic research and commercial application. The FSA, Japan's regulatory body, has been working to establish clear licensing and oversight frameworks for crypto exchanges and token issuers, providing a structured, though rigorous, environment for businesses to operate, ensuring they meet the highest standards of security and consumer protection.

The market advantage for Japan lies in its technologically proficient society and its need to modernize its financial infrastructure. This drives innovation in creating secure, user-friendly token wallets and trading platforms that cater to the specific demands of both retail and institutional investors. Major Japanese financial institutions and tech corporations are actively involved in research on advanced tokenization platforms and applications.

Furthermore, the high density of technology-savvy consumers in urban centers like Tokyo and Osaka serves as an early adopter and testing ground for new digital token applications. This combination of regulatory foresight, strong corporate support for technology, and a culture of technological adoption positions Japan as a unique and highly advanced market focused on leveraging digital tokens to enhance its digital economy.

Global Digital Tokens Market: Key Takeaways

- Global Market Size Insights: The Global Digital Tokens Market size is estimated to have a value of USD 16.1 billion in 2025 and is expected to reach USD 102.0 billion by the end of 2034.

- The Global Market Growth Rate: The market is growing at a CAGR of 22.8 percent over the forecasted period of 2025.

- The US Market Size Insights: The US Digital Tokens Market is projected to be valued at USD 5.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 31.1 billion in 2034 at a CAGR of 21.4%.

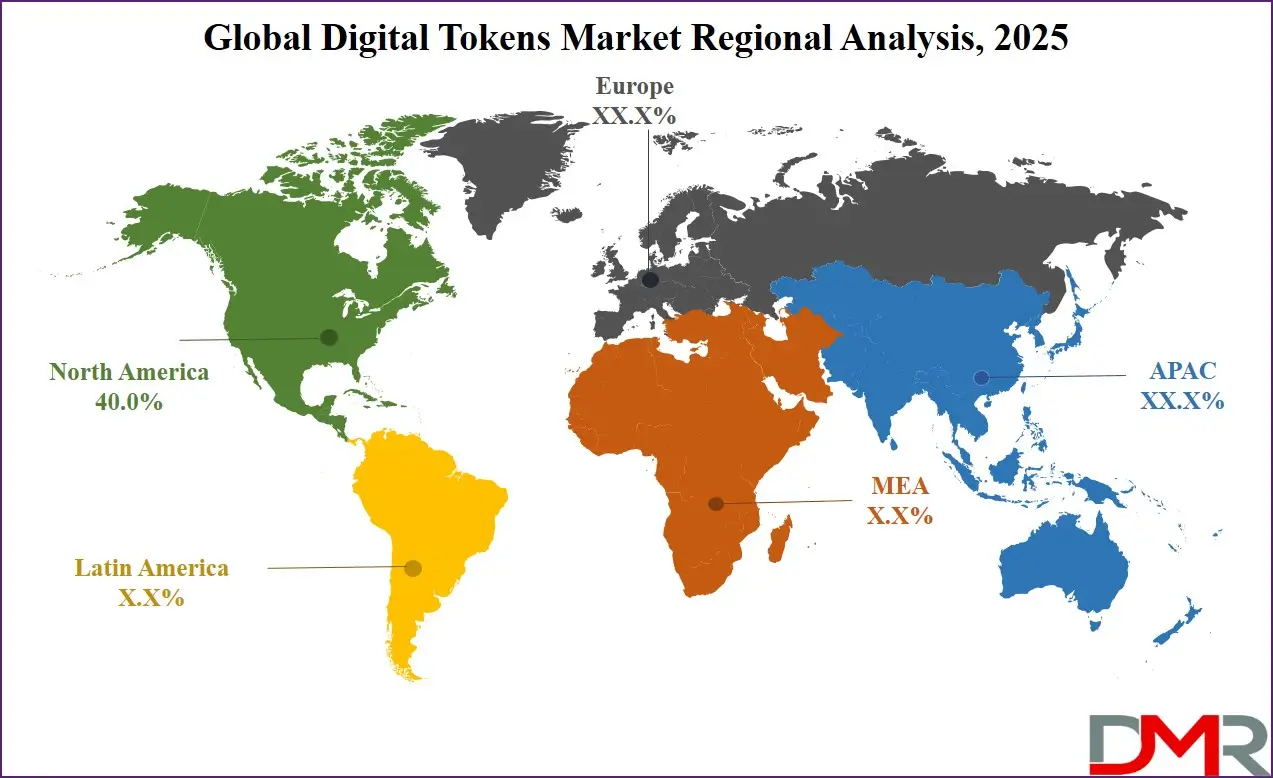

- Regional Insights: North America is expected to have the largest market share in the Global Digital Tokens Market with a share of about 40.0% in 2025.

- Key Players: Some of the major key players in the Global Digital Tokens Market are Coinbase Global, Inc., Binance Holdings Ltd., Ripple, Circle Internet Financial Ltd., ConsenSys Software Inc., Digital Asset Holdings, LLC, Blockdaemon Inc., Fireblocks, Anchorage Digital, and many others.

Global Digital Tokens Market: Use Cases

- Cross-Border Payments: Financial institutions use stablecoins and other digital tokens to settle cross-border transactions in near real-time, drastically reducing transfer times from days to minutes and lowering costs compared to traditional correspondent banking.

- Tokenized Securities: Real-world assets like real estate, fine art, and corporate bonds are fractionalized into digital tokens, enabling broader investor access, increased liquidity, and automated compliance through embedded smart contracts.

- Decentralized Finance (DeFi) Lending: Users can collateralize their digital assets to borrow and lend funds through automated, non-custodial DeFi protocols, creating permissionless and globally accessible financial markets.

- Supply Chain Provenance: Companies adopt utility tokens to represent physical goods in a supply chain, creating an immutable and transparent record of provenance, ownership, and state from manufacturer to end-consumer.

- Digital Identity & Access Management: Self-sovereign identity solutions leverage digital tokens to give users control over their personal data, allowing them to share verifiable credentials for services like KYC and access control without relying on a central authority.

Global Digital Tokens Market: Stats & Facts

U.S. Securities and Exchange Commission (SEC)

- SEC has published "Framework for 'Investment Contract' Analysis of Digital Assets" guidance (initial publication date: 3 April 2019).

- SEC's crypto-asset reporting page content was last marked "content current as of 15 June 2023."

- During the 2020-2023 period, the SEC reported over 100 enforcement actions related to digital asset securities.

Commodity Futures Trading Commission (CFTC)

- CFTC published an advisory on "Actual Delivery for Digital Assets" (final interpretive guidance date: 11 March 2020).

- A CFTC report on crypto derivatives noted USD 2.1 trillion in notional value of Bitcoin futures traded in 2023.

Financial Action Task Force (FATF)

- FATF is composed of 39 member jurisdictions (formal FATF membership structure).

- FATF published the "Updated Guidance for a Risk-Based Approach to Virtual Assets and VASPs" as a final document (published 28 October 2021, updated March 2022).

- FATF's 2022-2024 strategic work program recorded the release of several implementation guidance documents in 2023 to address decentralized finance (DeFi) and peer-to-peer transactions.

Bank for International Settlements (BIS)

- BIS analysis reported that an increase of ~USD 50 billion in stablecoin market cap was associated (on average) with an increase of about USD 80 billion in total crypto market capitalization.

- BIS found that a 1% increase in the value of Bitcoin corresponds to approximately a +0.7% increase in the value of other major digital tokens.

European Central Bank (ECB) / EU Policy

- The EU Markets in Crypto-Assets (MiCA) regulation, which applies to digital tokens marketed in the EU, entered into application in June 2023 (regulatory milestone relevant to token issuers and service providers).

International Organization of Securities Commissions (IOSCO)

- IOSCO's membership comprises 130 national securities regulators (context for global standard-setting).

- IOSCO's policy recommendations for crypto-asset markets show ~15 key policy areas identified for regulatory alignment across member jurisdictions.

World Economic Forum (WEF)

- WEF published "Digital Assets, Distributed Ledger Technology and the Future of Capital Markets" (publication date 15 January 2024), addressing systemic implications, regulation, and interoperability.

- WEF reporting noted that in a survey of financial institutions, ~60% of respondents were actively exploring or implementing digital token solutions.

Global Digital Tokens Market: Market Dynamic

Driving Factors in the Global Digital Tokens Market

Institutional Adoption and Financial Modernization

The global trend of financial institutions exploring and adopting digital assets is a primary driver for the digital tokens market. Major banks, asset managers, and custodians are developing infrastructure to support the tokenization of traditional assets and the trading of digital tokens. This modernization is driven by the need for operational efficiency, reduced settlement times, and access to new asset classes and revenue streams. Digital token technology is uniquely positioned to address these needs through the creation of programmable, instantly settled assets that can represent anything from securities to commodities, offering superior liquidity and transparency compared to traditional systems.

Supportive Regulatory Frameworks and Industry Standards

The gradual establishment of clearer regulatory pathways by major agencies, such as the EU's MiCA, and guidance from the SEC and CFTC in the U.S., has provided growing clarity for businesses to invest in the sector. These frameworks aim to validate the legality and operational safety of digital token activities, accelerating their integration into the mainstream financial system. Furthermore, substantial investment from venture capital and corporate R&D directly fuels foundational research and development in blockchain scalability, security, and interoperability. This financial and regulatory support de-risks innovation and catalyzes the transition of digital tokens from a niche technology to a core component of the future financial infrastructure.

Restraints in the Global Digital Tokens Market

Regulatory Uncertainty and Compliance Costs

The fragmented and evolving global regulatory landscape presents a major barrier to entry and scaling, particularly for startups and cross-border services. Navigating different legal classifications (security vs. commodity), licensing requirements, and anti-money laundering (AML) rules across jurisdictions requires significant legal expertise and financial resources. Beyond initial compliance, the total cost of operation includes ongoing reporting, auditing, and the implementation of sophisticated monitoring systems. This regulatory complexity can slow down widespread adoption, as businesses must conduct rigorous legal analyses and maintain flexibility to adapt to new regulations, often requiring demonstrable proof of robust compliance to secure banking partnerships and achieve sustainable operations.

Security Risks and Technical Complexity

The effective implementation and custody of digital tokens require a deep understanding of cybersecurity, cryptography, and distributed systems. There is a pronounced shortage of professionals trained in this niche intersection, creating a significant human resource bottleneck. The prevalence of hacks, smart contract vulnerabilities, and private key management challenges further exacerbates this challenge. Without a larger pool of qualified blockchain developers, security auditors, and compliance officers who can build secure systems, manage the digital asset lifecycle, and ensure operational integrity, the scalability of tokenization projects and the pace of institutional adoption are critically hampered.

Opportunities in the Global Digital Tokens Market

Expansion in Tokenized Real-World Assets (RWAs)

The tokenization of real-world assets represents one of the largest and most rapidly expanding opportunities. The technology is ideal for representing ownership of a wide array of illiquid assets with high precision and efficiency, including real estate, private equity, debt instruments, and commodities. The shift from traditional paper-based and centralized record-keeping to blockchain-based digital tokens offers significant gains in transparency, fractional ownership, and market liquidity. This financial disruption positions tokenization as a cornerstone technology for the future of capital markets.

Decentralized Finance (DeFi) and Automated Financial Services

A nascent but high-potential growth frontier lies in the decentralized finance sector, where digital tokens are being used to create automated, non-custodial financial protocols. This technology enables the creation of complex financial instruments like lending pools, derivatives, and asset management strategies that execute automatically via smart contracts. It allows for the provision of financial services without traditional intermediaries, potentially lowering costs and increasing access globally. This capability for open and programmable finance could revolutionize the availability of financial services, opening a completely new and substantial market segment for digital tokens beyond simple payments and speculative assets.

Trends in the Global Digital Tokens Market

Institutional-Grade Tokenization

A dominant trend is the migration of tokenization directly into the core systems of large financial institutions, establishing dedicated digital asset divisions. This shift enables the rapid creation and management of tokenized versions of traditional securities, funds, and alternative assets on demand. The benefits are profound, leading to reduced settlement times for trades, decreased counterparty risk, and the creation of new, programmable financial products. This model fosters a closer collaboration between technologists and financiers, transforming traditional capital market infrastructure and placing the power of asset issuance and management directly in the hands of financial innovators.

Interoperability and Cross-Chain Development

The industry is witnessing rapid innovation in the development of novel protocols and standards aimed at enabling seamless communication and transfer of value between different blockchain networks. This includes the creation of cross-chain bridges, interoperable token standards, and layer-2 scaling solutions that enhance transaction throughput and reduce fees. Concurrently, significant research is focused on zero-knowledge proofs and other privacy-enhancing technologies for transactions. These advancements are expanding the application horizon from isolated blockchain ecosystems to a cohesive, interconnected internet of value, pushing the boundaries of what is possible in global finance and digital ownership.

Global Digital Tokens Market: Research Scope and Analysis

By Component Analysis

The Infrastructure segment is projected to be the foundational and currently dominant component, with the Blockchain Protocols & Networks sub-segment as its core. This dominance is driven by the critical need for secure, scalable, and reliable distributed ledgers that form the very bedrock upon which all digital tokens are issued, transferred, and stored. These protocols are the public utilities of the digital asset world; without them, the market cannot function. The immense capital investment flows into the development, maintenance, and enhancement of these networks to handle increasing transaction volumes, ensure security against attacks, and reduce latency.

This sub-segment's dominance is evident in the vast resources dedicated to consensus mechanisms, network upgrades, and layer-2 scaling solutions, which are prerequisites for market growth. While services and software are essential, they are built on top of these foundational protocols. The high value is placed on the platforms that provide the highest degree of decentralization, security, and developer activity, as this creates powerful network effects that attract more projects and users, cementing the protocol layer's position as the most critical and capital-intensive sub-segment in the component landscape.

By Technology Analysis

Public/Permissionless Blockchains are expected to dominate the digital tokens landscape in terms of innovation, developer activity, and total economic value secured. Their supremacy stems from their core principles of open access, censorship resistance, and decentralization, which foster unparalleled innovation and network effects. This environment has given rise to the entire decentralized finance (DeFi) ecosystem, non-fungible tokens (NFTs), and a vast majority of the world's digital assets.

The wide availability of standardized token contracts (like ERC-20) and open-source developer tools on these networks creates a powerful, collaborative ecosystem that permissioned systems cannot match. While private blockchains serve important institutional purposes for specific use cases like internal settlements, they operate as closed ecosystems. In contrast, public blockchains function as global, neutral settlement layers, attracting the largest pool of capital, talent, and user activity. This makes them the dominant force for groundbreaking applications and the primary venue for the creation and exchange of digital value, solidifying their role as the engine of the entire market.

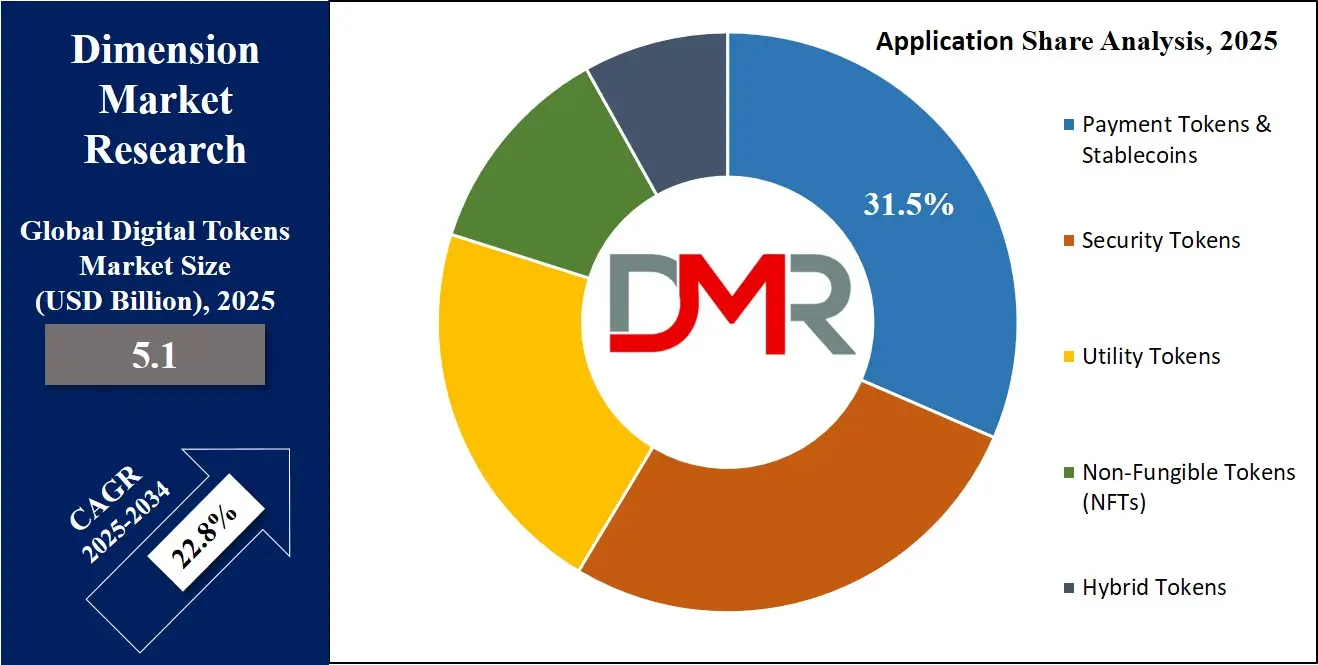

By Token Type Analysis

The Payment Tokens & Stablecoins are projected to be the undisputed leader by daily transaction volume, user base, and their role as the primary medium of exchange within the digital asset ecosystem. This dominance is fueled by their critical function as the on-ramp, off-ramp, and trading pair for virtually all other digital tokens. Stablecoins, in particular, have become the lifeblood of the market, offering the price stability of fiat currency with the efficiency of a digital asset. They are the dominant vehicle for remittances, cross-border B2B payments, and serve as a safe-haven asset within crypto portfolios during periods of high volatility.

Their utility is not speculative but functional, providing essential liquidity and stability that enables all other market activities. While security tokens represent high value per asset and NFTs enable digital ownership, neither matches the sheer transactional throughput and fundamental utility of payment-focused tokens. Their role as the foundational layer for trading, lending, and borrowing makes them the most widely used and essential token type, forming the core plumbing of the entire digital economy.

By Application Analysis

The Payments & Remittances application is expected to be the dominant sub-segment in terms of real-world utility and transaction volume. This dominance is anchored in its ability to solve a clear, global problem: the inefficiency of traditional cross-border money transfers. By leveraging digital tokens, specifically stablecoins, this application enables individuals and businesses to send value across the globe in minutes for a fraction of the cost charged by conventional correspondent banking networks.

This value proposition is immediate and profound, driving massive adoption in regions with high remittance flows or underdeveloped financial infrastructure. While the tokenization of capital markets holds immense future potential, it is still in a developmental and regulatory phase. In contrast, digital payments are a present-day, high-volume reality. This sub-segment directly demonstrates the core disruptive power of digital tokens by offering a faster, cheaper, and more accessible alternative to a foundational pillar of the existing financial system, making it the most actively used and practical application of the technology today.

By End-User Analysis

Cryptocurrency Exchanges & Trading Venues are poised to be the dominant end-user sub-segment, acting as the central nervous system of the entire digital token market. Their dominance is derived from their role as the primary gateways for capital entry (fiat on-ramps) and the core liquidity hubs for virtually all trading activity. These platforms are not just passive participants; they are the critical market infrastructure that facilitates price discovery, enables portfolio management, and provides the liquidity necessary for a healthy ecosystem. They serve all other end-user segments, from retail traders and institutions to the projects themselves that list their tokens. While institutional investors represent a rapidly growing segment, they largely depend on exchanges for execution and custody services. The immense revenue, user traffic, and market influence concentrated on these trading venues make them the most powerful and commercially dominant force. They are the indispensable intermediaries in a market designed for disintermediation, solidifying their position as the leading end-user driving market dynamics and growth.

The Global Digital Tokens Market Report is segmented on the basis of the following:

By Component

- Infrastructure

- Blockchain Protocols & Networks

- Node Infrastructure

- Custody & Wallet Solutions

- Trading & Exchange Platforms

- Staking & Validation Services

- Software

- Smart Contract Development Platforms

- Tokenization & Issuance Platforms

- Wallet & Key Management Software

- Compliance & AML/KYC Tools

- Analytics & Market Data Software

- Services

- Consulting & Advisory Services

- Development & Integration Services

- Security Auditing & Smart Contract Review

- Legal & Regulatory Compliance Services

- Maintenance & Support

By Technology

- Public/Permissionless Blockchains

- Private/Permissioned Blockchains

- Hybrid Blockchains

- Sidechains/Layer-2 Solutions

- Other Distributed Ledger Technologies (DLT)

By Token Type

- Payment Tokens & Stablecoins

- Security Tokens

- Utility Tokens

- Non-Fungible Tokens (NFTs)

- Hybrid Tokens

By Application

- Payments & Remittances

- Capital Markets & Tokenized Assets

- Decentralized Finance (DeFi)

- Supply Chain & Trade Finance

- Digital Identity & Access Management

- Gaming & Metaverse

- Other specialized applications

By End-User

- Cryptocurrency Exchanges & Trading Venues

- Financial Institutions & Banks

- Institutional Investors & Asset Managers

- Retail Users

- Technology & IT Companies

- Government & Public Sector

- Non-Profit Organizations

Impact of Artificial Intelligence on the Global Digital Tokens Market

- Enhanced Security & Fraud Detection: AI algorithms analyze transaction patterns and network behavior in real-time to identify fraudulent activities, money laundering, and smart contract vulnerabilities, improving the security of digital asset ecosystems.

- Optimized Trading & Market Making: AI-driven software automates trading strategies, predicts market movements, and provides liquidity through algorithmic market makers, increasing market efficiency and stability.

- Smart Contract Auditing & Code Verification: AI-powered tools scan and verify smart contract code for bugs, logical errors, and security flaws before deployment, reducing the risk of exploits and financial loss.

- Personalized Portfolio Management: AI assists in creating and managing dynamic, tokenized investment portfolios based on user risk profiles and market conditions, enabling automated, data-driven wealth management.

- Regulatory Compliance & Reporting: AI analyzes large datasets from blockchain transactions to automate compliance checks, generate regulatory reports, and monitor for suspicious activities, streamlining operations for regulated entities.

Global Digital Tokens Market: Regional Analysis

Region with the Largest Revenue Share

North America, led by the United States, is projected to command the largest share of the global digital tokens market with 40.0% of market share by the end of 2025, due to a powerful confluence of technological leadership, deep capital markets, and a dynamic regulatory environment. The region is home to many of the world's leading digital asset companies, such as Coinbase, Circle, and Ripple, which continuously drive innovation in both infrastructure and tokenized assets. This technological edge is complemented by active engagement from regulators like the SEC and CFTC, which are shaping the market structure.

The presence of a robust financial infrastructure with high levels of institutional investment enables banks and asset managers to pilot and deploy cutting-edge tokenization technology. Pioneering financial centers, including New York and San Francisco, have integrated digital asset services into their offerings. High levels of funding from venture capital firms fuel foundational research in blockchain scalability and new applications. This synergy between established tech players, engaged regulators, sophisticated financial end-users, and strong investment creates a virtuous cycle that solidifies North America's dominant market position.

Region with the Highest CAGR

The Asia Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) in the digital tokens market, fueled by massive digitalization, government-led blockchain initiatives, and a vast, tech-savvy population. Countries like Singapore, Japan, and South Korea are making substantial public and private investments in blockchain technology as a core part of their digital economy strategies. Initiatives such as Singapore's "Project Guardian" explicitly prioritize the development and adoption of tokenization, creating a powerful tailwind for the domestic industry. This is coupled with a rapidly expanding digital payments infrastructure aimed at serving a vast and increasingly online population. The region also has a high rate of mobile penetration and cryptocurrency adoption among retail users, which is driving demand for accessible token trading and utility. To address the needs of this large population base, there is a strong focus on developing innovative financial and digital services, and digital tokens offer a path to financial inclusion and new digital experiences. The growing presence of local exchanges and blockchain platforms is making the technology more accessible than ever. This combination of strong governmental support, urgent digital transformation needs, a growing user pool, and increasing local innovation creates an explosive growth environment, positioning the Asia Pacific as the fastest-growing market globally.

By Region

North America

Europe

- Germany

- The U.K.

- France

- Italy

- Russia

- Spain

- Benelux

- Nordic

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- ANZ

- ASEAN

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Egypt

- Rest of MEA

Global Digital Tokens Market: Competitive Landscape

The competitive landscape of the global digital tokens market is fragmented and highly dynamic, characterized by a mix of established cryptocurrency giants, specialized fintech firms, and a vibrant ecosystem of innovative startups and DeFi protocols. Dominant players like Coinbase Global, Inc., Binance Holdings Ltd., and Circle Internet Financial Ltd. leverage their extensive user bases, regulatory licenses, and robust technology platforms to maintain a stronghold, particularly in the realms of trading, custody, and stablecoin issuance. These companies compete not only on technology but also on the strength of their compliance programs and global market access. A significant trend is the deep foray of traditional financial conglomerates, such as BlackRock and JPMorgan Chase, which are aggressively investing in and integrating digital token technology to offer their own proprietary products, most notably tokenized money market funds and blockchain-based settlement systems. This vertical integration allows them to control the entire value chain from asset origination to investor distribution. Simultaneously, the market sees intense competition from specialized technology providers, including ConsenSys in Ethereum development tools and Fireblocks in institutional custody. The landscape is further energized by decentralized autonomous organizations (DAOs) and open-source DeFi protocols focusing on disruptive financial applications, ensuring continuous innovation and intensifying competition across all segments.

Some of the prominent players in the Global Digital Tokens Market are:

- Coinbase Global, Inc.

- Binance Holdings Ltd.

- Ripple

- Circle Internet Financial Ltd.

- ConsenSys Software Inc.

- Digital Asset Holdings, LLC

- Blockdaemon Inc.

- Fireblocks

- Anchorage Digital

- Paxos Trust Company, LLC

- Gemini Trust Company, LLC

- FTX Trading Ltd. (in bankruptcy)

- Kraken

- BitGo, Inc.

- Ledger

- Crypto.com

- Algorand Inc.

- Stellar Development Foundation

- Hedera

- The Diem Association (formerly Libra)

- Other Key Players

Recent Developments in the Global Digital Tokens Market

- May 2024: The Monetary Authority of Singapore (MAS) announces the successful launch of its first live issuances of digital bonds under its Project Guardian initiative, involving major international banks.

- April 2024: BlackRock, in partnership with Securitize, announces the launch of a tokenized money market fund on a public blockchain, representing a major step for institutional tokenization.

- March 2024: The European Banking Authority (EBA) begins its direct supervision of significant Crypto-Asset Service Providers (CASPs) under the MiCA framework, marking a new phase of EU-wide regulation.

- February 2024: A consortium of major banks, including JPMorgan, Apollo, and Barclays, completes a proof-of-concept for tokenizing alternative assets, demonstrating automated compliance and transferability.

- January 2024: The "Digital Asset Summit" (DAS 2024) is held in London, featuring keynotes on the institutional adoption of tokenization and the regulatory outlook for stablecoins.

- November 2023: Circle announces major upgrades to its USDC stablecoin platform, enhancing transparency and scalability for developers and enterprises.

- October 2023: The Depository Trust & Clearing Corporation (DTCC) and a group of financial firms complete a pilot project for a shared ledger settlement system for tokenized traditional assets.

- September 2023: SWIFT publishes the results of its experiments in connecting multiple blockchain networks for cross-border token transfers, highlighting progress on interoperability.

Report Details

| Report Characteristics |

| Market Size (2025) |

USD 16.1 Bn |

| Forecast Value (2034) |

USD 102.0 Bn |

| CAGR (2025–2034) |

22.8% |

| The US Market Size (2025) |

USD 5.4 Bn |

| Historical Data |

2019 – 2024 |

| Forecast Data |

2026 – 2034 |

| Base Year |

2024 |

| Estimate Year |

2025 |

| Report Coverage |

Market Revenue Estimation, Market Dynamics, Competitive Landscape, Growth Factors and etc. |

| Segments Covered |

By Component (Infrastructure, Software, Services), By Technology (Public/Permissionless Blockchains, Private/Permissioned Blockchains, Hybrid Blockchains, Sidechains/Layer-2 Solutions, Other Distributed Ledger Technologies (DLT)), By Token Type (Payment Tokens & Stablecoins, Security Tokens, Utility Tokens, Non-Fungible Tokens (NFTs), Hybrid Tokens), By Application (Payments & Remittances, Capital Markets & Tokenized Assets, Decentralized Finance (DeFi), Supply Chain & Trade Finance, Digital Identity & Access Management, Gaming & Metaverse, Other specialized applications), By End-User (Cryptocurrency Exchanges & Trading Venues, Financial Institutions & Banks, Institutional Investors & Asset Managers, Retail Users, Technology & IT Companies, Government & Public Sector, Non-Profit Organizations) |

| Regional Coverage |

North America – The US and Canada; Europe – Germany, The UK, France, Russia, Spain, Italy, Benelux, Nordic, & Rest of Europe; Asia-Pacific – China, Japan, South Korea, India, ANZ, ASEAN, Rest of APAC; Latin America – Brazil, Mexico, Argentina, Colombia, Rest of Latin America; Middle East & Africa – Saudi Arabia, UAE, South Africa, Turkey, Egypt, Israel, & Rest of MEA |

| Prominent Players |

Coinbase Global, Inc., Binance Holdings Ltd., Ripple, Circle Internet Financial Ltd., ConsenSys Software Inc., Digital Asset Holdings, LLC, Blockdaemon Inc., Fireblocks, Anchorage Digital, Paxos Trust Company, LLC, Gemini Trust Company, LLC, FTX Trading Ltd. (in bankruptcy), Kraken, BitGo, Inc., Ledger, Crypto.com, Algorand Inc., Stellar Development Foundation, Hedera, The Diem Association, and Other Key Players |

| Purchase Options |

We have three licenses to opt for: Single User License (Limited to 1 user), Multi-User License (Up to 5 Users) and Corporate Use License (Unlimited User) along with free report customization equivalent to 0 analyst working days, 3 analysts working days, and 5 analysts working days respectively. |

Frequently Asked Questions

The Global Digital Tokens Market size is estimated to have a value of USD 16.1 billion in 2025 and is expected to reach USD 102.0 billion by the end of 2034.

The market is growing at a CAGR of 22.8 percent over the forecasted period of 2025.

The US Digital Tokens Market is projected to be valued at USD 5.4 billion in 2025. It is expected to witness subsequent growth in the upcoming period as it holds USD 31.1 billion in 2034 at a CAGR of 21.4%.

North America is expected to have the largest market share in the Global Digital Tokens Market with a share of about 40.0% in 2025.

Some of the major key players in the Global Digital Tokens Market are Coinbase Global, Inc., Binance Holdings Ltd., Ripple, Circle Internet Financial Ltd., ConsenSys Software Inc., Digital Asset Holdings, LLC, Blockdaemon Inc., Fireblocks, Anchorage Digital, and many others.